- Home

- »

- Automotive & Transportation

- »

-

India Automotive Market Size & Share, Industry Report, 2030GVR Report cover

![India Automotive Market Size, Share & Trends Report]()

India Automotive Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Passenger Vehicles (Sedan, Hatchback, SUV, MUVs/MPVs), By Light Commercial Vehicles, By Heavy Trucks, By Buses & Coaches, And Segment Forecasts

- Report ID: GVR-4-68039-303-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Automotive Market Size & Trends

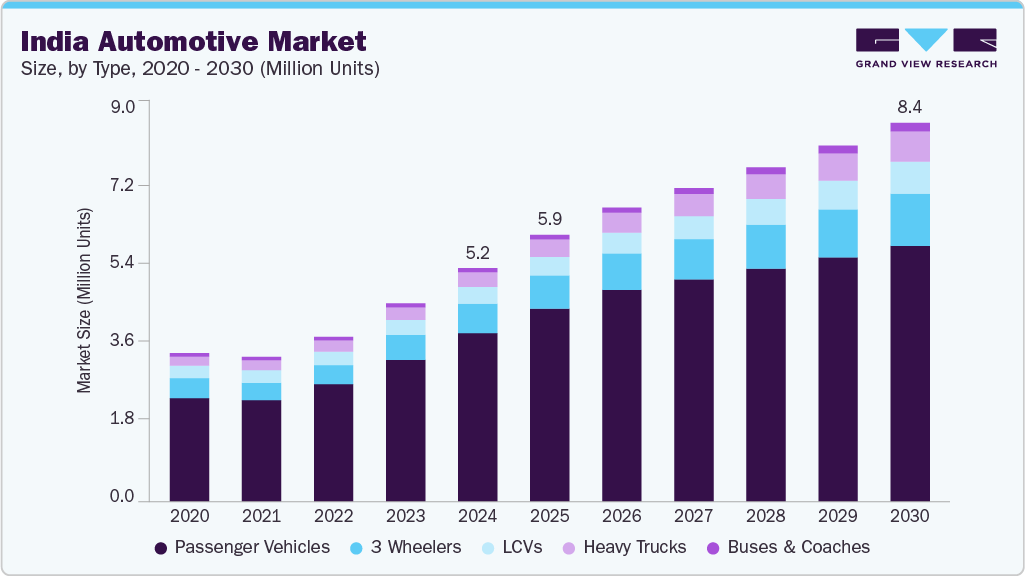

The India automotive market demand was pegged at 5,156,483 units in 2024 and is expected to grow at a CAGR of 7.3% from 2025 to 2030. According to statistics published in April 2018 by the European Automobile Manufacturers Association (ACEA), India is ranked fourth in the top ten global car-producing countries. The country’s automotive sector is powered by the rising population, increasing disposable income, and the ease of availability of credit and financing. Additionally, the market is expected to experience elevated demand for commercial vehicles from the flourishing logistics and passenger transport sectors. Government initiatives and policies influence market growth and are expected to maintain growth over the coming years.

The Ministry of Finance announced a cut in the corporate tax rate in 2019 to promote market growth. This revision in corporate taxes is anticipated to attract FDI in the country's manufacturing sector, which is expected to help the automotive industry marginally. Furthermore, Government initiatives like Make in India and Automotive Mission Plan 2026 have boosted the Indian automotive sector. The Automotive Mission Plan 2026 is a collective vision of India's automotive industry and the government that aims to make the Indian automotive industry the driving factor of the Make in India initiative.

Besides growing passenger vehicle demand, Light Commercial Vehicles (LCVs) are anticipated to grow substantially in the next seven years. LCVs' growth prospects look favorable, owing to a positive outlook on the country's overall logistics industry. As retail e-commerce has witnessed a boom over the last few quarters, the hub-n-spoke business model's proliferation is anticipated to favor sales of LCVs. Vendors are increasingly focusing on the country's untapped regional markets, including rural and semi-urban areas, to improve sales. Better credit and financing options are expected to elevate growth opportunities in these markets over the forecast period.

The increasing adoption of technology in vehicles, industry supply chains, and business models will change the automotive market outlook over the forecasted period. The advent of automated, electrified, and connected vehicles is aiding market growth by making driving easier, safer, and more comfortable. Growing awareness of the environmental hazards of emissions from ICE vehicles encourages users to adopt alternative fuel vehicles. The government focuses on the shift to electric mobility by providing tax rebates and subsidies for adopting electric vehicles. Thus, the electric mobility trend, coupled with the emergence of technologically advanced vehicles, is expected to uphold the market growth from 2023 to 2030.

