- Home

- »

- Micro Molding & Microspheres

- »

-

Injection Molding Machine Market Size, Industry Report, 2033GVR Report cover

![Injection Molding Machine Market Size, Share & Trends Report]()

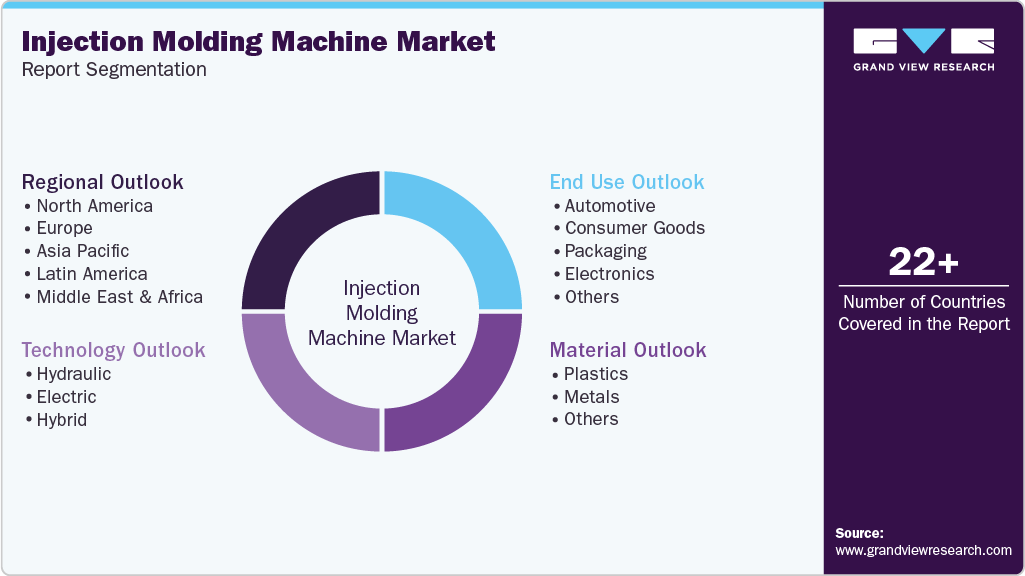

Injection Molding Machine Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Plastics, Metals), By Technology (Hydraulic, Hybrid), By End Use (Packaging, Electronics), By Region (North America, Europe, Asia Pacific, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-2-68038-652-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Injection Molding Machine Market Summary

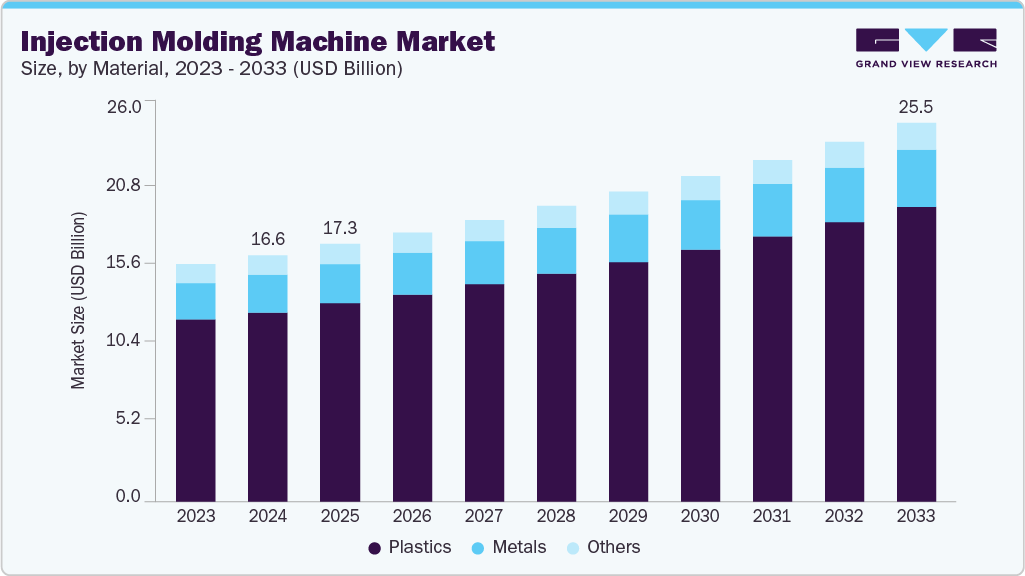

The global injection molding machine market size was estimated at USD 17,351.3 million in 2025 and is projected to reach USD 25,491.5 million by 2033, growing at a CAGR of 5.0% from 2026 to 2033. The growing demand for plastic products across the automotive, packaging, and consumer goods industries is a major market driver.

