- Home

- »

- Advanced Interior Materials

- »

-

Inductor Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Inductor Market Size, Share & Trends Report]()

Inductor Market (2024 - 2030) Size, Share & Trends Analysis Report By Inductance, By Type, By Core Type, By Shield Type, By Mounting Technique, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-216-2

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inductor Market Summary

The global inductor market size was estimated at USD 4,515.0 million in 2023 and is anticipated to reach USD 6,540.8 million by 2030, growing at a CAGR of 5.5% from 2024 to 2030. A rise in advancements and innovations within the consumer electronics sector is expected to serve as a major catalyst for market growth over the forecast period.

Key Market Trends & Insights

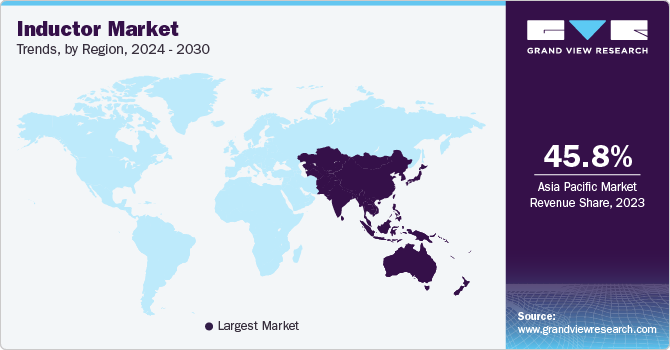

- The Asia Pacific accounted for the largest market revenue share of 45.8% in 2023.

- The China is expected to witness considerable growth from 2024 to 2030.

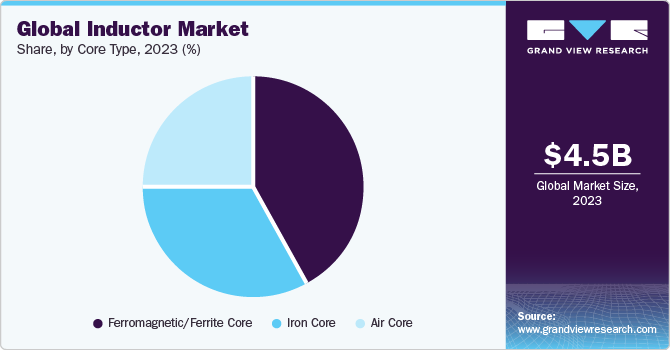

- By core type, the ferromagnetic/ferrite core segment led the market in 2023 and accounted for a share of 42.0%.

- By inductance, the fixed inductor segment held the largest share in 2023.

- By type, the film-type segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4,515.0 Million

- 2030 Projected Market Size: USD 6,540.8 Million

- CAGR (2024-2030): 5.5%

- Asia Pacific: Largest market in 2023

Moreover, the high adoption of smart homes and smart city technologies, necessitating energy-efficient electronic systems, is anticipated to further drive market growth. In the U.S., electric car sales increased by 55% in 2022, led by BEVs, according to IEA. Several factors contribute to the uptick in sales within the U.S. automotive market. The availability of a wider range of models, not limited to Tesla, the traditional frontrunner, has effectively addressed supply shortages.

Concurrently, there's a growing awareness catalyzed by both governmental and corporate efforts towards electrification. A notable statistic from the American Automobile Association reveals that in 2022, a quarter of Americans are anticipating their next vehicle purchase to be electric, further propelling this momentum. Moreover, high-frequency power inductors are extensively used in the automotive industry for reliability to reduce failure risks. Increasing U.S. government initiatives to boost the EV market, along with the high production of automotive vehicles, is expected to fuel market growth over the forecast period. Automation has come to take on a critical role in several industries.

The aerospace industry is one such sector that is increasingly using automated devices to address various tasks, such as aircraft maintenance procedures, conducting experiments in outer space, surveillance, intelligence gathering, and terrain mapping in defense. These technologically advanced devices use components like sensors, filters, motors, and transformers, which rely highly on inductors. Increasing demand for high-performance interfaces, increased security, and heavy processing requirements are boosting the demand for automated products, and with the emergence of industrial Internet of Things (IIoT) in this sector, aerospace manufacturers are steadily upgrading their factories.

