- Home

- »

- Petrochemicals

- »

-

Industrial Wax Market Size & Share, Industry Report, 2033GVR Report cover

![Industrial Wax Market Size, Share & Trends Report]()

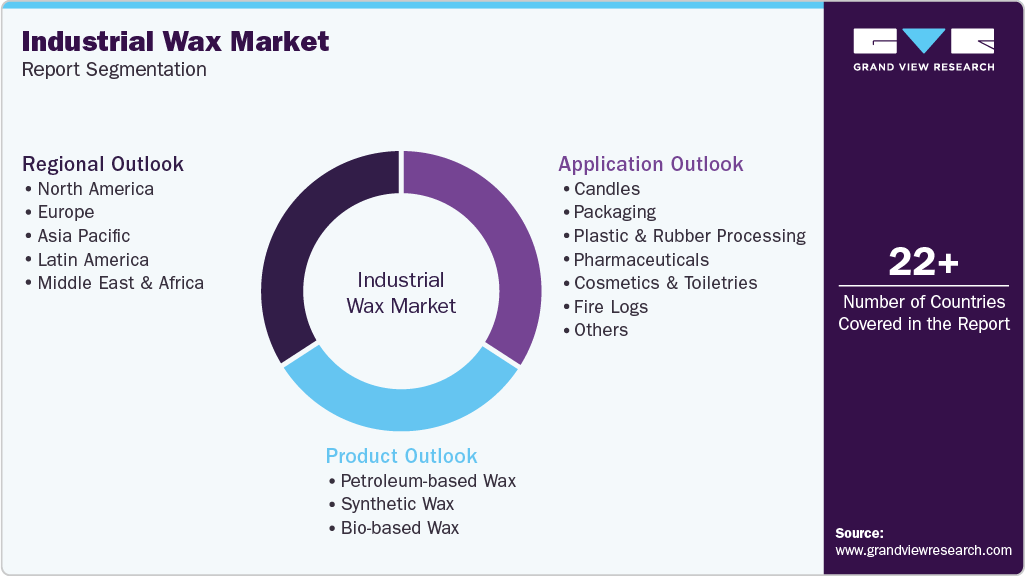

Industrial Wax Market (2026 - 2033) Size, Share & Trends Analysis Report Product (Petroleum-based Wax, Synthetic Wax, Bio-based Wax), By Application (Candles, Packaging, Plastic & Rubber Processing, Pharmaceuticals, Adhesives), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-847-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Wax Market Summary

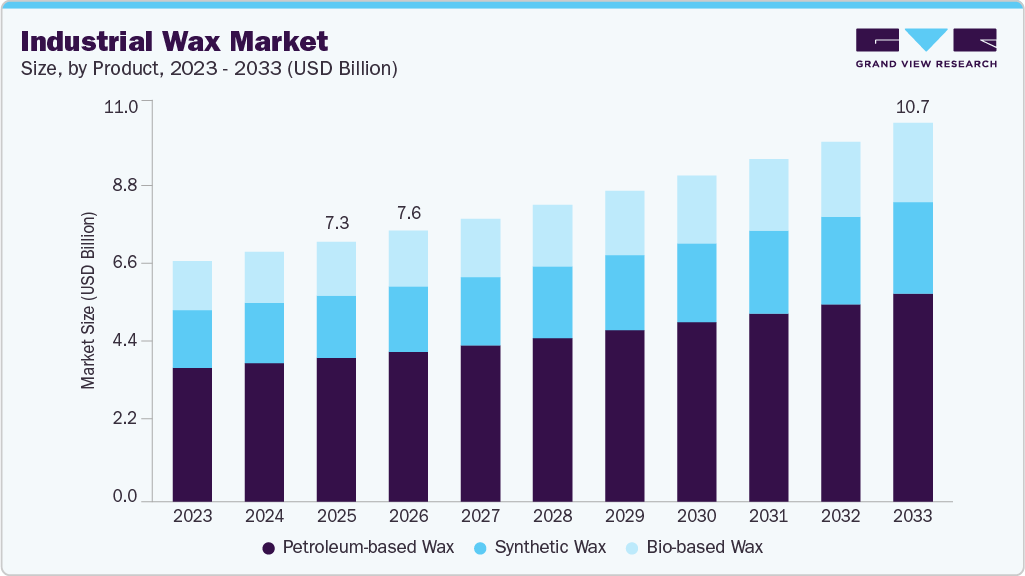

The global industrial wax market size was estimated at USD 7.33 billion in 2025 and is projected to reach USD 10.69 by 2033, growing at a CAGR of 4.9% from 2026 to 2033. The market growth is primarily driven by steady demand from candles, packaging, plastics & rubber processing, and adhesives, where waxes are critical for coating, lubrication, dispersion, and moisture-barrier functions.

