- Home

- »

- IT Services & Applications

- »

-

Manufacturing Execution Systems Market Size Report, 2030GVR Report cover

![Manufacturing Execution Systems Market Size, Share & Trends Report]()

Manufacturing Execution Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Software, Services), By Deployment (On-premise, Cloud-based), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-265-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Manufacturing Execution Systems Market Summary

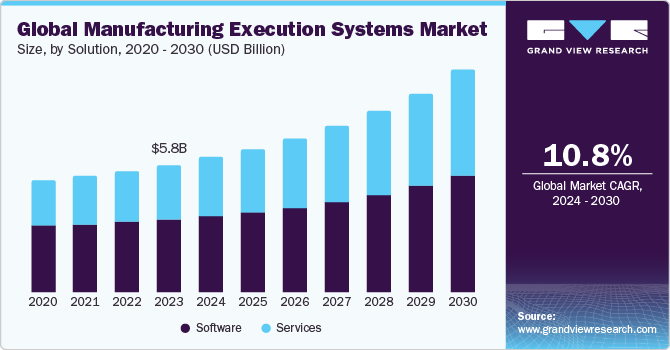

The global manufacturing execution systems market size was estimated at USD 15.01 billion in 2023 and is projected to reach USD 29.88 billion by 2030, growing at a CAGR of 10.8% from 2024 to 2030. The manufacturing execution systems market is driven by the increasing adoption of Industry 4.0 and Smart Manufacturing Initiatives.

Key Market Trends & Insights

- North America, with a 38.6% share, dominated the market in 2023.

- The U.S. dominated the market with a regional share of 70.2% and a global market share of 27.1% in the global market in 2023.

- Based on solution, the software segment, with a market share of 63.5%, dominated the market.

- Based on deployment, the on-premise segment held the largest market share in 2023.

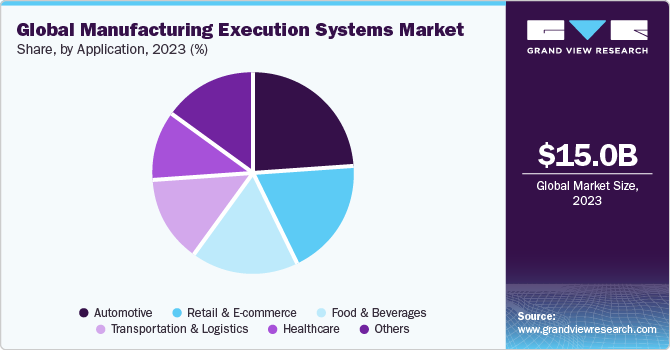

- Based on application, the automotive segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15.01 Billion

- 2030 Projected Market Size: USD 29.88 Billion

- CAGR (2024-2030): 10.8%

- North America: Largest Market in 2023

- Asia Pacific: Fastest growing market

Industry 4.0 technologies such as Internet of Things (IoT), artificial intelligence, and cloud computing are transforming manufacturing operations. MES plays a crucial role in integrating these technologies to enable real-time monitoring, data-driven decision-making, and automation of production processes. Artificial Intelligence (AI) is revolutionizing the MES market, offering unprecedented opportunities for optimizing production processes, improving efficiency, and driving innovation across various industries. AI-powered MES solutions offer predictive maintenance, autonomous quality control and defect detection, production planning and optimization, and process automation.

Several companies are developing innovative products by integrating AI in MES systems to provide better solutions. For instance, in May 2022, SymphonyAI Industrial, an autonomous manufacturing plant solutions provider, launched MOM 360, an advanced, AI-embedded manufacturing operations management system. MOM 360 aims to assist companies in achieving Industry 4.0 smart manufacturing objectives by optimizing processes through data-driven insights at an enterprise level. It offers modular capabilities, scalable deployment, and AI-driven optimization, unlike traditional solutions.

Manufacturers leverage data analytics to optimize production processes, improve quality, reduce costs, and drive innovations in their operations. MES gathers data from production equipment, sensors, IoT devices, enterprise systems such as enterprise resource planning, and external sources such as suppliers and customers. This data contains information on machine performance, production output, quality metrics, and inventory levels, among others. Big data capabilities enable MES to integrate and consolidate this data from disparate sources, providing a comprehensive view of operations.

