India Premium Bottled Water Market Summary

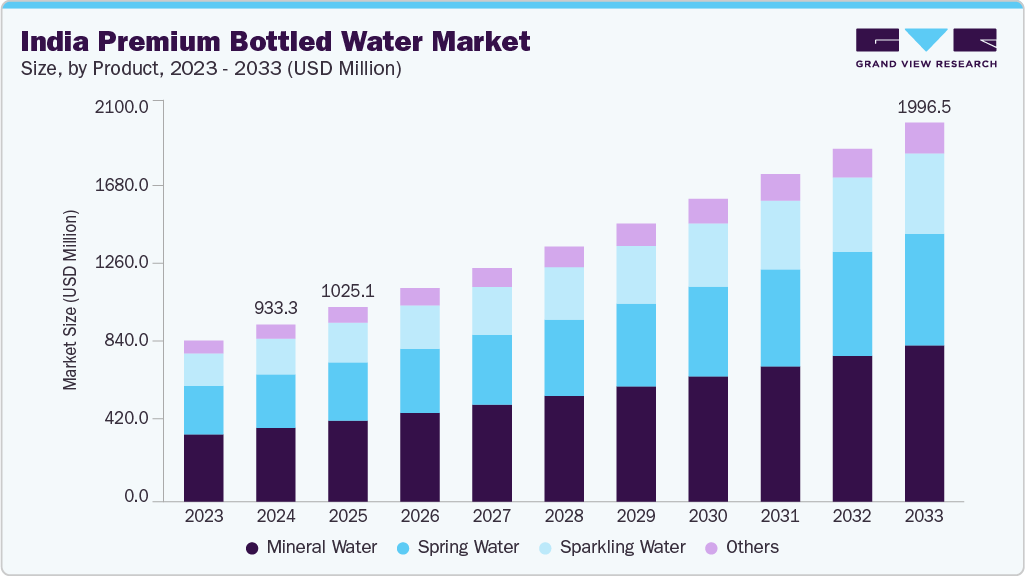

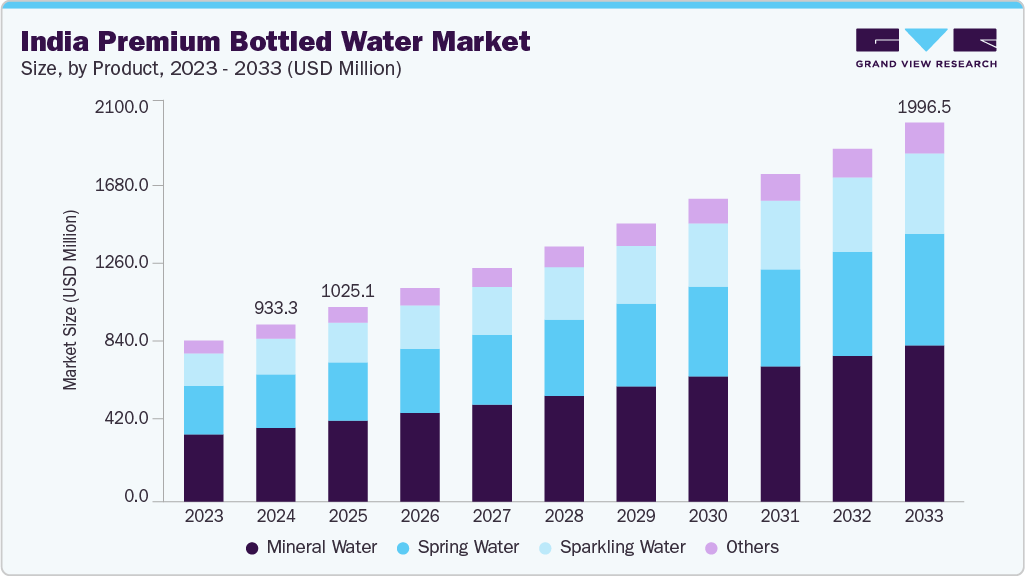

The India premium bottled water market size was estimated at USD 933.3 million in 2024 and is projected to reach USD 1,996.5 million by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The market is driven by increasing health consciousness, urbanization, and disposable income.

