- Home

- »

- Sensors & Controls

- »

-

Industrial Fixed Asset Management Market Size Report, 2033GVR Report cover

![Industrial Fixed Asset Management Market Size, Share & Trends Report]()

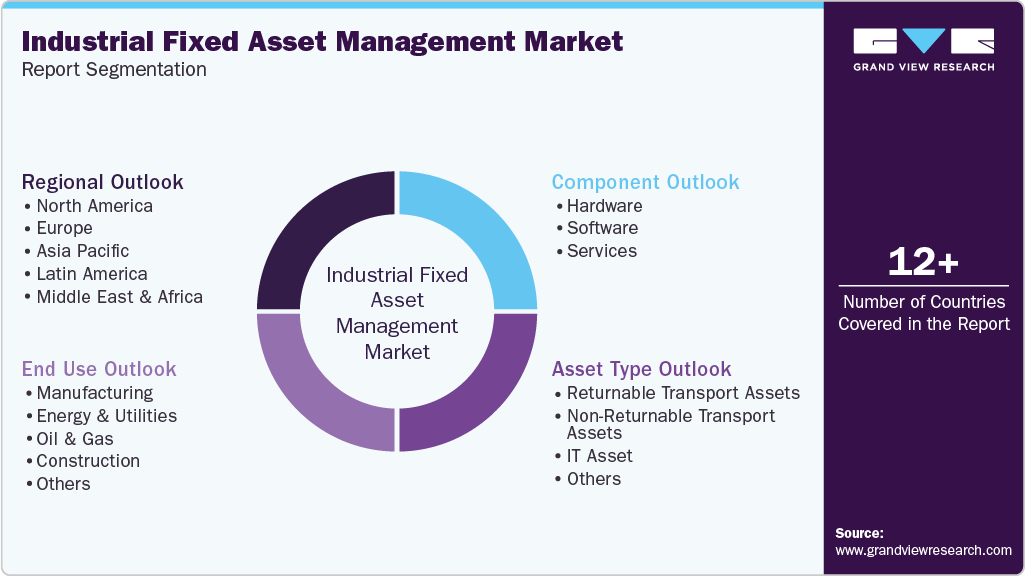

Industrial Fixed Asset Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Asset Type (Returnable Transport Assets, Non-returnable Transport Assets, IT Asset), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-768-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Fixed Asset Management Market Summary

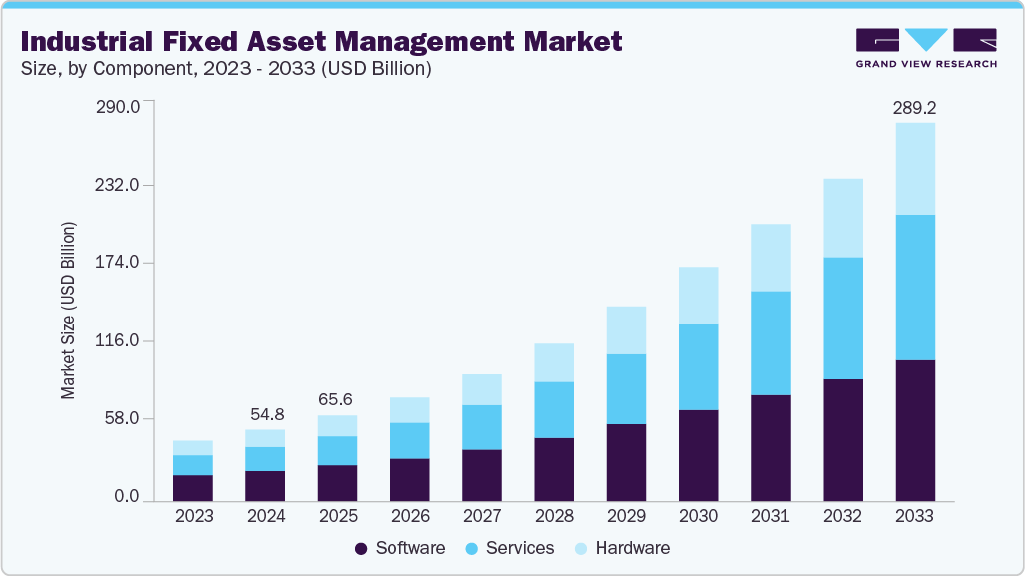

The global industrial fixed asset management market size was estimated at USD 54.83 billion in 2024 and is projected to reach USD 289.21 billion by 2033, growing at a CAGR of 20.4% from 2025 to 2033. The digital transformation of industries is driving the growth of the industry.

