- Home

- »

- Renewable Energy

- »

-

Hydrogen Generator Market Size, Industry Report, 2030GVR Report cover

![Hydrogen Generator Market Size, Share & Trends Report]()

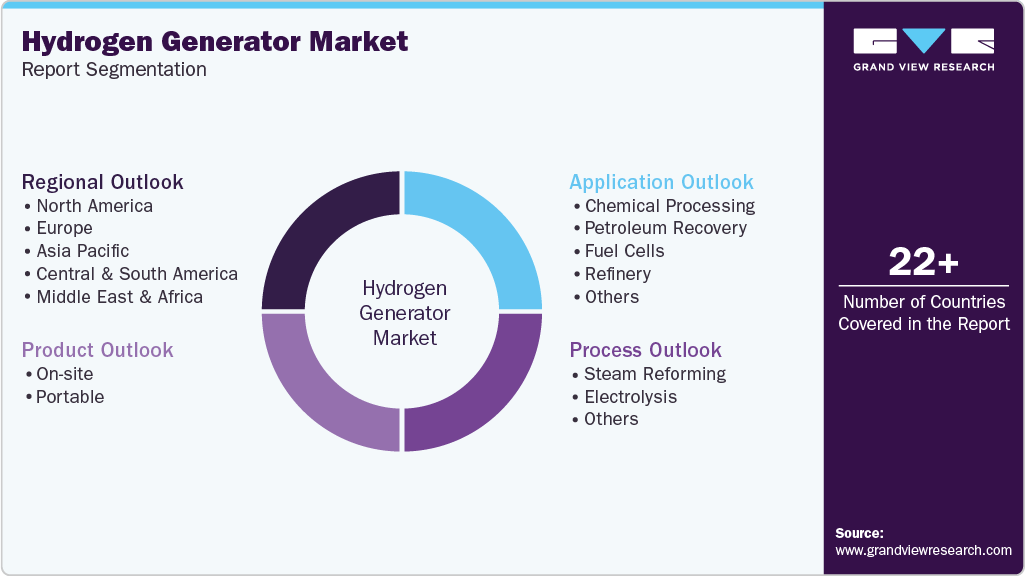

Hydrogen Generator Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (On-site, Portable), By Process (Steam Reforming, Electrolysis), By Application (Chemical Processing, Fuel Cell), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-472-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Generator Market Summary

The global hydrogen generator market size was valued at USD 749.7 million in 2024 and is projected to reach USD 1,120.3 million by 2030, growing at a CAGR of 7.0% from 2025 to 2030. Market growth is expected to be driven by increasing awareness regarding sustainability and the use of renewable energy, owing to the rising global concerns over climate change and carbon emissions.

Key Market Trends & Insights

- Asia Pacific dominated the global hydrogen generator market with a revenue share of 34.9% in 2024.

- The hydrogen generator market in China held the largest share in 2024.

- By product, the on-site segment held the largest revenue share of 74.8% in 2024.

- By process, the steam reforming segment held the largest revenue share in 2024.

- By application, chemical processing, a crucial segment in the hydrogen generator industry, held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 749.7 Million

- 2030 Projected Market Size: USD 1,120.3 Million

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

- North American: Fastest growing market

Governments across countries are expanding their hydrogen generation and export capabilities. For instance, under its National Green Hydrogen Mission, the Government of India aims to make the country a global hub for the production, usage, and export of green hydrogen and its derivatives by 2030. Countries across North America, Asia Pacific, and Latin America are witnessing a surge in demand for hydrogen generators. Governments worldwide are also implementing supportive policies and incentive programs to promote hydrogen as a viable alternative to fossil fuels, particularly in sectors such as transportation and industrial applications.Ongoing advancements in hydrogen generation technologies, including steam methane reforming and electrolysis, are enhancing efficiency and reducing production costs. The rising interest in hydrogen fuel cell electric vehicles (FCEVs) is also contributing to market expansion, particularly in regions like North America, where infrastructure development for hydrogen refueling stations is underway. Furthermore, the increasing use of hydrogen in chemical processing and refining applications underscores its versatility and importance in various industries, solidifying its role in the transition to a sustainable energy future.

