- Home

- »

- Advanced Interior Materials

- »

-

Iron Ore Pellets Market Size, Share And Growth Report, 2030GVR Report cover

![Iron Ore Pellets Market Size, Share & Trends Report]()

Iron Ore Pellets Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Blast Furnace, Direct Reduced), By Trade (Captive, Seaborne), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-594-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Iron Ore Pellets Market Summary

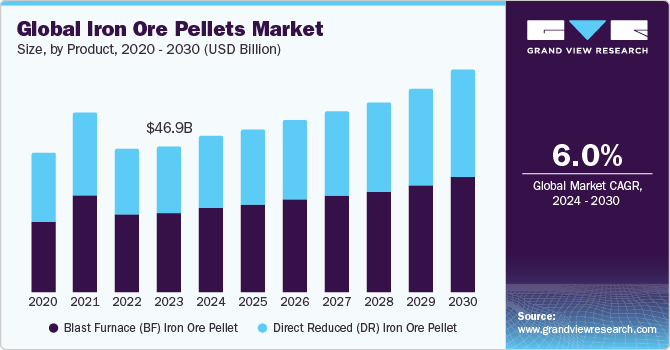

The global iron ore pellets market size was estimated at USD 46.9 billion in 2023 and is projected to reach USD 71.03 billion by 2030, growing at a CAGR of 6.0% from 2024 to 2030. The growth of steel production in emerging countries is expected to propel the demand for iron ore pellets. Iron ore pellets are commonly used in the production of steel.

Key Market Trends & Insights

- The iron ore pellets market in Asia Pacific held the largest share of 52% of the global revenue in 2023.

- The China iron ore pellets market held the largest revenue share in the Asia Pacific regional market in 2023.

- By product, the blast furnace (BF) pellets segment dominated the market in 2023.

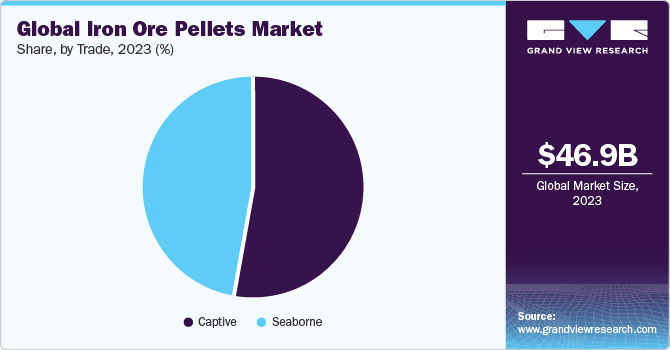

- By trade, the captive trade segment dominated the market in 2023 in terms of revenue share.

Market Size & Forecast

- 2023 Market Size: USD 46.9 Billion

- 2030 Projected Market Size: USD 71.03 Billion

- CAGR (2024-2030): 6.0%

- Asia Pacific: Largest market in 2023

Pellets are preferred over raw iron ore, as they allow for the maximum utilization of iron ore. This is particularly important as iron ore reserves are being depleted worldwide. Iron ore pellets are superior to their other substitutes because they have a high cold crushing strength, which results in minimal generation of fines even when subjected to multiple crushing cycles.

The U.S. is one of North America's largest producers and consumers of iron ore pellets. Positive government policy for green steel production is anticipated to propel market growth. For instance, the Federal Government is the world's largest direct purchaser of steel. In the U.S., around 18% of the nation's steel consumption is used in public construction projects. To achieve its climate emission targets, the government has introduced several initiatives to promote green steel. In September 2022, the government introduced the Federal Buy Clean Initiative.

The Federal Government will prioritize the purchase of low-carbon construction materials, including steel, glass, concrete, and asphalt, which account for 50% of industrial emissions in the country. This initiative is expected to reduce 2-10 million tons of CO2 emissions from the steel industry alone. Also, rising investment in the construction industry is expected to propel steel consumption, which is anticipated to have a positive influence on market growth. For instance, according to the U.S. Census Bureau, construction spending for March 2024 amounted to approximately USD 2,083.93 billion. This represents a 9.6% increase from March 2023. In 2023, construction expenditure amounted to around USD 2.096 trillion, which is a 13.9% increase from 2022.

Iron Ore Pellets Price Trends

The iron ore pellet prices declined largely in 2022. This was attributed to a decline in demand from China. The country’s crude steel production declined by 2.1% in 2022 on a y-o-y basis, whereas the global crude steel production declined by 4.3% on a y-o-y basis. The prices did not face any improvement in 2023 and as of March 2024, the prices are expected to further decline in Q2 2024, owing to low demand from major importers and rising inventory levels.

