- Home

- »

- Healthcare IT

- »

-

Internet Of Things In Healthcare Market Size Report, 2030GVR Report cover

![Internet Of Things In Healthcare Market Size, Share & Trends Report]()

Internet Of Things In Healthcare Market Size, Share & Trends Analysis Report By Component (Medical Devices, System & Software, Services), By Connectivity Technology, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-857-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

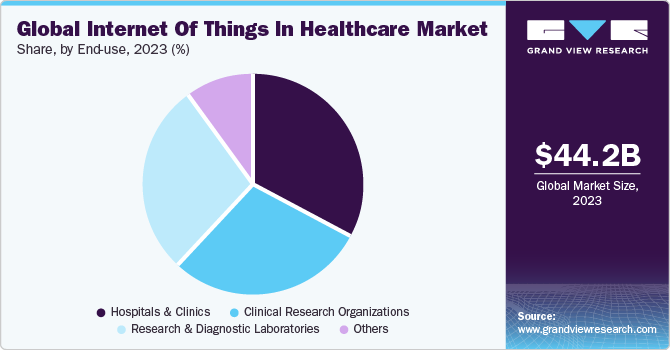

The global internet of things in healthcare market size was valued at USD 44.21 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 21.2% from 2024 to 2030. The market is driven by increasing usage of smartphones, smart devices, and wearables to monitor patients. Moreover, increasing adoption of remote patient monitoring for improved out-of-hospital care boosts the market.

Outbreak of COVID-19 positively impacted the IoT in healthcare market, accelerating the adoption of innovative technologies like the Internet of Things (IoT) in healthcare. With social distancing measures and concerns about in-person contact, the demand for remote patient monitoring solutions skyrocketed. IoT devices like wearable sensors, smart inhalers, and connected blood pressure monitors enabled healthcare providers to track patients' vital signs and health data remotely. This helped in early detection of potential health complications, improved disease management, and reduced hospital readmissions. For instance, in February 2022 Government of India announced two projects to enhance digital health for the people to fight against the pandemic. The government has projected to launch an open platform including digital registries for doctors, and other healthcare providers, novel healthcare identities, and global access to digital healthcare facilities. Such advancements boost the global market. Moreover, after COVID-19 pandemic, there has been a surge in adoption of telemedicine in the healthcare sector, which fosters the global market.

Rising investments in implementing digital technologies in healthcare institutions and emergence of connected care are the key factors boosting industry growth. Technological advancements, a growing geriatric population, and rising prevalence of chronic conditions positively impact the market expansion. Furthermore, growing affordability and reduced costs of hardware are driving the demand for smartphones in the market, which is expected to drive the market's growth. In addition, measures are taken to improve security of the data. For instance, in December 2022, Palo Alto Networks introduced a Zero Trust Security solution for medical IoT, aiming to enhance the secure management of connected devices for healthcare providers. This cybersecurity approach ensures the protection of organizational data by systematically validating each user and device, offering a swift and secure means of handling the diverse landscape of medical devices.

Increasing applications of smart devices and wearables in healthcare, such as glucometer, tablets, smartphones, smartwatches and headphones, heartrate cuff, bands, and others, is expanding the scope of Internet of Things, especially in healthcare as they give special attention to access the patients remotely. Moreover, the tracker system in these devices enables access to emergency patients by sending emergency alerts to seek medical help. Technological advancements in smartphone technology for improving disease diagnosis are anticipated to drive the growth of Internet of Things in the healthcare market. Moreover, smartphones offer advantages such as ease of use, portability, large storage capacity, and making them an optimal solution for diagnostic and monitoring services.

High penetration of smartphones is also one of the significant factors boosting the growth of internet of things in healthcare market. As per The Mobile Economy 2022, smartphone penetration was 67% of the global population in 2021 and is expected to reach 70% by 2025. An increase in number of mobile subscriptions is also contributing to an increase in the demand for IoT solutions. A rise in number of mobile subscriptions in emerging economies such as India, China, Indonesia, Bangladesh, and some African & Latin American countries is expected to further drive the market growth. In addition, continuous improvements in network infrastructure and growing network coverage are also creating opportunities for key players to grow in the market. Moreover, usage of mobile devices is rising among physicians.

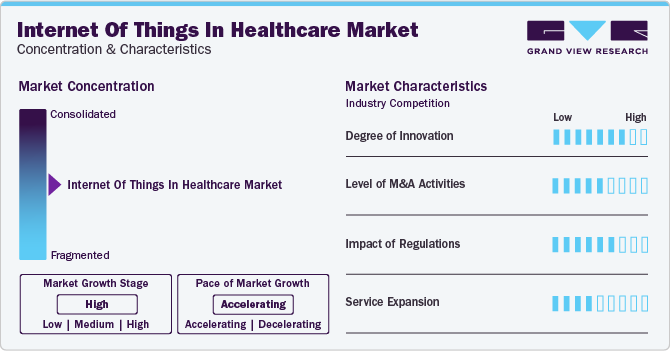

Market Concentration & Characteristics

Technological proliferation and increasing investments are expected to drive the global market over the forecast period. Significant advances in telehealthcare and growing penetration of Internet and broadband services have further propelled growth of the Internet of Things (IoT) in healthcare market.