Key Market Trends & Insights

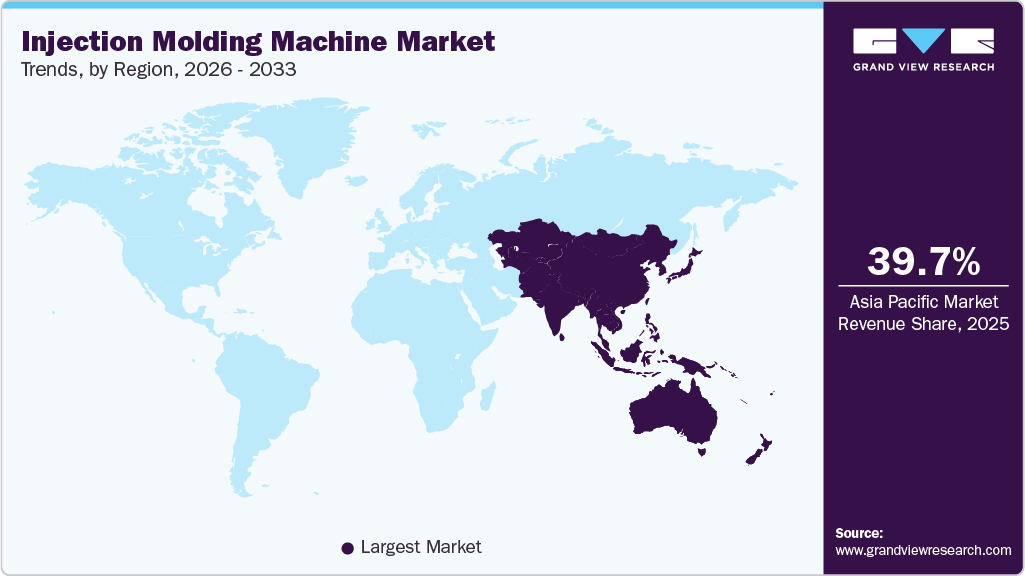

- Asia Pacific dominated the injection molding machine market with the largest revenue share of 39.7% in 2025.

- The injection molding machine market in India is expected to grow at a substantial CAGR of 6.5% from 2026 to 2033.

- By material, plastics is expected to grow at a considerable CAGR of 5.1% from 2026 to 2033 in terms of revenue.

- By end use, electronics is expected to grow at a considerable CAGR of 5.7% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 17,351.3 Million

- 2033 Projected Market Size: USD 25,491.5 Million

- CAGR (2026-2033): 5.0%

- Asia Pacific: Largest market in 2025

Rapid industrialization and urbanization have increased the need for mass production of precision plastic components. Technological advancements, such as electric and hybrid injection molding machines, improve efficiency and reduce energy consumption. Increasing adoption of lightweight materials in the automotive and electronics sectors is further fueling market expansion. Rising awareness about sustainable manufacturing practices encourages the use of energy-efficient and eco-friendly injection molding machines. The growth of e-commerce and packaging industries also contributes to higher demand for molded plastic products. Continuous innovation in machine design and automation ensures scalability and consistency, strengthening market traction globally.

