- Home

- »

- Next Generation Technologies

- »

-

Industrial Filtration Market Size, Share, Industry Report 2033GVR Report cover

![Industrial Filtration Market Size, Share & Trends Report]()

Industrial Filtration Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Air Filtration, Liquid Filtration), By Application (Chemicals & Petrochemicals, Pharmaceutical Manufacturing, Food & Beverages, Power Generation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-621-7

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Filtration Market Summary

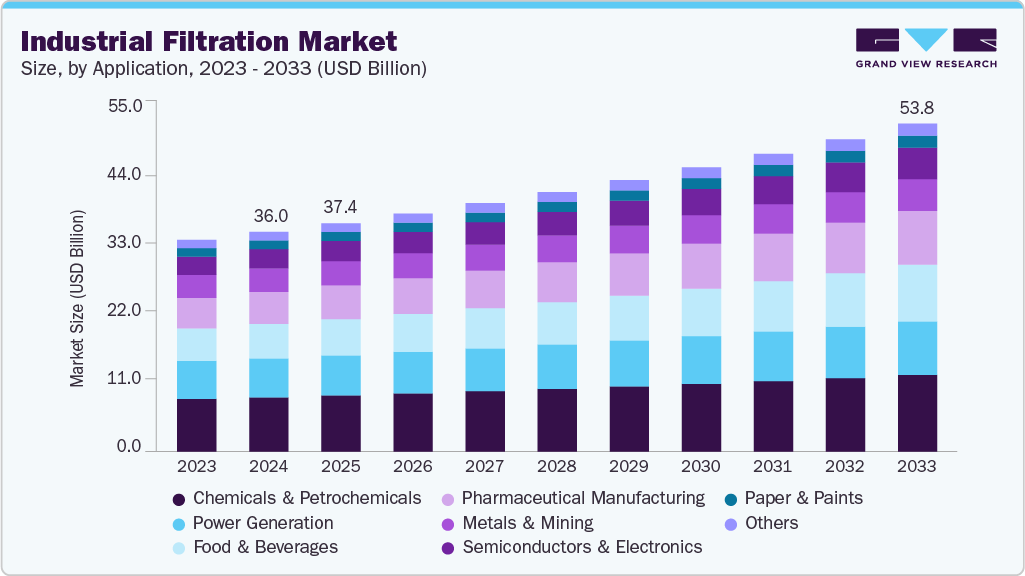

The global industrial filtration market was valued at USD 36.03 billion in 2024 and is projected to reach USD 53.81 billion by 2033, growing at a CAGR of 4.6% from 2025 to 2033. Increasing industrial activity, stricter environmental rules, and rising demand for cleaner air and water primarily drive this growth.

Key Market Trends & Insights

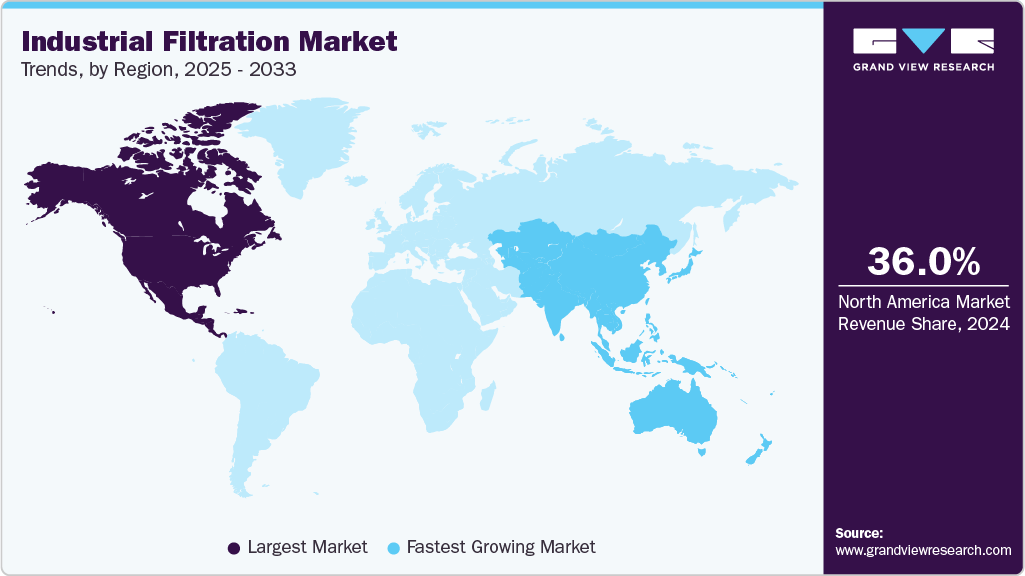

- North America dominated the global industrial filtration market with the largest revenue share of 36.8% in 2024.

