- Home

- »

- Advanced Interior Materials

- »

-

Plastic Injection Molding Machine Market Size Report, 2030GVR Report cover

![Plastic Injection Molding Machine Market Size, Share & Trends Report]()

Plastic Injection Molding Machine Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Hydraulic, Electric, Hybrid), By End-use (Automotive, Electronics, Packaging, Electronics, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-104-3

- Number of Report Pages: 169

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

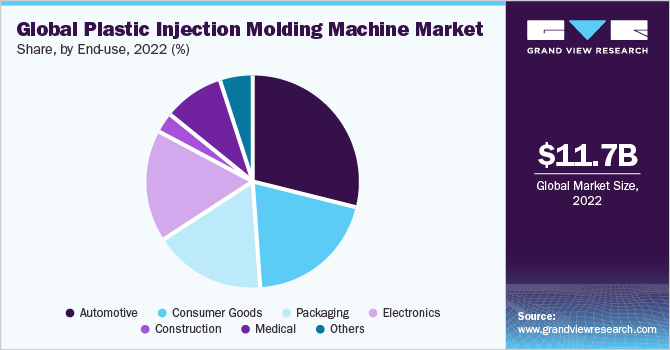

The global plastic injection molding machine market size was estimated at USD 11.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. The adoption of injection molded components is anticipated to increase across a variety of industries, including automotive, electronics, consumer products, packaging, and others. Manufacturers are focusing on the development of plastic injection molding machines, which can bring down production costs, provide flexibility in production, reduce scrap, reduce maintenance, shorten production cycle time, and are efficient. New plastic injection molding processes such as foam injection molding, co-injection molding, gas-assisted injection molding, and multiple component injection molding are creating high demand for injection-molded materials. This technological advancement has propelled the use of plastic injection molding machines in various industries such as medical, electronics, construction, aerospace, and defense.

Electric plastic injection molding machines are highly efficient and require less start-up time and run-time compared to that of hydraulic injection molding machines. Electric plastic injection molding machines use 50% to 75% less energy on average than their hydraulic equivalents because they are tighter, faster, and cleaner, and have a repeatable process production equipment with little waste. Moreover, factors such as quiet operation, energy savings from 30% to 70%, less wastage of material, and low requirements of power are expected to boost the demand for electric injection molding machines.

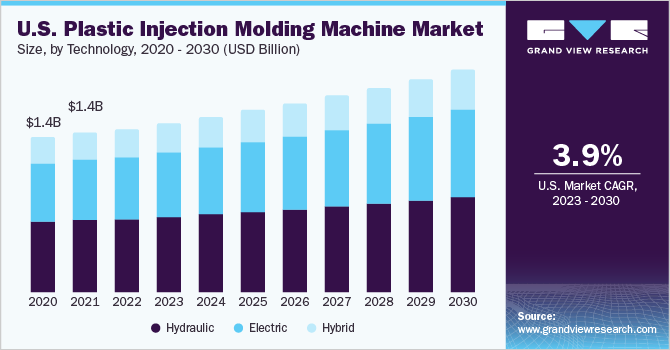

Factors such as easy access to new and advanced technologies in the EV industry, availability of a highly skilled workforce, presence of advanced processing capabilities, and increased R&D initiatives have boosted the penetration of electric vehicles in the U.S. The favorable government regulations and initiatives in the form of tax rebates and subsidies have further fueled the demand for electric vehicles in the U.S. Increasing demand for plastic injection molded components in conventional and electric vehicles for various interior and exterior parts are expected to augment the plastic injection molding market growth in the U.S.

Growing demand for on-the-go packaged products owing to increasing purchasing power and busy lifestyle in the U.S. is expected to have a positive impact on the packaging industry growth in the country. A plastic injection molding machine is used for manufacturing various packaging products such as containers, bottles, caps & closures, and covers. Growth in the packaging industry coupled with the rising adoption of plastic injection molding machines for manufacturing packaging products is expected to drive market growth in the country.

