- Home

- »

- Advanced Interior Materials

- »

-

In-Mold Labels Market Size, Share And Growth Report, 2030GVR Report cover

![In-Mold Labels Market Size, Share & Trends Report]()

In-Mold Labels Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PE, PP, PVC, ABS), By Production Process, By Printing Technology, By Application (Food & Beverages, Consumer Goods), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-246-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

In-Mold Labels Market Summary

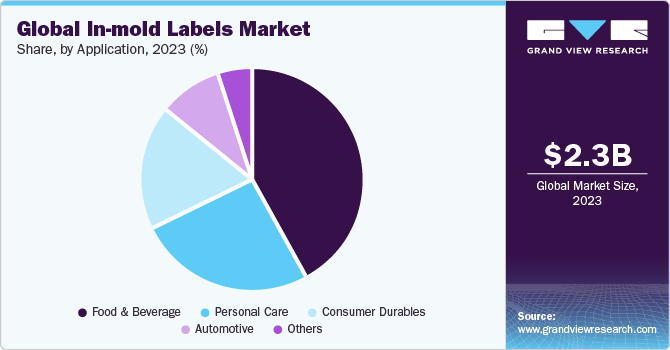

The global in-mold labels market size was estimated at USD 2.31 billion in 2023 and is projected to reach USD 3.14 billion by 2030, growing at a CAGR of 4.6% from 2024 to 2030. Increasing focus on the presentation of products, along with rising demand for aesthetically appealing packaging, and rising consumer preference for sustainable packaging, are a few key factors propelling market growth.

Key Market Trends & Insights

- The North America dominated the global industry in 2023 and accounted for the largest revenue share of 36.4%.

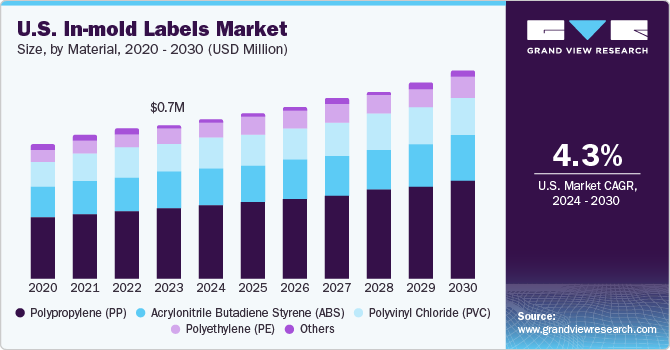

- The U.S. in-mold labels market is expected to witness significant growth from 2024 to 2030 due to the expanding packaging sector.

- Based on materials, the PP segment dominated the market with a share of 47.2% in 2023.

- Based on production process, the injection molding dominated the production process segment and accounted for a revenue share of more than 57.1% in 2023.

- Based on printing technology, the flexography printing segment dominated the market and accounted for a revenue share of over 52.45% in 2023.

- Based on application, the food & beverages segment dominated the market and accounted for the largest revenue share of over 41.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.31 Billion

- 2030 Projected Market Size: USD 3.14 Billion

- CAGR (2024-2030): 4.6%

- North America: Largest market in 2023

In-mold label is a high-growth labeling technology in which pre-printed labels are inserted into a packaging mold during a container’s manufacturing process, creating a fully recyclable, cost-effective, durable, and consistent product. In-mold labeling provides a versatile solution for packaging with its ability to offer high-quality graphics and branding opportunities.

Changing consumer preferences, including demand for convenience, product differentiation, and premium packaging experiences, are driving the adoption of in-mold labeling. The ability of in-mold labels to provide vibrant graphics and 3D effects enhances product visibility and attractiveness on retail shelves, thus influencing consumer purchasing decisions. Considering all these factors, the market is expected to grow at a rapid pace as manufacturers increasingly recognize the benefits of this labeling method and consumers continue to demand innovative and sustainable packaging solutions.