Several market players such as Medtronic, Cisco Systems, Inc., SAP SE, and Microsoft Corporation are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Favorable government regulations are driving growth in the market. It is regulated by the FDA’s Center for Devices and Radiological Health (CDRH) in the U.S. In 2017, the U.S. FDA launched its Digital Health Innovation Action Plan, which provides timelines and details regarding implementation of the 21st Century Cures Act. The government in the U.S. is also focusing on issues associated with IoT in healthcare with new governance.

End-use Insights

The hospitals and clinics segment captured largest revenue share 2023. Improved operational and functional efficiency gained by hospitals due to IoT is a key factor propelling growth of the market. For instance, these solutions help hospitals in management of real-time communication, medical records & billing, hospital workflows, and medication compliance improving overall operational efficiency. In addition, IoT solutions allow enhanced treatment outcomes, disease management, and patient experience leading to improved care delivery. Moreover, increasing investments by hospitals for accelerating the adoption of digital technology is another factor contributing to segment share.

Clinical research organizations (CROs) segment is anticipated to grow at a significant pace with fastest CAGR over the forecast period. Rising implementation of IoT solutions for enhancing accuracy of clinical research is a major factor fuelling the segment. CROs have augmented widespread use of these solutions for improving patient retention and recruitment process, which are potential issues in clinical research. Hence, these capabilities are estimated to drive the segment during the forecast period.

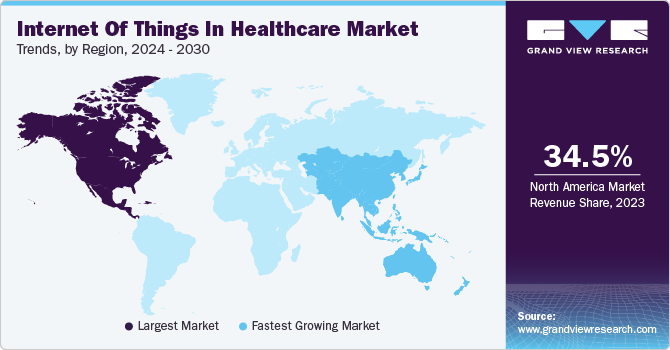

Regional Insights

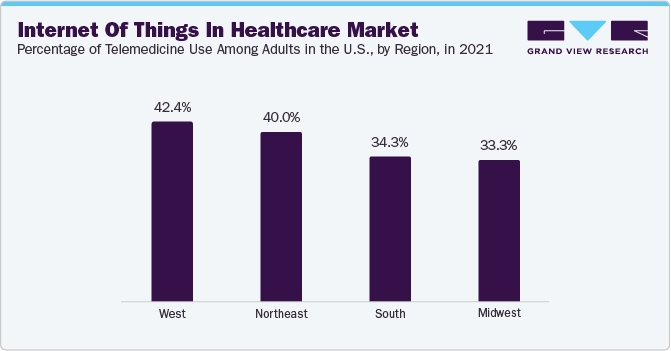

In 2023, North America dominated the market with a share of 34.5%. Increased usage of telehealth, e-prescribing, mHealth, and other HC IT technologies as a response to COVID-19, as well as increased government requirements & support for IoT solutions in healthcare, are primary growth factors driving the market. Furthermore, rise in number of hospitals, advanced research organizations, universities, and medical device manufacturers has a positive impact on market growth. Increase in adoption of electronic health records is increasing significantly in the U.S. As per the Health IT reports until 2021, nearly 9 out of 10 U.S.-based physicians have adopted EHR. Thus, high adoption rate also plays a crucial role in boosting market growth.

U.S. dominated the IoT in the healthcare market in North America. Growth in the country can be attributed to increasing development & deployment of innovative & advanced healthcare management software and presence of a large number of players operating across segments, such as mobile & network operations. Moreover, rising young population, increasing awareness about health-related issues, and surging disposable income contribute to market growth in the U.S. In addition, key players in the country are increasingly focusing on developing advanced healthcare products, including innovative & secure data storing & sharing platforms for EHR, building network infrastructure, and promoting adoption of various remote health & telemedicine services in the U.S.