Technology Insights

The hydraulic technology segment dominated the market in 2022 with the largest share of 52.5% in terms of revenue. The segment is expected to grow because of factors such as the ability to produce large quantities of parts, intricate parts for the automotive industry, lower initial costs, production of precise molds, higher wear and tear resistance of hydraulic parts, and widespread use in the automotive, marine, and aerospace industries where heavy force is required.

Electric plastic injection molding machine is anticipated to grow at the fastest CAGR of 5.5% from 2023 to 2030. These machines are highly efficient and require less start-up time and run-time compared to their hydraulic equivalents. Electric plastic injection molding machines use 50% to 75% less energy on average than their hydraulic equivalents because they are tighter, faster, cleaner, and repeatable process production equipment with little waste.

Electric plastic injection molding machines are run by digitally controlled servo motors with high speeds, aiding precise, faster, energy-efficient, and repeatable operations. The plastic injection molding process is predictable and can be replicated consistently, thereby providing high-quality components. Furthermore, with increased automated machines, the requirement for labor has been reduced, which in turn, is lowering labor costs and increasing profit margins.

A hybrid plastic injection molding machine combines the best of both hydraulic and electric injection molding machines. A hybrid injection molding machine offers high clamping force of the hydraulic machines and high precision, energy efficiency, reduced noise, and repeatability of the electric injection molding machines, leading to better performance for both thick- and thin-walled parts.

End-use Insights

The automotive end-use segment dominated the plastic injection molding market in 2022 with the largest revenue share of 29.2% owing to factors such as material compatibility, high precision, repeatability, and surface finish. Furthermore, increasing demand for lightweight automotive components and rising automotive production are expected to propel market growth.

In the automotive industry, plastic injection molding machines are used to manufacture the most complex-shaped critical parts. A plastic injection molding machine is used to produce a variety of automotive parts such as bumpers, electrical housings, exterior body panels, and dashboards. Injection molding machines are used in the automotive industry for manufacturing exterior parts such as door panels, car door trim, bumpers, trunk trims rear & front covering, floor rails, sensor holders, grilles, wheel arches, and fenders/mudguards. These aforementioned factors are anticipated to propel market growth throughout the forecast period.

The medical segment is anticipated to grow at the fastest CAGR of 5.9% over the forecast period. Plastic injection molding machines are used in the medical industry for manufacturing small and complex items such as dental implants, prosthetic replacements, endoscopic tools, tweezers, scissors, implantable components, orthopedics, and drug delivery equipment. The increasing demand for medical disposables, technological developments, and rising plastic consumption in healthcare applications are driving the industry growth for the plastic injection molding machine industry.

Plastic injection molding machine is used to manufacture consumer goods such as personal hygiene products, houseware, travel accessories, furniture, toys, cosmetics, and convenience goods. In the past few years, most traditional materials such as glass, wood, and metal are being replaced by high-quality plastics, thereby augmenting the demand for plastic injection molding machines.

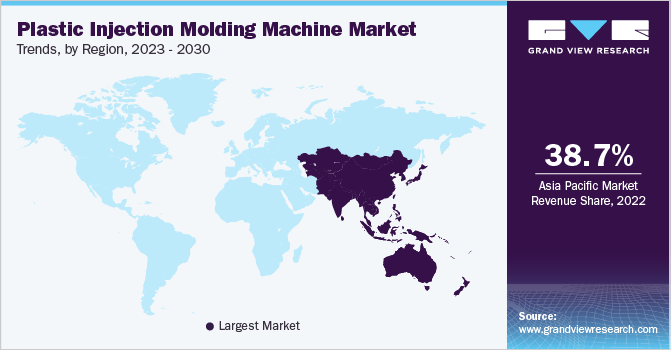

Regional Insights

The Asia Pacific region dominated the market in 2022 with the largest share of 38.7% in terms of revenue owing to the massive investments by the governments of different countries in the region for the development of public infrastructure and expansion of residential construction. Furthermore, there is rising awareness regarding energy saving globally, which is expected to further augment the market demand.

Growing demand for on-the-go packaged products owing to increasing purchasing power and busy lifestyle in the North America region is expected to have a positive impact on the packaging industry growth in the region. A plastic injection molding machine is used for manufacturing various packaging products such as containers, bottles, caps & closures, and covers. Growth in the packaging industry coupled with the rising adoption of plastic injection molding machines in this region for manufacturing packaging products is expected to drive market growth.

