- Home

- »

- Petrochemicals

- »

-

Industrial Gases Market Size & Share, Industry Report, 2033GVR Report cover

![Industrial Gases Market Size, Share & Trends Report]()

Industrial Gases Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Nitrogen, Oxygen, Hydrogen, Carbon Dioxide), By Application (Healthcare, Manufacturing, Retail), By Distribution (Bulk), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-468-0

- Number of Report Pages: 149

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Gases Market Summary

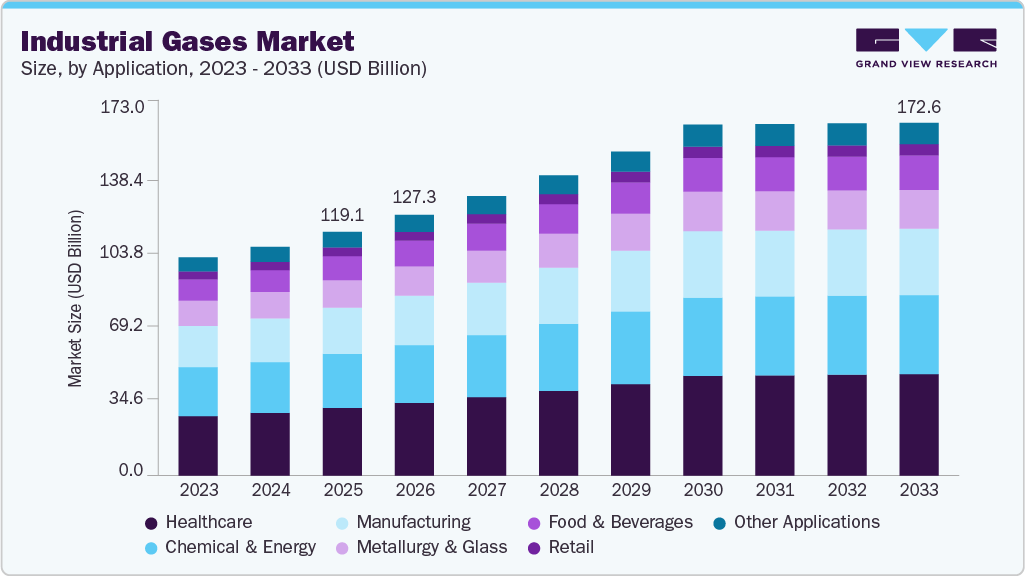

The global industrial gases market size was valued USD 119.11 billion in 2025 and is projected to reach USD 172.59 billion by 2033 growing at a CAGR of 4.4% from 2026 to 2033. The growth is primarily driven by the growing manufacturing industry in developing economies of the Asia Pacific region.