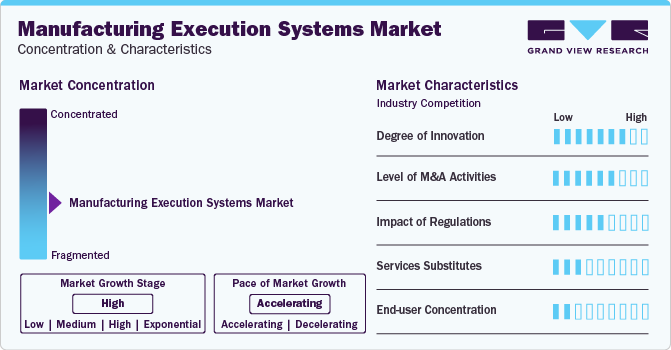

Market Concentration & Characteristics

The global manufacturing execution systems industry is fragmented, and it is growing at an accelerated pace. The industry is characterized by a high degree of innovation owing to the rapid technological advancements driven by advancements in Machine Learning algorithms, the availability of big data, and increasing computing power. Subsequently, innovative MES applications are being introduced into the market, disrupting existing industries and creating new ones.

M&As led by leading players drive industry growth owing to the need to gain access to new technologies and talent, consolidate in a rapidly growing market, and increase the strategic importance of MES. In October 2022, Epicor, an enterprise software leader, acquired eFlex Systems, a cloud-based MES provider, to advance its MES capabilities. The acquisition enabled advancements in production environments pertaining to digital work instructions, process control, and real-time visibility. It aligns with Epicor's goal to help manufacturers address labor challenges and improve productivity through connected devices.

End-users are fragmented due to diverse industries, company sizes, regions, and offerings. Larger enterprises in developed countries typically invest in comprehensive manufacturing execution systems, while smaller firms and emerging markets have varied adoption rates. Fragmentation poses challenges but also makes provisions for specialization. Trends such as cloud-based solutions and Industry 4.0 initiatives may affect the market, potentially leading to consolidation. However, the fragmented nature of the MES industry is expected to continue, prompting vendors to understand and cater to diverse user needs.

Solution Insights

The software segment, with a market share of 63.5%, dominated the market. The ongoing digital transformation in the manufacturing sector fuels the need for modern MES software to support connected, data-driven, and agile manufacturing operations. Manufacturers seek software solutions enabling seamless integration with IoT devices, sensors, and other digital technologies to drive innovation and competitiveness.

In February 2023, AVEVA Group, an engineering & industrial software developer, introduced AVEVA Manufacturing Execution System 2023 to streamline multi-site MES solutions. This enables seamless standardization and best practice implementation across multiple sites, enhancing operational efficiency and supply chain resilience. It offers unified visibility, reporting, and KPIs across operations, eliminating the need for IT infrastructure at each plant. It connects automated processes and IoT devices, collects data at the edge, and supports worker shift management and security enhancements.

The services segment is expected to grow at the fastest CAGR from 2024 to 2030. Many manufacturers outsource the management and maintenance of their MES systems to third-party service providers through managed services agreements. Managed service providers offer ongoing support, monitoring, and administration of MES systems, allowing manufacturers to focus on their core business activities while leveraging the expertise and resources of external service providers to ensure optimal performance and reliability of their MES systems.

Deployment Insights

The on-premise segment held the largest market share in 2023, owing to the increasing need for data privacy and security. Pharmaceuticals, aerospace, and defense sectors have stringent data security and compliance requirements due to the sensitive nature of their operations and regulatory mandates. On-premise MES solutions offer greater control over data security and compliance, as manufacturers retain ownership and management of their data within their IT infrastructure, mitigating risks associated with data breaches and regulatory non-compliance.

The cloud-based segment is expected to grow at the fastest CAGR through the forecast period. Cloud-based MES solutions offer scalability and flexibility, allowing manufacturers to scale their operations commensurate with the demand and without requiring extensive on-premise infrastructure investments. Cloud platforms dynamically allocate resources based on workload requirements, enabling manufacturers to adapt quickly to changing market conditions and production demands.

Application Insights

The automotive segment dominated the market in 2023; automotive manufacturers embrace lean manufacturing principles to eliminate waste, reduce lead times, and improve productivity. MES solutions support lean manufacturing practices by optimizing production workflows, minimizing inventory levels, and maximizing asset utilization. It enables automotive manufacturers to achieve operational excellence and cost savings, further driving the manufacturing execution market.

The healthcare segment is expected to grow at the fastest CAGR over the forecast period, owing to the emerging demand for traceability and serialization. Healthcare manufacturers are required to implement traceability and serialization measures to track and trace products throughout the supply chain, from raw materials to finished goods. MES solutions provide serialization, lot tracking, and product genealogy capabilities, helping healthcare manufacturers comply with regulatory requirements, prevent counterfeiting, and ensure patient safety.

