- Home

- »

- Automotive & Transportation

- »

-

Hydrogen Truck Market Size & Share, Industry Report, 2030GVR Report cover

![Hydrogen Truck Market Size, Share & Trends Report]()

Hydrogen Truck Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle, By Fuel Cell Technology (PEMFC, SOFC), By Range (Upto 300 miles, 300-500 miles), By Motor Power, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-511-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Truck Market Summary

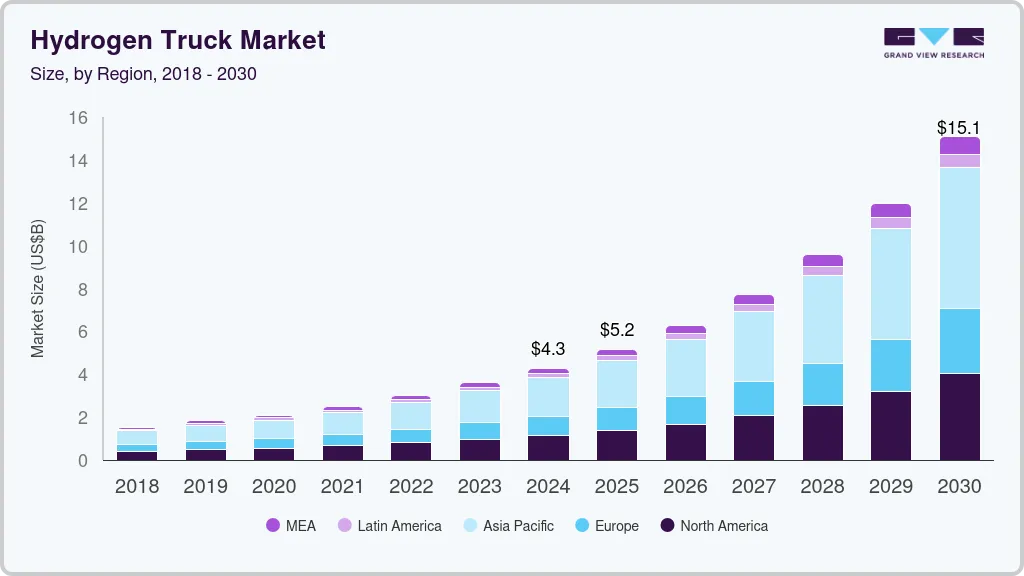

The global hydrogen truck market size was estimated at USD 4.3 billion in 2024 and is projected to reach USD 15.10 billion by 2030, growing at a CAGR of 23.9% from 2025 to 2030. Governments and regulatory bodies globally are implementing stringent emissions standards to combat climate change and reduce greenhouse gas (GHG) emissions.

Key Market Trends & Insights

- The Asia Pacific hydrogen trucks industry dominated and accounted for 41.9% share of the global revenue in 2024.

- China hydrogen trucks industry is driven by the integration of hydrogen in broader energy and environmental policies by the Government of China.

- By vehicle, the heavy-duty trucks segment led the market with a global revenue share of 50.22% in 2024.

- By fuel cell technology, the PEMFC segment dominated the market in 2024 in terms of market share.

- By motor power, the upto 200 kW segment is anticipated to witness significant growth over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.3 Billion

- 2030 Projected Market Size: USD 15.10 Billion

- CAGR (2025-2030): 23.9%

- Asia Pacific: Largest market in 2024

Traditional diesel-powered trucks are significant contributors to air pollution, prompting policymakers to promote the adoption of cleaner alternatives. Hydrogen trucks, which produce only water vapor as a byproduct, are emerging as a key solution to meet these regulatory requirements. This regulatory push is a critical factor driving investments in hydrogen truck technology and infrastructure. In addition, the global push towards sustainability is driving businesses to adopt greener transportation solutions. Fleet operators and logistics companies are increasingly prioritizing vehicles that align with their environmental, social, and governance (ESG) goals. Hydrogen trucks offer a zero-emission alternative that meets these objectives, making them an attractive option for companies seeking to reduce their carbon footprint while maintaining operational efficiency.

