- Home

- »

- Consumer F&B

- »

-

Ice Cream Parlor Market Size, Share & Growth Report, 2030GVR Report cover

![Ice Cream Parlor Market Size, Share & Trends Report]()

Ice Cream Parlor Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Traditional Ice Cream, Artisanal Ice Cream), By Type (Independent, Branded/Franchise), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-102-0

- Number of Report Pages: 93

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ice Cream Parlor Market Summary

The global ice cream parlor market size was estimated at USD 11,530.1 million in 2022 and is projected to reach USD 17,202.4 million by 2030, growing at a CAGR of 5.1% from 2023 to 2030. With changing consumer preferences and an increasing focus on indulgent and high-quality desserts, premium ice cream has become a popular choice among consumers.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

- Country-wise, Spain is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, branded/franchise accounted for a revenue of USD 6,912.5 million in 2022.

- Branded/Franchise is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 11,530.1 Million

- 2030 Projected Market Size: USD 17,202.4 Million

- CAGR (2023-2030): 5.1%

- Asia Pacific: Largest market in 2022

Ice cream is no longer considered a mere indulgence but has become a versatile dessert catering to a wide range of dietary requirements and preferences. The industry has witnessed a surge in demand for low-fat, low-sugar, and lactose-free options, as well as vegan and plant-based alternatives, providing consumers with more choices than ever before.

Moreover, the expansion of distribution channels and the advent of e-commerce have significantly contributed to market growth. The availability of ice cream through online platforms has made it easier for consumers to access a wide variety of flavors and brands, eliminating geographical barriers. The introduction of innovative flavors, formats, and packaging has also played a crucial role in driving market growth. Manufacturers are constantly striving to offer unique and enticing flavors, incorporating global and local inspirations, as well as experimenting with textures and ingredients. This continuous innovation not only attracts new consumers but also encourages existing consumers to explore new options and expand their preferences.

In April 2023, Milky Mist Dairy, an Indian manufacturer of dairy products, launched a new range of premium ice creams with classic and exotic flavors made from high-quality ingredients in various package sizes. The company's state-of-the-art factories have partnered with milk suppliers and farmers, reducing lead time and procurement costs. Social media platforms have played a significant role in driving the demand for innovative ice cream flavors. Customers now share their unique experiences and visually appealing creations on various online platforms, generating excitement and curiosity. This encourages ice cream parlors to continually introduce new and exciting flavors to attract customers, stay relevant, and generate buzz in the digital sphere.

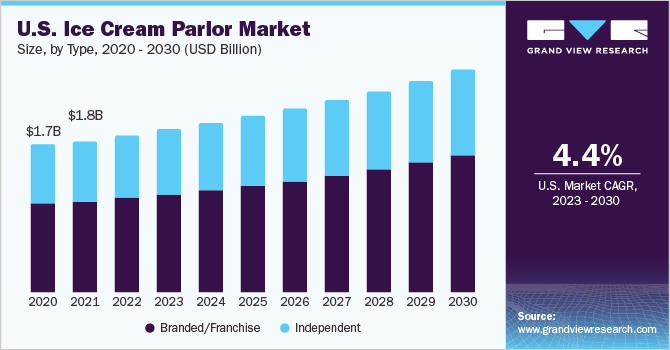

Type Insights

The branded/franchise segment held the largest market share of 60.0% in 2022 and is expected to maintain dominance over the forecast period. It is projected to grow with a CAGR of 5.4% from 2023 to 2030. Branded/franchise ice cream parlors are part of a larger chain or franchise that operates with stores in multiple locations. They usually have a well-known brand name associated with them, such as Baskin-Robbins, Ben & Jerry's, Cold Stone Creamery, or Dairy Queen. Branded ice cream parlors often offer consistent flavors, menu items, and overall experience across their locations. A franchise typically receives support and guidelines from the parent company in terms of operations, branding, and marketing. Branded parlors benefit from strong brand recognition and customer loyalty. Consumers are often familiar with the brand and its offerings, which can lead to higher initial adoption rates.