Key Market Trends & Insights

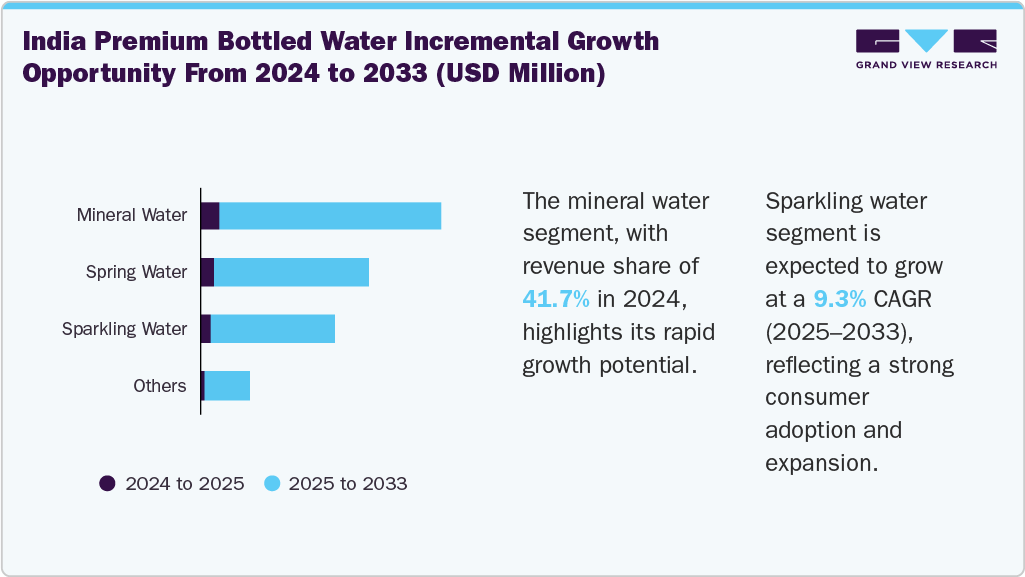

- By product, the mineral water segment held the largest market share of 41.7% in 2024.

