- Home

- »

- Renewable Energy

- »

-

India Solar PV Panels Market Size, Industry Report, 2030GVR Report cover

![India Solar PV Panels Market Size, Share & Trends Report]()

India Solar PV Panels Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Thin Film, Crystalline Silicon), By Grid (On Grid, Off Grid), By Application (Residential, Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-307-2

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Solar PV Panels Market Size & Trends

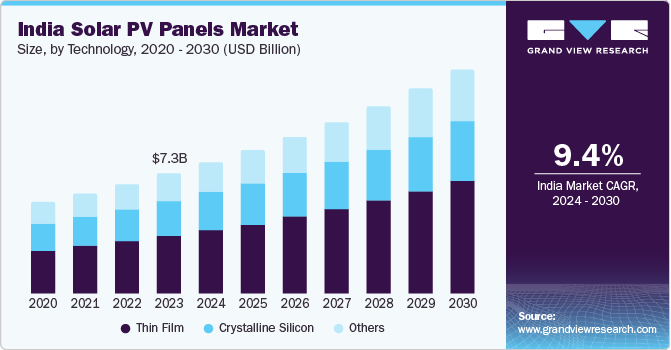

The India solar PV panels market size was estimated to be USD 7.31 billion in 2023 and is projected to grow at a CAGR of 9.4% from 2024 to 2030. The solar PV market in India is experiencing significant growth driven by a combination of factors. It includes supportive government policies such as the Jawaharlal Nehru National Solar Mission (JNNSM) and state-level initiatives, decreasing solar panel costs due to technological advancements and economies of scale.

Moreover, policies such as rising energy demand from population growth and economic development, a shift towards renewable energy sources to combat climate change and air pollution, continuous technological progress improving solar panel efficiency and grid integration solutions, and increasing adoption of solar power among businesses for sustainability goals and brand enhancement are also included.

Initiatives such as the Jawaharlal Nehru National Solar Mission (JNNSM) and various state-level policies offer subsidies, tax benefits, and incentives to promote solar energy adoption.JNNSM in India aims to promote solar energy adoption through initiatives such as pre-registration of solar power projects ranging from 100 KW to 2 MW capacity under the mission, facilitated by the Haryana Renewable Energy Development Agency (HAREDA) as a Competent Authority.

The decreasing cost of solar panels, driven by technological advancements, economies of scale, and increased competition, makes solar power more affordable and attractive. For instance, currently the solar Levelized Cost of Electricity (LCOE) in India is lower than that of fossil fuels, marking a substantial achievement in the country's renewable energy sector. The solar module prices in India have decreased by 82 to 85 percent in the last fifteen years, contributing to a significant reduction in solar power tariffs from over Rs 17 per unit to less than Rs 2.5 per unit.

India's growing population and expanding economy have led to an increasing demand for electricity, creating opportunities for solar PV as a renewable energy source. With concerns about climate change and air pollution, there is a growing emphasis on renewable energy sources such as solar power to reduce greenhouse gas emissions and improve air quality. Solar power reduces dependence on fossil fuels, enhancing energy security and reducing the country's vulnerability to fuel price fluctuations and geopolitical tensions.

Solar PV systems provide electricity to remote and off-grid areas where conventional electricity infrastructure is lacking or economically unfeasible. Ongoing advancements in solar panel efficiency, storage technologies, and grid integration solutions improve the performance and reliability of solar PV systems, driving market growth.

Many businesses in India are adopting solar power to meet their sustainability goals, reduce carbon footprints, and enhance their brand image. For instance, IKEA India installed a 10KW solar-powered electricity system at Bagalagunte Government Higher Primary School in Bengaluru as part of its CSR initiative, focusing on sustainability and community

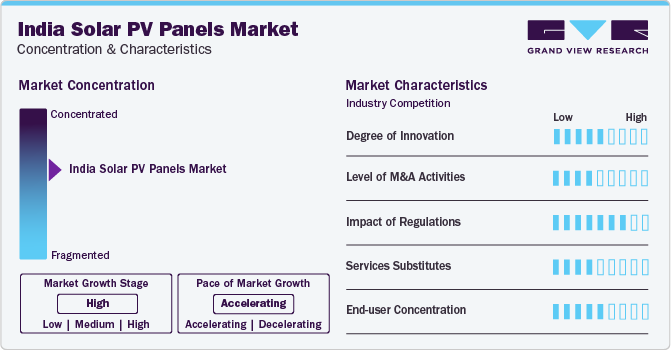

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The India solar PV panels industry is characterized by a moderate degree of innovation owing to the increasing adoption of advanced technologies and practices in the industry. The drivers behind this moderate level of innovation include government initiatives, growing demand for renewable energy sources, and technological advancements.

The India solar PV panels industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players This level is driven by the increasing demand for renewable energy sources, government incentives and policies supporting solar energy, and the need for companies to scale up their operations to compete effectively. For instance, the acquisition of SB Energy India by Adani Green Energy. This deal, valued at around $3.5 billion, allowed Adani Green Energy to strengthen its position as a leading renewable energy player in India by adding a significant portfolio of operational solar assets.

