- Home

- »

- Smart Textiles

- »

-

Law Enforcement PPE Market Size And Share Report, 2030GVR Report cover

![Law Enforcement Personal Protective Equipment Market Size, Share & Trends Report]()

Law Enforcement Personal Protective Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Protective Clothing, Respiratory Protection, Eye & Face Protection, Head Protection, Hand Protection), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-961-6

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Law Enforcement PPE Market Size & Trends

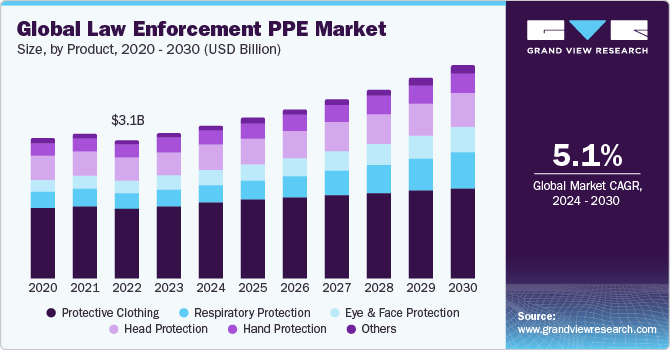

The global law enforcement personal protective equipment market size was estimated at USD 3,271.2 million in 2023 and is anticipated to grow at a compounded annual growth rate (CAGR) of 5.1% from 2024 to 2030. The rising awareness about officer safety in tactical and riot control situations is anticipated to positively impact the growth. Law enforcement officers are at the forefront of maintaining law and order in society, and it is essential to ensure their safety while they carry out their duties. The authorities are taking necessary steps to meet the rising demand for personal protective equipment (PPE) and provide adequate protection to law enforcement personnel. These aforementioned factors are expected to propel the demand for law enforcement personal protective equipment (PPE) market.

The U.S. National Institute of Justice (NIJ) has established distinct performance levels for body armor, categorized into five threat levels. Levels IIA, II, and IIIA typically involve soft armor, while hard armor plates may occasionally carry a Level IIIA rating. Levels III and IV generally pertain to hard armor plates. Each level corresponds to the type and level of protection offered, necessitating thorough research to match the specific threat level with the appropriate body armor type.

Prominent manufacturers of protective clothing in the law enforcement sector include 3M, MSA, DuPont, and XION Protective Gear. Notably, AMPART International Corp, a leading supplier to law enforcement and military end users, acquired the PPE line from Xion Protective Gear. This strategic move positions AMPART to expand its presence in the U.S. market, enhance product offerings, and pursue innovations in materials for generational improvements.

Law enforcement faces a rapidly evolving landscape with challenges on multiple fronts. The swift pace of change, emerging crime types, technological advancements, and strained community relations contribute to the dynamic environment. Officers are increasingly tasked with non-traditional responsibilities, such as handling mental health crises and combating drug dealers. Demographic shifts, including a younger officer culture perceiving policing as a job rather than a profession, further impact the industry's dynamics.

Law enforcement engages in a technical arms race with criminals, necessitating constant adaptation to new equipment and the acquisition of skills and knowledge for effective deployment. The evolving nature of crime, technology, and demographic shifts requires ongoing training and development for officers to stay ahead in this challenging environment.

Government packages and budgets for police departments in the U.S. are on the rise, facilitating increased expenditure on personal protective equipment. As of March 2022, the U.S. government spending plan included an additional USD 101 million for civil rights enforcement, potentially contributing to safety gear funding. The surge in demand for law enforcement PPE, driven by the COVID-19 outbreak and the need for protective clothing, respirators, face shields, masks, and goggles, is expected to persist due to ongoing safety requirements and the prevalence of infectious diseases.

