- Home

- »

- Communications Infrastructure

- »

-

Indoor Distributed Antenna Systems Market Size Report 2030GVR Report cover

![Indoor Distributed Antenna Systems Market Size, Share & Trends Report]()

Indoor Distributed Antenna Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type, By Financing Model, By Facility Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-138-8

- Number of Report Pages: 229

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Indoor Distributed Antenna Systems Market Summary

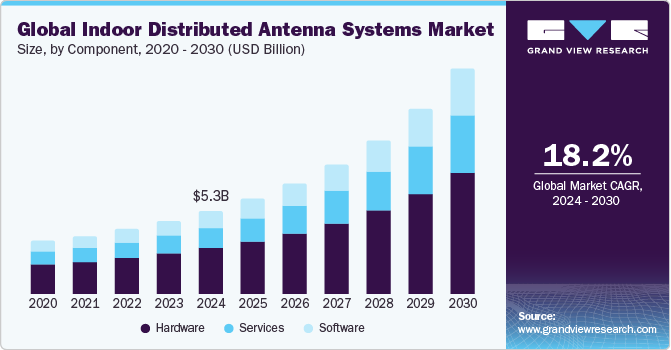

The global indoor distributed antenna system market size was estimated at USD 5.28 billion in 2023 and is expected to reach USD 16.33 billion by 2030, growing at a CAGR of 18.2% from 2024 to 2030. The widespread use of smartphones, tablets, and various wireless gadgets has created a growing need for reliable and fast wireless connections.

Key Market Trends & Insights

- North America dominated with a revenue share of over 35.0% in 2023.

- The U.S. Indoor Distributed Antenna Systems market is expected to grow at a CAGR of 8.6% from 2024 to 2030.

- By component, the hardware segment led the market and accounted for more than 55% share of the global revenue in 2023.

- By type, the active segment led the market and accounted for more than 41.0% share of the global revenue in 2023.

- By financing model, the operator funded segment led the market and accounted for more than 49% share of the global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.28 Billion

- 2030 Projected Market Size: USD 16.33 Billion

- CAGR (2024-2030): 18.2%

- North America: Largest market in 2023

The growth of the Internet of Things (IoT) and the deployment of 5G networks have driven the demand for more extensive and higher-capacity indoor wireless coverage. Moreover, regulations and mandates for public safety communications, such as FirstNet in the U.S., have increased the adoption of indoor distributed antenna systems in places such as airports, stadiums, and commercial buildings to ensure that emergency services have reliable connectivity. This demand extends to indoor spaces, where people increasingly expect uninterrupted access to communication and data services. These solutions are indispensable for enterprises seeking to foster a conducive work environment. By ensuring that employees and customers remain seamlessly connected, businesses can unlock improved productivity and heightened customer satisfaction, thus fostering growth and success.The distributed antenna system (DAS) comprises a comprehensive network of strategically positioned antennas that span a building or indoor environment. These antennas are intricately connected to a central hub or base station, which serves as the core for distributing wireless signals throughout the facility. The primary objective of distributed antenna system is to enhance and extend the coverage and capacity of wireless networks, including cellular, Wi-Fi, and public safety communications. The market is designed to improve wireless coverage and capacity, specifically within buildings, structures, or enclosed spaces. The significance of these systems arises from the growing demand for connectivity, their crucial role in business productivity and public safety, and the increasing data requirements of our modern digital age. As technology evolves, this market is essential in ensuring that individuals and organizations can enjoy a seamless and reliable indoor wireless experience.