Asia Pacific region is anticipated to witness fastest growth over the forecast period, owing to the improvement in healthcare infrastructure & increase in healthcare expenditure in developing Asian countries, owing to growth in adoption of advanced technology to cut down medical costs & streamline hospital workflow, are key drivers of demand for IoT in healthcare in the region. Moreover, several government initiatives and supportive programs are also boosting the adoption of such technologies. For instance, in Australia, the state and federal government support healthcare IT at their level. State-level programs, such as HealthSmart, and nationwide programs, such as HealthConnect, are examples of government programs undertaken to increase integration of IoT solutions in healthcare.

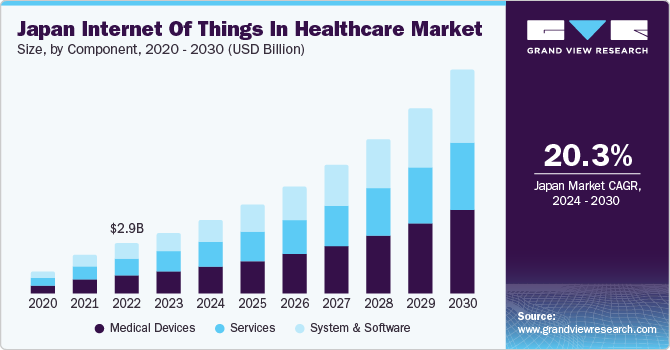

Digital ecosystem in Japan is likely to improve communication between patients and doctors. However, digital ecosystem in the country is currently unevenly developed. The government has approved only one or two mobile applications due to safety & accuracy concerns. More research on mobile apps is required to improve approval rates. In addition, Symax and Clintal are among the key digital health startups in the country. Moreover, due to increasing government spending on healthcare, high demand for eHealth services in healthcare sector is fueling Japan’s digital health market. This is expected to drive demand in the market during forecast period.

Component Insights

By component, medical devices segment held the largest share of 37.5% in 2023. This is attributed to large scale-adoption of medical devices owing to increasing need for efficient and cost-effective solutions for delivering healthcare services. For instance, medical devices are connected with IoT sensors to offer healthcare professionals a continuous stream of real-time health data such as glucose monitoring, heart rate, and blood pressure. In addition, the growing demand for self-monitoring devices such as wearable devices are expected to surge the demand for connected medical devices in healthcare sector. Several key players and universities are launching novel medical devices for self-monitoring of health indicators. For instance, in January 2022, Abbott introduced biowearables for self-monitoring of major nutritional health indicators. Such, initiatives are driving the medical devices segment.

System & software segment is anticipated to grow at fastest CAGR during the forecast period. This growth is attributed to technological advancements and growing investments by operating players for the development of novel connected solutions for life science industry. For instance, in September 2021, McKesson launched a rapid return solution for health systems, which helps health systems and hospitals increase the amount of credit received for returned pharmaceuticals & OTC products, simplify the returns process, and expedite credit processing. Furthermore, increasing adoption of connected systems and digital technologies in the health centers may boost the segment during study period. The need for managing medical records is rising in developed economies such as the U.S., which is positively influencing the demand for software solutions.

Connectivity Technology Insights

By connectivity technology, cellular segment held the largest share in 2023. Cellular technology enables us to send huge amount of data over a long distance. Cellular networks have wide range of applications. In healthcare, they are used for remote patient monitoring as it allows data from devices to be collected and made available to healthcare professionals in real-time. Therefore, it is regarded as a faster, safer, and conducive connectivity solution for remote monitoring. Cellular connectivity technology also improves usability, versatility, and portability for connected medical devices.

LPWANs (Low Power Wide Area Networks) segment is expected to witness rapid growth over the forecast period. This is attributed to unique characteristics of LPWANs, including low power consumption and the ability to establish long-range communication. These features make it well-suited for wireless monitoring and emerging healthcare applications. In telemedicine, where consistent data transmission is crucial, LPWANs prove advantageous, especially during adverse weather conditions that may result in increased error rates. The adaptation of modulation schemes by CR-LPWAN (Cognitive Radio LPWAN) to the appropriate frequency bands further enhances performance, making it particularly resilient during challenging weather conditions.

Application Insights

By application, telemedicine segment held the largest share in 2023. Increasing prevalence of chronic diseases and rising demand for patient monitoring are the major factors contributing to segment’s growth. Recent advancements in telemedicine technology coupled with launch of telemedicine services are fueling the demand for IoT solutions. For instance, in May 2021, Lytus Technologies, a platform services company launched its telemedicine services along with a network of local health centers in India offering additional services beyond virtual care. Moreover, key players in internet of things in healthcare are focused on development of innovative telemedicine solutions or devices for improving the healthcare system. For instance, CareClix offers a broad range of telehealth and telemedicine services through high-definition video examinations and remote consultations.

Furthermore, telemedicine segment is anticipated to witness fastest growth over the forecast period. The market is driven by consolidation across industry, strategic initiatives by key market players, and a rising need to reduce the cost of care. The market holds many growth opportunities owing to increasing consumer demand & patient acceptance, enhanced quality of care, and growing adoption of telemedicine. For instance, in May 2021, Walmart Inc. acquired MeMD-a- a telehealth provider- to provide virtual access to urgent, behavioral, and primary care services throughout the U.S.