They often have multiple locations, including outlets in popular shopping areas, malls, and entertainment centers. This widespread availability makes their products easily accessible to a larger customer base, increasing the potential for product adoption. Independent parlors accounted for a market share of approximately 40% in 2022. Independent ice cream parlors are standalone establishments that are not part of a larger chain or franchise. These parlors are typically locally owned and operated. They have more freedom to create their unique flavors, menu items, and overall ambiance. Independent parlors often focus on using high-quality ingredients and may have a more artisanal or gourmet approach to their ice cream offerings. They can provide a personalized experience and may have a stronger connection with the local community.

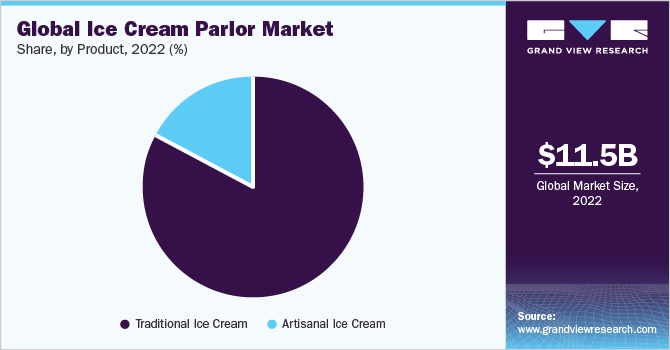

Product Insights

The traditional ice cream segment led the market and accounted for more than 80% share of the global revenue in 2022. Traditional ice creams are the classic and widely popular frozen treats that have been enjoyed for generations. They are typically made using a base of milk, cream, sugar, and flavorings. The production process involves pasteurizing the ingredients, churning them in an ice cream maker, and freezing the mixture to achieve a creamy texture. Traditional ice creams come in a variety of flavors, such as vanilla, chocolate, strawberry, and mint chocolate chip. They often have a smooth and consistent texture and are known for their nostalgic appeal.

Artisanal ice cream is anticipated to grow with a CAGR of 6.0% from 2023 to 2030. Artisanal ice creams are a more recent trend in the market, focusing on craftsmanship, unique flavors, and high-quality ingredients. Artisanal ice creams are handcrafted in smaller batches by skilled artisans using traditional methods and recipes. They mainly emphasize creativity, innovation, flavor combinations, and presentation. Artisanal ice creams tend to include high-quality ingredients, such as fresh fruits, natural flavors, and locally sourced or organic products. They may have fewer or no artificial additives.In May 2023, Naturals, a renowned artisanal ice cream chain in India, introduced a unique ice cream flavor called Meetha Paan for the summer season. This creation combines fresh betel leaves, milk, and sugar, resulting in a classic treat that captures the essence of Naturals' artisanal craftsmanship.

Regional Insights

The market in Asia Pacific is anticipated to grow at a CAGR of 6.0% from 2023 to 2030 and it accounted for a revenue share of more than 40% in 2022. The Asia Pacific market is characterized by an increasing demand for high-end ice creams. The changing consumption habits of consumers and the vast diversity in the region have led to the demand for varied flavor combinations and innovative ice creams. The region has also witnessed the introduction of new brands to the market, which has led to positive competition in the industry. For instance, Chicecream, founded in 2018, is a premium ice cream brand in China that focuses on high-end and creative ice creams. Chicecream was the No. 1 brand in terms of sales in the ice product sector on Tmall in 2020 and 2021.

It is also immensely popular at China's annual Double 11 and 618 shopping festivals. Rising product prices caused by inflation and the growing need to become viral on the internet—are likely to hamper sales at parlors. This is particularly true in China, which is one of the largest ice cream markets in the world. Therefore, recently introduced ice cream brands such as Chicecream now account for a significant share of the high-end ice cream market in China due to the high prices of previously leading players like Häagen-Dazs. Europe was the second largest contributor in the global market for ice cream parlors with a share of around 30% in 2022.

