- Home

- »

- Advanced Interior Materials

- »

-

LCD Glass Market Size And Share, Industry Report, 2033GVR Report cover

![LCD Glass Market Size, Share & Trends Report]()

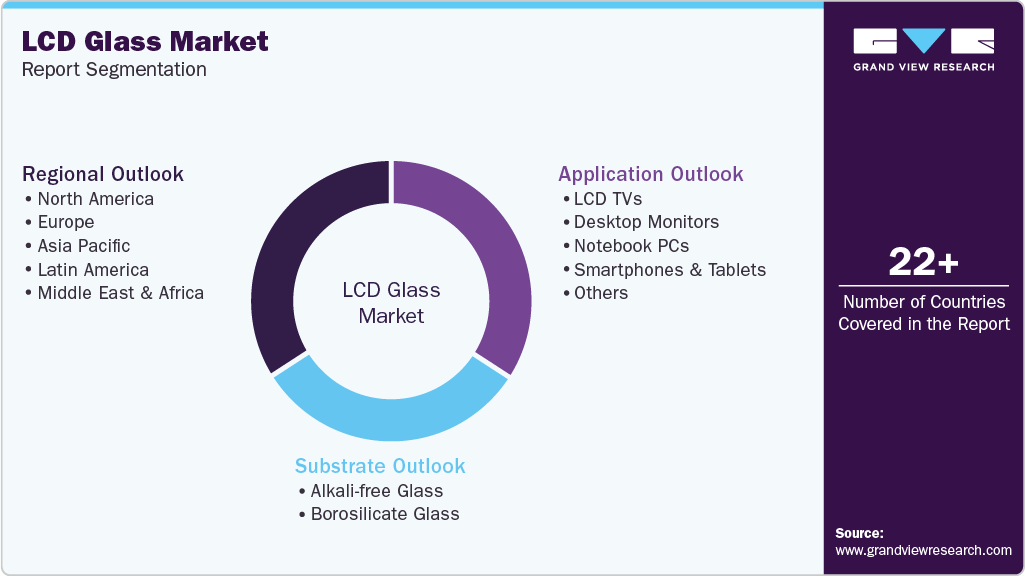

LCD Glass Market (2025 - 2033) Size, Share & Trends Analysis Report By Substrate Material (Alkali-free Glass, Borosilicate Glass), By Application (LCD TVs, Desktop Monitors), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-701-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

