- Home

- »

- Biotechnology

- »

-

India Oncology NGS Market Size And Share Report, 2030GVR Report cover

![India Oncology NGS Market Size, Share & Trends Report]()

India Oncology NGS Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Clinical Research, Hospitals & Clinics), By Technology, By Application, By Product & Service, By Workflow, And Segment Forecasts

- Report ID: GVR-4-68039-217-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Oncology NGS Market Size & Trends

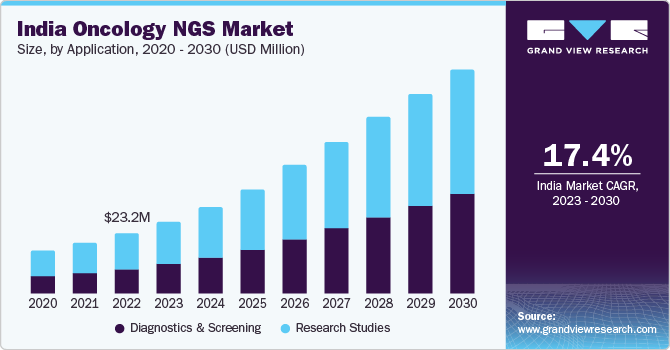

The India oncology NGS market size was valued at USD 23.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.4% from 2023 to 2030. The introduction of cloud-based solutions in clinical research, hospitals, and biotech entities is anticipated to ease the management of a wide range of NGS-generated data. In addition, initiatives to build a genomic database for the Indian population drive market growth. In July 2021, the National Institute of Biomedical Genomics, India, built dbGENVOC. It is a database of genomic variations in oral cancer. The Department of Biotechnology, India, funded the project to build a powerful bioinformatics analysis search engine. It involves large data, including approximately 24 million germline and somatic variants derived from whole-exome and whole-genome sequences.

In October 2021, professionals from Clever Gene stated that India holds great potential for genomics as it is a new and emerging market. Back in 2015, there were majorly 2 to 3 players, while in 2021, there are about 13 to 14 primary players in the Indian market, and about 3 to 4 companies have an optimal level of capacity and infrastructure to perform Next Generation Sequencing (NGS) workflows. The key advantage is the diversity in the populations, which assists in collecting a large pool of samples. Genotypic TechnologyPvt. Ltd., a Hyderabad-based sequencing company, shared their cost of sequencing 100 samples, which is around USD 10,683.73 (INR 1 = 0.013 USD), which accounts for USD 106.84 for one sample in 2021. However, an increase in the volume can help achieve economies of scale and deteriorate the cost further to USD 53.36 per sample. This exponential decline in the costs for genetic sequencing is a high-impact rendering driver of the market.

As the burden of cancer increases, there is a growing need for advanced diagnostic and treatment methods. Oncology NGS offers a comprehensive and precise approach to cancer profiling, aiding personalized treatment decisions and monitoring disease progression. The increasing prevalence of cancer in India is expected to drive the demand for Oncology NGS services. Cancer cases are estimated to grow from 1.46 million in 2022 to 1.57 million by 2025, per the National Cancer Registry Programme by the Indian Council of Medical Research.

Various immuno-oncology (IO) treatment options are available in India with a unique way of boosting the patient's immune system's ability to fight cancer. Recent developments in cancer immunotherapy study and therapy have occurred in India, such as the creation of cancer vaccines has been one of the most important developments. Indian researchers are aiming to create cancer vaccines that can elicit the immune system's attack on cancer cells.

In 2020, Nivolumab, the first immunotherapy medication to receive official approval in India, is a first-line therapy for a specific subtype of lung cancer. Additionally, a few Indian firms and hospitals are researching several immunotherapies, some of which are in phase 2 clinical trials with encouraging preliminary results. These immunotherapies include natural killer (NK) therapy, tumor-infiltrating lymphocytes (TIL) therapy, and chimeric antigenic receptor (CAR) - T cell therapy. Such developments and increasing focus on the medication would likely drive the Oncology NGS market in India.

