- Home

- »

- Beauty & Personal Care

- »

-

Interdental Cleaning Products Market, Industry Report, 2030GVR Report cover

![Interdental Cleaning Products Market Size, Share & Trends Report]()

Interdental Cleaning Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Interdental Brushes, Toothpicks, Dental Tapes), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-133-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Interdental Cleaning Products Market Summary

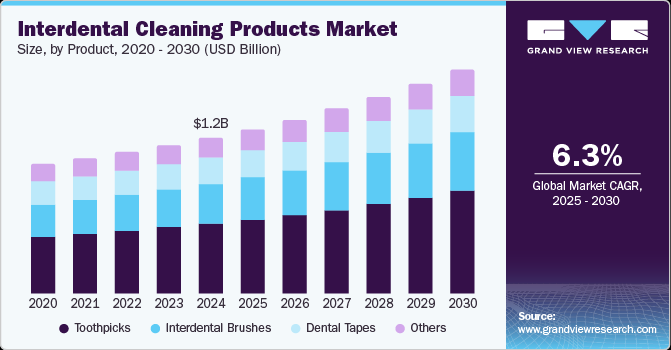

The global interdental cleaning products market size was estimated at USD 1.24 billion in 2024 and is projected to reach USD 1.77 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. Increasing awareness regarding the importance of maintaining oral health and rising incidences of disorders such as dental caries globally have highlighted the need for interdental cleaning products such as floss, interdental brushes, and picks.

Key Market Trends & Insights

- Europe dominated the global interdental cleaning products market with the largest revenue share of 44.6% in 2024.

- The interdental cleaning products market in the UK led the European market and held the largest revenue share in 2024.

- By product, the toothpicks segment led the market, holding the largest revenue share of 44.8% in 2024.

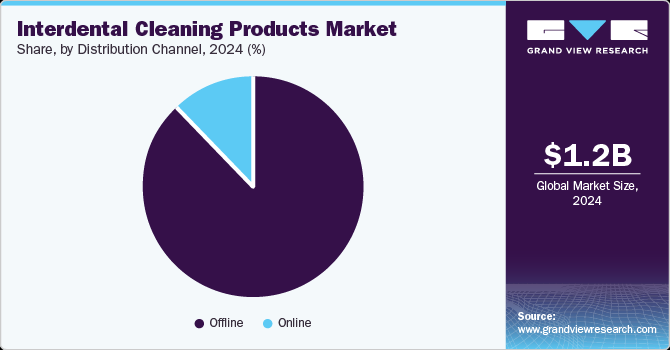

- By distribution channel, the online segment is expected to grow at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 1.24 Billion

- 2030 Projected Market Size: USD 1.77 Billion

- CAGR (2025-2030): 6.3%

- Europe: Largest market in 2024

Government and private organizations promotional campaigns concerning dental hygiene have further encouraged more people to incorporate interdental cleaning processes into their routines. The trend toward preventative healthcare has resulted in higher adoption rates of such products to prevent dental issues before they occur.

Factors such as unhealthy eating habits and poor lifestyle choices have led to the rising occurrence of conditions such as bad breath, cavities, and inflammation of the gums. According to a report by the World Health Organization (WHO) published in November 2024, around 3.5 billion people worldwide suffer from oral disorders, with dental caries being one of the most common conditions. Approximately 2 billion adults suffer from caries of permanent teeth, while more than 500 million children live with caries of primary teeth. Inadequate exposure to fluoride sources, consumption of food items with high sugar content, and lack of access to community healthcare services are major reasons for the persistence of these issues. As a result, dental professionals recommend techniques such as regular flossing, the use of oral irrigators, and interdental brushes to maintain proper hygiene and prevent these conditions. The steady growth of the global geriatric population presents another notable opportunity for companies in the interdental cleaning products industry to launch advanced solutions. Senior citizens are more likely to experience dental issues such as gum recession, which creates larger gaps between teeth, making interdental cleaning more necessary.