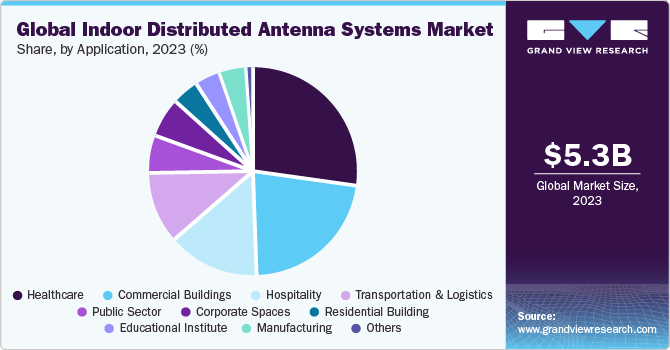

Indoor distributed antenna systems play a pivotal role in various industries, such as healthcare, manufacturing, hospitality & commercial, transportation & logistics, and others by ensuring robust indoor wireless connectivity. In office buildings, they facilitate uninterrupted communication and access to critical business applications, enhancing productivity and visitor experiences. Distributed Antenna Systems enriches the shopping experience in shopping malls, supports location-based marketing, and drives customer engagement. Within healthcare facilities, it is a lifeline for timely communication among healthcare professionals and provides patients with connectivity for comfort and stress reduction. DAS accommodates high-density crowds at stadiums and arenas, enhancing attendee experiences and enabling effective event organization. In the hospitality sector, these systems meet the evolving connectivity needs of guests and conferences, improving guest satisfaction and attracting events. Across these diverse use cases, indoor distributed antenna systems is a connectivity enabler, fostering improved experiences, productivity, and safety, making it an integral part of modern indoor infrastructure.

The indoor distributed antenna systems market is experiencing significant growth due to several key drivers. The increasing demand for enhanced connectivity, fueled by the widespread use of mobile and IoT devices, underscores the importance of DAS in ensuring seamless indoor wireless coverage. The rise in data consumption from activities like video streaming and online gaming necessitates robust network solutions, positioning distributed antenna systems as a crucial infrastructure component. Furthermore, advancements in technologies such as 5G and Wi-Fi 6 require indoor systems that can support higher speeds and lower latency, making distributed antenna systems essential. Public safety requirements also play a significant role, with regulations mandating reliable communication systems for emergency responders, which DAS supports effectively.

However, the market faces challenges such as high installation and maintenance costs, complex installation processes, and technological fragmentation. The initial investment and ongoing expenses can be barriers for smaller enterprises, while the complexity of deployment can lead to longer implementation times and higher costs. Supporting multiple frequency bands and technologies adds to the complexity and can complicate system design and integration.

Opportunities in the market are abundant, particularly in emerging regions where urbanization and infrastructure development drive demand for DAS. The integration of distributed antenna systems with smart building technologies offers potential for enhanced building intelligence and efficiency. Partnerships between DAS providers, telecom operators, and building owners can lead to cost-sharing and more efficient deployments, while collaborations with technology providers can result in innovative solutions and new business models. Challenges include regulatory and compliance issues, which vary across regions and can complicate deployments. Rapid technological changes require continuous investment in system upgrades to avoid obsolescence. In addition, ensuring optimal performance and mitigating interference in densely populated areas remain ongoing challenges.

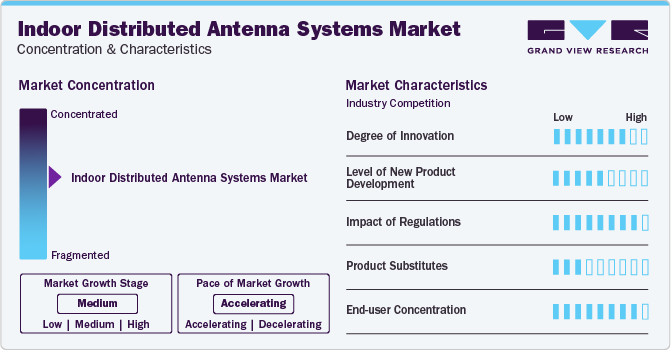

Market Concentration & Characteristics

The indoor distributed antenna systems market is characterized by a high degree of innovation due to the rapid advancements in wireless communication technologies. Innovations are driven by the increasing demand for enhanced mobile connectivity and coverage, particularly in dense urban environments and large buildings where signal penetration is poor. The advent of 5G technology has further spurred innovation, leading to the development of advanced DAS solutions that support higher data rates and lower latency. Companies are investing in research and development to create more efficient, scalable, and cost-effective distributed antenna systems solutions. Moreover, the integration of Internet of Things (IoT) devices and smart building technologies into DAS frameworks are pushing the boundaries of innovation, enabling more sophisticated network management and user experience enhancements.

The level of new product development in the indoor DAS market is moderate. While there is a continuous introduction of new products and upgrades to existing systems, the core technology remains relatively stable. Developments often focus on improving system efficiency, reducing installation and operational costs, and enhancing compatibility with emerging wireless standards such as 5G. Many companies prioritize incremental improvements and adaptations of existing technologies to meet specific customer needs and regulatory requirements. This medium level of new product development ensures a balance between maintaining reliability and integrating new features, catering to the evolving demands of end-users without overwhelming the market with frequent, radical changes.