Market Concentration & Characteristics

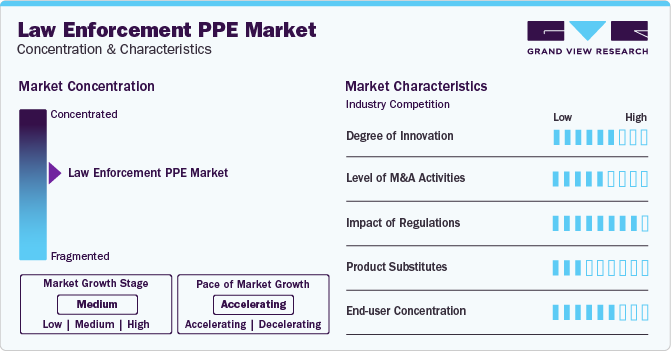

The market growth stage is medium, and the pace of the market growth is accelerating. The law enforcement PPE market is heavily influenced by stringent regulations and standards imposed by government bodies. For instance, the National Institute of Justice (NIJ) in the U.S. establishes standards for body armor. Manufacturers must adhere to these standards to ensure the safety and effectiveness of the equipment. Compliance with such regulations is crucial for market entry and sustained success.

The market is influenced by continuous innovations and advancements. New technical innovations such as smart sensors, AR & VR, body-worn cameras, and others are being developed in the law enforcement industry. Smart sensors can be used to collect a wide range of data to assist officers in performing their duties. In addition, the advent of nanotechnology is expected to facilitate the construction of lighter and more resilient body armor vests.

Moreover, the market is characterized by continuous technological advancements to enhance the protective capabilities of equipment. Innovations in materials, such as advanced fabrics, ballistic fibers, and impact-resistant polymers, contribute to the development of more lightweight and effective PPE. For example, the integration of smart technologies like sensors for monitoring vital signs within body armor is an emerging trend in the market.

Furthermore, law enforcement agencies' procurement of PPE is heavily influenced by government budgets and funding allocations. Economic fluctuations and changes in government priorities can impact the purchasing power of law enforcement agencies. Manufacturers and suppliers need to be attentive to budgetary constraints when developing and pricing their products. Additionally, rising awareness of environmental sustainability is influencing the market, leading to the development of eco-friendly materials and manufacturing processes. Companies that prioritize sustainable practices may gain a competitive edge in the law enforcement PPE market, appealing to agencies with environmental considerations.

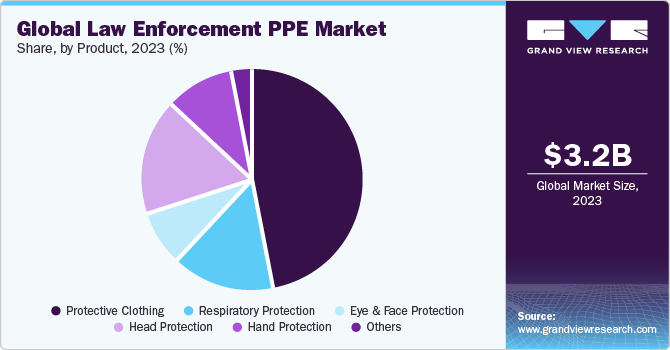

Product Insights

The protective clothing segment dominated the market and accounted for 46.5% in 2023. Protective clothing is used to absorb or deflect physical attacks that might otherwise be harmful. Originally meant to defend troops in battle, it now has a wide range of applications to safeguard individuals in a variety of professions. Riot police, private bodyguards, and ordinary civilians are among the most common categories of people who use protective clothing on a regular basis.

Head protection, categorized as personal protective equipment (PPE), is typically intended to safeguard the scalp and occasionally the jaw. Notably, head protection does not extend to cover the face and eyes. Contemporary police helmets are available in various styles, each with unique advantages.

Respiratory Protective Equipment falls under the category of Personal Protective Equipment and serves to shield individuals from inhaling harmful substances in the workplace. Its application is widespread in law enforcement agencies. Notably, 3M has introduced a specialized self-contained breathing apparatus (SCBA) solution tailored for law enforcement and special operations. The 3M Scott X3-21 Pro SCBA holds the distinction of being the initial SCBA certified according to the NFPA 1986 standard for respiratory protection equipment in tactical operations.

