- Home

- »

- Next Generation Technologies

- »

-

Industrial Refrigeration Systems Market Size Report, 2030GVR Report cover

![Industrial Refrigeration Systems Market Size, Share & Trends Report]()

Industrial Refrigeration Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Compressors, Condensers, Evaporators, Controls), By Capacity, By Refrigerant, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-101-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Refrigeration Systems Market Summary

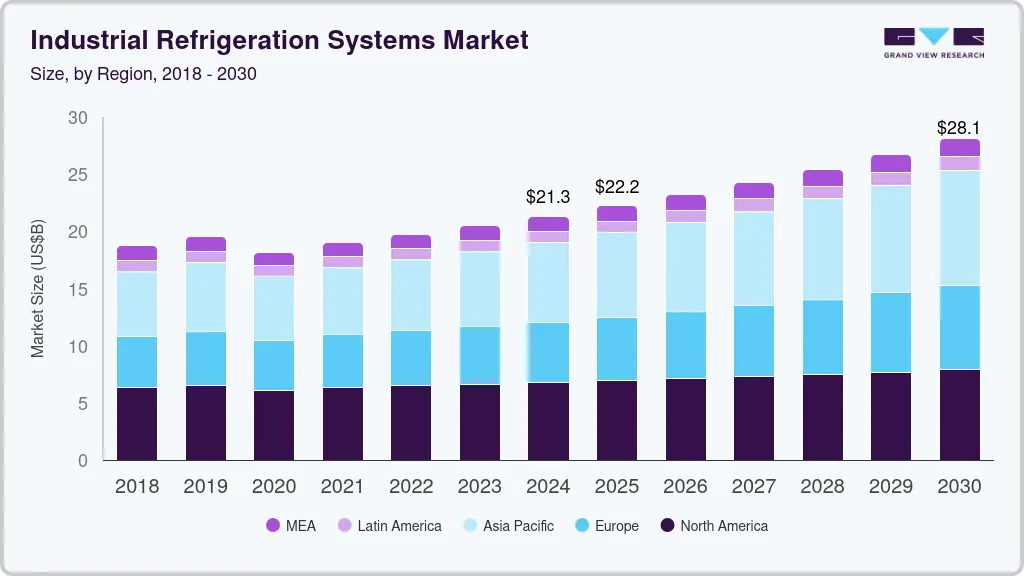

The global industrial refrigeration systems market size was estimated at USD 21.32 billion in 2024 and is projected to reach USD 28.11 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The market is witnessing robust growth, driven by increasing demand for cold storage solutions in food & beverage, pharmaceuticals, and chemical industries.

Key Market Trends & Insights

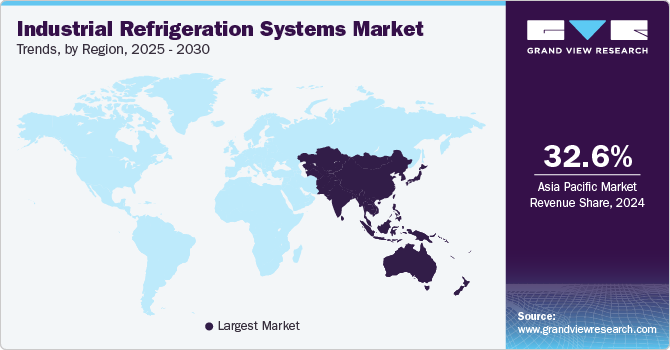

- The Asia Pacific region led the market with a revenue share of 32.62% in 2024.

- By component, the compressors segment captured a significant market share of around 23% in 2024.

- By capacity, the 500kW-1000kW segment captured the highest market share in 2024.

- By refrigerant, the HCFC segment captured the highest market share in 2024.

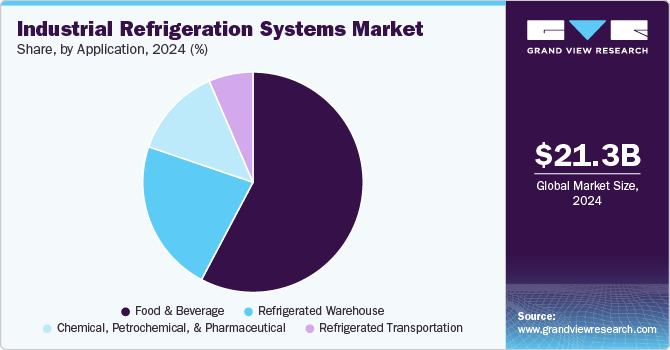

- By application, the food & beverage segment captured the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.32 Billion

