- Home

- »

- Next Generation Technologies

- »

-

Industrial Water Treatment Market Size, Industry Report 2033GVR Report cover

![Industrial Water Treatment Market Size, Share & Trends Report]()

Industrial Water Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Physical Treatment, Chemical Treatment), By Industry (Chemical Industry, Food & Beverage, Pharmaceuticals, Automotive, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-706-4

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Water Treatment Market Summary

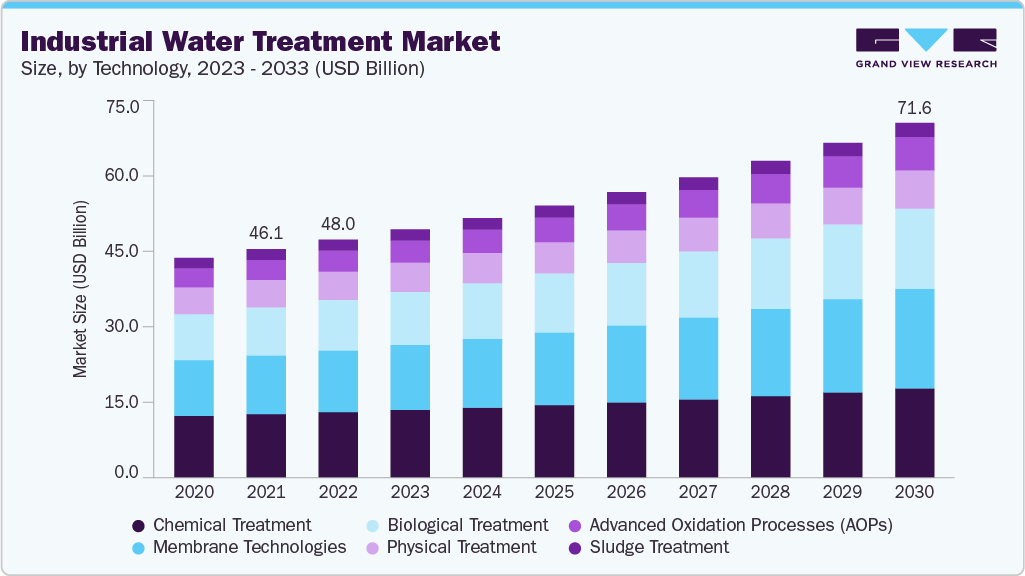

The global industrial water treatment market size was estimated at USD 46.13 billion in 2024 and is projected to reach USD 71.63 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market growth is primarily driven by the rising demand for clean and safe water, increasing regulatory pressure, growing adoption of zero liquid discharge (ZLD) systems, and the ongoing technological advancements in membrane filtration and biological treatment processes to enhance efficiency.

Key Market Trends & Insights

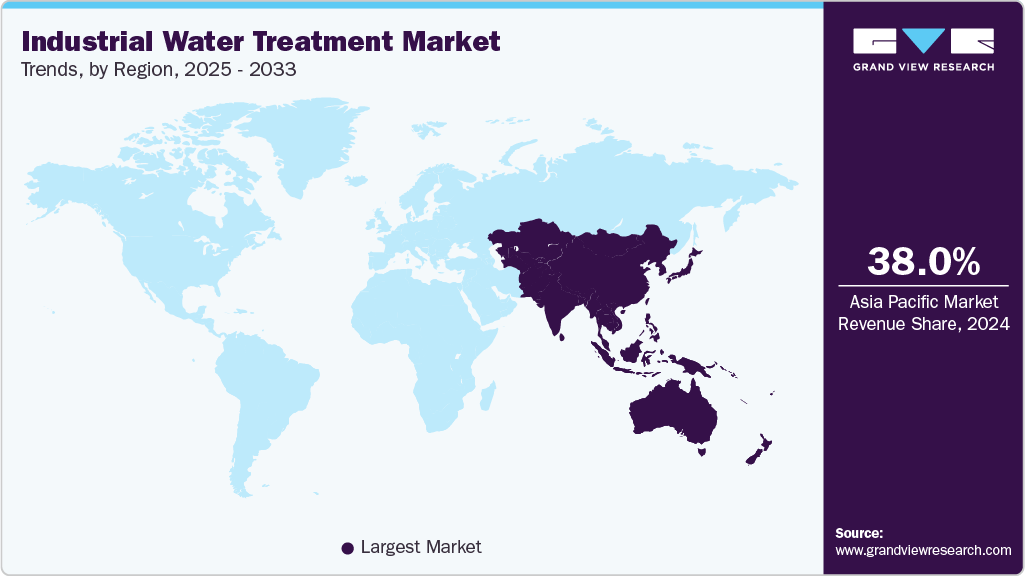

- Asia Pacific dominated the global industrial water treatment industry with the largest revenue share of over 38% in 2024.