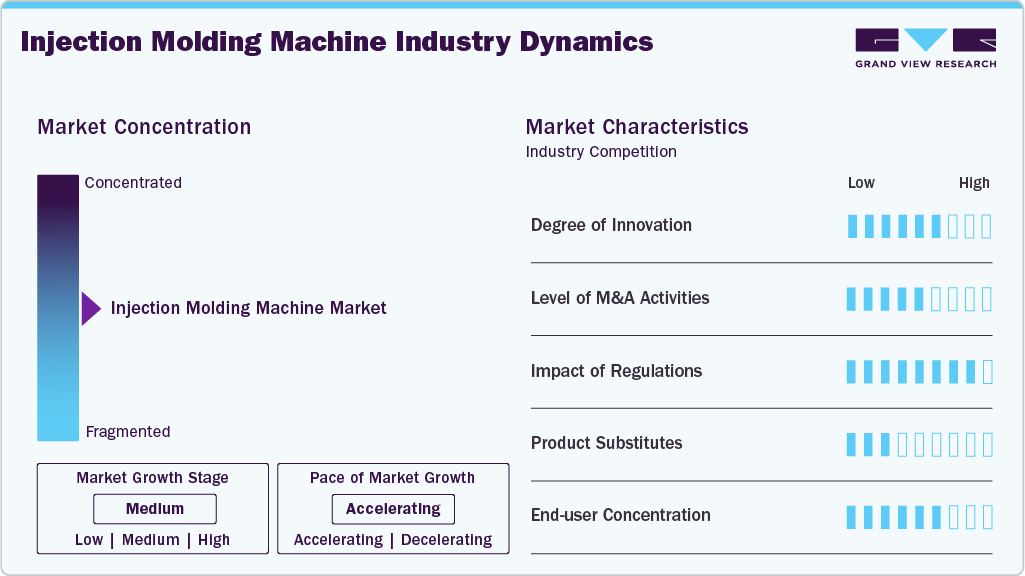

Market Concentration & Characteristics

The injection molding machine industry shows a moderately concentrated structure, led by a small group of global manufacturers with strong technology portfolios and wide distribution networks. These players dominate high-tonnage, fully electric, and automation-ready systems, giving them an edge in automotive and electronics applications. At the same time, the market remains partly fragmented at the regional level, where local and mid-sized suppliers compete aggressively on price and customization. This mix of global leaders and regional specialists keeps competition intense while allowing room for innovation and niche positioning.

The injection molding machine industry exhibits a moderate to high level of innovation, focusing on improving efficiency, precision, and energy savings. Manufacturers invest heavily in R&D to develop electric, hybrid, and automation-integrated machines. Innovations in materials, control systems, and production techniques enhance product quality and reduce cycle times. Continuous technological advancement helps companies maintain a competitive edge and meet evolving customer demands.

The market has witnessed a steady level of mergers and acquisitions, primarily aimed at expanding product portfolios and entering new regional markets. Large companies often acquire smaller players to strengthen technological capabilities and distribution reach. Strategic partnerships also enable collaboration on research and development initiatives. These M&A activities contribute to market consolidation and enhance overall competitiveness.

Regulatory standards related to environmental sustainability, energy efficiency, and workplace safety significantly influence the industry. Compliance with emission norms and energy consumption standards drives the adoption of eco-friendly and energy-efficient machines. Regulations also encourage companies to implement safe and sustainable manufacturing practices. Adhering to these rules affects production processes, costs, and overall market strategies.

Drivers, Opportunities & Restraints

Rising demand for plastic products in the automotive, packaging, and consumer goods sectors is a key driver for the injection molding machine industry. Technological advancements, such as electric and hybrid machines, increase production efficiency and reduce energy consumption. Growing focus on lightweight and durable materials further fuels market growth. Expansion of e-commerce and rapid industrialization also support higher adoption of injection molding solutions.

Emerging markets present significant growth opportunities due to rising manufacturing activities and infrastructure development. Increasing adoption of automation and IoT-enabled machines allows manufacturers to enhance precision and reduce operational costs. Sustainable and energy-efficient machinery adoption opens new avenues for environmentally conscious production. Collaborations and partnerships in R&D can lead to innovative solutions, creating a competitive advantage.

High initial investment costs of advanced injection molding machines limit adoption among small and medium-sized manufacturers. Fluctuating raw material prices can impact production costs and profitability. Technical complexities and the need for skilled operators may slow market expansion. Strict regulatory compliance and environmental standards can increase operational challenges and expenditure for manufacturers.

