- Home

- »

- Advanced Interior Materials

- »

-

Laboratory Glassware Market Size & Share Report, 2030GVR Report cover

![Laboratory Glassware Market Size, Share & Trends Report]()

Laboratory Glassware Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Pipette, Flasks, Beakers, Burette), By End-use (Research & Academic Institutes), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-434-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Laboratory Glassware Market Size & Trends

“2030 laboratory glassware market value to reach USD 2.45 billion.”

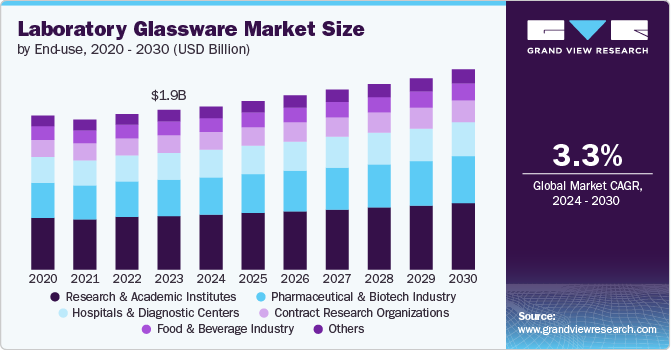

The global laboratory glassware market size was estimated at USD 1.96 billion in 2023 and is estimated to grow at a CAGR of 3.3% from 2024 to 2030. The primary driving factor of the market is the increasing demand for R&D in pharmaceuticals, biotechnology, and diagnostics, fueled by advancements in life sciences and healthcare.

Drivers, Opportunities & Restraints

The market is driven by rising demand for high-quality, durable glassware in R&D across pharmaceutical, biotech, and academic institutions. Growth in drug discovery, biopharmaceuticals, and clinical diagnostics, along with advances in chemical and life sciences research, are fueling the need for precise glassware like beakers, flasks, and pipettes. The rise of personalized medicine and biotechnology further boosts demand for specialized glassware.

Competition from cheaper, more durable plasticware poses a significant restraint, particularly in cost-sensitive sectors. Plasticware's convenience for certain uses, along with the challenge of meeting stringent quality standards for glassware, can slow market growth, especially in fields where high thermal resistance and chemical inertness are less critical.

Automation in labs offers opportunities for glassware manufacturers to create products compatible with robotic systems and advanced technology. The growth of digital tools and AI in labs is driving demand for highly accurate glassware that integrates seamlessly with automated systems, such as those used in precision medicine and diagnostics.

End-use Insights

“Research & academic institutes segment held the largest revenue share of laboratory glassware market in 2023.”

The research & academic institutes segment is the largest segment due to the extensive use of glassware in educational and experimental settings. Universities and research institutions depend heavily on glassware for teaching purposes, conducting experiments, and ongoing scientific exploration. With increasing government funding and growing interest in STEM education, demand for glassware such as beakers, flasks, and Petri dishes remains strong.

The pharmaceutical & biotech segment is anticipated to grow at the fastest CAGR from 2024 to 2030, driven by the expanding pharmaceutical industry and the rise of biotechnology innovations. The need for precision in drug formulation, quality control, and research activities is pushing the demand for laboratory glassware such as pipettes, flasks, and storage containers. The global focus on vaccine development and biopharmaceuticals, combined with an increase in R&D investments, particularly in personalized medicine, is fueling rapid growth in this segment.

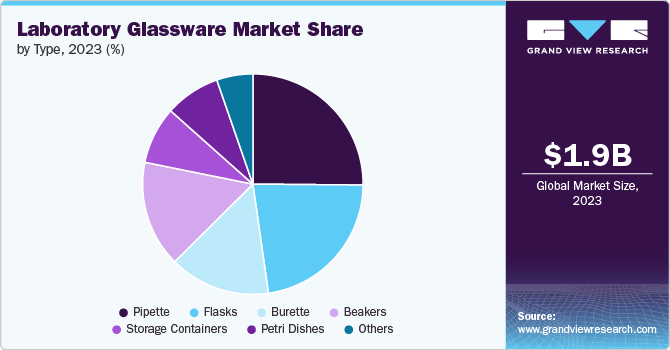

Type Insights

“Pipettes segment is anticipated to grow at fastest CAGR over the forecast period ranging from 2024-2030.”

Pipettes are emerging as the fastest-growing segment, driven by the increasing demand in the pharmaceutical and biotech sectors for precise liquid handling in drug development, molecular biology, and clinical diagnostics. Technological advancements in pipetting techniques, such as electronic pipettes, support this growth by enhancing accuracy and efficiency in research applications.

Beakers are widely used in various laboratory settings for mixing, heating, and holding liquids. Their versatility and broad applicability in research, educational institutions, and industrial labs make them a core piece of equipment. Growing scientific research and academic experiments drive demand for durable, heat-resistant beakers, especially in chemistry and biology labs.

Regional Insights

“North America dominated the revenue share of the global laboratory glassware market in 2023.”

