- Home

- »

- Medical Devices

- »

-

Joint Reconstruction Devices Market, Industry Report, 2033GVR Report cover

![Joint Reconstruction Devices Market Size, Share & Trends Report]()

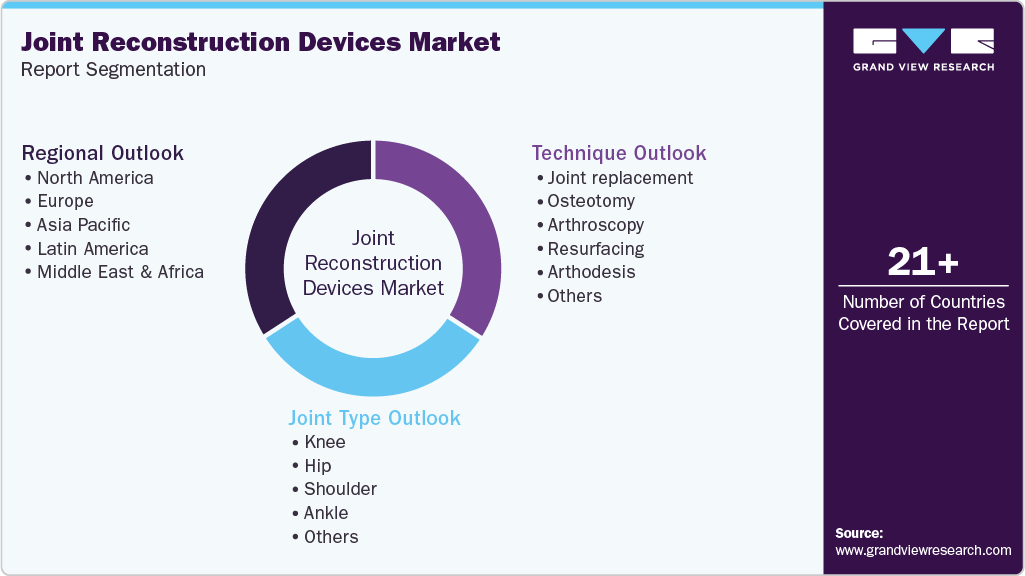

Joint Reconstruction Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Technique (Joint Replacement, Osteotomy, Arthroscopy, Resurfacing, Arthodesis), By Joint Type (Knee, Hip, Shoulder, Ankle), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-469-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Joint Reconstruction Devices Market Summary

