- Home

- »

- Next Generation Technologies

- »

-

In-car Wireless Charging Market Size, Industry Report, 2033GVR Report cover

![In-car Wireless Charging Market Size, Share & Trends Report]()

In-car Wireless Charging Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Inductive Charging, Resonant Charging), By Device Type (Smartphones, Tablets), By Vehicle Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-786-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In-car Wireless Charging Market Summary

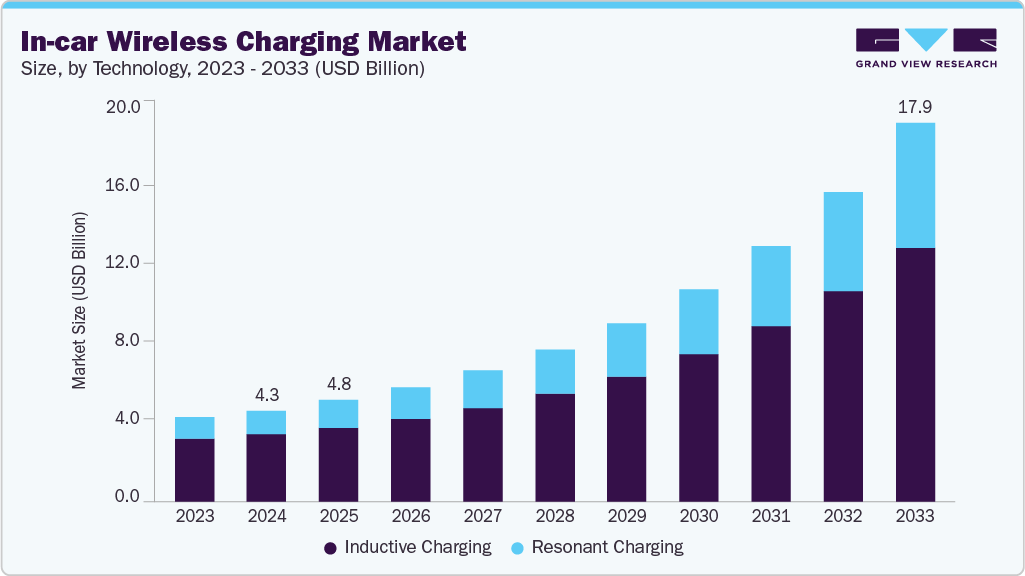

The global in-car wireless charging market size was estimated at USD 4.34 billion in 2024 and is projected to reach USD 17.98 billion by 2033, growing at a CAGR of 17.9% from 2025 to 2033. The in-car wireless charging industry has been driven by the growing consumer preference for convenience, connectivity, and seamless integration of smart technologies within vehicles.

Key Market Trends & Insights

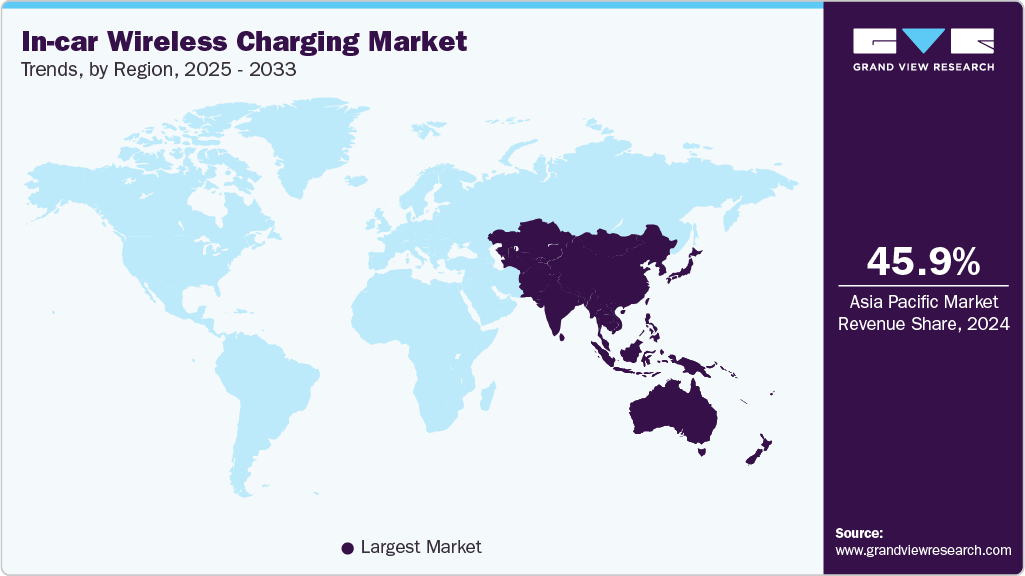

- Asia Pacific dominated the in-car wireless charging market with the largest revenue share of 45.9% in 2024

- By technology, the inductive charging segment led the market with the largest revenue share of 73.8% in 2024.

