- Home

- »

- Advanced Interior Materials

- »

-

Isostatic Pressing Market Size, Share & Growth Report, 2030GVR Report cover

![Isostatic Pressing Market Size, Share & Trends Report]()

Isostatic Pressing Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Systems, Services), By Type (Hot Isostatic Pressing, Cold Isostatic Pressing), By Capacity, By Process Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-220-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Isostatic Pressing Market Summary

The global isostatic pressing market size was estimated at USD 7,495.0 million in 2023 and is projected to reach USD 12,210.4 million by 2030, growing at a CAGR of 7.3% from 2024 to 2030. The market growth is attributed to a rising demand for intricate components coupled with increasing industrial applications and a growing need to adhere to stringent quality and performance standards.

Key Market Trends & Insights

- Asia Pacific dominated the market with the revenue share of 47.6% in 2023.

- The isostatic pressing market in China is witnessing substantial growth.

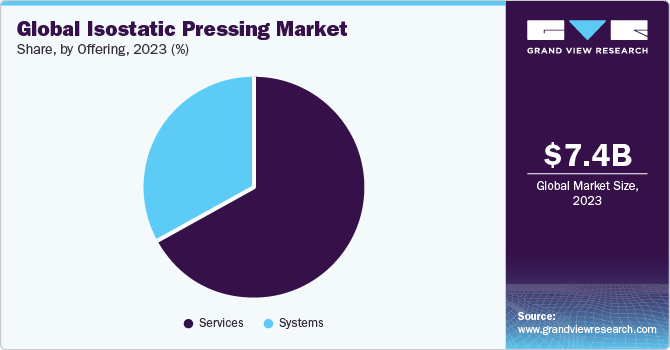

- Based on offering, the services segment led the market with the largest revenue share of 67.4% in 2023.

- Based on type, the hot isostatic pressing segment dominated the market in 2023.

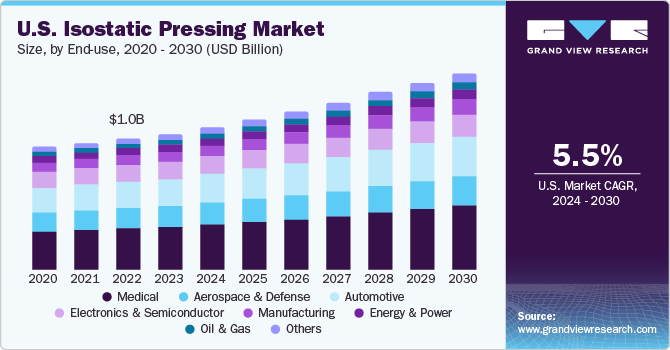

- Based on end-use, the medical segment is anticipated to grow at the lucrative CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 7,495.0 Million

- 2030 Projected Market Size: USD 12,210.4 Million

- CAGR (2024-2030): 7.3%

- Asia Pacific: Largest market in 2023

Hot Isostatic Pressing (HIP) is employed to eradicate porosity in castings and merge powder metallurgy materials into fully dense components. In addition, it enables the bonding of dissimilar materials to produce distinctive, cost-effective parts. HIP technology empowers engineers to optimize component design and manufacturing processes, concurrently enhancing microstructural homogeneity and material properties.According to the U.S. Centers for Medicare & Medicaid Services, the growth in U.S. healthcare spending reached 4.1% in 2022, totaling USD 4.5 trillion. This expenditure constituted 17.3% of the country’s GDP in 2022. In the highly regulated and performance-driven medical sector, material engineering plays a crucial role, especially in ensuring the reliability of prosthetics and implants. Isostatic pressing is crucial in the medical industry for manufacturing precise and biocompatible components such as orthopedic implants and dental restorations with enhanced structural integrity. Moreover, numerous medical implants necessitate a biomedical coating to facilitate the bond between the implant and body tissue. To achieve optimal results, the coated components undergo hot isostatic pressing, effectively eliminating porosity, enhancing fatigue life, and improving the bonding performance of the coating. These factors are anticipated to drive the demand for isostatic pressing in the coming years.