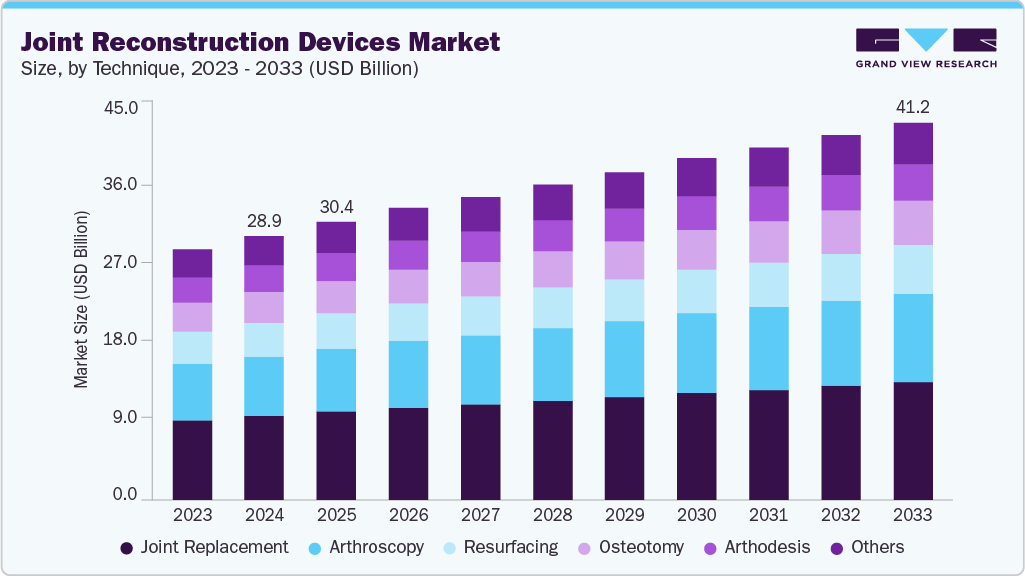

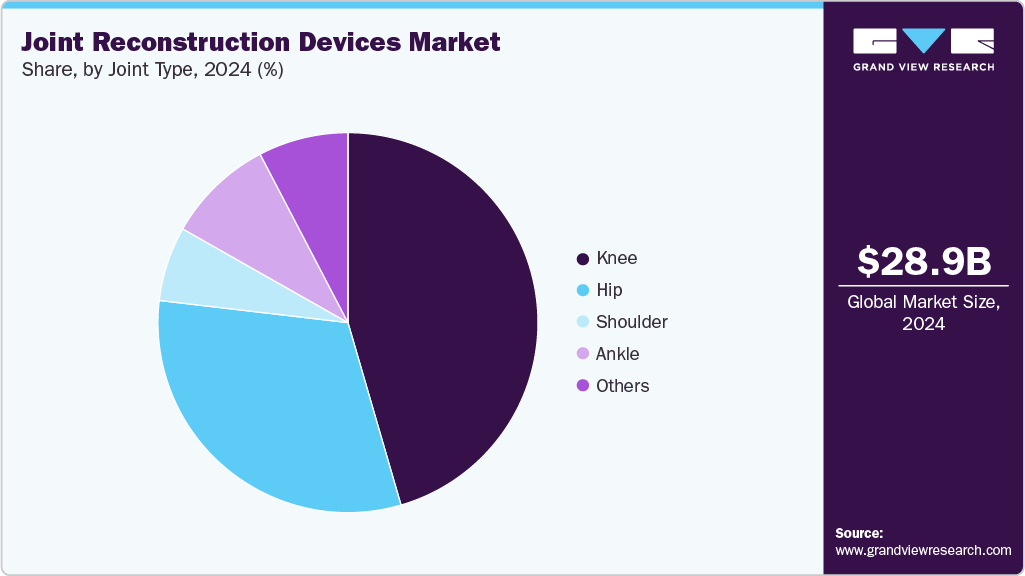

The global joint reconstruction devices market size was valued at USD 28.91 billion in 2024 and is expected to reach USD 41.23 billion by 2033, growing at a CAGR of 3.88% from 2025 to 2033. An aging global population, coupled with an increase in the prevalence of arthritis and other joint-related disorders, has increased the demand for joint reconstruction procedures.

Key Market Trends & Insights

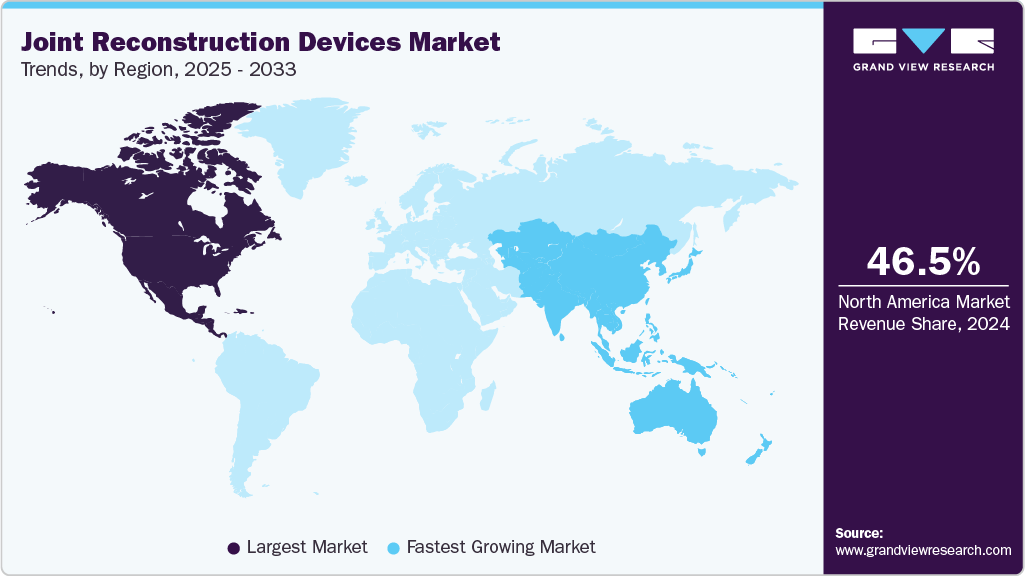

- The North America joint reconstruction devices market accounted for the largest global revenue share of 46.48% in 2024.

- The U.S. joint reconstruction devices industry is anticipated to register the fastest CAGR from 2025 to 2033.

- By technique, the joint replacement segment held the largest revenue share in 2024.