The COVID-19 pandemic and subsequent lockdowns have had an adverse impact on cancer care and oncology research in India. The uncertainty associated with the pandemic initiated novel risks for cancer patients as it disrupted the oncology treatment delivery and the continuity of research. Multiple research publications showed a nearly 80% drop-in cancer screening appointments in March and April 2020. Even after a reduction in the use of sequencing for oncology, sequencing platforms have been used in India to analyze SARS-CoV-2 for analysis of viral disease.

Technology Insights

The targeted & gene panel sequencing segment dominated the market with the largest revenue share in 2022. Targeted sequencing comprises the shortest read lengths and accounts for the largest share of the market. This is due to the high penetration rate and increasing market presence for a relatively longer duration than other sequencing technologies. Targeted sequencing panels are expected to remain the workhorse for cancer molecular diagnostics and are projected to be included in the routine diagnosis of heme malignancies and solid tumors. Private enterprises in India that offer genome mapping have also ventured into testing services that can predict the risk of diabetes and cancer. These tests may range from USD 350 to 700. However, these genetic tests do not guarantee individuals an accurate or comprehensive prognosis. The development of indigenous genomic databases can overcome these limitations.

In September 2021, research was published on the changing genomics in Triple-negative breast cancers in the Indian population. The study used the TruSeq Cancer Amplicon panel to sequence 51 samples of TNBC patients. The research aimed to understand the genomic landscape of TNBCs in the Indian population. Thus, such studies will boost the need for Amplicon-based NGS panels in India. The advancements in whole genome sequencing capabilities in India are anticipated to boost this segment at a substantial rate. Other factors responsible for the growth of this segment include the establishment of the base-by-base view of the rare mutations and variants detected in the cancer tissue. Moreover, introducing technologically advanced systems with simplified software and analysis algorithms is expected to increase the reliability of NGS technology, thus propelling market growth.

Application Insights

The research studies segment dominated the market and accounted for the largest revenue share of around 60% in 2022. Although NGS is extensively used for cancer research, recently, it has been used in NGS-based molecular cancer diagnosis. This is because the technology allows simultaneous sequencing of several target genes and provides rich diagnostic markers that aid in developing molecular diagnostic tests.

The diagnostics and screening segment is expected to grow at the fastest CAGR of 18.7% during the forecast period. The use of NGS technology in cancer treatment ensures early diagnosis, which helps initiate the treatment in time. As a result, the introduction of NGS for cancer diagnosis has unlocked many new doors in the diagnostics industry. Large-scale initiatives, like the International Cancer Genome Consortium (ICGC) and The Cancer Genome Atlas (TCGA), have already released data from thousands of tumors across leading cancer products & services that can be utilized to have a thorough overview of cancerous cells and help enhance the prognostic and therapeutic applications. Clinical oncology currently uses focused genetic tests as prognostic and diagnostic tools and the development of more comprehensive genomics is expected to drive the segment growth.

Product & Service Insights

The platforms and related products segment accounted for the largest revenue share in 2022. The presence of big-data analytics healthcare startups, such as inDNA Research Labs, which are at the forefront of accelerating the use of genomics technologies in routine clinical care, contributes to the revenue growth in this segment. inDNA Research Labs offers OncoNGx Genomic Workbench, a HIPAA-compliant cloud-based clinical annotation and informatics platform, which translates NGS data from a cancer testing gene panel into actionable insights for clinicians. Takara Bio, Agilent Technologies, and other global players assist the NGS analysis in India by providing consumables, such as library preparation kits and reagents, to India-based core facility NGS users. For instance, Takara Bio India Private Ltd. offers PrepX reagents for a simple, automated NGS library preparation process to accelerate the Illumina sequencing process.

MedGenome offers a wide range of library preparation kits based on the sequencing type. Furthermore, emerging new applications of NGS technology in diagnostics boost the adoption rate in this segment. For instance, the Direct-to-Consumer (DTC) genomics market has gained significant traction in developed countries like the U.S. In contrast, India's DTC genomics market is in its nascent stages. With roughly four times the U.S. population, the country represents a large consumer market with significant potential for lucrative growth in the coming years. Mapmygenome, one of India's first DTC genomics companies, leverages Illumina’s solutions to deliver several genetic tests to help consumers understand their genomes and their family’s genetic history.