- The industrial water treatment industry in China led the Asia Pacific market and held the largest revenue share in 2024.

- By technology, the chemical treatment segment held the largest revenue share of over 27% in 2024.

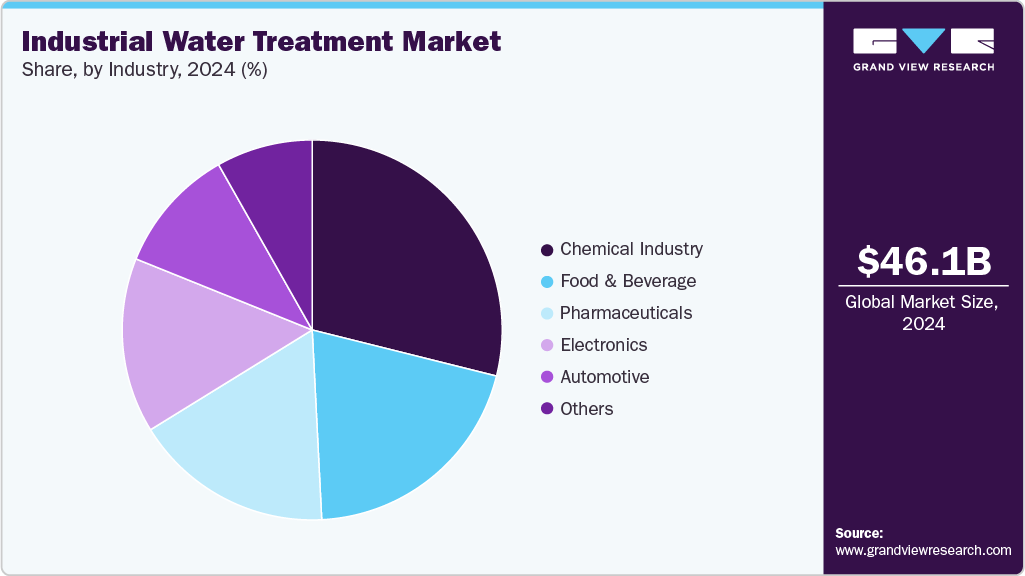

- By industry, the chemical industry segment held the largest revenue share of over 28% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 46.13 Billion

- 2033 Projected Market Size: USD 71.63 Billion

- CAGR (2025-2033): 5.1%

- Asia Pacific: Largest market in 2024

The market growth is primarily driven by the increasing demand for efficient water management solutions across industries such as power generation, food & beverage, pharmaceuticals, and chemicals. The growing adoption of automation and smart monitoring technologies in water treatment processes is fueling demand for advanced, real-time responsive water treatment systems. The integration of IoT, AI-based analytics, and remote monitoring is significantly enhancing operational efficiency, enabling predictive maintenance, and reducing system downtime. The shift toward circular water economy practices, including water reuse and recycling, is encouraging the development of innovative treatment solutions, which are expected to drive the industrial water treatment industry expansion.The rising demand for automation and precision in industrial operations is significantly fueling the growth of the market. Industries such as oil & gas, power generation, and pharmaceuticals are increasingly implementing advanced water treatment solutions to ensure consistent water quality, reduce manual intervention, and meet stringent process requirements. Industrial processes have become more complex and regulated, and automated water treatment systems offer the accuracy and control needed to maintain compliance and operational efficiency. This transition toward intelligent process automation is expanding the adoption of smart treatment technologies and driving continuous innovation in the sector.