- By joint type, the knee segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.91 Billion

- 2033 Projected Market Size: USD 41.23 Billion

- CAGR (2025-2033): 3.88%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the CDC, between 2019 and 2021, approximately 1 in 5 U.S. adults (21.2%), or around 53.2 million people, were diagnosed with arthritis. Advancements in medical technology, including the development of minimally invasive surgical techniques and the improvement of implant materials, have also contributed to market expansion. In September 2023, an article published in the Lancet Rheumatology reported that in 2020, knee osteoarthritis affected 4307 per 100,000 people globally and hip osteoarthritis affected 418 per 100,000, with age-standardized YLDs rising 8.2% for knee and 6.0% for hip since 1990. By 2050, knee cases are projected to increase by 74.9% and hip cases by 78.6%, driven by population ageing and high BMI as a key modifiable risk factor.

The factors driving growth in the joint reconstruction devices industry include demographic shifts and technological advancements. The aging population is particularly significant; as life expectancy increases, so does the incidence of joint degeneration and osteoarthritis, necessitating an increase in joint replacement surgeries. For instance, in February 2024, Materialize introduced a fully personalized TMJ Total Arthroplasty System designed for patients needing total temporomandibular joint (TMJ) replacement. This innovative solution integrates implants, guides, and digital planning into a cohesive package, offering a streamlined, patient-specific TMJ treatment, all provided by a single company. Technological innovations, such as 3D printing, robotics, and smart implants, have enhanced the precision and outcomes of joint reconstruction surgeries.

In addition, the expansion of healthcare infrastructure in emerging markets is a crucial driver of the joint reconstruction devices market. As developing regions invest in their healthcare systems, access to advanced medical treatments, including joint reconstruction surgeries, is improving. This expansion is coupled with rising healthcare spending and increased adoption of health insurance, making these procedures more accessible and affordable for a larger population. In May 2025, Apollo Hospitals in Chennai launched a joint preservation programme focused on early intervention and multi-modal therapies to maintain joint function and avoid unnecessary surgeries. The initiative emphasizes non-invasive and minimally invasive treatments, including lab-grown cartilage replacement, while promoting healthy lifestyle habits to prevent joint deterioration.

Furthermore, rising awareness about the benefits of early surgical intervention for joint disorders is also fueling market growth. Patients and healthcare providers are becoming increasingly aware of the benefits of timely joint reconstruction surgeries, which can prevent further deterioration and enhance long-term mobility and quality of life. This awareness is driving more patients to opt for surgical solutions earlier in the course of their disease, thereby increasing the demand for joint reconstruction devices. In February 2024, Materialise launched a personalized TMJ Arthroplasty System, combining custom implants, surgical guides, and digital planning, achieving a 100% one-year success rate with highly accurate implant placement.

Trends in Joint Reconstruction Devices: Technology and Patient-Centric Care

Robotics and Computer-Assisted Surgery

Robotic systems are increasingly used in knee and hip replacement surgeries to improve implant alignment and surgical precision. They help reduce intraoperative variability and may decrease revision rates in complex cases, particularly in total knee arthroplasty. In July 2025, Care Hospitals in Hyderabad launched the AI-powered Stryker Mako Robotic System to assist in joint replacement surgeries. The system integrates 3D CT-based surgical planning with real-time guidance and haptic feedback, enabling personalized procedures with minimal tissue damage, faster recovery, and improved implant positioning, according to hospital sources.

Case Study: Temporomandibular Joint Reconstruction Devices

Temporomandibular joint (TMJ) reconstruction addresses severe joint pathologies that have failed to respond to conservative treatments. The market includes autologous graft-based solutions and alloplastic joint replacement devices, with a growing emphasis on patient-specific implants and digital planning technologies.

Device Types and Materials

Autologous Grafts

-

Costochondral Grafts (CCG): Rib-derived, biologically compatible, growth potential in pediatric patients; high complication rates and unpredictable growth.

-

Coronoid Process Grafts (CPG): Cortical bone graft, durable, avoids secondary donor site; lower ankylosis rates.

-

Revascularized Fibula Transfer (RFT): Used for large mandibular defects; supports functional restoration but limited growth in pediatric patients.

Alloplastic TMJ Devices

-

Initial metal prostheses (stainless steel, Co-Cr-Mo) have evolved to titanium, polyethylene, ceramics, and 3D-printed patient-specific implants.

-

Advantages: predictable outcomes, reduced resorption, no donor site morbidity.

-

Modern designs increasingly integrate CAD/CAM and virtual surgical planning for enhanced precision.

Emerging Trends

-

3D Printing & Patient-Specific Implants: Custom prostheses improving fit, functionality, and esthetic outcomes.

-

Digital Surgical Planning: CAD/CAM-assisted reconstructions streamline procedures and reduce intraoperative errors.

-

Material Innovation: Shift toward titanium, ceramics, and polymer composites for durability and biocompatibility.