Material Insights

The metals segment is expected to grow at a significant CAGR of 4.7% from 2026 to 2033 in terms of revenue.Plastics dominated the market and accounted for a 77.0% share in 2025, due to their versatility, lightweight nature, and cost-effectiveness. High demand from automotive, packaging, and consumer goods sectors reinforces the preference for plastic materials. Advanced molding technologies allow the precise and high-volume production of plastic components efficiently. This widespread applicability ensures plastics remain the primary material in the industry.

The use of metals in injection molding is growing significantly, driven by industries requiring high-strength and durable components. Metal injection molding enables complex designs with superior mechanical properties for aerospace, automotive, and medical applications. Rising demand for metal parts in industrial machinery and electronics fuels this growth. Continuous innovation in metal molding processes further expands market potential.

Technology Insights

The electric segment is expected to grow at a considerable CAGR of 5.7% from 2026 to 2033 in terms of revenue. Hydraulic injection molding machines dominated the market and accounted for a 50.9% share in 2025, due to their robustness, high clamping force, and ability to handle large-scale production. They are widely used in automotive, packaging, and industrial applications for molding heavy and complex parts. Proven reliability and versatility make hydraulic systems a preferred choice among manufacturers. Continuous improvements in efficiency and control systems sustain their market leadership.

Electric injection molding machines are the fastest-growing technology segment, driven by energy efficiency and precise control over the molding process. They offer faster cycle times, lower maintenance costs, and reduced environmental impact compared to hydraulic systems. Increasing adoption in electronics, medical, and precision engineering industries fuels growth. Innovations in hybrid systems also support the rising demand for electric technology.

End Use Insights

The electronics segment is expected to grow at the fastest CAGR of 5.7% from 2026 to 2033 in terms of revenue.The automotive sector dominated the market and accounted for a 28.9% share in 2025, due to the high demand for lightweight, durable, and complex plastic components. Components like dashboards, bumpers, and interior fittings are increasingly manufactured using advanced injection molding technologies. Strict fuel efficiency and emission standards drive the adoption of lightweight materials. This sustained demand makes automotive the largest end-use segment.

The electronics sector is the fastest-growing end use segment, fueled by the rising production of smartphones, laptops, and household appliances. Precision, miniaturization, and high-quality finishes are critical, making injection molding an ideal manufacturing solution. Rapid technological advancements and increased consumer electronics consumption drive market growth. Emerging applications in IoT and wearable devices further accelerate demand.

Regional Insights

North America is growing significantly at a CAGR of 4.4%, driven by increasing demand for lightweight and high-precision components. The automotive and electronics industries are key drivers of market expansion. Adoption of energy-efficient and automated machines enhances manufacturing productivity. Strategic investments and modernization of production facilities support regional growth.

U.S. Injection Molding Machine Market Trends

The injection molding machine market in the U.S. dominated North America due to its advanced manufacturing base and well-established automotive and electronics industries. High demand for precision components and lightweight materials fueled steady market growth across end-use sectors. Manufacturers increasingly adopted automation and energy-efficient machines to improve productivity and reduce operating costs. Ongoing investment in R&D and technological innovation further strengthened the U.S. market position.

Mexico injection molding machine market is witnessing major market growth, driven by its expanding automotive, electronics, and packaging industries. Increasing foreign investments and industrial modernization support the adoption of advanced molding technologies. Proximity to the U.S. market enables easier access to high-demand sectors. Rising manufacturing activities and government incentives further boost regional market expansion.

Europe Injection Molding Machine Market Trends

The injection molding machine market in Europe is driven by advanced manufacturing technologies and the focus on sustainable production practices. Countries like Germany, Italy, and France lead in innovation and precision molding applications. The automotive, medical, and aerospace sectors contribute significantly to demand. Regulatory emphasis on energy efficiency and emissions encourages the adoption of modern injection molding machines.

Germany injection molding machine market dominates in Europe due to its strong industrial foundation and highly developed automotive and machinery sectors. Demand for precision-engineered components drove widespread adoption of advanced injection molding technologies across manufacturing facilities. Continuous investment in R&D, automation, and smart production systems improved operational efficiency and output quality.

