- Home

- »

- Advanced Interior Materials

- »

-

India Pipe Fabrication Market Size & Share Report, 2030GVR Report cover

![India Pipe Fabrication Market Size, Share & Trends Report]()

India Pipe Fabrication Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Manufacturing, Oil & Gas, Energy & Power, Construction, Automotive, Electronics), By Service (Welding, Cutting), And Segment Forecasts

- Report ID: GVR-4-68040-094-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

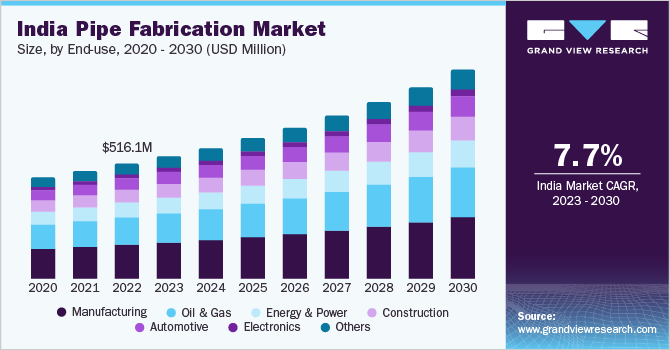

The India pipe fabrication market size was estimated at USD 516.1 million in 2022 and is anticipated to grow at a compounded annual growth rate (CAGR) of 7.7% from 2023 to 2030. The rising demand for piping systems used for transferring essential liquids and gases at industrial processing facilities is likely to boost the growth of the Indian pipe fabrication market. The growth can be attributed to the high demand for the product from various end-use industries such as chemical, oil & gas, electronics, food & beverage, and energy & power. The piping system is a significant part of any industrial process and activity, wherein pipe fabrication plays a vital role.

The growing population nationally and internationally also drives the production of consumer goods, clothing, electronics, energy, processed food & beverages, and other essential products. This is creating pressure on the local and global industrial players to expand the manufacturing output to cater to the growing need.

The players are likely to double the industrial output by launching increasing production lines or launching new production facilities. This is anticipated to augment the demand for pipe fabrication. For instance, in February 2023, Volvo CEO Jim Rowan announced the possibility of a new global electric vehicle plant set up in India. Moreover, the company is planning to go all-electric by the end of the decade and also collaborating with local partners for contract manufacturing.

End-use Insights

The manufacturing segment dominated the market in 2022 with a revenue share of 27.5%. The manufacturing industry includes food & beverage, textile, pharmaceutical, and chemicals, among other industries. The increasing expansion of various food processing and manufacturing facilities demands robust pipe fabrication made up of stainless steel owing to their corrosion resistance characteristics to transport liquids, water, steam, and gases. This growth in the food & beverage industry is likely to drive the demand for the market over the forecast period.

The oil and gas segment is expected to grow at a CAGR of 7.5% from 2023 to 2030. Pipe fabrication is essential in oil & gas construction projects where pipe networks are required. It is required to guarantee the utmost quality of work in the oil & gas industry and to ensure the proper functioning of the piping network is conducted to minimize accidents. The market is propelled by a significant increase in oil production, flourishing natural gas consumption, and pipeline expansion projects along with new gas pipeline projects. Which will positively impact the market growth.

The automotive segment was valued at USD 42.9 million in 2022 this is attributed to growing automotive production, along with the expansion of the automotive assembly line. In the automotive industry, welded steel pipes are significantly used for processing exhaust pipes, muffler condensation pipes, control shaft tube stack pipes, cooling water pipes, air conditioning pipes, oil shortage shafts, etc. This is one of the main factors driving the growth of the market.

