- Home

- »

- Network Security

- »

-

IoT Security Market Size, Share And Growth Report, 2030GVR Report cover

![IoT Security Market Size, Share & Trends Report]()

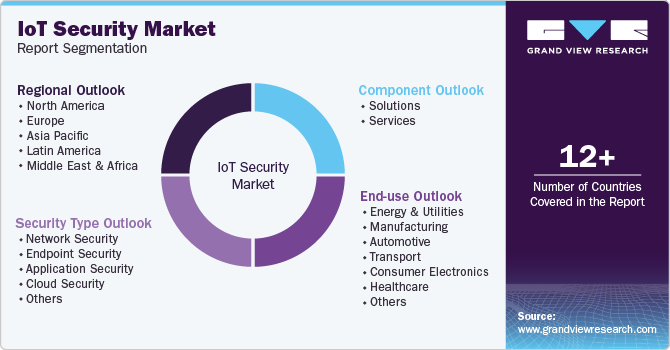

IoT Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Security Type (Network Security, Cloud Security), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-571-7

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Iot Security Market Summary

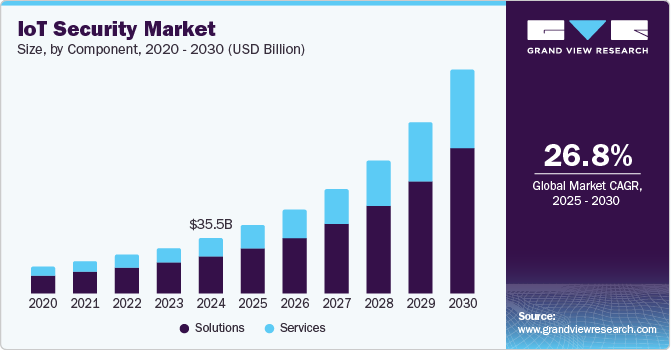

The global iot security market size was estimated at USD 35.50 billion in 2024 and is projected to reach USD 141.77 Billion by 2030, growing at a CAGR of 26.8% from 2025 to 2030. This is owing to the increasing incidence of cyber-attacks such as ransomware, DDoS attacks, and data breaches.

Key Market Trends & Insights

- The North America Internet of Things (IoT) security market dominated the global revenue with a 35.0% share in 2024.

- The U.S. IoT security market is expected to be driven by the high adoption of advanced technologies over the forecast period.

- By component, solutions dominated the market with a 67.5% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.50 Billion

- 2030 Projected Market Size: 141.77 Billion

- CAGR (2025-2030): 26.8%

- North America: Largest market in 2024

IoT devices have increasingly proliferated across various sectors, including healthcare and manufacturing, resulting in the potential attack surface for cybercriminals to expand significantly. This has heightened the need for robust security measures to protect sensitive data and ensure the integrity of connected systems.

Moreover, the growing adoption of IoT devices in consumer and industrial applications has propelled the market considerably. The convenience and efficiency offered by IoT technology have led to its widespread adoption. For instance, devices such as smart home systems, industrial sensors, and connected vehicles require sophisticated security solutions to prevent unauthorized access and data manipulation.

In addition, governments worldwide have recognized the importance of securing IoT infrastructure and have implemented stringent regulations to ensure compliance. These regulations often mandate the adoption of specific security standards and practices, thereby boosting the demand for IoT security solutions.

Furthermore, the advancement of technologies such as Artificial Intelligence (AI) and Machine Learning (ML) have been increasingly integrated into IoT security solutions to enhance their effectiveness. AI and ML can analyze vast data sets in real-time and identify potential threats and vulnerabilities more efficiently than traditional methods. This proactive approach to security is essential in mitigating risks associated with IoT devices.

Additionally, blockchain technology has contributed to the growth of the IoT security market as it provides a decentralized and secure way to manage data. By enabling secure and transparent transactions, blockchain can help prevent data tampering and unauthorized access, thereby enhancing the overall security of IoT networks.

Component Insights

Solutions dominated the market with a 67.5% share in 2024. With IoT devices becoming more prevalent, the complexity and frequency of cyber-attacks have escalated, requiring advanced security solutions. Components such as network, endpoint, and application security are crucial in protecting IoT ecosystems from these evolving threats. For instance, network security solutions are essential for safeguarding data as it travels across interconnected devices. Endpoint security is another critical component, as each connected device represents a potential entry point for cyber-attacks. These solutions protect individual devices from malware, unauthorized access, and other security breaches, thereby maintaining the overall security of the IoT network.

Services are expected to grow over the forecast period owing to the increasing complexity of IoT ecosystems. As organizations deploy more IoT devices, the need for services such as consulting, integration, and managed security services has grown significantly. These services help organizations design, implement, and manage robust security frameworks tailored to their specific IoT environments. For instance, consulting services are in demand, and businesses seek expert advice on securing their IoT deployments. These services provide critical insights into potential vulnerabilities and recommend best risk mitigation practices. Integration services ensure that various IoT devices and systems work seamlessly together while maintaining high-security standards. These services involve deploying security solutions that can integrate with existing IT infrastructure, ensuring comprehensive protection across all connected devices.

Security Type Insights

Network security dominated the market in 2024 due to the escalating frequency and severity of cyber-attacks. With the rising adoption of IoT devices, the potential attack surface for cybercriminals has expanded, leading to an increased need for robust network security solutions essential to protect sensitive data and maintain the integrity of connected systems.