Internet Of Things In Healthcare Market Share Insights

-

Medtronic, Cisco Systems Inc., IBM Corporation, and GE Healthcare are some of the dominant players operating in internet of things (IoT) market.

-

Medtronic has a global presence and operates from over 370 locations in approximately 160 countries.

-

IBM Corporation operates in over 170 countries. IBM serves its consumers from varied industries, such as automotive, banking, life sciences, retail, chemical & petroleum, and communication.

-

Infosys Limited, Cerner Corporation, Wipro ltd, and QUALCOMM Incorporated some of the emerging market players functioning in internet of things (IoT) market.

-

QUALCOMM Incorporated has 170 sales offices in more than 30 countries across the globe.

-

Wipro ltd caters to new age markets, network & edge providers, and utilities, as well as incumbents of the public sector.

Key Internet Of Things In Healthcare Companies:

- Medtronic

- Cisco Systems, Inc.

- IBM Corporation

- GE Healthcare

- Microsoft Corporation

- SAP SE

- Infosys Limited

- Cerner Corporation

- QUALCOMM Incorporated

- Amazon

- Intel corporation

- Wipro ltd

Recent Development

-

In September 2023, Infosys announced the expansion of its strategic collaboration with NVIDIA Corporation. This collaboration aimed to generate technology and expertise needed to drive productivity with generative AI applications and solutions across various industries, including healthcare.

-

In May 2023, SAP SE collaborated with Accenture. The aim behind the collaboration was to work collaboratively on several AI-based projects and extend product portfolios.

-

In February 2023, Wipro ltd partnered with Koninklijke Philips N.V. to offer Electronic Medical Record (EMR) enterprise solutions for the healthcare industry in Saudi Arabia. The integrated solution, which is in line with Saudi Arabia's Health Sector Transformation Programme- Vision 2030, will put a special emphasis on localized practice, adjustable workflows, data, and service linkages.

-

In June 2022, GE Healthcare launched Allia platform, which was designed for minimally invasive image-guided surgery. The platform was designed through a multiyear collaboration with surgeons and interventionists. Allia was designed with the purpose of improving workflow efficiency, enhancing user experience, and increasing the adoption of image guidance in daily practice.

Internet Of Things In Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 53.65 billion

Revenue forecast in 2030

USD 169.99 billion

Growth rate

CAGR of 21.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, connectivity technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific, Latin America, Africa

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, China, Japan, India, South Korea, Australia, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Medtronic; Cisco Systems, Inc.; IBM Corporation; GE Healthcare; Microsoft Corporation; SAP SE; Infosys Limited; Cerner Corporation; QUALCOMM Incorporated; Amazon; Intel corporation; Wipro ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Internet of Things in Healthcare Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Internet of Things in healthcare market report on the basis of component, connectivity technology, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Devices

-

Wearable External Devices

-

Implanted Medical Devices

-

Stationary Medical Devices

-

-

System and Software

-

Remote Device Management

-

Network Bandwidth Management

-

Data Analytics

-

Application Security

-

Network Security

-

-

Services

-

System Integration Services

-

Consulting, Training, and Education

-

Support and Maintenance Services

-

-

-

Connectivity Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cellular

-

Wi-Fi

-

Bluetooth

-

LPWANs

-

Zigbee

-

RFID

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Telemedicine

-

Patient Monitoring

-

Connected Imaging

-

Clinical Operations

-

Medical Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Clinical Research Organizations

-

Research and Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global internet of things in healthcare market size was estimated at USD 44.21 billion in 2023 and is expected to reach USD 53.65 billion in 2024.

b. The global internet of things in healthcare market is expected to grow at a compound annual growth rate of 21.2% from 2024 to 2030 to reach USD 169.99 billion by 2030.

b. North America dominated the internet of things in healthcare market with a share of 34.5%. The increased usage of telehealth, e-prescribing, mHealth, and other HC IT technologies as a response to COVID-19, as well as increased government requirements & support for IoT solutions in healthcare, are the primary growth factors driving the market.

b. Some key players operating in the IoT in Healthcare market include Key players operating in the predictive disease analytics market include Medtronic; Cisco Systems, Inc.; IBM Corporation; GE Healthcare; Microsoft Corporation; SAP SE; Infosys Limited; Cerner Corporation; QUALCOMM Incorporated; Amazon; Intel corporation; Wipro ltd.

b. Key factors that are driving the market growth include rising adoption of wearable technology, investments for implementing digital technologies in healthcare institutions, and emergence of connected care. Along with this, rising investments for implementing digital technologies in healthcare institutions, and the emergence of connected care are the key factors boosting industry growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."