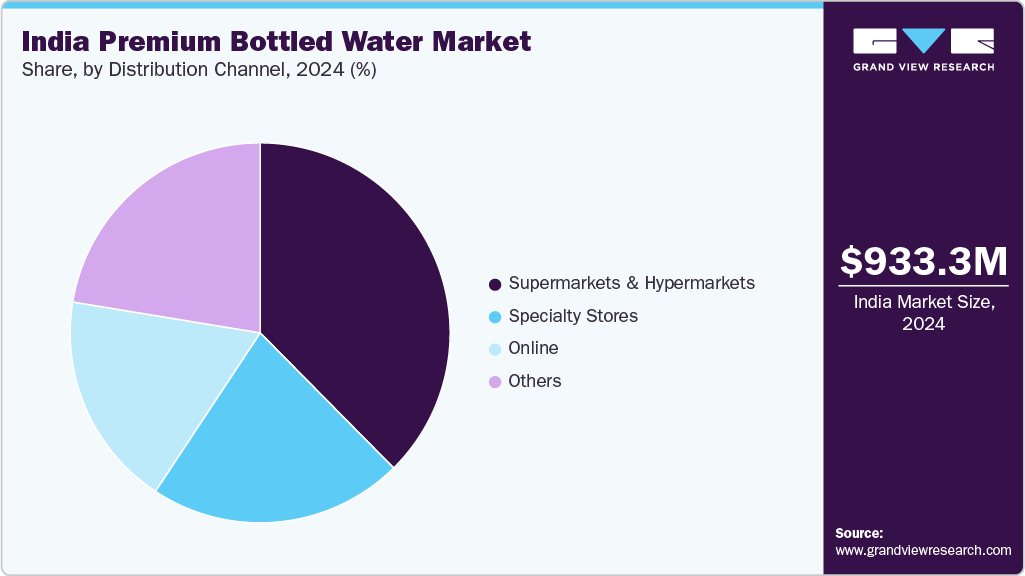

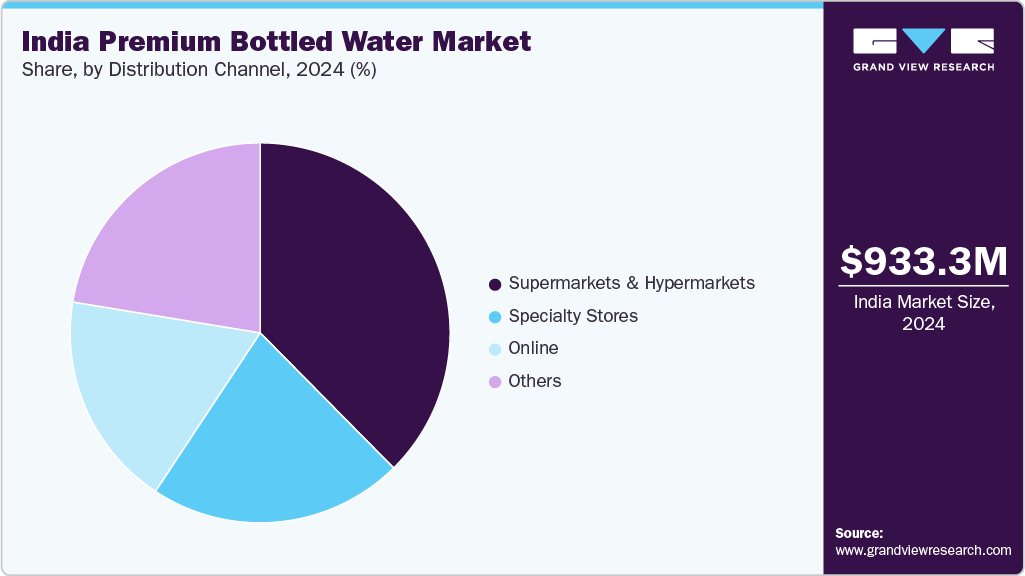

- By distribution channel, the supermarkets and hypermarkets segment accounted for largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 933.3 Million

- 2033 Projected Market Size: USD 1996.5 Million

- CAGR (2025-2033): 8.7%

Consumers prioritize safe, potable water sources over traditional tap water, which often fails to meet safety standards due to concerns over contamination and pollutants. The post-pandemic period further highlighted this trend with consumers sourcing water directly from trusted brands of premium bottled water to mitigate health risks. This shift has fostered trust in reputed brands offering premium bottled water, which adhere to stringent quality standards such as the Bureau of Indian Standards (BIS) and hold an FSSAI license.

With an expanding middle and upper-middle class, premium high-quality, aesthetically appealing, and health-oriented functional beverages have also become more affordable. The perception of bottled water as a social status contributed to its desirability among urban professionals, young adults, and the corporate sector. Moreover, the expanding modern retail outlets, supermarkets, and e-commerce platforms have made premium bottled water more accessible to a broader demographic.