In the aerospace sector, the presence of closed porosity and voids in cast engine components presents potential hazards for failure. This risk is especially pronounced in components subjected to high in-service stresses, making the elimination of porosity crucial to maximizing their properties and operational lifespan. Turbine blades and vanes located in the high-temperature sections of jet engines undergo regular HIP treatments to ensure the absence of residual microporosity. HIP plays a pivotal role in enhancing the properties of the single crystal and directionally solidified investment cast blades. These factors significantly contribute to the increasing demand for isostatic pressing in the foreseeable future.

The automotive industry faces challenges related to gas or shrinkage porosity in cast engine components, which can lead to leaks in pistons, cylinder heads, and other pressurized parts. If pores exceed critical defect sizes, they can result in engine failure, causing extensive damage. In the pursuit of faster, more profitable, and sustainable production, the automotive sector integrates isostatic pressing into its production processes. By ensuring lighter weight, superior performance, and enhanced durability, HIP technology solutions find application in various automotive components, from small parts to larger, intricately shaped components. These considerations are expected to drive the demand for isostatic pressing in the automotive industry over the forecast period.

For instance, Bodycote provides a densification service for aluminium alloy castings, reducing porosity in components like turbochargers, cylinder heads, and crankcases. This process enhances the properties of as-cast components, including proof strength, ultimate tensile strength, and ductility, while significantly improving creep and fatigue properties in cast aluminium alloys. This practical application underscores the role of isostatic pressing in optimizing material properties for improved component performance in various industries.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is characterized by its extensive application across diverse industries. It finds applications in the production of advanced ceramics, powdered metal components, carbon, and graphite materials, and even in the manufacturing of certain types of composites. The versatility of isostatic pressing makes it a preferred choice in industries such as aerospace, automotive, electronics, and medical devices.

The market is influenced by continuous material innovations and advancements. Manufacturers are constantly exploring new materials and formulations to enhance the performance and properties of the end products. This includes the development of high-performance ceramics, advanced metal alloys, and composite materials, which, in turn, drive the demand for isostatic pressing technologies.

Isostatic pressing is favoured for its ability to produce components with high density and precision. Industries requiring intricate and complex parts, such as semiconductor manufacturing or aerospace, rely on isostatic pressing to achieve the required level of accuracy. The market caters to the demand for components with tight tolerances and superior mechanical properties.

The market is influenced by global economic trends, geopolitical factors, and technological developments. Shifts in manufacturing capabilities and the emergence of new markets can impact the demand for isostatic pressing technologies. Moreover, the market is interconnected with the overall growth of end-use industries, and fluctuations in these sectors can affect the demand for isostatic pressing. Moreover, the market is characterized by a competitive landscape with several key players such as Bodycote, KOBE STEEL, LTD., Nikkiso Co., Ltd., and Kennametal Inc. investing in research and development to enhance isostatic pressing technologies. Technological advancements, such as automation, process control, and data analytics, are integrated into isostatic pressing systems to improve efficiency and reliability. This competitive environment encourages innovation and drives the market growth.

Type Insights

Based on type, the hot isostatic pressing segment dominated the market in 2023, owing to the increasing demand for intricate components across industries, particularly in aerospace and automotive applications, necessitating advanced manufacturing technologies like HIP to eliminate porosity and enhance material properties. As industries emphasize precision, efficiency, and cost-effectiveness, HIP technology aligns with these requirements by simultaneously applying high isostatic pressure and temperature to ensure fully dense components. Moreover, in sectors like medicine, the stringent control over material properties for prosthetics and implants fuels the adoption of HIP processes.

The Cold Isostatic Pressing (CIP) market is driven by several pivotal factors, such as the demand for precision components in industries such as electronics, automotive, and aerospace that fuels the adoption of CIP as it enables the production of high-density and intricate parts. The emphasis on cost-effectiveness and efficiency in manufacturing processes further boosts the use of CIP, which applies uniform pressure to shape powders into desired forms. As industries strive to meet stringent quality standards, CIP plays a crucial role in achieving the required material properties, especially in applications like semiconductor manufacturing.

