- Home

- »

- Biotechnology

- »

-

Induced Pluripotent Stem Cells Production Market Report, 2030GVR Report cover

![Induced Pluripotent Stem Cells Production Market Size, Share & Trends Report]()

Induced Pluripotent Stem Cells Production Market Size, Share & Trends Analysis Report By Process, By Workflow (Reprogramming, Cell Culture), By Product, By Application (Regenerative Medicine), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-549-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

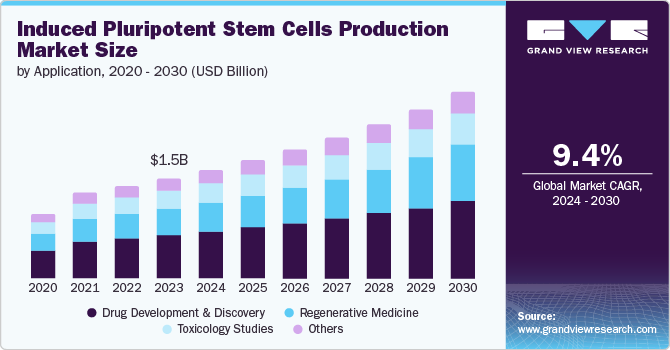

The global induced pluripotent stem cells production market size was estimated at USD 1.48 billion in 2023 and is anticipated to grow at a CAGR of 9.44% from 2024 to 2030. The potential of stem cell-based therapies, the growing incidence of cancer, increasing capital investments for stem cell-based research, and multiple advantages of induced pluripotent stem cells (iPSCs) over embryonic stem cells (ESCs) are driving the market growth significantly. According to the report published by the American Cancer Society, in 2023, it is anticipated that there will be approximately 1.9 million fresh cases diagnosed and around 609,820 deaths due to cancer in the U.S.

The increase in research activities during the COVID-19 pandemic also boosted iPSCs-based research activities. The continuous efforts by scientists to develop novel treatments and therapies to manage the SARS-CoV-2 infection have driven the demand for iPSCs as research tools. In addition, as induced pluripotent stem cells can generate physiologically similar organ models or organoids, these cells can be used to understand the pathophysiology of the virus infection in humans.

For example, in October 2022, according to an article published by the Journal of Nature Cell Biology, researchers from Japan tried to understand the role of salivary glands during COVID-19 infection. The researchers used human iPSCs to generate Human Induced Salivary Glands (hiSGs) to assess the role of salivary glands as virus reservoirs. As per the authors of this research article, hiSGs can prove to be a promising in-vitro model for future investigation. This further aids the understanding of SARS-CoV-2 infection spread, thereby driving the demand for induced pluripotent stem cells as a powerful research tool in the future.

The increased number of induced pluripotent stem cells-based research studies is expanding the market growth drastically. Currently, more than 120 clinical trials are underway that utilize iPSCs for disease intervention or the generation of iPSCs products. In addition, the advantages offered by induced pluripotent stem cells, such as the elimination of animal models and flexibility of ethical implications associated with embryonic stem cells further propel the market growth. This has created a favorable market for iPSCs-based therapeutics from many business entities in a wide range of applications, including searching for new drugs, modelling diseases, toxicological tests, and several others. For instance, in August 2021, Fate Therapeutics declared that FT819 had successfully treated its first patient in a clinical trial. The CAR-T cell treatment known as FT819 was created using iPSCs. FT819 is an iPSC-derived engineered CAR-T cell treatment.

Many companies and research organizations are discovering the therapeutic potency of stem cell products and targeting diseases with cell-based therapeutics. For example, in June 2021, Novo Nordisk A/S announced a global partnership with Heartseed Inc., an iPSC-producing startup in Japan. Through this collaboration, the company develops, manufactures, and commercializes HS-001, which are purified cardiomyocytes derived from iPSCs. HS-001 is an investigated cell therapy for heart failure. Additionally, in July 2022, Curi Bio announced the launch of the Mantarray platform for 3D cardiac and skeletal engineered muscle tissue (EMT) contractile activity analysis relevant to humans.