Growing preferences for Sports Utility Vehicles (SUVs), rising demand for commercial vehicles in the logistic sector, and pent-up demand are expected to drive the market over the coming years. Additionally, the electrification of vehicles, especially three-wheelers and small passenger cars, is expected to be a major factor influencing market growth in the future.The automotive industry is a highly competitive market that is witnessing growth owing to factors such as increasing disposable income, the availability of financing options, the rising urban population, and close substitutes for each segment, which are equipped with the best technological advancements such as active and passive safety systems, comfort features, and high performing powertrains. The market also grows due to the dynamic Indian public transportation network and the growing logistics.

The demand for electric vehicles is another factor contributing to the growth of the Indian automotive market. According to the Society of Indian Automobile Manufacturers, the domestic automobile sales trend indicates that the two-wheeler segment has the highest sales volume of 13,466,412 in 2021-22. This demand growth is attributed to the inclination towards two-wheelers among the middle-income group and the nation's youth. Furthermore, the government is also pushing for the development of the electric vehicle ecosystem by providing incentives such as FAME schemes. Manufacturers are also investing heavily and announcing partnerships to create EV infrastructure nationwide. For instance, in February 2022, Apollo Tyres Ltd and Tata Power entered a strategic alliance to establish 150 public charging stations across India. This government initiative is creating growth avenues for the Indian automotive industry.

Type Insights

The passenger vehicles segment dominated the market with a largest market share of 72.2% in 2024. The passenger vehicles segment in India is witnessing a significant transformation driven by evolving consumer preferences, technological advancements, and policy support. There is a growing demand for compact SUVs and feature-rich hatchbacks, as buyers prioritize fuel efficiency, connected car technology, and enhanced safety features. The increase in disposable incomes and greater urbanization resulted in a transition from two-wheelers to entry-level cars, especially in semi-urban and rural markets. Additionally, the push for electrification, supported by government incentives under schemes like FAME II, is prompting manufacturers to expand their electric vehicle offerings.

The SUVs segment is projected to expand at the fastest CAGR from 2025 to 2030. This surge is fueled by changing consumer lifestyles, with buyers seeking vehicles that offer a commanding road presence, higher ground clearance, and versatility for both city and highway driving. Compact and mid-size SUVs, in particular, are gaining popularity due to their balanced mix of affordability, style, and practicality. Automakers are responding by introducing models with bold designs, advanced infotainment systems, and enhanced safety features to cater to tech-savvy and safety-conscious customers. Moreover, the availability of petrol, diesel, hybrid, and electric variants across different price points has further broadened the appeal of SUVs among a diverse range of Indian buyers.

Passenger Vehicle Insights

The hatchback segment held the largest market share in 2024. The segment’s growth is attributed to its smaller size, suited to Indian roads. The country's prominent passenger car manufacturers have also developed small hatchbacks suited to the Indian market. With competitive pricing, premium features, small sizes, and ease of financing options, manufacturers have carved a niche for targeting the country's middle-class population.

The MPVs/MUVs/Van segment is projected to expand at a significant CAGR from 2025 to 2030. MUVs/MPVs are prominently used in India for passenger transportation and by large families. The segment is dominated by a few major players, accounting for more than half of the overall market. The standout feature for MPVs/MUVs is the ability to accommodate more than five people in a vehicle, making it a preferred choice for passenger transport. Additionally, the availability of CNG fuel for these vehicles reduces operating costs and significantly improves profit margins for passenger transport companies. Thus, the passenger transport industry is expected to meet the demand for MPVs/MUVs soon.

Light Commercial Vehicle Insights

The Light Commercial Vehicles (LCVs), segment dominated the market in 2024. The immense popularity of pickup trucks such as Mahindra Bolero Pickup, Ashok Leyland Dost, and Tata Super Ace contributes to the large share of the segment. Pickup trucks act as a perfect blend of compact size and high load-carrying capacity, making them a preferred choice of freight transport. Additionally, recreational pickups like Isuzu D-Max and Tata Xenon are expected to drive the 2 to 3.5 tons trucks segment demand from non-commercial applications.

The less than 2 tons segment is estimated to register the fastest CAGR from 2025 to 2030. The primary factor influencing the growth rate is the use of light vehicles for last-mile deliveries. Due to the country's small roads, compact and small-sized trucks and pickups are preferred for last-mile connectivity. Thus, the logistics sector is expected to promote a healthy CAGR for these trucks over the coming years.

Heavy Trucks Insights

The more than 25 tons segment held the largest volume share in 2024. Growing demand for goods and increased construction and infrastructure development drive the heavy trucks market demand. The trucks manufactured are fuel-efficient, reliable, and effective, and possess high load-carrying capacities compared to other trucks that were earlier manufactured. The increasing number of truck component vendors provides growth opportunities for the truck manufacturing market.

