- Home

- »

- Clothing, Footwear & Accessories

- »

-

Lingerie Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Lingerie Market Size, Share & Trends Report]()

Lingerie Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Briefs, Shapewear, Bras), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-2-68038-920-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lingerie Market Summary

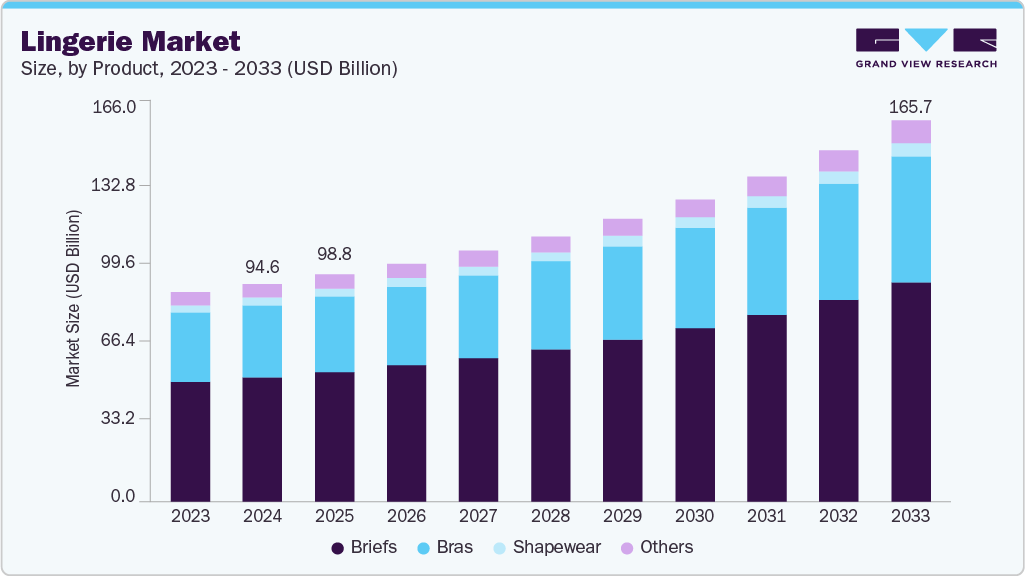

The global lingerie market size was estimated at USD 94.63 billion in 2024 and is projected to reach USD 165.69 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033, driven by rising body-positivity and inclusivity trends that boost demand for comfortable and diverse styles, along with e-commerce growth and social media marketing, which accelerate premiumization and global adoption. A key global trend in the market for lingerie is the shift toward comfort-first, wire-free, and multifunctional lingerie as consumers prioritize breathable, everyday styles like bralettes and seamless fits over traditional push-up designs, driven by hybrid lifestyles and demand for practical essentials.