The injection molding machine market in Denmark is experiencing growth, fueled by increasing demand from the automotive, medical, and packaging industries. Adoption of energy-efficient and automated machines supports production optimization. Investments in sustainable manufacturing practices further drive market expansion. Emerging industrial projects and technological innovation contribute to Denmark’s growing presence in the market.

Asia Pacific Injection Molding Machine Market Trends

The injection molding machine market in the Asia Pacific accounted for 39.7% share, due to its extensive manufacturing base and high demand from automotive, packaging, and consumer goods sectors. China, Japan, and India are key contributors, driven by industrial growth and technological adoption. Cost-effective labor and raw materials make the region attractive for large-scale production. Strong government initiatives supporting manufacturing and export further boost market dominance.

China injection molding machine market dominates in the Asia Pacific due to its large manufacturing base and high demand from automotive, packaging, and consumer goods sectors. Availability of cost-effective labor and raw materials supports mass production. Rapid industrialization and infrastructure development drive the adoption of advanced molding technologies. Strong government initiatives promoting manufacturing further reinforce China’s market leadership.

The injection molding machine market in India is witnessing significant growth, driven by expanding automotive, electronics, and packaging industries. Increasing adoption of energy-efficient and automated machines enhances production capabilities. Foreign investments and industrial modernization support market expansion. Rising demand for lightweight and precision components accelerates India’s growth in the regional market.

Middle East & Africa Injection Molding Machine Market Trends

The injection molding machine market in the Middle East and Africa shows growth potential due to rising industrialization and infrastructure development. Demand for automotive components, packaging solutions, and consumer goods drives market adoption. Countries like the UAE, Saudi Arabia, and South Africa are investing in modern manufacturing facilities. Increasing focus on technology integration and industrial diversification supports market expansion.

Saudi Arabia injection molding machine market dominates in the Middle East & Africa due to its strong industrial base and growing automotive and packaging sectors. Government initiatives promoting industrial diversification and manufacturing modernization drive the adoption of advanced molding technologies. High demand for durable and precision components supports market growth. Investments in infrastructure and technological innovation further strengthen Saudi Arabia’s leading position in the region.

Latin America Injection Molding Machine Market Trends

The injection molding machine market in Latin America is witnessing growing adoption of injection molding machines due to the expanding automotive and packaging industries. Brazil and Mexico are leading markets, supported by rising manufacturing activities. Increasing foreign investments and the modernization of industrial infrastructure drive demand. Focus on cost-effective production and regional industrialization further fuels market growth.

Brazil injection molding machine market dominates in Latin America due to its well-established automotive, packaging, and consumer goods industries. High demand for precision and lightweight plastic components drives the adoption of advanced molding technologies. Investments in modern manufacturing facilities and automation enhance production efficiency. Government support for industrial growth and infrastructure development further strengthens Brazil’s market leadership.

Key Injection Molding Machine Company Insights

Some of the key players operating in the market include Arburg GmbH + Co KG, Haitian International Holdings Limited, and Milacron.

-

Arburg GmbH + Co KG, headquartered in Lossburg, Germany, is renowned for its high-quality injection molding machines. The company offers a comprehensive range of machines, including hydraulic, hybrid, and electric models, catering to various industries such as automotive, medical technology, and packaging. Arburg emphasizes sustainability and innovation, integrating digitalization and automation into its production processes. The company operates globally, with a strong presence in over 100 countries, providing tailored solutions to meet diverse customer needs. Arburg's commitment to quality and customer satisfaction has solidified its position as a leader in the injection molding industry.

-

Haitian International Holdings Limited, headquartered in Ningbo, China, is a leading manufacturer of plastic injection molding machines under the Haitian and Zhafir brands. The company produces hydraulic, electric, and hybrid machines designed for efficiency and cost-effectiveness. Haitian invests heavily in technology and R&D to deliver advanced solutions across industries like automotive, electronics, and packaging. Its global network ensures widespread service and support, enhancing customer reach. Continuous innovation and a strong production capability keep Haitian at the forefront of the injection molding industry.

Key Injection Molding Machine Companies:

The following are the leading companies in the injection molding machine market. These companies collectively hold the largest market share and dictate industry trends.

