- Home

- »

- Electronic Devices

- »

-

IoT Microcontroller Market Size, Share, Industry Report, 2030GVR Report cover

![IoT Microcontroller Market Size, Share & Trends Report]()

IoT Microcontroller Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (8 Bit, 16 Bit, 32 Bit), By Application (Smart Home, Consumer Electronics, Industrial Automation), By Region (North America, Europe), And Segment Forecasts

- Report ID: 978-1-68038-706-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IoT Microcontroller Market Size & Trends

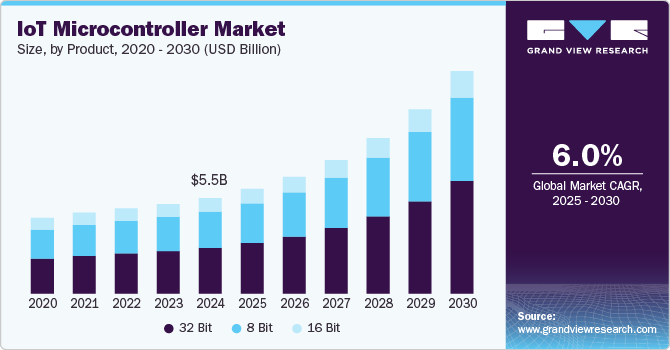

The global IoT microcontroller market size was estimated at USD 5.55 billion in 2024 and is expected to grow at a CAGR of 16.3% from 2025 to 2030. The market is experiencing robust growth, driven by the increasing application of IoT devices in both consumer and industrial applications. A key trend fueling this expansion is the demand for microcontrollers with enhanced power efficiency, processing capability, and connectivity features that support a wide range of IoT applications, from smart home devices to industrial automation systems. The rise of edge computing also plays a pivotal role, as manufacturers seek microcontrollers that enable real-time processing and data analysis at the device level, reducing latency and network dependency.

In the industrial domain, the adoption of the IoT microcontrollers industry is heavily influenced by the ongoing digital transformation initiatives within manufacturing, energy, and utility sectors. Industrial IoT applications rely on robust, high-performance microcontrollers to monitor and manage equipment, automate processes, and collect critical operational data. These microcontrollers are essential for smart factory implementations, predictive maintenance, and real-time asset tracking, creating a high demand for processors that can handle complex computations and support multiple sensor connections. This shift presents opportunities for manufacturers to innovate in designing microcontrollers that cater to specific industrial needs, helping drive productivity and reduce operational costs.

Moreover, advancements in edge computing are accelerating the IoT microcontrollers industry growth. As more companies shift data processing closer to the source to reduce latency and enhance responsiveness, microcontrollers that enable edge processing and local data storage have become crucial. These IoT microcontrollers help streamline data management by allowing devices to make quick decisions without relying on centralized cloud systems, which is particularly valuable in scenarios where low latency is critical, such as healthcare monitoring, autonomous vehicles, and industrial automation. This trend creates opportunities for microcontroller manufacturers to differentiate through innovation in computing capabilities and embedded security features, allowing them to capitalize on the shift towards decentralized processing.

Security remains a major concern, as IoT devices are vulnerable to cyber threats, which can compromise data integrity and user privacy. As a result, there is a growing focus on integrating advanced security protocols directly into IoT microcontrollers, offering features such as data encryption, secure boot, and hardware-based protection against tampering. This demand for secure microcontrollers is driven by both consumer and enterprise sectors, as organizations seek to prevent data breaches and adhere to compliance requirements.

Regulatory frameworks and laws are also shaping the IoT microcontroller market, particularly as governments and regulatory bodies worldwide implement stringent standards to protect data and ensure device interoperability. Regions such as the European Union have established regulations under the General Data Protection Regulation (GDPR) and the Radio Equipment Directive, setting requirements for data privacy, security, and compatibility in IoT devices. Additionally, the U.S. has introduced initiatives to standardize IoT device security, impacting how microcontrollers are designed and integrated. Compliance with these regulations is essential for market players, creating a need for investment in secure and compliant microcontroller solutions.