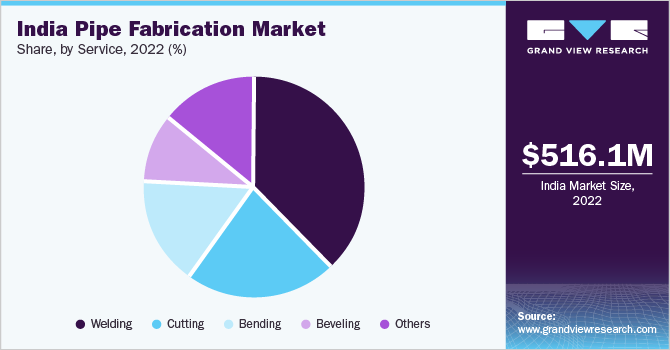

Service Insights

Welding held a 38.0% share of the India pipe fabrication market in 2022. Welding techniques used for pipe welding include tungsten inert gas (TIG) Welding, submerged arc welding, gas metal arc welding (GMAW), and flux-cored arc welding (FCAW). The pipe welding is utilized in various end-use industries including oil & gas, chemical, and automotive.

Pipe welding is frequently used in the oil & gas and chemical industries owing to exposure to caustic chemicals and high temperatures due to the hostile environment of chemical procedures. The expansion of new oil and gas pipeline projects across India is expected to positively impact the demand for the market in the coming years.

Cutting is anticipated to grow at a CAGR of 7.1% over the forecast period. The pipe cutting is a fabrication process to remove the extra material from the pipe to gain the desired profile. Normally fabrication includes midsection holes, saddles, miters, and straight cuts. Cutting techniques used for pipe fabrication include cold saw cutting, abrasive cutting, gas cutting, and laser cutting.

Pipe-cutting services are frequently used in the construction industry in various application such as residential & non-residential infrastructure for water distribution, HVAC systems, drainage, etc. Thus, the rising investment opportunities along with government initiatives boost the demand for pipe fabrication services such as cutting, bending, beveling, and welding.

Key Companies & Market Share Insights

The key players adopt various strategies such as novel expansions of production facilities, additional investments in manufacturing facilities, product launches, and collaborations to maintain a competitive edge in the market. Key service providers of pipe fabrication also opt for partnerships or collaborations with other companies or authorities to increase product penetration in desired regions or countries and increase brand awareness. For instance, in October 2022, McDermott built 2 offshore fabrication yards in partnership with Saudi Aramco to increase Saudi Arabia's fabrication capacity of the offshore facility by over 200 percent. Some prominent players in the India pipe fabrication market include:

-

Darshil Technology

-

FABRI-TEK ENGINEERS

-

McDermott

-

DEE Piping Systems

-

Artson

-

Shree Sainath Enterprises

-

TECHSKILL (INDIA) PVT. LTD.

-

Deepak Steel India

-

Radhe Enterprise

India Pipe Fabrication Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 935.1 million

Growth rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use

Country scope

India

Key companies profiled

Darshil Technology; FABRI-TEK ENGINEERS; McDermott; DEE Piping Systems; Artson; Shree Sainath Enterprises; TECHSKILL (INDIA) PVT. LTD. ; Deepak Steel India; Fabri-Tek Engineers; Radhe Enterprise

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Pipe Fabrication Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India pipe fabrication market report based on end-use and service:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Oil and Gas

-

Energy and Power

-

Construction

-

Automotive

-

Electronics

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Welding

-

Cutting

-

Bending

-

Beveling

-

Others

-

Frequently Asked Questions About This Report

b. The India pipe fabrication market size was estimated at USD 516.1 million in 2022.

b. The India pipe fabrication market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 935.1 million by 2030.

b. Manufacturing segment of the India pipe fabrication market is estimated to hold revenue share of 27.5% in 2022. The increased production and consumption of crude oil, petroleum products, and natural gas from 2020 to 2023, thus the rising production of oil & gas is anticipated to fuel the market demand.

b. Some of the key players operating in the India pipe fabrication market include: Darshil Technology; FABRI-TEK ENGINEERS; McDermott; DEE Piping Systems; Artson; Shree Sainath Enterprises; TECHSKILL (INDIA) PVT. LTD.; Deepak Steel India; Fabri-Tek Engineers; Radhe Enterprise

b. Key factors that are driving the India pipe fabrication is growing construction activities of the residential and non-residential buildings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.