- By device type, the smartphones segment accounted for the largest market revenue share in 2024.

- By vehicle type, the fuel-based vehicle accounted for the largest market revenue share in 2024.

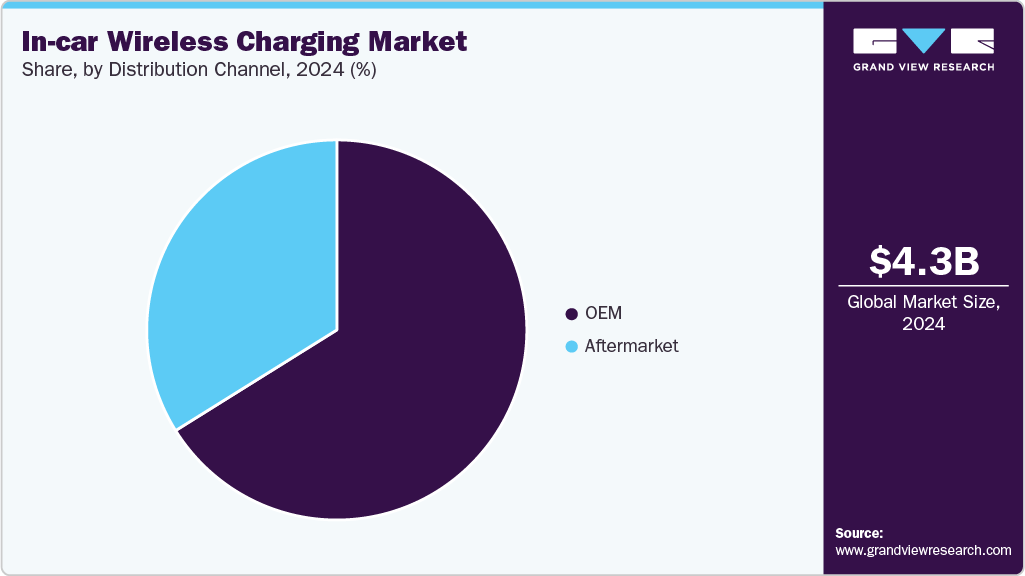

- By distribution channel, the OEM segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.34 Billion

- 2033 Projected Market Size: USD 17.98 Billion

- CAGR (2025-2033): 17.9%

- Asia Pacific: Largest market in 2024

The increasing adoption of smartphones and connected devices, combined with the rising demand for electric and hybrid vehicles, has accelerated the incorporation of wireless charging systems in automotive interiors. Automakers have been motivated to enhance user experience and reduce cable clutter by embedding inductive charging pads into dashboards, armrests, and center consoles. The shift toward advanced infotainment and digital cockpit systems has reinforced the inclusion of wireless charging as a standard feature across premium and mid-range vehicle models. Furthermore, the global transition toward connected and intelligent vehicles has significantly boosted the adoption of in-car wireless charging systems.

The standardization of wireless charging protocols, particularly through Qi certification, has been a major growth factor for the market. The adoption of Qi-based technology has ensured interoperability and reliability, allowing consumers to charge various devices seamlessly, regardless of brand or model. This alignment with global standards has been instrumental in increasing OEM confidence and accelerating large-scale implementation across vehicle models. The establishment of unified standards by organizations such as the Wireless Power Consortium (WPC) has also minimized compatibility risks and simplified product integration. Automakers continuing to prioritize user experience and safety compliance has led to the expansion of Qi-certified components, which is expected to strengthen the market’s technological foundation and drive its scalability.

