- Home

- »

- Clinical Diagnostics

- »

-

In-vitro Toxicology Testing Market Size & Share Report, 2030GVR Report cover

![In-vitro Toxicology Testing Market Size, Share & Trends Report]()

In-vitro Toxicology Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Cell Culture, High Throughput), By End-use, By Application, By Method (Cellular Assay), By Product, By Region, And Segment Forecasts

- Report ID: 978-1-68038-847-3

- Number of Report Pages: 117

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

In-vitro Toxicology Testing Market Summary

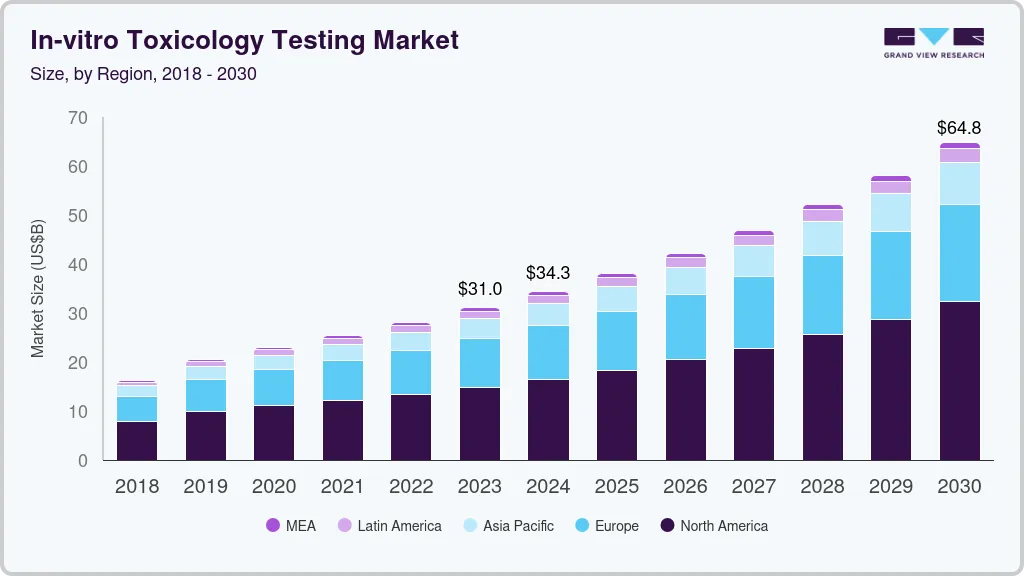

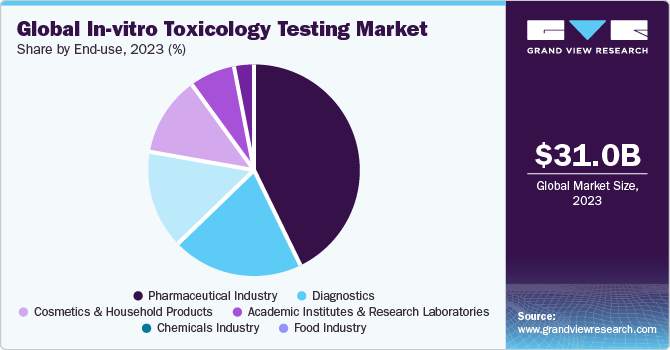

The global in-vitro toxicology testing market size was estimated at USD 31,029.0 million in 2023 and is projected to reach USD 64,815.2 million by 2030, growing at a CAGR of 11.1% from 2024 to 2030. The growth of the market is attributed to continuous developments in toxicology research and advancement of technologies.

Key Market Trends & Insights

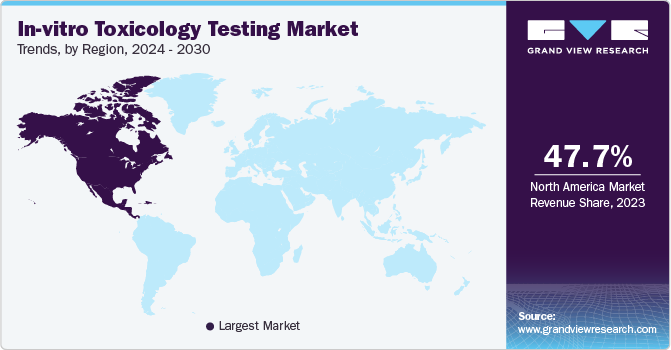

- North America dominated the market and accounted for a 47.73% share in 2023.

