- Home

- »

- Clothing, Footwear & Accessories

- »

-

Innerwear Market Size, Share, Trends & Growth Report 2030GVR Report cover

![Innerwear Market Size, Share & Trends Report]()

Innerwear Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Bottom Innerwear, Top Innerwear), By Material (Cotton, Polyester), By Distribution Channel (Offline, Online), By End-user (Men, Women), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-102-3

- Number of Report Pages: 133

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Innerwear Market Summary

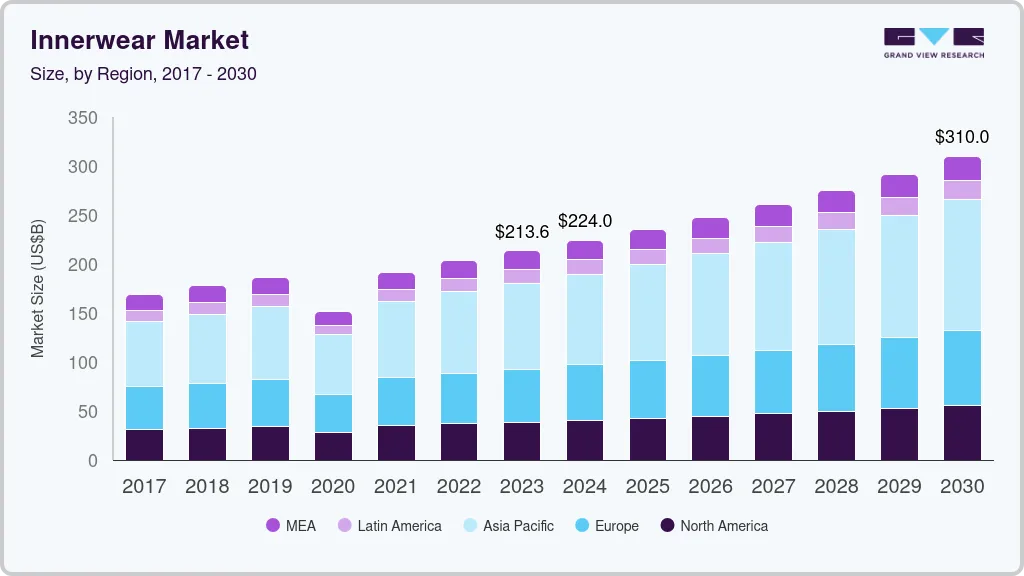

The global innerwear market size was estimated at USD 213.62 billion in 2023 and is projected to reach USD 310.02 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. There has been a significant shift in societal attitudes toward body positivity and self-acceptance. This has resulted in increased awareness and acceptance of diverse body types and sizes.

Key Market Trends & Insights

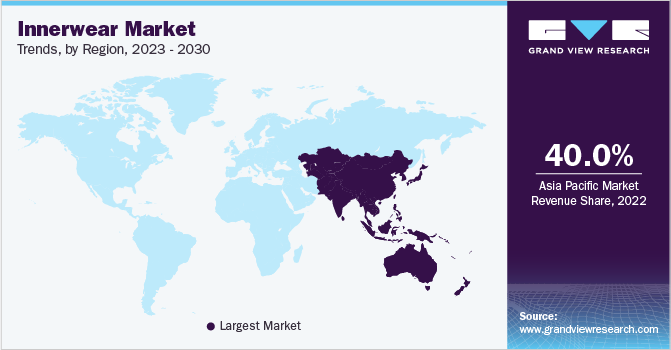

- Asia Pacific made the largest contribution to the global market and accounted for a revenue share of over 40% in 2022.

- By product, the bottom innerwear segment held the largest revenue share of 50.07% in 2022.

- By material, the cotton segment held the largest revenue share of above 50.0% in 2022.

- By end user, the women segment held the largest revenue share of above 60% in 2022.

