- Home

- »

- Healthcare IT

- »

-

Latin America Telehealth Market Size, Industry Report, 2030GVR Report cover

![Latin America Telehealth Market Size, Share & Trends Report]()

Latin America Telehealth Market Size, Share & Trends Analysis Report By Product Type (Hardware, Software, Services), By Delivery Mode (On-premise, Web-based), By End-use (Payers, Providers), By Disease Area, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-206-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Latin America Telehealth Market Trends

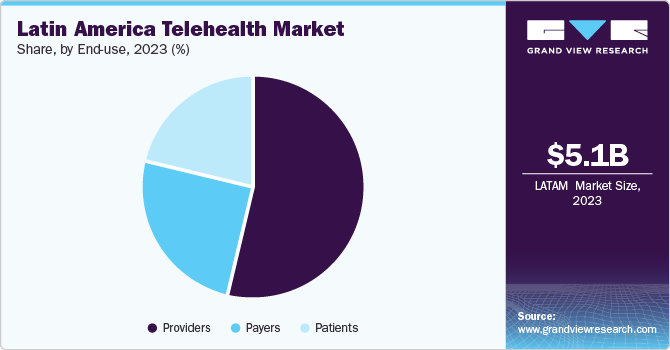

The Latin America telehealth market size was valued at USD 5.05 billion in 2023 and is expected to grow at compound annual growth rate (CAGR) of 24.1% from 2024 to 2030. The market growth is being driven by growing demand for remote healthcare services, especially due to the COVID-19 pandemic, where need for virtual consultations and remote monitoring surged.Advancements in technology, including robust internet connectivity and adoption of smartphones, contribute to expansion of telehealth by making healthcare services more accessible and convenient for patients.

The high prevalence of chronic diseases, such as cardiovascular disease, arthritis, & cancer, which necessitate ongoing medical supervision, is fueling demand for telehealth in Latin America. Furthermore, the aging population, which is more vulnerable to serious medical conditions, is driving the demand for homecare-based medical treatment, impelling market growth in the region. The increasing adoption of digitalization trends in the healthcare sector is boosting market growth. In addition, with the unexpected COVID-19 outbreak, many healthcare professionals and patients had started turning to telehealth services to reduce the risk of infection transmission during hospital or clinic visits. These people are continuing to use telehealth post-pandemic to receive faster diagnosis & treatment.

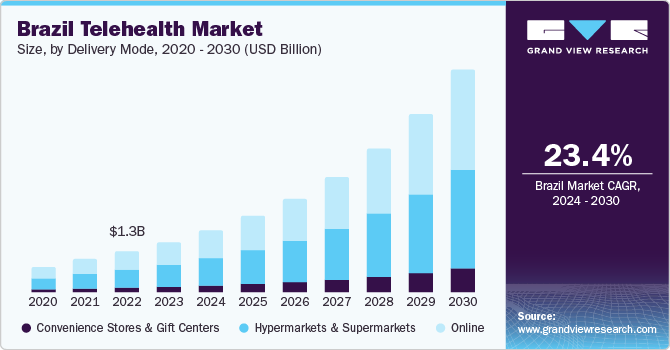

Increasing adoption of digital technology and growing healthcare sector have driven the telehealth market. The market is expected to grow at a significant rate owing to the availability of mobile health services & solutions. By 2026, approximately 185.4 million Brazilians will be using mobile internet, indicating a large pool of users turning to telehealth applications. Telehealth services & solutions help community healthcare workers efficiently handle surveillance studies. Increasing collaborations between the government and private investors to promote digitalization of healthcare services are expected to propel market growth in the country. For instance, Agfa Healthcare entered partnerships with several hospitals to provide eHealth solutions in Brazil, including telehealth.

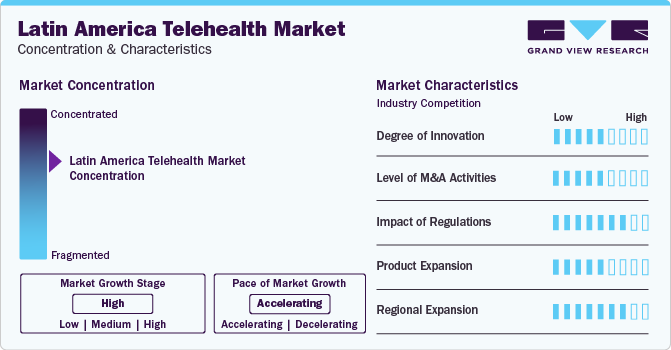

Market Concentration & Characteristics

The market growth stage is high, and the pace of market growth is accelerating. With increasing adoption of smartphones and easy availability of technologically advanced devices, innovators have started investing to make the most of the current situation of the industry.

