- Home

- »

- Medical Devices

- »

-

Intrauterine Devices Market Size, Share, Growth Report 2030GVR Report cover

![Intrauterine Devices Market Size, Share & Trends Report]()

Intrauterine Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Hormonal IUD, Copper IUD), By Distribution Channel (Hospital, Gynecology Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-383-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intrauterine Devices Market Summary

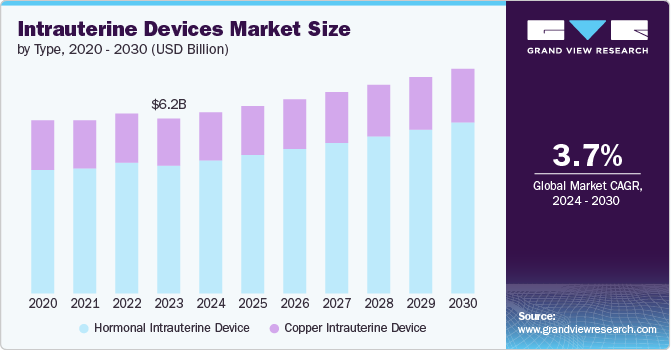

The global intrauterine devices market size was estimated at USD 6,248.1 million in 2023 and is projected to reach USD 8,020.6 million by 2030, growing at a CAGR of 3.7% from 2024 to 2030. The growing awareness among people about contraception has led to an increase in the number of campaigns, improved access to information, and educational programs.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Spain is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, hormonal intrauterine device accounted for a revenue of USD 4,560.7 million in 2023.

- Hormonal Intrauterine Device is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 6,248.1 Million

- 2030 Projected Market Size: USD 8,020.6 Million

- CAGR (2024-2030): 3.7%

- Asia Pacific: Largest market in 2023

These factors drive the usage of intrauterine devices (IUD), which are considered effective and reliable contraceptive methods. Moreover, there is a growing number of initiatives from various governments aiming to promote family planning, improve women's healthcare access facilities, and reduce unintended pregnancies, contributing to the market's growth.

The development of innovative products drives the market's growth. IUDs include shape memory alloy components, preventing malposition and uterine wall perforation. IUDs that limit inferior migration within the uterus are also contributing to this growth. This ensures effectiveness and highlights the correlation between education and parity with using these products. Hence, companies invest in R&D for innovative products to stay ahead of the competition. For instance, in May 2023, Sebela Pharmaceuticals announced positive Phase 3 study results for its investigational Copper 175 mm² IUD. This next-generation, low-dose, hormone-free copper IUD has achieved a 99% efficacy rate over three years, with a Pearl Index of 0.96. The study, conducted at 42 centers across the U.S., found that the IUD was well-tolerated, with a reported 98.8% placement success rate. Both clinicians and participants provided positive feedback regarding the IUD.

Government initiatives promoting family planning and reducing unintended pregnancies is expected to boost the market growth. These initiatives increase awareness, provide financial support, improve healthcare access, and implement favorable policies. Educational campaigns and subsidies make IUDs more affordable and accessible, while enhanced healthcare services ensure widespread availability. Training programs for healthcare professionals further support the adoption of IUDs by ensuring high-quality insertion and counseling services, contributing to the market’s growth over the forecast period.

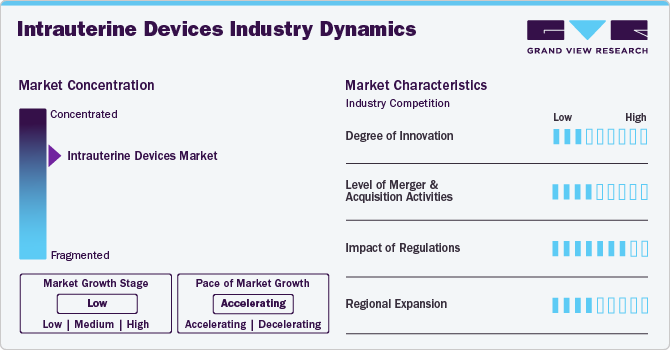

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the industry is consolidated, with the presence of few major manufacturers dominating the industry. The degree of innovation is moderate, and the level of mergers & acquisitions activities is moderate. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

