- Home

- »

- Medical Devices

- »

-

Intravenous Catheters Market Size, Industry Report, 2030GVR Report cover

![Intravenous Catheters Market Size, Share & Trends Report]()

Intravenous Catheters Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Peripheral Catheters, Midline Peripheral Catheters, Central Venous Catheters), By End-use (Hospital Pharmacies, Retail Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-165-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intravenous Catheters Market Summary

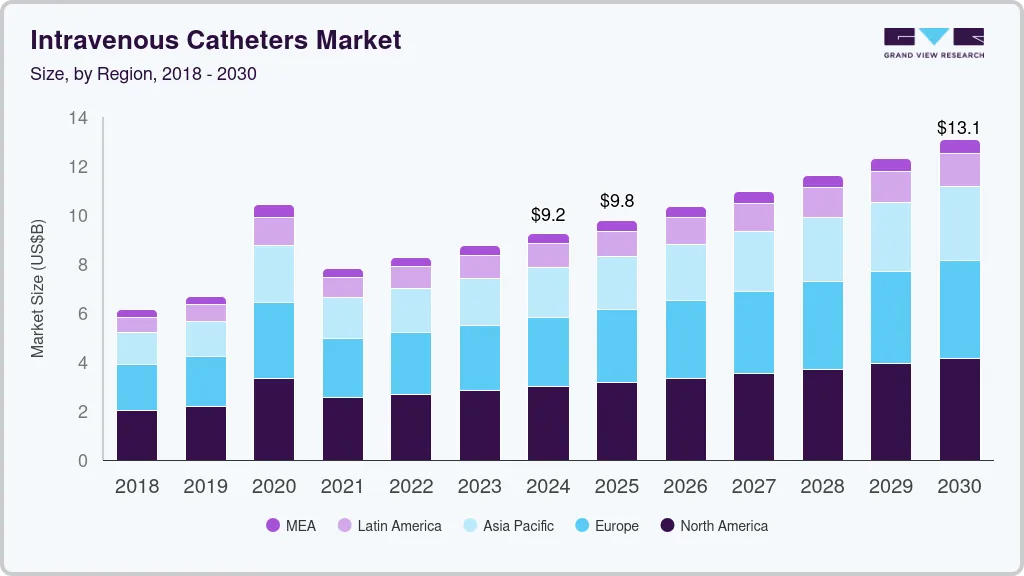

The global intravenous catheters market size was estimated at USD 9.24 billion in 2024 and is projected to reach USD 13.07 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The expansion can be attributed to the increasing aging population, the prevalence of chronic diseases, and the rising need for efficient healthcare systems and modern medical tools.

Key Market Trends & Insights

- North America intravenous catheter market accounted for the largest revenue share of 34.8%, in the global market in 2024.

- The intravenous catheter market in U.S. accounted for a dominant share in North America in 2024.

- Based on type, the peripheral catheters segment dominated with the largest revenue share of 41.1% in 2024.

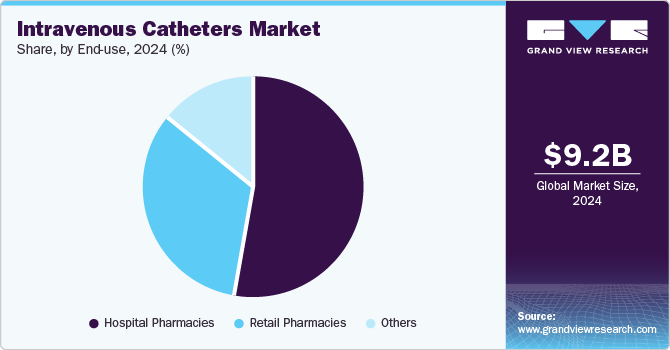

- Based on end use, the hospital pharmacies segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.24 Billion

- 2030 Projected Market Size: USD 13.07 Billion

- CAGR (2025 - 2030): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Intravenous (IV) catheters can deliver drugs, fluids, and nutrients directly into the bloodstream, which helps patients who require immediate and ongoing treatment. The rising number of surgical procedures and chronic conditions such as diabetes, cancer, and cardiovascular diseases frequently require long-term IV therapy, boosting the demand for IV catheters.Smart IV therapy and IV catheter systems, which include technology to monitor and control IV infusions that provide real-time data and analytics to improve patient monitoring and clinical decision-making, have come in demand to minimize complications such as catheter-related infections and thrombosis, which are significant concerns in IV therapy. So intravenous catheters worldwide are expected to be fueled by the demand, growing incidence of chronic diseases, innovative IV catheter solutions, technological advancements, and focus on patient safety and treatment quality.