The oncology NGS (Next-Generation Sequencing) market in India is being driven by several key factors. There is an increasing need for sophisticated diagnostic and therapy techniques like NGS, which can give full genetic information for personalized cancer care. NGS technological advancements have also played a crucial influence. NGS has grown more cost-effective, quicker, and capable of analyzing enormous amounts of genomic data over time. These technical improvements have made next-generation sequencing (NGS) an appealing tool for cancer research and therapeutic applications in India.

Workflow Insights

NGS sequencing is the most important phase of the workflow and accounted for the largest share in 2022. Platforms that are widely utilized for sequencing include Thermo Fisher Scientific’s Ion Torrent and a few products from Illumina, including the HiSeq X series, MiSeq, MiniSeq, NovaSeq, iSeq, and NextSeq.Tertiary data analysis is the final and third step of analyzing NGS data that addresses the major issue of making meaning of the raw data. The tertiary analysis has generated the largest revenue share from NGS data analysis, owing to important steps implemented in this segment. The process includes QA & QC of variant calls, population structure analysis, multi-sample processing, association analysis, exploratory analysis, data aggregation, and annotation & filtering.

The acceptance of NGS library preparation kits for tumor RNA and tumor DNA sequencing is expected to fuel the pre-sequencing segment. In addition, Lotus DNA Library Prep Kit, xGen Prism DNA Library Prep Kit by Integrated DNA Technologies, and other products in India will boost the market growth. Lotus applies enzymatic fragmentation technology to generate libraries appropriate for PCR-amplified, targeted, and PCR-free sequencing on Illumina platforms.

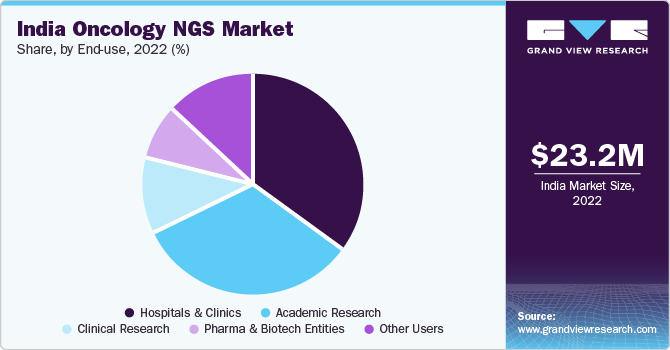

End Use Insights

The hospitals and clinics segment held the largest market share of around 35% in 2022. The increasing number of cancer cases necessitates robust and improvised diagnostics strategies. The introduction of NGS-based cancer tests and panels in Asia has considerably addressed initial phase cancer testing issues in the hospitals and clinics in India. The availability of on-site bioinformatics courses that include training on the practical execution of NGS sequencing and data analysis is anticipated to boost the revenue-generating capability via the academic research segment.

In July 2021, the Directorate of Public Health (DPH) and Preventive Medicine of India team underwent training in the next-generation sequencing in Bengaluru. The team will operate and manage the NGS facility at the DPH’s State Public Health Laboratory in Chennai. The team includes a biochemist, a doctor, a biotechnologist, and a microbiologist from DPH. Training specialists from various fields aim to optimize the use of NGS data in research in different streams. The research institutes are well-equipped with NGS platforms and solutions from major suppliers, such as Thermo Fisher and Illumina. For instance, the Genomics Core Facility (CCF) at the Rajiv Gandhi Centre for Biotechnology uses the Ion Proton system and Thermo Fisher’s Ion Personal Genome Machine System (PGM) to expand transcriptome sequencing, whole-genome sequencing (de novo and resequencing), metagenomics-based research activities, and exome sequencing.