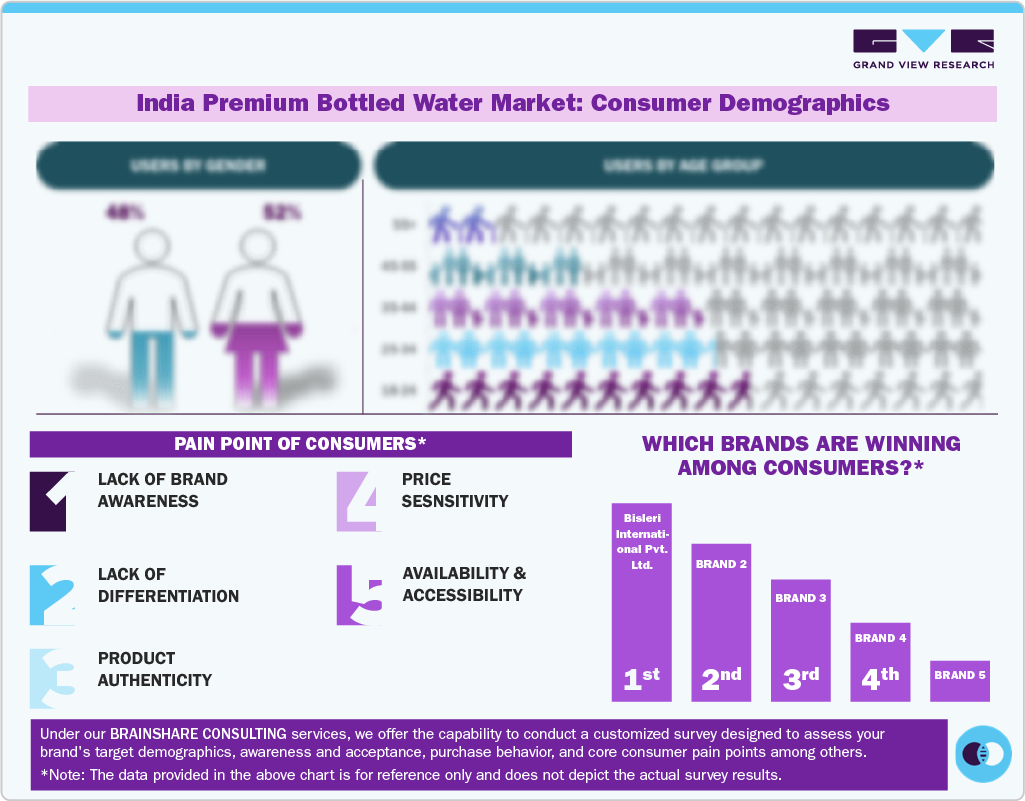

Consumer Insights

The Indian bottled water market is experiencing growth, driven by increasing health consciousness, rising disposable income, and evolving consumer preferences. According to the Trading Economics report, India's disposable income increased to USD 3,557 billion in 2023, up from USD 3,302 billion in 2022. Consumers are shifting toward functional beverages offering additional health benefits, such as vitamins and minerals. This aligns with the trend, where consumers are willing to pay a premium for products that enhance health and well-being. Brands increasingly emphasize their unique value propositions, focusing on natural, mineral-rich, eco-friendly offerings.

Consumption trends are driven by occasions, particularly in luxury settings such as fine dining, hospitality, and fitness centers. Consumers increasingly favor sustainable packaging and visually appealing designs. In addition, digital and e-commerce platforms play a significant role in shaping purchasing habits. Sparkling and flavored water continues attracting health-conscious consumers, particularly among younger demographics.