This is resulting in propelled market growth opportunities for inductors and manufacturers. Technological advancements represent a growing trend within the inductor industry, with major companies focusing on innovating new solutions to fortify their market standing. This trend is mirrored at a national level, exemplified by the University of Illinois Urbana Champaign-a prominent public research university-where researchers have devised a microchip inductor capable of achieving magnetic induction levels in the tens of millions of Teslas. This breakthrough underscores the collaborative efforts across academia and industry to push the boundaries of inductor technology.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributed to rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations exert a multifaceted impact on the inductor market, significantly shaping its dynamics across various dimensions. Environmental directives, such as RoHS compliance, drive manufacturers towards eco-friendly materials and processes, while energy efficiency standards influence inductor design for power-saving applications. Safety regulations necessitate the use of high-reliability components, particularly in sectors like automotive and aerospace. Adherence to industry standards ensures interoperability and reliability, fostering market trust. Moreover, trade regulations and tariffs can disrupt supply chains and alter manufacturing strategies, impacting market dynamics and pricing.

The degree of innovation in the inductor market has experienced significant acceleration in recent years, driven by the increasing demand for high-performance, miniaturized components across a broad spectrum of industries. Innovations in material science, such as the development of advanced magnetic materials and nanotechnology, have enabled the production of inductors with improved efficiency, power density, and frequency response.

End-user concentration in the market varies across different sectors, with notable concentrations observed in industries, such as consumer electronics, automotive, telecommunications, and industrial automation. Consumer electronics, including smartphones, tablets, and wearables, represent a significant portion of the market due to the widespread adoption of these devices globally. The automotive sector is another major end-user, driven by the increasing electrification of vehicles and the integration of advanced driver assistance systems (ADAS).

In the global market, product substitutes typically include alternative passive electronic components or active components that serve similar functions. Passive substitutes may include resistors, capacitors, or transformers, which can sometimes be used in place of inductors depending on the specific application requirements. In addition, active components, such as voltage regulators, switching regulators, or integrated circuits (ICs) with built-in inductive elements, may offer alternatives for certain functions traditionally performed by discrete inductors. However, while substitutes may exist, inductors often provide unique performance characteristics, such as energy storage, filtering, and signal conditioning capabilities, making them indispensable in many electronic circuits.

Core Type Insights

The ferromagnetic/ferrite core segment led the market in 2023 and accounted for a share of 42.0%. Ferrite core inductors are extensively used in various electronic devices and systems, including power supplies, filters, transformers, and RF circuits. Their ability to handle high currents and maintain stable performance over a wide temperature range makes them indispensable in demanding applications, such as automotive electronics, telecommunications infrastructure, and power distribution systems. The core type segment is anticipated to witness substantial growth from 2024 to 2030.

The demand for air core inductors is particularly prominent in industries, such as telecommunications, aerospace, and audio equipment manufacturing, where high-performance requirements outweigh the need for compact form factors. Furthermore, ongoing advancements in materials and manufacturing techniques are continuously elevating the performance and reliability of air-core inductors. These innovations are instrumental in driving the sustained adoption and prominence of air core inductors within the market segment.

Inductance Insights

The fixed inductor segment held the largest share in 2023. Fixed inductors offer stable and reliable performance with a predetermined inductance value, ensuring consistent operation over time and under various conditions. Their compact size makes them ideal for space-constrained applications, while their durability and longevity make them suitable for critical systems where reliability is paramount, such as automotive electronics, telecommunications, and industrial automation.

Variable inductors provide flexibility and adaptability in electronic circuits by allowing the adjustment of inductance values to suit specific requirements. Their tunable nature enables fine-tuning of circuit performance, frequency response, and impedance matching in applications, such as radio frequency (RF) tuning, antenna matching, and analog signal processing. This versatility makes variable inductors valuable in applications where precise control over inductance is needed, offering engineers the ability to optimize performance and achieve desired results efficiently.

Type Insights

The film-type segment held the largest market share in 2023. Film-type inductors offer numerous advantages, including high reliability, stability, and performance across a wide range of frequencies. The growing demand for compact, high-performance electronic components in various industries further propels the adoption of film-type inductors, as they offer a balance of size, efficiency, and reliability crucial for modern electronic systems.