Competitive Insights

To increase their market presence and meet consumer expectations, the operating firms are engaging in several strategic efforts in the oncology NGS market, such as new product development, mergers and acquisitions, and workflow expansion. For instance, in May 2023, Thermo Fisher Scientific Inc. and Pfizer Inc. entered into a partnership agreement to expand domestic access to NGS-based testing for patients with breast and lung cancer in more than 30 countries throughout Africa, Latin America, Asia, and the Middle East where advanced genomic testing has previously been restricted or unavailable. In order to enable healthcare professionals to choose the best treatment for each patient and access local NGS testing, which facilitates the faster study of genes related to disease.

In January 2023, Thermo Fisher Scientific Inc. completed the acquisition of the Binding Site Group Ltd. With this acquisition, Thermo Fisher Scientific Inc. gains access to The Binding Site's advanced specialty diagnostics portfolio, which includes innovative monitoring and diagnostic solutions for multiple myeloma. Early detection and informed treatment decisions are crucial in improving patient outcomes in the context of multiple myeloma.

Key Oncology NGS Companies:

- Illumina, Inc.

- Genotypic Technology Pvt Ltd

- Tecan Trading AG

- Xcelris Genomics.

- Eurofins Scientific

- 4baseCare

- MedGenome

- Sayre Therapeutics

- Redcliffe Lifesciences

- Partek Inc.

- Bio-Rad Laboratories

- Myriad Genetics

- Hologic, Inc. (Gen-Probe Inc.)

- Perkin Elmer, IncVela Diagnostics

- Premas Life Sciences Pvt Ltd (PLS)

India Oncology NGS Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 85.7 million

Growth rate

CAGR of 17.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, technology, application, workflow, end-use

Country scope

India

Key companies profiled

Illumina, Inc.; Genotypic Technology Pvt. Ltd.; Tecan Trading AG; SciGenom Labs Pvt. Ltd.; Xcelris Labs Ltd.; Eurofins Scientific; 4baseCare; MedGenome; Sayre Therapeutics; RedcliffeLifesciences; Partek Incorporated; Bio-Rad Laboratories; Myriad Genetics; Hologic, Inc. (Gen-Probe Incorporated); Perkin Elmer; Premas Life Sciences Pvt Ltd (PLS)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, workflow & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Oncology NGS Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India oncology NGS report based on technology, application, product & service, workflow, and end use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Genome Sequencing

-

Whole Exome Sequencing

-

Targeted & Gene Panel Sequencing

-

Amplicon-based

-

Hybridization-based

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics and Screening

-

Screening

-

Sporadic Cancer

-

Inherited Cancer

-

-

Companion Diagnostics

-

Other Diagnostics

-

-

Research Studies

-

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Platforms and Related Products

-

Panels

-

Consumables

-

Platforms

-

-

Services

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Sequencing

-

NGS Library Preparation Kits

-

Semi-automated Library Preparation

-

Automated Library Preparation

-

Clonal Amplification

-

-

Sequencing

-

NGS Data Analysis

-

NGS Primary Data Analysis

-

NGS Secondary Data Analysis

-

NGS Tertiary Data Analysis

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other users

-

Frequently Asked Questions About This Report

b. The India oncology NGS market size was estimated at USD 23.2 million in 2022 and is expected to reach USD 27.83 million in 2023.

b. The India oncology NGS market is expected to grow at a compound annual growth rate of 17.4% from 2023 to 2030 to reach USD 85.68 million by 2030.

b. Research Studies dominated the India oncology NGS market with a share of 59.05% in 2022. This is attributable to the increasing number of research programs within the country

b. Some key players operating in the India oncology NGS market include Illumina, Inc., Genotypic Technology Pvt. Ltd. (India), Tecan Group Ltd., SciGenom Labs Pvt. Ltd (India), Xcelris Genomics, Eurofins Scientific, 4baseCare, MedGenome Labs Ltd., Premas Life Sciences, and Sayre Therapeutics Pvt Ltd, RedCliffe Life Sciences (RCL).

b. Key factors that are driving the India oncology NGS market growth include Exponentially decreasing costs for genetic sequencing, Rising penetration for panel-oriented tests, Development of companion diagnostics and personalized medicine, Technological advancements in cloud computing & data integration, and Increasing prevalence of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.