Capacity Insights

Based on capacity, the small-sized HIP market caters to industries and applications with lower production volumes but high precision requirements. Typically, small-sized HIP have capacities ranging from a few liters to a few dozen liters. These systems are suitable for niche markets where intricate components are in demand, such as in medical devices, research & development, and specialized aerospace applications. For instance, companies like Quintus Technologies offer small-sized HIP systems with capacities suited for laboratories and smaller-scale production, providing precise and efficient solutions for industries with specific needs for high-quality components.

The medium-sized HIP market occupies a crucial space, catering to industries with moderate production requirements. These systems typically have capacities ranging from several dozen liters to a few hundred liters. They find applications in various sectors, including automotive, aerospace, and tooling industries, where a balance between production volume and component intricacy is essential. Medium-sized HIP systems, offered by companies like KOBE STEEL, LTD., offer versatility in handling diverse materials and are well-suited for mid-scale manufacturing processes, contributing to the overall efficiency and quality of components.

The large-sized HIP market addresses the needs of high-volume production in industries such as aerospace, energy, and heavy machinery. These HIP systems have capacities exceeding several hundred liters, allowing for the simultaneous processing of large quantities of components. Large-sized HIP, like those offered by companies such as Bodycote, are designed to handle bulk production requirements while maintaining the precision and quality associated with isostatic pressing. They play a crucial role in the production of critical components where economies of scale and high throughput are paramount, such as in the manufacturing of aircraft engine parts and power generation components.

Process Type Insights

Based on process-type, the dry bag isostatic pressing is a manufacturing process that involves compressing a powder or granular material within a flexible, sealed bag or container. The key characteristic of this method is the absence of any liquid or slurry during the pressing process. The dry bag pressing technique is commonly used in the production of advanced ceramics, powdered metals, and composite materials. Dry bag isostatic pressing offers several advantages, including the ability to produce components with uniform density, precise dimensions, and minimal porosity. This method is particularly suitable for materials that do not require the use of a liquid medium during the pressing stage. The dry bag pressing technique is utilized in industries such as aerospace, electronics, and medical devices, where the production of intricate and high-performance components is essential.

Wet bag isostatic pressing is another variant of the isostatic pressing process, distinguished by the use of a liquid medium in combination with the powder material. Wet bag isostatic pressing is commonly employed in the production of components with specific material requirements, such as certain types of ceramics and metal alloys. The use of a liquid medium allows for better control of the pressing conditions and is particularly beneficial for materials that exhibit higher compressibility in the presence of a fluid. This process is favored in industries where achieving a specific microstructure or material property is critical, such as in the manufacturing of advanced ceramics for electronic applications or specialized metal components.

End-use Insights

Based on end-use, the medical segment is anticipated to grow at the lucrative CAGR from 2024 to 2030, owing to rising need for the fabrication of precise, durable, and biocompatible components which is essential for various applications, including implants, prosthetics, and medical instruments. For instance, isostatic pressing is widely employed in the dental industry for the production of ceramic components used in dental restorations such as crowns, bridges, and dental implants. The method ensures that dental prosthetics exhibit the necessary strength, durability, and biocompatibility required for successful and long-lasting dental treatments. In addition, precision is crucial in the field of surgery, and isostatic pressing is applied to manufacture high-quality surgical instruments. The process allows for the creation of instruments with intricate designs, superior strength, and wear resistance. Surgeons rely on these precision-engineered tools for various medical procedures, contributing to the success and safety of surgeries.