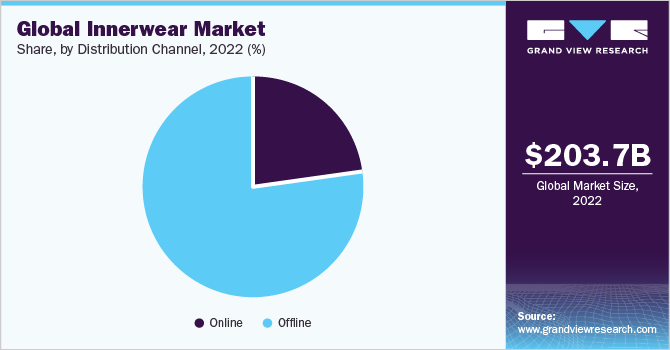

- By distribution channel, the offline segment accounted for the largest revenue share of 76.60% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 213.62 Billion

- 2030 Projected Market Size: USD 310.02 Billion

- CAGR (2024-2030): 5.5%

- Asia Pacific: Largest market in 2022

Consumers now seek innerwear that embraces their individuality, supports their body shape, and promotes self-confidence. Body positivity has compelled brands to expand their size ranges and offer a more inclusive range of products. Previously, the market predominantly focused on standard sizes; however, there is a growing demand for extended sizes, catering to various body shapes. This inclusivity has expanded the customer base and fostered a sense of empowerment and acceptance among consumers.

Body positivity has urged innerwear brands to feature a diverse range of models in their advertising campaigns. This shift from traditional beauty standards and embracing diverse body shapes, sizes, ages, and ethnicities has resonated with consumers. Seeing realistic representations of people in innerwear ads helps individuals feel more confident and comfortable with their bodies, driving them to explore and invest in products that complement their unique attributes. In recent years, the movement toward body inclusivity has had a significant impact on the global market. This trend has emerged as a response to the longstanding lack of representation and limited size ranges offered by traditional brands. Consumers are now demanding more inclusive options that cater to a diverse range of body types.

Brands have started recognizing the importance of offering body-inclusive sizing in their innerwear lines. They are expanding their size ranges to accommodate a wider variety of sizes and proportions. Inclusive sizing goes beyond simply extending the range of available sizes. It involves understanding the unique needs of different body types and creating designs that flatter and support them. Brands are investing in research and development to create innovative solutions, such as adjustable waistbands, stretchable fabrics, and thoughtful construction techniques. E-commerce retail channels play a vital role in product distribution, contributing significantly to the overall revenue generated by the market. A substantial portion of the market's revenue is derived from online sales channels.

These digital platforms provide consumers the convenience of browsing through a vast selection of underclothing products without the need to visit physical retail stores. By offering millions of products in one centralized location, online sales channels simplify the shopping experience for consumers. The rapid expansion of e-commerce and rising digitalization are driving innerwear online sales. Furthermore, online product sale is fueled by convenient payment methods and consumers' busy lifestyles. Moreover, the COVID-19 pandemic significantly accelerated the growth and adoption of online shopping, reshaping consumer behavior and expectations. It pushed retailers to prioritize their digital presence, adapt to changing consumer needs, and invest in technologies that enhance the online shopping experience.

The popularity of fashionable undergarments has risen in recent years owing to the growing influence of celebrities and social media. The availability of a larger platform to showcase innerwear brands presents lucrative opportunities for market players. It allows them to reach a wider audience and capitalize on the potential for increased visibility and brand exposure. Influenced by social media, fashion blogs, magazines, film, and television, consumers today are demanding underclothing with scope for innovation and experimentation in terms of design, fabric, and fit. The global market is characterized by fierce competition between major competitors, who have great brand recognition, significant geographic presence, and extensive distribution networks. To expand their product offerings and acquire a competitive edge, market players are shifting their focus on product innovation to meet trending consumer preferences.

Product Insights

The bottom innerwear segment held the largest revenue share of 50.07% in 2022 and is expected to maintain dominance over the forecast period.Bottom innerwear includes underwear, shapewear, and other types of intimate apparel. Different types of bottom undergarments have gained significant popularity and attention among users in recent years. The focus on comfort, functionality, and personal style has led to an increased interest in different types of bottom innerwear. Brands have also expanded their offerings to cater to a broader range of body types, providing more inclusive options and styles. The increasing availability of a wide range of products and designs suitable for various purposes, including sports, regular wear, and functional wear, is anticipated to further fuel the product demand.