Technological advancements in hydrogen fuel cell technology have significantly improved the performance, efficiency, and cost-effectiveness of fuel cell systems, addressing challenges such as energy density, durability, and scalability. One key development is the enhancement of energy density, which allows fuel cells to generate more power relative to their size. This has led to the creation of more compact systems that can be integrated into existing truck platforms without compromising payload capacity or operational efficiency. These improvements make hydrogen-powered trucks a more practical alternative to traditional internal combustion engine vehicles in commercial and industrial applications. In September 2023, Nikola Corporation launched its hydrogen fuel cell electric truck at its manufacturing facility in Arizona, U.S. The event featured demonstrations, sustainability discussions, and production line tours. The truck offers a range of up to 500 miles and refueling in approximately 20 minutes.

As countries seek to reduce their reliance on fossil fuels and enhance energy security, hydrogen is emerging as a key component for their energy diversification strategies. Hydrogen trucks not only support the transition to renewable energy but also help mitigate risks associated with fluctuating oil prices and supply chain disruptions. This growing focus on energy diversification is further boosting the demand for hydrogen trucks worldwide.

One of the primary challenges hindering the adoption of hydrogen trucks is their high initial costs. The expensive fuel cell technology and specialized hydrogen storage systems contribute to the steep upfront investment required for hydrogen-powered trucks. While these vehicles may offer operational savings in the long term, the high cost of ownership remains a barrier, particularly for small and medium-sized enterprises that are less equipped to absorb such significant expenditures. In addition, the infrastructure required to support these trucks, such as refueling stations, also requires substantial capital investment, further adding to the financial burden.

Vehicle Insights

The heavy-duty trucks segment led the market with a global revenue share of 50.22% in 2024. One of the primary factors driving this dominance is the superior energy efficiency and extended range offered by hydrogen fuel cells. Unlike battery-electric trucks, which often require large, heavy batteries for long-haul applications, hydrogen-powered trucks can achieve significant mileage without compromising payload capacity. This makes them ideal for the logistics and freight industries, where long-distance travel and heavy loads are routine.

The small-duty trucks segment is expected to register the fastest growth over the forecast period due to several factors driving its adoption. One key reason is the increasing demand for sustainable and efficient transportation solutions in urban and suburban areas. Small-duty trucks are widely used for last-mile delivery and short-haul logistics, sectors that are experiencing rapid growth due to the rise of E-commerce and consumer expectations for quick deliveries.

Fuel Cell Technology Insights

The PEMFC segment dominated the market in 2024 in terms of market share. This significant market share reflects the widespread adoption of PEMFC technology due to its advanced performance characteristics, compatibility with hydrogen fuel, and suitability for various truck applications. PEMFCs are particularly advantageous in heavy-duty and commercial vehicle segments because of their high-power density, quick start-up capabilities, and efficient operation at relatively low temperatures (around 80°C). These attributes make PEMFCs ideal for trucks that need consistent, reliable energy output under diverse operational conditions, including long-haul freight and urban delivery routes. In addition, their ability to deliver zero-emission energy aligns with stringent global regulations promoting cleaner transportation solutions.

The SOFC segment is anticipated to register the fastest growth over the forecast period. One of the key factors propelling the growth of the SOFC segment is its ability to operate at high temperatures (approximately 600-1,000°C), which allows for greater energy conversion efficiency compared to other fuel cell types. This makes SOFCs particularly suitable for applications requiring consistent and prolonged energy output, such as long-haul trucking and heavy-duty operations. In addition, SOFCs are known for their durability and reduced need for frequent maintenance, which appeals to fleet operators looking for cost-effective and reliable energy solutions. Their capability to utilize various fuel sources also makes them a flexible option, especially in regions where hydrogen infrastructure is still developing.

Range Insights

The 300-500 miles segment led the market in 2024. This dominance is attributed to its alignment with the operational requirements of medium- to long-haul transportation, which represents a significant portion of the trucking industry. Hydrogen trucks with a range of 300-500 miles provide an ideal balance between range and refueling efficiency. This range is particularly suitable for regional freight routes and logistics operations that demand vehicles capable of covering substantial distances without frequent refueling stops. The ability to refuel hydrogen trucks quickly compared to battery-electric alternatives further enhances their appeal for fleet operators aiming to minimize downtime.