Isostatic pressing finds extensive application in the manufacturing of sputtering targets, crucial components for coating flat panel displays, semiconductors, data storage devices, architectural glass, and solar panels. In the sputtering process, achieving both a fine microstructure and full density in targets is essential. HIP technology facilitates the densification of powders to complete density while preserving a fine microstructure, ensuring the production of high-quality sputtering targets. Moreover, HIP allows the blending of dissimilar materials as powders, enabling the creation of innovative combinations for sputtering applications. In addition, HIP is utilized for diffusion bonding backing plates to sputtering targets, enhancing bond strength and overall performance in coating processes.

Offering Insights

Based on offering, the services segment led the market with the largest revenue share of 67.4% in 2023. Isostatic pressing ensures precise and uniform compaction of powdered or granular materials. This leads to components with consistent density and minimal variation in dimensions, making it a preferred choice for applications where precision is crucial. Moreover, isostatic pressing can optimize material properties, such as strength and hardness, by eliminating voids and achieving higher density. This is particularly valuable in industries where the mechanical performance of components is paramount, including medical, aerospace, and automotive.

Isostatic pressing systems are driven by the demand for precision in component fabrication, enabling the production of intricate and complex parts with consistent density. The systems' versatility, and capable of working with a diverse range of materials, including ceramics, metals, and composites, positions them as a go-to solution across various industries. The capability to achieve full density while maintaining fine microstructures is crucial in applications such as aerospace, medical, and electronics. Isostatic pressing systems contribute to material homogeneity, eliminating porosity and ensuring uniform material properties, enhancing the reliability and performance of the final products. As industries prioritize quality, innovation, and the optimization of material properties, isostatic pressing systems emerge as a key enabler, providing the necessary precision, flexibility, and efficiency to meet stringent manufacturing requirements.

Regional Insights

The isostatic pressing market in North America is driven by increasing investment in the technological innovations in the automotive industry of the region. Titanium alloy is vastly used in lightweight vehicles. Market players are investing in the making of titanium alloy using hot isostatic pressing to reduce the cost of manufacturing titanium parts for vehicles.

U.S. Isostatic Pressing Market Trends

The isostatic pressing market in U.S. is characterized by steady growth driven growing medical, aerospace, automotive, and energy sectors, contributing to the demand for precision components manufactured through isostatic pressing. Moreover, the expansion of medical industry in the U.S. contributes to the demand for isostatic pressing in the manufacturing of medical implants, dental restorations, and other precision components.

The Canada isostatic pressing market is characterized by steady growth driven by the country's diverse industrial landscape, including medical, aerospace, automotive, and energy sectors, contributing to the demand for precision components manufactured through isostatic pressing. As Canada continues to invest in technological advancements and innovation, isostatic pressing plays a crucial role in producing intricate parts with consistent density and enhanced material properties. For instance, Canada's Burloak Technologies is elevating additive manufacturing capabilities to unprecedented levels with the implementation of a QIH 60 M URC Hot Isostatic Press from Quintus Technologies. This cutting-edge technology allows Burloak to achieve unparalleled mechanical performance and strength properties in components designed for mission-critical applications, showcasing the company's commitment to pushing the boundaries of additive manufacturing.

Europe Isostatic Pressing Market Trends

The isostatic pressing market of Europe is expected to grow at a lucrative CAGR during the forecast period. The market is driven by the vast automotive, aerospace, and machinery manufacturing industries in the region. Four of the top 10 global automakers originate from the region, namely, Volkswagen, BMW, Stellantis, and Mercedes-Benz. Europe is also one of the largest producers of machinery and industrial equipment.

The Germany isostatic pressing market stands as a robust and technologically advanced sector, driven by the country's strong industrial base and emphasis on precision engineering. As a powerhouse in automotive, aerospace, and machinery manufacturing, Germany relies on isostatic pressing technologies for the production of high-quality, intricate components with consistent density and superior material properties. Moreover, the country is a major player in the global automotive industry and is home to some of the world's leading car manufacturers. According to data from the German Association of the Automotive Industry (VDA), in December 2023, Germany produced 4.1 million cars, an increase of 1% as compared to December 2022. Moreover, the country remains a key player in the global automotive industry, with its car manufacturers known for their high-quality engineering and advanced technology, thereby driving market growth.

