- Home

- »

- Advanced Interior Materials

- »

-

HVAC Distribution Market Size, Share, Industry Report, 2030GVR Report cover

![HVAC Distribution Market Size, Share & Trends Report]()

HVAC Distribution Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Heat Pump, Furnace), By Application (New Construction, Retrofit & Renovation), By End Use (Commercial, Residential), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-581-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

HVAC Distribution Market Size & Trends

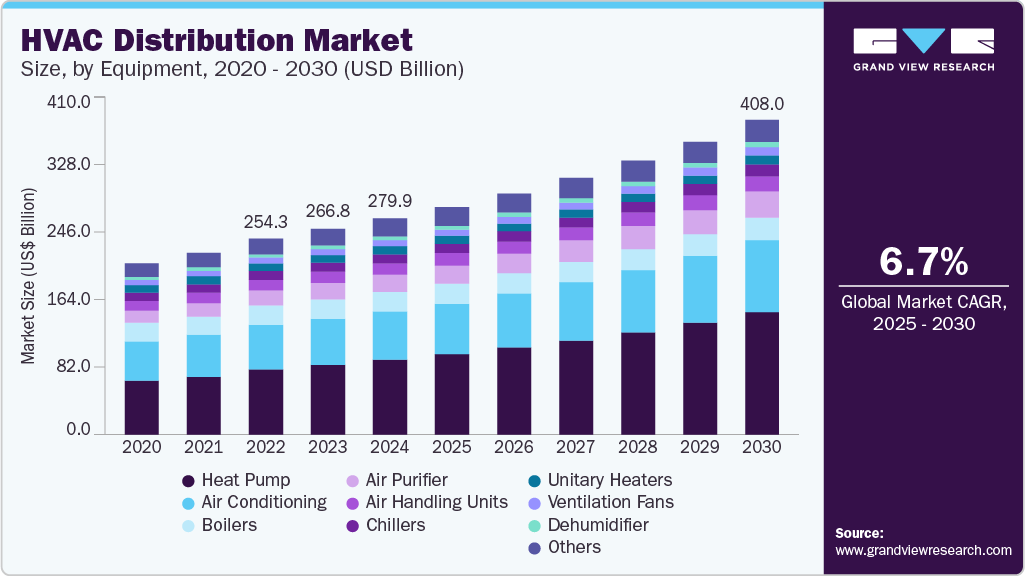

The global HVAC distribution market size was estimated at USD 279.90 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The HVAC distribution industry plays a crucial role in ensuring the efficient delivery of heating, ventilation, and air conditioning systems across various sectors, including residential, commercial, and industrial.

Key Highlights:

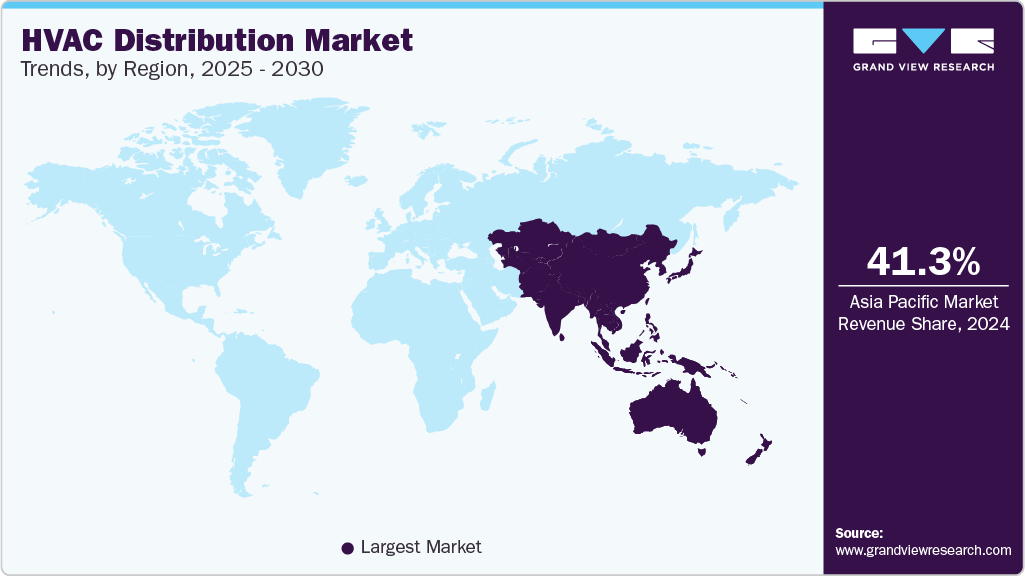

- The Asia Pacific HVAC distribution industry held a significant share of 41.3% in 2024.