Key Market Trends & Insights

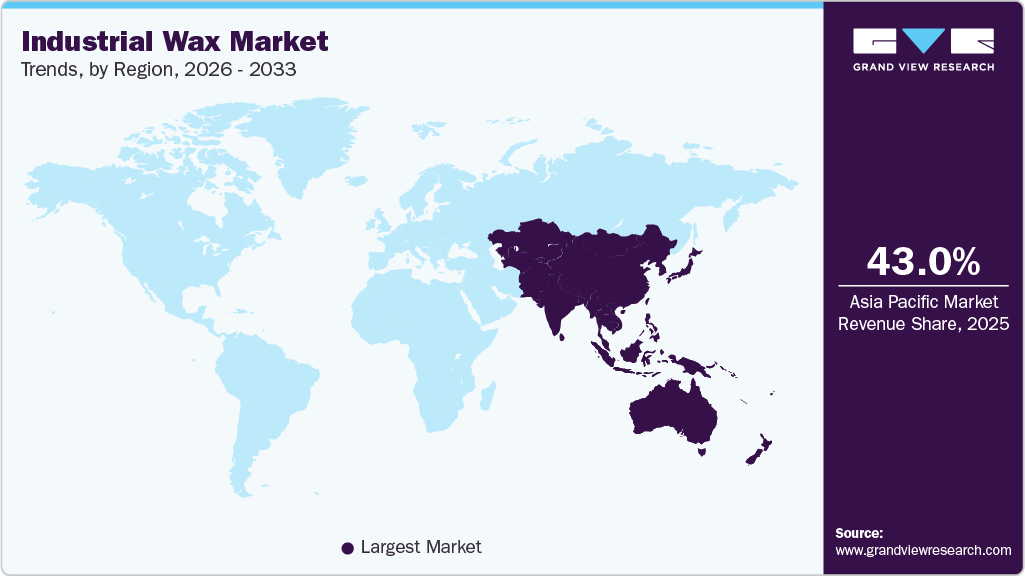

- Asia Pacific dominated the industrial wax market with the largest revenue share of 43.0% in 2025.

- China's industrial wax market accounted for a 46.3% share of Asia Pacific in 2025.

- By product, the petroleum-based wax segment held the largest revenue share of 55.4% in 2025 in terms of value.

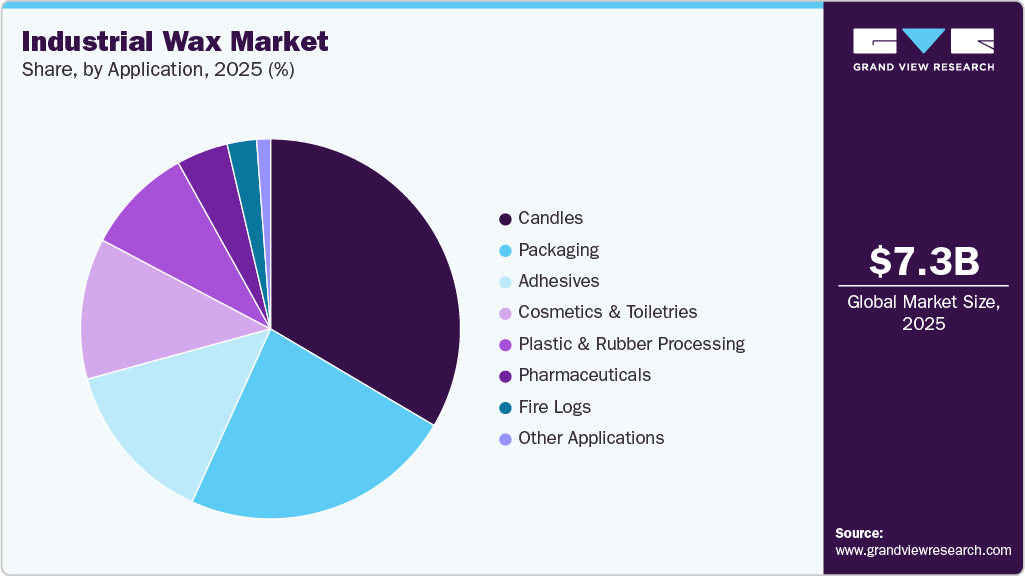

- By application, the candles segment held the largest revenue share of 33.5% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 7.33 billion