The above 500 miles segment is anticipated to register the fastest CAGR over the forecast period. The expansion of hydrogen refueling infrastructure along major trucking routes, particularly in regions prioritizing green transportation initiatives, is another factor contributing to the growth of this segment. Governments and private stakeholders are investing heavily in hydrogen corridors and high-capacity refueling stations to support long-haul trucking needs, creating a conducive environment for the adoption of trucks in this range.

Motor Power Insights

The above 400 kW segment led the market in 2024. Trucks with power ratings above 400 kW are specifically designed to handle heavy loads and long-distance travel, making them indispensable for industries that require robust performance. Their high torque and superior acceleration enable efficient operations, even in challenging terrains and adverse conditions. In addition, leading manufacturers are focusing on developing and deploying vehicles in this power range, further solidifying the segment's market position. Their investments in research and development have resulted in more efficient and cost-effective solutions for end users.

The upto 200 kW segment is anticipated to witness significant growth over the forecast period. The expansion of e-commerce and urban delivery networks has created a strong demand for light- and medium-duty trucks. The upto 200 kW segment is well-suited for these applications, providing efficient and reliable performance within city limits while adhering to zero-emission mandates. In addition, hydrogen trucks in the upto 200 kW category are generally more affordable to produce and operate compared to their higher-power counterparts. This affordability appeals to small- and medium-sized businesses looking to transition to cleaner energy without incurring prohibitive costs.

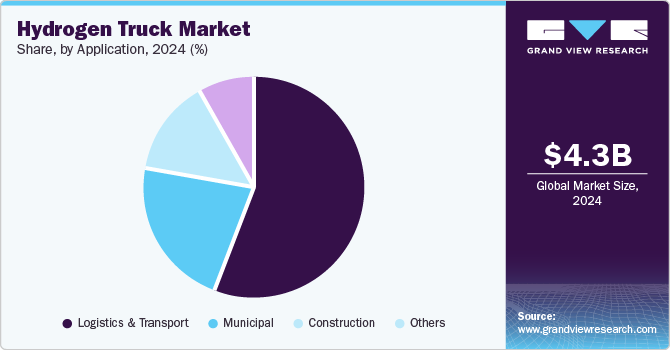

Application Insights

The logistics segment led the market in 2024. Logistics operations, which encompass freight transportation, regional deliveries, and last-mile distribution, demand vehicles capable of handling diverse payloads while ensuring operational efficiency and reliability. Hydrogen trucks have proven to be a game-changer in addressing these requirements, offering benefits that traditional diesel vehicles and other zero-emission alternatives struggle to match.

The municipal segment is expected to witness significant growth in the hydrogen trucks market over the forecast period, driven by increasing government initiatives to reduce carbon emissions, the adoption of clean energy solutions, and the need for efficient and sustainable vehicles in public services. Municipalities are actively transitioning their fleets to zero-emission alternatives to align with environmental goals and enhance operational efficiency in urban and peri-urban areas. In addition, hydrogen-powered trucks are well-suited for various municipal operations, including waste management, road maintenance, and emergency services. Their ability to deliver high performance, even in stop-and-go traffic typical of urban areas, ensures reliability and efficiency in fulfilling municipal duties.

Regional Insights

The North America hydrogen trucks market is witnessing growth due to several key drivers, which include policy initiatives, environmental concerns, advancements in hydrogen technology, and growing interest from the logistics sector. For instance, in May 2025, Cummins Inc., one of the leading engine manufacturers, announced plans to invest over USD 1 billion across its U.S. engine manufacturing network to support the transition to hydrogen fuel. This investment will upgrade facilities in Indiana, North Carolina, and New York to produce the industry's first fuel-agnostic engine platforms capable of operating on various low-carbon and zero-carbon fuels.

U.S. Hydrogen Trucks Market Trends

The hydrogen trucks industry in the U.S. is driven by the implementation of decarbonization goals, with several programs supporting hydrogen adoption. The Bipartisan Infrastructure Law allocates USD 8 billion for developing regional hydrogen hubs across the country, facilitating hydrogen production, storage, and refueling infrastructure. These hubs are designed to address critical challenges in scaling hydrogen as a viable energy solution, supporting its adoption in industries such as power generation, manufacturing, and transportation. Additionally, these hubs will also include investments in refueling stations, pipelines, and storage facilities. This infrastructure is vital for the hydrogen trucks market, as it ensures a consistent supply of hydrogen and convenient refueling options for fleet operators.