The degree of innovation in the industry is moderate. Recent developments include the introduction of slimmer IUDs, such as Skyla, designed to be more comfortable and easier to insert than traditional models. This innovation aims to increase adoption rates, especially among women. However, stringent regulatory requirements slow down the development of new products. Cost constraints also prevent the adoption of expensive innovative solutions, and extensive clinical trials are necessary to prove the safety and effectiveness of new products.

The level of mergers & acquisitions in the industry is moderate. This is due to the industry's stable and mature nature, which limits the potential for disruptive changes that typically drive M&A activity. In addition, the moderate pace of innovation and the presence of established players with well-defined market positions reduce the trend for acquisitions aimed at gaining a competitive advantage.

The impact of regulations on the industry is highdue to strict requirements for safety, efficacy, and manufacturing standards governing the development and approval of medical devices. These regulations ensure that new products undergo rigorous testing and adhere to strict guidelines, which can significantly affect time-to-market, development costs, and overall industry dynamics. Compliance with these regulations is crucial for gaining industry access and maintaining consumer trust, thereby substantially impacting the industry.

The level of regional expansion in the industry is moderate due to varying levels of industry maturity, regulatory requirements, and healthcare infrastructure across different regions. While there is growing demand in emerging markets, challenges such as differing regulatory standards, local healthcare practices, and varying levels of awareness and access to family planning services can limit rapid expansion. In addition, established markets with mature infrastructure and high competition constrain the pace of growth in new regions.

Type Insights

Based on type, the hormonal IUD segment led the market with the largest revenue share of 72.99% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The growth is driven by its high efficacy in preventing pregnancy, additional benefits such as reduced menstrual bleeding, improved management of menstrual symptoms and increasing awareness among users about these advantages. Healthcare providers frequently recommend hormonal IUDs for their dual benefits of contraception and menstrual symptom relief, while ongoing innovations and advancements in technology continue to attract consumers seeking the latest and most effective options.

The copper IUD segment is anticipated to grow at a significant CAGR over the forecast period. The growth of the segment is driven by the popularity of Copper IUDs as a non-hormonal contraceptive option, with highly effective in preventing pregnancy and increasing demand for non-hormonal alternatives. Copper IUDs are suitable for women with hormonal sensitivities, and there is growing awareness and preference for non-hormonal methods. Furthermore, the expansion of healthcare coverage and insurance reimbursement is also contributing to the growth of this segment.

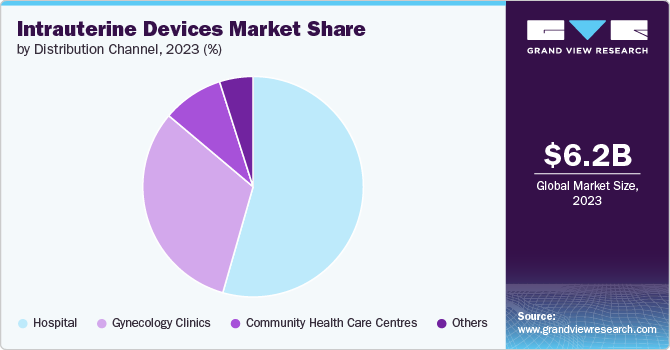

Distribution Channel Insights

Based on distribution channel, the hospital segment led the market with the largest revenue share of 54.44% in 2023. The increased adoption of IUDs due to their high efficacy and long-term contraceptive benefits, coupled with hospitals' ability to provide comprehensive family planning services, including counseling and insertion. Enhanced integration of healthcare services within hospitals, expanding insurance coverage for IUDs, and the presence of specialized staff trained in IUD management further boost demand and drive growth in this segment.