- 2033 Projected Market Size: USD 10.69 billion

- CAGR (2026-2033): 4.9%

- Asia Pacific: Largest market in 2025

Growth in consumer goods, flexible packaging, and hygiene products, particularly in Asia Pacific and North America, continues to support volume consumption of petroleum-based waxes. In parallel, industrial expansion and polymer processing activities are driving demand for synthetic waxes due to their superior thermal stability and consistent performance. The rising consumption of cosmetics, toiletries, and pharmaceutical formulations is driving value growth, benefiting both high-purity mineral waxes and specialty synthetic alternatives offered by integrated players such as ExxonMobil, Shell, BASF, Dow, and Evonik.The industrial wax industry presents significant opportunities driven by the structural shift toward bio-based and specialty waxes, supported by sustainability mandates, decarbonization goals, and tightening environmental regulations across Europe and North America. Bio-based waxes derived from vegetable and renewable feedstocks are gaining traction in cosmetics, packaging, and pharmaceutical applications, creating premium growth avenues for chemical innovators and specialty producers. Moreover, advancements in synthetic wax formulations, enabling improved performance in hot-melt adhesives, plastics processing, and high-temperature applications, are expanding addressable markets beyond traditional uses. Emerging economies, particularly in Asia Pacific and Latin America, offer long-term volume growth potential driven by rising manufacturing output, urbanization, and increased consumption of candles, packaging materials, and personal care products.

Despite stable demand fundamentals, the industrial wax market faces challenges related to feedstock price volatility, supply chain disruptions, and environmental scrutiny, particularly for petroleum-based waxes. Fluctuations in crude oil refining economics directly affect the availability and pricing of mineral waxes, putting downstream manufacturers under margin pressure. In addition, stringent environmental regulations and sustainability expectations are accelerating the transition away from fossil-based waxes, increasing compliance costs for traditional producers. Bio-based waxes, while attractive, face challenges related to higher production costs, limited scale, and feedstock availability, which can restrict widespread adoption. Furthermore, intense competition among global integrated oil & gas companies and specialty chemical manufacturers continues to exert pressure on pricing, differentiation, and long-term profitability.