The increasing number of surgical procedures also adds to the need for their demand; with continuous advancements and innovations in the healthcare sector to improve patient outcomes and operational efficiencies, safety-engineered catheters and antimicrobial coatings are being developed for advanced medical devices, including IV catheters.

Type Insights

Based on type, the peripheral catheters segment dominated with the largest revenue share of 41.1% in 2024, owing to their applications and adaptability in various clinical practices. The peripheral catheters help deliver fluids, drugs, and blood products to the body with minimal complication risks, making them demanding in hospitals, outpatient facilities, and emergency care. They are easy to insert and remove, making them popular since they allow quick venous system access, especially for patients requiring short term therapy. Moreover, peripheral catheters are in demand due to advancements, including safety-engineered designs, reducing the risk of needle injuries and catheter-related infections.

The central venous catheters (CVC) segment is expected to advance at the fastest CAGR of 6.5% over the forecast period due to their increased adoption in healthcare. Patients who need long-term intravenous access, such as chemotherapy, total parenteral nutrition, or hemodialysis, require CVCs as they can deliver fluids and nutrients into central venous circulation with efficient and quick treatment results. In addition, the need for CVCs is driven largely by a growing aging population with chronic diseases, which require advanced vascular solutions, such as ultrasound-guided insertion techniques, and safety features, which minimize the risk and infections.

End-use Insights

Based on end use, the hospital pharmacies segment accounted for the largest revenue share in 2024, as they are the primary provider of IV therapies that require precise administration of medications, fluids, and nutrients. The need for catheters has increased due to rising chronic diseases, which require long-term treatment; further advancements, including safer and more efficient catheters, have been adopted in the hospital sector, enhancing patient outcomes and reducing complications. The healthcare sector has seen large investments to improve healthcare services, eventually leading to significant investments in enhancing hospital pharmacy services.

The other distribution channels, including online portals and drugstores, are estimated to witness significant growth over the forecast period due to changing dynamics as patients require more accessible and convenient medical supplies, which drug stores and online platforms provide; patients with long-term illnesses requiring regular infusions or medications administered via IV. Moreover, consumer behavior has transformed with the rise in e-commerce, which makes it easier for patients to get supplies due to advantages such as 24/7 availability and easy home delivery.

Regional Insights

North America intravenous catheter market accounted for the largest revenue share of 34.8%, in the global market in 2024 due to its well-established healthcare infrastructure, advanced medical facilities, and high-standard healthcare. Healthcare providers frequently use intravenous catheters for various treatments, including fluid replacement and blood transfusions. In addition, the presence of key players such as BD and Medtronic in the region fosters advancements in catheter technology, including antimicrobial coatings and improved designs.

U.S. Intravenous Catheters Market Trends

The intravenous catheter market in U.S. accounted for a dominant share in North America in 2024, with an advanced healthcare infrastructure, specialized clinics, and healthcare providers. U.S. companies have significant investments in medical technology and R&D, leading to new catheter design and functionality, innovations that improve clinical outcomes, reduce risks such as infections and occlusions, and make it appealing to healthcare providers. Moreover, regulatory support also plays an important role in the U.S. market, with established precise standards for the approval of medical devices by the Food and Drug Administration (FDA), ensuring high-quality products are in the market.

Asia Pacific Intravenous Catheters Market Trends

The intravenous catheter market in Asia Pacific is expected to witness the fastest CAGR of 6.6% from 2025 to 2030, driven by a rapid increase in chronic diseases and lifestyle-related conditions, becoming more common due to dietary changes, urbanization, and the aging population. Countries such as India, China, and Indonesia face a rise in health challenges and a surge in intravenous therapy demand. In addition to telemedicine, e-commerce platforms have led to market expansion as it is easier for healthcare providers and patients to access medical supplies, improving convenience and reducing purchasing time.