With growing environmental concerns, there is a heightened focus on sustainable packaging solutions. In-mold labeling aligns well with this trend as it reduces the need for secondary packaging materials and can be recycled along with the container, contributing to overall packaging sustainability efforts. Stringent regulations regarding labeling and packaging materials have also contributed to the market growth. In-mold labels can comply with regulatory requirements regarding food contact materials and recyclability, making them a preferred choice for many manufacturers.

In September 2023, SABIC partnered with three specialists namely Dubai-based film supplier Taghleef Industries Group, Greek firm printing specialist Stephanos Karydakis IML S.A., and injection molder Kotronis Packaging to create a single-step IML technology with a seamless part decoration right in the injection mold. This partnership will demonstrate the use of certified renewable polypropylene (PP) resins in high-quality mono-PP thin-wall container packaging. Single-step IML technology achieves a seamless part decoration right in the injection mold, where the label becomes an integral component of the packaging itself.

In April 2023, Scantrust, a leading software provider for QR-code-based compliance, traceability, and anti-counterfeiting solutions, announced a strategic partnership with Multi-Color Corporation (MCC). The new strategic partnership is aimed at helping wine producers all over the world comply with the newest EU wine labeling regulations. Scantrust’s software and experience using QR codes on products is combined with MCC’s expertise in label production and global presence to deliver an e-label solution that is easy to use & implement and assists with compliance for wine producers.

Market Concentration & Characteristics

Prominent players operating in the market include Multi-Color Corporation (MCC), CCL Industries Inc., Taghleef Industries Inc., Constantia Flexibles GmbH, Coveris Holdings, Cenveo Inc., Fuji Seal International Inc., EVCO Plastics, Fort Dearborn Company, John Herrod & Associates, Inland Packaging, Aspasie Inc., General Press Corporation, Smyth Companies LLC, and Huhtamaki Group.

The global in-mold labels market is fragmented with the presence of a significant number of packaging manufacturers. Companies operational in this market space are focusing on mergers and acquisitions to maintain their share. For instance, In October 2023, Multi-Color Corporation (MCC) acquired Greece-based Stephanos Karydakis IML SA, a leading provider of in-mold label (IML) solutions. The new business will be known as MCC Karydakis. The acquisition expands its position in Europe and Middle East & Africa.

In July 2023, CCL Industries Inc., a world leader in specialty label, security, and packaging solutions for global corporations, acquired privately held Creaprint S.L., based in Alicante, Spain. Creaprint is a specialist in mold label production with a manufacturing facility in Alicante, Spain, and a sales office in Miami, Florida, U.S. for USD 38.1 million. The entity will now trade as CCL Label, Spain, and become an integral part of the Food & Beverage unit in Europe.

Material Insights

Based on materials, the market is segmented into polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polystyrene (PS), acrylonitrile butadiene styrene (ABS), and others. The PP segment dominated the market with a share of 47.2% in 2023, as polypropylene possesses higher toughness, chemical resistance, and adaptability, it is highly utilized for the manufacturing of in-mold labels utilized across industries including packaging, food & beverages, household goods, personal care, and others.

Acrylonitrile butadiene styrene is also a key segment of the market as it has a smooth surface that allows for excellent printability. In-mold labels require precise and high-quality printing to ensure clear and vibrant graphics. ABS facilitates the adherence of inks and coatings, resulting in sharp and durable prints on the label. It is also resistant to a wide range of chemicals, including solvents and oils.

Production Process Insights

Injection molding dominated the production process segment and accounted for a revenue share of more than 57.1% in 2023. In this process, molten plastic material is injected into a mold cavity containing the label. The label fuses with the plastic substrate during the molding cycle, resulting in a seamless integration of the label with the container or product. Injection molding allows for precise and high-speed production of in-mold labeled products, making it suitable for high-volume manufacturing.

The thermoforming production process is expected to register a significant growth rate of 3.6% from 2024 to 2030. It is mainly used for applications requiring large and shallow containers or products. In thermoforming, a plastic sheet is heated until it becomes pliable and then formed into the desired shape using a mold. A label is placed in the mold before the plastic sheet is formed, allowing it to bond with the substrate during the forming process. Thermoforming is often used for packaging applications in industries such as food and beverage, where large, shallow containers are common.