- The industrial filtration market in the U.S. led the North America market and held the largest revenue share in 2024.

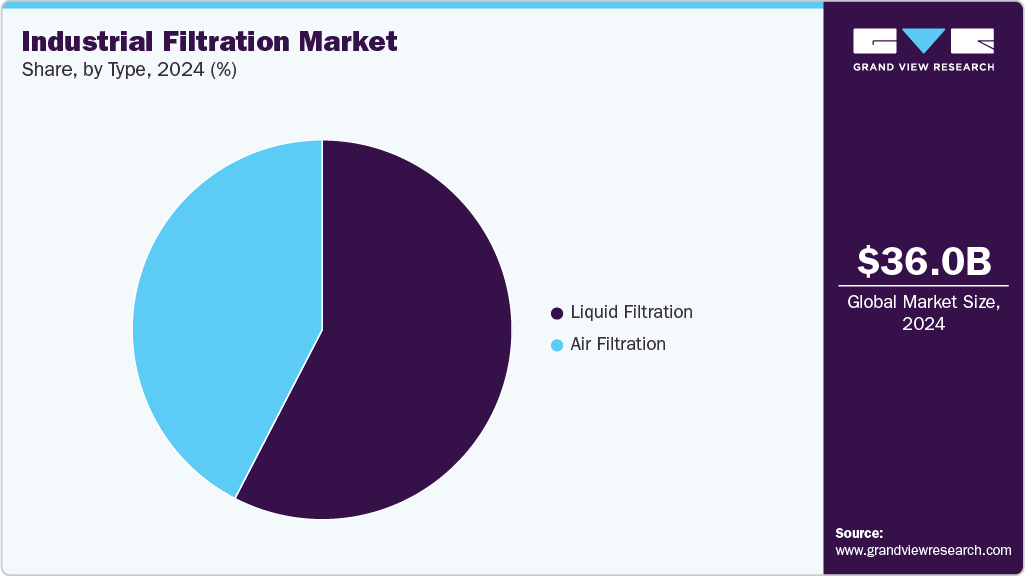

- By type, liquid filtration segment led the market and held the largest revenue share of 57.6% in 2024.

- By application, the chemicals & petrochemicals segment held the dominant position in the market and accounted for the leading revenue share of 24.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 36.03 Billion

- 2033 Projected Market Size: USD 53.81 Billion

- CAGR (2025-2033): 4.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global industrial filtration industry is largely driven by increasing industrialization and stricter environmental regulations across the world. Growing awareness of air and water pollution control has prompted industries to adopt advanced filtration solutions to meet compliance standards. Additionally, there is a rising demand for efficient filtration systems from key sectors such as automotive, pharmaceuticals, and food processing. The emphasis on sustainability and reducing operational costs further motivates companies to implement eco-friendly and energy-efficient filtration technologies. Together, these factors contribute to steady market growth globally.

A notable trend in the market is the integration of smart technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), into filtration systems. These technologies facilitate real-time monitoring, predictive maintenance, and enhanced filtration efficiency. There is also a growing movement towards environmentally friendly materials and reusable filters to minimize waste. Furthermore, industries are increasingly focusing on customized filtration solutions tailored to specific applications, which enhances operational performance. These trends underscore the market's shift towards innovation and sustainability.

Leading companies in the industrial filtration sector are actively investing in research and development to innovate filtration technologies and expand their product portfolios. Strategic partnerships, mergers, and acquisitions are common practices to strengthen market presence and broaden geographic reach. Companies also emphasize digital transformation by incorporating smart filtration solutions into their offerings. Additionally, many firms are prioritizing sustainability by developing eco-friendly products and solutions. These initiatives help companies remain competitive and meet evolving customer demands globally.