The 7.5 to 12 segment is expected to grow at the fastest CAGR from 2025 to 2030. Applications such as intrastate goods transportation do not require a large load-carrying capacity. However, pickup trucks and LCVs serve a different purpose than goods transportation, prompting users to adopt medium-duty trucks with tonnage capacity between 7.5 to 12 tons. These trucks' lower purchase price is also expected to be a key driving factor for segmental growth in the forthcoming years.

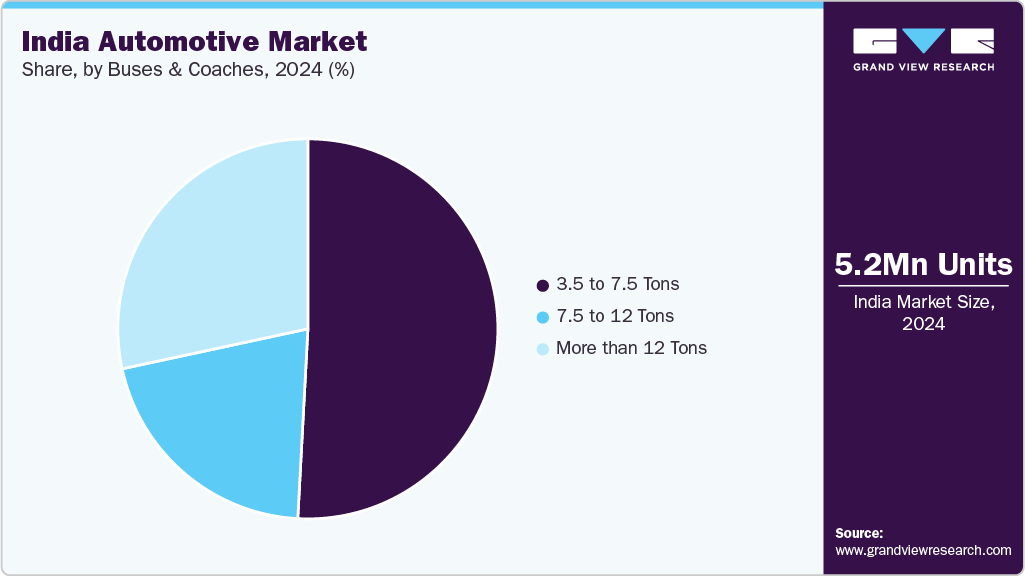

Buses & Coaches Insights

The 3.5 to 7.5 tons segment held the largest volume share in 2024. The segment primarily includes intra-city buses and special-purpose buses used for school, local tours, ambulance, hospitality, and other services. The increasing population contributes to the increasing demand for buses in school and hospitality service applications. Further, light-duty buses for transportation of employees of companies in the metro cities are expected to upkeep the segment dominance over the forecast period.

The more than 12 tons segment is expected to grow at the fastest CAGR from 2025 to 2030.This growth is attributable to increasing connectivity among states promoting long-distance travel. Additionally, the growing trend of working in metropolitan cities in different states makes frequent log travel necessary. The bus/coach manufacturers have equipped vehicles with features and services that offer the utmost comfort, making coaches a preferred choice for long travels among customers.

Key India Automotive Company Insights

Some of the major players in the India Automotive Market include MARUTI SUZUKI INDIA LIMITED, Tata Motors, Mahindra&Mahindra Ltd., Hyundai Motor India, Bajaj Auto Ltd., among others. The India automotive market players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in July 2023, Maruti Suzuki, an automaker company, introduced the Invicto, a multi-purpose vehicle. This launch signifies the company's expansion into the premium three-row segment, offering customers a blend of upscale design, smart packaging, and an array of safety features and innovations. The Invicto caters to those seeking a premium three-row vehicle that embodies the qualities of both an SUV and an MPV.

-

MARUTI SUZUKI INDIA LIMITED, is a prominent company in India’s passenger vehicle segment. Known for its cost-effective, fuel-efficient vehicles and expansive dealer and service network, the company has become synonymous with personal mobility in India. With best-selling models like Alto, Swift, Baleno, and Brezza, Maruti Suzuki caters to the needs of both urban and rural consumers. The company is also making strategic inroads into electrification, with investments in hybrid powertrains and plans for its first EV rollout by 2025.

-

Tata Motors stands out as a diversified and innovation-driven force in the Indian automotive market, with prominent positions in both commercial and passenger vehicle segments. The company has made significant strides in EVs, with the Nexon EV and Tiago EV becoming top-selling electric cars in India. Tata’s focus on design, safety, and performance has transformed its brand perception, particularly in the urban SUV space. On the commercial side, Tata Motors dominates with a comprehensive portfolio of trucks, buses, and light commercial vehicles, supporting logistics and public mobility across the country.

Key India Automotive Companies:

- ASHOK LEYLAND

- Bajaj Auto Ltd.

- Mercedes-Benz Group AG.

- EICHER MOTORS LIMITED

- Honda Motor Co., Ltd.