Regulation plays a significant role in the Indoor DAS market, influencing various aspects of product development, deployment, and operation. Regulatory bodies, such as the Federal Communications Commission (FCC) in the United States, set stringent standards for spectrum usage, signal strength, and safety, ensuring that DAS installations do not interfere with other wireless services. Compliance with these regulations requires significant investment in certification and testing processes, impacting the cost and speed of bringing new products to market. In addition, regulations related to building codes and safety standards affect the design and installation of DAS systems, necessitating collaboration with local authorities and adherence to specific guidelines to ensure legal and functional compliance.

The availability of substitutes for Indoor DAS is low, primarily due to the unique benefits and capabilities that DAS provides in enhancing indoor wireless coverage and capacity. While small cells and Wi-Fi can offer some level of indoor connectivity, they do not match the seamless integration and signal quality provided by DAS, especially in large and complex environments such as stadiums, airports, and high-rise buildings. DAS offers a more robust and scalable solution that can handle high user densities and diverse service requirements, making it the preferred choice for enterprises seeking reliable and high-quality indoor connectivity. The limited efficacy of substitutes reinforces the reliance on DAS for comprehensive indoor wireless solutions.

The Indoor DAS market experiences high end-user concentration, with a significant portion of demand coming from specific sectors such as commercial real estate, hospitality, healthcare, and large public venues. These end-users require reliable and extensive wireless coverage to support a large number of mobile users and devices. For instance, hospitals need robust DAS solutions to support medical communications and patient monitoring systems, while commercial buildings and hotels demand high-quality wireless service to enhance the customer experience. This concentration leads to targeted marketing and customization of DAS solutions to meet the unique requirements of these sectors, fostering strong relationships between DAS providers and their key clients.

Component Insights

The hardware segment led the market and accounted for more than 55% share of the global revenue in 2023. By component segment, the market is bifurcated into hardware, software, and services. The hardware segment is further categorized as antenna nodes, base stations, and others (radio frequency cables, connectors and splitters, fiber optics. The primary role of DAS hardware components, such as antennas, cabling, and amplifiers, is to extend wireless coverage and capacity within indoor spaces. By strategically placing antennas and using quality cabling, distributed antenna systems ensure that cellular and wireless signals reach every building corner, eliminating dead zones and ensuring a seamless user experience. Indoor DAS hardware is designed to support multiple frequencies and technologies, including cellular, Wi-Fi, and public safety communications. This flexibility ensures that the DAS can adapt to changing wireless standards and evolving user needs, making it a future-proof solution for indoor connectivity.

The services segment is anticipated to witness the fastest growth, growing at a CAGR of 19.1% throughout the forecast period. Services play a critical role in tandem with hardware components, delivering comprehensive solutions for optimal indoor wireless connectivity. Their significance is underscored by a range of benefits, such as reliable connectivity, enhanced user experience, improved wireless coverage, and enhanced data speeds that drive market growth. DAS service providers offer expertise and tailored consultation, ensuring that distributed antenna systems solutions align with unique indoor requirements. Professional installation services maximize system effectiveness, optimizing coverage and performance.

Network optimization enhances voice and data quality, delivering a seamless user experience. Regular maintenance and support minimize downtime and disruptions, while compliance with industry standards ensures safety and regulatory adherence. Scalability accommodates evolving demands, and cost-efficient solutions mitigate errors, yielding long-term savings. Streamlined deployment processes expedite implementations, and an improved user experience fosters satisfaction. Lastly, these services provide organizations with a competitive edge, attracting and retaining customers and tenants.

Type Insights

The active segment led the market and accounted for more than 41.0% share of the global revenue in 2023. By end-user segment, the market is bifurcated into active, passive, and hybrid. Active DAS plays a pivotal role in the indoor DAS market due to their ability to efficiently amplify and distribute wireless signals within buildings. Their significance stems from several key benefits that drive their growth. Active indoor distributed antenna systems offer enhanced coverage, eliminating dead zones and ensuring consistent connectivity, which is especially vital in large venues like stadiums and malls. Secondly, these systems improve network capacity, handling high data traffic during crowded events without compromising service quality. Their scalability supports future expansion and is carrier agnostic, catering to diverse user bases. In addition, active distributed antenna systems optimize network performance, deliver high data rates, and are crucial for public safety communication. Investing in active indoor distributed antenna systems provides businesses and venues with a competitive edge, reliability, and futureproofing in an ever-evolving telecommunications landscape.