Market Concentration & Characteristics

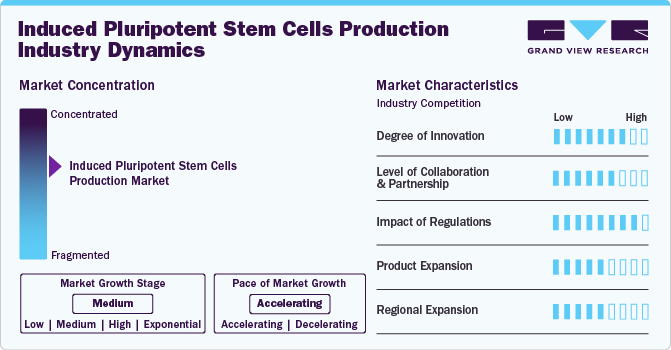

The induced pluripotent stem cells production industry has seen significant innovation in recent years, with the introduction of advanced technologies that have improved the efficiency and accuracy of data analysis. The development of 3D culture systems and organoid technology has further allowed for more accurate modeling of human tissues and organs, improving the utility of iPSCs in drug testing and disease modeling. This has led to broader application and more intricate analyses.

In this industry, partnerships and collaboration activities are moderately prevalent, reflecting a medium level of engagement within the industry.In April 2023, Axol Biosciences signed an exclusive agreement with the Francis Crick Institute. Under this agreement, the company received exclusive rights to a methodology to generate hPSC used in drug screening and cardiotoxicity assays.

The regulatory significantly impact the induced pluripotent stem cells production industry. Regulatory authorities are focusing on establishing stringent guidelines for biosafety, contamination control, cell line authentication, and other factors. This compliance with regulatory standards represents significant challenges that may limit the growth of the market.

The industry has seen moderate growth in recent years, driven by the increasing demand for induced pluripotent stem cells due to the rising demand for personalized medicine and increasing research & development activities focused on iPSC. For instance, in June 2022, Axol BioScience Ltd introduced Comprehensive In Vitro Proarrhythmia Assay (CiPA)-validated, hiPSC-derived ventricular cardiomyocytes to help enhance drug discovery.

The industry is experiencing a high level of regional expansion, indicating rapid growth and increasing market presence across different geographic regions. This expansion is driven by several factors, including the increased research and development focused on iPSCs for regenerative medicine, disease modeling, and drug discovery, driving demand and expansion. For instance, in August 2022, Thermo Fisher Scientific, Inc. expanded its cell culture media manufacturing site in the U.S., and such expansions can help the company increase its iPSC generation capacity.

Process Insights

The manual iPSC production process segment dominated the market and accounted for the largest revenue share in 2023. The manual iPSC production process begins with the introduction of genes/transcription factors into rising somatic cells, a reprogramming step & selection of iPSC colonies, expansion, and passaging of iPSCs. Companies with expertise in tissue procurement, gene introduction, RNA reprogramming, and cell culture and expansion drive revenue generation in this segment. For example, REPROCELL, Inc. a Japan-based company, provides GMP iPSCs manufacturing services. The company offers to generate the GMP master cell bank of iPSCs via manufacturing processes which is consistent with global regulatory guidelines.

The automated iPSC production process segment is estimated to exhibit the fastest CAGR of 11.73% during the forecast period. The increasing demand for stem cell-based therapies requires scaling up. This demand for generating large-scale induced pluripotent stem cells (iPSCs) in a reproducible manner with minimum alterations is propelling the adoption of automated production platforms. Most companies working on iPSCs-based therapies rely on lines of allogenic cells that are taken from multiple donors. These cells are then created into off-the-shelf products on a large scale which can be used for the treatment of patients affected with the same diseases.

Workflow Insights

The cell culture segment dominated the market with the largest revenue share of 37.34% in 2023. Cell culture workflow is inclusive of revenues generated from iPSC harvest products, expansion products, and differentiation products; thus contributing to the market relevance of this segment. Cell culture plays a pivotal role in various stages of induced pluripotent stem cells (iPSCs) generation and continuous investments by key players operating in this market globally have made an important contribution to the segment’s revenue generation. For example, in August 2021, HebeCell Corp. announced that it had raised USD 53 million in financing to advance its R&D program, clinical operations, and commercialization for off-the-shelf pluripotent stem cell-CAR-NK products. Additionally, costs associated with cell culture matrices, media, and regular maintenance of these cells add up to the revenue generated by this segment.

The cell characterization/analysis segment is expected to grow at the fastest CAGR of 16.02% over the forecast period, owing to factors such as the growing use of assays based on cells in drug discovery due to their consistency in producing tissue-specific results. Additionally, the segment is anticipated to grow due to the rising incidence of chronic diseases like cancer, which has seen an increase in the use of cell-based assays for detection and treatment. In 2020, Thermo Fisher acquired Phitonex, inc. Through this acquisition, Thermo Fisher was able to enhance its image multiplexing and flow cytometry capabilities for the study on protein and cell analysis.