Multilayered inductors offer compact form factors and high performance, making them ideal for space-constrained applications, such as consumer electronics, automotive, and IoT devices. The proliferation of portable electronics, the rise of 5G technology, and increasing demand for miniaturization are driving the adoption of multilayered inductors, positioning them as indispensable components in modern electronic systems.

Sheild Type Insights

The shielded type segment is anticipated to witness lucrative growth from 2024 to 2030. Shielded inductors offer several advantages over their unshielded counterparts, including reduced electromagnetic radiation emissions, improved noise suppression, and enhanced immunity to external interference. These features make shielded inductors essential components in applications where EMI control is critical, such as automotive electronics, industrial automation, telecommunications, and medical devices.

Unshielded inductors offer straightforward construction and are typically smaller and less expensive compared to shielded counterparts, making them suitable for space-constrained applications and cost-sensitive designs. While unshielded inductors may exhibit higher susceptibility to EMI and noise interference, they remain widely used in various electronic circuits where EMI control is not critical, such as low-frequency signal filtering, power supply circuits, and basic analog applications.

Mounting Technique Insights

The surface mounting technique segment is anticipated to register significant growth from 2024 to 2030. These inductors are well-suited for high-volume manufacturing processes, enabling efficient assembly and reduced production costs. In addition, the miniaturization trend in electronic devices further drives the preference for surface mount components, as they allow for smaller, lighter, and more compact designs. Through-hole inductors offer mechanical stability and are less prone to mechanical stress or vibration compared to surface mount counterparts, making them suitable for harsh environments and high-reliability applications, such as automotive, aerospace, and industrial equipment.

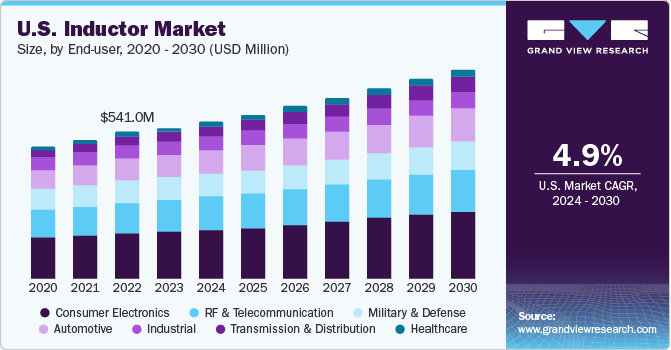

End-user Insights

The consumer electronics end-user segment is anticipated to record considerable growth from 2024 to 2030. The growing demand for consumer electronics products, such as smartphones, laptops, and tablets, is a significant factor driving the industry's growth. These devices require a variety of inductors for filtering, power supply smoothing, and energy storage. With the increasing adoption of these devices, the demand for inductors is also increasing.

With the rising demand for electric vehicles (EVs) and growing trend of integrating advanced electronics in automobiles, the need for inductors has significantly increased. Inductors play a vital role in automotive applications, such as powertrain systems, infotainment systems, and lighting systems, among others. The ability of inductors to store energy in a magnetic field and release it when required makes them an essential component in these applications. Thus, the automotive end-user segment is expected to continue growing in the coming years.

Regional Insights

North America led the market due to a rise in demand for consumer electronics, such as laptops, smartphones, and earphones. As per the data published by GSMA’s Mobile Economy report, the introduction of commercial 5G networks is expected to reach 675 million 5G connections by 2025, which is more than half of the global 5G total expected by that time. The automotive industry in the region is also seeing a surge in EV demand. This is expected to further fuel the demand for inductors in the region.

U.S. Inductor Market Trends

The inductor market in U.S. is experiencing steady growth, primarily driven by increasing demand in various sectors such as consumer electronics, automotive, telecommunications, and industrial applications. Inductors are essential components used in electronic circuits for energy storage, filtering, and signal processing, making them crucial in a wide range of electronic devices and systems. The expansion of 5G networks and the ongoing deployment of high-speed broadband infrastructure necessitated the use of inductors in communication equipment such as base stations, routers, and switches.