Key Market Trends & Insights

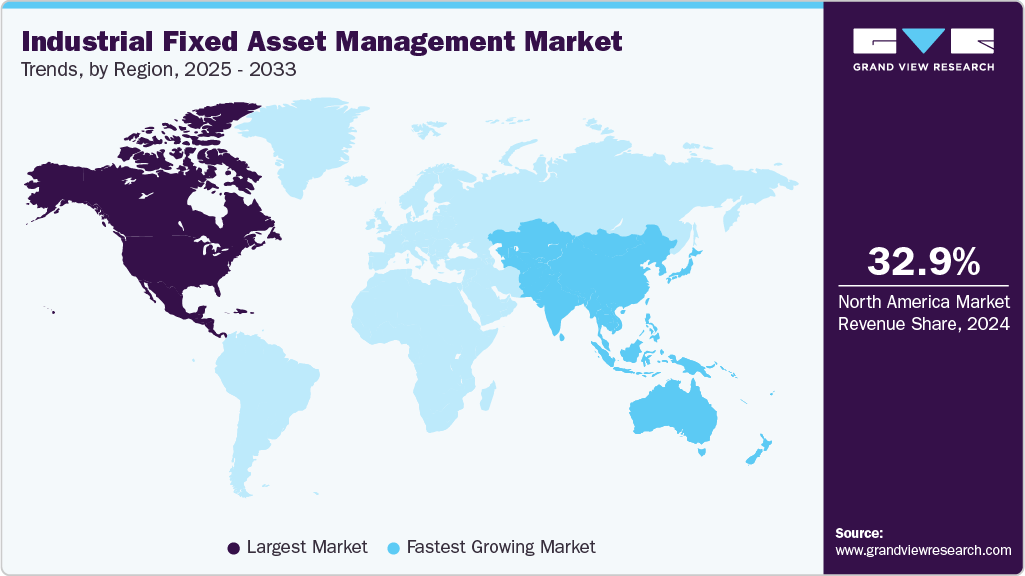

- North America industrial fixed asset management market dominated the global market with the largest revenue share of 32.9% in 2024.

- The industrial fixed asset management industry in the U.S. is expected to grow significantly over the forecast period.

- By component, software led the market and held the largest revenue share of 42.6% in 2024.

- By asset type, the IT asset segment held the dominant position in the market and accounted for the largest revenue share in 2024.