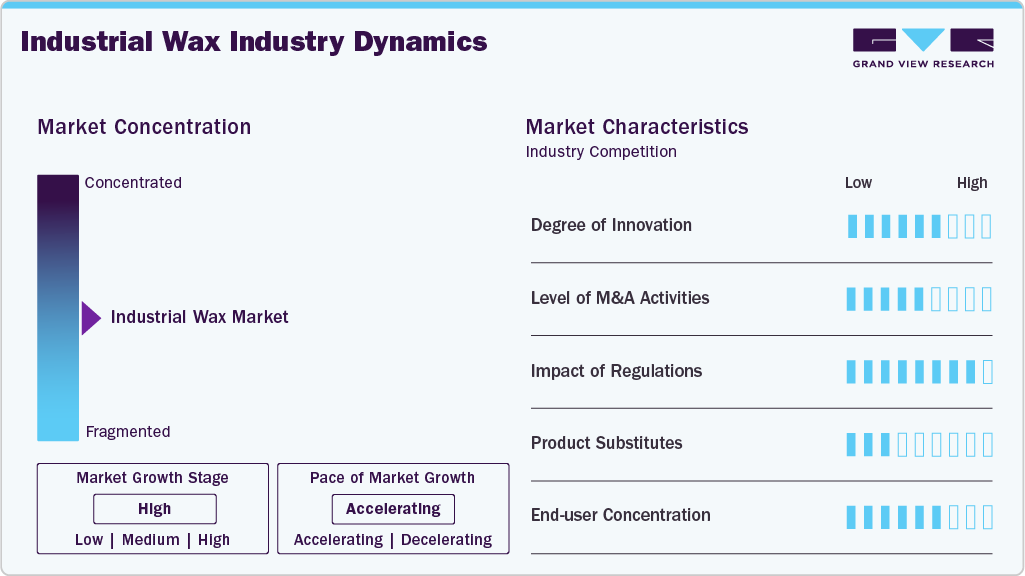

Market Concentration & Characteristics

The industrial wax market is moderately consolidated, with competition shaped by the presence of large integrated oil & gas companies, diversified chemical manufacturers, and specialized wax producers. Major petroleum-based wax supply is dominated by integrated refiners such as Sinopec Corp, China National Petroleum Corporation (CNPC), Exxon Mobil Corporation, BP p.l.c., Royal Dutch Shell p.l.c., Sasol Limited, and HollyFrontier Corporation, which benefit from secure feedstock access, large-scale refining assets, and global distribution networks. These players compete primarily on volume, cost efficiency, and supply reliability, serving high-demand applications such as candles, packaging, and rubber processing, particularly across Asia Pacific and North America.

In contrast, synthetic and specialty wax segments are led by chemical companies including BASF SE, Dow, Evonik Industries AG, Mitsui Chemicals, Honeywell International, Baker Hughes, Nippon Seiro, and The International Group (IGI), where differentiation is driven by product performance, purity, and application-specific formulations. These players focus on value-added applications such as adhesives, plastics processing, cosmetics, and pharmaceuticals, where margins are higher, and customer qualification cycles are longer. Competitive intensity is increasing as companies expand bio-based wax portfolios, invest in R&D, and pursue strategic partnerships and capacity expansions to address sustainability requirements and evolving end-user specifications, making innovation and application expertise key determinants of long-term market positioning.

Product Insights

The petroleum-based wax segment dominated the global industrial wax market in 2025, accounting for the largest revenue share of approximately 55.4%, driven by its cost competitiveness, large-scale availability, and broad applicability across high-volume end uses. Petroleum-based waxes, including paraffin and microcrystalline waxes, benefit from well-established refining infrastructure and integrated supply chains, particularly among major oil & gas companies. These waxes remain the preferred choice for candles, packaging coatings, rubber processing, and fire logs, where performance requirements are standardized, and price sensitivity remains high. Additionally, consistent demand from emerging economies, coupled with the ability of refiners to supply large volumes reliably, has reinforced the segment’s dominant position in the global market.

In contrast, synthetic and bio-based waxes are gaining traction as higher-growth segments, supported by evolving application requirements and sustainability considerations. Synthetic waxes are increasingly adopted in plastics and rubber processing, hot-melt adhesives, and specialty industrial applications due to their superior thermal stability, controlled molecular structure, and consistent performance, enabling manufacturers to achieve tighter process tolerances. Meanwhile, bio-based waxes, derived from renewable feedstocks, are witnessing accelerating adoption in cosmetics, pharmaceuticals, and sustainable packaging, driven by regulatory pressure, brand-led sustainability initiatives, and consumer preference for bio-based ingredients. Although these segments currently represent a smaller share of total revenue, continued investments in product innovation, capacity expansion, and green chemistry are expected to gradually reshape the product mix over the forecast period.

Application Insights

The candles segment led the industrial wax industry, accounting for the largest revenue share of 33.5% in 2025, driven by high-volume consumption and widespread use across residential, religious, decorative, and emergency lighting applications. Candle manufacturing remains one of the most wax-intensive end uses, with petroleum-based waxes continuing to dominate due to their low cost, ease of processing, and consistent burn characteristics. Strong demand from Asia Pacific and North America, coupled with the growing popularity of scented and decorative candles, has sustained large-scale wax consumption. The presence of well-established manufacturing hubs and export-oriented production, particularly in China, has reinforced the segment’s leading position in overall market revenue.

Beyond candles, packaging and plastics & rubber processing represent significant and stable demand centers, driven by the continued growth of food packaging, consumer goods, and industrial manufacturing activities. Industrial waxes are widely used in paper and paperboard coatings, moisture barriers, polymer processing aids, and mold-release applications, ensuring consistent baseline demand. Meanwhile, pharmaceuticals and cosmetics & toiletries are emerging as higher-value application segments, supported by rising healthcare spending, premium personal care consumption, and increasing demand for high-purity and bio-based wax formulations. Applications such as adhesives and fire logs contribute steady niche demand, particularly in developed markets, while other applications, including polishes, textiles, leather processing, and specialty industrial uses, provide incremental growth opportunities and diversification across end-use industries.