The growing pace of urbanization and rising disposable income levels of consumers have increased their acceptance of investing in premium oral care products. Higher-income consumers are more likely to purchase specialized dental care tools such as interdental brushes, electric flossers, and other advanced oral hygiene products. Furthermore, the growing variety and innovations in interdental cleaning products, such as electric flossers, water flossers, and ergonomic brushes, have made it easier and more convenient for people to clean their teeth. Manufacturers are introducing a range of options to cater to varying consumer preferences and needs, such as easy-to-use devices for people with arthritis or sensitive gums. Dentists and hygienists regularly emphasize the importance of using these products during checkups, and many dental offices even provide samples or discounts on them, encouraging patients to make purchases. Additionally, several studies over the past few years have highlighted the benefits of specialized cleaning products in maintaining and improving oral health, which is expected to create opportunities for market players to advertise their products among both younger and aging demographics.

A number of research studies conducted in recent years have shown a connection between the oral health of individuals and systemic conditions such as heart disease, diabetes, and stroke. For instance, in July 2023, results from a study conducted by Clinic Masae Minami/Minami Diabetes Clinical Research Center in collaboration with Sunstar found that patients with type 2 diabetes who undertake interdental cleaning activities regularly display substantially lower blood glucose levels. The report further highlighted the importance of preventing tooth loss among this demographic through good oral care practices and regular dental checkups for improved blood glycemic control. Such developments are expected to encourage people to demand better dental hygiene practices, driving the popularity of interdental cleaning products.

Product Insights

The toothpicks segment accounted for the largest revenue share of 44.8% in the global market in 2024 and is further expected to maintain its leading position during the forecast period. Growing awareness among consumers regarding toothpicks due to their easy usability and widespread availability has resulted in a consistently strong demand for these products. Their low cost due to relatively basic design and manufacturing has made them affordable even for low-income individuals. Toothpicks are often seen as a quick and convenient option for removing food particles between teeth, especially when people are away from home or cannot access floss or other dental tools. Their portability has made them a popular choice for people who want an easy solution to maintain oral cleanliness.

The interdental brushes segment is expected to grow at the fastest CAGR from 2025 to 2030 in the global interdental cleaning products industry. The increasing pace of the launch of battery-powered and electric toothbrushes has resulted in the growing demand for these products among middle- and high-income consumers. A steady rise in the geriatric population, particularly in economies such as Japan and the U.S., is another notable factor driving segment expansion. Studies have shown that these brushes are more effective than dental floss at removing plaque between teeth, resulting in their growing popularity among consumers. Their ability to clean more effectively in spaces between teeth contributes to increased demand, particularly among people with tighter gaps or those struggling with traditional flossing. Many brands have improved the design of interdental brushes, making them more comfortable to hold and easier to maneuver. Innovations such as flexible heads, angled handles, and improved bristles have enhanced the user experience, contributing to greater satisfaction and higher demand.

Distribution Channel Insights

The offline channel accounted for a dominant revenue share in the global market in 2024, owing to the increasing availability of these products in convenience stores, pharmacies, dental clinics, and other physical retail outlets. The convenience offered by this distribution channel is particularly important for consumers who frequently need to replace their interdental brushes and prefer buying them on the go. Moreover, customers can interact with in-store staff, who provide recommendations and educate them about the benefits of interdental brushes. This interaction often leads to increased consumer confidence in the product, driving demand. Pharmacies, in particular, generally have pharmacists or dental care professionals who can answer questions and make personalized product suggestions. Dental clinics are another notable offline medium where professionals recommend interdental brushes to visitors.

The online segment is expected to advance at the fastest CAGR during the forecast period in the interdental cleaning products industry. Increasing availability of these products through online retailers such as Amazon, Walmart, and specialized health stores allows consumers to purchase them without geographical limitations while also helping companies expand their user base. Additionally, online platforms offer a broader range of interdental cleaning products compared to physical stores. Consumers can easily find different types of brushes, flossers, and picks in various sizes, shapes, and brands, allowing them to choose products that meet their specific dental needs. Several online retailers, particularly those focused on health and wellness, feature product reviews from dental professionals or influencers in the oral care space. These endorsements can strongly influence consumer purchasing decisions and drive market expansion.