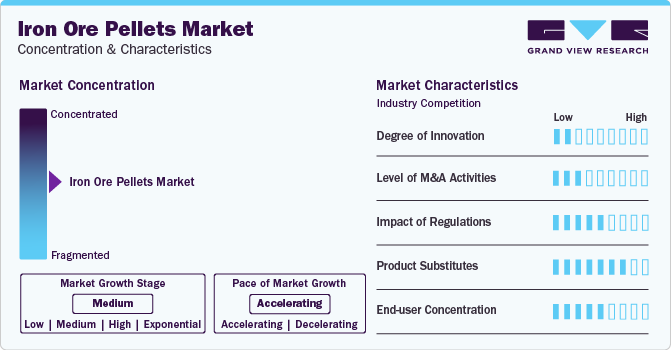

Market Concentration & Characteristics

Iron ore pellets are witnessing increasing demand from steel producers owing to their reduction in carbon emissions. These products reduce the use of coal and coke in blast furnaces for iron ore sintering. Government policies, such as an increase in the price of carbon permits in the European Union, have also benefited the utilization rates of pellets at steel mills to improve emission performance.

The relationship between demand and supply dynamics significantly contributes to the volatility in raw material prices, directly affecting the cost of producing steel and its associated products. Such fluctuations in production costs can, in turn, impact the pricing of final goods. Thus, these price variations play a crucial role in the purchasing decisions concerning iron ore pellets, acting as a limiting factor for market expansion.

Product Insights

The blast furnace (BF) pellets segment dominated the market in 2023. Products used in the BF method are of a lower grade compared to those used in the direct reduced (DR) method. As a result, they are less expensive than their counterparts. Integrated steel plants typically use the BF method. The lower cost of these pellets, combined with the abundance of integrated steel plants found in developed economies, is the primary factor driving growth in the BF segment.

The DR segment is predicted to exhibit the highest CAGR of 3.8% from 2024 to 2030 in terms of revenue. After firing, these pellets typically possess high mechanical strength. These products exhibit improved reducibility, swelling, and softening melting characteristics resulting in better performance in the blast furnace.

Trade Insights

The captive trade segment dominated the market in 2023 in terms of revenue share. Iron ore pellets are either used for in-house production or transported to nearby customers for steel manufacturing purposes. The majority of the world's major steel companies, including ArcelorMittal, which contribute significantly to global steel production, obtain their iron ore pellets from their own manufacturing facilities.

The seaborne trade segment is predicted to register the fastest CAGR, in terms of revenue, from 2024 to 2030. This growth can be attributed to increased demand for iron ore pellets from non-integrated steel manufacturers. The price of iron ore pellets in various regions plays a significant role in determining the size of the seaborne trade.

Regional Insights

The iron ore pellets market in North America is expected to experience the fastest growth rate during the forecast period due to the high demand from the construction, aerospace & defense, and automotive industries. The increasing production of electric vehicles (EVs) in the region, as well as the revival of aircraft manufacturing operations, is expected to drive the steel demand. This is likely to increase the demand for pellets in the coming years.

U.S. Iron Ore Pellets Market Trends

The U.S. iron ore pellets market held the largest revenue share in 2023. The growth of the product market is attributed to increasing steel production and the push towards more sustainable manufacturing practices.

Europe Iron Ore Pellets Market Trends

The iron ore pellets market in Europe accounted for over 25% share of the global revenue. The region has strict environmental regulations to minimize carbon emissions. Iron pellets are a greener alternative raw material for steel production in comparison to traditional methods. They can more efficiently reduce greenhouse gas (GHG) emissions in the steel-making process.

The Germany iron ore pellets market is expected to register the fastest growth rate, in terms of revenue, from 2024 to 2030. Rising demand for steel in various industries is propelling the product demand.

Asia Pacific Iron Ore Pellets Market Trends

The iron ore pellets market in Asia Pacific held the largest share of 52% of the global revenue in 2023. This trend is anticipated to continue over the forecast period. The regional market’s growth is attributed to the presence of developing economies, such as China, India, and Vietnam, which are witnessing increasing spending in the manufacturing segment along with other end-use industries and have a wide crude steel production industry.

The China iron ore pellets market held the largest revenue share in the Asia Pacific regional market in 2023. The product helps in reducing energy consumption and GHG emissions in blast furnaces, which is in line with China's green and sustainable development goals. Due to this, there is a growing product demand in the country.

The iron ore pellets market in India is expected to register the fastest CAGR over the forecast period.The development of palletization technology has led to improved cost-effectiveness and efficiency, resulting in increased investments by mining companies in iron ore pellet production. As a result of this technological advancement, India’s domestic market is experiencing growth.