Product Insights

The 32-bit product segment accounted for the largest market share of over 48% in 2024. The segment is witnessing significant growth due to the product’s advanced processing capabilities and versatility, making it suitable for complex IoT applications requiring real-time data processing, such as industrial automation, smart healthcare, and connected vehicles. A primary driver here is the demand for more robust processing power and memory to support advanced IoT functions like machine learning and data analytics. As industries prioritize more sophisticated IoT solutions, 32-bit microcontrollers enable enhanced device functionality and connectivity, positioning this segment for rapid growth. Opportunities in this segment are further supported by advancements in IoT ecosystems, as businesses look to integrate high-performance controllers to drive digital transformation in industries with complex IoT requirements.

The 8 bit segment is expected to grow at a significant CAGR during the forecast period. The segment is experiencing steady growth, primarily driven by cost efficiency and low-power consumption, making it ideal for basic IoT applications. A key driver for this segment is its suitability for simpler devices such as smart meters, wearables, and basic sensors where processing requirements are minimal. Additionally, manufacturers are increasingly focusing on enhancing the efficiency and integration of 8-bit controllers to meet the needs of low-cost IoT devices in emerging markets. Opportunities in this segment also lie in smart homes and consumer electronics, where 8-bit microcontrollers can efficiently perform specific tasks, promoting the adoption of IoT in budget-sensitive applications.

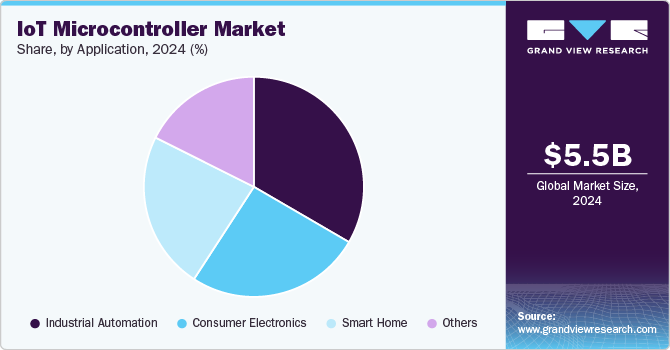

Application Insights

The industrial automation segment accounted for the largest market share of over 33% in 2024. IoT microcontrollers are driving the segment growth as industries embrace automation for operational efficiency and data-driven insights. The demand for real-time monitoring and control across manufacturing processes is spurring the adoption of IoT microcontrollers, which enable precise control over machinery, predictive maintenance, and streamlined workflows. Increasing investments in smart factories and Industry 4.0 are further supporting growth by opening opportunities to implement robust IoT-enabled systems. Additionally, the integration of IoT microcontrollers in industrial settings supports energy efficiency and productivity improvements, positioning this segment as a vital component of the larger industrial transformation.

The smart home segment is expected to grow at a significant rate during the forecast period. The Smart Home segment is experiencing significant growth as IoT microcontrollers industry become central to interconnected home environments, fueling advancements in device compatibility, energy management, and enhanced security. A primary driver is the increasing consumer demand for convenience and personalized automation, which IoT microcontrollers enable by connecting appliances, lighting, and HVAC systems to unified platforms. Opportunities are expanding as IoT microcontrollers become more affordable and adaptable, enabling seamless integration across various smart devices. Moreover, rising awareness of energy efficiency and the convenience of remote home monitoring further drive the adoption of IoT solutions in the residential sector, strengthening this segment’s growth trajectory

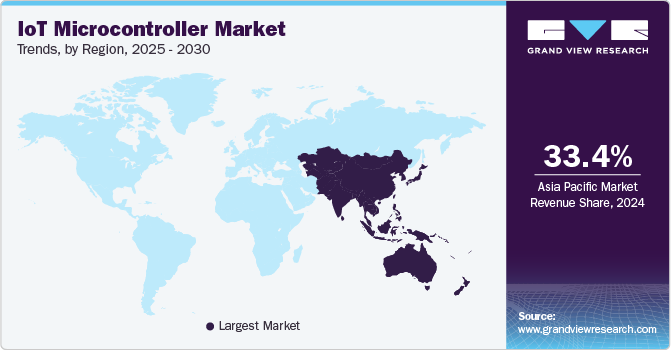

Regional Insights

In the IoT microcontroller industry North America held a market share of over 29% in 2024. The market growth is propelled by the rapid adoption of IoT technologies in sectors like healthcare, automotive, and industrial automation. Major investments in smart city projects and an established tech ecosystem enable the widespread integration of IoT microcontrollers in connected devices. The growth of edge computing and increased R&D investments in IoT technologies are also creating new opportunities, especially in real-time data processing and enhanced network security. The presence of key industry players in the U.S. drives innovation, positioning North America as a pivotal market for IoT advancements.