The intravenous catheter market in China held a significant revenue share in Asia Pacific due to the rapid growth of healthcare infrastructure, increasing government support for healthcare initiatives, and rising chronic diseases. Initiatives expanding healthcare insurance coverage and reducing out-of-pocket patient expenses have made medical care more accessible. Regulatory reforms have encouraged both domestic and international manufacturers to enter the market.

Europe Intravenous Catheters Market Trends

Europe is anticipated to contribute substantially to the global market over the forecast period, driven by improved healthcare infrastructure and the European Medicines Agency and other national regulatory bodies that enforce strict standards for the safety and efficacy of medical devices. In addition, increasing incidence of urinary diseases and surgeries, increasing rates of cardiovascular and chronic diseases, evolving healthcare practices, and demographic changes contribute to the growth of the IV catheters market.

The UK intravenous catheters market accounted for the largest revenue share of the regional market in 2024, aided by a strong foothold in the European central venous catheter market, with technological innovations and a preference for enhanced outpatient care.

Key Intravenous Catheters Company Insights

Key companies involved in the intravenous catheter market include Mediplus India Ltd, Sterimed Group, Medilivescare Manufacturing Pvt. Ltd., Angiplast Pvt Ltd., Medtronic Boston Scientific Corporation, Teleflex Incorporated, B. Braun SE, BD, Terumo Medical Corporation, and Nipro Europe Group Companies.

Key Intravenous Catheters Companies:

The following are the leading companies in the intravenous (IV) catheters market. These companies collectively hold the largest market share and dictate industry trends.

- Mediplus India Ltd

- Sterimed Group

- Medilivescare Manufacturing Pvt. Ltd.

- Angiplast Pvt Ltd.

- Medtronic

- Boston Scientific Corporation

- Teleflex Incorporated

- B. Braun SE

- BD

- Terumo Medical Corporation

- Nipro Europe Group Companies

Recent Developments

-

In April 2024, BD launched "UltraTouch" for the blood collection process, which reduces patient pain and discomfort with a single prick success, which is likely to lessen needle phobia related to first-time blood collection, with accurate test results and no treatment delays which patient expects.

-

November 2023, Medtronic announced the FDA-approved ‘Symplicity Spyral’ ‘renal denervation (RDN) system, also called the "Symplicity," a minimally invasive device to treat hypertension.This device targets the renal nerves, essential for controlling blood pressure. This system seeks to interfere with the hyperactive sympathetic nervous system linked to resistant hypertension by sending radiofrequency energy to these nerves.

Intravenous Catheters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.78 billion

Revenue forecast in 2030

USD 13.07 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, End-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Mediplus India Ltd, Sterimed Group, Medilivescare Manufacturing Pvt. Ltd., Angiplast Pvt Ltd., Medtronic Boston Scientific Corporation, Teleflex Incorporated, B. Braun SE, BD, Terumo Medical Corporation, Nipro Europe Group Companies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intravenous Catheters Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intravenous catheters market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Catheters

-

Midline Peripheral Catheters

-

Central Venous Catheters

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intravenous catheters market was valued at USD 9.24 billion in 2024 and is expected to reach USD 9.78 billion in 2025.

b. The global intravenous catheters market is estimated to expand at a compounded annual growth rate of 6.0% from 2025 to 2030 to reach USD 13.07 billion by 2030.

b. In 2024, peripheral catheters segment dominated the intravenous catheters with a market share of around 41.1%. Peripheral catheters (PIVCs) are easy to install and remove. PIVCs offer a more comfortable and minimally invasive method of obtaining therapy, which can contribute to an increase in patient satisfaction.

b. Some prominent players in the intravenous catheters market include Mediplus India Ltd, Sterimed Group, Medilivescare Manufacturing Pvt. Ltd., Angiplast Pvt Ltd., Medtronic Boston Scientific Corporation, Teleflex Incorporated, B. Braun SE, BD, Terumo Medical Corporation, Nipro Europe Group Companies

b. The demand for intravenous catheters is anticipated to upsurge owing to the increasing regulatory approval for IV catheters, rising incidence of various chronic disorders such as neurological, cardiovascular, and urological disorders along with growing elderly population. In addition, the growing awareness for the catheter-related bloodstream infection (CRBSI) control among the population will further increase the demand for intravenous catheters over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.