- 2030 Projected Market Size: USD 28.11 Billion

- CAGR (2025-2030): 4.8%

- Asia Pacific: Largest market in 2024

The rising need for efficient perishable goods storage and transportation is a key driver, especially with the expansion of global food supply chains. Stringent regulations on food safety and energy efficiency push industries to adopt advanced refrigeration technologies. Integrating IoT and automation in refrigeration systems improves energy efficiency and predictive maintenance, reducing operational costs. The shift toward natural refrigerants like CO₂ and ammonia due to environmental concerns also shapes market trends. In addition, the rapid expansion of e-commerce and online grocery delivery services is fueling demand for large-scale refrigerated warehouses. As industries focus on sustainability, energy efficiency, and digitalization, the market for industrial refrigeration systems is expected to grow steadily.

The industrial refrigeration system industry rapidly incorporates IoT-enabled technologies and smart monitoring solutions to enhance operational efficiency. Advanced refrigeration systems now feature AI-powered analytics, real-time temperature monitoring, and predictive maintenance capabilities. By utilizing cloud-based data insights, businesses can optimize refrigeration performance, reduce downtime, and improve energy efficiency. Remote monitoring solutions are becoming a game-changer for large-scale cold storage facilities, food processing plants, and logistics companies. As industries continue their digital transformation, IoT-driven refrigeration systems will become a standard component of modern industrial operations.

Rising energy costs and stringent environmental regulations push the industrial refrigeration system industry to adopt energy-efficient solutions. Businesses are investing in advanced technologies such as variable speed compressors, thermal energy storage, and enhanced insulation to minimize energy consumption. Government incentives and sustainability goals further drive the shift toward eco-friendly refrigeration systems. The food and beverage sector is upgrading its refrigeration infrastructure to align with carbon footprint reduction initiatives. As energy efficiency remains a key industry focus, manufacturers prioritize developing cost-effective, high-performance cooling solutions.

The rapid growth of the e-commerce and online grocery sectors is propelling the industrial refrigeration system industry to expand cold storage and logistics capabilities. With increasing consumer demand for frozen and perishable goods, companies invest in temperature-controlled warehouses and distribution centers. Advanced industrial refrigeration technologies such as blast freezing, multi-temperature storage, and automation-driven solutions are becoming essential. Emerging economies in Asia Pacific and Latin America are experiencing major investments in cold chain logistics to support the growth of food, pharmaceuticals, and healthcare industries. This trend is expected to accelerate as global supply chains continue to modernize and adapt to changing market needs.

Safety concerns and evolving regulations drive the industrial refrigeration industry to adopt low-charge ammonia systems. Traditional ammonia refrigeration setups require large refrigerant charges, raising risks related to leaks and compliance issues. Low-charge ammonia systems utilize innovative designs that minimize refrigerant quantities while maintaining high efficiency and reliability. Industries such as dairy, meat processing, and brewing are increasingly adopting these systems to balance safety, performance, and sustainability. As regulatory frameworks tighten, low-charge ammonia refrigeration is expected to gain widespread adoption in industrial settings.

The industrial refrigeration system industry is experiencing a surge in adopting CO₂ transcritical systems due to their environmental benefits and superior efficiency. These systems are particularly beneficial in cold storage, food processing, and supermarket refrigeration, where sustainability and operational reliability are critical. Innovations such as parallel compression, ejector technology, and heat recovery integration are enhancing the energy efficiency of CO₂ transcritical systems. Companies increasingly choose these solutions to future-proof their refrigeration infrastructure against evolving environmental regulations. With the growing emphasis on decarbonization, CO₂ transcritical refrigeration is expected to dominate the industrial market in the coming years.

Component Insights

The compressors segment captured a significant market share of around 23% in 2024. The industrial refrigeration system industry is increasingly shifting toward energy-efficient compressors to reduce operational costs and carbon footprints. Businesses are adopting advanced compressor technologies such as variable speed drives (VSD) and two-stage compression systems to optimize energy consumption. These innovations help industries achieve higher cooling efficiency while minimizing power wastage. Regulatory policies promoting energy conservation further drive the adoption of high-efficiency compressors in industrial refrigeration. As sustainability becomes a priority, manufacturers invest in next-generation compressors to meet industry demand.