The hybrid indoor DAS segment is anticipated to grow at a considerable CAGR of 20.9% throughout the forecast period. Hybrid Indoor Distributed Antenna Systems are gaining significant importance in the indoor distributed antenna systems market due to their ability to leverage the strengths of both active and passive distributed antenna systems solutions. Their key advantages drive their adoption. Hybrid DAS systems offer optimal coverage, intelligently combining active and passive components to ensure comprehensive wireless signal distribution throughout buildings. They provide flexibility in deployment, allowing organizations to balance performance requirements with cost-effectiveness. Scalability is a notable feature, enabling these systems to grow with evolving connectivity demands. Hybrid distributed antenna systems solutions optimize costs by using passive components where appropriate and active components where needed, ensuring a strong return on investment. They also deliver reliability, support multiple carriers, adapt to emerging technologies, optimize network performance, and enhance the overall user experience. The versatility of hybrid DAS makes them suitable for various indoor environments, meeting the diverse needs of different industries.

Financing Model Insights

The operator funded segment led the market and accounted for more than 49% share of the global revenue in 2023 and is anticipated to grow at a CAGR of 17.0% throughout the forecast period. By financing model, the market is bifurcated into operator funded, build to suit (third party owner), and venue/customer funded. The mobile network operators (MNOs) cover the costs of installing and maintaining DAS infrastructure within a venue. This model's dominance is due to the considerable benefits it provides to both operators and venue owners. Operators are driven to enhance their network coverage and capacity to maintain customer satisfaction and reduce churn. They invest in DAS to deliver high-quality service in high-traffic locations like shopping malls, stadiums, airports, and corporate buildings, where seamless connectivity is essential. For operators, this model presents the opportunity to directly control network performance and quality. By financing the DAS infrastructure, operators can ensure that the systems are optimized for their specific network needs, leading to improved service delivery and higher customer satisfaction.

The venue/customer funded model is the fastest-growing financing approach in the Indoor DAS market. In this model, venue owners or customers themselves finance the installation and maintenance of the DAS infrastructure. Several factors drive this growth. Firstly, venue owners are increasingly aware of the critical importance of reliable wireless connectivity to attract and retain customers and tenants. High-quality indoor connectivity has become a key differentiator, enhancing customer experience and satisfaction. Additionally, advancements in financing options and more affordable DAS solutions have made it easier for venues to invest in their own DAS infrastructure. This financing model offers significant opportunities for venue owners to customize DAS solutions to meet their specific needs and preferences, ensuring the system supports their unique environment and customer base. It also allows venues to negotiate with multiple operators to integrate their networks into a single DAS infrastructure, maximizing coverage and service diversity.

Facility Type Insights

The large buildings (over 500 thousand square feet) segment led the market and accounted for more than 45% share of the global revenue in 2023 and is anticipated to grow at a CAGR of 16.4% throughout the forecast period. Large buildings, such as shopping malls, airports, hospitals, and corporate headquarters, represent the dominant segment in the Indoor DAS market. The sheer size and structural complexity of these buildings often result in poor wireless signal penetration and coverage, necessitating the deployment of robust DAS solutions to ensure reliable connectivity. Growth in this segment is driven by the increasing demand for uninterrupted, high-quality wireless services from both consumers and businesses. The rise of smart building technologies and the Internet of Things (IoT) further amplifies the need for comprehensive indoor wireless coverage to support a growing array of connected devices and applications.

The small buildings segment is expected to grow at a highest CAGR of 20.6% during the forecast period due to the significant opportunities for DAS providers to expand their market reach by offering scalable and affordable solutions tailored to the needs of smaller facilities. The growing awareness among small building owners about the competitive advantage of superior wireless connectivity can drive demand for DAS installations. Furthermore, the opportunity to provide modular and easily upgradable DAS solutions caters to the evolving needs of small building environments. As small businesses and residential complexes increasingly prioritize connectivity, DAS providers can tap into a burgeoning market segment, offering customized and efficient solutions that enhance user experience and operational efficiency in smaller spaces.