Market Insights

-

Growing demand for customized, patient-specific TMJ devices, particularly in complex or pediatric cases.

-

Increasing adoption of digital planning and 3D printing technologies is driving innovation and competitive differentiation in the TMJ reconstruction devices market.

-

Device choice is influenced by patient age, pathology severity, and surgical technique, with alloplastic solutions favored for predictable outcomes in adults.

Investments in Joint Reconstruction Devices Market

Investment in the joint reconstruction devices industry is driven by the increasing prevalence of orthopedic conditions and the aging population. Companies are focusing on R&D to improve implant designs, biomaterials and to integrate digital technologies such as robotic-assisted surgery and preoperative planning software. Investments also target expanding manufacturing, forming partnerships with healthcare providers, and entering emerging markets to capture demand, thereby supporting growth and enabling more precise joint reconstruction procedures. In October 2025, London-based start-up OSSTEC secured USD 3.36 million in funding to launch its innovative 3D-printed knee joint replacement technology. Developed over a decade of research at Imperial College London, the technology aims to enhance implant fixation and reduce failure rates, offering a promising solution for patients with knee osteoarthritis.

Advancements in Orthopedic Surgical Technology

Advancements in orthopedic surgery are increasingly focused on improving surgical efficiency, reducing physical strain on surgeons, and enhancing patient outcomes. Automation and robotics are being integrated into operating rooms to manage complex procedures, minimize repetitive high-force tasks, and support faster recovery. In June 2025, Johnson & Johnson launched the KINCISE 2 Surgical Automated System in the U.S., the first automated impactor approved for both primary and revision hip and knee procedures, designed to reduce surgeon fatigue and improve workflow efficiency. The system includes Acetabular Cup Extraction and aims to enhance precision and patient outcomes compared to traditional mallets.

Average Procedural Volume for Participating Surgeons, 2024

Procedure Type

Surgeons

Procedures

Total Hip Arthroplasty

3,235

159,711

Hemiarthroplasty

2,512

13,753

Hip Resurfacing

29

44

Other Procedures

773

1,581

Revision Hip Arthroplasty

2,273

15,529

THA for Fracture

1,692

5,856

Source: American Joint Replacement Registry (AJRR), 2025 Annual Report

In 2025, procedural volumes showed clear concentration in standard total hip arthroplasty, which involved the largest share of participating surgeons, while revision surgery and hemiarthroplasty followed at a noticeably smaller but still substantial scale. THA for fracture reflected a more focused clinical workload, handled by a comparatively smaller surgeon pool. Hip resurfacing remained rare, with activity limited to only a handful of specialists, and other procedure types contributed marginally overall.

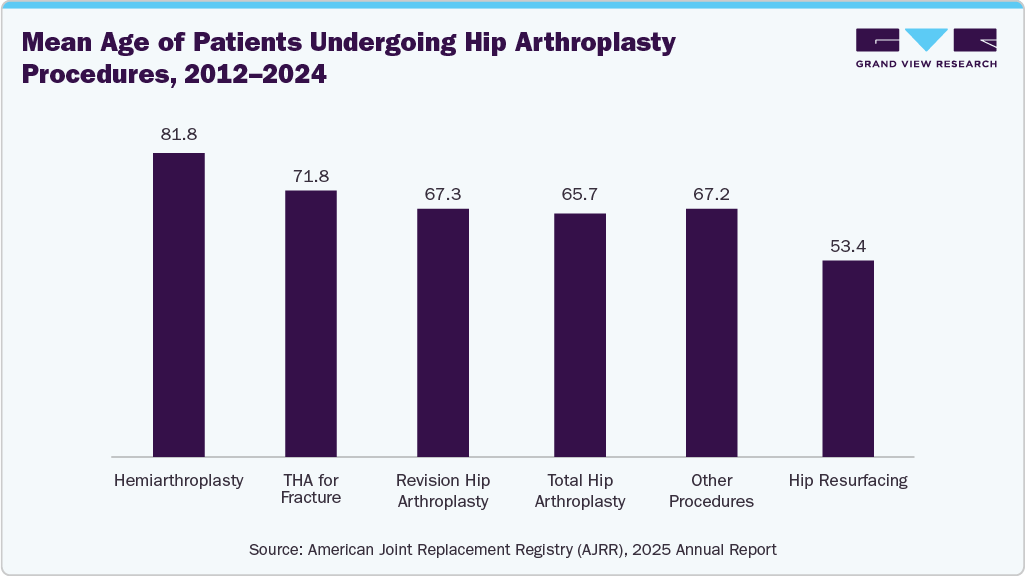

In 2025, AJRR data revealed that age profiles varied significantly across hip arthroplasty types during the 2012-2024 period. Total hip arthroplasty dominated in volume, with patients averaging 65.7 years, while revision cases were only slightly older at 67.3 years. Hemiarthroplasty stood out with the highest average age of 81.8, reflecting its use in frail, fracture-driven cases. THA for fracture followed at 71.8 years, indicating a distinctly older demographic. At the younger end, hip resurfacing was performed at a mean age of 53.4 years, indicating a preference among active patients seeking to preserve their bone.