Focusing on delivering quality healthcare & comfort through various mobile platforms, which would help patients track their fitness regimes and obtain answers to medical inquiries over the phone, WhatsApp, or through several mobile applications. For instance, apps such as Teladoc Health, Doctor Anywhere, Doctor on Call, and ClicknCare have been introduced to help patient’s book appointments, track their consultations & medical prescriptions, and store their healthcare information over course of the treatment.

The Latin America telehealth market is characterized by a high level of M&A activities undertaken by leading players. This is due to factors including the increasing focus on enhancing companies' products & services portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of aesthetic treatments. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in August 2021, NANO-X Imaging Ltd., a Brazil-based medical imaging company, announced its plans to acquire Zebra Medical Vision for USD 100 million. The acquisition was aimed at fueling the companies’ shared goals of developing next-generation AI-driven devices.

Telehealth practice is regulated by statutory provisions, regulations, or professional guidelines implemented by state professional licensing bodies, such as the Board of Medicine. The Argentine Ministry of Health issued a set of guidelines for “telehealth” supply in 2019 (Disposition No. 21/2019). The “Guidelines for the utilization of telehealth services between both the healthcare provider and the patient using real-time ICT” were created by a group of healthcare professionals, organized by the Ministry of Health, with the goal of developing a guideline for safe, efficient, and ethical provision of telehealth. Prior to the COVID-19 pandemic, private health insurers that provided this type of care voluntarily followed this set of recommendations, but compliance was not required. However, this has changed since the COVID-19 pandemic and lockdown measures adopted by the government.

Telehealth hardware consists of monitors and medical peripheral devices. The medical peripheral devices include blood pressure meters, blood glucose meters, pulse oximeters, peak flow meters, ECG monitors, weighing scales, and others. Software types include standalone software and integrated software. Remote patient monitoring, real-time interactions, store & forward, and other services are covered under services of telehealth technology. The telehealth market is demand-driven, and the market players launch several new systems and products to meet the growing needs of consumers. For instance, in January 2023, Teladoc Health introduced a complete integrated healthcare solution via a new comprehensive digital platform that facilitates tailored, all-encompassing care for individuals. Clients can now effortlessly avail Teladoc Health's comprehensive offerings, covering primary healthcare, mental wellness, and ongoing ailment supervision; all consolidated within a singular accessible account.

Companies such as GE Healthcare, Siemens Healthineers, Medtronic, Omint Health Group, and Nano-X Imaging Ltd. have a strong presence in the Latin America market and have established manufacturing facilities in the region. However, these companies are also focusing on market expansion in other countries across the world.

End-use Insights

Providers held the largest share of 53.7% in 2023. The segment growth is attributable to the increasing adoption of teleconsultation, telemedicine, and telehealth among healthcare professionals to reduce burden on healthcare facilities. Moreover, increased convenience offered by these solutions for quick and seamless access to real-time quality reporting, patient health records, improved decision-making, improved data management, and eHealth solutions is expected to increase adoption of these services among the providers. Many healthcare facilities have witnessed considerable improvement in workflow management through adopting these services, which is boosting its adoption.

The payers’ segment is anticipated to grow at the fastest rate over the forecast period. Payers comprise insurance companies, health plan sponsors (employers and unions), and third-party payers. The payer industry has witnessed a rapid increase in telehealth claims due to the COVID-19 pandemic and providers are adopting telehealth for all in-person and non-urgent care. Payers are turning toward telehealth to provide its members with the right care at the right time in the right place. Telehealth services offer major cost-saving opportunities, including lower cost per visit in comparison with in-person visits and fewer diagnostics associated with telehealth visits than with in-person visits.

Product Type Insights

Services segment held the largest revenue share of 47% in 2023. The segment is anticipated to expand at a lucrative rate owing to the prevailing trend of outsourcing these services. As healthcare facilities lack resources and skill sets required for deployment of digital health solutions, these services are outsourced. Growing need of telehealth application in chronic disease management, real-time monitoring, rapid advancements in digital infrastructure, growing internet & smartphone penetration, development in hardware & software components is driving segment growth. As a result, constantly evolving digital space is expected to support the growing need for these services.

The software segment is anticipated to witness the fastest CAGR over the forecast period. High demand for reducing rapidly rising medical costs, growing need for accurate & timely information procurement, and rising patient care costs are among key factors responsible for segment growth. In addition, owing to government reforms and a rise in demand for technologically advanced Healthcare IT solutions, companies in the market are emphasizing launching advanced products and improved versions of existing software.