Printing Technology Insights

Based on printing technology, the market is segmented into flexography printing, offset printing, gravure printing, digital printing, and others. Flexography printing dominated the market and accounted for a revenue share of over 52.45% in 2023. Flexography printing is commonly used in the production of in-mold labels (IML) due to its suitability for printing on flexible substrates like plastic films or paper.

Digital printing and other products are expected to progress with a significant CAGR of 4.3% from 2024 to 2030. Digital printing technologies enable high-resolution printing with vibrant colors and intricate details. This allows for the reproduction of complex designs, photographic images, and variable data with exceptional clarity and precision. Digital printing eliminates the need for printing plates, resulting in faster setup times and reduced costs for short to medium-print runs.

Application Insights

Food & beverages dominated the application segment and accounted for the largest revenue share of over 41.3% in 2023. This positive outlook is due to the growing demand for packaged food products and the requirement for sturdy packaging products to protect food during transit. Furthermore, the growth of the online food delivery industry is expected to contribute to the dominance of the food segment in the market. In-mold labeling offers several advantages over traditional labeling methods, such as pressure-sensitive labeling or sleeve labeling. These include improved durability, resistance to wear & tear, and enhanced aesthetics.

As a result, many industries, including food & beverage, cosmetics, and consumer goods, are increasingly adopting in-mold labeling for their products. The consumer durables application segment is expected to progress with a CAGR of 4.4% from 2024 to 2030. Technological advancements in printing and labeling equipment have made in-mold labeling more efficient and cost-effective. Automation and digital printing technologies have improved the speed and quality of in-mold labeling processes, making them more attractive to manufacturers.

Regional Insights

The in-mold labels market in North America dominated the global industry in 2023 and accounted for the largest revenue share of 36.4%. Changing dietary habits, rapid urbanization, and the convenience factor are driving the consumption of packaged foods and beverages in North America. As a result, there's a growing demand for aesthetically appealing and informative packaging solutions. In-mold labels not only enhance the visual appeal of packaged products but also provide space for detailed product information, branding, and promotional messages, catering to the evolving preferences of Indian consumers.

U.S. In-Mold Labels Market Trends

The U.S. in-mold labels market is expected to witness significant growth from 2024 to 2030 due to the expanding packaging sector. The packaging industry in the U.S. is growing due to rapid e-commerce expansion, increasing consumer awareness regarding sustainable packaging solutions, and the need for innovative & visually appealing packaging.

Asia Pacific In-mold Labels Market

The in-mold labels market in Asia Pacific is projected to expand at a CAGR of 5.1% from 2024 to 2030. The regional market growth can be attributed to the region's robust economic growth, rapid urbanization, and rising disposable incomes, which is boosting the demand for packaged goods across various industries, such as food & beverage, cosmetics, and consumer electronics, consequently driving the need for innovative and visually appealing labeling solutions.

The China in-mold labels market is expanding at a high pace, owing to rising consumer awareness and preferences for premium packaging experiences are driving the adoption of in-mold labels, which offer vibrant graphics and 3D effects, thus influencing purchasing decisions in the country.

The in-mold labels market in India is witnessing significant expansion, driven by the growing retail sector. With the proliferation of supermarkets, hypermarkets, and convenience stores, there's an increasing demand for attractively packaged products to stand out on the shelves. In-mold labels offer eye-catching branding opportunities and help products differentiate themselves in a competitive market, thereby driving their adoption.

Europe In-Mold Labels Market Trends

The Europe in-mold labels market will witness steady growth from 2024 to 2030. Sustainability is gaining traction, driven by environmental concerns, and changing consumer preferences. With increasing awareness about plastic pollution and waste management issues, there's a growing demand for sustainable packaging solutions. In-mold labels align well with this trend as they enable the use of recyclable materials and reduce the need for secondary packaging, contributing to overall packaging sustainability efforts in the country.