Mean Age of Patients Undergoing Knee Arthroplasty Procedures, 2012-2024

Procedure Type

Total Procedures

Mean Age (Years)

Partial Knee Arthroplasty

108,569

64.6

Revision Knee Arthroplasty

229,826

67.0

Total Knee Arthroplasty

2,268,315

67.8

Source: American Joint Replacement Registry (AJRR), 2025 Annual Report

In 2025, AJRR data covering more than a decade of knee arthroplasty procedures showed a consistent age pattern across partial, revision, and total knee replacements. Partial knee arthroplasty involved the youngest patients on average. In contrast, revision procedures and total knee arthroplasties were slightly clustered in older patients, reflecting the progression of degenerative disease and the typical timeline leading to primary surgery and eventual revision. The dataset highlights a relatively narrow but clinically meaningful age gradient across knee procedure types.

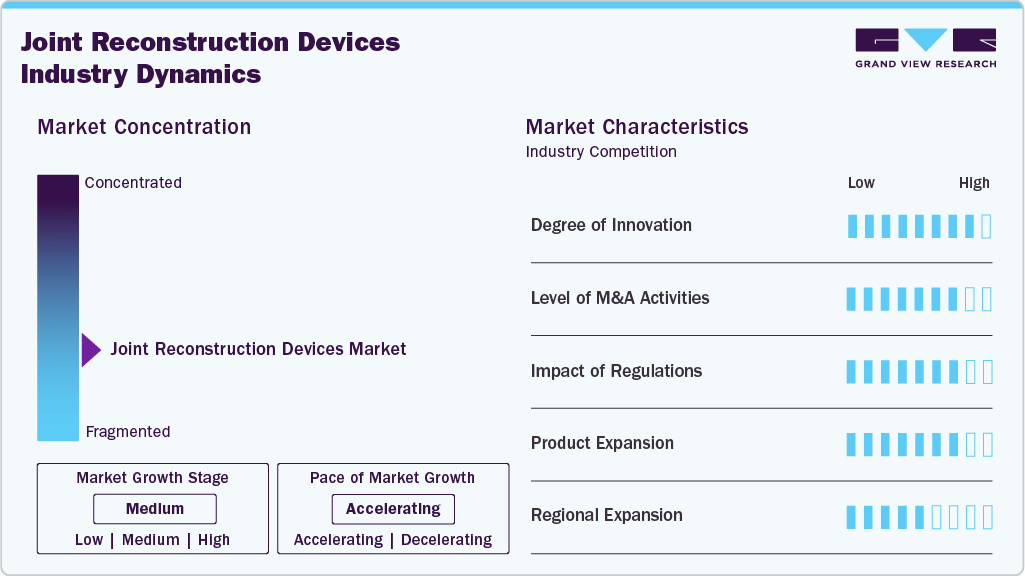

Market Concentration & Characteristics

The joint reconstruction devices market is marked by a high degree of innovation, featuring advancements such as 3D printing, robotic-assisted surgeries, and smart implants. These technologies enhance precision, improve patient outcomes, and reduce recovery times, significantly advancing the effectiveness and attractiveness of joint reconstruction procedures. In April 2024, Manipal Hospital in Pune, India, launched robotic-assisted joint replacement technology. It enables personalized 3D CT scans, sub-millimetre implant accuracy, and real-time bone monitoring, reducing pain, recovery time, and infection risk, with a 98% success rate.

Regulations significantly impact the joint reconstruction devices market by ensuring safety and efficacy standards, but they also introduce challenges such as lengthy approval processes and high compliance costs. Strict regulatory requirements can delay the introduction of new products and increase development expenses. However, these regulations are crucial for maintaining patient safety and fostering trust in medical devices, ultimately benefiting the market in the long run.

M&A activities in the market for joint reconstruction devices are high, reflecting strategic efforts to expand market share and enhance product offerings. For instance, in December 2023, Stryker acquired Serf Sas's joint replacement business. This acquisition is expected to drive Stryker’s European operations and enhance its joint replacement portfolio.