- By method, the cellular assay accounted for the largest share in terms of revenue and is expected to grow over the forecasted period.

- By product, the consumables segment dominated the market in 2023 and is estimated to grow at the fastest CAGR over the forecast period.

- By end use. the pharmaceutical industry end-use segment held a major share in the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 31,029.0 Million

- 2030 Projected Market Size: USD 64,815.2 Million

- CAGR (2024-2030): 11.1%

- North America: Largest market in 2023

In addition, rising emphasis on development of personalized medicines is further expected to boost the market during the forecast period. Awareness regarding the limitations and challenges associated with traditional toxicology screening methods has been growing. This has led to a broader acceptance of in-vitro testing as a valuable tool for assessing the safety and efficacy of compounds.In recent times, validation, and acceptance of in vitro and alternative testing methods by regulatory authorities is increasing at a lucrative rate. In addition, ongoing technological advancements to replace the use of animals for toxicology testing purposes have increased the use of in vitro screening and monitoring models. The advent of 3D cell culture is recognized as one of the most significant advancements, which enables safety testing of new compounds in the in vitro environment that mirrors the host physiology. As a result, researchers are engaged in developing and adapting novel in vitro test methods based on 3D human tissue constructs, co-culture systems, and kinetic tissue culture methods to address the various issues related to animal testing. Various examples of nonanimal technologies that are developed against animal testing are direct peptide reactivity assay, ARE-Nrf2 Luciferase assay, and Human Cell Line Activation Test (h-CLAT). Furthermore, the development of an integrated approach is recognized as a key to capitalizing on market opportunities. Another development that is anticipated to greatly influence the growth of this market is the growing trend of outsourcing toxicology assessment services.

The usage of new food additives along with innovations in food contact substance development has propelled manufacturers and researchers to explore the use of high-throughput chemical toxicity testing. Moreover, limited resources with respect to budget and time for examining chemicals have fomented the product manufacturers to adopt new cost-effective methods for animal-free (in vitro) High-Throughput Screening (HTS). One such method is the quantitative HTS (qHTS) program, which is considered a cost- and time-efficient method for toxicological evaluation. Furthermore, ongoing development in these programs is anticipated to expand the application scope of in vitro testing market. For example, the development of Collaborative Programs Tox21, a multi-agency, automated qHTS program, for efficient safety testing of chemicals by enhancing efficiency along with reduction of overall testing costs. However, such a program exhibits certain challenges such as extrapolation of such data to decide in vivo doses. Moreover, the data required to implement the use of information acquired from in vitro testing assay to estimate and validate the dosage of a drug product in the target organ or disease site are often unavailable.

Furthermore, several academic centers have taken in vitro toxicology initiatives to expand on the use of in vitro models across various applications, such as skin toxicity and genotoxicity. Development and implementation of suitable in vitro models that deliver highly relevant biological data across several therapeutic areas are aiding segment growth; for example, the use of Reinnervate’s Alvetex, a synthetic scaffold, to design 3D culture assays for routine assessment of cancer cell cytotoxicity. Moreover, a group of researchers from the University of CESPU Health Sciences Department, Portugal, and Albert Labs International Corp. announced a collaboration to conduct toxicology testing on KRN-101, a candidate for mental health.

Additionally, in-vitro toxicological testing has seen substantial success in different areas like genetic toxicology, skin absorption, and reproductive toxicology. The “EpiSkin test” is an example of in-vitro toxicology testing as it uses the human epidermis instead of rabbit skin to perform an irritation study. The major players present in the market include Agilent Technologies, Covance, Bio-Rad Laboratories, General Electric Company, Eurofins Scientific SE, BioReliance, Charles River Laboratories International, Thermo Fisher Scientific, Catalent, and Cyprotex. For instance, in January 2023, AmplifyBio raised USD 50 million to improve its business plans. In March 2022, Toxys BV opened a new office in the U.S. to expand its business processes and operations in the international market. The company provides in vitro toxicology services in a wide range of areas.