Global solar PV panels industry thrives due to the impact of regulations in the industry. India’s National Solar Mission has been a key driver in promoting solar energy adoption in the country. According to the Ministry of New and Renewable Energy, as of March 2021, India’s total installed solar capacity reached 39.2 GW. In addition, initiatives such as the Solar Energy Corporation of India (SECI) have been instrumental in facilitating solar power projects and auctions, further driving innovation in the sector.

The level of service substitutes in the India solar PV panels market can be classified as moderate. This is due to the presence of alternative sources of energy such as wind power, hydropower, and biomass energy that can serve as substitutes to solar PV panels. While these alternatives offer renewable energy solutions, they do not directly compete with solar PV panels in terms of efficiency and cost-effectiveness.

End user concentration is low in the solar PV panels industry due to the diverse range of end users in the market, including residential, commercial, and industrial sectors. Residential users are increasingly adopting solar panels for their homes to reduce electricity bills and contribute to sustainability efforts. Commercial and industrial users are also investing in solar PV panels to meet their energy needs and reduce carbon footprints. Recent statistics show that India added 1,545 MW of rooftop solar capacity in 2020, indicating a growing interest among various ends users.

Technology Insights

The thin film segment dominated the market and accounted for a share of48.32% in 2023 and is also expected to grow at the fastest CAGR over the forecast period. This can be attributed to several drivers, including its cost-effectiveness, flexibility, and efficiency. Thin film technology offers a lower cost per watt compared to traditional crystalline silicon panels, making it an attractive option for large-scale solar projects in India.

In addition, thin film panels are lightweight and flexible, allowing for easier installation on various surfaces and in diverse environments. Furthermore, advancements in thin film technology have improved its efficiency levels, making it a competitive choice in the market. For instance, thin-film solar technology in India focuses on First Solar's CdTe technology expansion driven by the U.S. Inflation Reduction Act and new manufacturing facilities, showcasing the growing significance and potential of thin-film solar solutions in the market.

The crystalline silicon segment is expected to grow at a significant rate. It is due to its high efficiency, reliability, and cost-effectiveness. Crystalline silicon panels have been the preferred choice for solar installations in India due to their proven track record of performance in various environmental conditions, making them a reliable option for investors and developers. Additionally, advancements in technology have led to increased efficiency levels of crystalline silicon panels, further boosting their demand in the market. For instance, as per an article by Economic Time, currently, in India, the majority of solar photovoltaic (PV) panel installations, approximately 90%, utilize crystalline silicon technology, which reaches a maximum efficiency of around 22%.

Grid Insights

On Grid segment accounted for the largest revenue share in 2023. It is due to state policy incentives, financial considerations, cost reductions, and government support and incentives. It all works together to promote the growth of commercial solar PV capacity by creating a favorable environment for solar energy integration into the grid, making it more accessible and economically viable for businesses and industries. In January 2024, Prime Minister Narendra Modi unveiled Lakshadweep's inaugural grid-connected solar initiative, showcasing a cutting-edge Battery Energy Storage System (BESS) developed by SECI. This project encompasses Kavaratti and Agatti islands, with a total solar capacity of 1.7 MW and a 1.4 MWh battery storage facility situated in Kavaratti.

Off Grid is expected to register the fastest CAGR of 14.2% during the forecast period.The growth of the off-grid segment in India can be attributed to the presence of private sector off-grid systems operating alongside government initiatives, the untapped market potential in unrecorded localities, and the opportunities arising from the unreliable grid infrastructure. This sector provides alternative electricity supply solutions, particularly in areas not accounted for in official records, where private sector participation is currently limited but shows promise for expansion alongside existing government grid and off-grid frameworks. For instance, the Off-grid Solar PV Programme in India aims to provide solar PV-based applications in areas without reliable grid power, covering systems such as solar home lighting, street lighting, power plants, pumps, lanterns, and study lamps, with targets set under the National Solar Mission for decentralized PV systems.

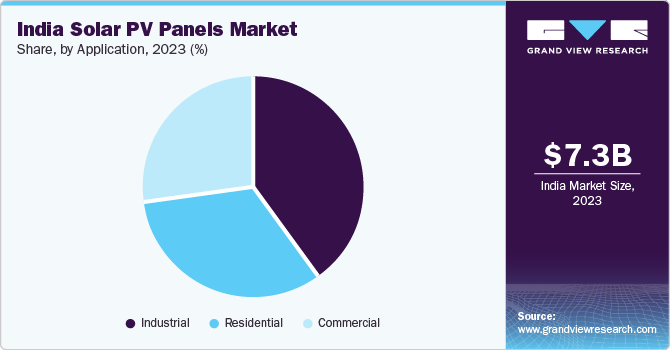

Application Insights

Industrial segment dominated the market in 2023. The rise in the industrial segment's involvement in the solar panel market is propelled by factors such as the advancement of photovoltaic power distribution systems improving industrial competitiveness, the dynamic nature of solar module prices affected by market demand, and the declining profitability of module manufacturers resulting in price reductions. Furthermore, the price fluctuations of silver, an essential component in solar modules, drive the demand for solar panel installations and contribute to the growth of the solar energy industry. For instance, in April 2023, Avaada Group raised USD 1.07 billion for green hydrogen and green ammonia ventures in India, with investments from Brookfield and GPSC, aligning with their global energy transition strategy and expansion into solar PV manufacturing.