Product Insights

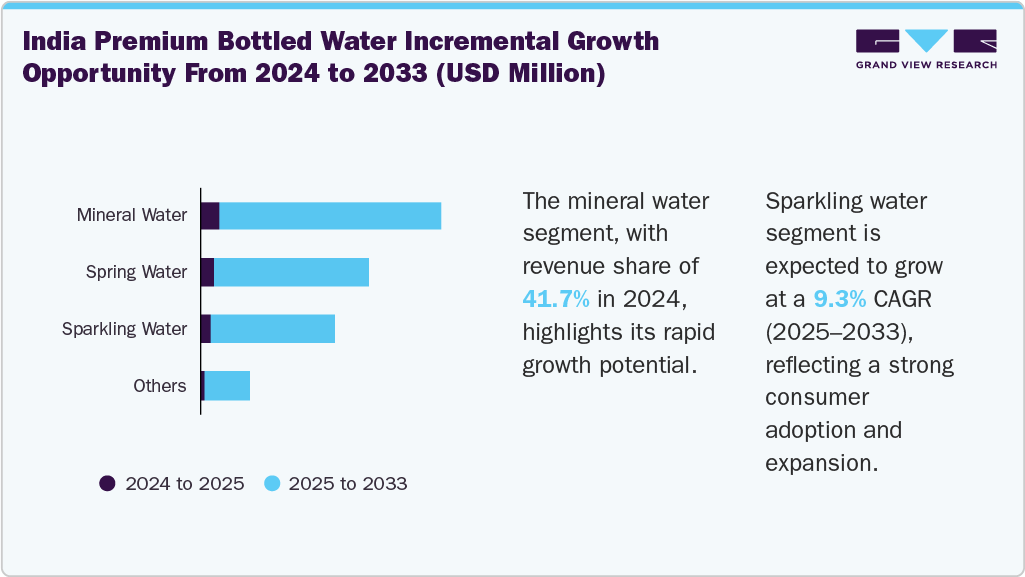

The mineral water segment dominated the market with a revenue share of 41.7% in 2024. It is driven by increasing environmental pollution and a decline in the quality of municipal water supplies. According to the IQair report, in 2024, the average PM2.5 concentration was over 10.1 times the WHO-recommended level. This increasing air pollution contaminates water sources, emphasizing consumer demand for clean, reliable bottled water options.

The sparkling water segment is expected to register the fastest CAGR of 9.3% between 2025 and 2033. A primary factor driving the demand is the increasing health consciousness among consumers, who seek healthier alternatives over traditional carbonated soft drinks. In addition, product innovation in flavored and functional variants continues to attract consumers seeking variety and added health benefits. In January 2022, Zenzi, a sparkling water brand, was launched in India. The company introduced affordable, calorie-free, natural sparkling water with unique flavors.

Distribution Channel Insights

The supermarket and hypermarket segment accounted for the largest revenue share of the India premium bottled water market in 2024. This growth is attributable to rising urbanization, retail expansion, and health-conscious consumers seeking quality and branded products. These modern retail setups offer better visibility, assured authenticity, and convenience, aligning with consumer lifestyles. In addition, strategic promotions, one-stop shopping experiences, and trust in product quality make these channels ideal for bottled water sales.

The online channel segment is anticipated to experience the fastest CAGR from 2025 to 2033. The market is driven by evolving consumer preferences and technological advancements. Increasing health awareness and a preference for premium, high-quality water among urban and digitally engaged consumers have led to greater reliance on e-commerce and quick commerce platforms. With a fast-paced lifestyle, consumers in India increasingly rely on e-commerce platforms such as Zepto, Blinkit, and Amazon.