Regional Insights

North America accounted for a substantial revenue share in the global interdental cleaning products industry in 2024. An increasing prevalence of conditions such as periodontitis and gingivitis in economies such as the U.S. and Canada has led to the adoption of these solutions as part of oral hygiene routines for effective management. Working professionals consider dental hygiene a vital aspect of their overall appearance, creating a substantial demand for dental tapes, flosses, and brushes that can remove debris between teeth and maintain their cleanliness. The increasing presence of dental clinics and skilled professionals has resulted in improved knowledge among consumers regarding different types of oral cleaning equipment. For instance, in Canada, during the period between November 2023 and March 2024, 72% of people reported visiting an oral health expert over the previous 12 months. This highlights a strong interest in oral care routines among individuals, which is expected to create healthy demand for this market in the coming years.

U.S. Interdental Cleaning Products Market Trends

The U.S. accounted for the largest revenue share in the regional market in 2024. Dentists and dental hygienists in the country frequently recommend the use of interdental cleaning products as part of a complete oral hygiene routine. Regular dental check-ups have reinforced the importance of flossing and other tools among individuals. This professional recommendation drives demand for products such as floss, interdental brushes, and water flossers. Moreover, the emergence and rapid adoption of smart devices in oral care, including toothbrushes and flossers that connect to mobile apps, has influenced the manner in which consumers approach oral hygiene. These devices allow consumers to track their oral hygiene habits and receive personalized recommendations, increasing their adherence to daily cleaning routines. This trend has contributed to the growing demand for more advanced interdental cleaning tools.

Europe Interdental Cleaning Products Market Trends

The Europe interdental cleaning products market accounted for the leading global revenue share of 29.8% in 2024, aided by the rising frequency of public health campaigns focusing on oral hygiene in regional economies. Government and non-government organizations, such as the European Federation of Periodontology, actively promote the benefits of interdental cleaning as a key component of maintaining oral health. These campaigns emphasize the importance of proper cleaning between teeth to prevent gum disease, cavities, and bad breath, leading to better awareness among consumers about such solutions. According to a WHO report published in April 2023, the region accounted for the highest prevalence of oral diseases globally in 2019, including the highest incidence rate of caries of permanent teeth. The report also found that Europe had almost double the global prevalence of tooth loss cases at 12.4%, translating to around 88 million affected adults aged 20 years and above. Such instances highlight the promising market available for interdental cleaning product companies to address these oral health issues among the regional population.

The UK accounted for the largest revenue share in the regional market for interdental cleaning products in 2024. The economy has seen a steady increase in the introduction of public health initiatives to raise awareness about the importance of oral health. For instance, campaigns led by the British Dental Association (BDA) and other public health organizations encourage people to clean their teeth to prevent gum disease and cavities. This has helped drive demand for interdental cleaning products such as floss, interdental brushes, and water flossers. Oral health surveys conducted in the UK have further highlighted the rising incidence of gum diseases among the national population, leading to dentists encouraging individuals to make interdental cleaning products a part of their daily personal hygiene routine.

Asia Pacific Interdental Cleaning Products Market Trends

The Asia Pacific region is expected to advance at the highest CAGR in the global market from 2025 to 2030. The steadily growing regional population and increasing awareness regarding optimal oral health practices are expected to shape market demand positively in the coming years. The rising adoption of sugary and processed food items in diets due to urbanization and busy consumer lifestyles has increased the risk of dental issues such as gum diseases and cavities, particularly among children. This has highlighted an urgent need for effective oral hygiene products, including interdental cleaning tools, to prevent plaque buildup and gum inflammation. Additionally, the presence of fast-growing economies such as India, China, and South Korea and improving standards of living have increased the spending power of regional consumers, resulting in an increased purchase of high-quality products, including electric flossers, water flossers, and premium dental tools.