Market Characteristics

The market is estimated to witness substantial growth along with considerable CAGR. The in-vitro toxicology testing market is characterized by a high degree of innovation coupled with rapid technological advancements. In addition, continual growth of the pharmaceutical and biotechnology industries, along with extended research and development activities, are expected to substantially positive impact on the market growth during the forecast period.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, such as considerable investments by market players and increasing emphasis of regulatory bodies on drug development processes.

The market is also subject to increasing regulatory scrutiny due emphasis on utilizing alternatives against animal experimentation. Increasing ethical concerns and regulatory pressure have driven a growing demand for in vitro testing methods as alternatives to traditional animal testing.

End-user concentration is a substantial factor in the in-vitro toxicology testing market. Since the global biotechnology and pharmaceutical market is witnessing considerable rise in drug development and research & innovation, these industries are likely to have positive impact on the adoption of in-vitro toxicology testing.

Technology Insights

Cell culture technology segment held a dominant market share of 43.88% in the global market in 2023. Cell culture serves as an excellent model for studying the effects of toxins on cells due to its major advantage of consistency and results reproducibility. Cell culture technology aids in the early-stage detection of toxicity during the drug development process. Along with such benefits, rising number of investments by market players is expected to have a positive impact on the segment growth. For instance, in March 2023, ZEISS Ventures announced an investment in InSphero to promote its research in 3D cell culture.

High throughput technology is expected to register the fastest CAGR during the forecast period. Growing preference for nonmaterial safety supplemented the demand for HTT; for instance, high-throughput screening provides nonmaterial safety testing and allows the use of different types of cells at different concentrations that lead to a decrease in timelines, costs, & end-result variations. Several companies offer HTT-based in vitro toxicology analysis, e.g., Solidus Bioscience’s MetaChip Technology, which provides solutions for in vitro toxicology analysis using HTT.

Method Insights

Cellular assay accounted for the largest share in terms of revenue and is expected to grow over the forecasted period owing to the wider availability of these techniques for pharmacokinetic profiling of drug products. Applications of these assays have been increasing over the recent years. Currently, cell assays are also employed in oncological research to estimate both compound toxicity and tumor cell growth inhibition. In vitro toxicology cell assays have some advantages such as minimal cost, speed, and potential for automation. In addition, key efforts laid down by manufacturers for the development of novel cellular assays boost the market progression.

The biochemical assay segment is projected to expand at a significant rate during the forecast period. In vitro biochemical assays are potentially used to evaluate acute toxicity. These assays include specific protein assays, gene expression, and protein secretion assays. Specific protein assays help investigate whether the drug component binds to a particular receptor or biomolecule, or inhibits the particular biomolecule (enzyme), thereby testing a specific mechanism at the molecular level.

Application Insights

The systemic toxicology application segment dominated the market in 2023 due to the increasing number of research & development activities and rising initiatives by several public and private organizations for the replacement of animals by in-vitro techniques for acute systemic toxicity testing. Moreover, systemic toxicology testing provides a holistic view of the potential adverse effects of a substance on various organs and physiological systems. This comprehensive assessment is crucial for understanding the overall safety profile of a product. Such benefits are also projected to offer favorable opportunities for segment growth.

The ocular toxicity segment is estimated to register a considerable CAGR during the forecast period. Ocular toxicity is caused by the intended or unintended exposure of ocular tissues to xenobiotics. Xenobiotics are foreign chemical substances that cause damage to the eyes. Further, increasing awareness about ocular toxicity is likely to boost the segment growth. For instance, according to an article published by Oncology Nursing in April 2023, ocular toxicity is one of the important factors during the treatment of mirvetuximab soravtansine.

Product Insights

The consumables segment dominated the market in 2023 and is estimated to grow at the fastest CAGR over the forecast period due to the increasing adoption of in-vitro toxicology testing in drug development and research. In in vitro toxicology testing, a wide range of consumables is required to carry out experiments, including reagents, culture media, cell lines, assay plates, and other lab supplies. Reagents are essential for many experiments, including assays that measure the toxicity of chemicals or drugs.