- Arburg GmbH + Co KG

- Haitian International Holdings Limited

- Milacron

- Nissei Plastic Industrial Co., Limited.

- Engel Austria GmbH

- Sumitomo (SHI) Demag Plastics Machinery GmbH

- Chen Hsong Holdings Limited

- Toyo Machinery & Metal Co., Ltd

- Husky Injection Molding Systems Ltd

- Japan Steel Works Limited

- KraussMaffei Group

- UBE Machinery

- Shibaura Machine Co. Ltd.

- Wittmann Battenfeld

Recent Developments

-

In January 2025, at Plastimagen 2025 in Mexico City, ARBURG displayed its latest injection molding machines, including the electric Allrounder 720 E Golden Electric and the hybrid Allrounder 470 H. The 720 E Golden Electric, featuring a 2,800 kN clamping force and compact design, demonstrated efficient production for the mobility sector. The 470 H showcased hybrid technology by producing a drinking cup, highlighting versatility and performance. ARBURG also introduced digital solutions like the ALS host system, arburgXworld portal, and ARS Remote Service, emphasizing innovation and sustainability in plastics manufacturing.

-

In October 2024, at Fakuma 2024, Milacron unveiled the eQ180-MSW, an all-electric injection molding machine featuring innovative monosandwich technology. This design allows multi-layer parts to be produced using up to 60% post-consumer recyclable (PCR) materials in the core. With a 180-ton clamping force and optimized screw dimensions, the machine achieves efficient cycle times while supporting sustainable manufacturing practices.

-

In February 2024, Haitian introduced its fifth-generation injection molding machines, featuring advanced AI and sensor technologies for smarter process control. The machines include functions like HT Inject for weight control, HT Energy for efficient energy use, HT Clamp for precise mould operation, and HT Lubricate for automated maintenance. With flexible integration options, they can easily connect to peripherals and automation systems, enhancing productivity and efficiency.

Injection Molding Machine Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 18,146.3 million

Revenue forecast in 2033

USD 25,491.5 million

Growth rate

CAGR of 5.0% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Denmark; Germany; Austria; France; Spain; Italy; China; Japan; India; Taiwan; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Arburg GmbH + Co KG; Haitian International Holdings Limited; Milacron; Nissei Plastic Industrial Co., Limited.; Engel Austria GmbH; Sumitomo (SHI) Demag Plastics Machinery GmbH; Chen Hsong Holdings Limited; Toyo Machinery & Metal Co., Ltd.; Husky Injection Molding Systems Ltd; Japan Steel Works Limited; KraussMaffei Group; UBE Machinery; Shibaura Machine Co. Ltd.; Wittmann Battenfeld

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Injection Molding Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global injection molding machine market report based on material, technology, end use, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Metals

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Hydraulic

-

Electric

-

Hybrid

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Consumer Goods

-

Packaging

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Austria

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global injection molding machine market size was estimated at USD 16,606.3 million in 2024 and is expected to be USD 17,351.3 million in 2025.

b. The global injection molding machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2033 to reach USD 25,491.5 million by 2033.

b. Plastics accounted for 76.9% of the injection molding machine market in 2024, driven by their versatility, lightweight properties, and cost-effectiveness. Strong demand from automotive, packaging, and consumer goods industries continues to reinforce their dominance. Advancements in molding technologies have further improved precision, efficiency, and scalability, supporting high-volume production.

b. Some of the key players operating in the global injection molding machine market include Arburg GmbH + Co KG; Haitian International Holdings Limited; Milacron; Nissei Plastic Industrial Co., Limited.; Engel Austria GmbH; Sumitomo (SHI) Demag Plastics Machinery GmbH; Chen Hsong Holdings Limited; Toyo Machinery & Metal Co., Ltd.; Husky Injection Molding Systems Ltd; Japan Steel Works Limited; KraussMaffei Group; UBE Machinery; Shibaura Machine Co. Ltd.; Wittmann Battenfeld.

b. The key factors that are driving the injection molding machine market include growing demand in the automotive industry, technological advancement in injection molding, and high demand from the packaging industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.