Product Insights

The consumables and kits segment dominated the market and accounted for the largest revenue share of 40.32% in 2023. The never-ceasing research and development activities in the iPSCs space are driving the demand for various consumables & kits. Multiple induced pluripotent stem cells (iPSCs) kits such as reprogramming kits, differentiation kits, and generation kits along with a selection of media & other consumables by key players are allowing end users to utilize these products as per intended application. In addition, the utility of kits and media during toxicology testing is further propelling the growth of this product segment.

The automated platforms segment is expected to grow at the fastest CAGR of 13.92% during the forecast period, due to the demand for stem cell products, the scaling up of clinical phase iPSC therapies, and regulatory level quality control. The automated platforms provide reproducible & reliable results, reduce labor dependence, and provide well-maintained conditions of manufacturing, and standardization of protocols while eliminating human biases. For instance, Hitachi Ltd. offers an automated equipment for iPSCs culture with an aim to spread regenerative medicines. Many other companies are also offering such automated platforms to increase throughput, decrease operational costs, and increase adaptability for iPSCs production.

Application Insights

The drug development & discovery segment dominated the market with the largest revenue share of 43.33% in 2023. As the world is witnessing a rise in chronic diseases, The Partnership to Fight Chronic Disease (PFCD) estimated that more than 130 million Americans are affected with chronic diseases like diabetes, asthma, heart problems, and cancer. PFCD also stated that more than 1 in 2 American adults lives with one chronic disease and about 1 in 3 suffers from two or more chronic diseases. Thus, the prevalence of diseased conditions is driving the demand for disease understanding, and induced pluripotent stem cells are widely used in disease modeling leading to the development & discovery of innovative treatment plans. For example, Edigene, Inc. and Neukio Biotherapeutics collaborated in February 2022, for development and research to create next-generation immune cell therapies using iPSC and natural killer cells (NK Cell).

The regenerative medicine segment is expected to grow at the fastest CAGR of 11.84% over the forecast period of 2024 to 2030, owing to the vast applications and robust product pipelines by companies. In addition, iPSCs can be mediated for disease-specific therapies and provide greater and safer drug development platforms. Also, iPSC-derived organoids and organs are recently being analyzed for both disease modeling and regenerative therapy. In disease modeling, induced pluripotent stem cells enable drug discovery for innovative therapeutics, and in regenerative therapy, iPSCs are proceeding with clinical trials. For example, in April 2022, Editas Medicine, Inc. announced its preclinical data (both in-vitro & in-vivo) for tumor killing capability of its NK cell therapy derived from induced pluripotent stem cells (iPSCs).

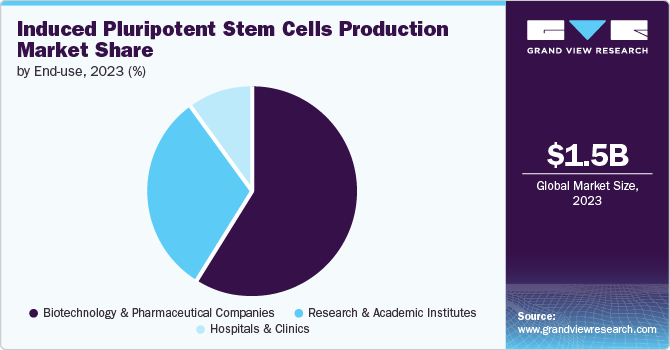

End-use Insights

The biotechnology & pharmaceutical companies segment dominated the market with the largest revenue share of 59.35% in 2023. The availability and adoption of various kits, consumables, and instruments along with iPSCs products are driving the revenue generation in this segment. To utilize the market opportunity of the stem cell-based therapy market, biotechnology and pharmaceutical companies are boosting new product developments via intensive R&D efforts. For example, in October 2022, Fate Therapeutics announced that it will be presenting its preclinical and clinical data of multiple iPSC product platforms at the Society for Immunotherapy of Cancer (SITC) meeting to be held in November 2022. This demonstrates the robust induced pluripotent stem cells (iPSCs) product pipeline in the market, further fueling the growth.