Several companies offer a wide range of reagents and products for in vitro toxicology testing, including cell culture media & supplements; assay kits for measuring cytotoxicity, genotoxicity, & other endpoints; and fluorescent probes & antibodies for detecting specific biomarkers. Examples of such companies are Sigma-Aldrich and Thermo Fisher Scientific.

The Assays segment is estimated to register a substantial CAGR during the forecast period. In vitro toxicity assays help regulate the potential of new agrochemicals, food additives, pharmaceuticals, or other hazardous chemical products on humans. Further, strategic activities by the key market players are the major factor driving the segment's growth during the review period. For instance, in March 2022, Toxys BV, a Dutch biotech company, opened a sales office in New York and a production facility in Gaithersburg to help its business grow.

End-use Insights

The pharmaceutical industry end-use segment held a major share in the market in 2023. It is the largest market for in vitro toxicological testing as it involves the identification of a potential drug candidate at the primary stage. It is progressively functioning on the 3 R's principle, which means that the pharmaceutical industry is ready to replace, reduce, & refine the use of animals in the drug development process and toxicological profiling.

Diagnostics segment is estimated to register the fastest CAGR amongst other segment during the forecast period. The presence of companies, such as Toxikon, which are engaged in providing customized solutions to assist in the clinical development of diagnostics devices, is attributive to the estimated share. Biocompatibility testing is used to test the potentially adverse effects of a medical device, which can be dangerous to human use. Moreover, companies have comprehensive product lines for the detection of point-of-care drug testing, long-term alcohol abuse, and therapeutic drug monitoring which are anticipated to boost the segment growth.

Regional Insights

North America dominated the market and accounted for a 47.73% share in 2023. Certain factors such as the increased focus of government bodies on drug discovery, rise in healthcare expenditure, and the presence of adequate infrastructure for the growth & development of drug discovery technologies are majorly driving the North America in-vitro toxicology testing market. Furthermore, strong regulatory guidelines pertaining to drug development and approval have increased the adoption of services in this regional market.

Asia Pacific is anticipated to witness significant growth in the in vitro toxicology testing market. The overall regional growth can be attributed to countries such as China, India, and South Korea. China’s market is estimated to be the largest revenue-generating market, while India is projected to witness the fastest growth rate.

In vitro toxicology testing in India is indeed becoming increasingly competitive as pharmaceutical companies are expanding their testing capacities. The country has emerged as a hub for pharmaceutical research and development in recent years, with many multinational companies establishing operations in India to take advantage of its skilled workforce, advanced infrastructure, and lower costs. As a result of this trend, there has been a significant increase in demand for in vitro toxicology testing services in India. This has led to the emergence of a number of new testing companies, as well as the expansion of existing players in the market. For instance, in January 2023, Eurofins Scientific announced the establishment of a laboratory campus in Hyderabad. The acquisition includes a facility that can cater to the needs of both large global and regional pharmaceutical clients, as well as small biotech firms.

Key Companies & Market Share Insights

Some of the key players operating in the market include Charles River Laboratories International, Inc., SGS S.A., Merck KGaA, Eurofins Scientific, and Abbott Laboratories. These companies focus on expanding their service portfolios, enhancing technological capabilities, and strategic collaborations to strengthen their market presence. With increasing demand for reliable and cost-effective testing solutions, these companies are actively engaged in innovative research and development to address emerging challenges in toxicology testing.

Emerging players in the in-vitro toxicology testing market, like InSphero and MatTek Corporation, are leveraging cutting-edge technologies and forming strategic partnerships to gain a foothold. Their activities include developing advanced 3D cell culture models and organ-on-a-chip platforms. These companies aim to disrupt the market by offering innovative and more predictive in-vitro toxicology solutions, catering to the growing demand for alternatives to traditional animal testing methods.

Key In-vitro Toxicology Testing Companies:

- Charles River Laboratories International, Inc.

- SGS S.A.

- Merck KGaA

- Eurofins Scientific

- Abbott Laboratories

- Laboratory Corporation of America Holdings

- Evotec S.E.

- Thermo Fisher Scientific, Inc.

- Quest Diagnostics Incorporated

- Agilent Technologies, Inc.