The Canada inductor market is influenced by various factors, including the country's industrial landscape, technological advancements, and regulatory environment. The growth of Canada's telecommunications sector, fueled by investments in 5G infrastructure and broadband expansion, drives the demand for inductors used in base stations, antennas, and network equipment. Similarly, the automotive manufacturing sector in Canada, though smaller compared to other countries, still contributes to the demand for inductors in EVs, ADAS systems, and automotive electronics. Canada has a diverse economy with significant contributions from industries, such as telecommunications, automotive manufacturing, aerospace, renewable energy, and consumer electronics.

Asia Pacific Inductor Market Trends

The inductor market in Asia Pacific accounted for the largest revenue share of 45.8% in 2023 due to the high demand for consumer electronics and automotive products. The market exhibits high competitiveness, with numerous players providing a diverse array of inductors. Key industry participants include TDK Corporation, Murata Manufacturing Co., Ltd., Taiyo Yuden Co., Ltd., and Vishay Intertechnology, Inc.

The China inductor market is expected to witness considerable growth from 2024 to 2030. The consumer electronics sector in the country is poised for a resurgence with a projected uptick in demand and innovation, driving retail expenditure. The surge is notably fueled by the rising preference for high-end smartphones, including models with cutting-edge features like folding screens. Domestic manufacturers are actively enhancing screen quality, battery longevity, and device thickness to entice consumers. Moreover, a preference for wireless communication is anticipated to propel China's inductor market growth. Inductors play pivotal roles in wireless communication devices, such as routers and smartphones, enabling optimization of signal transmission, reception, and antenna matching, thereby underpinning the market's growth trajectory.

Europe Inductor Market Trends

The inductor market in Europewill witness considerable growth driven by rising demand for inductors in automotive vehicles. The automotive industry is also seeing rising demand due to various government schemes focusing on the promotion of EVs in the region. Inductors are also a key component in many electronic components and electric grids. Thus, the market in this region is expected to witness substantial growth.

The Germany inductor market is expected to witness growth in the coming years owing to growing demand for automotive vehicles, predominantly EVs. Supported by the country’s ambitious e-mobility plans, the German government has set itself the goal of 15 million fully EVs by the year 2030 and has a role as the lead provider and market for e-mobility solutions. The speed and scale of transformation in mobility and the automotive sector are remarkable. Thus, the rapidly expanding automotive industry is anticipated to fuel inductors market growth as it plays a significant role in reducing electromagnetic interference (EMI) and power supply noise, which helps ensure the smooth operation of sensitive electronics in vehicles.

South & Central America Inductor Market Trends

The inductor market in South & Central Americais driven by rising usage of consumer electronics in the region. A rise in demand for consumer electronics, such as tablets, smartphones, portable gaming consoles, laptops, and set-top boxes, is the major factor propelling the demand for inductors. An inductor is mostly used in electrical power and electronic devices for blocking, choking, attenuating, or filtering/smoothing high-frequency noise in electrical circuits, transferring and storing energy in power converters, impedance matching, and other applications.

The Brazil inductor market is influenced by several factors, including the country's industrial landscape, technological advancements, and economic conditions. Brazil's economy is diverse, with significant contributions from industries, such as telecommunications, automotive manufacturing, renewable energy, and consumer electronics. These industries represent key end-user sectors for inductors, driving demand from applications ranging from telecommunications infrastructure and automotive electronics to renewable energy systems and consumer electronics.

Middle East & Africa Inductor Market Trends

The inductor market in Middle East & Africais driven forward since the countries in Middle East & Africa are developing at a faster pace owing to rapid industrialization and urbanization. The UAE plans to increase the contribution of the manufacturing sector and, amid the outbreak, reduce the dependency on imports by diversifying the investments. The increasing expansion of the grid owing to growth in renewable power generation is propelling the need for using advanced and efficient inductors in the line.

The Saudi Arabia inductor market is experiencing significant growth owing to the government’s efforts to actively promote local automotive manufacturing through initiatives such as the National Industrial Development and Logistics Program (NIDLP). Saudi Arabia has seen an increase in vehicle assembly operations, with companies like Toyota, Ford, and Hyundai setting up assembly plants in the country. Thus, the growing automotive industry is anticipated to have a positive impact on the growth of the inductor sector in Saudi Arabia.