Europe held the second-largest revenue share in the market in 2022. The flourishing electronics sector, primarily due to the growing adoption of flexible electronics in Europe, has led to a new application scope in the region. The plastic injection molding machine is used to manufacture electronic components such as sensors, meters, testing equipment, electronic connectors, and processing equipment. The flourishing electronics industry in the region is anticipated to contribute to the growth of the market in Europe over the forecast period.

During the projected period, Central and South America are expected to grow at a CAGR of 5.1%. Demand for plastic injection molding machines is anticipated to witness substantial growth owing to the increasing demand for manufacturing facilities in the emerging economies of the region. This is projected to have a positive impact on industrial construction, thereby boosting the industry demand over the forecast period.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including geographical expansions, product launches, and mergers & acquisitions to enhance market penetration and cater to the changing technological requirements from various applications such as automotive, consumer goods, packaging, and others.

In April 2023, Haitian International expanded its logistics & production network in Europe and invested in producing a plant with an overall area of 250,000 m2 at its site in Serbia, which is scheduled to operate in the first quarter of 2025. Some prominent players in the global plastic injection molding machine market include:

-

Arburg GmbH + Co KG

-

HAITIAN INTERNATIONAL

-

KraussMaffei

-

Milacron

-

NISSEI PLASTIC INDUSTRIAL CO., LTD.

-

ENGEL AUSTRIA GmbH

-

Chen Hsong Holdings Limited

-

UBE Machinery Inc.

-

Husky Technologies

-

WITTMANN Technology GmbH

Plastic Injection Molding Machine Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.3 billion

Revenue forecast in 2030

USD 17.1 billion

Growth Rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Arburg GmbH + Co KG; HAITIAN INTERNATIONAL; KraussMaffei; Milacron; NISSEI PLASTIC INDUSTRIAL CO, LTD.; ENGEL AUSTRIA GmbH; Hsong Holdings Limited; UBE Machinery Inc.; Husky Technologies; WITTMANN Technology GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

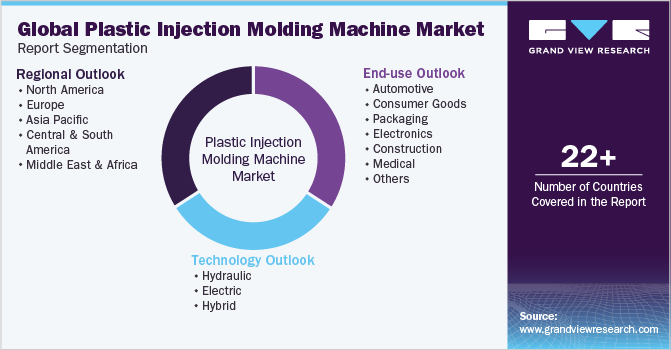

Global Plastic Injection Molding Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic injection molding machine market report based on technology, end-use, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hydraulic

-

Electric

-

Hybrid

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Consumer Goods

-

Packaging

-

Electronics

-

Construction

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic injection molding machine market size was estimated at USD 11.7 billion in 2022 and is expected to be USD 12.3 billion in 2023.

b. The plastic injection molding machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 17.1 billion by 2030.

b. Asia Pacific region dominated the market in 2022 by accounting for a share of 38.7% of the market owing to the massive investments by the governments of different countries in the region for the development of public infrastructure and the expansion of residential construction. Furthermore, there is rising awareness regarding energy saving throughout the world which is expected to further augment the market demand.

b. Some of the key players operating in the plastic injection molding machine market include Arburg GmbH + Co KG, HAITIAN INTERNATIONAL, KraussMaffei, Milacron, NISSEI PLASTIC INDUSTRIAL CO., LTD., ENGEL AUSTRIA GmbH, Hsong Holdings Limited, UBE Machinery Inc., Husky Technologies, WITTMANN Technology GmbH.

b. The adoption of injection molded components is anticipated to increase across a variety of industries, including automotive, electronics, consumer products, packaging, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.