- Hyundai Motor India

- Mahindra&Mahindra Ltd.

- MARUTI SUZUKI INDIA LIMITED

- Piaggio & C. SpA

- Tata Motors

Recent Developments

-

In May 2025, Tata Motors has launched the All-New Altroz in India at a starting price of around USD 8,300 (INR 6.89 lakhs), positioning it as a premium hatchback with a bold design, luxurious interiors, and advanced features. The vehicle now includes segment-first features such as flush door handles, Infinity LED tail lamps, Luminate LED headlamps with DRLs, and a 3D front grille. The interior offers a refined, comfort-focused experience with executive lounge-style rear seats, ambient lighting, and a soft-touch dashboard. Building on its 5-star GNCAP safety rating, the Altroz is available in Petrol, Diesel (the only one in its segment), and iCNG variants. It also introduces a new 5-speed AMT alongside existing 5-speed manual and 6-speed DCA options, expanding accessibility to automatic transmissions.

-

In April 2025, Mercedes-Benz India has achieved a significant milestone by rolling out its 200,000th locally produced car from its manufacturing facility in Chakan, Pune. This landmark unit was the EQS SUV, the brand's flagship electric vehicle. The milestone reflects Mercedes-Benz’s strong commitment to local manufacturing and its growing footprint in the Indian luxury automobile market. The Chakan facility has been instrumental in producing a wide range of Mercedes-Benz models for the Indian market. This achievement also underscores the brand’s focus on electric mobility and premium innovation in India.

-

In March 2025, Mercedes-Benz has launched the Mercedes-Maybach SL 680 Monogram Series in India at an ex-showroom price of approximately USD 504,000. Deliveries are expected to begin in Q1 2026, with customer consultations starting immediately. The open-top two-seater combines classic SL design with exclusive Maybach styling, powered by a 4.0-liter V8 biturbo engine delivering 585 hp and 800 Nm of torque, accelerating from 0–100 km/h in 4.1 seconds. The vehicle features 4MATIC+ all-wheel drive, a 9G automatic transmission, and is offered in two design themes: "Red Ambience" and "White Ambience". Key highlights include a Maybach grille, rose gold headlight accents, 21-inch forged wheels, and a distinctive soft-top roof with Maybach monograms.

India Automotive Market Report Scope

Report Attribute

Details

Market Volume in 2025

5,890,977 units

Revenue Volume in 2030

8,363,344 units

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in units and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, passenger vehicles, light commercial vehicles, heavy trucks, buses & coaches

Key companies profiled

ASHOK LEYLAND; Bajaj Auto Ltd.; Mercedes-Benz Group AG.; EICHER MOTORS LIMITED; Honda Motor Co., Ltd.; Hyundai Motor India; Mahindra&Mahindra Ltd.; MARUTI SUZUKI INDIA LIMITED; Piaggio & C. SpA; Tata Motors; TOYOTA MOTOR CORPORATION.; Volkswagen Group; AB Volvo.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Automotive Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India automotive market based on type, passenger vehicles, light commercial vehicles, heavy trucks, and buses and coaches:

-

Type Outlook (Volume, Units, 2018 - 2030)

-

Passenger Vehicles

-

LCVs

-

Heavy Trucks

-

Buses & Coaches

-

3 Wheelers

-

-

Passenger Vehicles Outlook (Volume, Units, 2018 - 2030)

-

Sedan

-

Hatchback

-

Mini Hatchback

-

Small Hatchback

-

-

SUVs

-

MUVs/MPVs

-

-

Light Commercial Vehicles Outlook (Volume, Units, 2018 - 2030)

-

Less than 2 Tons

-

2 to 3.5 Tons

-

3.5 to 7.5 Tons

-

-

Heavy Trucks Outlook (Volume, Units, 2018 - 2030)

-

7.5 to 12 Tons

-

12 to 25 Tons

-

More than 25 Tons

-

-

Buses & Coaches Outlook (Volume, Units, 2018 - 2030)

-

3.5 to 7.5 Tons

-

7.5 to 12 Tons

-

More than 12 Tons

-

Frequently Asked Questions About This Report

b. The India automotive market demand was pegged at 5,156,483 units in 2024 and is expected to reach 5,890,977 units in 2025.

b. The India automotive market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach 8,363,344 units by 2030.

b. The passenger segment dominated the India automotive market with a share of 72.4% in 2024. This is attributable to rising disposable incomes aiding smaller families to adopt small passenger vehicles.

b. Some key players operating in the India automotive market include Ashok Leyland; Bajaj Auto Ltd.; Daimler AG; Eicher Motors Limited; Ford Motor Company; Honda Motor Co., Ltd.; and Hyundai Motor India.

b. Key factors that are driving the market growth include a growing population, increasing investments in the road infrastructure, growing logistics industry, and increasing popularity of SUVs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.