Key Inductor Company Insights

The market is fragmented, with various global and regional product manufacturers releasing innovative systems and technologies. Various industry participants' strategies typically involve new product development, product upgrades, and expansions to boost market penetration and respond to the changing technical needs of the application industries. The major players form technical partnerships to innovate and develop novel product lines, therefore expanding their consumer base. In addition, evolving consumer preferences, along with quality requirements as well as energy efficiency, are projected to offer new opportunities for key participants in the coming years.

In January 2024, Murata broadened its product range with the introduction of the DFE2MCPH_JL series, comprising automotive-grade power inductors featuring values of 0.33µH and 0.47µH. These inductors are meticulously tailored for automotive powertrain and safety equipment applications, ensuring optimal performance and reliability. Looking ahead, Murata plans to further augment the inductance value spectrum, extending from 0.1 µH to 4.7µH, to cater to evolving market demands and broaden the scope of automotive applications.

Key Inductor Companies:

The following are the leading companies in the inductor market. These companies collectively hold the largest market share and dictate industry trends.

- Murata Manufacturing

- TDK

- Vishay Intertechnology

- TAIYO YUDEN

- Chilisin

- Delta Electronics

- Panasonic

- ABC Taiwan Electronics

- Pulse Electronics

- Coilcraft

- Shenzhen Sunlord Electronics

- Bourns

- ICE Components

- Kyocera Corp AVX

- Bel Fuse Inc.

Recent Developments

-

In January 2024, TDK unveiled the KLZ2012-A series, their newest line of tiny inductors specifically designed for car audio systems. These compact components prioritize durability, wide operating range, and consistent inductance, making them ideal for the demanding environment of modern vehicles. Mass production began in January, marking a significant step forward in automotive audio technology

-

In March 2023, Abracon, LLC (Abracon), Innovation for Tomorrow's Designs announced the launch of their Interactive Inductor Catalog, which includes more than 200 series. Smaller chip inductors and larger wire-wound inductors are among the sizes of inductors offered by Abracon. These inductors are ideal for use in a variety of applications, such as high-speed data transfer, wireless communication, and power management. Every inductor's precise specification, such as its inductance, DC resistance, and current rating, is listed in the new inductor catalog along with details on its construction type and package dimensions

Inductor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4,739.40 million

Revenue forecast in 2030

USD 6,540.8 million

Growth rate

CAGR of 5.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Inductance, type, core type, shield type, mounting technique, end-user, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Murata Manufacturing; TDK; Vishay Intertechnology; TAIYO YUDEN; Chilisin; Delta Electronics; Panasonic; ABC Taiwan Electronics; Pulse Electronics; Coilcraft; Shenzhen Sunlord Electronics; Bourns; ICE Components; Kyocera Corp. AVX; Bel Fuse Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inductor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the inductor market report on the basis of inductance, type, core type, shield type, mounting technique, end-user, and region:

-

Inductance Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Inductors

-

Variable Inductors

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Film Type

-

Multilayered

-

Wire Wound

-

Molded

-

-

Core Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Air Core

-

Ferromagnetic/Ferrite Core

-

Iron Core

-

-

Shield Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Shielded

-

Unshielded

-

-

Mounting Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Surface Mount

-

Through Hole

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Industrial

-

RF & Telecommunication

-

Military & Defense

-

Consumer Electronics

-

Transmission & Distribution

-

Healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inductor market size was estimated at USD 4,515.0 million in 2023 and is expected to reach USD 4,739.40 million in 2024.

b. The global inductor market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 6,540.8 million by 2030.

b. Asia Pacific dominated the global inductor market and accounted for a 45.8% share, in terms of revenue, in 2023 on account of the rising consumer electronics industry. Furthermore, the demand for smartphones, laptops, tablets, wearables, and other consumer electronics fuels the need for inductors, especially miniaturized and high-performance ones.

b. Some of the key players operating in the inductor market include Murata Manufacturing, TDK, Vishay Intertechnology, TAIYO YUDEN, Chilisin, Delta Electronics, Panasonic, ABC Taiwan Electronics, Pulse Electronics, Coilcraft, Shenzhen Sunlord Electronics, Bourns, ICE Components, Kyocera Corp AVX, Bel Fuse Inc.

b. The key factors that are driving the inductor market include the rise in innovations and advances in consumer electronic devices are significant factors anticipated to propel the growth of the inductor market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.