Regional Insights

North America, with a 38.6% share, dominated the market in 2023. North America is renowned for its cutting-edge manufacturing expertise across sectors such as automotive, aerospace, electronics, and pharmaceuticals, thereby focusing on efficiency, quality, and innovation. This drive fuels the widespread adoption of MES solutions, which are pivotal for optimizing operations, boosting productivity, and sustaining competitiveness.

U.S. Manufacturing Execution Systems Market Trends

The U.S. dominated the market with a regional share of 70.2% and a global market share of 27.1% in the global market in 2023. It is attributed to the need for regulatory compliance and quality standards. U.S. manufacturers prioritize MES solutions to ensure compliance, quality control, and product safety across diverse industries such as pharmaceuticals, medical devices, and food production, with rigorous regulatory requirements from FDA and adherence to ISO 9001 quality standards.

The manufacturing execution systems market in Canada is the fastest-growing in the region, owing to the advent of digital transformation. Canadian government programs such as the Next Generation Manufacturing Supercluster and Strategic Innovation Fund promote digitalization and technology adoption in manufacturing, offering financial support for MES implementation.

Europe Manufacturing Execution Systems Market Trends

Europe is viewed as a lucrative marketplace with its robust manufacturing sector that accounts for approximately 20% of global manufacturing output. Key industries such as automotive, aerospace, pharmaceuticals, and machinery are actively modernizing, paving the way for MES adoption. Leveraging this strong manufacturing tradition, European manufacturers increasingly embrace MES solutions to optimize production efficiency, ensure quality control, and meet evolving customer demands.

The manufacturing execution systems market in Germany held the largest share in 2023. German companies prioritize innovation and invest heavily in R&D to maintain technological leadership. MES solutions enable German manufacturers to leverage real-time data insights, optimize production workflows, and continuously innovate, boosting manufacturing execution systems market growth.

The France manufacturing execution systems market is expected to grow at the fastest CAGR over the forecast period. France houses large-scale manufacturing sectors, including aerospace, automotive, luxury goods, and pharmaceuticals. MES solutions are particularly relevant in these industries, where precision, quality, and traceability are paramount, driving the demand for advanced production management systems.

Asia Pacific Manufacturing Execution Systems Market Trends

Asia Pacific is anticipated to witness the fastest growth in the coming years. The region is experiencing rapid industrialization, driven by economic growth, urbanization, and the expansion of manufacturing sectors. MES solutions are essential for optimizing production processes, improving efficiency, and meeting the increasing demand for high-quality products across diverse industries.

The manufacturing execution systems market in China held the largest share in 2023 in the region and is expected to grow rapidly over the forecast period. The Chinese government has launched various initiatives, such as Made in China 2025 and the Industrial Internet Development Plan, to promote the adoption of advanced manufacturing technologies, including MES. These policies aim to upgrade China's manufacturing capabilities, enhance productivity, and drive innovation across industries.

The India manufacturing execution systems market is expected to witness the fastest growth in the region, owing to the increased adoption of manufacturing execution systems by small- and medium-sized enterprises (SMEs). Indian manufacturing companies operate within complex and fragmented supply chains; MES facilitates supply chain integration and optimization by providing visibility, coordination, and data integration across suppliers, manufacturers, and distributors, enabling efficient inventory management, production planning, and logistics operations.

The manufacturing execution systems market in Latin America is expected to grow substantially during the forecast period due to the increasing focus on Industry 4.0 principles. Regional economies are actively embracing digital transformation, automation, and smart manufacturing practices to enhance their manufacturing competitiveness. This emphasis on Industry 4.0 is accelerating the adoption of MES, which is crucial in enabling advanced manufacturing technologies and processes.

MEA Manufacturing Execution Systems Market Trends

The Middle East & Africa region is expected to grow substantially in the forecast period due to the rising industry diversification. Many countries in the MEA region strive to diversify their economies beyond traditional sectors such as oil and gas. There is a growing focus on expanding manufacturing industries as part of economic diversification efforts. MES solutions play a crucial role in enhancing the efficiency and competitiveness of emerging manufacturing sectors in the region.

The manufacturing execution systems market in UAE held the largest share in 2023. The UAE is a regional hub for trade and investment, with strong links to neighboring Gulf Cooperation Council (GCC) countries and beyond. Manufacturing execution systems facilitate supply chain integration and collaboration across borders, enabling efficient inventory management, production planning, and logistics operations to support regional trade and economic integration.

Key Manufacturing Execution Systems Company Insights

Some of the key players operating in the market include Siemens, Honeywell, Rockwell Automation, Dassault Systèmes, and SAP.