Technological innovation has played a crucial role in driving the growth of in-car wireless charging industry. Continuous improvements in resonant and inductive charging technologies have enabled faster charging speeds, higher energy efficiency, and lower power loss compared to previous generations. Manufacturers have focused on refining coil alignment, optimizing magnetic resonance, and integrating advanced temperature management mechanisms to ensure performance consistency. The introduction of multi-coil configurations has also supported simultaneous charging of several devices inside vehicles. These developments have enhanced system reliability and positioned in-car wireless charging as a vital feature for modern vehicles.

A key challenge in the in-car wireless charging industry has been the high cost of integration and the technical limitations associated with the technology. The implementation of wireless charging systems in vehicles requires precise alignment of coils, advanced power electronics, and robust thermal management, which increases production complexity and expenses. In addition, charging efficiency remains lower than that of wired alternatives, and variations in device compatibility have limited consumer adoption. The need to maintain safety standards while embedding wireless charging modules into diverse vehicle architectures has further constrained rapid deployment. These factors have created barriers for widespread adoption, particularly in entry-level and mid-range vehicles, slowing the overall market growth despite rising demand.

Technology Insights

The inductive charging segment led the market with the largest revenue share of 73.8% in 2024. The growth of the inductive charging segment has been driven by its mature technology and widespread adoption in automotive applications. Inductive systems have been increasingly embedded into dashboards, center consoles, and armrests, providing reliable and convenient device charging for smartphones, wearables, and other portable electronics. OEMs have prioritized inductive charging due to its proven efficiency, safety compliance, and ease of integration into existing vehicle architectures. Furthermore, the increasing number of Qi-enabled devices has reinforced the adoption of inductive charging systems, as they offer a standardized, cost-effective solution that meets consumer expectations for seamless in-cabin power delivery.

The resonant charging segment is expected to grow at the fastest CAGR over the forecast period. The segment’s growth can be attributed to its ability to deliver higher power transfer over variable distances and support multiple devices simultaneously. The technology has been increasingly deployed in electric and hybrid vehicles to provide flexible, cable-free charging for smartphones, tablets, and future smart devices. Automakers and technology providers have focused on resonant systems to enhance user convenience and enable multi-coil or multi-device configurations, which are difficult to achieve with traditional inductive solutions. In addition, ongoing R&D efforts aimed at improving efficiency, reducing electromagnetic interference, and integrating smart control features have positioned resonant charging as a critical technology for the next generation of connected vehicle ecosystems.

Device Type Insights

The smartphones segment accounted for the largest market revenue share in 2024. The growth of the smartphone segment has been driven by the ubiquity of mobile devices and increasing consumer demand for convenience. Smartphones have become essential for navigation, communication, and entertainment, making an uninterrupted in-cabin power supply a priority for vehicle owners. Automakers have integrated wireless charging pads into dashboards, center consoles, and armrests to meet these expectations, particularly in premium and mid-range vehicles. Consumer preference for clutter-free interiors and cable-free charging experiences has reinforced the adoption of wireless smartphone charging solutions in vehicles.

The other devices segment is expected to grow at the fastest CAGR of 14.7% during the forecast period. The other devices include wearables and portable accessories. The segment’s growth has been supported by the rise of multi-device usage and connected lifestyles. Vehicle owners increasingly seek the ability to charge multiple devices simultaneously, prompting automakers to offer multi-coil charging pads and advanced resonant charging systems. The expansion of device ecosystems, including smartwatches, earbuds, and portable gaming devices, has increased demand for flexible in-car charging solutions. Furthermore, advancements in charging efficiency, automatic device recognition, and safety features have enhanced consumer confidence, driving broader adoption of wireless charging for secondary devices alongside primary smartphones.

Vehicle Type Insights

The fuel-based vehicle segment accounted for the largest market revenue share in 2024. The growth of the segment is driven by the ongoing demand for convenience and digital integration in conventional cars. Vehicle owners have increasingly sought clutter-free, cable-free charging solutions for smartphones and other portable devices, particularly in mid-range and premium segments. Automakers have responded by integrating inductive charging pads into dashboards, center consoles, and armrests, enhancing the in-cabin user experience. In addition, the existing high volume of fuel-based vehicles on roads has provided a broad base for aftermarket wireless charging solutions, enabling retrofitting and adoption without the need for full vehicle redesign. These factors have collectively supported market growth despite the gradual shift toward electrification.