Delivery Mode Insights

Based on delivery mode, web-based delivery mode held the largest share of 45.4% in 2023, owing to rise of virtual care & web-based applications and an increasing adoption of web-based delivery methods that provide patients with direct access to healthcare services. Web-based solutions are delivered to users through web servers using internet protocol. Web-based solutions comprise four aspects, including internet connection, data administrator, web server, and software coding system. Utilizing internet and web-based services provides access to most remote areas using only one computer or monitoring device.

Cloud-based delivery segment is anticipated to witness the fastest CAGR over the forecast period owing to rising adoption of cloud-based applications by both healthcare providers and patients, along with introduction of technologically advanced solutions. Moreover, seamless data storage & recovery, high bandwidth, enhanced security, easy accessibility provided by cloud-based applications are further contributing to the growth of the segment. Cloud-based solutions enable patient monitoring and teleconsultation for individuals, which require immediate medical assistance in rural and remote locations.

Disease Area Insights

The radiology segment dominated the market with a share of 13.1%. Teleradiology allows underservice hospitals to have timely access to a radiologist who functions similar to being on-site. Teleradiology applications comprise teleconsultation, telemonitoring, and telediagnosis, which enables radiologists to effectively perform their daily work. It provides effective on-site solutions via cloud networks globally and real-time interpretation. Increasing incidences of chronic diseases including breast cancer, cellulitis, & osteomyelitis and a growing number of emergency cases in less-developed areas are expected to drive the market.

The psychiatry segment is anticipated to grow at the fastest from 2024 to 2030. There is currently a shortage of available psychiatrists, especially in specialties such as child psychiatry in the region. Several individuals do not have sufficient access to mental health services and professionals in their area. As a result, more people are turning to tele-psychiatry solutions, which allow them to connect with mental health professionals regardless of their location.

Country Insights

Latin America accounted for a market share of 5.0% in 2023. The high prevalence of chronic diseases, such as cardiovascular disease, arthritis, & cancer, which necessitate ongoing medical supervision, is fueling demand for telehealth in Latin America.

Brazil Skincare Products Market Trends

The Brazil telehealth market along with its healthcare sector is undergoing a digital transformation. Teleconsultation implementation is becoming a reality due to the COVID-19 pandemic. Because of the quarantine scenario, the government was forced to temporarily legalize teleconsultations for all doctors and healthcare professionals. Telehealth has a wide range of applications in Brazil. Mobile health (mHealth), health-related Information Technology (IT), wearables, telehealth & telemedicine, and personalized medicine are some of the categories covered under digital transformation plan. Appointments with doctors, e.g., can be held using general videoconferencing/teleconferencing apps such as Skype, Zoom, and Microsoft Teams.

Mexico Skincare Products Market Trends

The telehealth market in Mexico is still in a developing phase and is expected to grow at a significant rate during the forecast period. Favorable public programs, such as National Universal Health Coverage Policy, National Digital Strategy, and Telehealth Program of Action, have contributed to the development of a sustainable digital environment in Mexico. Initiation of various digital health projects is expected to further boost the demand for telehealth services in Mexico. For instance, Frugal Innovations in Health Care Delivery, surveys and analyzes MedicallHome, which provides telephonic access to licensed doctors in larger hospitals, labs, and clinics.

Argentina Skincare Products Market Trends

Healthcare infrastructure in a few parts of Argentina is largely underdeveloped. In Argentina telehealth market, especially the rural areas lack basic healthcare access due to remote presence, lack of funding, and shortage of skilled healthcare professionals. The government of Argentina is focusing on providing access to healthcare services in these underdeveloped parts of the country through digitalization of healthcare, including telehealth and EHR management. The government is also collaborating with private organizations, such as The Omint Health Group, a developer of an online medical platform that enables video consultations between patients & doctors.

Chile Skincare Products Market Trends

The telehealth market in Chile is anticipated to witness substantial growth over the forecast period. Also, there is consensus on the imperative need to integrate technologies and manage improvements. As a result, a specialized strategic program is needed to address gaps, catalyze & optimize regulatory processes, and accelerate adoption of technologies & services in a short term, which will position Chile as a regional leader. Although telemedicine thrived during the pandemic and its adoption progressed in many countries, as of 2019, telemedicine had a 65% adoption rate in Chilean hospitals. In Chile, telemedicine has been considered as an essential solution for issues such as coverage, lack of specialists, and care in remote areas.