Application Insights

The chemicals and petrochemicals segment accounted for a significant share of the industrial filtration industry in 2024. This segment's leading position is driven by the critical need for efficient filtration systems that manage hazardous fluids, separate solid particles, and maintain process purity. Filtration ensures operational safety, product consistency, and compliance with strict environmental and safety regulations. Handling aggressive chemicals and the necessity to prevent contamination in high-temperature and high-pressure processes further increases the demand for durable and high-performance filtration solutions in the chemicals and petrochemical industry.

The pharmaceutical manufacturing segment is projected to experience the highest growth rate during the forecast period. This demand is also linked to the growing global need for high-purity drug production, stricter regulatory requirements, and the imperative to prevent cross-contamination during manufacturing. Filtration systems are vital for maintaining cleanroom environments, ensuring sterile processing, and removing particulate matter from liquids and gases used in drug formulation. Additionally, the increasing production of biologics, vaccines, and personalized medicines drives pharmaceutical companies to invest in advanced filtration technologies. As regulatory scrutiny and quality standards rise, the pharmaceutical industry increasingly relies on effective filtration solutions.

Type Insights

The liquid filtration segment accounted for a significant market share of over 57.6% in 2024. The dominant position of liquid filtration systems is primarily attributed to their extensive use in critical industries, including chemicals, pharmaceuticals, food and beverage, and water treatment. These sectors depend heavily on liquid filtration to eliminate solid contaminants, ensure process integrity, and comply with stringent environmental and quality standards. Additionally, the rising global demand for clean water, increased volumes of industrial wastewater, and heightened regulatory pressure on effluent discharge are driving the adoption of advanced liquid filtration technologies. As a result, liquid filtration remains a fundamental component of industrial operations.

On the other hand, the air filtration segment is expected to experience the fastest growth in the industrial filtration industry during the forecast period. The growth is driven by growing awareness of occupational health, heightened concerns about indoor and outdoor air pollution, and stricter emission control regulations. Industries such as electronics, pharmaceuticals, metals, and manufacturing are investing in high-performance air filtration systems to maintain cleanroom standards and reduce exposure to harmful airborne particles. Furthermore, the increasing prevalence of respiratory illnesses and the global push for carbon-neutral operations encourage industries to adopt advanced air purification and filtration systems. This shift will significantly boost the demand for air filtration solutions across various regions.

Regional Insights

North America accounted for the largest market share of over 36% in 2024. The dominance of this region is largely due to its well-established industrial sectors, including chemicals, oil and gas, food processing, and pharmaceuticals. Stringent regulations from agencies such as the U.S. Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA) drive industries to adopt advanced air and liquid filtration systems. Additionally, a growing emphasis on workplace safety, environmental compliance, and water reuse further supports the demand for these systems. Key trends in the market include the adoption of smart filters and predictive maintenance tools. Major players contributing to the strength of this regional market include Donaldson Company, Parker Hannifin, Pall Corporation, and 3M, all of which have significant manufacturing and research and development (R&D) operations in North America.

U.S. Industrial Filtration Market Trends

The U.S. industrial filtration market is experiencing steady growth in 2024, driven by strict environmental regulations, aging infrastructure, and an increasing demand for cleaner manufacturing processes. Industries such as oil and gas, chemicals, and food processing are upgrading their filtration systems to comply with air and water quality standards set by the EPA and other regulatory agencies. There is a noticeable trend toward energy-efficient and high-capacity filtration solutions, particularly in compressed air, dust collection, and process liquid filtration. Additionally, manufacturers in the U.S. are incorporating IoT-enabled filters that allow for real-time monitoring and predictive maintenance, which enhances operational efficiency and reduces unplanned downtime in industrial settings.

Europe Industrial Filtration Market Trends

The European industrial filtration market is expected to grow in 2024 due to strict environmental regulations, consistent industrial activity, and a strong focus on sustainability. Key industries utilizing filtration systems include automotive, food and beverage, power generation, and manufacturing. European regulations, such as the Industrial Emissions Directive and the Water Framework Directive, encourage companies to install efficient air, liquid, and dust filtration systems. There is also a noticeable shift toward reusable and high-capacity filters to minimize waste and meet climate goals. Companies are investing in upgraded technologies to enhance process efficiency. As a result, the industrial filtration market in Europe is steadily expanding.