The research & academic institutes segment is expected to grow at the fastest CAGR of 11.30% over the forecast period. This is due to iPSCs having wide applications and thus being utilized in many research as well as clinical studies. The increasing utilization of iPSCs in regenerative studies provides favorable prospects for translating this technology into clinical use. For instance, in March 2022, researchers from Indiana University in collaboration with other institutions investigated the use of human induced pluripotent stem cells for the regeneration of visual acuity among diabetes patients. Furthermore, a growing research setting to evaluate the safety and efficacy of iPSC-based treatments will drive market growth.

Regional Insights

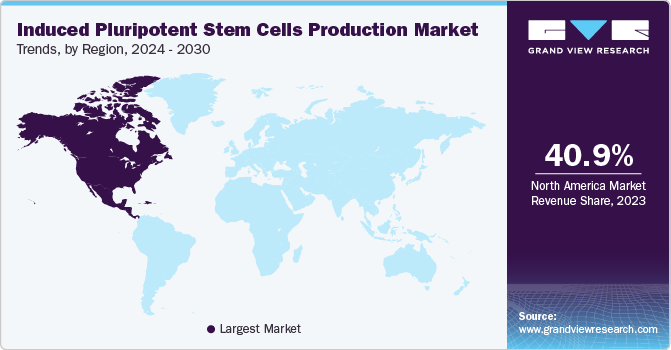

North America accounted for the largest market share of 40.98% in 2023 for the induced pluripotent stem cells production market. The growing incidence of chronic diseases in this region, developed healthcare infrastructure, funds from private & government initiatives, and strategic business models are driving the revenue generation in the market space. In addition, North America is also observing the highest number of clinical trials for iPSCs. Currently, there are more than 58 clinical trials that are underway in this region. Moreover, institutes like NIH, California Institute for Regenerative Medicine (CIRM), National Institute of Neurological Disorders and Stroke (NINDS), and many more support induced pluripotent stem cells (iPSCs) related research activities.

U.S. Induced Pluripotent Stem Cells Production Market Trends

The induced pluripotent stem cells (iPSC) production market in the U.S. is expected to grow over the forecast period due to a growing availability of funds from government organizations. Moreover, stem cell-based companies received significant support during the COVID-19 pandemic to develop therapies.

Europe Induced Pluripotent Stem Cells Production Market Trends

The induced pluripotent stem cells (iPSC) production market in Europe was identified as a lucrative space. This can be attributed to the increasing demand for advanced therapy products and several companies & clinics are entering the region.

The induced pluripotent stem cells production market in the UK held a significant share in 2023. This is attributed to the major private players are entering the market through strategic initiatives, such as mergers and acquisitions.

France induced pluripotent stem cells production market is expected to grow remarkably over the forecast period. France has witnessed an increase in the number of stem cell clinical trials. Researchers are studying intravenous injection of autologous mesenchymal stem cell therapy for the treatment of ischemic stroke.

The induced pluripotent stem cells production market in Germany is anticipated to grow significantly over the forecast period. The presence of a substantial number of providers offering iPSC products and initiatives undertaken by them to expand their businesses is propelling the growth of the market in Germany.

Asia Pacific Induced Pluripotent Stem Cells Production Market Trends

The induced pluripotent stem cells (iPSC) production market in Asia Pacific held the highest CAGR of 11.15% over the forecast period. Key factors such as intensive low-cost driven stem cell-based research, growing economies, betterment in healthcare plans, and the rising awareness of the potential of personalized treatments will drive revenue generation during the forecasted period. Moreover, the presence of multiple start-ups, academic universities, collaborative efforts by international companies, and new product/service launches in this region will contribute to APAC’s growth.

The induced pluripotent stem cells production market in China is expected to grow over the forecast period. The China induced pluripotent stem cells production market is driven by several initiatives undertaken by companies and research institutes.

Japan induced pluripotent stem cells production market is witnessing rapid growth. In June 2023, REPROCELL, Inc., a Japanese company, announced the debut of Pharmacology-AI, a brand-new paid service. The Hartree National Centre for Digital Innovation (HNCDI), in collaboration with IBM and the Science and Technology Facilities Council (STFC) Hartree Centre, has just finished one of the first EXCELERATE projects. REPROCELL and HNCDI worked together to develop EXCELERATE, a machine learning (ML) platform that streamlines and expedites the processing of large amounts of information from drug creation studies. Also, REPROCELL, Inc. and JTB Corp announced a business alliance in October 2022, and by using the Japan Medical & Health Tourism Centre (JMHC), a medical coordinating branch set up by JTB, they will start offering "Personal iPS" (REPROCELL's iPSC store as well as manufacturing service) worldwide.