- The HVAC distribution industry in the U.S. is expected to grow at a CAGR of 6.3% from 2025 to 2030.

- By equipment, the heat pump segment held a significant market share of 34.7% in 2024.

- By application, the new construction segment held a significant share of the market and accounted for a share of 56.7% in 2024.

- By end use, the residential segment held a significant market share of 39.0% in 2024.

This market encompasses the manufacturers, suppliers, and distributors that provide HVAC equipment and components, ensuring their availability for end users. Technological advancements influence the sector in energy efficiency, smart systems, and sustainability. As environmental concerns and energy regulations tighten, the demand for energy-efficient and eco-friendly HVAC solutions continues to grow, driving innovation and competition in the market.

In recent years, there has been an increasing shift toward integrated HVAC solutions that combine heating, cooling, and air quality management, leading to a rise in demand for advanced systems. Distribution networks are evolving to meet the needs of modern consumers, who prioritize both performance and sustainability in their systems. Furthermore, with the growing adoption of smart technologies, the market is seeing a shift toward digitally connected products that offer greater control and automation. As urbanization and industrialization continue globally, the HVAC distribution market is poised for steady growth, with a focus on improving system reliability, energy efficiency, and environmental impact.

The global HVAC distribution industry is influenced by dynamic trade flows, with Asia Pacific continuing to serve as the central manufacturing and export hub. Countries such as China, India, and Vietnam dominate global exports, benefiting from established production capabilities and cost advantages. At the same time, North America-particularly the United States and Mexico-has emerged as a significant manufacturing and re-export region due to increasing nearshoring trends and favorable trade agreements. Trade tensions, shifting tariffs, and supply chain disruptions have prompted key HVAC distributors and OEMs to diversify sourcing strategies, invest in localized production, and reassess cross-border logistics.

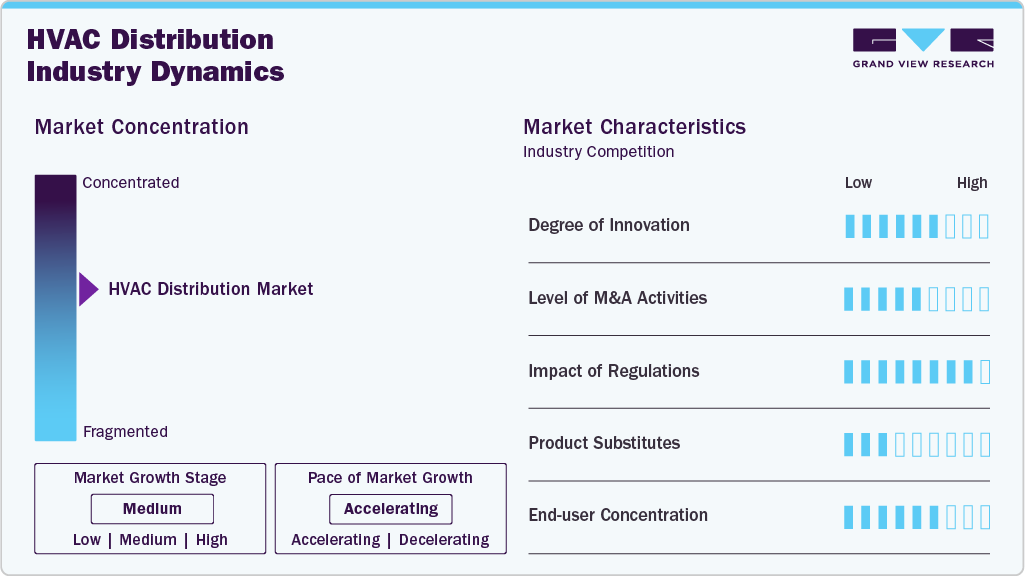

Market Concentration & Characteristics

The HVAC distribution market exhibits a moderately fragmented structure, defined by the presence of established global players alongside a growing number of regional and specialized distributors. Prominent companies such as Carrier Global Corporation, Johnson Controls, Trane Technologies, Daikin Industries, and Lennox International have cemented strong market positions through comprehensive product portfolios, advanced technologies, and expansive distribution networks. In parallel, regional players and independent distributors play a vital role in serving local markets by offering tailored solutions that align with regional climate conditions, building codes, and customer preferences.

