- Home

- »

- Advanced Interior Materials

- »

-

KSA Cement Market Size And Share, Industry Report, 2035GVR Report cover

![KSA Cement Market Size, Share & Trends Report]()

KSA Cement Market (2025 - 2035) Size, Share & Trends Analysis Report By Product (Portland Cement, White Cement), By Application (Residential, Commercial, Industrial, Infrastructural), And Segment Forecasts

- Report ID: GVR-4-68040-432-9

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2015 - 2024

- Forecast Period: 2025 - 2035

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

KSA Cement Market Summary

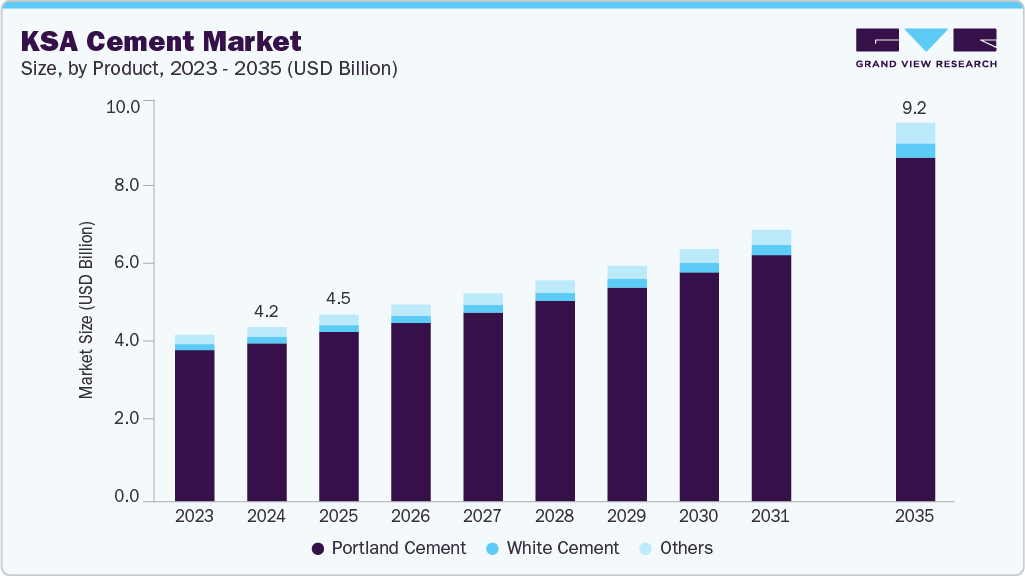

The KSA cement market size was estimated at USD 4.22 billion in 2024 and is projected to reach USD 9.18 billion by 2035, growing at a CAGR of 7.3% from 2025 to 2035. Kingdom of Saudi Arabia (KSA) cement market is driven by its rising application in the construction industry in the country, owing to the country's ambitious Vision 2030 initiative, which focuses on extensive infrastructure and urban development.

Key Market Trends & Insights

- By product, the white cement segment is expected to grow at the fastest CAGR of 7.6% over the forecast period.

- By application, the residential segment is expected to grow at the fastest CAGR of 7.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.22 Billion

- 2035 Projected Market Size: USD 9.18 Billion

- CAGR (2025-2035): 7.3%

The rapid urbanization and expansion of major cities, coupled with a surge in population, are fueling a robust demand for residential and commercial construction. In addition, ongoing economic diversification efforts and increased private sector investments in real estate and construction further stimulate product consumption.The Saudi Vision 2030 plan is a significant catalyst for the product market. This blueprint for economic diversification and modernization includes extensive infrastructure projects such as new highways, bridges, airports, and public transportation systems. These large-scale projects require substantial amounts of product, driving up demand and fostering industry growth. Notable examples include the development of the King Abdulaziz International Airport expansion and the Red Sea Project, which necessitate high volumes of product for construction.

Rapid urbanization in Saudi Arabia, particularly in major cities like Riyadh, Jeddah, and Dammam, is a major driver of product demand. The ongoing expansion and modernization of urban areas have led to an increased construction of residential, commercial, and mixed-use developments. As new residential neighborhoods and commercial centers are built to accommodate a growing urban population, the demand for products continues to rise.