Cloud security is expected to grow at a CAGR of 27.5% over the forecast period. Cloud computing offers scalability and flexibility that are crucial for managing the vast amounts of data generated by IoT devices. However, introducing new security challenges necessitates advanced network security measures to safeguard data as it moves between devices and cloud platforms. Moreover, governments worldwide have implemented stringent regulations that mandate adopting specific security standards and practices.

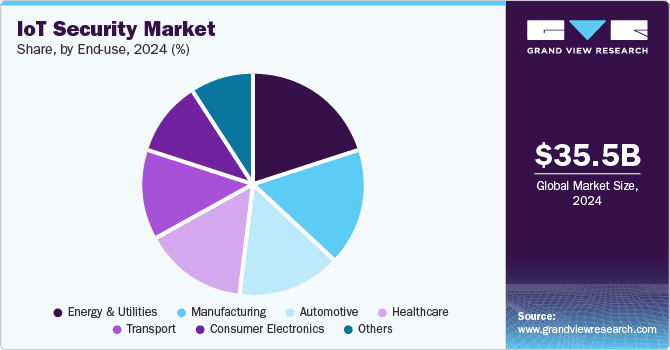

End-use Insights

Energy and utility held a dominant market share of 19.6% in 2024 due to the rising adoption of smart grids and smart meters. These technologies enable real-time monitoring and management of energy consumption, which is crucial for optimizing energy use and enhancing grid reliability. Moreover, the growing integration of renewable energy sources including solar and wind has resulted in increased complexity in managing and securing the grid. IoT security solutions are essential for protecting the data and systems that manage these distributed energy resources, ensuring their reliable and secure operation.

Consumer electronics are expected to emerge as the fastest growing segment over the forecast period. The growth can be attributed to the increasing demand for convenience and enhanced lifestyle. Consumers have increasingly adopted smart home devices, such as smart speakers, thermostats, and security cameras, which offer greater control and automation of home environments. This surge in smart device usage necessitates robust IoT security solutions to protect against potential cyber threats. In addition, the market witnessed a rising necessity for home monitoring, particularly from remote locations, leading to the ongoing adoption of connected security systems and cameras. These devices require strong security protocols to prevent unauthorized access and ensure the privacy and safety of users.

Regional Insights

The North America IoT security market dominated the global revenue with a 35.0% share in 2024 owing to the increased frequency and sophistication of cyber-attacks. The potential attack surfaces for cybercriminals has grown significantly with the number of connected devices. This has led to a heightened demand for robust IoT security solutions to protect sensitive data and ensure the integrity of connected systems.

U.S. IoT Security Market Trends

The U.S. IoT security market is expected to be driven by the high adoption of advanced technologies over the forecast period. The country is at the forefront of technological innovation, with widespread implementation of IoT devices across various sectors, including healthcare, manufacturing, and smart homes. This rapid adoption necessitates robust security measures to protect sensitive data and ensure the integrity of connected systems. In addition, the U.S. government has implemented stringent regulations to ensure the security of IoT devices and networks. Initiatives such as the “U.S. Cyber Trust Mark” help consumers identify secure IoT devices, promoting higher security standards across the industry.

Asia Pacific IoT Security Market Trends

The Asia Pacific IoT security market registered a 26.5% share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth can be credited to the rapid expansion of IoT applications across industries, including manufacturing, healthcare, smart cities, transportation, and retail, which led to a heightened need for security solutions to protect the growing number of connected devices from cyber threats. Moreover, the rollout of 5G networks in APAC accelerated the adoption of IoT devices, particularly in industrial automation, automotive, and healthcare. Additionally, the demand for IoT security solutions increased as more devices became interconnected through high-speed, low-latency networks.

Europe IoT Security Market Trends

The IoT security market in Europe accounted for a 26.0% share in 2024 owing to the increasing number of IoT devices across various sectors, including healthcare, manufacturing, and smart cities. This proliferation of connected devices necessitates robust security measures to protect sensitive data and ensure the integrity of interconnected systems.

Key IoT Security Company Insights

The global Internet of Things (IoT) security market is fragmented featuring key players such as Microsoft, Amazon Web Services, Inc., Google, and others.

- Microsoft’s cloud platform, Microsoft Azure, offers a comprehensive suite of services, including computing, analytics, storage, and networking. Azure is particularly noted for its integration with other Microsoft products, including Office 365 and Dynamics 365, providing a seamless business experience.

Key IoT Security Companies:

The following are the leading companies in the IoT security market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Amazon Web Services, Inc.

- IBM

- Intel Corporation

- Cisco Systems, Inc.

- Telefonaktiebolaget LM Ericsson

- Thales TCT

- Allot

- Atos SE

Recent Developments

-

In September 2024, Oracle and AWS introduced Oracle Database@AWS, enabling customers to utilize Oracle Autonomous Database on dedicated infrastructure and Oracle Exadata Database Service within AWS. This offering ensures a seamless experience between AWS and Oracle Cloud Infrastructure (OCI), simplifying database management, billing, and customer support.

IoT Security Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.23 billion

Revenue forecast in 2030

USD 141.77 billion

Growth Rate

CAGR of 26.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, security type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Netherlands, China, Japan, India, Australia, South Korea, Brazil, Africa, Saudi Arabia, UAE

Key companies profiled

Microsoft; Amazon Web Services, Inc.; Google; IBM; Intel Corporation; Cisco Systems, Inc.; Telefonaktiebolaget LM Ericsson; Thales TCT; Allot; Atos SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IoT Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT security market report based on component, security type, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Services

-

-

Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Network Security

-

Endpoint Security

-

Application Security

-

Cloud Security

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy and Utilities

-

Manufacturing

-

Automotive

-

Transport

-

Consumer Electronics

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.