- Home

- »

- Homecare & Decor

- »

-

India Kitchenware Market Size, Share, Industry Report, 2033GVR Report cover

![India Kitchenware Market Size, Share & Trends Report]()

India Kitchenware Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cookware, Bakeware, Tableware), By Application (Residential, Commercial), By Distribution Channel (Specialty Stores, Online Retail), And Segment Forecasts

- Report ID: GVR-4-68040-682-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Kitchenware Market Size & Trends

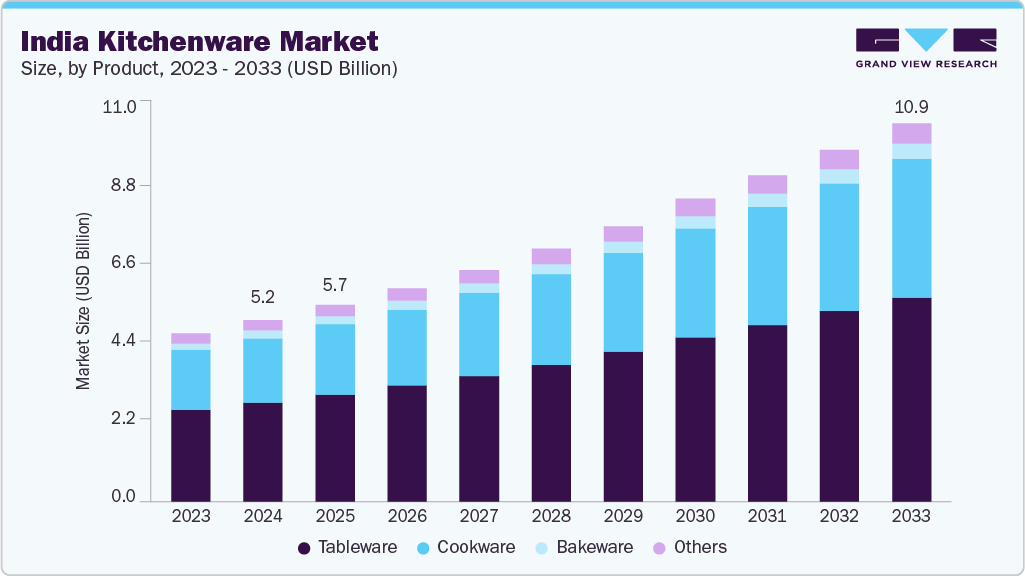

The India kitchenware market size was estimated at USD 5,229.9 million in 2024 and is projected to reach 10,889.0 million by 2033, growing at a CAGR of 8.5% from 2025 to 2033. The market is experiencing notable growth, driven by shifting consumer preferences, an increased focus on health, and the rising appeal of compact, smart home solutions. As urban homes become more compact and daily routines more fast-paced, there is a growing demand for durable, stylish, and food-safe kitchen items that are locally manufactured.

Increasing health consciousness is key in influencing kitchenware choices across India. More consumers are shifting towards appliances such as air fryers, steamers, and blenders that enable low-oil, nutrient-rich cooking. Alongside this, there's a noticeable shift toward safer materials such as stainless steel, ceramic, and glass, as people become more cautious about the potential health risks of traditional non-stick coatings. For instance, the Wonderchef brand offers a variety of kitchen appliances and cookware tailored to the needs of health-focused, contemporary households.

Local companies increasingly provide high-quality kitchenware that aligns with international standards, while embracing approaches such as multi-level marketing (MLM) to establish community-driven sales networks. This strategy is particularly focused on empowering women and homemakers. Industry experts noted that the goal is to deliver smart, functional, and safe kitchen solutions manufactured in India. The adoption of the MLM model, they explained, enables deeper market penetration, supports job creation, and fosters economic self-sufficiency. This approach, they emphasized, embodies the essence of keeping the nation's wealth within its borders, contributing to a healthier and more self-reliant India.

Rising environmental consciousness is increasingly influencing consumer choices in the kitchenware market. Implementing the Bureau of Indian Standards' Ecomark Rule, 2024, has motivated manufacturers to focus on producing environmentally friendly products. As a result, more consumers opt for biodegradable storage solutions, bamboo-based utensils, and items crafted from recycled materials. This shift goes beyond just eco-responsibility; it reflects a broader movement toward embracing a lifestyle centered around sustainability.

Consumer Insights & Surveys

Consumers are placing greater emphasis on functionality and affordability when choosing kitchenware. Practical, time-saving features such as induction-friendly or non-stick cookware and easy-to-clean kitchenware products lead to higher repeat purchases. At the same time, price remains a key factor, particularly for younger and budget-conscious buyers. While premium products attract wealthy consumers, the wider market is fueled by demand for affordable, practical options, with mid-tier brands and discounted online bundles becoming more popular.