- Catalent, Inc.

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- BioIVT

- Gentronix

Recent Developments

-

In April 2023, Thermo Fisher Scientific launched its first real-time PCR assay kit 37 CE-IVD for testing of infectious diseases.

-

In April 2023, Gentronix, Ltd expanded its laboratory with the aim of fulfilling the growing demand.

-

In February 2023, Evotec announced the relocation of Cyprotex US, LLC—a subsidiary of Evotec—from Watertown to Framingham, U.S. This relocation had the motto of expanding the new facility for faster turnaround time.

-

In March 2022, WuXi AppTec expanded its toxicology footprint abilities with new a Chengdu facility. This expansion helped them ensure better service with faster initiation for clinical studies.

-

In January 2021, Charles River announced a partnership with Cypre, Inc. to expand its 3D in vitro services for cancer immunotherapy as well as targeted therapy drug screening. This partnership enabled the company to access Cypre’s patented 3D hydrogel patterning technology, or Falcon-X, to expand its in vitro testing services.

In-vitro Toxicology Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.33 billion

Revenue forecast in 2030

USD 64.81 billion

Growth Rate

CAGR of 11.17% from 2024 to 2030

Actual years

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, method, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Charles River Laboratories International, Inc.; SGS S.A.; Merck KGaA; Eurofins Scientific; Abbott Laboratories; Laboratory Corporation of America Holdings; Evotec S.E.; Thermo Fisher Scientific, Inc.; Quest Diagnostics Incorporated; Agilent Technologies, Inc.; Catalent, Inc.; Danaher Corporation; Bio-Rad Laboratories, Inc.; BioIVT; Gentronix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In-vitro Toxicology Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-vitro toxicology testing market report based on product, application, method, technology, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Culture Technology

-

High Throughput Technology

-

Molecular Imaging Technology

-

OMICS Technology

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Assays

-

Instruments

-

Software

-

Services

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Cellular Assay

-

Live Cells

-

High Throughput / High Content Screening

-

Molecular Imaging

-

Confocal Microscopy

-

Others

-

-

Others

-

-

Fixed Cells

-

-

Biochemical Assay

-

In Silico

-

Ex-vivo

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Systemic Toxicology

-

Acute Toxicity

-

Carcinogenicity

-

Developmental Toxicity

-

Others

-

-

Dermal Toxicity

-

Skin Irritation Test

-

Skin Sensitization Test

-

Skin Corrosion Test

-

Phototoxicity Test

-

Others

-

-

Endocrine Disruption

-

Dioxins

-

Phthalates

-

Polychlorinated biphenyls (PCB)

-

-

Ocular Toxicity

-

Intravitreal

-

Subretinal

-

Others

-

-

Others

-

Immunotoxicity

-

Reproductive Toxicity

-

Neurotoxicity

-

Epigenetic Alterations

-

Genotoxicity

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Industry

-

Cosmetics & Household Products

-

Academic Institutes & Research Laboratories

-

Diagnostics

-

Medical Devices

-

Others

-

-

Chemicals Industry

-

Food Industry

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global in-vitro toxicology testing market size was estimated at USD 31.03 billion in 2023 and is expected to reach USD 34.33 billion in 2024.

b. The global in-vitro toxicology testing market is expected to grow at a compound annual growth rate of 11.17% from 2024 to 2030 to reach USD 64.81 billion by 2030.

b. Cell culture technology dominated the in-vitro toxicology testing market with a share of 43.88% in 2023 due to its ability to serve as an excellent model for examining toxic effects on cells in a reproducible manner.

b. Some key players operating in the in-vitro toxicology testing market include Merck KGaA; Charles River; Bio-Rad Laboratories, Inc.; Abbott; Thermo Fisher Scientific Inc.; Catalent, Inc.; GE Healthcare; Quest Diagnostics Incorporated; Eurofins Scientific; Laboratory Corporation of America Holdings; Evotec; Creative Bioarray; Gentronix; BioIVT; SGS SA; and Agilent Technologies.

b. Key factors that are driving the in-vitro toxicology testing market growth include the rise in government funding for toxicology research, opposition to animal testing, and ongoing developments to advance toxicology research.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.