Central & South America Iron Ore Pellets Market Trends

The Central & South American iron ore pellets market is expected to register a CAGR of 4.9% during the forecast period. Brazil, among other countries, plays a vital role in the global market. The reason behind this is the increased investment in mining operations and pelletizing facilities, which has resulted in improved availability and production capacity of iron ore pellets, leading to market growth.

The iron ore pellets market in Brazil held the largest share in 2023.The demand for iron ore pellets worldwide is increasing, especially from nations that aim to reduce their environmental impact in steel manufacturing. Brazil, with its considerable reserves and established mining infrastructure, is in a good position to meet this international demand. This has resulted in a rise in both production and consumption domestically.

Key Iron Ore Pellets Company Insights

The market has been characterized by intense competition with some major industry players holding a considerable share. Vale and Rio Tinto are among the largest producers of iron ore pellets in the world. The majority of Vale’s iron ore mines are concentrated in Brazil and China. The market is largely dictated by multinational players who own established iron ore mines and processing facilities, making entry of new players difficult. Major players focus on long-term agreements with steel producers and compete primarily based on price and quality. Some of the key players operating in the market include Vale, LKAB, and Cleveland-Cliffs.

-

Vale is one the largest iron ore-producing companies in the world. According to the company, it produced 89.4 million tons of products in 2023

-

U.S. Steel Mining Solutions produces taconite pellets for blast furnace operations. Its Minntac and Keetac mines, located in Northern Minnesota, U.S., have a capacity of up to 22 million tons annually. In addition, the company has joint-venture ownership in a Hibbing mine that has an annual capacity of about 1.3 million tons

-

Brahmani River Pellets Ltd., founded in 2006, is one of India's largest manufacturers of merchant pellets, with a pellet manufacturing capacity of 4 MTPA and a beneficiation capacity of 4.7 MTPA

Key Iron Ore Pellets Companies:

The following are the leading companies in the iron ore pellets market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Bahrain Steel

- Cleveland-Cliffs

- Ferrexpo PLC

- JSW

- LKAB

- METALLOINVEST MC LLC

- Rio Tinto

- Samarco

- Tata Steel

- Vale

Recent Developments

-

In March 2023, Blastr Green Steel announced the construction of an iron ore pellet manufacturing plant in Northern Norway, with an estimated investment of EUR 1.00 billion (USD 1.10 billion). The plant’s production will cater to the supply of a green steel mill in Finland. A final decision on the investment will be made by 2025, subject to relevant permits and agreements. If the project is approved, the facility will tentatively start production by 2028

-

In May 2023, JSW announced the investment of INR 90,000.0 million (USD 1,077.8 million) in the construction of an 8.0 million tons per year pallet production plant in Odisha, India

Iron Ore Pellets Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 49.94 billion

Revenue forecast in 2030

USD 71.03 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, trade, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; China; India; Japan; Brazil; Iran

Key companies profiled

ArcelorMittal; Bahrain Steel; Cleveland-Cliffs; Ferrexpo PLC; JSW; LKAB; METALLOINVEST MC LLC; Rio Tinto; Samarco; Tata Steel; Vale

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Iron Ore Pellets Market Report Segmentation

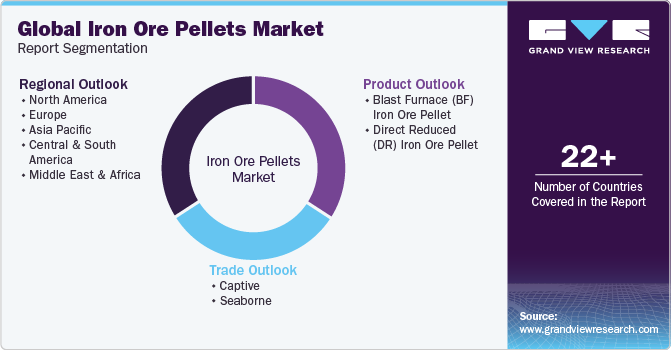

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global iron ore pellets market report based on product, trade, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Blast Furnace (BF) Iron Ore Pellet

-

Direct Reduced (DR) Iron Ore Pellet

-

-

Trade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Captive

-

Seaborne

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global iron ore pellets market size was estimated at USD 46.86 billion in 2023 and is expected to reach USD 49.94 billion in 2024.

b. The global iron ore pellets market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 71.03 billion by 2030.

b. Based on region, Asia Pacific dominated the iron ore pellets market with a revenue share of over 52.0% in 2023. This is attributable to China's large steel manufacturing base.

b. Some key players operating in the iron ore pellets market include Vale, Cleveland-Cliffs, ArcelorMittal, Rio Tinto, and BHP Billiton.

b. Key factors that are driving the market growth include the expanding steel production in economies such as India, Russia, South Korea, and Iran. In 2023, global crude steel production increased in Africa, Asia and Oceania, Middle East, and Russia on a y-o-y basis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.