Environmental regulations and energy efficiency standards significantly influence the dynamics of the HVAC distribution industry. Governments and regulatory bodies across the globe are enforcing building efficiency codes and sustainability mandates that encourage the adoption of energy-efficient HVAC systems. Distributors are increasingly required to stock and promote systems that meet these standards, driving a shift toward environmentally friendly products. This regulatory pressure not only stimulates market demand but also encourages manufacturers and distributors to invest in innovative and compliant technologies.

Technological advancements continue to reshape the HVAC distribution landscape. The integration of smart technologies, such as IoT-enabled HVAC systems and advanced building automation, is transforming how heating and cooling solutions are delivered and maintained. Improvements in energy management, remote monitoring, and predictive maintenance are becoming standard features, pushing distributors to offer products that incorporate these innovations. Additionally, the use of low-global-warming-potential (GWP) refrigerants and variable-speed compressors is gaining traction, enabling systems to achieve greater efficiency and adaptability across varying climate zones and building types.

Regionally, North America holds a dominant share of the HVAC distribution market, supported by robust construction activity, regulatory incentives for energy-efficient systems, and a strong aftermarket service industry. Europe closely follows, driven by a commitment to sustainable building practices and the widespread adoption of green technologies. The Asia-Pacific region is experiencing rapid growth, fueled by urbanization, infrastructure expansion, and rising demand for climate control in emerging economies such as China and India. These regional trends underscore the global shift toward high-performance, sustainable HVAC solutions distributed through increasingly sophisticated and diverse networks.

Drivers, Opportunities & Restraints

A primary driver of the HVAC distribution industry is the increasing demand for energy-efficient and smart HVAC systems. As concerns over energy consumption and environmental sustainability continue to grow, both residential and commercial consumers are seeking solutions that reduce operational costs while enhancing comfort. Government regulations and incentives aimed at promoting green building practices further support this trend, encouraging the adoption of advanced HVAC technologies. As a result, distributors are expanding their offerings to include high-efficiency systems integrated with smart controls and IoT capabilities.

Despite the growing demand, the market faces a significant restraint in the form of high upfront costs associated with advanced HVAC systems. Many energy-efficient and smart systems require substantial initial investment, which can be a deterrent for cost-sensitive consumers, particularly in developing regions. Additionally, the market is challenged by complexities in regulatory compliance, regional disparities in building codes, and ongoing supply chain disruptions, all of which can hinder smooth distribution and installation processes.

An important opportunity for the HVAC distribution market lies in the rapid urbanization and infrastructure development taking place in emerging economies. Countries across Asia-Pacific, Latin America, and parts of Africa are witnessing a surge in construction activity, creating substantial demand for modern HVAC systems. Distributors that can tailor their product offerings to meet the specific needs of these diverse markets, such as affordability, energy efficiency, and ease of maintenance, are well-positioned to capture significant growth. Establishing strong local partnerships and expanding distribution networks in these regions will further enhance market penetration and brand presence.

Equipment Insights

The heat pump equipment segment held a significant market share of 34.7% in 2024. The global heat pump market is experiencing significant growth, driven by increasing demand for energy-efficient and sustainable heating and cooling solutions. Governments worldwide are implementing policies and offering incentives to promote the adoption of heat pumps, aiming to reduce greenhouse gas emissions and enhance energy efficiency. Technological advancements, such as the development of low-GWP refrigerants and integration with renewable energy sources, are further propelling market expansion.

The HVAC distribution market for air conditioning systems is witnessing steady growth, driven by increasing urbanization, rising temperatures, and growing demand for energy-efficient cooling solutions. The demand for both residential and commercial air conditioning units is surging, particularly in regions experiencing extreme heat or rapid infrastructural development. In addition to traditional air conditioning units, the market is also seeing a rise in demand for smart HVAC systems that offer greater control, energy efficiency, and integration with home automation systems.

Application Insights

The new construction application segment held a significant share of the market and accounted for a share of 56.7% in 2024. In the HVAC distribution market, the new construction segment represents a significant growth driver, driven by the global expansion of residential, commercial, and industrial infrastructure. As developers prioritize energy efficiency and compliance with green building standards from the outset, demand is rising for advanced HVAC systems that integrate seamlessly into modern building designs. Distributors play a key role in supplying high-efficiency units, smart HVAC technologies, and customizable system configurations tailored to new building specifications.