Regional Insights

Asia Pacific dominated the global industrial wax market in 2025 with a 43.0% revenue share, driven by large-scale manufacturing activity, cost-competitive production, and strong downstream demand from candles, packaging, plastics processing, and consumer goods. The region benefits from high-volume candle manufacturing hubs, expanding packaging industries, and rapid urbanization, particularly in China, India, and Southeast Asia. Availability of petroleum-based feedstocks, growing chemical production capacity, and rising consumption of personal care products further support sustained demand, positioning Asia Pacific as the primary growth engine of the global market.

China'sindustrial wax market accounted for a 46.3% share of Asia Pacific in 2025, underpinned by its role as the largest global producer and consumer of candles, packaging materials, and manufactured consumer goods. Strong domestic demand, coupled with export-oriented candle and packaging production, continues to drive large-scale wax consumption. In addition, China’s integrated refining capacity and expanding chemical industry support a steady supply of petroleum-based and synthetic waxes, while increasing adoption of higher-value specialty and bio-based waxes in cosmetics and pharmaceuticals is gradually enhancing market value growth.

Europe Industrial Wax Market Trends

Europe represented 27.1% of the global industrial wax industry in 2025, characterized by strong demand for specialty, high-purity, and sustainable wax solutions. The region’s market is supported by well-established cosmetics, pharmaceuticals, packaging, and industrial manufacturing sectors, as well as stringent environmental and product-quality regulations. Europe is witnessing a gradual shift away from conventional petroleum-based waxes toward synthetic and bio-based alternatives, driven by sustainability mandates, circular economy initiatives, and increased R&D investment by major chemical producers.

Germany's industrial wax market serves as a key market within Europe, supported by its advanced manufacturing base, strong chemical industry, and high-value end-use applications. Demand is largely driven by plastics and rubber processing, adhesives, pharmaceuticals, and specialty industrial uses, where performance consistency and regulatory compliance are critical. German manufacturers increasingly favor synthetic and specialty waxes to meet precision processing and sustainability requirements, positioning the country as a strategic hub for innovation-driven wax consumption rather than volume-led demand.

North America Industrial Wax Market Trends

North America accounted for approximately 22.0% of the global industrial wax industry in 2025, supported by stable demand from packaging, adhesives, candles, and personal care applications. The region benefits from mature refining infrastructure, strong distribution networks, and consistent industrial activity, particularly in the United States. While petroleum-based waxes continue to dominate volumes, growing emphasis on sustainable materials, premium consumer products, and specialty applications is driving incremental demand for synthetic and bio-based wax formulations.

U.S. Industrial Wax Market Trends

The U.S. accounted for about 72.9% of the North America industrial wax industry in 2025, reflecting its large consumer base, diversified industrial base, and strong presence of integrated oil & gas and chemical companies. Demand is driven by packaging, hot-melt adhesives, cosmetics & toiletries, and pharmaceutical applications, supported by high standards for product quality and performance. In addition, increased focus on bio-based materials and clean-label personal care products is creating growth opportunities for specialty wax suppliers, even as petroleum-based waxes remain dominant in volume.

Middle East & Africa Industrial Wax Market Trends

The Middle East & Africa industrial wax industry is supported by abundant petroleum resources, expanding refining capacity, and gradual growth in packaging and construction-related applications. Petroleum-based waxes dominate regional consumption due to cost advantages and feedstock availability, particularly in the Middle East. While the overall market size remains comparatively smaller, rising industrialization, infrastructure development, and consumer goods manufacturing in select African economies are creating long-term demand opportunities, especially for basic industrial wax applications.

Latin America Industrial Wax Market Trends

Latin America represented a moderate but steadily growing industrial wax industry, driven by packaging, candles, adhesives, and consumer goods manufacturing, particularly in Brazil and Mexico. The region benefits from local refining activity and growing domestic consumption, though demand remains sensitive to economic cycles and raw-material price fluctuations. Over the medium term, rising urbanization, expansion of food packaging, and increasing personal care consumption are expected to support incremental growth, with petroleum-based waxes continuing to account for the majority of regional demand.