Asia Pacific Isostatic Pressing Market Trends

Asia Pacific dominated the market with the revenue share of 47.6% in 2023. The region has become a hub for medical tourism, and many countries have invested heavily in their medical industry to attract patients from around the globe. In addition, the rising middle class in countries such as China and India has increased demand for medical services and products. As industries expand, there is a greater need for precision components, leading to the adoption of isostatic pressing technologies. Moreover, the medical industry's expansion in the Asia Pacific region contributes to the demand for isostatic pressing in the manufacturing of medical implants, dental restorations, and other precision components.

The isostatic pressing market in China is witnessing substantial growth driven by the country's thriving manufacturing sector and technological advancements. With a focus on industries such as automotive, electronics, and aerospace, China's demand for precision-engineered components has surged, positioning Isostatic Pressing as a key technology for producing intricate parts with uniform density. Furthermore, with the growth of online marketplaces like Alibaba, and JD.com, it has become easier than ever for consumers to purchase electronics online. This has led to increased competition among electronics retailers, as well as greater access to a wider range of products for consumers. The electronics industry demonstrates a growing demand for isostatic pressing, leveraging its precision and versatility for the fabrication of intricate components such as ceramic substrates and sputtering targets essential for electronic devices.

Central & South America Isostatic Pressing Market Trends

The Central & South America isostatic pressing market is driven by the increasing demand for light weight components in different industries in the region. Isostatic pressing offers a cost-effective alternative to titanium alloy and can be used to make multiple parts such as balls, tubes, lighting tubes, and more. Rise in demand for products with a short production cycle is expected to fuel the market growth in the region.

The isostatic pressing market in Brazil is experiencing significant growth, driven by the country's expanding industrial sector and demand for high-quality components. With a focus on industries such as automotive, aerospace, and energy, the country relies on isostatic pressing technology to manufacture precision parts with consistent density and enhanced material properties in the automotive industry.

Middle East & Africa Isostatic Pressing Market Trends

The Middle East & Africa isostatic pressing market is driven by the rising vertical integration in the automotive, aerospace, energy, and manufacturing sectors of the region. These sectors can benefit from the isostatic pressing since it is appropriate for a variety of applications and can be used to consolidate and densify a range of materials such as ceramics, metals, and more.

The demand for isostatic pressing in Saudi Arabia is driven by the country's burgeoning industrial sector, particularly in oil & gas, aerospace, and renewable energy. The region boasts the world second-largest confirmed oil reserves, and Saudi Aramco, a global giant in integrated energy & chemicals, operates extensively in the upstream, midstream, and downstream sectors. In 2022, Aramco maintained an average hydrocarbon production of 13.6 million barrels per day, with 11.5 million barrels per day dedicated to crude oil. Oil & gas industries in Saudi Arabia increasingly rely on isostatic pressing for the manufacturing of critical components with precise specifications. In addition, the growing interest in renewable energy projects in Saudi Arabia propels the demand for isostatic pressing in the production of components for solar panels and other sustainable technologies.

Key Isostatic Pressing Company Insights

The market is extremely fragmented, with various global and regional product manufacturers releasing innovative systems and technologies. Various industry participants' strategies typically involve product development, mergers & acquisitions, investments, and expansions to boost market penetration and respond to the changing technical needs of the application industries.

In January 2024, Bodycote finalized the acquisition of Lake City HT, a prominent hot isostatic pressing (HIP) and vacuum heat treatment company located in Warsaw, Indiana. Lake City HT predominantly serves the orthopedic implant market and Civil Aerospace, making it a valuable addition to Bodycote's portfolio. This strategic acquisition is expected to substantially broaden Bodycote's customer base in the medical market.

Key Isostatic Pressing Companies:

The following are the leading companies in the isostatic pressing market. These companies collectively hold the largest market share and dictate industry trends.

- KOBE STEEL, LTD.