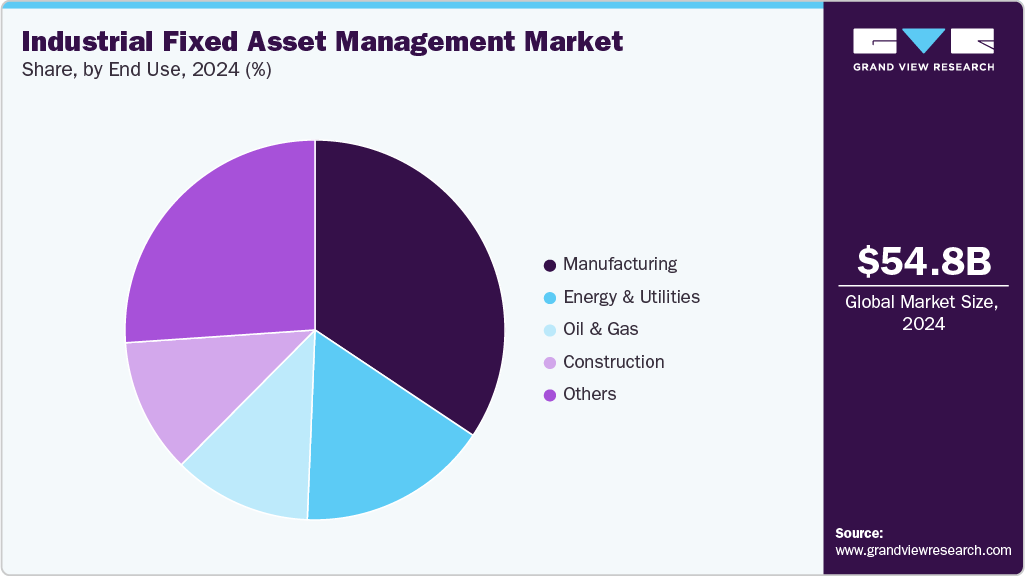

- By end use, the manufacturing segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 54.83 Billion

- 2033 Projected Market Size: USD 289.21 Billion

- CAGR (2025-2033): 20.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With Industry 4.0, IoT-enabled sensors, cloud computing, artificial intelligence, and predictive analytics are being integrated into asset management systems to provide deeper insights into asset conditions and performance. This enables predictive and preventive maintenance strategies, where issues can be identified before they escalate into failures, reducing costly unplanned downtime.Industrial Fixed Asset Management (IFAM) systems are undergoing a significant evolution, driven by advancements in AI, edge computing, IoT, and digital twin technologies that are fundamentally reshaping how organizations manage asset-intensive operations. A pivotal shift lies in the integration of AI-driven predictive analytics directly into asset management platforms, allowing enterprises to forecast equipment failures, optimize maintenance intervals, and reduce total cost of ownership, transforming asset oversight from reactive to predictive. These systems leverage real-time sensor data, contextual analytics, and machine learning models to enable faster, data-backed decisions. Increasingly, this intelligence is processed locally using edge computing nodes, especially in remote industrial environments where cloud latency or connectivity is a concern.

In parallel, the deployment of digital twins has gained traction in sectors such as energy, mining, and manufacturing. These dynamic models simulate asset behavior under varied conditions, enabling scenario-based performance optimization, downtime risk forecasting, and lifecycle extension. For example, in June 2022, Siemens launched an updated version of its Xcelerator platform with enhanced digital twin orchestration across multi-plant industrial networks, allowing real-time visibility into asset condition, performance deviations, and carbon footprint tracking. Furthermore, OEMs like Caterpillar have deepened native equipment integration with platforms such as VisionLink, which now enables unified asset monitoring across mixed fleets, predictive alerting, and role-based dashboards. This integration is reshaping equipment value propositions, embedding service-based models around uptime and efficiency.

Component Insights

The software segment dominated the market and accounted for a revenue share of 42.6% in 2024. The shift toward cloud-based platforms is also fueling the expansion of the software segment in industrial fixed asset management. Cloud-based asset management systems provide scalability, flexibility, and cost-effectiveness, enabling organizations to manage assets across global operations seamlessly. These platforms eliminate the need for heavy IT infrastructure investments and allow real-time data access from anywhere, empowering decision-makers to respond quickly to changing operational needs. The segment is further bifurcated into location & movement tracking, check-in/check-out, repair & maintenance, and others.

The services segment is anticipated to grow at the highest CAGR during the forecast period. The rising emphasis on predictive maintenance and operational efficiency is fueling demand for professional services. While software and hardware solutions collect vast amounts of asset data, interpreting this data and applying it effectively often requires specialized knowledge. Service providers assist in configuring analytics platforms, developing predictive maintenance models, and identifying patterns in equipment behavior that can reduce unplanned downtime. The segment is further bifurcated into strategic asset management, operational asset management, and tactical asset management.