Key Industrial Wax Company Insights

Key players, such as Sinopec Corp., China National Petroleum Corporation, HollyFrontier Corporation, Nippon Seiro Co., Ltd., Baker Hughes Company, and BP p.l.c., dominate the industrial wax market.

-

Sinopec Corp

-

Sinopec Corporation is a leading integrated energy and chemical company with a strong presence in the petroleum-based industrial wax market, supported by its large-scale refining and downstream infrastructure in China. The company benefits from secure feedstock access, cost-efficient production, and extensive distribution networks, enabling it to serve high-volume applications such as candles, packaging, and rubber processing. Leveraging China’s dominant manufacturing base, Sinopec plays a key role in supplying industrial waxes to both domestic and export markets, reinforcing its position as a major global supplier.

-

Key Industrial Wax Companies:

The following key companies have been profiled for this study on the industrial wax market.

- Sinopec Corp

- China National Petroleum Corporation

- HollyFrontier Corporation

- Nippon Seiro Co., Ltd

- Baker Hughes Company

- BP p.l.c.

- Exxon Mobil Corporation

- Sasol Limited

- The International Group, Inc.

- Evonik Industries AG

- BASF SE

- Dow

- Honeywell International Inc.

- Royal Dutch Shell P.L.C

- Mitsui Chemicals, Inc.

Recent Developments

-

In February 2025, Sasol Chemicals expanded its product offerings with the launch of SASOLWAX LC Spray 30 G and SASOLWAX LC Spray 30 G-EF, micronized waxes delivering approximately 32% lower product carbon footprint while maintaining performance for coatings, inks, and specialty applications.

-

In April 2024, ExxonMobil launched a new wax product brand, Prowaxx, to standardize and differentiate its wax portfolio, including fully refined, semi-refined, and slack wax grades, demonstrating strategic investment in wax innovation and expanded customer solutions.

Industrial Wax Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.64 billion

Revenue forecast in 2033

USD 10.69 billion

Growth rate

CAGR of 4.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Sinopec Corp; China National Petroleum Corporation; HollyFrontier Corporation; Nippon Seiro Co., Ltd; Baker Hughes Company; BP p.l.c.; Exxon Mobil Corporation; Sasol Limited; The International Group, Inc.; Evonik Industries AG; BASF SE; Dow; Honeywell International Inc.; Royal Dutch Shell P.L.C.; Mitsui Chemicals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Wax Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global industrial wax market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Petroleum-based Wax

-

Synthetic Wax

-

Bio-based Wax

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Candles

-

Packaging

-

Plastic and Rubber Processing

-

Pharmaceuticals

-

Cosmetics and Toiletries

-

Fire Logs

-

Adhesives

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global industrial wax market size was estimated at USD 7.33 billion in 2025 and is expected to reach USD 7.64 billion in 2026.

b. The industrial wax market is expected to grow at a compound annual growth rate of 4.9% from 2026 to 2033 to reach USD 10.69 billion by 2033.

b. The petroleum-based wax segment dominated the global industrial wax market with the largest revenue share of 55.4% in 2025 due to its cost efficiency, large-scale availability from integrated refining operations, and widespread suitability for high-volume applications such as candles, packaging, fire logs, and rubber processing. In addition, established supply chains, consistent product performance, and strong demand from price-sensitive end users, particularly in Asia Pacific and North America, reinforced the segment’s leading position.

b. Some of the key players operating in the industrial wax market include Sinopec Corp, China National Petroleum Corporation, HollyFrontier Corporation, Nippon Seiro Co., Ltd, Baker Hughes Company, BP p.l.c., Exxon Mobil Corporation, Sasol Limited, The International Group, Inc., Evonik Industries AG, BASF SE, Dow, Honeywell International Inc., Royal Dutch Shell P.L.C, and Mitsui Chemicals, Inc.

b. The global industrial wax market is driven by strong demand from candles, packaging, plastics & rubber processing, and adhesives, where waxes are essential for coating, lubrication, and moisture-barrier functions. In addition, growth in consumer goods manufacturing, expanding packaging applications, and rising use of specialty waxes in cosmetics and pharmaceuticals continue to support steady market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.