The market is experiencing significant growth, primarily due to the global shift toward clean and renewable energy sources, spurred by increasing concerns over climate change and the need to reduce carbon emissions. Governments of various countries are implementing supportive policies and incentive programs to promote hydrogen as a sustainable alternative to traditional fossil fuels, particularly in transportation and industrial sectors. For instance, in the U.S., hydrogen policy is guided by the U.S. Department of Energy’s Hydrogen Program Plan. The plan emphasizes innovation, commercialization, and market expansion of hydrogen technologies. This includes incentives such as tax benefits, R&D, and public-private partnership. The rising demand for hydrogen in fuel cells, especially for electric vehicles, is also a key driver, as it offers low emissions and high efficiency.

The market presents numerous growth opportunities driven by the global push for clean energy solutions. As per the International Energy Agency (IEA), since 1975, the demand for hydrogen gas has tripled. Most of it is produced from fossil fuels, accounting for about 6% of global natural gas use and 2% of global coal consumption. Significant opportunity lies in the increasing focus on achieving net-zero emission targets by 2050, prompting investments in hydrogen technologies across various sectors. The demand for portable hydrogen generators is anticipated to grow rapidly, fueled by a shift toward renewable energy and the need for decentralized energy solutions.In buildings, hydrogen could be blended into existing natural gas networks, with the highest potential in multifamily and commercial buildings, particularly in dense cities, while long-term prospects could include the direct use of hydrogen in hydrogen boilers or fuel cells.

Market Concentration & Characteristics

Designing and manufacturing hydrogen generators requires sound technological capabilities and considerable capital. Hence, the market is dominated by a few key players, including Air Liquide, Linde, Air Products, and Hydrogenics. This makes the market concentration moderately high. The market is considered to have a slightly high degree of innovation due to the integration of hydrogen with renewable energy sources, EPM electrolyzers, and the development of new hydrogen storage materials. Companies are investing considerably in the development of new hydrogen generation techniques and enhancing the efficiency of existing processes. For instance, Aramco uses innovative technologies to produce blue hydrogen and transport it safely.

M&A activities are witnessing significant growth, with companies focusing on advancements to enhance hydrogen vehicles and investments in hydrogen technologies. Since hydrogen is an inflammable gas, governments are imposing strict regulations and policies to promote the safe use of hydrogen generators. For instance, the European Union defines criteria for renewable hydrogen, requiring it to achieve at least 70% greenhouse gas emissions savings compared to fossil fuels.

There are very few substitutes for hydrogen generators because other options are expensive, difficult to manage, and cannot do the same job. Alternatives like nitrogen generators, zero-air generators, and regular gas generators are available, but they serve different purposes and cannot fully replace hydrogen, especially in labs and clean energy applications.

Hence, most of the industries, including pharmaceuticals, environmental testing, and chemical processing, use hydrogen generators. Even though making, storing, and transporting hydrogen can be costly and complex, hydrogen is widely available and clean, making it a good choice for the future. Since there aren’t many good alternatives, most end users continue to depend on hydrogen generators, leading to a moderately-high end user concentration.

Product Insights

The on-site segment held the largest revenue share of 74.8% in 2024, driven by the increasing demand for clean energy solutions and the push toward decarbonization. This segment primarily focuses on centralized hydrogen production facilities that supply hydrogen to various industries, including transportation, chemical processing, and energy generation. Several hydrogen generation plants are being set up worldwide to meet the growing need for clean energy. For instance, in 2025, ENEOS, a Japanese energy company, invested USD 200 million to set up a green hydrogen demonstration plant in Brisbane, Australia. The plant is expected to produce up to 680 kilograms of green hydrogen per day from 2026, in the form of methylcyclohexane (MCH) for easy storage and transport. ENEOS plans to ship a portion of the production to Japan, collaborating with both Japanese and Australian companies on the project. Governments worldwide are also implementing incentives and supportive policies to promote the adoption of on-site hydrogen generation technologies, particularly in industrial applications.