The in-mold labels market in Germany is growing on account of the versatility of IML, allowing for intricate designs, vibrant colors, and variable data printing, which is further driving its adoption. A combination of sustainability, technological innovation, consumer preferences, and versatility is propelling the market growth in Germany.

The UK in-mold labels market is growing at a rapid pace, due to rising e-commerce and online retail channels, which is driving the need for visually appealing packaging to stand out in a competitive market landscape, further boosting the demand for in-mold labels.

Key In-Mold Labels Company Insights

The in-mold labels market is fragmented with the presence of global as well as local companies offering various types of labels. Major players operating in the market undertake various strategies, such as mergers, acquisitions, geographical expansion, new product launches, and joint ventures, to strengthen their market presence.

-

In April 2023, Multi-Color Corp. acquired Türkiye-based Korsini, a leading provider of in-mold label (IML) solutions. The acquisition expands MCC’s in-mold labeling network and creates a new foothold to complement its position in Europe, Middle East, African and Asian markets. Enrico Corsini to continue running business under the MCC Korsini brand

-

In July 2023, CCL Industries Inc. acquired privately held Faubel & Co. Nachfolger GmbH, headquartered in Melsungen, Germany. Faubel is a specialist in labels for pharmaceutical clinical trials with a manufacturing facility in Melsungen, Germany, and sales offices in the U.S. and China. Faubel also has a controlling interest in a small technology subsidiary located in Paderborn, Germany, developing next-generation solutions for clinical trials including RFID. The business will now trade as CCL Faubel

Key In-Mold Labels Companies:

The following are the leading companies in the in-mold labels market. These companies collectively hold the largest market share and dictate industry trends.

- Multi-Color Corporation (MCC)

- CCL Industries Inc.

- Taghleef Industries Inc.

- Constantia Flexibles GmbH

- Coveris Holdings

- Cenveo Inc.

- Fuji Seal International Inc.

- EVCO Plastics

- Fort Dearborn Company

- John Herrod & Associates

- Inland Packaging

- Aspasie Inc.

- General Press Corporation

- Smyth Companies LLC

- NHuhtamaki Group

In-Mold Labels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.40 billion

Revenue forecast in 2030

USD 3.14 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million square meter; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors and Trends

Segments covered

Material, production process, printing technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Multi-Color Corp. (MCC); CCL Industries Inc.; Taghleef Industries Inc.; Constantia Flexibles GmbH; Coveris Holdings; Cenveo Inc.; Fuji Seal International Inc.; EVCO Plastics; Fort Dearborn Company; John Herrod & Associates; Inland Packaging; Aspasie Inc.; General Press Corp.; Smyth Companies LLC; Huhtamaki Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-Mold Labels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global in-mold labels market report on the basis of material, production process, printing technology, application, and region:

-

Material Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Others

-

-

Production Process Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Extrusion

-

Injection Molding

-

Thermoforming

-

-

Printing Technology Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Flexography Printing

-

Offset Printing

-

Gravure Printing

-

Digital Printing

-

Others

-

-

Application Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Consumer Durables

-

Personal Care

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-mold labels market was estimated at around USD 2.31 billion in the year 2023 and is expected to reach around USD 2.40 billion in 2024.

b. The global in-mold labels market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach around USD 3.14 billion by 2030.

b. Food & beverages emerged as a dominating application with a value share of around 41.0% in the year 2023 owing to the growing demand for packaged food products and requirement for sturdy packaging products to protect food during transit.

b. The key player in the in-mold labels market includes Multi-Color Corporation (MCC), CCL Industries Inc., Taghleef Industries Inc., Contantia Flexibles GmbH, Coveris Holdings, Cenveo Inc., Fuji Seal International Inc., EVCO Plastics, Fort Dearborn Company, John Herrod & Associates, Inland Packaging, Aspasie Inc., General Press Corporation, Smyth Companies LLC, and Huhtamaki Group.

b. Increasing focus on presentation of product, along with rising demand for aesthetically appealing packaging, and rising consumer preference for sustainable packaging, are a few key factors propelling the demand for the in-mold labels across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.