Regional Insights

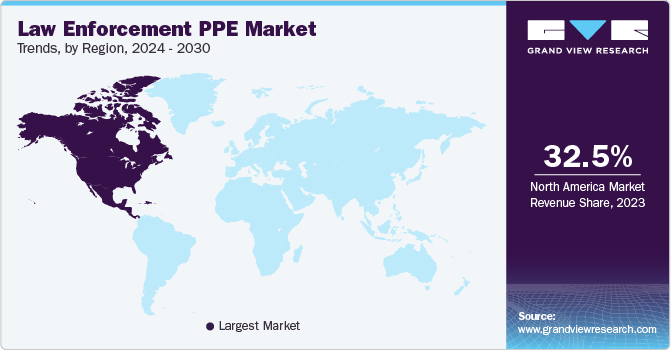

North America dominated the global law enforcement personal protective equipment (PPE) market dominated market in 2023 and accounted for over 32.5% in the same year. The current state and federal occupational health and safety protocols, coupled with an increase in protests and demonstrations in the U.S. that have led to escalated police confrontation and violence, are driving the demand for PPE for frontline law enforcement officers. Moreover, new technical innovations such as smart sensors, AR & VR, body-worn cameras, and others are being developed in North America's law enforcement industry.

U.S. Law Enforcement PPE Market Trends

The law enforcement personal protective equipment market in the U.S. is driven by several factors such as the increasing number of law enforcement personnel coupled with the growing threat of violence against law enforcement personnel in the country. As more police officers and other law enforcement officials are hired, the demand for personal protective equipment such as body armor, helmets, and gloves increases.Moreover, with the rise of mass shootings and other violent incidents, the need for protective gear has become more pressing.

The law enforcement PPE market in Canada is characterized by the increasing awareness of officer safety, coupled with the dynamic nature of modern threats, necessitating continuous advancements in PPE technology. The rise of new criminal activities, technological challenges, and evolving societal expectations place law enforcement in a constant state of adaptation. For instance, data from Statistics Canada shows that violent crime increased by 5% in 2022, following a 6% rise in 2021, as indicated by the Crime Severity Index. Additionally, demographic shifts, such as a younger generation of officers with different perspectives on policing, contribute to the demand for innovative and versatile PPE solutions. As government budgets allocate more resources to law enforcement, there is a heightened focus on acquiring cutting-edge protective gear, creating a conducive environment for the development and adoption of advanced PPE in Canada's law enforcement sector.

Europe Law Enforcement PPE Market Trends

Europe’s law enforcement personal protective equipment market is influenced by a combination of factors, including the imperative to ensure the safety of officers in the face of evolving threats. First, workplace safety concerns drive demand for effective protective gear. With strong research and development investments, rising adoption of resilient protective clothing is expected.

The law enforcement PPE market in Germany emphasizes technological advancements and adherence to rigorous standards, with a focus on providing law enforcement personnel with state-of-the-art protective gear. As law enforcement roles expand to address diverse challenges, including public health emergencies and evolving criminal activities, there is a growing need for versatile and specialized PPE.

Asia Pacific Law Enforcement PPE Market Trends

Asia Pacific law enforcement personal protective equipment is being driven by geopolitical tensions and security threats in various Asian countries. The government emphasizes ensuring the safety and well-being of police officers during their duty and the rise in the number of civil unrests and protests is leading to higher adoption of robust PPE for law enhancement.

The law enforcement personal protective equipment market in China is increasing due to the awareness of officer safety among law enforcement agencies, and the need for comprehensive protective measures. The country has been investing in modernizing its law enforcement practices, which may include the adoption of advanced and specialized personal protective equipment to enhance the safety and effectiveness of law enforcement officers.

Central & South America Law Enforcement PPE Market Trends

Central & South America law enforcement personal protective equipment market is driven by a complex interplay of factors. The country faces diverse security challenges, including urban violence and organized crime, necessitating advanced and comprehensive protective measures for law enforcement officers. Stringent government regulations emphasize safety, driving the adoption of PPE. In the coming years, the focus will remain on enhancing police survivability, especially during law and order situations such as riots and protests.

The law enforcement personal protective equipment market in Brazil is growing due to the modernization of the country’s law enforcement practices, which is leading to a growing emphasis on adopting state-of-the-art PPE to enhance the safety and operational capabilities of officers. The demand is also influenced by global events, such as the COVID-19 pandemic, which has heightened the need for additional protective gear. Moreover, the commitment to officer safety, combined with the evolving nature of security threats, fuels the continuous demand for versatile and technologically advanced personal protective equipment within the Brazilian law enforcement sector.

Middle East & Africa Law Enforcement PPE Market Trends

Middle East and Africa law enforcement personal protective equipment market is propelled by the country's commitment to ensuring the safety and well-being of its law enforcement personnel. With a focus on modernizing security practices, there is an increasing need for advanced PPE to effectively address evolving threats.