The portable hydrogen generator market segment is expected to record the fastest CAGR, fueled by increasing global demand for hydrogen as a clean energy source on the go. Several companies are investing in developing efficient hydrogen fuel cells for automotive and transportation applications. These fuel cells are projected to be a cleaner source of fuel with minimum emissions and carbon footprint. For instance, Adani Enterprises (India) developed the country’s first hydrogen-powered fuel cell truck. The truck was deployed at the Gare Pelma III coal block in Chhattisgarh and designed to carry up to 40 tons of cargo with a range of approximately 200 kilometers. In another instance, Hitachi Energy tested its HyFlex hydrogen power generator on a construction site in Gothenburg (Sweden), supplying clean power to a battery-powered excavator, demonstrating the viability of hydrogen fuel cells in construction.

Process Insights

The steam reforming segment held the largest revenue share in 2024. This process uses steam methane reforming (SMR) method to convert methane and steam into hydrogen, carbon monoxide, and carbon dioxide, making it a widely adopted method for hydrogen production. Shell, a leading oil & gas company, uses its blue hydrogen process to produce low-carbon hydrogen from natural gas. The company incorporated proven carbon capture technologies to reduce emissions, enabling chemical and refining operations to diversify their products while supporting the transition to cleaner energy. Some of the factors driving the segment’s growth include increasing demand for hydrogen across various applications and advancements in technologies enhancing hydrogen extraction efficiency and reducing costs.

The electrolysis segment is expected to record notable growth over the forecast period, driven by the increasing emphasis on green hydrogen production as a clean energy source. This method uses renewable energy to split water into hydrogen and oxygen, aligning global sustainability goals and efforts to reduce carbon emissions. The market growth is fueled by advancements in electrolysis technologies, including Proton Exchange Membrane (PEM) and alkaline electrolysis, for efficient and affordable hydrogen generation. As industries seek to transition away from fossil fuels, the demand for electrolysis-based hydrogen generators is expected to rise, supporting various applications in transportation, chemical processing, and energy storage.

Application Insights

Chemical processing, a crucial segment in the hydrogen generator industry, held the largest revenue share in 2024. Hydrogen plays a vital role in ammonia production through the Haber-Bosh process, primarily used for fertilizers, and in manufacturing products such as chemicals, plastics, and explosives. Green hydrogen, generated through electrolysis, is especially useful for lowering the carbon emissions associated with chemical processes. Hence, the demand for hydrogen generators in this segment is driven by the extensive use of hydrogen in producing various chemical products.

The refinery segment is expected to grow at the fastest CAGR over the forecast period, driven by the increasing need for hydrogen in refining processes. Hydrogen is essential for desulfurization, which reduces the sulfur content in diesel and gasoline to help meet stringent environmental regulations. The demand for hydrogen in refineries has grown due to rising diesel fuel demand both in the U.S. and abroad, as well as stricter regulations on sulfur content. This growing need is projected to significantly drive the use of hydrogen generators within the segment, supported by rising global energy demand and the ongoing transition toward cleaner fuels.

Regional Insights

The North American hydrogen generator market is expected to record the fastest CAGR over the forecast period, due to increasing demand for clean energy solutions and advancements in hydrogen production technologies. This is one of the key regions in the global hydrogen generation market, primarily due to the high demand for hydrogen in fuel cell electric vehicles (FCEVs) and industrial applications such as refining and chemical processing. Major players, including Air Products and Chemicals, Inc. and Air Liquide, play a crucial role in market growth, supported by government initiatives promoting hydrogen as a clean fuel. For instance, as per the Hydrogen Strategy released in 2020, the Canadian government aims to become a global hydrogen leader by 2050, emphasizing green hydrogen from renewables, particularly in British Columbia and Québec.