The increasing emphasis on energy-efficient and eco-friendly solutions is becoming a major growth driver for the industrial water treatment industry. Traditional water treatment systems often involve high energy consumption and chemical usage; however, modern solutions such as membrane bioreactors, reverse osmosis, and advanced oxidation processes are offering improved energy profiles and lower environmental footprints. These trends are driving the uptake of green technologies and bolstering market expansion.

Furthermore, the integration of IoT and smart sensor technologies is revolutionizing the capabilities of the market. These technologies enable real-time water quality monitoring, predictive maintenance, and adaptive control of treatment parameters, leading to improved performance and reduced operational risks. Digital transformation becomes integral to industrial operations, smart water treatment systems are gaining traction across established and emerging markets.

Moreover, increasing collaboration between OEMs (Original Equipment Manufacturers) and water technology providers is enhancing the development of customized water treatment solutions. These partnerships are fostering innovations tailored to industries like microelectronics and food processing. The growing need for decentralized systems in remote or temporary sites is further encouraging joint R&D initiatives. This collaborative ecosystem is driving innovation, improving system reliability, and accelerating the deployment of advanced industrial water treatment solutions worldwide.

Technology Insights

The chemical treatment segment dominated the market with a market share of over 27% in 2024, owing to its critical role in effectively removing contaminants, preventing scaling, and controlling microbial growth in industrial water systems. Rising industrialization in emerging economies, stricter environmental discharge regulations, and growing awareness of water reuse and recycling are prompting industries to invest heavily in chemical-based treatment solutions. The ongoing innovations in high-performance chemical formulations that reduce environmental impact while improving treatment efficacy reinforce the segment’s leadership in the market.

The membrane technologies segment is expected to witness the fastest CAGR of over 6% from 2025 to 2033. This growth is attributed to the rising demand for advanced filtration systems capable of meeting stringent industrial wastewater discharge regulations. The segment is further driven by the growing adoption of reverse osmosis, ultrafiltration, and nanofiltration technologies. The increasing integration of smart monitoring systems and IoT-enabled sensors into membrane-based plants is enhancing operational efficiency through real-time performance tracking, thereby accelerating the segment’s expansion in the industrial water treatment industry.

Industry Insights

The chemical industry segment accounted for the largest market share in 2024, driven by its heavy dependence on high-quality process water and the need for advanced wastewater treatment to handle complex effluents. Operations in petrochemicals, fertilizers, pharmaceuticals, and specialty chemicals require technologies such as membrane filtration, advanced oxidation processes (AOPs), and zero liquid discharge (ZLD) systems to meet stringent global regulations. The adoption of IoT-enabled monitoring, AI-driven optimization, and automated dosing is further boosting efficiency, reinforcing the segment’s dominance in the market.

The pharmaceuticals segment is expected to witness the fastest CAGR from 2025 to 2033. This growth is driven by the increasing need for contamination-free water in drug manufacturing and laboratory processes. Pharmaceutical production is becoming more sophisticated, driving a growing demand for advanced industrial water treatment industry. The growing prevalence of biologics and injectable drugs, which require exceptionally pure water, is further boosting the adoption of reverse osmosis, deionization, and advanced filtration technologies. This shift toward high-performance, compliance-focused water purification solutions is accelerating investment in this segment.

Regional Insights

The North America industrial water treatment industry accounted for a significant global market share of over 24% in 2024, primarily driven by the region’s strong presence of a well-established manufacturing base and ongoing infrastructure modernization. The rapid growth of sectors such as oil & gas, food & beverage, and chemicals is creating a sustained demand for advanced water treatment technologies to ensure regulatory compliance and environmental stewardship. The increasing focus on digital water management and sensor-based monitoring is encouraging companies to upgrade legacy systems with smart, automated solutions, thereby accelerating market growth in the region.

U.S. Industrial Water Treatment Market Trends

The U.S. industrial water treatment industry is expected to grow at a CAGR of over 3% from 2025 to 2033, driven by the country’s robust sustainable water management technologies. The rising adoption of advanced water treatment solutions in sectors such as power generation, chemicals, food processing, and pharmaceuticals is fueling market demand. Supportive government initiatives aimed at revitalizing domestic infrastructure and enforcing stricter environmental compliance are further propelling the growth of the industrial water treatment industry across the U.S.