Key Market Trends & Insights

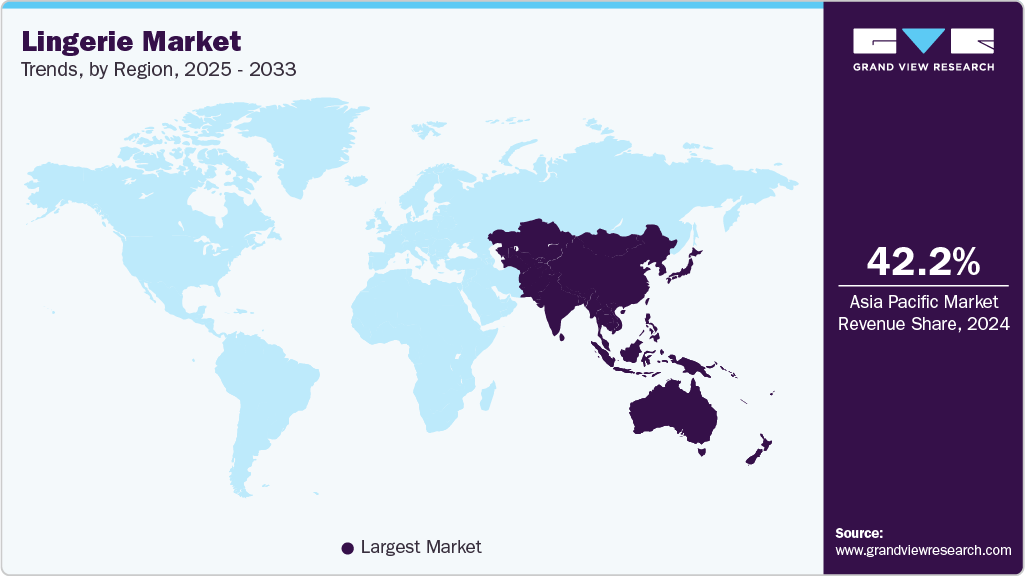

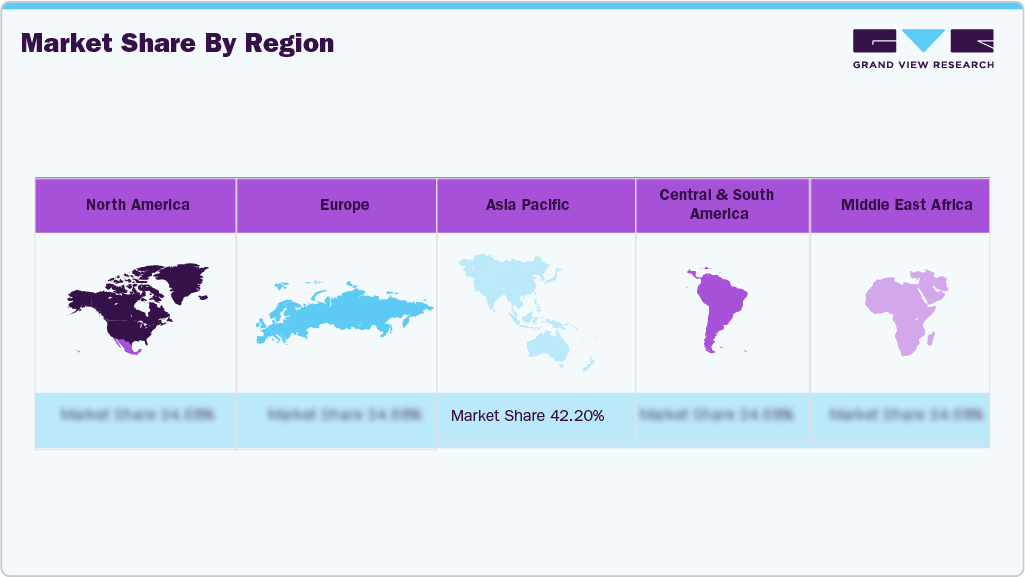

- The Asia Pacific Lingerie industry accounted for a share of 42.20% of the global market in 2024.

- The U.S. lingerie industry is expected to witness a significant CAGR from 2025 to 2033.

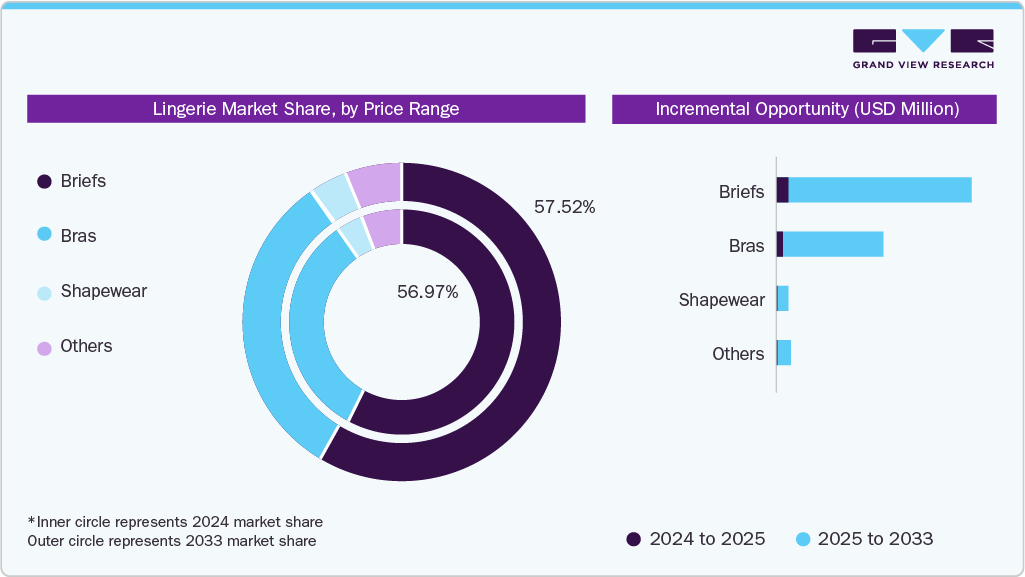

- By product, briefs led the market and accounted for a share of 56.97% in 2024.