U.S. Hydrogen Generator Market Trends

The U.S. hydrogen generator market is expected to grow with the increasing demand for clean energy and advancements in hydrogen production technologies. Hydrogen is essential for various applications, including fuel-cell electric vehicles, chemical processing, and refining. The market is influenced by government initiatives aiming to promote hydrogen as a sustainable fuel source alongside investments in infrastructure such as hydrogen refueling stations. For instance, the State of California's Advanced Clean Cars Program offers assistance for establishing publicly accessible hydrogen vehicle fueling stations throughout California to promote a consumer market for zero-emission fuel cell vehicles. Major players, including Air Products and Air Liquide, are actively engaged in developing techniques to enhance hydrogen production efficiency. The U.S. market is well-positioned for continued expansion and innovation, as industries seek to reduce carbon emissions and transition to cleaner energy solutions.

Europe Hydrogen Generators Market Trends

The hydrogen generator market in Europe is experiencing growth, driven by a strong commitment to green hydrogen initiatives and sustainability goals. European countries are investing heavily in hydrogen production technologies, particularly electrolysis, to reduce the consumption of fossil fuels and achieve carbon neutrality. Governments are supporting projects, such as the EU's hydrogen accelerator strategy, with an aim to enhance renewable hydrogen production and infrastructure.

The Germany hydrogen generator market is expected to grow over the forecast period. As a pioneer in sustainable technologies, Germany aims to increase its domestic hydrogen production capacity, focusing on electrolysis powered by renewable energy sources. For instance, in January 2022, the German Federal Ministry of Education and Research announced a funding of USD 835.64 million for three key hydrogen projects in the country. These projects conduct research in the areas of offshore hydrogen production (H2-Mare), technologies for hydrogen transport (TransHyDE), and the serial development of electrolyzers (H2-Giga). The country's strategies include developing hydrogen infrastructure and collaborating with neighboring countries to harness their renewable resources. With a strong motivation of reducing the use of fossil fuels, Germany is set to play a pivotal role in the European hydrogen landscape and position itself as a key player in the transition toward a low-carbon economy.

The hydrogen generator market in France is rapidly evolving, driven by the country's strong commitment to sustainable energy solutions and the transition to green hydrogen. With a focus on reducing carbon emissions and achieving carbon neutrality, the government is investing heavily in hydrogen production technologies and the use of green hydrogen. For instance, the French government allocated USD 2.15 billion specifically for the development of green hydrogen projects under the "France 2030" investment plan.

Asia Pacific Hydrogen Generator Market Trends

Asia Pacific dominated the global hydrogen generator market with a revenue share of 34.9% in 2024. Factors such as surging electricity demand and supportive policies of local governments are accelerating market expansion. Major economies are investing heavily in hydrogen production technologies, particularly electrolysis, to reduce reliance on fossil fuels and achieve carbon neutrality. The market expansion is driven by the region's commitment to decarbonizing industries such as steel, chemicals, and transportation. Countries such as China, India, and Australia are investing heavily in hydrogen technologies to support this transition.

The hydrogen generator market in China held the largest share in 2024, owing to strong government support and significant investments in hydrogen production technologies. The country aims to enhance its hydrogen economy through ambitious targets and policies that promote the use of hydrogen in various industrial applications, including oil refining and ammonia production. Recent developments include the launch of the world's largest green hydrogen plant by Sinopec, highlighting China's commitment to decarbonization.

The Japan hydrogen generator market is expected to grow over the forecast period. Japan has set ambitious targets for hydrogen production, focusing on electrolysis powered by renewable energy to reduce reliance on fossil fuels. Major initiatives, such as the establishment of hydrogen supply chains and investments in infrastructure, are underway to support the growth of hydrogen technologies. Companies including Toshiba and Air Liquide are leading innovations in hydrogen production and storage solutions. Other companies are also investing heavily in hydrogen powered automotive and transportation sectors. For instance, East Japan Railway Company (JR East), in collaboration with Toyota Motor Corporation and Hitachi Ltd., developed Japan's first hydrogen-powered hybrid train, named "Hybari." This initiative is a part of JR East's strategy to achieve net-zero carbon dioxide emissions by 2050.