China accounted for the largest revenue share in the Asia Pacific market for interdental cleaning products in 2024. The establishment of various public health campaigns and initiatives to showcase the importance of oral and dental hygiene is expected to act as a primary factor for market expansion. Additionally, social media platforms have emerged as a useful tool for companies to market their interdental cleaning solutions. According to a report published by Jing Daily regarding the economy's oral care sector, between 2021 and 2022, the short video app Douyin saw a 138% increase in oral health-related content, with products such as dental floss, mouthwashes, and whitening products being particularly popular among the younger generation. The Chinese government's 'Healthy China 2030 Plan' involves improving oral health awareness and reducing dental caries in children to 25% per city by 2030. Such initiatives are expected to boost sales of interdental cleaning products in the country during the forecast period.

Key Interdental Cleaning Products Company Insights

Some major companies involved in the global interdental cleaning products industry include Colgate-Palmolive, Procter & Gamble, and CURADEN AG, among others.

-

Colgate-Palmolive is an American multinational consumer products company specializing in producing and distributing a wide range of household, personal care, and pet nutrition products. The company develops a range of oral care solutions through the Colgate division, such as toothpaste, toothbrushes, mouthwashes, whitening products, and other specialty solutions. Colgate offers a range of interdental cleaning products designed to clean the spaces between teeth and remove plaque. Colgate Total Interdental Brushes feature an innovative handle and Tri-Proxi bristle technology that adapts to the natural anatomy of interdental spaces. These brushes are available in different configurations and sizes to meet various patient needs and allow for better access around the mouth.

-

CURADEN AG is a Swiss oral care company specializing in training dental professionals and manufacturing advanced oral care products. The Curaprox brand offers oral healthcare products such as toothpaste and toothbrushes, along with interdental products such as interdental brushes. Notable offerings in this category include the INTERDENTAL BRUSH PRIME START MIXED SET, CPS 09 PRIME START, CPS 07 SET, INTERDENTAL BRUSH CPS 459 PRIME POCKET SET, INTERDENTAL BRUSH HOLDER, and INTERDENTAL BRUSH REFILL PRIME. The company also offers specialized products such as the CPS 505 REFILL, CPS 507 REFILL, and CPS 508 REFILL, among others.

Key Interdental Cleaning Products Companies:

The following are the leading companies in the interdental cleaning products market. These companies collectively hold the largest market share and dictate industry trends.

- CURADEN AG

- Prestige Consumer Healthcare Inc.

- Colgate-Palmolive Company

- Procter & Gamble

- Sunstar Suisse S.A.

- Koninklijke Philips N.V.

- DENTALPRO Co., Ltd.

- TePe Oral Health Care, Inc.

- TRISA AG

- The Humble Co.

Recent Developments

-

In March 2024, TRISA announced the launch of interdental brushes manufactured from paper, with the pouch and handle of these products made from FSC-certified paper. Additionally, the bristles of these brushes have been made from renewable raw materials and claim to ensure efficient cleaning of interdental spaces. This launch forms a part of the company’s drive toward sustainability, with TRISA having previously launched environment-friendly dental care solutions prepared from materials such as bio-based plastics, wood, and recycled PET bottles.

-

In May 2023, the Sweden-based oral care brand TePe announced an exclusive distribution partnership agreement with Clinical Research Dental (CRD), covering the Caribbean region and Canada. The partnership would enable CRD to expand its hygiene portfolio while providing extensive visibility to TePe’s products for clinicians in these regions. TePe is a multinational company that develops premium-quality oral health offerings, including toothbrushes, toothpicks, interdental brushes, and specialty toothbrushes.

Interdental Cleaning Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.30 billion

Revenue forecast in 2030

USD 1.77 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa; Saudi Arabia

Key companies profiled

CURADEN AG; Prestige Consumer Healthcare Inc.; Colgate-Palmolive Company; Procter & Gamble; Sunstar Suisse S.A.; Koninklijke Philips N.V.; DENTALPRO Co., Ltd.; TePe Oral Health Care, Inc.; TRISA AG; The Humble Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Interdental Cleaning Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global interdental cleaning products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Interdental Brushes

-

Toothpicks

-

Dental Tapes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.