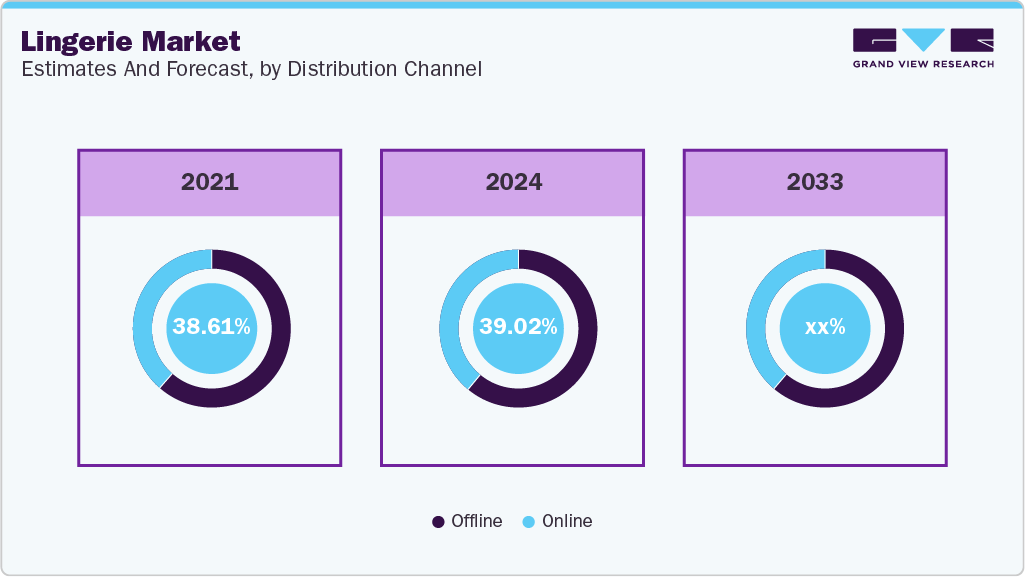

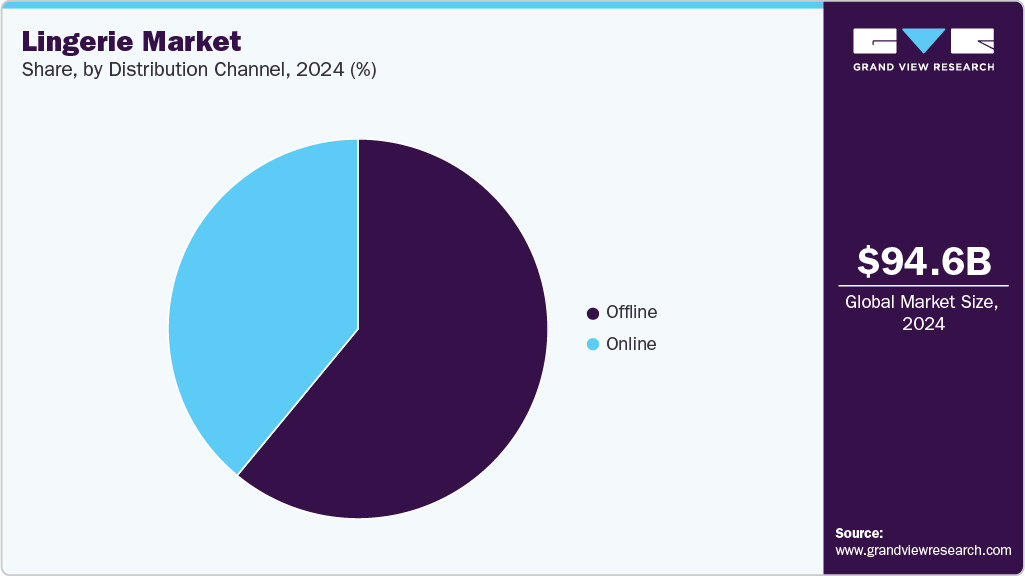

- By distribution channel, the offline sales held the largest market share of 60.98% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 94.63 Billion

- 2033 Projected Market Size: USD 165.69 Billion

- CAGR (2025-2033): 6.7%

- Asia Pacific: Largest Market in 2024

Growth in the global market is being driven by a functional shift in women’s wardrobes, where lingerie is no longer just an innerwear purchase but part of daily comfort and wellness. Post-pandemic lifestyle changes and hybrid work culture have fueled demand for wire-free, breathable, and stretch-fit bras that can be worn for long hours, replacing traditional push-up designs. Sales data from retail platforms like ASOS, Zalando, and Myntra show bralette and seamless categories growing faster than underwire bras, reflecting a real behavioral shift rather than a fashion cycle.Another major driver is the rise of size-inclusivity and body realism, which is expanding the customer base globally. Instead of limited “S-M-L” options, brands now offer inclusive fits across band and cup combinations, including plus-size and petite segments. Retailers such as Savage X Fenty, Marks & Spencer, and H&M have scaled sizing ranges based on demand analytics, while AI-powered virtual fitting tech from companies like TrueFit and Fit Finder has reduced return rates by solving size mismatch issues-converting more shoppers online and boosting lingerie revenue.

