- Home

- »

- Next Generation Technologies

- »

-

Industrial Services Market Size, Share, Growth Report, 2030GVR Report cover

![Industrial Services Market Size, Share & Trends Report]()

Industrial Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Engineering & Consulting, Installation & Commissioning, Operational Improvement & Maintenance), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-368-8

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Services Market Summary

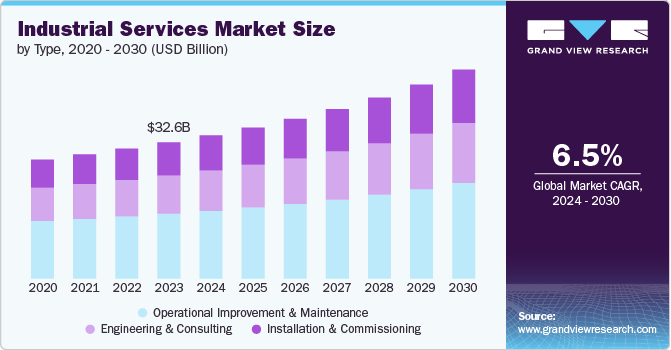

The global industrial services market size was estimated at USD 32.65 billion in 2023 and is projected to reach USD 50.09 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030. This growth can be attributed to the rapid progress in industrial automation, IoT, and AI significantly boosting demand for sophisticated industrial services.

Key Market Trends & Insights

- North America dominated the industrial services market share of 34.66% in 2023.

- U.S. held the largest market share in the North American in 2023.

- Based on type, the operational improvement & maintenance segment led the market with the largest revenue share of 47.65% in 2023.

- Based on application, the distributed control system (DCS) segment led the market with the largest revenue share of 20.14% in 2023.

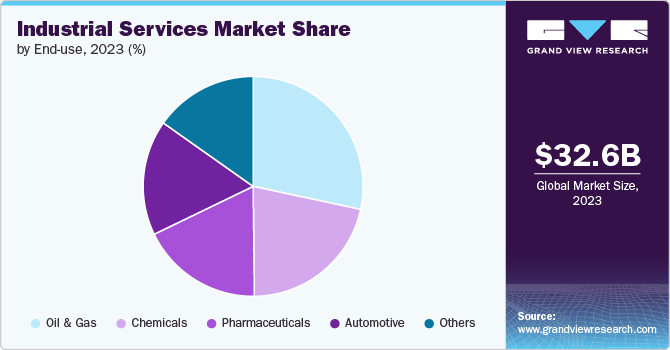

- Based on end use, the oil and gas segment led the market with the largest revenue share of 28.36% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 32.65 Billion

- 2030 Projected Market Size: USD 50.09 Billion

- CAGR (2024-2030): 6.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Companies are increasingly integrating these technologies to improve operational efficiency, reduce downtime, and enhance productivity. This technological integration not only optimizes processes but also enables the development of more advanced and reliable industrial services.

There is also a growing emphasis on predictive maintenance, which relies on data analytics and real-time monitoring to anticipate equipment failures and optimize maintenance schedules. The adoption of predictive maintenance solutions helps industries reduce operational costs and extend the lifespan of machinery, thus driving demand for these services. Increasing industrialization, especially in emerging economies, contributes to the expanding market. Regions such as Asia-Pacific are experiencing significant growth in manufacturing and production activities, leading to higher demand for industrial services. This industrial expansion in emerging markets is a key factor in overall market growth.

Stringent regulatory requirements also play a crucial role. Compliance with safety and environmental regulations necessitates regular maintenance and servicing of industrial equipment, ensuring a steady demand for industrial services to maintain compliance and avoid penalties. These regulatory pressures drive the need for ongoing maintenance and upgrades.

Industries are focusing on energy efficiency to reduce operational costs and meet sustainability goals. Industrial services that focus on energy audits, optimization, and efficient energy management are in high demand. This focus on energy efficiency aligns with broader environmental and economic objectives, further driving market growth.

Outsourcing trends are also influencing the global market, with companies increasingly outsourcing industrial services to specialized providers. This allows businesses to focus on their core competencies while leveraging the expertise of service providers for maintenance, repair, and operational support. The complexity of modern machinery, which requires specialized skills and knowledge, further drives demand for comprehensive industrial service solutions.

Type Insights

Based on type, the operational improvement & maintenance segment led the market with the largest revenue share of 47.65% in 2023, due to its critical role in enhancing efficiency, reducing downtime, and prolonging equipment lifespan. Companies prioritize this segment to ensure optimal performance and compliance with regulatory standards, thereby driving demand. In addition, the growing complexity of industrial machinery necessitates specialized maintenance services, further bolstering this segment's dominance.