The gynecology clinics segment is anticipated to grow at the fastest CAGR over the forecast period, driven by the increasing preference for specialized, personalized care and counseling that gynecology clinics offer. These clinics provide targeted expertise in contraceptive options, including IUDs, which attract patients seeking dedicated reproductive health services. In addition, the rising demand for long-term contraceptive methods and the ability of gynecology clinics to offer comprehensive care, including insertion and follow-up, further fuels the segment’s growth.

Regional Insights

The intrauterine devices (IUD) market North America is expected to witness at a significant CAGR over the forecast period. This is due to the increasing acceptance and awareness of IUDs as a reliable contraceptive option, supportive government initiatives and policies promoting reproductive health and family planning, and a growing emphasis on women's healthcare and access to contraception. In addition, the availability of advanced IUD options, technological advancements, comprehensive insurance coverage, high healthcare expenditure, and a rising preference for long-acting reversible contraception further drive market growth in the region.

U.S. Intrauterine Devices Market Trends

The intrauterine devices (IUD) market in U.S. held the largest share in 2023 in the North America, owing to the growing usage of IUDs and increasing awareness of the benefits of these devices among the women population of the U.S. In addition, government policies and programs, such as Title X and the Affordable Care Act, which mandate insurance coverage for contraceptive methods, have significantly improved access to and affordability.

Asia Pacific Intrauterine Devices Market Trends

Asia Pacific dominated the intrauterine devices (IUD) market with the largest revenue share of 32.08% in 2023. A rapidly growing population, increased demand for effective contraception, government initiatives promoting family planning, and expanding healthcare infrastructure are expected to drive the market growth. Rising awareness and acceptance of modern contraception, women's empowerment, urbanization, and changing lifestyles are expected to drive the market growth.

The Chinaintrauterine devices (IUD) marketheld the largest share of Asia Pacific in 2023 driven by the rapidly growing population seeking effective contraception methods, and government initiatives aimed at promoting family planning. Moreover, China's expanding healthcare infrastructure makes it easier for people to access various contraceptive methods, including IUDs.

The intrauterine devices (IUD) marketin Indiais expected to witness at a significant CAGR over the forecast period.The Indian government prioritizes reducing maternal mortality and unintended pregnancies. The Health Mission India Programs like ‘Mission Parivar Seva’ promote IUDs as a safe and effective birth control method. In addition to address accessibility concerns, the Indian government launched the IUD insertion training program (IUD-STP) recently. This program aims to train more healthcare providers to perform insertions, particularly in rural areas.

Europe Intrauterine Devices Market Trends

The intrauterine devices (IUD) market inEuropeis anticipated to grow at a significant CAGR over the forecast period, due to the increasing disposable income in many European countries, which allows more women to access and afford IUDs. In addition, the cost-effectiveness of IUDs compared to other contraceptive methods, such as hormonal pills or IVF, makes them an attractive option for many.

The UK intrauterine devices (IUD) market is expected to grow at a significant CAGR over the forecast period, due to a rise in public awareness and education about IUD benefits, supportive government policies and family planning initiatives, and improved integration of services within the National Health Service (NHS). Comprehensive insurance coverage under the NHS enhances affordability, while a rising preference for long-acting reversible contraceptives and the availability of advanced IUD options further fuel market expansion.

The intrauterine devices (IUD) marketin Germanyheld a significant market share of Europe in 2023, owing to the trend towards delayed pregnancies and birth spacing. Many women and couples in Germany are choosing to postpone childbearing for various reasons, including career advancement, financial stability, or personal preference. Moreover, there is growing awareness among the population about the benefits of using IUDs, such as their high efficacy, minimal maintenance, and long duration of action compared to other contraceptive methods.

Latin America Intrauterine Devices Market Trends

The intrauterine devices (IUD) marketin Latin Americais anticipated to grow at a significant CAGR during the forecast period. Governments and healthcare organizations are prioritizing access to modern contraception methods, including IUDs, to improve maternal health outcomes. Campaigns and internet information are raising awareness about IUDs as a viable option, leading to potential market growth. However, limited access to skilled healthcare providers remains a market growth barrier, particularly in rural regions.