Key Market Trends & Insights

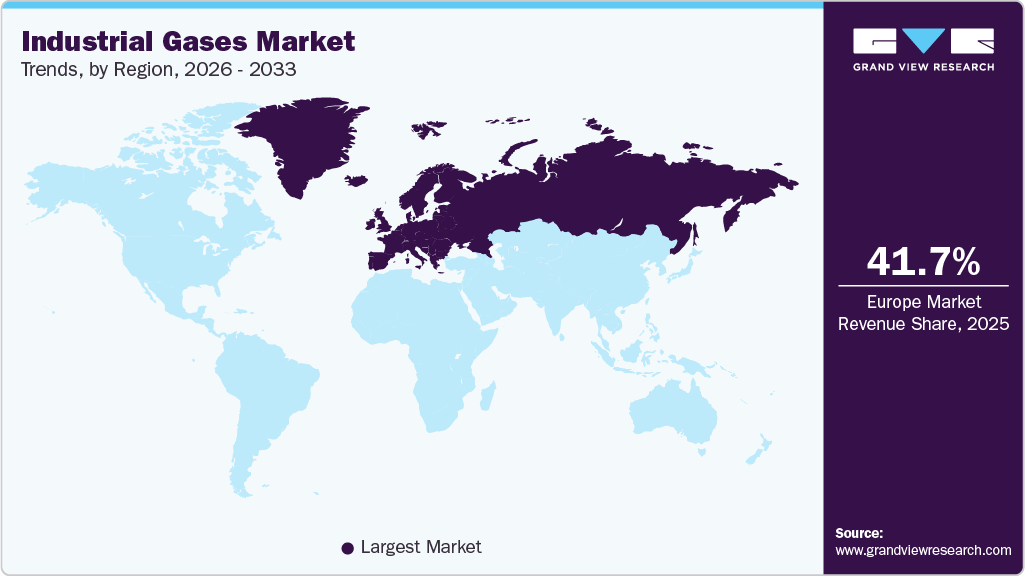

- Europe led the market with a 41.67% revenue share in 2025.

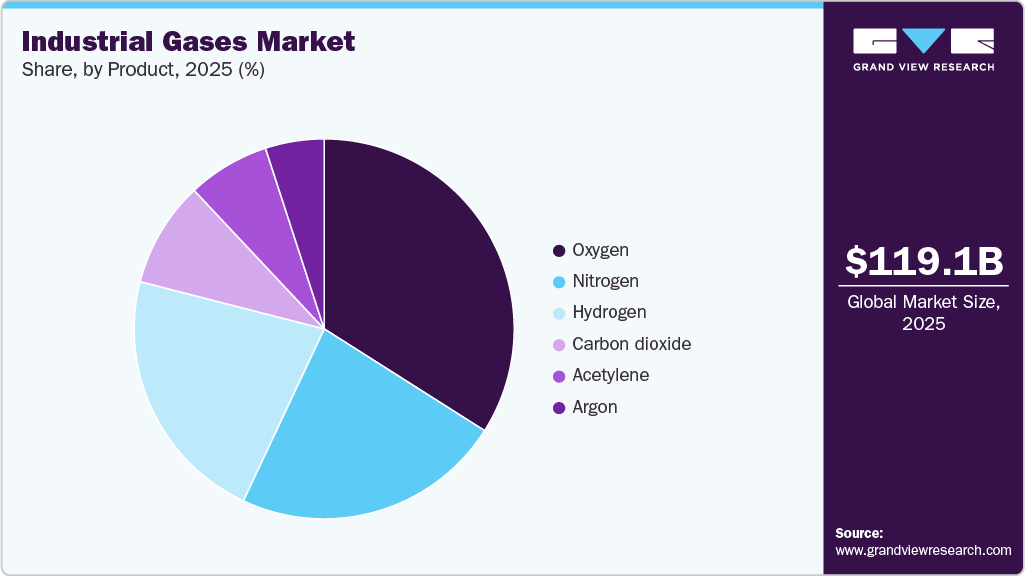

- Oxygen segment dominated the market and accounted for the largest revenue share of 38.52% in 2025.

- The healthcare segment dominated the market and accounted for the largest revenue share of 27.04% in 2025.

Market Size & Forecasts

- 2025 Market Size: USD 119.11 Billion

- 2033 Projected Market Size: USD 172.59 Billion

- CAGR (2025-2033): 4.4%

- Europe: Largest market in 2025

Rapid industrialization and the application of industrial gases in various industries, such as manufacturing, mining, metals, food & beverage, and healthcare, are further expected to influence the market growth in the coming years. However, environmental regulations, safety, and high gas conversion costs may hinder the industry's growth during the forecast period. The U.S. accounted for a majority share in the North America regional market and is expected to retain its leading position throughout the forecast period. The U.S. emerged as one of the major countries utilizing industrial gases, as the country has the presence of a large number of major industrial gas suppliers, such as Linde, Air Liquide, Messer, and Air Products & Chemicals. The growing healthcare industry in the U.S., coupled with growing R&D in the healthcare sector owing to the recent outbreak of the COVID-19 pandemic, is expected to propel the demand for industrial gases in the U.S.