The law enforcement personal protective equipment market in Saudi Arabia is propelled by strategic investments in technology and security measures that contribute to the demand for state-of-the-art protective gear for law enforcement officers. Additionally, the growing awareness of global security challenges and the importance of equipping officers with comprehensive protective measures further underscores the continuous demand for cutting-edge personal protective equipment in the law enforcement sector of Saudi Arabia.

Key Law Enforcement PPE Company Insights

The market is characterized by the presence of large- and small-scale manufacturers across the globe, thereby resulting in a significant level of concentration. The competition in the market is intense and is marked by the demand for innovative and reliable protective solutions. Most manufacturers are engaged in offering products by implementing the most innovative and state-of-the-art technologies to ensure optimum comfort, durability, and protection to end-users working in different professional fields. Major players in the market compete based on product differentiation and diversified product offerings. For instance, in October 2021, DuPont introduced Core Matrix Technology that improves fragmentation and ballistic performance in armor, thereby improving the safety of law enforcement officers on duty.

Key Law Enforcement PPE Companies:

The following are the leading companies in the law enforcement personal protective equipment market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- The SAFARILAND Group

- MSA Safety

- Honeywell International Inc.

- DuPont de Nemours Inc.

- XION Protective Gear

- ArmorSource LLC

- Lakeland Industries, Inc.

- Ansell Protective Solutions

- Avon Rubber PLC

- COFRA SRL

- Point Blank Enterprises Inc.

- Ballistic Body Armour Pty.

- Craig International Ballistics Pty. Ltd.

Recent Developments

-

In December 2022, Honeywell International Inc. agreed to supply helmets and a range of accessory products to NATO and Partner nations, structured under a multi-year outline agreement contract with the NATO Support and Procurement Agency (NSPA).

-

In February 2022, LION acquired the Elbeco brand through an asset purchase. Elbeco, a prominent entity for many years, specializes in designing, manufacturing, and distributing performance uniforms tailored for law enforcement, EMS, firefighters, and various other public safety professionals.

Law Enforcement Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,422.6 million

Revenue forecast in 2030

USD 4,616.8 million

Growth rate

CAGR of 5.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

December 2021

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

3M; The SAFARILAND Group; MSA Safety; Honeywell International Inc.; DuPont de Nemours Inc.; XION Protective Gear; ArmorSource LLC; Lakeland Industries, Inc.; Ansell Protective Solutions; Avon Rubber PLC; COFRA SRL; Point Blank Enterprises Inc.; Ballistic Body Armour Pty; Craig International Ballistics Pty. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Law Enforcement PPE Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global law enforcement personal protective equipment market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protective Clothing

-

Hi-Vis Clothing

-

Protective Vests/ Body Armor

-

Coveralls/Gowns

-

General Use

-

-

Respiratory Protection

-

Respiratory Masks

-

Air Purifying Respirators

-

Others

-

-

Eye & Face Protection

-

Head Protection

-

Hand Protection

-

Disposable Gloves

-

Durable/Tactical

-

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global law enforcement personal protective equipment market size was estimated at USD 3,271.2 million in 2023 and is expected to reach USD 3,422.6 million in 2024.

b. The law enforcement personal protective equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 4,616.8 million by 2030.

b. North America dominated the global law enforcement personal protective equipment market dominated the market in 2023 and accounted for over 23% in the same year. The current state and federal occupational health and safety protocols, coupled with an increase in protests in a demonstration in the U.S. that have led to escalated police confrontation and violence, are driving the demand for PPE for frontline law enforcement officers.

b. Some of the key players operating in the law enforcement PPE market include 3M, The SAFARILAND Group, MSA Safety, Honeywell International Inc., DuPont de Nemours Inc., XION Protective Gear, ArmorSource LLC, Lakeland Industries, Inc., Ansell Protective Solutions, Avon Rubber PLC, COFRA SRL, Point Blank Enterprises Inc., Ballistic Body Armour Pty, Craig International Ballistics Pty. Ltd. among others.

b. The rising awareness and demand for higher-quality protective gear among law enforcement agencies and officers are driving the growth of the market. Law enforcement professionals are becoming more aware of the risks they face on the job and are demanding gear that can keep them safe while allowing them to perform their duties effectively.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.