-

Siemens AG is a German multinational conglomerate specializing in electrification, automation, and digitalization across various industries. Its MES offerings include Simatic IT MES Suite, covering core MES functionalities like production planning, scheduling, execution, and performance monitoring.

-

Dassault Systèmes is a global software company renowned for its pioneering work in 3D design, 3D digital mock-up, and Product Lifecycle Management (PLM) solutions. DELMIA Apriso is anall-inclusive MES platform for production planning, scheduling, execution, and performance management.

OHM Logic, Inc., Octavic, and Andonix are some of the other market participants in the market.

-

OHM Logic is a provider of MES solutions for various industries, including automotive, aerospace, medical devices, and electronics. The company offers a comprehensive suite of MES software and services such as OHM MES, OHM MES Analytics, OHM MES Quality, OHM MES Supply Chain, and OHM MES Integration.

-

Octavic is a leading provider of manufacturing execution systems (MES) that help organizations optimize their production processes. The company’s offerings are designed to provide real-time visibility and control over manufacturing operations, enabling manufacturers to improve efficiency, reduce costs, and increase quality.

Key Manufacturing Execution Systems Companies:

The following are the leading companies in the manufacturing execution systems market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens

- Honeywell International Inc.

- Rockwell Automation

- Dassault Systèmes

- Schneider Electric

- SAP GmbH

- ABB

- General Electric

- Oracle

- Octavic

- OHM Logic, Inc

Recent Developments

-

In September 2023, Rockwell Automation Inc. announced the successful implementation of its Plex MES at BIC’s Bizerte plant. BIC is a producer of shavers, lighters, and stationery. The aim was to improve operations while focusing on efficiency and innovation by providing a 360-degree view of the plant. BIC plans to extend this partnership to digitize its other factories using Plex MES.

-

In January 2023, Schneider Electric completed the acquisition of AVEVA, a software solutions provider, aiming to drive change and innovation and enhance value delivery to its customers by providing digital transformation platforms. Schneider Electric plans to accelerate its goal of becoming a Software-as-a-Service (SaaS) leader and a subscription-only enterprise model in the market.

Manufacturing Execution Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.18 billion

Revenue forecast in 2030

USD 29.88 billion

Growth rate

CAGR of 10.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; UAE; KSA; South Africa

Key companies profiled

Siemens; Honeywell International Inc.; Rockwell Automation; Dassault Systèmes; Schneider Electric; SAP GmbH; ABB; General Electric; Oracle; Octavic; OHM Logic, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Manufacturing Execution Systems Market Report Segmentation

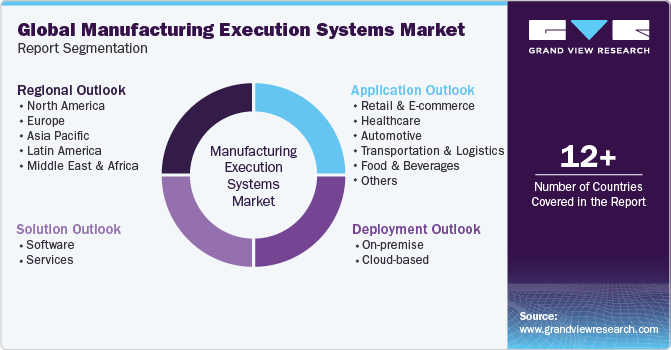

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global manufacturing execution systems market report based on solution, deployment, application, and region:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

Professional Service

-

Strategic Advisory

-

Administrative Services

-

Marketing Services

-

-

Managed Services

-

System Integration

-

Maintenance & Support

-

Data Analytics

-

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premise

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Healthcare

-

Automotive

-

Transportation & Logistics

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global manufacturing execution systems market size was estimated at USD 15.01 billion in 2023 and is expected to reach USD 16.18 billion in 2024

b. The global manufacturing execution systems market is expected to grow at a compound annual growth rate of 10.8% from 2024 to 2030 to reach USD 29.88 billion by 2030.

b. North America dominated the market and accounted for a 38.6% share in 2023. North America is renowned for its cutting-edge manufacturing expertise across sectors like automotive, aerospace, electronics, and pharmaceuticals, leading to a high focus on efficiency, quality, and innovation.

b. Some key players operating in the manufacturing execution systems market include Siemens AG; Honeywell International Inc.; Rockwell Automation Inc.; Dassault Systèmes; Schneider Electric; SAP GmbH; ABB; General Electric Company; Oracle Corporation, OHM Logic, Inc., Otavic

b. Key factors driving the market growth include increasing adoption of Industry 4.0, industrial automation, and Smart Manufacturing Initiatives

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.