The electric vehicle segment is expected to grow at the fastest CAGR during the forecast period. The expanding EV market and the increasing emphasis on integrated digital ecosystems drive the growth of the segment. EV manufacturers have adopted wireless charging as a key feature to complement the modern, connected vehicle experience, reducing reliance on cables and enhancing convenience for drivers. Resonant and inductive charging systems have been deployed to enable multi-device charging, improved efficiency, and smart power management, aligning with EV energy optimization strategies. In addition, consumer expectations for premium, tech-enabled interiors in EVs have encouraged OEMs to embed wireless charging systems as standard features, thereby driving the segment’s growth.

Distribution Channel Insights

The OEM segment accounted for the largest market revenue share in 2024. The growth of the OEM segment has been driven by the increasing integration of charging systems into new vehicle models. Automakers have prioritized providing advanced in-cabin features to enhance user convenience and differentiate their offerings in competitive markets. Wireless charging pads are increasingly being embedded into dashboards, center consoles, and armrests during the manufacturing process, particularly in premium and mid-range vehicles. These factors have reinforced OEMs as the primary channel for delivering wireless charging solutions to end consumers, enabling widespread adoption directly at the point of sale.

The aftermarket segment is expected to witness at the fastest CAGR over the forecast period. The growth of the aftermarket segment has been supported by the rising consumer demand for retrofitting older vehicles with wireless charging capabilities. Vehicle owners are increasingly seeking the convenience of cable-free charging for smartphones, tablets, and other portable devices, even in cars that were not originally equipped with charging pads. Advances in compact, easy-to-install charging solutions have made retrofitting simpler and more cost-effective, encouraging adoption. In addition, the aftermarket provides flexibility for multi-device charging and integration of advanced features, such as smart charging detection and temperature regulation. This segment has experienced growth in both developed and emerging markets, driven by vehicle longevity, consumer convenience trends, and the increasing popularity of wireless charging technology across device types.

Regional Insights

The in-car wireless charging market in North America is expected to grow at a notable CAGR during the forecast period, driven by increasing demand for connected and smart vehicles. Automakers have prioritized the integration of wireless charging systems in premium and mid-range vehicles to meet consumer expectations for convenience and a clutter-free cabin experience.

U.S. In-Car Wireless Charging Market Trends

The in-car wireless charging market in U.S. accounted for the largest market revenue share in North America in 2024, due to high vehicle electrification rates and consumer affinity for smart technology features. OEMs have been increasingly embedding wireless charging pads in dashboards and center consoles of new vehicle models. The growth is further supported by government incentives for electric vehicles, coupled with a robust automotive R&D ecosystem focused on connected mobility.

Asia Pacific In-Car Wireless Charging Market Trends

Asia Pacific dominated the in-car wireless charging market with the largest revenue share of 45.9% in 2024, driven by rapid automotive production, increasing adoption of electric vehicles, and high consumer demand for connected technologies. Countries in the region have experienced substantial growth in smartphone penetration and IoT-enabled devices, creating strong demand for wireless charging solutions within vehicles.

The in-car wireless charging market in India is expected to grow at the fastest CAGR during the forecast period, due to the rising adoption of electric vehicles and increased smartphone penetration. OEMs have been introducing wireless charging pads in premium and mid-range vehicles to cater to urban consumers seeking convenience and connectivity. The aftermarket segment is also gaining traction as vehicle owners retrofit older models with inductive charging solutions.

The China in-car wireless charging market held a substantial market share in 2024, supported by its large automotive base and rapid electric vehicle adoption. Chinese automakers have been integrating wireless charging solutions into new EV and hybrid models to enhance the in-cabin digital experience. The high smartphone penetration rate and consumer preference for connected vehicle features have accelerated adoption.

Europe In-Car Wireless Charging Market Trends

The in-car wireless charging market in Europe is expected to register at a moderate CAGR from 2025 to 2033. Europe has demonstrated strong adoption of in-car wireless charging, driven by stringent regulations promoting electric mobility and energy efficiency. Premium vehicle manufacturers in Germany, the UK, and other European countries have been incorporating wireless charging systems into high-end and mid-range models. Consumers’ preference for seamless device connectivity and cable-free convenience has reinforced adoption.