Another key factor driving the market growth is the premiumization of everyday lingerie, powered by social media discovery and brand storytelling. Consumers across middle-income countries are trading up from unbranded basics to branded mid-segment products offering better fabric, fit, and durability. In markets such as India, Brazil, and Southeast Asia, brands like Clovia, Zivame, and Hope Lingerie are monetizing aspirational buying through influencer try-on content, installment payments, and style education. This has turned lingerie from a low-involvement purchase into a lifestyle product, raising average selling prices and accelerating market growth.

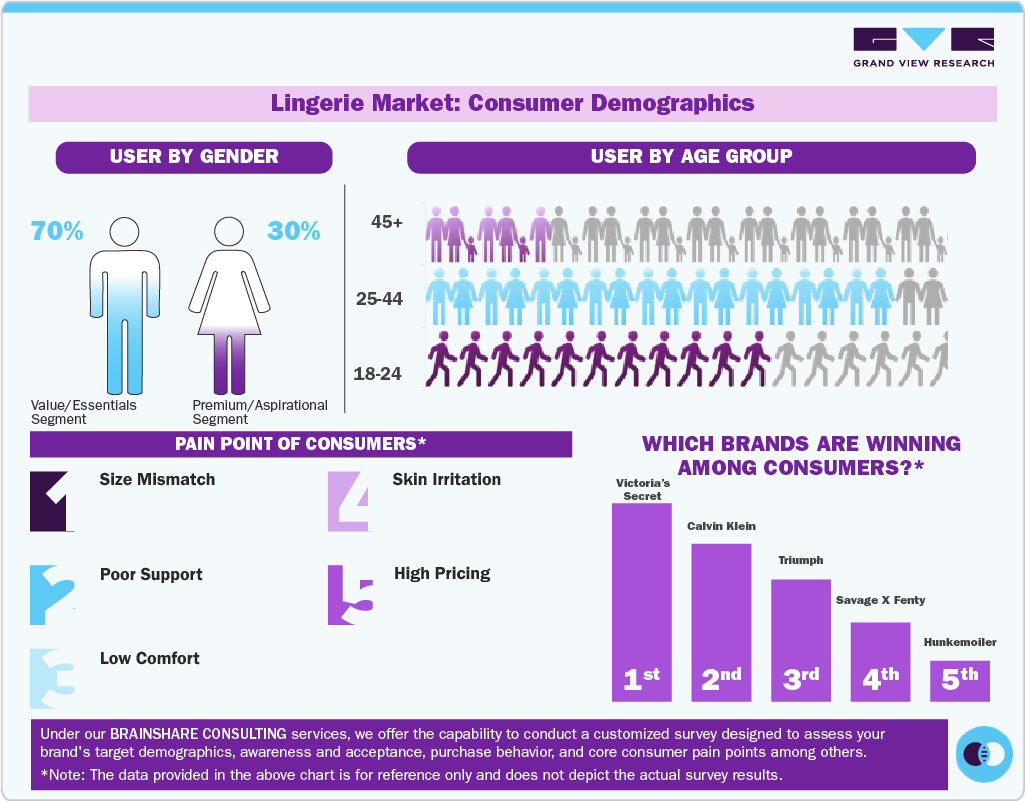

Consumer Insights

The global market for lingerie caters to both mass and premium consumers. About 70% of buyers in the value or essentials segment look for affordable, functional products. Meanwhile, 30% belong to the premium or aspirational segment and prioritize high-quality fabrics, designer labels, and exclusivity. This split illustrates a market where everyday comfort drives volume and premium products fuel revenue growth and brand distinction.

Age demographics significantly influence buying behavior. The 25 to 44 age group makes up the largest consumer base at 50 to 55%. This group includes working professionals and young parents who value both comfort and style. Younger consumers, aged 18 to 24, represent 22 to 25% and are interested in trendy, fashionable lingerie. The 45 and older segment accounts for 20 to 25%, focusing more on functional and supportive designs, often prioritizing fit and wellness over looks.