Asia Pacific Hydrogen Trucks Market Trends

The Asia Pacific hydrogen trucks industry dominated and accounted for 41.9% share of the global revenue in 2024. Many countries in the region, particularly China, Japan, and South Korea have made significant strides in adopting policies that promote clean energy technologies, including hydrogen. This includes government subsidies, incentives, and investments aimed at reducing carbon emissions and encouraging the transition to hydrogen-powered vehicles. Additionally, the development of hydrogen refueling infrastructure in Asia Pacific has been more advanced compared to other regions. Countries such as Japan and South Korea have made considerable investments in hydrogen stations and other related infrastructure, making the use of hydrogen trucks more feasible for businesses in the region.

China hydrogen trucks industry is driven by the integration of hydrogen in broader energy and environmental policies by the Government of China. These include financial incentives for manufacturers, subsidies for hydrogen vehicles, and the development of a national hydrogen infrastructure. For instance, Dongfeng Motor Corporation (DMC), one of China’s leading truck manufacturers, has partnered with local governments and the state-owned oil company Sinopec to launch pilot projects using hydrogen fuel cell trucks for logistics and freight operations. One notable initiative involved the deployment of hydrogen-powered trucks in Wuhan, with the goal of testing their viability in long-haul commercial transport.

The India hydrogen trucks industry is driven by government support and the launch of the National Hydrogen Mission in 2021, which has a vision to promote the production and use of green hydrogen across sectors, including transportation. This mission aims to make India a global hub for hydrogen production, focusing on clean and sustainable energy, including hydrogen-powered trucks. It supports research and development in fuel cell technology, and infrastructure development for hydrogen vehicles.

Europe Hydrogen Truck Market Trends

The Europe hydrogen trucks industry is anticipated to grow over the forecast period. The European Union (EU) has implemented ambitious targets under the European Green Deal, aiming for a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels. Specific mandates, such as the Euro 7 standards for heavy-duty vehicles, encourage the adoption of zero-emission alternatives like hydrogen trucks. Additionally, Europe is investing heavily in hydrogen infrastructure through programs such as the EU Hydrogen Strategy, which aims to install at least 40 gigawatts of electrolyzer capacity and produce 10 million tons of renewable hydrogen by 2030. Countries like Germany and France are leading with national hydrogen strategies and investments in refueling networks along major freight corridors.

The UK hydrogen trucks industry is positioning itself as a significant player in the market, driven by government policies, industry collaboration, and the need to decarbonize heavy-duty transportation. With ambitious targets to achieve net-zero emissions by 2050, the UK government has introduced several initiatives to support hydrogen adoption. The Hydrogen Strategy and the Ten Point Plan for a Green Industrial Revolution are pivotal in driving investment in hydrogen production, infrastructure, and innovation. These programs, along with the Net Zero Hydrogen Fund (NZHF) and the Zero Emission Road Freight Trials (ZERFT), aim to scale up hydrogen solutions, particularly for logistics and freight applications.

Germany hydrogen trucks industry is leading Europe in hydrogen refueling infrastructure, with over 100 hydrogen stations operational as of 2024, and plans to increase this number significantly by 2030. Initiatives such as the H2 Mobility Germany consortium and collaborations with European Union projects like Hydrogen Europe aim to establish refueling stations along key freight corridors. This focus on infrastructure addresses range anxiety and operational limitations for fleet operators. The country is also advancing renewable hydrogen production. Projects like HyPerformer and HyLand focus on local hydrogen production clusters, supporting regional hydrogen demand for transportation and industrial applications.

Key Hydrogen Truck Company Insights

The market is consolidated in nature. The market is in a growth stage, and the competition is anticipated to intensify over the forecast period. Prominent players are adopting various strategies, such as partnerships, strategic joint ventures, mergers & acquisitions, and geographical expansion, to cement their foothold in the market. In addition, players are investing in research and development (R&D) to improve the performance, efficiency, and cost-effectiveness of hydrogen trucks. This includes innovations in fuel storage, fuel cells, and lightweight materials. As the market matures, competition is expected to intensify further, with new entrants driving innovation, reducing costs, and expanding the adoption of hydrogen trucks in the global transportation sector.