The dependence of the electronics end-use sector on industrial gases has provided an alternate source of opportunity for the market, given the broad range of applications from flat-panel displays and semiconductors to LED lights and solar cells. Unlike the petrochemical and metallurgy industry, the electronics end-use industry embraces suppliers to greater standards with regard to project experience, coverage, and technical specifications. Asia Pacific accounted for a significant revenue share in 2025 and is projected to continue to dominate the global market during the forecast period. The economic growth in countries, such as China, India, and South Korea, has shown strong growth and the trend is expected to continue over the forecast period. The presence of major electronics companies in the U.S. is also one of the major reasons driving the demand for industrial gases. In the U.S., the usage of electronics is increasing day by day, with an ever-growing number of electronic devices and gadgets being manufactured for the convenience of consumers. The growing healthcare and electronic industries across the region are likely to promote market growth. Expansion of the industrial sector is anticipated to further fuel the regional market.

Product Insights

On the basis of products, the global industry has been further categorized into oxygen, nitrogen, hydrogen, carbon dioxide, acetylene, and argon. The oxygen product segment dominated the industry in 2025 and accounted for the highest share of 38.52% of the overall revenue. Oxygen is utilized for fabrication, steel melting, medical applications, copper smelting, etc. Oxygen is known to improve the thermal efficiency of fuel. Thus, oxygen can be used as a methodology for obtaining better energy from fuel.

Similarly, it can also be used for the cleanup of hazardous, treatment of polluted water, and coal gasification systems. It is considered an alternative to chlorine in the pulp & paper industry to decrease pollution.Nitrogen has the highest growth rate and penetration owing to large-scale applications in the medical and pharmaceutical industries. The global pandemic has resulted in healthcare facilities demanding essential medical supplies and other essential life-saving devices to prevent the spread of the virus and provide optimum care to infected patients.

Distribution Insights

The cylinder segment led the industry in 2025 and accounted for the largest revenue share of 36.55%. It is the most preferred form of distribution by consumers. This type of distribution is practiced by independent gas distributors by purchasing gas from producers and compressing them in their packaging facilities. Many gases are also supplied at room temperature in the liquid state. The gases are stored at low pressure in thin-walled steel or composite aluminum cylinders. The bulk (Liquid Gas Transport) distribution segment accounted for the second-largest share in 2025. This involves the gas in a liquefied or natural state being transported by either road (dedicated trailers) or via pipelines (over long distances).

This mode of delivery is ideally opted when the demand for gases is higher than packaged gas distribution and lesser than onsite distribution. This is a more efficient form of distribution and is, therefore, more preferred than the other modes of distribution since it ensures a continuous supply of gases. The onsite form of distribution is the most conducive form of distribution for the manufacturing companies like Air Products & Chemicals, The Linde Group, Air Liquide, etc. since it reduces their transportation costs. The company’s onsite plant usually integrates onsite facilities at refueling stations to optimize its operations. The supply systems are set up around standardized components to ensure maximum cost efficiency.

Application Insights

The healthcare industry application segment accounted for the largest share of 27.04% of the overall revenue in 2025 and is projected to grow at the second-highest CAGR during the forecast period. Governments across the globe are investing in medical research as medical institutes and pharmaceutical companies are working towards developing vaccines and medicine to fight novel coronavirus. This is driving the demand for industrial nitrogen, which is used in the healthcare industry. Carbon dioxide is also widely used for cryopreservation applications, where tissues, gametes, cellular samples, and embryos are preserved at extremely low temperatures. Industrial gases also find application in various other industries including automotive & transportation, aerospace & aircraft, water & wastewater treatment, and others.