The controls segment is expected to witness a significant CAGR of around 5.3% from 2025 to 2030. The industrial refrigeration system industry is experiencing a surge in demand for adaptive and remote-control technologies that offer greater flexibility and efficiency. Wireless control systems, cloud-based dashboards, and remote diagnostics allow facility managers to monitor and adjust refrigeration performance from any location. These systems improve response times to operational issues and help businesses optimize energy usage. Adaptive controls can adjust cooling output based on external factors such as ambient temperature and humidity, further improving efficiency. As businesses seek scalable and cost-effective solutions, remote and adaptive refrigeration controls will continue to grow in popularity.

Capacity Insights

The 500kW-1000kW segment captured the highest market share in 2024. The 500kW-1000kW refrigeration segment is experiencing strong growth, driven by the expansion of mid-sized cold storage facilities and distribution centers. With the rise of urbanization and e-commerce, companies are setting up regional cold storage hubs to ensure efficient food and pharmaceutical distribution. These mid-scale facilities require reliable refrigeration systems that balance high cooling performance with energy efficiency. The need for localized cold chain solutions is growing as businesses seek to reduce transportation costs and improve delivery speed. This trend pushes investment in refrigeration systems within this capacity range to support evolving logistics networks.

1000kW-5000kW is expected to witness the fastest CAGR from 2025 to 2030. The demand for high-capacity refrigeration systems in the 1000kW-5000kW range is increasing due to the rapid growth of large cold storage warehouses and distribution centers. The rise of online grocery shopping, global food trade, and pharmaceutical storage requires reliable, high-efficiency refrigeration solutions. Businesses invest in large-scale systems to support extended storage times and reduce product spoilage. Governments worldwide also promote cold chain infrastructure to enhance food security and minimize post-harvest losses. This trend is driving the installation of more high-capacity refrigeration units to meet growing storage demands.

Refrigerant Insights

The HCFC segment captured the highest market share in 2024. Hydrochlorofluorocarbons (HCFCs) are being phased out globally due to their ozone-depleting potential (ODP) and high global warming potential (GWP). International agreements like the Montreal Protocol and the Kigali Amendment drive regulatory measures to reduce HCFC consumption. Many industries are transitioning to eco-friendly refrigerants, such as hydrofluoroolefins (HFOs), natural refrigerants (CO₂, ammonia), and hydrocarbons. Governments are enforcing strict bans, quota reductions, and financial incentives for businesses to adopt sustainable alternatives. As a result, manufacturers are investing in low-GWP and energy-efficient refrigeration technologies to stay compliant.

Ammonia is expected to witness the fastest CAGR from 2025 to 2030. Technological innovations are improving ammonia refrigeration systems' safety, efficiency, and application scope. The development of low-charge ammonia systems is reducing the risks associated with toxicity, making it more accessible for commercial applications. Hybrid ammonia-CO₂ refrigeration systems are gaining traction, offering enhanced energy efficiency and safety benefits. Smart monitoring systems with IoT integration and AI-driven optimization also enhance ammonia system performance. These advancements make ammonia a viable and scalable solution for a broader range of industries.

Application Insights

The food & beverage segment captured the highest market share in 2024. The increasing consumption of frozen and processed foods is driving the demand for advanced refrigeration systems in the food & beverage industry. As global supply chains expand, manufacturers and retailers require efficient cold storage and processing facilities to maintain food quality and safety. Large-scale food distributors invest in modern refrigeration solutions to extend product shelf life and minimize spoilage. Furthermore, the rise of e-commerce grocery services further fuels the need for temperature-controlled logistics. This trend pushes food businesses to adopt high-efficiency refrigeration systems that ensure compliance with food safety standards.

Chemical, petrochemical, & pharmaceutical is expected to witness CAGR from 2025 to 2030. The rise of specialty chemicals and biotechnology increases the need for advanced refrigeration solutions tailored to specific manufacturing processes. Many specialty chemicals require controlled cooling during synthesis, storage, and transportation to maintain product integrity. In biotech and pharmaceutical industries, cell culture storage, biological drug production, and gene therapy manufacturing rely on highly controlled refrigeration environments. Companies are investing in customized refrigeration solutions to meet these sectors' growing demand for precision cooling. As biotechnology and specialty chemical production expand, refrigeration technology will evolve to meet their unique requirements.

Regional Insights

The industrial refrigeration systems market in North America generated a significant revenue share, accounting for over 31% in 2024. The market is witnessing strong growth due to increasing demand for cold storage and food processing facilities. The rise of e-commerce grocery platforms and pharmaceutical cold chains drives investment in energy-efficient refrigeration solutions. Government incentives promoting sustainable refrigeration technologies are further shaping market trends in the region.