Asset Type Insights

The IT asset segment dominated the market and accounted for the largest revenue share in 2024. The rising adoption of hybrid IT environments, where organizations operate a mix of on-premises infrastructure and cloud-based platforms, is also driving growth in IT asset management. Managing assets across multiple environments can be complex, with challenges related to software licensing, configuration tracking, and hardware utilization. Industrial fixed asset management systems provide a unified platform to monitor and optimize IT assets across both physical and virtual infrastructures.

The returnable transport assets segment is expected to grow at a significant CAGR during the forecast period. The rise of collaborative supply chain models is contributing to growth in this segment. Many industrial organizations engage in shared logistics networks, pooling RTAs with suppliers, distributors, and partners to reduce costs and improve sustainability. In such collaborative setups, tracking and accountability for RTAs are critical to prevent loss, ensure fair usage, and maintain operational efficiency. Industrial fixed asset management solutions offer transparency and shared visibility into RTA movements, usage patterns, and return schedules across multiple partners.

End Use Insights

The manufacturing segment dominated the market and accounted for the largest revenue share in 2024. The shift toward digital transformation and smart manufacturing also fuels the adoption of industrial fixed asset management. Modern manufacturing facilities are increasingly integrating Industry 4.0 technologies, including robotics, IoT-enabled machinery, automated production lines, and data analytics platforms. Managing these complex assets manually is inefficient and prone to errors, while IFAM systems provide centralized visibility, control, and analytics.

The construction segment is expected to grow at a significant CAGR over the forecast period. The push toward modular construction and prefabricated building methods is driving segment growth. Prefabricated components often require precise scheduling and movement of specialized equipment between manufacturing facilities and construction sites. Without advanced monitoring systems, the risk of delays, mismanagement, or loss of valuable prefabricated units increases. Industrial fixed asset management solutions address this by providing end-to-end visibility across the supply chain, ensuring equipment and components arrive exactly when and where they are needed, supporting the efficiency of modular building practices.

Regional Insights

North America industrial fixed asset management industry dominated the global market with the largest revenue share of 32.9% in 2024. The market in North America is being shaped by several key trends, including the rapid modernization of manufacturing infrastructure, increased adoption of smart asset technologies, and rising demand for predictive maintenance across industrial sectors.

The industrial fixed asset management market in the U.S. is expected to grow significantly at a CAGR of 16.8% from 2025 to 2033. The industrial fixed asset management market in the United States is experiencing robust growth, supported by rising corporate capital expenditures across infrastructure, automation, and technology-driven industrial assets. Organizations are increasingly investing in digital tools that support real-time tracking, predictive maintenance, and lifecycle optimization to manage the growing complexity and scale of asset portfolios.

Europe Industrial Fixed Asset Management Market Trends

The industrial fixed asset management market in Europe is anticipated to register considerable growth from 2025 to 2033. The industrial fixed asset management market in Europe is experiencing significant growth as organizations across manufacturing, energy, and infrastructure sectors prioritize operational efficiency, regulatory compliance, and long-term asset optimization.

The UK industrial fixed asset management market is expected to grow rapidly in the coming years. The industrial fixed asset management market in the UK is experiencing strong growth as companies across manufacturing, utilities, transportation, and energy sectors increasingly adopt digital solutions to enhance asset visibility, operational efficiency, and regulatory compliance.

The industrial fixed asset management market in Germany held a substantial share in 2024. The industrial fixed asset management market in Germany is undergoing a strategic transformation as companies across manufacturing, energy, and infrastructure sectors prioritize digital modernization to enhance asset lifecycle performance, regulatory compliance, and operational transparency.

Asia Pacific Industrial Fixed Asset Management Market Trends

The industrial fixed asset management market in Asia Pacific held a significant share in the global market in 2024. The industrial fixed asset management market in the Asia Pacific region is experiencing robust growth as public and private sector entities across manufacturing, energy, logistics, and infrastructure sectors embrace digital transformation to improve asset efficiency, operational resilience, and regulatory compliance.