Application Insights

The healthcare segment led the market and accounted for 27.0% share of the global revenue in 2023. By application segment, the market is bifurcated into healthcare, manufacturing, hospitality & commercial, transportation & logistics, others (government, educational institutes, warehouse). This significance of these systems within the healthcare sector arises from seamless and real-time communication, which is essential for medical staff to coordinate patient care and access electronic health records, which distributed antenna systems facilitates, leading to improved patient outcomes. Additionally, augmenting telemedicine services requires robust indoor wireless connectivity, and DAS supports effective virtual consultations and remote patient monitoring. These systems enhance the overall patient experience by enabling patient and family connectivity, particularly during hospital stays. Moreover, DAS in healthcare facilities ensures immediate and reliable communication for first responders during emergencies, improving response times and patient safety. Compliance with strict regulatory requirements regarding indoor communication, data access, and data security is another significant aspect, and DAS helps healthcare facilities meet these standards. Furthermore, distributed antenna systems investments offer long-term value by improving patient care, reducing operational inefficiencies, and attracting top medical talent. As the Internet of Things (IoT) becomes more integrated into healthcare facilities, distributed antenna systems can accommodate the increasing number of connected devices.

The residential buildings segment is anticipated to grow at a considerable CAGR of 20.3% throughout the forecast period. The residential buildings segment presents significant opportunities for DAS providers to capitalize on a rapidly growing market. There is immense potential for deploying DAS solutions in new housing developments, retrofitting older buildings, and addressing the unique connectivity challenges in dense urban residential areas. By offering tailored DAS solutions, providers can enhance the value of residential properties, attracting tenants and homeowners who prioritize strong connectivity. Additionally, the residential market allows for innovative pricing and service models, such as subscription-based offerings or bundled packages with home internet services. With scalable and cost-effective solutions, DAS providers can meet the diverse needs of residential buildings, from single-family homes to large apartment complexes, ensuring comprehensive coverage and addressing the evolving connectivity demands of modern households.

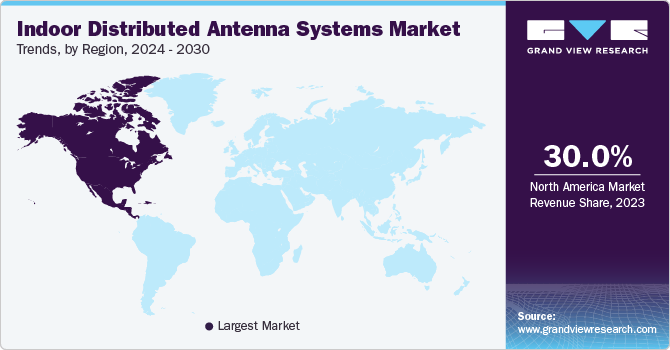

Regional Insights

North America is estimated to have a market share of 30.0% in 2023. Indoor DAS holds significant importance in North America due to the region's advanced telecommunications landscape and the increasing demand for uninterrupted connectivity. The region's population is highly connected with widespread smartphone and IoT device usage, making indoor DAS crucial for meeting the demands of seamless data access and communication. Additionally, North America prioritizes public safety compliance, where indoor DAS systems support first responders and emergency communication. Furthermore, these systems are integral to the corporate sector, fostering productivity, collaboration, and customer engagement. It also plays a vital role in the advanced healthcare system, retail innovation, transportation hubs, data centers, government facilities, and educational institutions.

U.S. Indoor Distributed Antenna Systems Market Trends

The U.S. indoor distributed antenna systems market is robust and mature, driven by the high demand for enhanced wireless connectivity in large commercial venues such as stadiums, airports, and shopping malls. The proliferation of smart devices and the increasing reliance on mobile internet for business and personal use have spurred the adoption of DAS solutions. The rollout of 5G networks is a significant growth driver, as DAS systems need to support higher data rates and greater device densities. Additionally, regulatory support and incentives for improving telecommunications infrastructure have further boosted market growth. Major players like CommScope, Corning, and American Tower dominate the market, continually innovating to improve system efficiency and coverage.

Asia Pacific Indoor Distributed Antenna Systems Market Trends

Asia Pacific is expected to grow notably with a CAGR of 20.4%. Asia Pacific holds a prominent position in the market due to its vast and diverse geography and robust economy. High population density, particularly in urban areas, fuels the demand for these systems to ensure consistent and high-quality connectivity for mobile users. Additionally, Asia Pacific encompasses emerging markets where indoor DAS is pivotal for fostering economic growth, supporting businesses, and extending digital services to remote areas. The region's transition to smart cities relies on indoor DAS for IoT deployment and efficient public services. Moreover, Asia Pacific's status as a global tourism hub benefit from indoor DAS, enhancing the experience for travelers in hotels, resorts, and tourist destinations. These systems are also crucial in manufacturing, remote area connectivity, e-commerce operations, digital transformations, public safety, and disaster management. The region presents substantial investment opportunities for indoor DAS providers, with governments and businesses actively investing in digital infrastructure to drive economic development and innovation.