The installation & commissioning segment is anticipated to grow at the fastest CAGR of 7.3% from 2024 - 2030, due to the increasing adoption of advanced industrial equipment and automation technologies. This growth is driven by the need for expert services to ensure proper setup and integration of new systems, minimizing downtime and operational disruptions. In addition, the rise in new industrial projects and expansions, particularly in emerging economies, fuels demand for these specialized services.

Application Insights

Based on application, the distributed control system (DCS) segment led the market with the largest revenue share of 20.14% in 2023, due to its essential role in managing complex industrial processes with high reliability and precision. DCS systems are crucial for optimizing production efficiency, ensuring consistent product quality, and facilitating real-time monitoring and control. Their widespread adoption across various industries, including oil and gas, chemicals, and power generation, underscores their importance in maintaining seamless and efficient operations, thereby driving significant demand in the global market.

The manufacturing execution system (MES) segment is expected to grow at the fastest CAGR of 7.6% during the forecast period, because of its critical role in bridging the gap between enterprise-level planning and shop-floor operations. MES solutions enhance production efficiency, enable real-time tracking of manufacturing processes, and ensure higher quality control, making them indispensable for modern manufacturing environments. The increasing adoption of Industry 4.0 technologies and the need for greater operational transparency and agility drive the demand for MES. In addition, the push towards digital transformation and smart manufacturing in various industries further accelerates the growth of this segment.

End-use Insights

Based on end use, the oil and gas segment led the market with the largest revenue share of 28.36% in 2023. It is expected to maintain its dominance from 2024 to 2030, due to the sector's substantial reliance on industrial services for operational efficiency, safety, and regulatory compliance. The complexity and scale of oil and gas operations necessitate continuous maintenance, advanced monitoring, and specialized services to ensure optimal performance and minimize downtime. In addition, the ongoing investments in exploration and production activities, coupled with the adoption of advanced technologies, further drive demand for industrial services in this sector, solidifying its leading market position.

The pharmaceuticals segment is anticipated to grow at the fastest CAGR of 7.1% from 2024-2030 due to the increasing demand for precision and compliance in drug manufacturing processes. The sector's stringent regulatory requirements necessitate comprehensive validation, maintenance, and calibration services to ensure product quality and safety. In addition, the rapid advancements in biotechnology and the rise in personalized medicine drive the need for specialized industrial services, further contributing to the segment's robust growth.

Regional Insights

North America dominated the industrial services market share of 34.66% in 2023, primarily due to its advanced industrial infrastructure and high level of technological adoption. The presence of key industries, including oil and gas, pharmaceuticals, and manufacturing, drives significant demand for industrial services. In addition, stringent regulatory standards and a strong emphasis on safety and efficiency compel companies to invest in maintenance and operational improvement services. The ongoing trend toward digital transformation and automation further solidifies North America's leading position in the global market.

U.S. Industrial Services Market Trends

The industrial services market in the U.S. held the largest market share in the North American in 2023, due to its extensive industrial base and robust economic infrastructure. The presence of diverse industries, including manufacturing, oil and gas, and pharmaceuticals, drives significant demand for specialized services. In addition, the U.S. leads in technological innovation and adoption, facilitating advancements in automation and digital solutions. Strong regulatory frameworks and a focus on operational efficiency further compel companies to invest in comprehensive industrial services, reinforcing the dominant position in the market.

Asia Pacific Industrial Services Market Trends

The industrial services market in Asia Pacific is anticipated to grow at the fastest CAGR of 7.2% from 2024-2030, driven by rapid industrialization and increasing manufacturing activities in the region. The growing demand for advanced technologies and automation solutions is prompting businesses to seek comprehensive industrial services to enhance efficiency and productivity. In addition, government initiatives to support infrastructure development and investment in emerging economies are contributing to market growth.

Europe Industrial Services Market Trends

The industrial services market in Europe is characterized by growth driven by stringent regulatory standards and a strong focus on safety and sustainability. The region's commitment to reducing carbon emissions and promoting energy efficiency is leading industries to invest in advanced industrial services. In addition, the increasing adoption of automation and digital technologies is enhancing operational efficiency and productivity. The presence of well-established manufacturing sectors further supports the demand for comprehensive industrial services, ensuring continued market expansion.

Key Industrial Services Company Insights

Some of the key companies operating in the global market include ABB, and Siemens, among others.