U.S. Industrial Refrigeration Systems Market Trends

The industrial refrigeration systems market in the U.S. held a dominant position in 2024. Stringent environmental regulations are accelerating the transition to low-GWP refrigerants such as CO₂ and ammonia in industrial refrigeration systems. Food processing, pharmaceuticals, and petrochemical industries are investing in eco-friendly cooling technologies to meet sustainability goals. The market is also seeing a surge in smart refrigeration solutions to optimize energy consumption and operational efficiency.

Europe Industrial Refrigeration Systems Market Trends

The industrial refrigeration systems market in Europe was identified as a lucrative region in 2024. Due to strict environmental regulations, Europe’s market is shifting toward high-efficiency systems. Adopting natural refrigerants, such as ammonia and CO₂, is accelerating as companies strive to reduce emissions and energy costs. Automation and AI-driven monitoring are becoming standard to optimize refrigeration performance and maintenance.

The UK industrial refrigeration systems market is seeing a rise in investments in sustainable and modular refrigeration solutions across the food and pharmaceutical industries. The transition to net-zero carbon emissions pushes companies to adopt energy-efficient refrigeration systems. Digital monitoring and predictive maintenance technologies are gaining traction to enhance system reliability.

The industrial refrigeration systems market in Germany integrates automation and AI-driven control systems to improve efficiency and reduce operational costs. The demand for high-performance refrigeration in the automotive, chemical, and food processing industries is rising. Smart monitoring solutions are crucial in optimizing energy consumption and predictive maintenance.

Asia Pacific Industrial Refrigeration Systems Market Trends

The industrial refrigeration systems market in the Asia Pacific region led the market with a revenue share of 32.62% in 2024 and is expected to grow at the highest CAGR of over 6.4% from 2025 to 2030. The Asia Pacific region is witnessing significant growth in industrial refrigeration due to expanding food processing and logistics sectors. Rising urbanization and increased demand for frozen foods drive the need for advanced cold storage solutions. Governments are supporting investments in energy-efficient refrigeration to meet environmental targets.

China industrial refrigeration systems market is expected to grow significantly due to the growing industrial sector, especially in food processing and pharmaceuticals, which is boosting demand for large-scale refrigeration systems. The country is investing in sustainable and smart refrigeration technologies to enhance energy efficiency. Strict environmental regulations are also pushing industries to transition toward low-GWP refrigerants.

The industrial refrigeration systems market in Japan is at the forefront of adopting cutting-edge refrigeration technologies, including AI-driven automation and IoT-enabled monitoring. The country’s focus on sustainability is driving the transition to natural refrigerants and high-efficiency cooling systems. The demand for precise temperature control in the pharmaceutical and electronics industries is further shaping market trends.

Key Industrial Refrigeration Systems Company Insights

Some key players operating in the market include Johnson Controls and Emerson Electric Co.

-

Johnson Controls is a well-established commercial and industrial refrigeration leader, offering advanced cooling solutions for data centers, healthcare, and retail industries. The company invests heavily in smart refrigeration systems with IoT-enabled predictive maintenance capabilities. Johnson Controls is also expanding its portfolio of low-GWP (Global Warming Potential) refrigerants to align with global sustainability goals. Its long-standing industry expertise and strategic acquisitions strengthen its position in the competitive market.

-

Emerson Electric Co. is a dominant force in the refrigeration industry, known for its Copeland-branded compressors and automation solutions. The company is focused on integrating AI and IoT technologies to optimize refrigeration efficiency and reduce operational costs. Emerson is also driving sustainability initiatives by developing CO₂ and low-GWP refrigerant-based cooling systems. With a strong global presence and continued investments in digital transformation, Emerson remains a key player in the refrigeration sector.

EVAPCO Inc. andGuntner GmbH & Co. KG are some of the emerging participants in the market.

-

EVAPCO Inc. is a rapidly growing player in the industrial refrigeration and cooling solutions market. The company specializes in energy-efficient evaporative cooling, hybrid, and dry cooling technologies for commercial and industrial applications. With increasing demand for sustainable refrigeration, EVAPCO has been investing in environmentally friendly solutions, such as natural refrigerants and advanced heat transfer technologies. The company’s focus on innovation and regulatory compliance positions it as a key emerging competitor in the market.