The UK industrial filtration market growth is driven by rising manufacturing, water treatment, and food demand. Local environmental policies and emission standards are prompting industries to upgrade their filtration equipment. There is a growing emphasis on workplace safety, product quality, and energy efficiency. Companies are investing in liquid and air filtration systems to comply with ISO standards and local regulations. Key players in the UK market include Parker Hannifin, Pall Corporation, and Donaldson. Owing to these ongoing investments and regulatory pressures, the industrial filtration market in the United Kingdom is expected to continue its growth.

The Germany industrial filtration market in 2024 is driven by high demand from industries such as automotive, chemicals, and pharmaceuticals. Regulations concerning air pollution, water reuse, and process emissions encourage industries to adopt advanced filtration systems. Companies opt for high-performance filters to enhance plant efficiency, reduce maintenance costs, and meet compliance targets. Some industries are also adopting digital tools for monitoring and predictive maintenance. Owing to strong industrial demand and a focus on regulatory compliance, the industrial filtration market in Germany remains robust and continues to grow.

Asia Pacific Industrial Filtration Market Trends

The Asia Pacific industrial filtration market is the fastest-growing region globally, driven by rapid industrialization and increased environmental regulations. Industries such as manufacturing, chemical processing, pharmaceuticals, and food and beverage are adopting advanced filtration systems to ensure product quality and comply with stricter pollution controls. There is also a growing interest in sustainable and energy-efficient filtration technologies. Innovations such as IoT-enabled smart filtration systems are being increasingly utilized for improved monitoring and maintenance. As a result of these factors, the industrial filtration market in the Asia Pacific is expanding rapidly.

The China industrial filtration market plays a major role in the region's fast-growing industrial filtration market, supported by its vast manufacturing base and a strong government focus on environmental sustainability. Key sectors, including automotive, pharmaceuticals, and chemicals, invest in efficient filtration technologies to reduce emissions and comply with regulations. The market is also witnessing advances in filtration materials and digital monitoring tools, which help companies improve operational efficiency and meet regulatory demands. Consequently, China’s industrial filtration market continues to grow quickly.

The India industrial filtration market is also experiencing rapid growth, propelled by expanding industrial activity and an increased focus on environmental compliance. Key sectors such as automotive, pharmaceuticals, and food processing are adopting advanced filtration solutions to enhance product quality and meet pollution control standards. There is a rising adoption of smart filtration technologies that integrate AI and IoT to improve efficiency and reduce downtime. Strengthened government regulations regarding air and water pollution are encouraging the upgrade of filtration systems. Due to these trends, India’s industrial filtration market is growing quickly.

Key Industrial Filtration Company Insights

Some of the key players operating in the market are 3M Company, Alfa Laval Inc., Donaldson Company, Inc., among others.

-

Through its separation and purification technologies business, 3M Company offers a wide array of industrial filtration products. This range includes depth and membrane filters, liquid filtration cartridges, gas filtration units, and housing systems used to manufacture chemicals, pharmaceuticals, electronics, and food and beverages. In 2024, this division was spun off into a new company called Solventum, which operates the filtration business as a stand-alone unit focusing on scalable, high-performance applications.

-

Alfa Laval Inc. provides filtration and separation systems as part of its heat transfer and fluid handling capabilities. Its industrial filtration products include centrifugal separators, decanters, and pressure filters for effective solid-liquid separation. These products are particularly applicable in marine, oil and gas, food processing, water treatment, and energy production. Additionally, Alfa Laval addresses filtration needs in biopharmaceutical and chemical processing applications.

-

Donaldson Company, Inc. manufactures air and liquid filtration products for various industrial settings. Its product line includes industrial dust collection systems, process filtration units, compressed air purification equipment, and hydraulic filtration systems. Donaldson's technology supports heavy-duty equipment, manufacturing processes, and cleanroom environments. The company also expands into the life sciences and membrane filtration markets through investments and strategic alliances.

Filtration Group, Freudenberg Filtration Technologies SE & Co. KG, and Mann + Hummel are some of the emerging market participants in the Industrial Filtration Market.

-

Filtration Group offers a variety of filtration products for industrial, healthcare, and environmental markets. The firm operates through several business units, providing clean air solutions, process liquid filtration, and gas filtration systems. Its products find application in industries such as food and beverage, HVAC, life sciences, and industrial manufacturing. Filtration Group also addresses specialized filtration needs through subsidiaries that cater to localized and niche markets.