The product expansion in the joint reconstruction devices industry is robust, with companies continually innovating to meet the increasing demand. For instance, in August 2022, Exactech, known for its development and production of innovative implants, instrumentation, and smart technologies for joint replacement surgery, reported the successful completion of initial surgeries using the Spartan Stem and Logical Cup System for total hip arthroplasty. These expansions cater to diverse patient needs, from minimally invasive procedures to complex joint replacements, ensuring comprehensive solutions and driving competitiveness in the market.

The global expansion level in the joint reconstruction devices market is substantial, driven by increasing demand for advanced surgical solutions worldwide. These efforts aim to penetrate emerging markets and strengthen existing footholds in developed regions. By expanding their distribution networks and localizing product offerings, companies aim to capitalize on the diverse healthcare needs and opportunities for growth globally.

Technique Insights

The joint replacement segment led the joint reconstruction devices industry, with the largest revenue share of 31.88% in 2024, driven by technological advancements and increasing adoption of joint replacement surgeries in hospitals. Innovations such as 3D printing, robotic-assisted surgeries, and smart implants have revolutionized joint replacement procedures, enhancing precision, improving patient outcomes, and reducing recovery times. For instance, in February 2024, SIMS Hospital's Asian Orthopaedic Institute (AOI) launched a novel ceramic knee replacement system. Hospitals are increasingly integrating these advanced technologies to offer more effective and less invasive treatment options, attracting a higher number of patients seeking joint replacement surgeries.

The arthroscopy segment is projected to grow fastest in the coming years, largely attributed to advancements in technology and digital innovation. These developments have facilitated easier access to arthroscopic procedures online, offering healthcare providers and patients streamlined information and consultations. For instance, in January 2024, Arthrex, a player in minimally invasive surgical technology and surgical education, unveiled TheNanoExperience.com, a new patient-oriented resource platform. This platform emphasizes Nano arthroscopy, an advanced orthopedic procedure known for minimal invasiveness, potentially enabling swift recovery and reduced discomfort. Technological advancements, such as enhanced imaging capabilities and minimally invasive techniques, are driving this growth by improving surgical precision and patient outcomes.

Joint Type Insights

The knee segment led the joint reconstruction devices market, with the largest revenue share of 45.50% in 2024, driven by various factors, including technological advancements, demographic trends, and evolving patient preferences. For instance, in May 2024, Exactech, a global medical technology company, introduced an advanced iteration of its ligament-driven balancing technology. This innovation includes the latest ExactechGPS software, designed to facilitate personalized surgical planning and align with contemporary alignment strategies for total knee replacement procedures. This segment focuses on addressing knee joint issues through surgical interventions ranging from partial to total knee replacements, catering to a wide spectrum of patient needs and conditions.

The shoulder segment is expected to grow at a significant CAGR over the forecast period. The factors, such as improved healthcare access, including insurance coverage, availability of specialized surgeons, and well-equipped medical facilities, make shoulder surgery more accessible to a larger portion of the population. Innovations such as minimally invasive procedures, advanced imaging techniques, and the development of customizable implants are enhancing surgical precision and patient outcomes. For instance, in April 2024, Kokilaben Dhirubhai Ambani Hospital introduced the Arthrex Modular Glenoid System featuring Virtual Implant Positioning (VIP) for shoulder replacement surgery in India. These technological advancements are expanding treatment options for shoulder joint disorders, addressing diverse patient needs and driving competitiveness among medical device manufacturers in the global market.

Regional Insights

The North America joint reconstruction devices market held the dominant global revenue share of 46.48% in 2024, driven by the rising prevalence of arthritis. According to the CDC, in 2022, 18.9% of adults had diagnosed arthritis, with women (21.5%) more affected than men (16.1%) in U.S. This increasing arthritis prevalence underscores the growing demand for joint reconstruction devices, as more individuals seek medical solutions to manage and alleviate their joint pain and improve their quality of life.

U.S. Joint Reconstruction Devices Market Trends

The U.S. joint reconstruction devices industry held a significant share of North America in 2024, driven by increasing demand for joint reconstruction procedures. For instance, approximately 790,000 total knee replacements and 544,000 hip replacements are performed annually in the U.S. This surge is driven by the rising prevalence of arthritis and an aging population. As more individuals seek to alleviate joint pain and improve mobility, the need for advanced joint reconstruction devices escalates. This trend highlights the market's growth and the pivotal role of medical innovation in improving patient outcomes.

Europe Joint Reconstruction Devices Market Trends

The Europe joint reconstruction devices industry is experiencing significant growth, fueled by the increasing prevalence of conditions such as psoriasis. A Medscape report published in March 2024 estimates that psoriasis affects roughly 6.4 billion individuals across Europe. As more individuals suffer from joint issues associated with this chronic skin condition, the demand for joint reconstruction procedures rises. This trend highlights the growing need for advanced medical devices to manage joint pain and improve mobility, driving market growth in the region.