Moreover, Saudi Arabia's efforts to reduce its economic reliance on oil are resulting in significant investments across various sectors, including real estate, tourism, and entertainment. This diversification strategy includes the development of new business hubs, tourism destinations, and recreational facilities, all of which require considerable product for construction. Projects like the NEOM city and the Red Sea tourism developments are prime examples of initiatives driving product consumption.

The Saudi Arabian product market faces several restraints that could impact its growth trajectory. One significant challenge is the volatility of raw material prices, particularly for key inputs like clinker, limestone, and gypsum. Fluctuations in these costs can lead to increased production expenses and affect profit margins for product manufacturers. In addition, the industry is grappling with overcapacity issues, which can lead to intense competition and pricing pressures among producers.

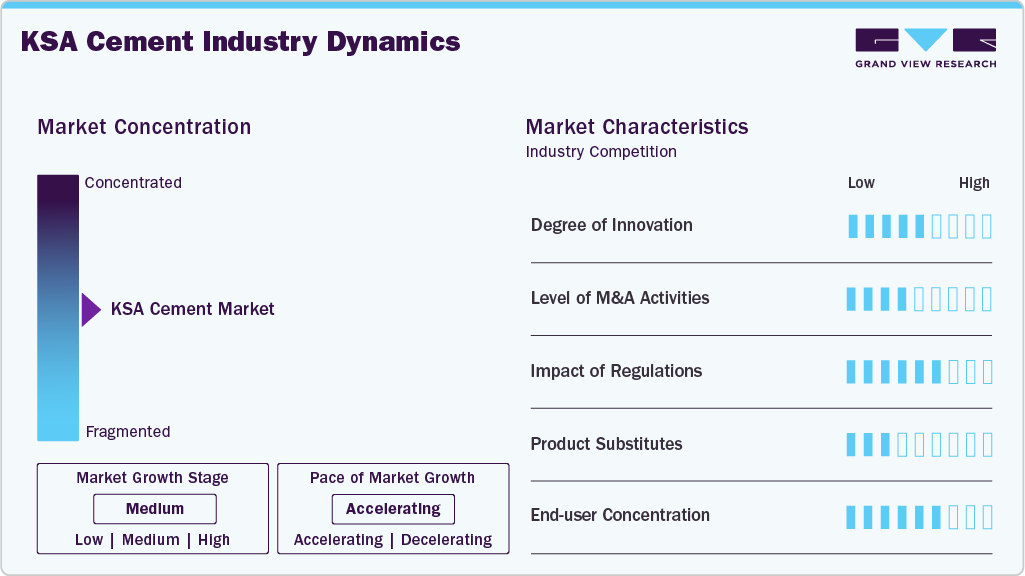

Market Concentration & Characteristics

The market is moderately concentrated among a set of large incumbents (e.g., Saudi Cement, Yamama, Qassim, Eastern, City Cement, Najran, others), each owning multi-million tonnes per annum (tpa) capacity and geographically distributed plants. Capacity additions and relocations have been tracked closely; some players lead in specific regions (e.g., central, eastern, and south). While several large players control a substantial portion of national capacity, regional fragmentation persists due to plant location economics and captive quarries, meaning local market power matters at the governorate level. Overall, national volumes are dominated by a handful of major firms, but competitive intensity is medium due to logistical and contract dynamics.

The threat of substitutes is low for bulk structural cement because there are few direct volume substitutes on the scale. Concrete/ready-mix is the primary application and requires cement/clinker. However, partial substitution occurs through the high-volume use of SCMs (slag, fly ash) and blended cements, which reduce the volumes of pure OPC. Alternative construction methods (timber-frame, steel modular construction, precast elements) can reduce on-site cement use per project but do not eliminate demand for factory-produced precast concrete (which still consumes cement). The reuse and recycling of demolition aggregate have a marginal substitution effect at present.

Product Insights

The Portland cement dominated the market with a revenue share of 90.8% in 2024, owing to its essential role in modern infrastructure and building projects. The product is renowned for its versatility and strength. Portland cement is used in a wide array of applications, including residential, commercial, and industrial construction. Its ability to form strong, durable concrete makes it ideal for structural applications like bridges, roads, and high-rise buildings.