The UK in-car wireless charging market is expected to grow at a significant CAGR from 2025 to 2033. The market growth is driven by rising electric vehicle penetration and consumer demand for advanced in-cabin features. Automakers have been focusing on integrating inductive charging pads and multi-device charging systems in new vehicle models to enhance the user experience. The aftermarket segment has also contributed to growth, allowing retrofitting of wireless charging solutions into existing vehicles.

The in-car wireless charging market in Germany held a substantial market share in 2024. Germany, as a hub of automotive innovation, has become a key market for in-car wireless charging solutions. Leading OEMs have been integrating advanced wireless charging systems in both electric and premium conventional vehicles to meet consumer expectations for convenience and technological sophistication. The increasing adoption of EVs and supportive government policies for sustainable mobility have positioned Germany as a strategic market for wireless charging technology in Europe.

Key In-Car Wireless Charging Company Insights

Some of the key companies in the in-car wireless charging industry include Powermat Technologies Ltd., Infineon Technologies AG and Ericsson, among others. These companies are continuously investing in research and development to enhance charging efficiency, safety, and multi-device compatibility. Strategic partnerships between automakers and wireless charging technology companies have become a key competitive strategy to accelerate integration into new vehicle models.

-

Powermat Technologies Ltd. is a global provider of wireless charging platforms, bringing wireless power technology to consumers worldwide. The company specializes in inductive charging solutions and has partnered with major automotive manufacturers to integrate its technology into vehicles. Powermat's wireless charging technology is embedded in over 8 million vehicles globally, supporting devices such as smartphones, wearables, and other Qi-enabled devices. The company offers turnkey solutions for automotive OEMs, including system hardware design, integration, and support.

-

Infineon Technologies AG is a German semiconductor manufacturer that provides innovative solutions for in-cabin wireless charging in the automotive sector. The company offers turnkey system solutions, including wireless charging ICs, power MOSFETs, and secure elements, to deliver secure and efficient automotive wireless charging experiences.

Key In-Car Wireless Charging Companies:

The following are the leading companies in the in-car wireless charging market. These companies collectively hold the largest market share and dictate industry trends.

- Powermat

- Aircharge

- Infineon Technologies AG

- Mojo Mobility Inc.

- Wieson Automotive Co., Ltd.

- Monolithic Power Systems, Inc.

- Zens

- Molex

- General Motors

- Scosche

Recent Developments

-

In October 2025, Anker introduced its new Prime Wireless Car Charger series (MagGo, AirCool, Pad) in Europe. Currently available in a single country, the product is expected to expand to additional markets soon. Key features include a TEC cooling system, a Qi2-certified wireless charging pad, and a range of complementary accessories.

In-Car Wireless Charging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.82 billion

Revenue forecast in 2033

USD 17.98 billion

Growth rate

CAGR of 17.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, device type, vehicle type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Powermat; Aircharge; Infineon Technologies AG; Mojo Mobility Inc.; Wieson Automotive Co., Ltd.; Monolithic Power Systems, Inc.; Zens; Molex; General Motors; Scosche

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-car Wireless Charging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global in-car wireless charging market report based on technology, device type, vehicle type, distribution channel, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Inductive Charging

-

Resonant Charging

-

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Smartphones

-

Tablets

-

Other Devices

-

-

Vehicle Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Fuel-based Vehicle

-

Electric Vehicle

-

Hybrid Vehicle

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-car wireless charging market size was estimated at USD 4.34 billion in 2024 and is expected to reach USD 4.82 billion in 2025.

b. The global in-car wireless charging market is expected to grow at a compound annual growth rate of 17.9% from 2025 to 2030 to reach USD 17.98 billion by 2030.

b. The inductive charging segment dominated the market in 2024 and accounted for the largest share of 73.8%. The growth of inductive charging segment has been driven by its mature technology and widespread adoption in automotive applications.

b. Some key players operating in the in-car wireless charging market include Powermat, Aircharge, Infineon Technologies AG, Mojo Mobility Inc., Wieson Automotive Co., Ltd., Monolithic Power Systems, Inc., Zens, Molex, General Motors, and Scosche.

b. The in-car wireless charging market has been driven by the growing consumer preference for convenience, connectivity, and seamless integration of smart technologies within vehicles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.