The China indoor distributed antenna systems market is experiencing rapid growth, fueled by the country’s aggressive 5G rollout and the increasing demand for high-speed internet in urban areas. The government's strategic initiatives to bolster digital infrastructure and smart city projects significantly contribute to the market expansion. High population density in urban centers necessitates robust DAS solutions to ensure seamless connectivity in high-rise buildings, shopping centers, and transport hubs. Chinese technology giants such as Huawei and ZTE play a pivotal role in the market, providing advanced and cost-effective DAS solutions. The market also benefits from substantial investments in research and development, driving innovation and efficiency in DAS technologies.

Europe Indoor Distributed Antenna Systems Market Trends

The indoor distributed antenna systems market in Europe is growing steadily, driven by the need to enhance indoor mobile connectivity across diverse environments, including commercial buildings, transportation hubs, and educational institutions. The region’s focus on digital transformation and smart infrastructure development supports this growth. The adoption of 5G technology is a key driver, requiring upgraded DAS systems to handle higher data throughput and extensive device connectivity. Countries such as Germany, France, and Italy are leading the market with significant investments in DAS installations. European regulations aimed at improving telecommunications infrastructure further facilitate market growth, with prominent players like Nokia and Ericsson leading the innovation and deployment of advanced DAS solutions.

The UK indoor distributed antenna systems market is expanding, driven by the increasing need for reliable indoor connectivity in urban and suburban areas. The growing adoption of 5G technology necessitates the deployment of advanced DAS solutions to support enhanced mobile experiences. Key sectors such as healthcare, education, and retail are significant adopters of DAS, aiming to provide seamless connectivity for critical applications and customer services. Government initiatives to improve digital infrastructure and support for smart city projects are further boosting the market. Leading companies such as BT and Vodafone are investing heavily in DAS technology to enhance their service offerings, ensuring robust and comprehensive coverage across the UK.

Key Indoor Distributed Antenna Systems Company Insights

Some of the key companies operating in the Market include Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd, among others.

-

Telefonaktiebolaget LM Ericsson is one of the leading companies in the indoor distributed antenna systems market and offers a wide range of indoor DAS solutions. The company’s portfolio includes antennas, antenna system accessories, and radios, such as the Indoor AIR 1279, for indoor applications. The company invests significantly in Research and Development (R&D) to introduce innovative solutions. In 2023, it spent USD 5.03 billion on R&D, an increase of over 7% in its R&D expenses from 2022.

-

Huawei Technologies Co., Ltd. provides a wide range of antenna and indoor connectivity solutions through its LampSite range of solutions. Huawei LampSite Family solutions adapt seamlessly to a variety of indoor scenarios, catering to both varying capacity requirements and coverage needs. In recent years, Huawei Technologies Co., Ltd. has engaged in product development and partnerships & collaborations to improve its indoor connectivity solutions. The company’s global presence has also contributed to its dominance in the market.

Blu Wireless, and SOLiD are some of the emerging market companies in the target market.

-

SOLiD is an emerging player in the Indoor DAS market, gaining recognition for its cutting-edge technology and flexible solutions. The company focuses on addressing the connectivity challenges in various environments such as commercial buildings, hospitals, educational institutions, transportation hubs, and large venues like stadiums and shopping malls. By offering scalable and customizable DAS solutions, SOLiD caters to a wide range of customers, from small enterprises to large network operators.

-

As an emerging player in the Indoor DAS market, Blu Wireless is gaining recognition for its advanced mmWave solutions that provide ultra-high-speed connectivity and significant bandwidth. The company's technology is particularly suited for environments that require high data rates and low latency, such as smart buildings, transport hubs, and large public venues. Blu Wireless’s mmWave technology is integral to the deployment of 5G networks, making it a key player in the evolving landscape of indoor wireless communication.

Key Indoor Distributed Antenna Systems Companies:

The following are the leading companies in the indoor distributed antenna systems market. These companies collectively hold the largest market share and dictate industry trends.

- CommScope

- Corning Incorporated

- Comba Telecom Systems Holdings Ltd.