The retrofit & renovation application segment is a crucial part of the HVAC distribution industry, fueled by the need to upgrade aging infrastructure and improve the energy performance of existing buildings. Building owners are increasingly replacing outdated HVAC systems with more efficient, environmentally friendly alternatives to comply with evolving regulations and reduce operating costs. This segment presents opportunities for distributors to supply compact, adaptable systems designed for retrofitting without major structural changes.

End Use Insights

The residential end use segment held a significant market share of 39.0% in 2024. In the residential HVAC distribution market, there is a notable shift towards energy-efficient and sustainable solutions. Homeowners are increasingly opting for systems that not only provide comfort but also contribute to environmental conservation. Rising energy costs and heightened environmental awareness drive this trend. Distributors are responding by offering products that incorporate advanced technologies such as smart thermostats, variable refrigerant flow (VRF) systems, and eco-friendly refrigerants.

The commercial HVAC distribution market is experiencing a transformation with the integration of smart technologies and a focus on sustainability. Businesses are increasingly adopting HVAC systems equipped with IoT capabilities, enabling real-time monitoring and predictive maintenance. This shift enhances operational efficiency and reduces downtime. Moreover, there is a growing emphasis on energy-efficient solutions to comply with stringent environmental regulations and reduce operational costs. Distributors are expanding their offerings to include systems that support renewable energy integration and provide scalable solutions for diverse commercial applications, from office buildings to industrial facilities.

Distribution Channel Insights

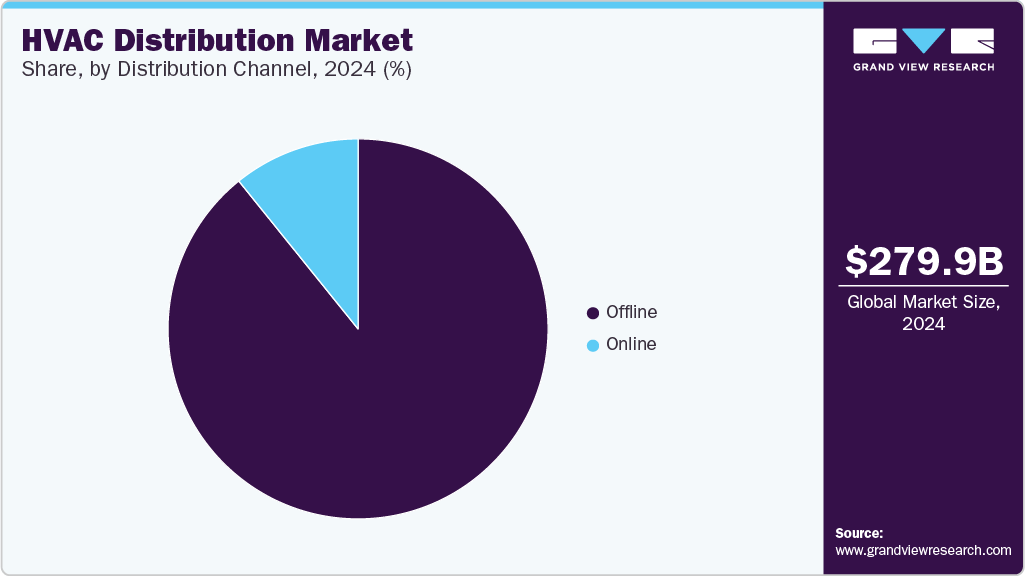

The offline distribution channel segment held a significant share of the market with 89.2% in 2024. The online distribution channel in the HVAC market is experiencing significant growth, driven by the increasing adoption of e-commerce platforms and changing consumer preferences. Customers now seek the convenience of browsing, comparing, and purchasing HVAC products from the comfort of their homes. Online platforms offer a wide range of products, detailed specifications, and customer reviews, empowering consumers to make informed decisions.

Despite the rise of online channels, the offline distribution channel remains a cornerstone of the HVAC market. Traditional brick-and-mortar stores, authorized dealers, and HVAC contractors continue to play a crucial role, especially for complex installations and commercial projects. These channels provide personalized services, expert advice, and immediate product availability, which are essential for customers requiring tailored solutions and professional installation.

Regional Insights

North America HVAC distribution market is experiencing a shift toward energy-efficient and smart technologies, driven by stringent environmental regulations and rising consumer demand for sustainability. The integration of smart HVAC systems, including AI-based automation and IoT connectivity, is gaining momentum in both residential and commercial sectors.