-

Hyundai Motor Company is a South Korean multinational automotive manufacturer headquartered in Seoul, South Korea. The company’s portfolio includes passenger cars, commercial vehicles, and advanced green technologies, including electric and hydrogen-powered vehicles. The Hyundai XCIENT Fuel Cell is the world’s first mass-produced hydrogen-powered heavy-duty truck. The XCIENT Fuel Cell offers a range of up to 400 kilometers (248 miles) per refueling, making it suitable for regional and long-haul logistics.

-

Nikola Corporation is an American manufacturer specializing in hydrogen-powered trucks, electric vehicles (EVs), and related energy infrastructure. The company designs and manufactures Class 8 trucks powered by hydrogen fuel cells and battery-electric systems to cater to regional and long-haul freight markets. These trucks aim to reduce carbon emissions, address operational efficiency, and lower total costs of ownership for fleet operators.

Key Hydrogen Truck Companies:

The following are the leading companies in the hydrogen truck market. These companies collectively hold the largest market share and dictate industry trends.

- Hyundai Motor Company

- Nikola Corporation

- Daimler Truck AG (Mercedes-Benz Group AG)

- Volvo Group

- TRATON GROUP (MAN Truck & Bus SE)

- Scania

- PACCAR Holding B.V. (DAF)

- Dongfeng Motor Corporation

- Foton International

- Yutong International Holding Co., Ltd.

Recent Developments

-

In June 2024, Xuzhou Construction Machinery Group Co., Ltd., one of the leading Chinese construction equipment manufacturers, launched the EHSL552F, a hydrogen fuel cell dump truck designed to reduce greenhouse gas emissions in large-scale transportation projects such as mining operations. This development aligns with the company’s commitment to expanding its renewable energy fleet and promoting environmentally friendly practices within the construction and mining industries.

-

In April 2024, MAN Truck & Bus SE introduced the MAN hTGX, a hydrogen combustion engine truck. The hTGX is designed for specific heavy-duty applications, such as transporting construction materials, timber, and heavy goods. It features the H45 hydrogen combustion engine, providing a power output of 383 kW and a range of up to 600 kilometers. This hydrogen-powered truck can be refueled in under 15 minutes and operates as a zero-emission vehicle, supporting the EU’s stringent CO2 regulations

Hydrogen Truck Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.17 billion

Revenue forecast in 2030

USD 15.10 billion

Growth Rate

CAGR of 23.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Vehicle, fuel cell technology, range, motor power, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Hyundai Motor Company; Nikola Corporation; Daimler Truck AG (Mercedes-Benz Group AG); Volvo Group; TRATON GROUP (MAN Truck & Bus SE); Scania; PACCAR Holding B.V. (DAF); Dongfeng Motor Corporation; Foton International; Yutong International Holding Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Truck Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydrogen truck market report based on vehicle, fuel cell technology, range, motor power, application, and region.

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heavy-duty trucks

-

Medium-duty trucks

-

Small-duty trucks

-

-

Fuel Cell Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

PEMFC

-

SOFC

-

-

Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Upto 300 miles

-

300-500 miles

-

Above 500 miles

-

-

Motor Power Outlook (Revenue, USD Billion, 2018 - 2030)

-

Upto 200 Kw

-

200-400 Kw

-

Above 400 Kw

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Logistics and Transport

-

Municipal

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydrogen truck market size was estimated at USD 4.29 billion in 2024 and is expected to reach USD 5.17 billion in 2025.

b. The global hydrogen truck market is expected to grow at a compound annual growth rate of 23.9% from 2025 to 2030 to reach USD 15.10 billion by 2030.

b. Asia Pacific dominated the hydrogen truck market with a share of 41.9% in 2024. Many countries in the region, particularly China, Japan, and South Korea have made significant strides in adopting policies that promote clean energy technologies, including hydrogen.

b. Some key players operating in the hydrogen trucks market include Hyundai Motor Company; Nikola Corporation; Daimler Truck AG (Mercedes-Benz Group AG); Volvo Group; TRATON GROUP (MAN Truck & Bus SE); Scania; PACCAR Holding B.V. (DAF); Dongfeng Motor Corporation; Foton International; Yutong International Holding Co., Ltd.

b. Key factors that are driving the market growth include stringent emission regulations and push for green transportation, and advancements in hydrogen fueling infrastructure and technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.