Manufacturing is estimated to be the fastest-growing segmentfrom 2026 to 2033. The demand for industrial gases in the manufacturing industry is projected to witness rapid growth owing to various applications. Carbon dioxide is frequently used in the rubber industry in the form of dry ice for the non-abrasive cleaning of rubber molds. It is commonly used by manufacturers of molded rubber products to reduce production downtime and maintenance & labor costs. The use of carbon dioxide for the cleaning of essential tools and molds in the rubber industry offers various advantages over conventional cleaning methods.

Regional Insights

On the basis of geographies, the global industry has been further categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. Europe dominated the industry in 2025, in terms of revenue share. The growth and demand is strong in chemicals, healthcare, metallurgy, and electronics, with increasing focus on green hydrogen and carbon capture applications. While traditional industrial demand is relatively stable, energy costs and regulatory compliance significantly influence pricing and investment decisions. Innovation and sustainability-driven applications are key growth drivers.

Germany Industrial Gases Market Trends

Germany is one of Europe’s key industrial gases consumers, supported by its strong manufacturing, automotive, chemicals, and engineering sectors. Demand is increasingly influenced by energy transition initiatives, particularly hydrogen and low-carbon industrial processes. While traditional demand is mature, investment in green technologies sustains long-term growth potential.

North America Industrial Gases Market Trends

In 2025, North America accounted for the second-largest revenue share. The growing healthcare industry and expansion of the industrial sector in the U.S. and Canada are expected to foster the demand for industrial gases in the region.

Asia Pacific Industrial Gases Market Trends

Asia Pacific’sexpansion of end-use industries in key markets like India, China, South Korea, and Japan are expected to driven by rapid industrialization, urbanization, and expansion of manufacturing across China, India, Japan, and Southeast Asia. Strong demand from steel, chemicals, electronics, healthcare, and food & beverage industries supports sustained growth. Increasing investments in electronics fabrication, clean energy, and hydrogen infrastructure further enhance market potential. Merchant liquid supply and on-site gas generation models are expanding across the region to support large industrial customers.

China is the largest country market in the APAC regional market owing to increasing demand for industrial gases in the aerospace industry for high-quality gas solutions. Growth and expansion of the food & beverage and industrial sectors in key markets like China and India are also expected to fuel the demand for industrial gases over the forecast period.

Latin America Industrial Gases Market Trends

The Latin America industrial gases market is developing and demand-driven, supported by growth in metals & mining, oil & gas, food processing, and healthcare. Countries such as Brazil, Mexico, and Chile account for the majority of consumption. Market growth is linked to industrial expansion and infrastructure development, though investment is constrained by economic volatility and limited pipeline infrastructure. Merchant liquid and cylinder supply models dominate the region.

MEA Industrial Gases Market Trends

The MEA industrial gases market is emerging but high-potential, driven by oil & gas, refining, chemicals, and large-scale infrastructure projects. The Middle East shows strong demand for hydrogen, oxygen, and nitrogen, supported by petrochemical complexes and energy-intensive industries. In Africa, demand growth is led by mining, healthcare, and basic manufacturing, though infrastructure limitations remain a constraint. Long-term industrial diversification strategies support gradual market expansion.

Key Industrial Gases Company Insights

The global industry is highly competitive due to the strong presence of many regional as well as multinational companies.Key industry participants are involved in research and development and constant innovation, which have become among the most important factors for them to perform in the competitive industry.

Key Industrial Gases Companies:

The following are the leading companies in the industrial gases market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide

- Air Products Inc.

- INOX-Air Products Inc.

- Iwatani Corp.

- Linde plc

- Messer

- SOL Group

- Strandmøllen A / S

- Taiyo Nippon Sanso Corp.

- Matheson Tri-Gas Inc.