The UK joint reconstruction devices market is one of the major markets in the region, experiencing notable growth, driven by an aging population and increased incidence of joint disorders. Key market players are leading this expansion by innovating and introducing advanced joint reconstruction solutions. In July 2025, Embody Orthopaedic’s H1 hip implant received CE approval, allowing women and smaller men to undergo hip resurfacing that was previously limited to men. Trials showed that patients could resume activities like cycling and swimming within six weeks.

The joint reconstruction devices market in Germany is witnessing notable growth, propelled by an aging population and the increasing prevalence of rheumatoid arthritis. A February 2024 report by the Scandinavian Journal of Rheumatology projects that the total number of rheumatoid arthritis cases in Germany will increase to 284,000 by 2040, representing a 38% relative rise from 2015 to 2040. As more elderly individuals and those with rheumatoid arthritis seek effective treatments, the demand for advanced joint reconstruction solutions rises. This trend is driving market expansion and innovation, with key players continuously developing new devices to enhance patient mobility and quality of life.

Asia Pacific Joint Reconstruction Devices Market Trends

The Asia Pacific joint reconstruction devices industry is experiencing the fastest growth, driven by an aging population, increasing prevalence of joint disorders, and rising healthcare expenditure. Advancements in medical technology and increased awareness of joint health are also contributing to the market's expansion. As more patients seek effective treatments for joint pain and mobility issues, the demand for joint reconstruction devices continues to surge across the region. In October 2025, Japan authorized the first-ever iodine-coated total hip replacement system, which helps prevent bacterial buildup and biofilm formation, targeting the 1- 2% of joint replacement patients who are affected by periprosthetic infections.

The China joint reconstruction devices market is driven by the increasing number of joint replacement surgeries. Factors such as an aging population, rising prevalence of joint disorders, and improvements in healthcare infrastructure contribute to this trend. As more patients opt for joint replacement procedures to alleviate pain and enhance mobility, the demand for advanced joint reconstruction devices continues to rise in China. In July 2025, China approved and launched the Biotype Knee Prosthesis System, the nation’s first non-cemented knee implant featuring a 3D-printed zonal trabecular bone design, which improves bone integration, ensures better mechanical stability, and reduces the risks associated with bone cement.

The joint reconstruction devices market in Japan is experiencing substantial growth, fueled by technological advancements and an aging population. Innovations in medical technology, including minimally invasive surgical techniques and advanced implant materials, are driving the market forward. For instance, in May 2024, OrthAlign, Inc., an innovator in surgical technology, announced the launch of its flagship product, Lantern, in Japan. Lantern is designed for use in total, partial, and revision knee arthroplasty procedures. As these advancements improve surgical outcomes and recovery times, the demand for joint reconstruction devices continues to increase, addressing the needs of Japan's growing elderly population with joint disorders.

Latin America Joint Reconstruction Devices Market Trends

The Latin America joint reconstruction devices industry is experiencing notable growth, driven by an aging population and increasing incidence of joint problems. As the elderly population increases, so does the prevalence of conditions such as arthritis, resulting in a greater demand for effective joint reconstruction solutions. In October 2024, an article published in Expert Opinion on Pharmacotherapy reported that rheumatoid arthritis prevalence in Latin America is notably higher among indigenous populations, with many areas facing severe rheumatologist shortages and high non-adherence rates due to socioeconomic barriers.

The Brazil joint reconstruction devices market is experiencing significant growth driven by an increase in joint surgery procedures. Factors such as an aging population and a higher incidence of joint disorders are contributing to this surge. As more patients seek surgical solutions for joint issues, demand for advanced reconstruction devices continues to rise. In November 2024, Brazilian surgeons received training on robotic-assisted total joint replacement using the VELYS system, advancing precision knee surgery and enhancing patient outcomes and recovery.

Middle East Joint Reconstruction Devices Market Trends

The joint reconstruction devices industry in MEA is experiencing growth, driven by an aging population and the rising number of surgical hospitals. As the elderly population increases, so does the prevalence of joint disorders, leading to a higher demand for reconstructive procedures. In October 2025, Mediclinic Durbanville in South Africa advanced limb and joint reconstruction using 3D-printed implants, motorized bone transport devices, and other cutting-edge techniques to restore mobility and improve patient outcomes.

The joint reconstruction devices market in Saudi Arabia is witnessing growth, fueled by an aging population and expanding healthcare infrastructure. The rising prevalence of joint disorders among the elderly is driving demand for advanced reconstruction procedures and surgical interventions. In May 2024, Saudi Arabia’s NGHA in Medina performed its first AI‑assisted robotic total knee replacement, achieving 99% precision in joint alignment and improving surgical outcomes.