Central & South America Hydrogen Generator Market Trends

Key countries such as Brazil and Chile are investing in hydrogen projects to enhance energy security and reduce carbon emissions. Upcoming initiatives include various green hydrogen plants and collaborations with international firms to develop infrastructure. As countries in the region seek to diversify their energy portfolios and meet global sustainability goals, the market is expected to grow, positioning Central and South America as a noteworthy region in the global hydrogen landscape.

Middle East & Africa Hydrogen Generator Market Trends

The hydrogen generator market in the Middle East and Africa is rapidly developing, driven by abundant renewable energy resources and governments’ support for green hydrogen initiatives. Countries including Saudi Arabia, Egypt, and Morocco are investing in large-scale hydrogen projects, leveraging their solar and wind potential to produce hydrogen through electrolysis. For instance, in March 2025, a Moroccan government committee approved green hydrogen projects worth USD 32.5 billion to focus on the production of ammonia, steel, and industrial fuel. Strategic partnerships with international firms are further enhancing infrastructure development, positioning the region as a key player in the global hydrogen economy. The focus on decarbonizing industries and transportation is further expected to favor market growth, making the Middle East and Africa a significant hub for sustainable hydrogen production and innovation.

Key Hydrogen Generator Company Insights

Some of the key players in the global hydrogen generator industry include Air Liquide, Air Products and Chemicals Inc., Linde AG, Praxair Inc., Proton On-Site, Hydrogenics Corporation, Nel Hydrogen, McPhy Energy, and Plug Power. These companies are actively involved in developing innovative hydrogen production technologies, such as proton exchange membrane (PEM) and alkaline electrolyzers, to enhance efficiency and reduce costs. They are also significantly expanding their global footprint through strategic partnerships, mergers and acquisitions, and investments in hydrogen infrastructure projects.

Key Hydrogen Generator Companies:

The following are the leading companies in the hydrogen generator market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide (L’AIR LIQUIDE S.A.)

- Air Products and Chemicals

- Epoch Energy Technology Corporation

- LNI Swissgas

- Idroenergy

- Linde

- McPhy Energy S.A.

- Nel ASA

- Parker Hannifin Corp

- Peak Scientific Instruments

Recent Developments

-

In March 2025, Samsung Engineering & Architecture (E&A) acquired a 9.1% stake in Norwegian hydrogen company Nel ASA for approximately USD 33 million. This strategic partnership aims to enhance collaboration in hydrogen plant projects.

-

In June 2024, Caterpillar Inc. announced the addition of Cat CG260 gas generator sets to its range of commercially available power solutions that can operate on hydrogen fuel. These generator sets are now accessible through global Cat dealers and are designed to run on gas containing up to 25% hydrogen by volume. In addition to the new models, Caterpillar provides retrofit kits for existing CG260 generator sets, enabling them to use the same hydrogen capabilities.

-

In April 2024, Panasonic's Electric Works Company announced its plan to introduce a new pure hydrogen fuel cell generator in Europe, Australia, and China in October 2024. This innovative technology generates electricity through a chemical process that combines high-purity hydrogen with oxygen from the air.

-

In March 2025, Aramco completed the acquisition of a 50% equity interest in the Jubail-based Blue Hydrogen Industrial Gases Company (BHIG). The agreement aimed to provide the Jubail Industrial City area with hydrogen, including lower-carbon hydrogen, at scale.

Hydrogen Generator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 800.8 million

Revenue forecast in 2030

USD 1,120.3 million

Growth Rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030.

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends.

Segments covered

Product, process, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Brazil, Argentina, Saudi Arabia, South Africa. UAE.

Key companies profiled

Air Liquide (L’AIR LIQUIDE S.A.); Air Products and Chemicals; Epoch Energy Technology Corporation; LNI Swissgas; Idroenergy; Linde; McPhy Energy S.A.; Nel ASA; Parker Hannifin Corp; Peak Scientific Instruments

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Generator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global Hydrogen Generator market report based on product, process, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

On-site

-

Portable

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Steam Reforming

-

Electrolysis

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical Processing

-

Petroleum Recovery

-

Fuel Cells

-

Refinery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.