Consumers face persistent pain points that influence their buying decisions. Common pain points include size mismatches, inadequate support, low comfort, skin irritation, and high prices. Brands that tackle these challenges through inclusive sizing, improved fabric quality, and ergonomic designs tend to win repeat buyers and foster greater loyalty in a market increasingly influenced by real consumer needs rather than just looks.

In terms of brand preference, Victoria’s Secret, Calvin Klein, Triumph, Savage X Fenty, and Hunkemöller lead in global consumer awareness. These brands effectively combine comfort, style, and inclusivity while utilizing strong marketing, a notable social media presence, and collections that align with current trends. Their popularity shows that consumers now place a higher value on fit, versatility, and aspirational branding alongside traditional fashion appeal.

Product Insights

Briefs accounted for a 56.97% share of the global revenue in 2024, as they combine everyday comfort, versatile fit, and affordability, making them the go-to choice across age groups and markets. Unlike fashion-focused or premium designs, briefs suit daily wear, are easier to produce in multiple sizes, and appeal to both mass and premium consumers, driving consistent high sales globally.

Shapewear is anticipated to grow at a CAGR of 7.4% from 2025 to 2033, due to rising body-consciousness and demand for figure-enhancing, confidence-boosting apparel. Consumers increasingly prefer versatile, comfortable shapewear that can be worn under everyday or formal outfits, while social media trends and influencer promotions are driving awareness and adoption globally.

Distribution Channel Insights

The sale of lingerie through offline channels accounted for 60.98% of the market in 2024. This can be attributed to the consistent consumer preference for in-person fitting, tactile experience, and immediate purchase, especially for items where comfort and fit are critical. Brick-and-mortar stores also offer personalized assistance, size guidance, and the ability to try multiple styles at once, making them the preferred choice for most buyers despite the rise of e-commerce. Brands like Victoria’s Secret and Marks & Spencer have leveraged this to boost sales and customer loyalty.

The sale of lingerie through the online channel is expected to grow at a CAGR of 7.1% from 2025 to 2033, due to the convenience of home delivery, wider variety, and digital personalization. E-commerce platforms like ASOS, Zivame, and Shein offer extensive size ranges, style filters, and virtual fitting tools, making it easier for consumers to explore and purchase lingerie without visiting a store. Social media marketing and influencer-led promotions further accelerate online adoption globally.

Regional Insights

The Asia Pacific Lingerie industry accounted for a share of 42.20% of the global market in 2024, largely due to younger, urban consumers who are blending traditional modesty with modern style, creating demand for hybrid products such as seamless bralettes, wireless lingerie, and shapewear suitable for both home and public wear. In markets like China and India, fast-growing e-commerce platforms such as Myntra and Tmall are accelerating adoption by offering inclusive sizing and influencer-driven collections, making Asia a hotspot for both volume and innovation.

North America Lingerie Market Trends

The North America lingerie industry is projected to grow at a CAGR of 6.7% from 2025 to 2033, driven by increasing demand for comfort-focused and inclusive lingerie. Consumers are increasingly favoring wire-free bras, bralettes, and multifunctional intimates, while brands like Victoria’s Secret, Savage X Fenty, and ThirdLove leverage social media, subscription models, and virtual fitting tools to capture younger and diverse audiences, sustaining steady market growth.

The U.S. lingerie industry is expected to witness a significant CAGR from 2025 to 2033. This growth comes from lifestyle changes after the pandemic that favor comfort at home and self-expression. More consumers are opting for wire-free bras, bralettes, and lingerie inspired by athleisure. E-commerce leaders like Amazon, ThirdLove, and Savage X Fenty encourage this trend with virtual fitting, subscription models, and campaigns led by influencers. They cater to a diverse audience that promotes body positivity, which is distinctive in the U.S.

Key Lingerie Company Insights

The global lingerie industry features a mix of established mid-tier brands, leading premium companies, and new challengers. Each of these groups contributes to growth in various segments. Established names such as Victoria’s Secret, Calvin Klein, and Triumph lead the mid-range segment by using their brand recognition, reliable fit, and stylish designs. Shapewear and designer lingerie from brands such as Savage X Fenty and La Perla appeal to consumers who want high-quality fabrics, skilled craftsmanship, and trendy styles. At the same time, regional leaders like Clovia in India and Zivame in Southeast Asia focus on budget-conscious and first-time buyers, increasing their presence in emerging markets and enhancing the overall global reach of lingerie.