North America laboratory glassware market holds a substantial share in 2023, supported by a robust pharmaceutical and biotechnology industry. The region’s strong focus on R&D, particularly in the U.S., drives consistent demand for laboratory glassware in academic institutions, clinical research labs, and pharmaceutical companies.

U.S. Laboratory Glassware Market Trends

The laboratory glassware market in the U.S. dominates the North American market, with extensive R&D activities in drug development, biopharmaceutical research, and life sciences fueling demand for advanced laboratory glassware. The presence of key market players and large-scale research institutes strengthens the U.S.’s leadership in the laboratory glassware market, especially in precision-oriented sectors.

Asia Pacific Laboratory Glassware Market Trends

The Asia Pacific region is witnessing rapid growth in the laboratory glassware market due to expanding healthcare infrastructure, increasing investments in scientific research, and growing pharmaceutical and biotechnology sectors. China and India are key growth drivers in the region, with rising demand for glassware in academic and industrial research institutions as well as pharmaceutical manufacturing facilities.

Europe Laboratory Glassware Market Trends

The laboratory glassware in Europe is a significant market for laboratory glassware, supported by well-established academic institutions, advanced research centers, and a strong presence of pharmaceutical companies. Countries like Germany and the UK lead in scientific research and innovation, driving the demand for high-quality laboratory glassware. The region’s focus on environmental sustainability also supports the adoption of recyclable and eco-friendly glassware solutions.

Key Laboratory Glassware Company Insights

Some key players operating in the market include Corning Incorporated and DWK Life Sciences.

-

Corning Incorporated is a prominent player in the laboratory glassware market, known for its expertise in materials science. The company operates across various segments, including life sciences, where it produces laboratory products like flasks, pipettes, beakers, and petri dishes. Corning’s laboratory glassware is widely used in research institutions, pharmaceutical labs, and biotech companies due to its high-quality and durability.

-

DWK Life Sciences is a global manufacturer specializing in high-quality laboratory glassware and plasticware. The company provides a broad portfolio of products, including beakers, storage containers, and precision glassware under well-known brands such as DURAN®, WHEATON®, and KIMBLE®. Serving sectors like pharmaceuticals, research, and diagnostics, DWK Life Sciences emphasizes precision and reliability in its glassware offerings, catering to both academic institutions and industrial laboratories.

Key Laboratory Glassware Companies:

The following are the leading companies in the laboratory glassware market. These companies collectively hold the largest market share and dictate industry trends.

- Bellco Glass, Inc.

- Corning Incorporated

- Crystalgen Inc.

- DWK Life Sciences

- Eppendorf AG

- Gerresheimer AG

- Mettler Toledo International, Inc.

- Sartorius AG

- Technosklo Ltd.

- Thermo Fisher Scientific

Recent Developments

-

In August 2024, Calibre Scientific acquired U.S.-based Industrial Glassware, a manufacturer of caps, vials, bottles, and related laboratory consumables. This acquisition strengthens Calibre Scientific’s U.S. manufacturing operations and broadens its global portfolio of laboratory products.

-

In October 2023, Gerresheimer AG launched its new “Cyclic Olefin Polymer vials," specifically designed for the storage and filling of highly sensitive biologics. This product introduction substantially increased the company's revenue and strengthened its position as a leading provider of laboratory consumables.

-

In September 2023, Sartorius AG introduced the New Picus 2, a cutting-edge connected electronic pipette that redefined industry standards. This product launch expanded their customer base and reinforced their leadership in the laboratory equipment sector.

Laboratory Glassware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.02 billion

Revenue forecast in 2030

USD 2.45 billion

Growth rate

CAGR of 3.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Corning Incorporated; Bellco Glass, Inc.; Gerresheimer AG; Thermo Fisher Scientific; Mettler Toledo International, Inc.; Sartorius AG; Eppendorf AG; Technosklo Ltd.; Crystalgen Inc.; DWK Life Sciences.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Glassware Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory glassware market report based on the type, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pipette

-

Flasks

-

Burette

-

Beakers

-

Storage Containers

-

Petri Dishes

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Research & Academic Institutes

-

Pharmaceutical & Biotech Industry

-

Hospitals & Diagnostic Centers

-

Contract Research Organizations

-

Food & Beverage Industry

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global laboratory glassware market size was estimated at USD 1.96 billion in 2023 and is expected to reach USD 2.02 billion in 2024.

b. The global laboratory glassware market is expected to grow at a compound annual growth rate of 3.3% from 2024 to 2030 to reach USD 2.45 billion by 2030.

b. By type, pipette dominated the market with a revenue share of over 25.0% in 2023.

b. Some of the key vendors in the global laboratory glassware market are Corning Incorporated, Bellco Glass, Inc., Gerresheimer AG, Thermo Fisher Scientific, Mettler Toledo International, Inc., Sartorius AG, Eppendorf AG, Technosklo Ltd., Crystalgen Inc., DWK Life Sciences, among others.

b. The key factor driving the growth of the global laboratory glassware market is attributed to the significant growth driven by increasing demand for R&D in pharmaceuticals, biotechnology, and diagnostics, fueled by advancements in life sciences and healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.