Europe Industrial Water Treatment Market Trends

The Europe industrial water treatment industry is expected to grow at a CAGR of over 4% from 2025 to 2033. In Europe, the market is driven by the region’s strong regulatory framework focused on environmental protection, water conservation, and circular economic principles. Rising concerns over water scarcity in Southern Europe and the need for sustainable water reuse in manufacturing and energy sectors are also accelerating market demand. The presence of global water technology leaders and active collaboration between public and private sectors further supports innovation and long-term growth in the regional industrial water treatment industry.

The UK industrial water treatment industry is expected to grow at a significant rate in the coming years. The market is being driven by stringent environmental regulations imposed by agencies such as the Environment Agency (EA) and increasing pressure on industries to reduce water pollution and enhance sustainability practices. The UK’s strong focus on achieving net-zero carbon emissions by 2050 is encouraging the adoption of energy-efficient water treatment technologies. The country's advanced research capabilities further promote the development of innovative treatment solutions across the industrial water treatment industry.

The Germany industrial water treatment industry is driven by the country’s robust industrial infrastructure and stringent environmental regulations. The country’s strong push toward the circular economy and resource-efficient production is promoting water recycling and zero-liquid-discharge systems. Government-backed initiatives under Germany’s Energy Efficiency Strategy for Industry and the broader Industry 4.0 framework are further accelerating the adoption of smart, automated, and energy-efficient industrial water treatment solutions across industrial facilities.

Asia Pacific Industrial Water Treatment Market Trends

Asia Pacific dominated the industrial water treatment industry with the largest revenue share of over 38.0% in 2024 and is expected to grow at the fastest CAGR of over 6% from 2025 to 2033, driven by rapid industrialization, increasing urban population, and rising water stress. Strict regulatory frameworks for industrial effluent discharge, coupled with growing investments in infrastructure and smart industrial parks, are accelerating the adoption of advanced water treatment technologies. The surge in semiconductor manufacturing, power generation, and food processing sectors is further propelling demand for high-efficiency water treatment systems to ensure process reliability and regulatory compliance across the Asia Pacific region.

The Japan industrial water treatment industry is gaining traction, driven by the country’s advanced industrial base and strong commitment to sustainability and technological innovation. Japan’s manufacturing and electronics sectors, which require ultra-pure water and high-efficiency wastewater treatment, are major contributors to the rising demand. The integration of smart monitoring systems and IoT-based solutions in water treatment plants is also accelerating, aligning with the country’s broader “Society 5.0” initiative. These factors collectively position Japan as a key adopter of industrial water treatment technologies.

The China industrial water treatment industry is witnessing robust growth, driven by the country’s accelerated urbanization and increasingly stringent environmental regulations. Significant investments in smart manufacturing and industrial automation are boosting demand for intelligent water treatment systems equipped with real-time monitoring and predictive maintenance capabilities. With strong policy support, rapid technology adoption, and a growing focus on water reuse and recycling, China is solidifying its position as a major growth engine for the global market.

Key Industrial Water Treatment Company Insights

Some of the key players operating in the market include Veolia and Ecolab Inc. among others.

-

Veolia is a global leader in water, waste, and energy management, with a dominant presence in the industrial water treatment industry. Through its water technologies division, Veolia offers cutting-edge solutions such as wastewater reuse, zero liquid discharge (ZLD), and process water treatment systems tailored to sectors like energy, pharmaceuticals, and food & beverage. The company’s proprietary technologies enhance operational efficiency while meeting stringent environmental standards. Veolia’s global footprint and commitment to sustainability position it as a critical player in driving circular water economy solutions across industrial sectors.

-

Ecolab Inc. is a prominent provider of water, hygiene, and energy technologies, offering comprehensive industrial water treatment solutions through its Nalco Water division. Ecolab Inc. delivers advanced programs for boiler, cooling, and wastewater systems, integrating real-time monitoring tools to improve performance and conserve resources. Ecolab’s focus on digitalization, predictive analytics, and sustainability has made it a trusted partner for industries aiming to reduce water usage, improve operational reliability, and comply with environmental regulations.

SWA Water Australia and WOG GROUP are some of the emerging market participants in the industrial water treatment industry.