Key Lingerie Companies:

The following are the leading companies in the lingerie market. These companies collectively hold the largest market share and dictate industry trends.

- Jockey International Inc.

- Victoria’s Secret

- Zivame

- Gap, Inc.

- Hanesbrands Inc.

- Triumph International Ltd.

- Hunkemoller

- Bare Necessities

- Calvin Klein

- MAS Holdings

Recent Developments

-

In September 2025, Adore Me launched the new Soft Touch loungewear collection and debuted its first men's underwear line. The collection features over 100 comfortable styles for men and women, priced under USD 50 for VIP members, and is available online and soon at Macy’s, Nordstrom, and Target.

-

In August 2025, Wacoal unveiled its Autumn/Winter 2025 Lingerie Collection, a refined assortment designed to balance seasonal elegance with everyday practicality. The range introduced festive statement pieces and updated essentials, highlighted by luxurious lacework, rich seasonal tones, and fabrics crafted with sustainability in mind.

-

In July 2025, Victoria’s Secret introduced the Body by Victoria FlexFactor Bra, a breakthrough innovation designed with a flexible titanium underwire and adaptive memory foam for unmatched comfort and support. The line features a variety of inclusive sizes and styles, giving women options that balance movement, fit, and elegance.

Lingerie Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 98.71 billion

Revenue forecast in 2033

USD 165.69 billion

Growth Rate (Revenue)

CAGR of 6.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India, Australia; South Korea; Brazil; South Africa

Key companies profiled

Jockey International Inc.; Victoria’s Secret; Zivame; Gap, Inc.; Hanesbrands Inc.; Triumph International Ltd.; Hunkemoller; Bare Necessities; Calvin Klein; MAS Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

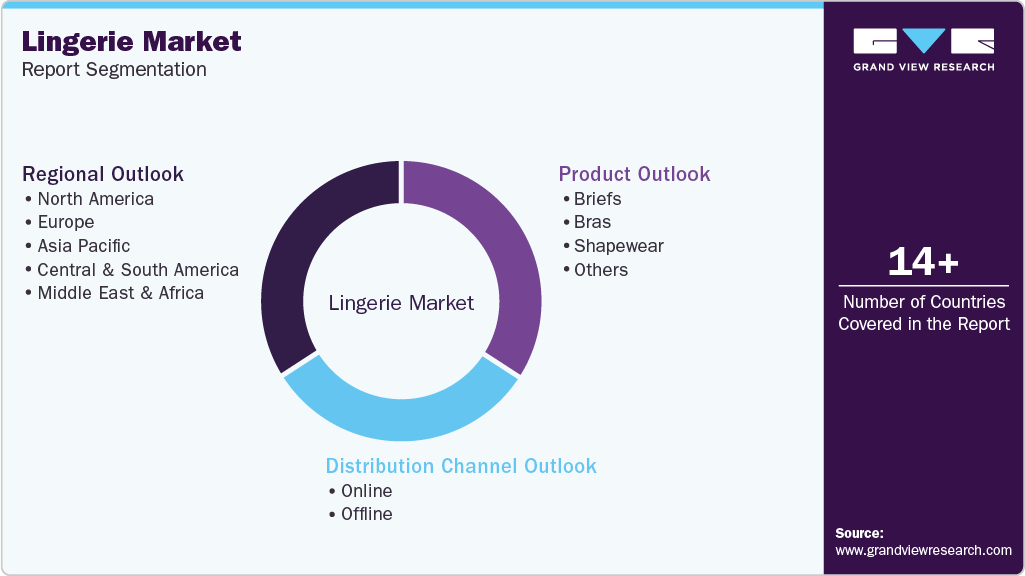

Global Lingerie Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global lingerie market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Briefs

-

Bras

-

Shapewear

-

Others

-

-

Distribution Channel (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lingerie market size was estimated at USD 94.63 billion in 2024 and is expected to reach USD 98.71 billion in 2025.

b. The global lingerie market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 165.59 billion by 2033.

b. Asia Pacific dominated the lingerie market with a share of 42.40% in 2024. This is attributable to the high preference for premium lingerie brands among an expanding consumer base, most notably in countries such as China and India.

b. Some key players operating in the lingerie market include Jockey International Inc.; Victoria’s Secret; Zivame; Gap, Inc.; Hanesbrands Inc.; Triumph International Ltd.; Hunkemoller; Bare necessities; Calvin Klein; and MAS Holdings.

b. Key factors that are driving the market growth include the increasing availability of a broad range of products with innovative designs and the rising popularity of sports brassieres.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.