- ATC TRS V LLC

- HUBER+SUHNER

- TE Connectivity

- Telefonaktiebolaget LM Ericsson

- Nokia

- ZTE Corporation

- Huawei Technologies Co., Ltd.

- Galtronics

- Boingo Wireless, Inc.

- PBE Group

Recent Developments

-

In January 2024, Rosenberger Hochfrequenztechnik GmbH & Co. KG, partnered with TTI, Inc.- Europe, a German-based, distributor of various components, including passive and interconnect components. This agreement ensures the immediate availability of Rosenberger Hochfrequenztechnik GmbH & Co. KG's product portfolio to customers in the Europe, Middle East & Africa (EMEA) region, leveraging TTI, Inc.- Europe's extensive sales network.

-

In March 2024, Boldyn Networks announced the acquisition of Apogee, a provider of on-campus connectivity infrastructure in the U.S. The higher education industry is bolstering Boldyn Networks' presence and capabilities in the education sector and fueling its rapid expansion in the U.S. Apogee's clients are expected to benefit from Boldyn Networks' expanded wireless solutions, combining their full range of infrastructure. offerings and substantial investment to enhance connectivity nationwide, especially within the higher education sector.

Indoor Distributed Antenna Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.99 billion

Revenue forecast in 2030

USD 16.33 billion

Growth rate

CAGR of 18.2% from 2024 to 2030

Base year for estimation

2023

Historic year

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, financing model, facility type, application, region

Regional scope

North America; Europe, Asia Pacific; Latin America; Middle East; Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Switzerland; Netherlands; India; China; Japan; South Korea; Thailand; Philippines; Indonesia; Malaysia; Bangladesh; Brazil; Argentina; Colombia; Chile; Peru; UAE; Saudi Arabia; Qatar; Oman; Kuwait; South Africa; Morocco; Egypt; Nigeria; Kenya

Key companies profiled

CommScope; Corning Incorporated; Comba Telecom Systems Holdings Ltd.; ATC TRS V LLC; HUBER+SUHNER; TE Connectivity; Telefonaktiebolaget LM Ericsson; Nokia; ZTE Corporation; Huawei Technologies Co., Ltd.; Galtronics; Boingo Wireless, Inc.; PBE Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Indoor Distributed Antenna Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global indoor distributed antenna systems market report based on component, type, financing model, facility type, application, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Antenna Nodes/Radio Nodes

-

Base Station

-

Others

-

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Active

-

Passive

-

Hybrid

-

-

Financing Model Outlook (Revenue, USD Million, 2017 - 2030)

-

Operator Funded

-

Build to Suit (Third Party Owner)

-

Venue/Customer Funded

-

-

Facility Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Buildings (Over 500 thousand square feet)

-

Medium Buildings (50 thousand to 499 thousand square feet)

-

Small Buildings (Below 50 thousand square feet)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Commercial Buildings

-

Residential Building

-

Corporate Spaces

-

Educational Institute

-

Manufacturing

-

Hospitality

-

Transportation & Logistics

-

Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Philippines

-

Indonesia

-

Malaysia

-

Bangladesh

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

-

Middle East

-

UAE

-

Saudi Arabia

-

Qatar

-

Oman

-

Kuwait

-

-

Africa

-

South Africa

-

Morocco

-

Egypt

-

Nigeria

-

Kenya

-

-

Frequently Asked Questions About This Report

b. The global indoor distributed antenna systems market size was estimated at USD 5.28 billion in 2023 and is expected to reach USD 5.99 billion in 2024.

b. The global indoor distributed antenna systems market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 16.33 billion by 2030.

b. North America is expected to dominate the market and grow at a CAGR of 15.9%. Indoor DAS holds significant importance in North America due to the region's advanced telecommunications landscape and the increasing demand for uninterrupted connectivity. The region's population is highly connected with widespread smartphone and IoT device usage, making indoor DAS crucial for meeting the demands of seamless data access and communication.

b. Some prominent players in the indoor distributed antenna systems market include Commscope, Corning Incorporated, Comba Telecom Systems Holdings Ltd., ATC TRS V LLC. (American Towers), HUBER+SUHNER, TE Connectivity, Galtronics, Boingo Wireless, Inc., and PBE Group, among others.

b. Key factors driving the indoor distributed antenna systems market growth include the widespread use of smartphones, tablets, and various wireless gadgets has created a growing need for reliable and fast wireless connections.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.