Ordinary Portland Cement (OPC) is mainly composed of clinker, a granular material produced by heating limestone and other raw ingredients at high temperatures in a kiln. Its key components, such as calcium silicates, calcium aluminates, and calcium ferrites, contribute to its strength and binding properties. The primary types of Portland cement include Type I, Type II, Type III, and Type IV, each designed for specific performance needs. Alongside OPC, the market also features Blended Cement, which integrates clinker with additives like fly ash, slag, or pozzolana for improved sustainability, and Other Specialty Cements, tailored for unique structural and environmental applications.

The white cement segment is expected to grow at the fastest CAGR of 7.6% over the forecast period, due to its extensive use in architectural and decorative applications such as facades, interior finishes, tiles, and precast elements. Its superior aesthetic appeal, high reflectivity, and smooth surface finish make it a preferred choice for high-end commercial and residential projects across Riyadh, Jeddah, and NEOM developments. The growing demand for premium and visually appealing infrastructure, coupled with the rising construction of luxury housing and hospitality projects, has driven the consumption of white cement in the Kingdom.

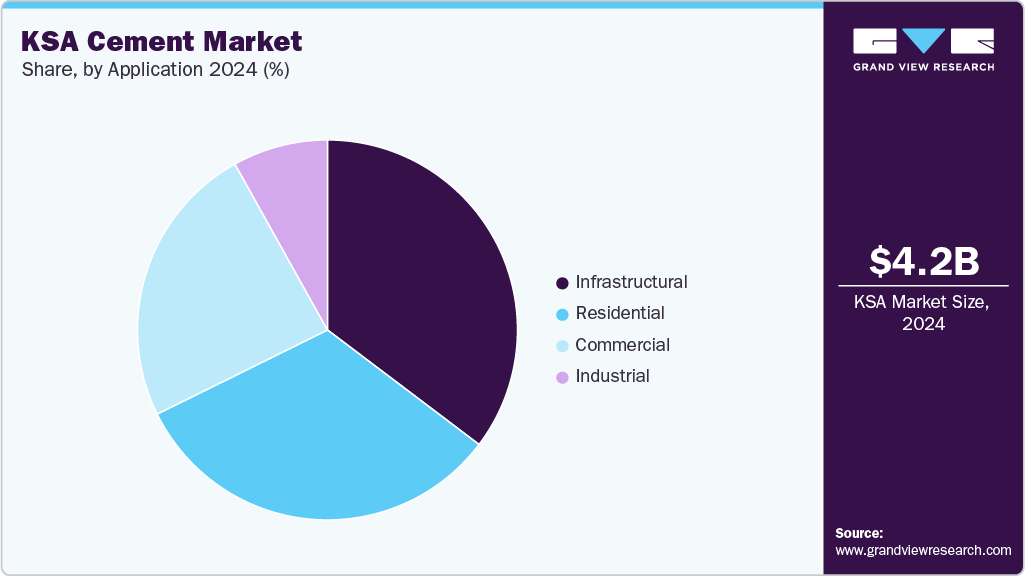

Application Insights

The infrastructural segment held the largest revenue market share of 35.3% in 2024, supported by mega-projects such as NEOM, The Line, Qiddiya, and the Red Sea Development. Massive investments in roads, bridges, airports, industrial zones, and transportation networks are generating sustained cement consumption on a large scale. Government-backed funding and public-private partnerships have accelerated project execution timelines, ensuring consistent offtake for major cement producers. The ongoing development of smart cities and industrial corridors, coupled with modernization of utilities and transport systems, further consolidates the infrastructural segment’s dominance in Saudi Arabia’s cement market.

The residential segment is expected to grow at the fastest CAGR of 7.5% over the forecast period, fueled by massive housing development initiatives under Vision 2030 and government programs like Sakani, which aim to expand homeownership. Rapid urbanization, a growing young population, and rising middle-class housing needs have resulted in a steady demand for cement-based construction materials. Large-scale residential communities and affordable housing projects across major cities such as Riyadh, Dammam, and Jeddah are major contributors. In addition, the shift toward sustainable and energy-efficient housing further supports cement demand for both traditional and modern building solutions.