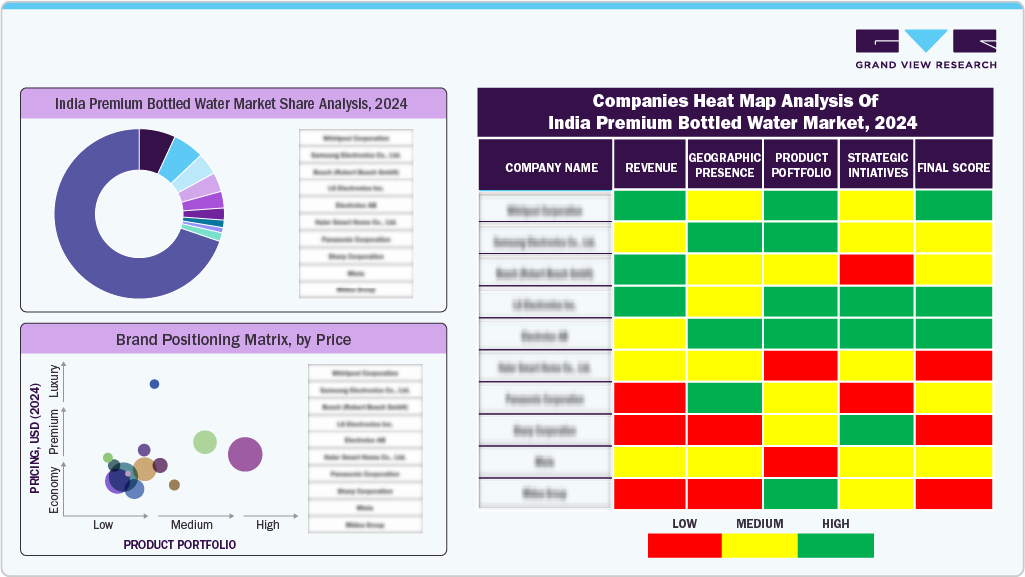

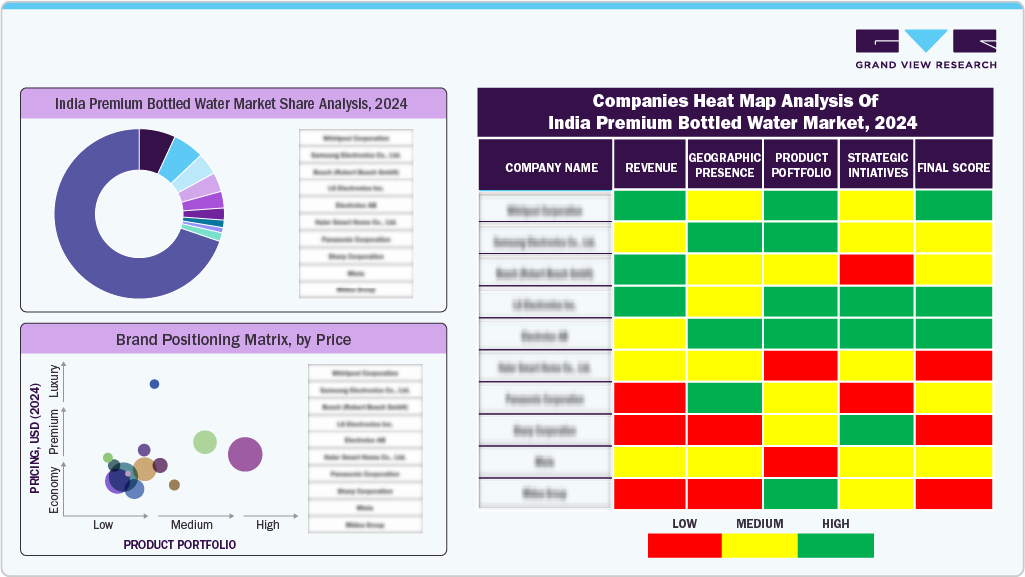

Key India Premium Bottled Water Company Insights

Some of the key players in India's premium bottled water market include Nestlé, Reignwood Group, and Hindustan Coca-Cola Beverages Pvt. Ltd.

-

Nestlé is dedicated to enhancing the quality of life through nutritious, safe, and sustainable products. With a presence in 185 countries and over 2,000 brands, the company offers diverse varieties, including dairy, beverages, pet care, healthcare nutrition, and more. Its core focus is on delivering delicious, nourishing products.

-

Hindustan Coca-Cola Beverages has been manufacturing beverages since 1997. With a portfolio of 37 products across 8 categories, the company serves over 3 million customers. Its mission is to deliver high-quality beverages while promoting sustainable practices and community engagement.

Key India Premium Bottled Water Companies:

- Nestlé

- Reignwood Group

- Hindustan Coca-Cola Beverages Pvt. Ltd.

- Bisleri

- Parle Agro

Recent Developments

-

In December 2024, Diageo India launched Godawan Estuary Premium Water across major retail outlets and e-commerce platforms in collaboration with Estuary Water.

-

In May 2024, Marvelle Healthcare launched Rhythm Water in India, a premium natural mineral water sourced from the Himalayas. The brand offered two varieties and is focused on a 20-year filtration process to ensure purity and mineral retention.

-

In October 2023, Bisleri International launched Vedica Himalayan Sparkling Water in India, expanding its premium beverage portfolio.

India Premium Bottled Water Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1,025.1 million

|

|

Revenue forecast in 2033

|

USD 1,996.5 million

|

|

Growth rate

|

CAGR of 8.7% from 2025 to 2033

|

|

Actual data

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, distribution channel

|

|

Key companies profiled

|

Nestlé; Reignwood Group; Hindustan Coca- Cola Beverages Pvt. Ltd.; Bisleri International Pvt. Ltd.; Parle Agro

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

India Premium Bottled Water Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the India premium bottled water market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Spring Water

-

Sparkling Water

-

Mineral Water

-

Others

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)