Europe ice cream parlor industry is mainly driven by innovation in ice creams and new product development. Italy, Germany, the UK, France, Spain, and the Netherlands are among the key countries in Europe in terms of ice cream consumption. Gelato ice creams are gaining popularity globally, but the demand for gelato ice creams is fast-growing in Europe. Gelato ice cream brands in Europe are expanding their presence across countries. For instance, in February 2023, Italian gelato brand Amorino announced the expansion of its UK franchise via a partnership with food franchise specialist Seeds Consulting. The brand has been a recipient of many awards for its focus on organic flavors and emphasis on environment-friendly production methods.

Key Companies & Market Share Insights

The market comprises companies with a stronghold in the ice cream parlor business and is still developing, where new entrants are launching products.The industry is known for its constant innovation and product launches that cater to diverse consumer tastes and preferences. From unique flavors to inventive formats, manufacturers continuously strive to captivate ice cream enthusiasts with new offerings. For instance:

-

In June 2023, Ben & Jerry’s came together with The Entrepreneurial Refugee Network (TERN) to craft a fresh flavor called Sunny Honey Home. This unique blend is specifically designed to raise funds and provide support for the entrepreneurial endeavors of refugees in the UK.

-

In May 2023, Baskin-Robbins re-opened its parlor in Bay City, Michigan. The store was closed in December 2022 and was seeking new owners to take over. The re-opened store is witnessing colossal traffic and customer demand ever since

-

In May 2023, Dairy Queen announced to launch of its new blizzard flavor ‘cake cookie batter dough’ in June

-

In February 2023, Cold Stone Creamery, in collaboration with Reese, launched Reese-inspired ice creams like Reese’s Take 5 peanut butter ice cream and Reese’s Peanut Butter Cup ice cream. The company also launched marshmallow-flavored ice cream

-

In July 2022, Amorino launched three organic flavors for sorbets: tangerine acerola, blueberry açai, and blood orange ginger

-

In April 2022, Baskin-Robbins got a logo makeover and updated its employee uniforms. The new logo was designed to cater to adult customers and widen its target audience

Some of the key players in the global ice cream parlor market include:

-

Baskin-Robbins

-

D.Q. Corp.

-

Cold Stone Creamery (Kahala Franchising, LLC.).

-

Ben & Jerry's Homemade, Inc.

-

Häagen-Dazs

-

Amorino

-

Ghirardelli Chocolate Company

-

Marble Slab Creamery

-

Cream Stone

-

Natural Ice Creams

Ice Cream Parlor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.04 billion

Revenue forecast in 2030

USD 17.20 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Baskin-Robbins, D.Q. Corp.; Cold Stone Creamery (Kahala Franchising, LLC.); Ben & Jerry's Homemade Inc.; Häagen-Dazs; Amorino; Ghirardelli Chocolate Company; Marble Slab Creamery; Cream Stone; Natural Ice Creams

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ice Cream Parlor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ice cream parlor market report on the basis of type, product, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Branded/Franchise

-

Independent

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Traditional Ice Cream

-

Artisanal Ice Cream

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ice cream parlor market size was estimated at USD 11.53 billion in 2022 and is expected to reach USD 12.04 billion in 2023.

b. The global ice cream parlor market is expected to grow at a compounded growth rate of 5.1% from 2023 to 2030 to reach USD 17.20 billion by 2030.

b. Asia Pacific Region dominated the global ice cream parlor market with a share of 41.02% in 2022. This is attributed to the changing consumption habits of consumers and the vast diversity in the region has led to the demand for varied flavor combinations and innovative ice creams.

b. Some key players operating in the ice cream parlor market include Baskin-Robbins, D.Q. Corp., Cold Stone Creamery (Kahala Franchising, LLC.), Ben & Jerry's Homemade, Inc., Häagen-Dazs, Amorino, Ghirardelli Chocolate Company, Marble Slab Creamery, Cream Stone, Natural Ice Creams.

b. Key factors that are driving the market growth include increasing focus on indulgent and high-quality desserts, premium ice cream has become a popular choice among ice cream enthusiasts. The availability of ice cream through online platforms has made it easier for consumers to access a wide variety of flavors and brands, eliminating geographical barriers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.