Industrial Gases Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 127.34 billion

Revenue forecast in 2033

USD 172.59 billion

Growth rate

CAGR of 4.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, volume in million SCF, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution, and region

Regional scope

Asia Pacific; North America; Europe; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; The Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Thailand; Singapore; Brazil; Saudi Arabia; UAE

Key companies profiled

Air Liquide; Linde plc; Air Products Inc.; Taiyo Nippon Sanso Corp.; Messer; SOL Group; Iwatani Corp.; Matheson Tri-Gas, Inc.; INOX-Air Products Inc.; Strandmøllen A/S

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

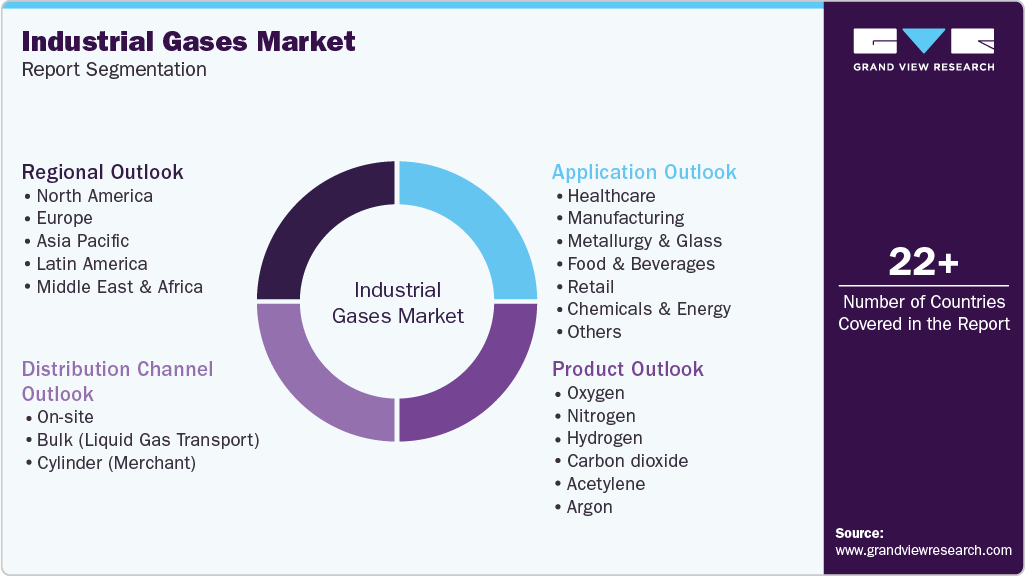

Global Industrial Gases Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For the purpose of this study, Grand View Research has segmented the global industrial gases market report based on product, application, distribution, and region:

-

Product Outlook (Volume, Million SCF; Revenue, USD Million, 2018 - 2033)

-

Oxygen

-

Nitrogen

-

Hydrogen

-

Carbon dioxide

-

Acetylene

-

Argon

-

-

Application Outlook (Volume, Million SCF; Revenue, USD Million, 2018 - 2033)

-

Healthcare

-

Manufacturing

-

Metallurgy & Glass

-

Food & Beverages

-

Retail

-

Chemicals & Energy

-

Others

-

-

Distribution Outlook (Volume, Million SCF; Revenue, USD Million, 2018 - 2033)

-

On-site

-

Bulk (Liquid Gas Transport)

-

Cylinder (Merchant)

-

-

Regional Outlook (Volume, Million SCF; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial gases market size was estimated at USD 119.11 billion in 2025 and is expected to reach USD 172.58 billion in 2026.

b. The global industrial gases market is expected to witness a compound annual growth rate of 4.4% from 2026 to 2033 to reach USD 172.58 billion by 2033.

b. Manufacturing applications captured a market share of nearly 27.19% in 2025 of the industrial gases market owing to growing demand for advanced industrial gas in electronic industry.

b. Some of the key players operating in the industrial gases market include Air Liquide, Air Products & Chemicals, Messer Group, Taiyo Nippon Sanso, The Linde Group, among others.

b. Key factors that are driving the industrial gases market growth include rising end-user industry growth coupled with growing manufacturing industries in developing economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.