- Bodycote

- Isostatic Pressing Services

- Nikkiso Co., Ltd.

- Kennametal Inc.

- DORST Technologies GmbH & Co. KG

- American Isostatic Presses Inc

- EPSI

- Shanxi Golden Kaiyuan Co., Ltd.

- Fluitron

- Pressure Technology, Inc.

- Kittyhawk

- Sandvik AB

- KMTI Corporation

- PTC Industries

- Höganäs AB

Recent Developments

-

In October 2023, Quintus Technologies delivered a QIC 2.4 x 4.5 - 2000 press model designed to optimize operational efficiency and output capabilities. This press not only established new standards but also incorporated an innovative energy management system, providing energy savings exceeding 30% when compared to traditional intensifier solutions

-

In July 2023, Wallwork inaugurated a cutting-edge hot isostatic pressing center at its Bury location in North Manchester, making a substantial investment of USD 10.71 million. Quintus Technologies successfully installed the initial hot isostatic press (HIP) for Wallwork. As a renowned global leader in high-pressure technology, Quintus Technologies operates over 2,000 systems globally, catering to various industries such as aerospace, energy, medical implants, space, automotive, and food processing

-

In July 2022, Bodycote, expanded its Hot Isostatic Pressing capability in Greenville, South Carolina, U.S. The HIP capacity was operational by the end of 2022, specifically oriented towards advancements in additive manufacturing and cutting-edge materials. With the incorporation of two additional vessels, this expansion significantly enhanced Bodycote's extensive installed capacity worldwide

Isostatic Pressing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8,000.9 million

Revenue forecast in 2030

USD 12,210.4 million

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, type, capacity, process type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

KOBE STEEL, LTD.; Bodycote; Isostatic Pressing Services; Nikkiso Co., Ltd.; Kennametal Inc.; DORST Technologies GmbH & Co.; KG; American Isostatic Presses Inc; EPSI; Shanxi Golden Kaiyuan Co., Ltd.; Fluitron; Pressure Technology, Inc.; Kittyhawk; Sandvik AB; MTI Corporation; PTC Industries; Höganäs AB

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Isostatic Pressing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global isostatic pressing market based on offering, type, capacity, process type, end-use, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Systems

-

Services

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Hot Isostatic Pressing

-

Cold Isostatic Pressing

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Small-sized HIP

-

Medium-sized HIP

-

Large-sized HIP

-

-

Process Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Bag Pressing

-

Wet Bag Pressing

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Automotive

-

Electronics & Semiconductor

-

Medical

-

Aerospace & Defense

-

Energy & Power

-

Oil & Gas

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global isostatic pressing market size was estimated at USD 7,495.0 million in 2023 and is expected to reach USD 8,009.0 million in 2024.

b. The isostatic pressing market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 12,210.4 million by 2030.

b. Asia Pacific dominated the global isostatic pressing market dominated market in 2023. The region has become a hub for medical tourism, and many countries have invested heavily in their medical industry to attract patients from around the globe. In addition, the rising middle class in countries such as China and India has increased demand for medical services and products. As industries expand, there is a greater need for precision components, leading to the adoption of isostatic pressing technologies.

b. Some of the key players operating in the isostatic pressing market include KOBE STEEL, LTD., Bodycote, Isostatic Pressing Services, Nikkiso Co., Ltd., Kennametal Inc., DORST Technologies GmbH & Co. KG, American Isostatic Presses Inc, EPSI, Shanxi Golden Kaiyuan Co., Ltd., Fluitron, Pressure Technology, Inc., Kittyhawk, Sandvik AB, MTI Corporation, PTC Industries, Höganäs AB among others.

b. The market growth is attributed to rising demand for intricate components, progress in material science, a focus on precision and quality, the necessity for efficiency and cost-effectiveness, increasing industrial applications, and a growing need to adhere to stringent quality and performance standards. Hot Isostatic Pressing (HIP) is employed to eradicate porosity in castings and merge powder metallurgy materials into fully dense components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.