Key KSA Cement Company Insights

Some of the key players operating in the market include Saudi Cement and Najran Cement

-

Saudi Cement Company is one of the Kingdom’s largest cement producers. The company operates two plants in Hofuf and Ain Dar, supplying high-quality clinker and cement products for domestic and export markets. It plays a key role in supporting Saudi Arabia’s infrastructure and construction sectors.

-

Established in 2005, Najran Cement Company is based in the Najran region of Saudi Arabia. It operates an integrated cement plant with its own quarry and captive power generation unit. The company serves major construction and infrastructure projects across the Kingdom and also exports to neighboring markets.

Yanbu Cement and Qassim Cement are some of the emerging market participants in the KSA market.

-

Yanbu Cement Company (YCC) is a prominent cement producer in Saudi Arabia, distinguished as the largest cement manufacturer in the Western Region. This Saudi joint-stock company has a total installed capacity exceeding 7.0 million tons of clinker and a cement dispatch capability surpassing 10.0 million tons annually. With a paid-up capital of SR 1.575 billion, Yanbu Cement ranks among the top 50 companies in the region. Its production facilities are situated at Ras Baridi, along the Red Sea coast, approximately 70 kilometers northwest of the Port of Yanbu.

-

Founded in 1976 and headquartered in Buraydah, Qassim Cement Company is a leading Saudi cement producer. It operates an advanced manufacturing facility in the central region and provides a wide range of cement types for residential, commercial, and industrial applications. The company is known for maintaining strong operational efficiency and consistent product quality.

Key KSA Cement Companies:

- Saudi Cement

- Najran Cement

- Yanbu Cement

- Arabian Cement

- Qassim Cement

- Al Safwa Cement

- Saudi White Cement

- City Cement

- Eastern Province Cement

- Tabuk Cement

Recent Developments

In July 2024, NEOM projects are set to receive cement worth SR104 million ($27.7 million) through a partnership between Saudi Arabia's Al Jouf Cement Co. and Italy's Webuild SpA. The agreement, lasting 41 months, involves supplying cement for various developments within NEOM, which is a $500 billion giga-project located at the northern tip of the Red Sea. The partnership is expected to positively impact Al Jouf's financial statements starting from the third quarter of this year.

KSA Cement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.53 billion

Revenue forecast in 2035

USD 9.18 billion

Growth rate

CAGR of 7.3% from 2025 to 2035

Base year for estimation

2024

Historical data

2015 - 2024

Forecast period

2025 - 2035

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2035

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Saudi Cement; Najran Cement; Yanbu Cement; Arabian Cement; Qassim Cement; Al Safwa Cement; Saudi White Cement; City Cement; Eastern Province Cement; Tabuk Cement

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

KSA Cement Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2015 to 2035. For this study, Grand View Research has segmented the KSA (Kingdom of Saudi Arabia) cement market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2015 - 2035)

-

Portland Cement

-

OPC

-

Blended

-

Others

-

-

White Cement

-

Others

-

-

Application Outlook (Revenue, USD Million, 2015 - 2035)

-

Residential

-

Commercial

-

Industrial

-

Infrastructural

-

Frequently Asked Questions About This Report

b. The KSA cement market size was estimated at USD 4.22 billion in 2024 and is expected to reach USD 4.53 billion in 2025.

b. The KSA cement market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2035 to reach USD 9.18 billion by 2035.

b. Portland cement dominated the market with a revenue share of 90.8% in 2024, owing to its essential role in modern infrastructure and building projects.

b. Some of the key players operating in the KSA cement market include Saudi Cement, Najran Cement, Yanbu Cement, Arabian Cement, Qassim Cement, Al Safwa Cement, Saudi White Cement, City Cement, Tabuk Cement, and Eastern Province Cement

b. Key factors driving the KSA cement market include rapid infrastructure development, large-scale housing projects under Vision 2030, government-led mega construction initiatives, and growing investments in industrial and urban expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.