Key Latin America Telehealth Company Insights

The key companies in Latin America telehealth market have been involved in mergers and acquisitions to increase their share in the market and provide innovative solutions to the users which is anticipated to boost the market growth during the forecast period. Furthermore, several initiatives are being undertaken by the key players globally, which have significantly contributed to the market growth during COVID-19. Several market players reported exponential growth in revenue during the pandemic as compared to the previous years. For instance, Teladoc Health Inc. reported 63% year-on-year growth in the first two quarters of 2020 as compared to the first two quarters of 2019.

Key Latin America Telehealth Companies:

- Koninklijke Philips N.V

- GE Healthcare

- Oracle Cerner (earlier Cerner Corporation)

- Siemens Healthineers

- Medtronic

- Teladoc Health Inc

- American Well

- Doctor On Demand

- Global Med

Recent Developments

-

In October 2023, Glenn Gaunt MD launched an alternative to traditional healthcare. The platform offers accessible and convenient healthcare services, enabling patients to receive medical attention from the comfort of their homes

-

In January 2023, Teladoc Health introduced a complete integrated healthcare solution via a new comprehensive digital platform that facilitates tailored, all-encompassing care for individuals. Clients can now effortlessly avail Teladoc Health's comprehensive offerings, covering primary healthcare, mental wellness, and ongoing ailment supervision; all consolidated within a singular accessible account.

-

In February 2022, Alice, a Brazilian health tech company entered into a strategic partnership with TytoCare. With the help of this partnership, Alice planned to enable seamless digital diagnostics, while allowing physicians to deliver virtual clinic-quality care.

-

In February 2022, Teladoc Health, Inc. launched Chronic Care Complete, a first-of-its-kind complete chronic condition management solution aimed at improving healthcare outcomes.

-

In February 2022, GlobalMed introduced Transportable Audiology Backpack to facilitate remote telehealth audiology examinations for extended patient care.

Latin America Telehealth Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.21 billion

Revenue forecast in 2030

USD 22.83 billion

Growth Rate

CAGR of 24.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, delivery mode, end-use, disease area, country

Country scope

Brazil; Mexico; Argentina; Chile

Key companies profiled

Koninklijke Philips N.V.; GE Healthcare; Cerner Corporation (Oracle); Siemens Healthineers; Medtronic; Teladoc Health Inc.; American Well; MDLive; Doctor On Demand; Global Med

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Telehealth Market Report Segmentation

This report forecasts revenue growth in the Latin America market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America telehealth market based on product type, delivery mode, end-use, disease area, and country:

-

Product Type (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Monitors

-

Medical Peripheral Devices

-

Blood Pressure Meters

-

Blood Glucose Meters

-

Weighing Scales

-

Pulse Oximeters

-

Peak Flow Meters

-

ECG Monitors

-

Others

-

-

-

Software

-

Standalone Software

-

Integrated Software

-

-

Services

-

Remote Patient Monitoring

-

Real-Time Interactions

-

Store and Forward

-

Others

-

-

-

Delivery Mode (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Web-based

-

Cloud-based

-

-

End-use (Revenue, USD Million, 2018 - 2030)

-

Payers

-

Providers

-

Patients

-

-

Disease Area (Revenue, USD Million, 2018 - 2030)

-

Psychiatry

-

Substance Use

-

Radiology

-

Endocrinology

-

Dermatology

-

Gastroenterology

-

Neurological Medicine

-

ENT

-

Cardiology

-

Oncology

-

Dental

-

Gynecology

-

General Medicine

-

Others

-

-

Country (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Mexico

-

Argentina

-

Chile

-

Frequently Asked Questions About This Report

b. The Latin America telehealth market size was estimated at USD 5.05 billion in 2023 and is expected to reach USD 6.21 billion in 2024.

b. Latin America telehealth market is expected to grow at a compound annual growth rate of 24.1% from 2024 to 2030 to reach USD 22.83 billion by 2030.

b. The services segment held the largest revenue share of 47.2% in 2023. The segment is anticipated to grow at a lucrative rate owing to the prevailing trend of outsourcing these services. These services are outsourced because healthcare facilities lack the resources and skill sets required to deploy digital health solutions.

b. Some of the key players in Latin America telehealth market include GE Healthcare, Oracle Cerner (earlier Cerner Corporation), Siemens Healthineers, Medtronic, and Teladoc Health Inc, among others

b. The market growth is being driven by growing demand for remote healthcare services, especially due to COVID-19 pandemic, where need for virtual consultations and remote monitoring surged.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."