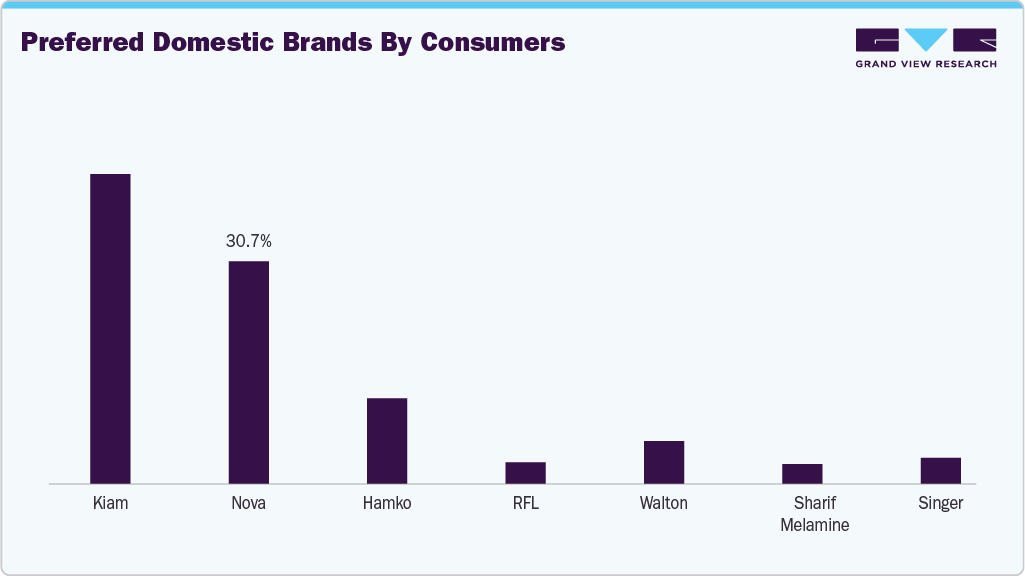

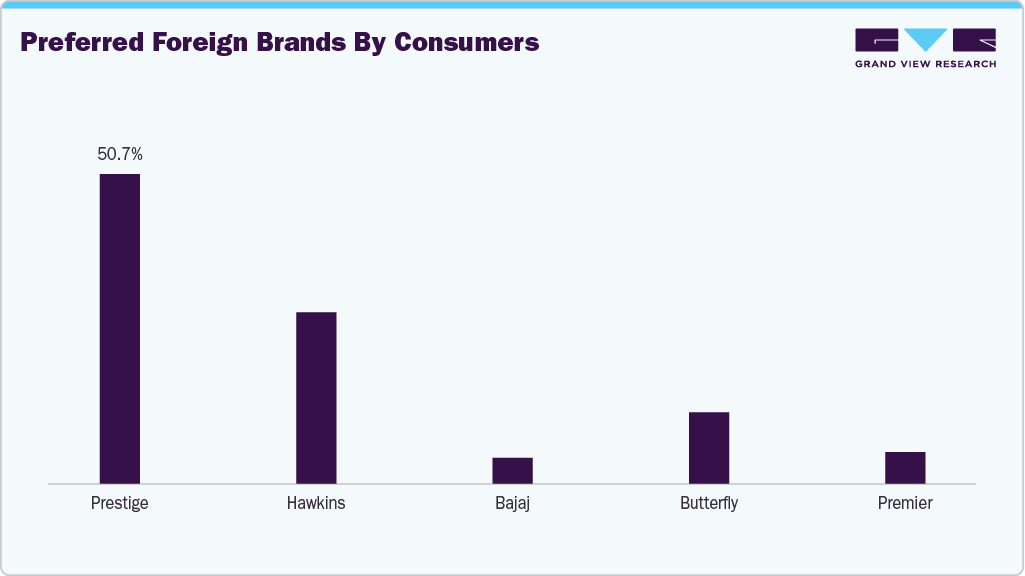

According to the World Journal of Advanced Research and Reviews (WJARR) survey, which provides an overview of consumer preferences for domestic and foreign kitchenware brands, a few leading brands dominate each category, with others having relatively lower levels of consumer preference. Among domestic brands, consumer interest is concentrated around a couple of top names, while foreign brands also reflect a strong preference for select well-established companies.

Product Insights

Demand for tableware accounted for the revenue share of about 54.59% of the India kitchenware market in 2024. The market is influenced by rising disposable incomes, increasing urbanization, and evolving consumer lifestyles, boosting demand for stylish and functional products. In addition, tableware items are often replaced more frequently due to breakage or changing preferences, and they remain a popular choice for gifting during weddings and festivals. The expanding hospitality and foodservice industry has fueled demand for durable and aesthetically appealing tableware suitable for commercial use.