U.S. IoT Microcontroller Market Trends

The IoT microcontroller industry in the U.S. is growing significantly at a CAGR of 14.6% from 2025 to 2030. With a robust R&D landscape, the U.S. leads in IoT innovation, creating opportunities in data security and analytics applications. Additionally, government and private sector investments in smart infrastructure support sustained growth, positioning the U.S. as a critical market for IoT technology.

Asia Pacific IoT Microcontroller Market Trends

The IoT microcontroller industry in Asia Pacific is growing significantly at a CAGR of 16.2% from 2025 to 2030. The Asia Pacific IoT microcontroller industry is experiencing rapid growth, primarily driven by extensive IoT adoption in consumer electronics, manufacturing, and smart cities. China and India lead the region with strong government support for digital infrastructure and initiatives to boost IoT in sectors such as transportation and public safety. With a vast manufacturing base and high consumer demand for smart devices, opportunities for IoT microcontrollers are expanding. The region’s drive towards 5G deployment further accelerates IoT connectivity, making Asia Pacific a significant growth area for IoT advancements.

The China IoT microcontroller market is growing swiftly due to the government’s emphasis on smart city projects and the industrial internet. China’s large-scale manufacturing capabilities and focus on digital infrastructure foster rapid IoT integration across sectors. Opportunities abound as the country invests in IoT for public services, energy management, and urban transportation. With the advancement of 5G networks, China is positioned to lead in IoT connectivity, driving demand for powerful microcontrollers to support these ambitious initiatives.

The IoT microcontroller market in India is driven by its digital transformation initiatives, especially in smart agriculture, urban development, and remote healthcare. The government’s focus on ‘Digital India’ and investments in 5G infrastructure create a conducive environment for IoT adoption, fueling IoT microcontrollers industry growth. Opportunities in agriculture and healthcare IoT offer significant growth potential as IoT solutions improve efficiency and accessibility. With a growing tech ecosystem and supportive policies, India is rapidly integrating IoT microcontrollers in key sectors.

Europe IoT Microcontroller Market Trends

The IoT microcontroller industry in Europe is growing significantly at a CAGR of 17.4% from 2025 to 2030. The Europe market is expanding as the region emphasizes energy efficiency and regulatory compliance across industries. Growth in the automotive sector, particularly in electric and autonomous vehicles, is boosting the demand for high-performance IoT microcontrollers capable of supporting complex functions. Additionally, government initiatives for sustainable development encourage the adoption of IoT solutions in energy and environmental monitoring, opening new opportunities for IoT microcontroller applications. Europe’s focus on digital transformation and industry standards further strengthens its IoT ecosystem, supporting steady market growth.

The IoT microcontroller market in the UK is witnessing increased IoT microcontroller adoption driven by advancements in smart city infrastructure and digital healthcare initiatives. As the country prioritizes IoT-enabled solutions for energy management and healthcare modernization, the demand for advanced microcontrollers grows.

The Germany IoT microcontroller market is propelled by its industrial manufacturing strength, with high demand for IoT integration in production and logistics. As Industry 4.0 continues to reshape German manufacturing, IoT microcontrollers play a critical role in enabling smart machinery and predictive maintenance.

Key IoT Microcontroller Company Insights

Some of the key players in the IoT microcontroller industry include Broadcom; Espressif Systems (Shanghai) Co., Ltd; Holtek Semiconductor Inc.; Infineon Technologies; Microchip Technology Inc.; Nuvoton Technology Corporation; NXP Semiconductors; Silicon Laboratories; STMicroelectronics; Texas Instruments Incorporated; and Renesas Electronics Corporation. Companies in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, STMicroelectronics announced a strategic collaboration with Qualcomm Technologies International to enhance industrial and consumer IoT solutions with edge AI capabilities. This partnership will integrate Qualcomm’s advanced AI-powered wireless connectivity technologies, starting with a Bluetooth, Wi-Fi, Thread combo system-on-a-chip, with ST’s leading microcontroller ecosystem. Developers will benefit from seamless connectivity and software integration into STM32 general-purpose MCUs, enabling rapid adoption through ST’s extensive global sales channels.