The thermals and base layers segment is projected to register the fastest CAGR of 7.0% from 2023 to 2030. Thermals and base layers are specialized types of underclothing designed to provide insulation and regulate body temperature in cold weather or during outdoor activities. Thermals are typically made from thermal fabrics such as Merino wool, synthetic blends, or cotton blends, whereas base layers are generally made from technical fabrics like polyester, nylon, or Merino wool. Both thermals and base layers play an essential role in providing comfort and regulating body temperature in cold weather or during outdoor activities. They provide insulation, moisture management, and breathability to ensure optimal performance and comfort.

Material Insights

The cotton segment held the largest revenue share of above 50.0% in 2022 and is expected to maintain dominance over the forecast period. Cotton is a popular material for undergarments due to its natural breathability, softness, and moisture-wicking properties. It is hypoallergenic and less likely to cause skin irritation or allergies compared to synthetic fabrics. This quality makes cotton innerwear suitable for people with sensitive skin. It also has excellent moisture absorption properties, which help wick away sweat and keep the body dry. This feature is particularly beneficial for sportswear or in hot and humid climates.

The polyester segment is projected to register the fastest CAGR of 6.5% from 2023 to 2030. Polyester is a synthetic fabric and is widely used to manufacture men’s underwear since it is soft and comfortable. It is also resistant to wrinkles, mildew, and abrasion. Polyester products are strong, do not shrink or stretch, and retain their original shape and size. Owing to the abovementioned factors, products made from polyester have high durability compared to other fabrics.

End-user Insights

The women segment held the largest revenue share of above 60% in 2022 and is expected to maintain dominance over the forecast period. It is also anticipated to register the fastest CAGR of 5.8% during the forecast period.Women are increasingly prioritizing comfort in their choice of innerwear. Brands have responded by offering a wide range of options that focus on soft, breathable fabrics, seamless construction, and designs catering to different body types.

Comfort-driven features, such as adjustable straps, wireless bras, and tagless designs, are gaining popularity. The body positivity movement has played a significant role in changing the perception of women's bodies and influencing the demand for inclusive and diverse undergarments options. Brands are increasingly offering a wider range of sizes, including plus sizes, and embracing a more inclusive approach to design and marketing. This allows women of all body shapes and sizes to find innerwear that makes them feel confident and comfortable.

Distribution Channel Insights

The offline segment accounted for the largest revenue share of 76.60% in 2022.Bras, bralettes, briefs, vests, and other intimate products are predominantly found in stores that specialize in innerwear products, as these stores offer a wide range of options to cater to various preferences and sizes. These stores often have fitting rooms where customers can try on different styles and sizes, ensuring a proper fit and comfort. Store-based retailers like specialty clothing stores, multi-brand stores, and supermarkets also stock multiple brands and styles to provide customers with choices. Wholesalers and distributors play a significant role in the offline distribution of underclothing products. They work directly with manufacturers to purchase bulk quantities of innerwear products and then distribute them to various retail stores.

The online segment is anticipated to grow at the fastest CAGR of 7.5% from 2023 to 2030. Online shopping allows customers to browse and purchase innerwear products from the comfort of their homes, eliminating the need to visit physical stores. This convenience is especially appealing when buying innerwear items like underwear, lingerie, and sleepwear, as it provides privacy and a more comfortable experience. Also, online retailers frequently offer discounts, promotions, and exclusive deals, allowing customers to find products at more affordable prices compared to traditional brick-and-mortar stores.

Regional Insights

Asia Pacific made the largest contribution to the global market and accounted for a revenue share of over 40% in 2022. The regional market is experiencing significant growth and holds promising opportunities. The region is estimated to grow at a CAGR of 6.1% during the forecast period. The region encompasses diverse countries with varying cultural norms, preferences, and purchasing power, making it a vibrant and dynamic market for innerwear. One of the key drivers of the market growth in Asia Pacific is the rising disposable income and growing middle-income groups in countries, such as China, India, and Southeast Asian nations. As incomes increase, consumers are allocating a larger portion of their budget to personal care and fashion, including undergarments. This trend is fueling the demand for a wide range of innerwear products, from basic everyday essentials to luxurious and premium designs.

Europe made the second-largest contribution to the global market and accounted for a revenue share of 25.4% in 2022. Europe has a strong fashion culture and is known for its emphasis on style and trends. The region's consumers are fashion-conscious and value high-quality and aesthetically appealing innerwear. The influence of European fashion designers and brands has driven market growth. European societies have witnessed a shift in cultural norms and attitudes towards underclothing. There is greater acceptance and openness regarding self-expression, body positivity, and embracing diverse beauty standards. This change in mindset has led to an increased demand for a wider range of underclothing styles and sizes to cater to different body types and personal preferences.