Japan industrial fixed asset management market is expected to grow rapidly in the coming years. The industrial fixed asset management market in Japan is evolving rapidly as enterprises across manufacturing, energy, and infrastructure sectors adopt advanced digital solutions to improve asset visibility, predictive maintenance, and lifecycle efficiency.

The industrial fixed asset management market in China held a substantial market share in 2024. National strategies such as Made in China 2025 continue to accelerate the adoption of smart manufacturing systems and factory automation, reinforcing the role of asset management as a core enabler of industrial modernization.

Key Industrial Fixed Asset Management Companies Insights

Key players operating in the industrial fixed asset management market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Industrial Fixed Asset Management Companies:

The following are the leading companies in the industrial fixed asset management market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- AMCS Group

- Assertive Industries, Inc

- Bentley Systems, Incorporated

- CPCON Group

- Honeywell International Inc.

- Radiant RFID

- Regal Rexnord

- Rockwell Automation

- RSM US LLP

- Schneider Electric

- Siemens AG

- Verasset

- WSP

- Zebra Technologies Corp.

Recent Developments

-

In May 2025, ABB introduced Genix APM Copilot, which integrates generative AI (leveraging LLMs like GPT‑4 via Azure OpenAI) into its Asset Performance Management (APM) suite. It enables capabilities like intelligent alert triage, predictive diagnostics, natural-language queries, and proactive maintenance workflows. Reported benefits include up to 40% operational cost savings, 30% more efficient production, and 25% improvements in energy and emissions.

-

In April 2025, Bentley Systems partnered with Google to enhance industrial fixed asset management by integrating Google's high-quality geospatial imagery and AI capabilities with Bentley’s infrastructure engineering software. This collaboration enables faster, more efficient roadway asset inspections, automated condition detection, and improved maintenance decision-making, helping infrastructure professionals optimize asset performance and support disaster recovery efforts.

Industrial Fixed Asset Management Market Report Scope

Report Attribute

Details

Market size in 2025

USD 65.56 billion

Revenue forecast in 2033

USD 289.21 billion

Growth rate

CAGR of 20.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, asset type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ABB; AMCS Group; Assertive Industries, Inc.; Bentley Systems; Incorporated; CPCON Group; Honeywell International Inc.; Radiant RFID; Regal Rexnord; Rockwell Automation; RSM US LLP; Schneider Electric; Siemens AG; Verasset; WSP; Zebra Technologies Corp.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Fixed Asset Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial fixed asset management market report based on component, asset type, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

RTLS

-

Barcode

-

Mobile Computer

-

Labels

-

GPS

-

Others

-

-

Software

-

Location & Movement Tracking

-

Check In/Check Out

-

Repair & Maintenance

-

Others

-

-

Services

-

Strategic Asset Management

-

Operational Asset Management

-

Tactical Asset Management

-

-

-

Asset Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Returnable Transport Assets

-

Non-Returnable Transport Assets

-

IT Asset

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturing

-

Energy & Utilities

-

Oil & Gas

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial fixed asset management market size was estimated at USD 54.83 billion in 2024 and is expected to reach USD 65.56 billion in 2025.

b. The global industrial fixed asset management market is expected to grow at a compound annual growth rate of 20.4% from 2025 to 2033 to reach USD 289.21 billion by 2033.

b. The software segment dominated the market and accounted for the revenue share of 42.6% in 2024. The shift toward cloud-based platforms is fueling the expansion of the software segment in industrial fixed asset management.

b. Some key players operating in the industrial fixed asset management market include ABB, AMCS Group, Assertive Industries, Inc., Bentley Systems, Incorporated, CPCON Group, Honeywell International Inc., Radiant RFID, Regal Rexnord, Rockwell Automation, RSM US LLP, Schneider Electric, Siemens AG, Verasset, WSP, and Zebra Technologies Corp.

b. The digital transformation of industries drives the global industrial fixed asset management market. Industry 4.0 integrates IoT-enabled sensors, cloud computing, artificial intelligence, and predictive analytics into asset management systems to provide deeper insights into asset conditions and performance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.