The Brazilintrauterine devices (IUD) marketis anticipated to grow at a significant CAGR during the forecast period, due to the improved healthcare systems providing better access to contraceptives, as well as the increasing awareness of modern contraception methods among the population.

Middle East Intrauterine Devices Market Trends

The intrauterine devices (IUD) market inMiddle East & Africais expected to grow at a significant CAGR over the forecast period. The market growth is driven by increasing awareness of modern contraceptive methods, rising healthcare investments, and supportive government policies aimed at family planning and reproductive health. Cultural shifts towards smaller family sizes and greater acceptance of contraception are further contributing to the market growth.

The South Africaintrauterine devices (IUD) marketis anticipated to grow at a significant CAGR during the forecast period, due to the advancements in the healthcare sector that improve access to contraceptives. In addition, there's a rising awareness about modern methods of contraception among the population, which contributes to the market's expansion.

Key Intrauterine Devices Company Insights

The market is concentrated, with major players operating in this space and a rise in investment in R&D by manufacturers is driving the market growth. To stay ahead of the competition, companies are adopting various strategies such as collaborations, acquisitions, partnerships, and launching new devices.

Key Intrauterine Devices Companies:

The following are the leading companies in the intrauterine devices market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Bayer AG

- CooperSurgical Inc.

- DKT International

- EUROGINE, S.L.

- Mona Lisa N.V.

- OCON Medical Ltd.

- Pregna International Limited.

- Prosan International BV

- SMB Corporation of India

Recent Developments

-

In August 2022, Bayer AG received FDA approval for a supplemental new drug application (sNDA) for Mirena IUD, extending its period of use to up to eight years. This approval is intended to ensure that women have access to the contraceptive options needed at various stages of their reproductive life

-

In January 2024, Medicines360, a global nonprofit in women's health, and DKT WomanCare, a global distributor of contraceptive products, partnered to expand access to AVIBELA. AVIBELA is a cost-effective, high-quality hormonal IUD with over 99% effectiveness. This collaboration aims to increase awareness, accessibility, and usage of this highly effective contraceptive option

-

In June 2023, Pregna International Limited, a company specializing in women's reproductive health, received an initial private equity investment of USD 16 million (₹130 crore) from India Life Sciences Fund III (ILSF III), managed by the private equity firm InvAscent. This investment aims to fuel Pregna's growth and empower them to address the evolving needs of women globally

Intrauterine Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.47 billion

Revenue forecast in 2030

USD 8.02 billion

Growth rate

CAGR of 3.66% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Bayer AG; CooperSurgical Inc.; DKT International; EUROGINE, S.L.; Mona Lisa N.V.; OCON Medical Ltd.; Pregna International Limited.; Prosan International BV; SMB Corporation of India

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intrauterine Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intrauterine devices (IUD) market report based on type, distribution channel, and regions.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal IUD

-

Copper IUD

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Gynecology Clinics

-

Community Health Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Intrauterine Devices (IUD) market size was estimated at USD 6.25 billion in 2023 and is expected to reach USD 6.47 billion in 2024.

b. The global Intrauterine Devices (IUD)market is expected to grow at a compound annual growth rate of 3.66% from 2024 to 2030 to reach USD 8.02 billion by 2030.

b. Asia Pacific region dominated the Intrauterine Devices (IUD) market with a share of 32.98% in 2023, owing to the increasing focus on women's healthcare which could lead to increased promotion of various contraceptive methods, including IUDs.

b. Some key players operating in the Intrauterine Devices (IUD) market include AbbVie Inc., Bayer AG, CooperSurgical Inc., DKT International, EUROGINE, S.L., Mona Lisa N.V., OCON Medical Ltd., Pregna International Limited., Prosan International BV, and SMB Corporation of India.

b. Key factors that are driving the Intrauterine Devices (IUD) market growth include government and NGO initiatives to promote IUD methods, increasing prevalence of unwanted pregnancies and rising number of women with unment contraceptive needs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.