Key Companies & Market Share Insights

The market comprises companies with a strong hold in the global industry.Well-timed and properly-executed product launches can generate buzz and excitement among customers. By introducing innovative products, companies can differentiate themselves in the market and gain a competitive edge. Some of the initiatives undertaken by companies are:

-

In June 2023, Victoria’s Secret and Amazon Fashion collaborated to improve the shopping experience for customers. The collaboration will include over 4,000 fashion items from Victoria's Secret and PINK, including panties, bras, swimwear, loungewear, and sleepwear. Particular bra and apparel styles will also be available on Amazon Prime’s Try Before You Buy program

-

In February 2023, HanesBrands Inc. launched the Hanes Originals collection, which encompasses a range of innerwear for women, men, girls, and boys, including bras, underwear, T-shirts, and tanks. The collection is a fusion of vibrant patterns and colors and innovative fabrics. It includes men's boxer briefs and trunks in youthful prints, modern fits, and lower rise, as well as women’s bra-tops, bralettes, boyshorts, bikinis, and thongs in seasonal prints and a soft cotton blend

-

In November 2022, Jockey International Inc. announced the launch of its 10th exclusive brand store in the UAE. The launch earmarked a significant milestone in the network of exclusive Jockey stores since its first store launch in 2014

-

In August 2022, Calvin Klein revealed the ‘Autumn 2022’ campaign featuring a diverse group of culture shapers. The campaign showcased new underwear and loungewear styles, including the Embossed Icon collection, the Modern Cotton silhouettes collection, and the Modern Cotton Naturals collection

Some of the prominent players in the global innerwear market include:

-

Hanesbrands Inc.

-

Berkshire Hathaway Inc. (Fruit of the Loom)

-

PVH Corp.

-

Jockey International Inc.

-

icebreaker

-

Minus33 Merino Wool Clothing

-

American Eagle Outfitters, Inc.

-

Ralph Lauren Corporation

-

Wacoal Holdings Corporation

-

Spanx, LLC

-

Victoria's Secret

-

Calvin Klein

-

Marks and Spencer plc

Innerwear Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 310.02 Billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million units, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Hanesbrands Inc.; Berkshire Hathaway Inc. (Fruit of the Loom); PVH Corp.; Jockey International Inc.; icebreaker; Minus33 Merino Wool Clothing; American Eagle Outfitters, Inc.; Ralph Lauren Corporation; Wacoal Holdings Corporation; Spanx, LLC; Victoria's Secret; Calvin Klein; Marks and Spencer plc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Innerwear Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global innerwear market report based on product, material, end-user, distribution channel, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Billion, 2017 - 2030)

-

Top Innerwear

-

Bottom Innerwear

-

Thermals and Base Layers

-

-

Material Outlook (Volume, Million Units; Revenue, USD Billion, 2017 - 2030)

-

Cotton

-

Wool

-

Polyester

-

Nylon

-

Others

-

-

End-user Outlook (Volume, Million Units; Revenue, USD Billion, 2017 - 2030)

-

Men

-

Women

-

Kids

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global innerwear market size was estimated at USD 203.72 billion in 2022 and is expected to reach USD 213.62 billion in 2023.

b. The global innerwear market is expected to grow at a compounded growth rate of 5.4% from 2023 to 2030 to reach USD 310.02 billion by 2030.

b. The bottom Innerwear segment dominated the global innerwear market with a share of 50.73% in 2022. This is attributed to comfort, functionality, and personal style in bottom undergarments. The increasing availability of a wide range of products and designs suitable for various purposes, including sports, regular wear, and functional wear, is anticipated to further fuel the product demand.

b. Some key players operating in innerwear market include Hanesbrands Inc., PVH Corp., Jockey International Inc., Ralph Lauren Corporation, Calvin Klein, • American Eagle Outfitters, Inc.

b. Key factors that are driving the innerwear market growth include a significant shift in societal attitudes toward body positivity and self-acceptance. Consumers now seek innerwear that embraces their individuality, supports their body shape, and promotes self-confidence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.