The demand for cookware is projected to grow at a CAGR of 8.9% from 2025 to 2033 in India kitchenware industry. Rising health consciousness encourages consumers to invest in safer, non-toxic, and more efficient cookware options such as non-stick, ceramic, and induction-compatible products. In addition, the increasing number of nuclear families and working professionals has driven the need for convenient, time-saving cooking solutions. The popularity of home cooking, fueled by social media, food influencers, and cooking shows, has also contributed to greater experimentation in kitchens, encouraging the purchase of diverse cookware types. For instance, Prestige by TTK Prestige Ltd. is known for its wide range of pressure cookers, non-stick cookware, and induction-compatible products.

Application Insights

Kitchenware used for residential application accounted for about 67.73% of the India kitchenware market due to the country’s growing population, home-cooked meals remain a cultural norm across urban and rural areas. Most Indian households prefer preparing fresh food at home daily, driving consistent demand for a wide range of kitchenware products such as cookware, tableware, storage containers, and kitchen tools. The rise of nuclear families, urbanization, and increasing working individuals has further fueled the need for user-friendly, efficient, and durable kitchen solutions. The growing influence of lifestyle trends, cooking shows, and e-commerce platforms has made modern kitchenware more accessible to residential buyers, contributing to the segment’s dominance.

The demand for kitchenware used for commercial application is estimated to grow at a CAGR of 9.0% over the forecast period. The rise in restaurants, cafes, QSRs (Quick Service Restaurants), and cloud kitchens across urban and semi-urban areas has created a strong need for high-quality, durable, and efficient kitchenware. The National Restaurant Association of India (NRAI) reported that 1,000-2,000 new restaurants opened monthly in early 2025. Organized food chains and franchise models are scaling up operations, requiring standardized and professional-grade equipment to maintain consistency, hygiene, and productivity in food preparation.

Changing consumer lifestyles, including a preference for dining out and increased dependence on food delivery, have further fueled this growth. As a result, commercial kitchens are investing in kitchenware that supports speed, safety, and easy maintenance to meet growing demand. Products that ensure hygiene, comply with food safety standards, and enhance operational efficiency are in high demand, making them essential for modern food businesses operating in a competitive and fast-paced environment.

Distribution Channel Insights

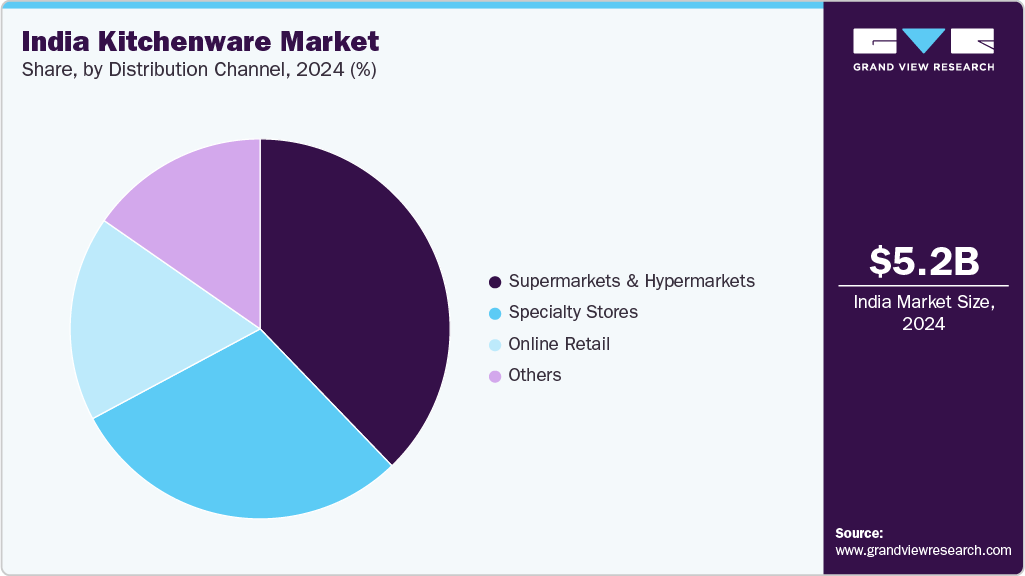

The sale of kitchenware through supermarkets and hypermarkets accounted for a revenue share of about 37.80% in 2024driven by their convenience and all-in-one shopping experience. These large-format retail outlets enable consumers to explore various kitchenware while completing regular grocery purchases, making them a practical choice for many shoppers. Customers can physically examine and compare products, with the added support of in-store staff for guidance. These stores cater to diverse budgets, offering budget-friendly basics and premium cookware options. Additionally, attractive promotions, bundle offers, and loyalty rewards encourage purchases, enhancing overall customer value.