-

ABB is a technology company that provides products and solutions across areas/applications such as electrification, robotics, automation, and motion. The company also offers the ABB Ability Marketplace portal, which provides clients and customers with access to more than 100 cloud-based digital applications. The company caters to industries such as aluminium, buildings and infrastructure, automobile, cement, chemical, data centres, food and beverage, marine, metals, life sciences, mining, power generation, pulp and paper, oil and gas, ports, printing, process automation, water, railway, solar power, and wind power. ABB operates through four segments, namely electrification, process automation, motion, and robotics & discrete automation. The electrification segment produces and markets electrical goods and solutions that help ensure the safe, intelligent, and long-lasting flow of electricity from the substation to the outlet. These products and services are provided through six operating divisions: smart power, distribution solutions, smart buildings, installation products, e-mobility, and power conversion

SKF and Metso Technologies are some of the emerging market companies in the target market.

- SKF provides products and solutions such as bearings and units, mechatronics systems, seals, services, as well as lubrication systems. The company conducts its business activities through two segments, namely Automotive and Industrial. Through the Automotive segment, the company manufactures cars, light and heavy trucks, buses, trailers, and two-wheelers with customized seals, bearings, and other related products. The company sells its automotive products through a network of over 10,000 distributors globally. SKF has a presence in over 130 countries across the globe, around 91 manufacturing units, and 15 technology centres. Light vehicles, industrial distribution, vehicle aftermarket, and heavy industries are the company’s largest customer industries in the Latin America region. SKF caters to industrial distribution, renewable energy, off-highway, heavy machinery industries, and light vehicles, trucks, and vehicle aftermarkets. The company focuses on reducing product failures and providing seamless integration of bearing performance. The company is listed on the Nasdaq Nordic (Stockholm Stock Exchange) under the ticker symbols SKF A and SKF B

Key Industrial Services Companies:

The following are the leading companies in the industrial services market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric Company

- ABB

- Emerson Electric Co.

- Honeywell International Inc.

- Metso

- Rockwell Automation

- Samson

- Schneider Electric

- Siemens

- SKF

- John Wood Group PLC

Recent Developments

-

In June 2024, Honeywell launched its Battery Manufacturing Excellence Platform (Battery MXP), leveraging AI-powered software to optimize gigafactory operations from inception. This innovation aims to enhance battery cell yields, accelerate facility startups, and reduce material waste by 60% during the initial phases. By integrating AI and machine learning, Battery MXP detects and addresses quality issues proactively, enabling manufacturers to improve efficiency, cut production ramp-up times, and meet increasing demand for lithium-based batteries. This solution ensures real-time traceability of battery cells from raw materials to finished products, enhancing quality control and safety measures in gigafactories worldwide, supporting Honeywell's commitment to advancing industrial automation and meeting global electrification demands

-

In February 2023, ABB launched its latest ABB Ability Symphony Plus distributed control system (DCS), enhancing digital transformation in electricity generation and water industries. This release facilitates seamless access to a broader digital ecosystem and supports secure OPC UA connections to Edge and Cloud platforms without compromising core control functionalities. The update includes HTML5 web-based mobile operations for real-time access to critical data, promoting collaboration and maximizing plant uptime. These advancements aim to foster productivity, sustainability, and operational efficiency across industrial sectors

Industrial Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.31 billion

Revenue forecast in 2030

USD 50.09 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

General Electric Company; ABB; Emerson Electric Co.; Honeywell International Inc; Metso; Rockwell Automation; Samson; Schneider Electric; Siemens; SKF; John Wood Group PLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global industrial services market report based on type, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Engineering & Consulting

-

Installation & Commissioning

-

Operational Improvement & Maintenance

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Distributed Control System (DCS)

-

Programmable Controller Logic (PLC)

-

Supervisory Control and Data Acquisition (SCADA)

-

Electric Motors & Drives

-

Valves & Actuators

-

Manufacturing Execution System

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil and Gas

-

Chemicals

-

Automotive

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial services market size was estimated at USD 32.65 billion in 2023 and is expected to reach USD 34.31 billion in 2024.

b. The global industrial services market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 50.09 billion by 2030.

b. North America dominated the industrial services market with a share of over 34.7% in 2023. This is attributable to the advanced industrial infrastructure and high level of technological adoption.

b. Some key players operating in the industrial services market include General Electric Company, ABB, Emerson Electric Co., Honeywell International Inc, Metso, Rockwell Automation, Samson, Schneider Electric, Siemens, SKF, and John Wood Group PLC.

b. Key factors driving market growth include the increasing demand for predictive maintenance, regulatory compliance, aging infrastructure, and focus on energy efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.