The residential sector is projected to grow at the fastest CAGR over the forecast period. The rising consciousness and acceptance of renewable energy sources among homeowners have increased the demand for solar PV panels in residential properties. Government initiatives and subsidies aimed at promoting solar energy installations in households have further encouraged homeowners to invest in solar panels. Moreover, the decreasing cost of solar technology and the availability of financing options have enhanced accessibility for residential consumers to set up solar PV systems on their rooftops.

The solar panel subsidy in India focuses on encouraging solar system installations in institutional, residential, and social sectors to lower electricity costs and boost solar energy usage, with the exclusion of commercial, industrial, and public sector entities. For instance, PM-Surya Ghar: Muft Bijli Yojana, which grants households up to Rs 78,000 subsidy for solar plant installations and offers 300 units of free monthly power for one crore households.

Key India Solar PV Panels Company Insights

Some of the key companies in the India solar PV panels market include Tata Power Solar, Adani Solar, Vikram Solar, Waaree Energies, Saatvik Green Energy, RenewSys, Loom Solar, Goldi Solar.

-

Tata Power Solar offers a range of solar products and services, including solar modules, solar rooftops, solar panels, solar pumps, solar water heaters, solar power systems for residential, commercial, and industrial applications, as well as innovative solutions such as solar trees, solar power shades, and solar balconies.

-

Adani Solar is a leading solar panel manufacturer in India, known for high-quality mono and bifacial modules using PERC technology. With a 4 GW capacity and plans for a 10 GW ecosystem, they prioritize sustainability and innovation in the solar industry.

Key India Solar PV Panels Companies:

- Tata Power Solar Systems Ltd.

- Adani Group

- VIKRAM SOLAR LTD.

- Waaree Energies Ltd.

- Saatvik Green Energy Pvt Ltd.

- RenewSys India Pvt. Ltd.

- LOOM SOLAR PVT. LTD.

- Goldi Solar, Inc.

- Servotech Power Systems

- Bluebird Solar

- SWELECT Energy systems Ltd

- Panasonic Solar

- JA SOLAR Technology Co., Ltd.

- Microtek Solar Solutions

- Luminous India

Recent Developments

-

In March 2024, BluPine Energy, a renewable energy company backed by Actis, acquired 369 MW of solar assets from the Acme Group, expanding its total renewable capacity to 2.4 GW in India. This acquisition demonstrates BluPine Energy's commitment to fostering a sustainable future through renewable energy solutions in India.

-

In February 2024, Avaada Energy acquired 1400 MWp of solar projects in India through tenders issued by central and state government agencies, marking a significant advancement in the country's renewable energy sector.

-

In February 2024, Epsilon Advanced Materials acquired a lithium-ion phosphate (LFP) cathode technology center in Germany, positioning India as a key player in LFP cathode manufacturing outside of China. This acquisition strengthens Epsilon's position in the market by enabling comprehensive solutions through the integration of cathode and anode materials for lithium-ion batteries.

India Solar PV Panels Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 13.69 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, grid, application

Country scope

India

Tata Power Solar Systems Ltd.; Adani Group; VIKRAM SOLAR LTD.; Waaree Energies Ltd.; Saatvik Green Energy Pvt Ltd.; RenewSys India Pvt. Ltd.; LOOM SOLAR PVT. LTD.; Goldi Solar, Inc.; Servotech Power Systems Bluebird Solar; SWELECT Energy systems Ltd; Panasonic Solar; JA SOLAR Technology Co., Ltd.; Microtek Solar Solutions; Luminous India

;Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Solar PV Panels Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India solar PV panels market report based on technology, grid, and application.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Thin Film

-

Crystalline Silicon

-

Others

-

-

Grid Outlook (Revenue, USD Billion, 2018 - 2030)

-

On Grid

-

Off Grid

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

Frequently Asked Questions About This Report

b. India solar PV panels market size was estimated at USD 7.31 billion in 2023 and is expected to reach USD 8.0 billion in 2024

b. The India solar PV panels market is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030 to reach USD 13.69 billion by 2030

b. On Grid dominated the market with the largest share of 97.71% in 2023. It dominates the market due to the simplicity of grid-connected PV systems, cheap operating and maintenance expenses, and policies such as feed-in tariffs and net metering that stimulate growth.

b. Some key players operating in the India solar PV panels market include Tata Power Solar, Adani Solar, Vikram Solar, Waaree Energies, Saatvik Green Energy, RenewSys, Loom Solar, Goldi Solar

b. Key factors driving the market growth include increasing investments in renewable energy and government support through favorable policies, leading to significant growth in the sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.