The sale of kitchenware through online retail channels is expected to grow at a CAGR of 9.4% from 2025 to 2033. Consumers are increasingly turning to online retail channels for kitchenware purchases due to their convenience, wide product selection, and competitive pricing. Online platforms allow shoppers to browse and compare products anytime, making them ideal for busy individuals or those in remote locations. The availability of various brands across different price ranges, along with customer reviews, detailed specifications, and video demos, helps guide informed decisions. In addition, exclusive discounts, flash sales, easy returns, and doorstep delivery have made online shopping more appealing and reliable, especially in the post-pandemic era.

Key India Kitchenware Company Insights

The market comprises established brands and emerging players, with leading companies continuously adapting to changing consumer preferences. They focus on product innovation and expanding their offerings to maintain and strengthen their competitive position.

-

Tramontina is a globally recognized manufacturer of high-quality kitchenware and home solutions. The company operates in over 120 countries and offers over 22,000 products across various categories, including cookware, cutlery, kitchen utensils, home appliances, furniture, and tools. The brand emphasizes health and safety by ensuring its products are 100% toxin-free and PFAS-free, catering to home cooks and professional chefs.

-

TTK Prestige Ltd., part of the TTK Group, is a prominent Indian company specializing in kitchen and home appliances. Initially known for its pressure cookers. The company has significantly expanded its offerings to include various kitchen products under its key brands, Prestige and Judge. Its product range comprises non-stick cookware, gas stoves, induction cooktops, mixer grinders, chimneys, and various small kitchen appliances. In addition to cooking solutions, TTK Prestige has diversified into home care products.

Key India Kitchenware Companies:

- Tramontina

- TTK Prestige Ltd.

- Hawkins Cookers Ltd.

- Stovekraft Pvt. Ltd.

- Bajaj Electricals India

- Wonderchef Home Appliances Pvt. Ltd

- Usha International Limited

- Borosil Limited

- Hamilton Housewares Pvt. Ltd.

- Cello World Limited.

Recent Developments

-

In February 2025, Tramontina partnered with Indian precision manufacturing company Aequs to launch a joint venture focused on setting up a cookware manufacturing facility in India. This alliance seeks to leverage Aequs’s advanced manufacturing expertise alongside Tramontina’s deep experience in cookware production to serve both domestic and international markets.

-

In December 2024, Tramontina introduced its Aeion pressure cooker and pressure pan to the Indian market. These products are specifically designed to meet the demands of modern Indian cooking. Crafted with tri-ply stainless steel, they offer induction compatibility, enhanced safety features, and a focus on durability and efficient, health-conscious cooking.

-

In August 2024, Lucaris launched its premium MUSE collection of crystalline wine glasses in India, specifically designed for luxury hotels and upscale hospitality segments. The range includes five carefully engineered glass types, Bordeaux, Burgundy, Cabernet, Chardonnay, and Sparkling, each crafted to elevate the wine-drinking experience. Inspired by modern geometric art, the collection features sleek, angular forms with flat bases and tapered rims, enhancing aroma and flavor release. As India leads the Asia-Pacific region in luxury hotel development, Lucaris aims to meet the rising demand for elegant, high-performance glassware that blends style with functionality for discerning hospitality clients.

India Kitchenware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,656.7 million

Revenue forecast in 2033

USD 10,889.0 million

Growth rate

CAGR of 8.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

India

Key companies profiled

Tramontina; TTK Prestige Ltd.; Hawkins Cookers Ltd.; Stovekraft Pvt. Ltd.; Bajaj Electricals India; Wonderchef Home Appliances Pvt. Ltd; Usha International Limited; Borosil Limited; Hamilton Housewares Pvt. Ltd.; Cello World Limited.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options India Kitchenware Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the India kitchenware market report by product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cookware

-

Pots & Pan

-

Pressure Cooker

-

Microware Cookware

-

-

Bakeware

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Tableware

-

Dinnerware

-

Flatware

-

Stemware

-

-

Others

-

Cooking Racks

-

Cooking Tools

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

Frequently Asked Questions About This Report

b. The India kitchenware market was estimated at USD 5,229.9 million in 2024 and is expected to reach USD 5,656.7 million in 2025.

b. The India kitchenware market is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2033 to reach USD 10,889.0 million by 2033.

b. Tableware accounted for the revenue share of about 54.59% of the India kitchenware market in 2024. The market is influenced by rising disposable incomes, increasing urbanization, and evolving consumer lifestyles, which have boosted demand for stylish and functional products

b. Some of the key players in the India kitchenware market is Tramontina; TTK Prestige Ltd.; Hawkins Cookers Ltd.; Stovekraft Pvt. Ltd.; Bajaj Electricals India; Wonderchef Home Appliances Pvt. Ltd; Usha International Limited; Borosil Limited; Hamilton Housewares Pvt. Ltd.; Cello World Limited.

b. India’s kitchenware market is experiencing notable growth, driven by shifting consumer preferences, an increased focus on health, and the rising appeal of compact, smart home solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.