U.S. HVAC Distribution Market Trends

The HVAC distribution industry in the U.S. is expected to grow at a CAGR of 6.3% from 2025 to 2030. The U.S. market is witnessing increased demand for energy-efficient systems, particularly heat pumps, as part of efforts to reduce carbon emissions and enhance energy efficiency. Government initiatives, such as the U.S. Department of Energy's investment in heat pump manufacturing, are bolstering market growth.

The HVAC distribution market in Canada is expected to grow at a CAGR of 6.6% from 2025 to 2030. Canada's market is benefiting from robust infrastructure investments, particularly in residential and social infrastructure projects. Government funding for retrofitting and upgrading existing buildings is driving demand for energy-efficient HVAC solutions. The market is also seeing a shift towards sustainable technologies, including the adoption of low-GWP refrigerants and integration with renewable energy sources, aligning with the country's environmental goals.

Europe HVAC Distribution Market Trends

Europe's HVAC distribution industry is influenced by a strong emphasis on energy efficiency and decarbonization, with a focus on heat pump adoption. Government incentives and regulations are playing a significant role in promoting sustainable HVAC solutions. However, recent political uncertainties and changes in support schemes have impacted market dynamics, leading to fluctuations in heat pump sales across different countries.

Germany HVAC distribution market held a 32.4% share of the Europe market in 2024. A strong commitment to sustainability and energy efficiency characterizes Germany's market. The country's focus on reducing carbon emissions and enhancing energy performance in buildings is driving the demand for advanced HVAC systems. Despite challenges such as fluctuating support schemes and economic factors, the market continues to prioritize the adoption of energy-efficient technologies.

The HVAC distribution market in the UK is experiencing growth due to increasing demand for cooling solutions and the government's commitment to achieving net-zero greenhouse gas emissions by 2050. Reversible heat pumps are gaining popularity as a cost-effective and sustainable solution for both heating and cooling needs.

Asia Pacific HVAC Distribution Market Trends

The Asia Pacific HVAC distribution industry held a significant share of 41.3% in 2024. The Asia Pacific market is expanding rapidly, driven by urbanization, industrialization, and increasing construction activities. Countries in the region are adopting energy-efficient HVAC systems, with a focus on integrating renewable energy sources and low-GWP refrigerants. The market is also witnessing the rise of smart HVAC systems and IoT integration, enhancing system efficiency and user control.

China HVAC distribution market held a significant share of Asia Pacific. China's HVAC distribution industry is experiencing significant growth due to rapid urbanization and industrial development. The government's focus on energy efficiency and environmental sustainability is driving the adoption of advanced HVAC technologies. The market is also witnessing increased demand for smart HVAC systems and integration with renewable energy sources, aligning with the country's green building initiatives.

The HVAC distribution market in India is expected to grow at a CAGR of 7.2% from 2025 to 2030. India's market is expanding in response to rapid urbanization and increasing construction activities. The government's initiatives to promote energy efficiency and sustainable building practices are driving demand for advanced HVAC systems. The market is also seeing a rise in the adoption of smart HVAC technologies and low-GWP refrigerants, reflecting a shift towards environmentally friendly solutions.

Middle East & Africa HVAC Distribution Market Trends

Extreme climate conditions and growing infrastructure development influence the Middle East and Africa's HVAC distribution industry. Countries in the region are investing in energy-efficient HVAC systems to reduce energy consumption and enhance indoor comfort. The market is also witnessing increased adoption of smart HVAC technologies and sustainable solutions, reflecting a shift towards environmentally friendly practices.

Saudi Arabia's HVAC distribution market is expanding in response to urbanization and infrastructure development. The government's initiatives to promote energy efficiency and sustainable building practices are driving demand for advanced HVAC systems. The market is also seeing a rise in the adoption of smart HVAC technologies and low-GWP refrigerants, aligning with the country's Vision 2030 goals for sustainability.

Latin America HVAC Distribution Market Trends

Latin America's HVAC distribution industry is influenced by growing infrastructure development and urbanization. Countries in the region are increasingly adopting energy-efficient HVAC systems, driven by government incentives and regulations. The market is also witnessing a shift towards sustainable technologies, including the use of low-GWP refrigerants and integration with renewable energy sources.

Brazil's HVAC distribution market is expanding due to increasing demand for cooling solutions in the residential and commercial sectors. The government's focus on energy efficiency and environmental sustainability is driving the adoption of advanced HVAC technologies. The market is also seeing a rise in the use of smart HVAC systems and low-GWP refrigerants, aligning with global sustainability trends.