-

In May 2024, Renesas Electronics Corporation, a global microcontrollers solution provider announced the acquisition of Sequans Communications, a fabless semiconductor company. This strategic move aims to strengthen Renesas' position in the IoT microcontroller market, particularly in 5G/4G cellular IoT technologies. The acquisition is expected to finalize by the first quarter of 2024, pending regulatory approvals.

Key IoT Microcontroller Companies:

The following are the leading companies in the IoT microcontroller market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom

- Espressif Systems (Shanghai) Co., Ltd

- Holtek Semiconductor Inc.

- Infineon Technologies

- Microchip Technology Inc.

- Nuvoton Technology Corporation

- NXP Semiconductors

- Silicon Laboratories

- STMicroelectronics

- Texas Instruments Incorporated

- Renesas Electronics Corporation

IoT Microcontroller Market Scope

Report Attribute

Details

Market size value in 2025

USD 6.08 billion

Revenue forecast in 2030

USD 12.94 billion

Growth rate

CAGR of 16.3% from 2025 to 2030

Base year estimation

2024

Historic data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa.

Key companies profiled

Broadcom; Espressif Systems (Shanghai) Co., Ltd; Holtek Semiconductor Inc.; Infineon Technologies; Microchip Technology Inc.; Nuvoton Technology Corporation; NXP Semiconductors; Silicon Laboratories; STMicroelectronics; Texas Instruments Incorporated; Renesas Electronics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

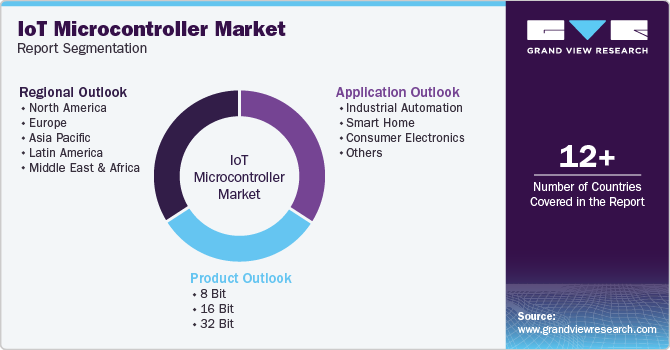

Global IoT Microcontroller Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For the purpose of this study, Grand View Research has segmented the global IoT microcontroller market report based on product, application, and region:

-

Product Outlook (Revenue; USD Billion, 2018 - 2030)

-

8 Bit

-

16 Bit

-

32 Bit

-

-

Application Outlook (Revenue; USD Billion, 2018 - 2030)

-

Industrial Automation

-

Smart Home

-

Consumer Electronics

-

Smartphones

-

Wearables

-

Others

-

-

Others

-

-

Regional Outlook (Revenue: USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IoT microcontroller market size was estimated at USD 5.55 million in 2024 and is expected to reach USD 6.08 million in 2025.

b. The global IoT microcontroller market is expected to grow at a compound annual growth rate of 16.3% from 2025 to 2030 to reach USD 12.94 billion by 2030.

b. The 32-bit product segment accounted for the largest market share of over 48% in 2024. The 32-bit microcontroller segment is witnessing significant growth due to its advanced processing capabilities and versatility, making it suitable for complex IoT applications requiring real-time data processing, such as industrial automation, smart healthcare, and connected vehicles.

b. Some key players operating in the IoT microcontroller market include Broadcom, Espressif Systems (Shanghai) Co., Ltd; Holtek Semiconductor Inc.; Infineon Technologies; Microchip Technology Inc.; Nuvoton Technology Corporation; NXP Semiconductors; Silicon Laboratories; STMicroelectronics; Texas Instruments Incorporated; and Renesas Electronics Corporation among others.

b. Key factors that are driving the IoT microcontroller market growth include the IoT Microcontroller market is experiencing robust growth, driven by the increasing application of IoT devices in both consumer and industrial applications. A key trend fueling this expansion is the demand for microcontrollers with enhanced power efficiency, processing capability, and connectivity features that support a wide range of IoT applications, from smart home devices to industrial automation systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.