-

Freudenberg Filtration Technologies SE & Co. KG designs and supplies air and liquid filtration systems that focus on indoor air quality, process safety, and equipment protection. Their offerings include HVAC filters, gas turbine intake filters, automobile cabin air filters, and pre-filtration solutions. The company’s filtration media are utilized in cleanroom technologies and process industries, such as pharmaceuticals, semiconductors, and chemicals. They market these solutions under their brands, including Viledon and micronAir.

-

Mann + Hummel produces a comprehensive range of filtration systems used in air, water, fuel, and oil applications for industrial, automotive, and environmental sectors. Its industrial product line features dust collector cartridges, HEPA filters, ultrafiltration membranes, and engine air intake systems. The company operates worldwide manufacturing and R&D facilities, and offers aftermarket solutions for filters used in heavy-duty and construction equipment.

Key Industrial Filtration Companies:

The following are the leading companies in the industrial filtration market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Alfa Laval Inc.

- Donaldson Company, Inc.

- Filtration Group

- Freudenberg Filtration Technologies SE & Co. KG

- Mann + Hummel

- Pall Corporation

- Parker Hannifin Corp.

- Ahlstrom-Munksjö

- Hollingsworth & Vose Company

Recent Developments

-

In 2025, Donaldson Company, Inc. partnered with Daimler Truck North America to support the Freightliner SuperTruck III project, which is funded by the U.S. Department of Energy funds. This initiative aims to improve the efficiency of heavy-duty trucks. Donaldson will provide advanced filtration technology for the truck's hydrogen fuel cell systems and other vehicle subsystems, reinforcing its position in next-generation commercial vehicle platforms that focus on sustainable transportation and emissions reduction.

-

In 2025, Thermo Fisher Scientific announced its plan to acquire Solventum's Purification and Filtration Business, which was spun off from 3M, for approximately $4.1 billion in cash. This acquisition includes a portfolio of high-value filtration and purification products for the biopharma and life sciences sectors, aligning with Thermo Fisher's strategy to expand its bioprocessing capabilities. The deal is expected to close by the end of the year, pending regulatory approval.

-

In 2024, Donaldson Company, Inc. acquired a 49% stake in Medica S.p.A., an Italian company specializing in hollow fiber membrane filtration for medical and water purification applications. This strategic investment aims to enhance Donaldson's Life Sciences portfolio and provide access to advanced membrane technology, which is critical for healthcare and clean water solutions. The deal supports Donaldson's long-term growth in high-value filtration segments.

Industrial Filtration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.46 billion

Revenue forecast in 2033

USD 53.81 billion

Growth rate

CAGR of 4.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/ billion, and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK, Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

3M Company; Alfa Laval Inc.; Donaldson Company, Inc.; Filtration Group; Freudenberg Filtration Technologies SE & Co. KG; Mann + Hummel; Pall Corporation; Parker Hannifin Corp.; Ahlstrom-Munksjö; Hollingsworth & Vose Company

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Industrial Filtration Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial filtration market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Air Filtration

-

Liquid Filtration

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Power Generation

-

Semiconductors & Electronics

-

Chemicals & Petrochemicals

-

Pharmaceutical Manufacturing

-

Metals & Mining

-

Paper & Paints

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial filtration market size was estimated at USD 33.03 billion in 2024 and is expected to reach USD 37.46 billion in 2025.

b. The global industrial filtration market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033 to reach USD 53.81 billion by 2033.

b. North America accounted for the largest share of over 36% in 2024. The growth is primarily driven by increasing industrial activities, stringent environmental regulations, and rising demand for clean air and water across various industries such as chemicals, pharmaceuticals, and food processing. Additionally, advancements in filtration technology and growing awareness about workplace safety contribute to market expansion in the region.

b. The key players in the industrial filtration market include 3M Company; Alfa Laval Inc.; Donaldson Company, Inc.; Filtration Group; Freudenberg Filtration Technologies SE & Co. KG; Mann + Hummel; Pall Corporation; Parker Hannifin Corp.; Ahlstrom-Munksjö; and Hollingsworth & Vose Company.

b. Key factors driving market growth include rising industrialization, stricter environmental regulations, growing demand for clean air and water, advances in filtration technology, and increased focus on health and safety across industries like chemicals, pharmaceuticals, and food processing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.