Key HVAC Distribution Company Insights

Some of the key players operating in the market include Watsco, Inc.; Winsupply Inc.; and Ferguson Enterprises.

-

Watsco, Inc. is the largest distributor of air conditioning, heating, and refrigeration (HVAC/R) equipment and related parts and supplies in North America. Founded in 1956 and headquartered in Miami, Florida, Watsco operates over 670 locations across the United States, Canada, Mexico, and Puerto Rico. The company serves more than 350,000 contractors and technicians annually, offering a wide range of products, including residential and commercial HVAC systems, parts, and supplies. Watsco's business strategy focuses on acquiring businesses to build density in existing markets and expand its network into new geographic areas.

-

Winsupply Inc. is a leading supplier of residential and commercial construction and industrial supplies and equipment in the United States. Established in 1956 and headquartered in Dayton, Ohio, Winsupply operates approximately 630 wholesaling locations across 45 states. The company offers a diverse range of products, including plumbing, HVAC, electrical, industrial pipe, valves and fittings, and waterworks supplies.

Key HVAC Distribution Companies:

The following are the leading companies in the HVAC distribution market. These companies collectively hold the largest market share and dictate industry trends.

- HVAC Distributors

- Watsco, Inc.

- CAREL Japan

- Salvador Escoda

- Ferguson Enterprises

- Reece Group

- Winsupply Inc.

- Johnstone Supply

- Dynamic distributors

- Gustave A. Larson Company

- United Refrigeration, Inc.

- 2J Supply HVAC Distributors

- Duncan Supply Co. Inc.

- Crescent Parts & Equipment

- Northeastern Supply Co.

- Guangzhou Tofee Electro-Mechanical Equipment Co., Ltd.

Recent Developments

-

In May 2025, Watsco completed the acquisition of Southern Ice Equipment Distributors, alongside two other transactions earlier in the year. In January, Watsco acquired Lashley & Associates, a U.S. based distributor specializing in custom air movement products and commercial supplies. This was followed by the acquisition of Hawkins HVAC Distributors in April 2025, a supplier of HVAC supplies and equipment with locations in North Carolina, and South Carolina. The terms of these transactions were not disclosed.

-

In May 2025, Winsupply acquired Industrial Sales Co. which serves water, gas, telecom, geothermal, landscape and equipment customers throughout the Midwest.Terms of the deal were not disclosed.

HVAC Distribution Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 294.78 billion

Revenue forecast in 2030

USD 408.03 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, end use, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

HVAC Distributors; Watsco, Inc.; CAREL Japan; Salvador Escoda; Ferguson Enterprises; Reece Group; Winsupply Inc.; Johnstone Supply; Dynamic distributors; Gustave A. Larson Company; United Refrigeration, Inc.; 2J Supply HVAC Distributors; Duncan Supply Co. Inc.; Crescent Parts & Equipment; Northeastern Supply Co.; Guangzhou Tofee Electro-Mechanical Equipment Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HVAC Distribution Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HVAC distribution market report based on equipment, end use, distribution channel, application, and region:

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heat Pump

-

Furnace

-

Unitary Heaters

-

Boilers

-

Air Purifier

-

Dehumidifier

-

Air Handling Units

-

Ventilation Fans

-

Air Conditioning

-

Chillers

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

B2B

-

B2C

-

-

Online

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

New Construction

-

Retrofit & Renovation

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Spain

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global HVAC distribution market size was estimated at USD 279.90 million in 2024 and is expected to be USD 294.78 million in 2025.

b. The global HVAC distribution market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 408.30 million by 2030.

b. Heat pump equipment segment held a significant share of the market and accounted for a share of 34.7% in 2024. The global heat pump market is experiencing significant growth, driven by increasing demand for energy-efficient and sustainable heating and cooling solutions.

b. Some of the key players operating in the HVAC distribution market include HVAC Distributors, Watsco, Inc., CAREL Japan, Salvador Escoda, Ferguson Enterprises, Reece Group, Winsupply Inc., Johnstone Supply, Dynamic distributors, Gustave A. Larson Company, United Refrigeration, Inc., 2J Supply HVAC Distributors, Duncan Supply Co. Inc., Crescent Parts & Equipment, Northeastern Supply Co., Guangzhou Tofee Electro-Mechanical Equipment Co., Ltd.

b. The market is influenced by technological advancements in energy efficiency, smart systems, and sustainability. As environmental concerns and energy regulations tighten, the demand for energy-efficient and eco-friendly HVAC solutions continues to grow, driving innovation and competition in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.