-

SWA Water Australia is an emerging player in the industrial water treatment industry, known for its expertise in designing and manufacturing custom-built treatment systems. The company specializes in oil-water separation, dissolved air flotation (DAF), and wastewater recycling technologies suited for sectors such as mining, petrochemicals, and food processing. With a strong regional presence and a focus on modular, cost-effective systems, SWA Water Australia is gaining traction among clients seeking efficient and adaptable water treatment solutions in remote or resource-intensive operations.

-

WOG GROUP is an emerging global water treatment solutions provider with growing relevance in industrial markets. The company offers a broad portfolio including effluent treatment plants (ETPs), sewage treatment plants (STPs), and zero liquid discharge (ZLD) systems, catering to industries like textiles, chemicals, and oil & gas. WOG GROUP emphasizes turnkey project execution, integrating engineering, procurement, and construction (EPC) capabilities. Its increasing involvement in decentralized water treatment and commitment to eco-friendly technologies make it a rising force in the evolving industrial water treatment industry.

Key Industrial Water Treatment Companies:

The following are the leading companies in the industrial water treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia

- Ecolab Inc.

- Xylem.

- Pentair.

- Kurita Water Industries Ltd.

- Solenis

- SWA Water Australia

- WOG GROUP

- Kemira

- Feralco AB

Recent Developments

-

In May 2025, Veolia announced its acquisition of full ownership of its Water Technologies and Solutions unit by purchasing the remaining stake from CDPQ. This strategic move enhances Veolia’s leadership in the industrial water treatment industry, enabling the company to fully integrate operations and accelerate innovation. By consolidating control, Veolia is positioned to provide more efficient and sustainable water treatment technologies and services, supporting critical industries and reinforcing its growth trajectory in this vital market.

-

In March 2025, Ecolab Inc. reinforced its leadership in industrial water treatment by leveraging AI-driven water conservation solutions to optimize water use, reduce environmental impact, and enhance operational efficiency across various industries. Collaborating with key partners, Ecolab’s innovative AI-powered systems enable real-time monitoring and predictive analytics that improve water reuse and extend equipment lifespan. These advancements are driving significant progress in the industrial water treatment industry.

-

In August 2024, Nalco Water, an Ecolab Inc. company, and Danieli announced a strategic collaboration to enhance industrial water treatment for the metals industry. By combining Nalco Water’s chemical and service expertise with Danieli’s technological capabilities, the partnership aims to improve production processes, reduce carbon and water footprints, and boost plant performance and reliability. This initiative leverages digitally enabled solutions to optimize water management, lower operational costs, and support sustainable manufacturing practices in the market.

Industrial Water Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 48.04 billion

Revenue forecast in 2033

USD 71.63 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, industry, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Veolia; Ecolab Inc.; Xylem; Pentair; Kurita Water Industries Ltd.; Solenis; SWA Water Australia; WOG GROUP; Kemira; Feralco AB

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Industrial Water Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial water treatment market report based on technology, industry, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Physical Treatment

-

Chemical Treatment

-

Biological Treatment

-

Membrane Technologies

-

Advanced Oxidation Processes (AOPs)

-

Sludge Treatment

-

-

Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemical Industry

-

Food & Beverage

-

Pharmaceuticals

-

Automotive

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial water treatment market was estimated at USD 46.13 billion in 2024 and is expected to reach USD 48.04 billion in 2025.

b. The global industrial water treatment market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 71.63 billion by 2033.

b. The Asia Pacific industrial water treatment market is expected to grow at the highest CAGR of over 6.4% from 2025 to 2033, fueled by rapid industrialization, tightening environmental regulations on wastewater discharge, increasing adoption of advanced treatment technologies, and rising demand for clean water across key industries such as power generation, chemicals, pharmaceuticals, and food & beverages.

b. The key players in the industrial water treatment market are Veolia, Ecolab Inc., Xylem., Pentair., Kurita Water Industries Ltd., Solenis, SWA Water Australia, WOG GROUP, Kemira, Feralco AB.

b. Key drivers of the industrial water treatment market include rising water scarcity concerns, stricter regulatory requirements on wastewater discharge, growing industrial demand for process water, increasing adoption of membrane-based and zero-liquid discharge technologies, and the need for cost-efficient recycling and reuse solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.