MEA Induced Pluripotent Stem Cells Production Market Trends

The induced pluripotent stem cells production market in MEA is expected to grow exponentially over the forecast period. This is attributed to considerable support received from the local government and the healthcare transformation mission undertaken for the next few years. With the rapid expansion of cell banks and an increase in awareness about stem cell preservation, the market for induced pluripotent stem cells production is expected to rapidly grow in the coming years.

Saudi Arabia induced pluripotent stem cells production market is expected to grow over the forecast period. In March 2022, Saudi Arabia announced the development of a specialized bank of iPS cells sourced from Saudi donors, allowing patients in the country to discover tailored cell therapy solutions.

The induced pluripotent stem cells production market in Kuwait is anticipated to grow over the forecast period. The increase in the number of new cancer cases is driving the market growth in Kuwait.

Key Induced Pluripotent Stem Cells Production Company Insights

The market players operating in the induced pluripotent stem cells (IPSC) production market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Induced Pluripotent Stem Cells Production Companies:

The following are the leading companies in the Induced Pluripotent Stem Cells Production market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza

- Axol Bioscience Ltd.

- Evotec

- Hitachi, Ltd.

- REPROCELL Inc.

- Merck KGaA

- REPROCELLS, Inc.

- Fate Therapeutics

- Thermo Fisher Scientific, Inc.

- StemCellsFactory III

- Applied StemCells, Inc.

Recent Developments

-

In October 2023, QHP Capital acquired Applied StemCell, and this acquisition was expected to scale up the manufacturing of various types of cells, including iPSCs.

-

In September 2023, Ushio, Inc. collaborated with Axol Bioscience as its supplier for iPSC-derived sensory neuron cells. This new contract allowed Ushio to use human iPSC-derived axoCells sensory neurons in its in vitro Nerve Plate platform.

-

In June 2023, Merck KGaA expanded reagent manufacturing in China. It invested USD 74.2 million for this expansion. Such investments in reagent production can fuel iPSC production.

-

In May 2023, Evotec SE introduced new High-Throughput Screening (HTS) facilities at its headquarters in Hamberg, Germany. These facilities would be utilized for research related to human iPSCs. Such launches of facilities for iPSC-based research are anticipated to boost iPSC production.

Induced Pluripotent Stem Cells Production Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.61 billion

Revenue forecast in 2030

USD 2.76 billion

Growth rate

CAGR of 9.44% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, workflow, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lonza; Axol Bioscience Ltd.; Evotec; Hitachi, Ltd.; REPROCELL Inc.; Merck KGaA; REPROCELLS, Inc.; Fate Therapeutics; Thermo Fisher Scientific, Inc.; StemCellsFactory III; Applied StemCells, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Induced Pluripotent Stem Cells Production Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global induced pluripotent stem cells production market report based on process, workflow, product, application, end-use, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual iPSC Production Process

-

Automated iPSC Production Process

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Reprogramming

-

Cell Culture

-

Cell Characterization/Analysis

-

Engineering

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments/ Devices

-

Automated Platforms

-

Consumables & Kits

-

Media

-

Kits

-

Others

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Development & Discovery

-

Regenerative Medicine

-

Toxicology Studies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research & Academic Institutes

-

Biotechnology & Pharmaceutical Companies

-

Hospitals & Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global induced pluripotent stem cells production market size was estimated at USD 1.48 billion in 2023 and is expected to reach USD 1.61 billion in 2024.

b. The global induced pluripotent stem cells production market is expected to grow at a compound annual growth rate of 9.44% from 2024 to 2030 to reach USD 2.76 billion by 2030.

b. The manual iPSCs production process segment dominated the global iPSCs production market and held the largest revenue share of 77.26% in 2023. It serves as a convenient method for parallel production of various iPSC lines, which has led to the segment’s dominance

b. Some key players operating in the iPSCs generation market include Lonza; Axol Biosciences Ltd.; Evotec; Hitachi Ltd.; Merck KGaA; REPROCELL Inc.; Fate Therapeutics; Thermo Fisher Scientific, Inc.; StemCellFactory III; and Applied StemCell Inc.

b. Key factors that are driving the iPSCs production market growth include a robust pipeline for induced pluripotent stem cell-derived cell therapeutics coupled with increasing demand for iPSCs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."