-

Guntner GmbH & Co. KG is expanding its footprint in the global refrigeration sector by providing high-performance heat exchangers for industrial and commercial applications. The company is leveraging digitalization and IoT to enhance operational efficiency in refrigeration systems. Guntner is also investing in sustainable cooling technologies, including CO₂ refrigeration and ammonia-based solutions, to meet stringent environmental regulations. Its strong focus on R&D and customized cooling solutions is helping it gain traction in the industry.

Key Industrial Refrigeration Systems Companies:

The following are the leading companies in the industrial refrigeration systems market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Controls

- Emerson Electric Co.

- Danfoss

- GEA Group Aktiengesellschaft

- MAYEKAWA MFG Co. Ltd.

- BITZER Kuhlmaschinenbau GmbH

- DAIKIN Industries Ltd.

- EVAPCO Inc.

- Guntner GmbH & Co. KG

- LU-VE S.p.A

Recent Developments

-

In March 2024, Hillphoenix Industrial entered a strategic partnership with Cool Refrigeration Systems & Solutions, a Hagerstown, Maryland-based company. Under this agreement, Cool Refrigeration will represent Hillphoenix’s industrial CO₂ refrigeration solutions across the Eastern U.S. and Canada.

-

In November 2023, Daikin introduced a new lineup of full-electric and plug-in hybrid transport refrigeration systems at SOLUTRANS in Lyon. With decades of expertise in commercial and industrial refrigeration, Daikin Transportation Refrigeration and the Zanotti brand specialize in the transportation of fresh and frozen products. Both entities operate under Daikin Europe, a subsidiary of Daikin Industries, the global leader in refrigeration, cooling, heating, ventilation, and air purification solutions.

-

In October 2023, Emerson launched a modular refrigeration unit featuring CO₂ (R744) scroll compressors, designed for small to medium-sized retail stores in Europe. The Copeland-branded units offer flexible installation options for indoor and outdoor settings, including packed or split configurations. Moreover, in 2021, Emerson introduced a CO₂ scroll compressor for commercial refrigeration applications, available in both low-temperature and medium-temperature variants. These compressors were a key highlight at Emerson’s 2022 Chillventa exhibition.

Industrial Refrigeration Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.24 billion

Revenue forecast in 2030

USD 28.11 billion

Growth rate

CAGR of 4.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, capacity, refrigerant, application, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Johnson Controls; Emerson Electric Co.; Danfoss; GEA Group Aktiengesellschaft; MAYEKAWA MFG Co. Ltd.; BITZER Kuhlmaschinenbau GmbH; DAIKIN Industries Ltd.; EVAPCO Inc.; Guntner GmbH & Co. KG; LU-VE S.p.A

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Refrigeration Systems Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global industrial refrigeration systems market report based on component, capacity, refrigerant, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Compressors

-

Rotary Screw Compressors

-

Centrifugal Compressors

-

Reciprocating Compressors

-

Others

-

-

Condensers

-

Evaporators

-

Controls

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 100 kW

-

100-500 kW

-

500kW-1000kW

-

1000kW-5000kW

-

More than 5000 kW

-

-

Refrigerant Outlook (Revenue, USD Million, 2018 - 2030)

-

Ammonia

-

Carbon Dioxide

-

HFC

-

HCFC

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerated Warehouse

-

Food & Beverage

-

Chemical, Petrochemical, & Pharmaceutical

-

Refrigerated Transportation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the industrial refrigeration systems market growth include increasing adoption of natural refrigerant-based refrigeration systems owing to strict regulatory policies, and the growing need for refrigeration for freezing, cooling, and chilling of food at large owing to the growth in food production.

b. The global industrial refrigeration systems market size was estimated at USD 21.32 billion in 2024 and is expected to reach USD 22.24 billion in 2025.

b. The global industrial refrigeration systems market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 28.10 billion by 2030.

b. North America dominated the industrial refrigeration systems market with a share of 31% in 2024. This is attributable to the rising demand for beverages, fresh food products, and medicines, and government initiatives to phase out HCFCs refrigerants and adopt natural refrigerants in various refrigeration applications.

b. Some key players operating in the industrial refrigeration systems market include Johnson Controls, Emerson Electric Co., Danfoss, GEA Group Aktiengesellschaft, MAYEKAWA MFG. CO., LTD., BITZER Kühlmaschinenbau GmbH, DAIKIN INDUSTRIES, Ltd., EVAPCO, Inc., Güntner GmbH & Co. KG, and LU-VE S.p.A.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.