Key Joint Reconstruction Devices Company Insights

The competitive scenario in the joint reconstruction devices industry is highly competitive. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Joint Reconstruction Devices Companies:

The following are the leading companies in the joint reconstruction devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker

- Aesculap, Inc. (B. Braun SE)

- Zimmer Biomet

- DePuy Synthes (Johnson and Johnson)

- Smith+Nephew

- CONMED Corporation

- DJO, LLC (Enovis)

- NuVasive, Inc. (Globus Medical)

- Arthrex, Inc.

Recent Developments

-

In October 2025, DePuy Synthes (Johnson and Johnson) launched the INHANCE INTACT total shoulder replacement system in the U.S., featuring a tissue-sparing approach that preserves the subscapularis muscle and allows day-one post-op mobility.

-

In June 2025, Johnson & Johnson MedTech launched the KINCISE 2 Surgical Automated System in the U.S., designed for primary and revision hip and knee procedures. The system aims to improve surgical efficiency, reduce physical strain on surgeons, and expand capabilities in complex joint reconstruction surgeries.

-

In March 2025, Johnson & Johnson MedTech highlighted its latest advancements in joint reconstruction at AAOS 2025, showcasing robotic-assisted solutions such as VELYS for knee procedures and the ATTUNE Knee System. The company emphasized improving surgical precision, reducing revision risks, and enabling more personalized care for patients through the use of data-driven technologies and advanced implants.

-

In February 2024, Smith+Nephew, a global medical technology company, launched its AETOS Shoulder System for full commercial availability in the U.S. Additionally, it has received 510(k) clearance for its integration with 3D Planning Software for total shoulder arthroplasty.

-

In February 2024, AddUp, a global OEM specializing in metal additive manufacturing, and Anatomic Implants announced their collaboration to submit a 510(k) joint type for the world’s inaugural 3D-printed toe joint replacement.

-

In January 2024, Bruker Corporation acquired Chemspeed Technologies, a company specializing in vendor-agnostic automated laboratory R&D. Chemspeed focuses on modular automation and robotics solutions for pharmaceutical drug formulation. Strategic acquisitions enable firms to access new markets, augment their R&D capabilities, and strengthen their competitive positions in the rapidly evolving landscape of laboratory automation and robotics.

-

In February 2024, THINK Surgical, Inc., revealed a new partnership with Waldemar Link of Germany, known for its groundbreaking joint replacement solutions. Under this partnership, THINK Surgical will integrate the LinkSymphoKnee System into THINK Surgical's ID-HUB.

Joint Reconstruction Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30.40 billion

Revenue forecast in 2033

USD 41.23 billion

Growth rate

CAGR of 3.88% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, joint type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Stryker; Aesculap, Inc. (B. Braun SE; Zimmer Biomet; DePuy Synthes (Johnson and Johnson); Smith+Nephew; CONMED Corporation; DJO, LLC (Enovis); NuVasive, Inc. (Globus Medical); Arthrex, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Joint Reconstruction Devices Market Report Segmentation

This report forecasts volume & revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the joint reconstruction devices market report based on technique, joint type, and region:

-

Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Joint replacement

-

Osteotomy

-

Arthroscopy

-

Resurfacing

-

Arthodesis

-

Others

-

-

Joint Type Outlook (Procedure Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Knee

-

Hip

-

Shoulder

-

Ankle

-

Others

-

-

Regional Outlook (Procedure Volume, Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global joint reconstruction devices market size was estimated at USD 28.91 billion in 2024 and is expected to reach USD 30.40 billion in 2025.

b. The global joint reconstruction devices market is expected to grow at a compound annual growth rate of 3.88% from 2025 to 2033 to reach USD 41.23 billion by 2033.

b. North America dominated the joint reconstruction devices market with a share of 46.48% in 2024. This is attributable to rising demand for minimally invasive diagnostic and surgical techniques and growing prevalence of orthopedic conditions.

b. Some key players operating in the joint reconstruction devices market include Medtronic; Stryker; Aesculap, Inc. (B. Braun SE; Zimmer Biomet; DePuy Synthes (Johnson and Johnson); Smith+Nephew; CONMED Corporation; DJO, LLC (Enovis); NuVasive, Inc. (Globus Medical); Arthrex, Inc.

b. Key factors that are driving the market growth include growing cases of surgeries associated to orthopedic disorders such as arthritis, osteoporosis, gout, bone degenerative diseases, and injuries and increasing patient base with growing population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.