LCD Glass Market Summary

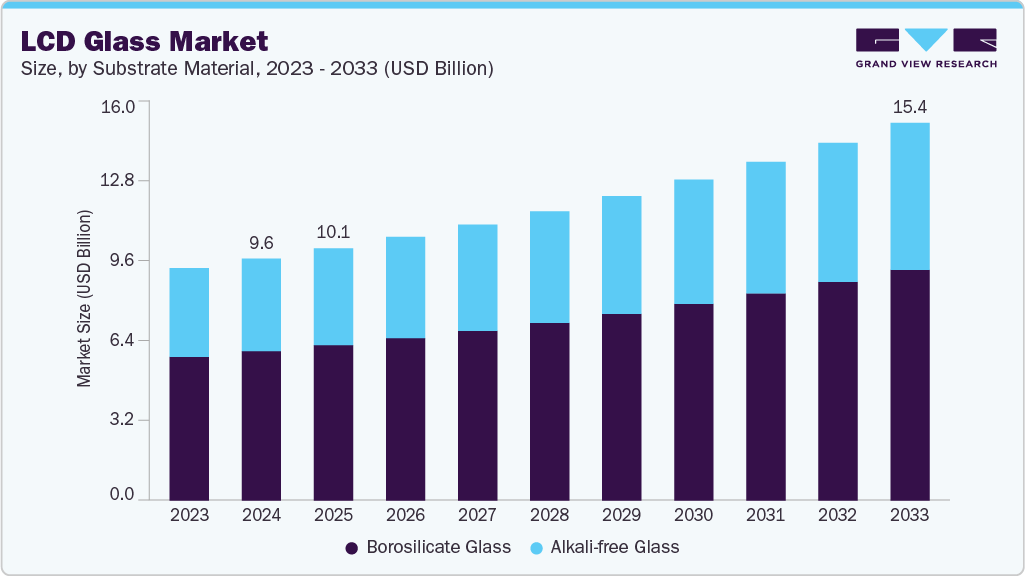

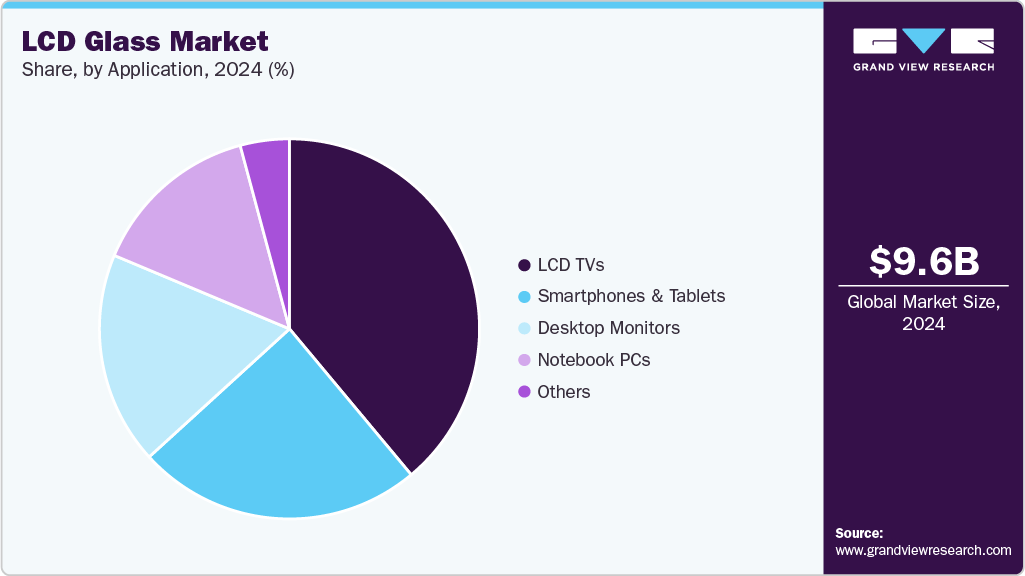

The global LCD glass market size was estimated at USD 9.64 billion in 2024 and is projected to reach USD 15.42 billion by 2033, at a CAGR of 5.5% from 2025 to 2033. The market is witnessing substantial growth driven by the global demand for consumer electronics such as smartphones, tablets, laptops, and televisions.

Key Market Trends & Insights

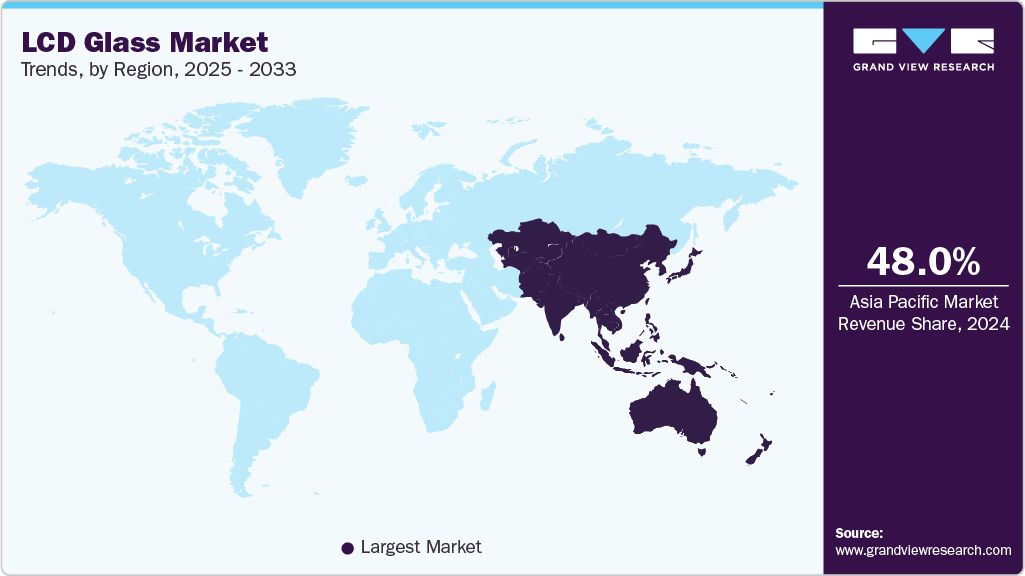

- Asia Pacific dominated the LCD glass market with the largest market revenue share of 48%.

- LCD glass market in the U.S. is expected to grow at a substantial CAGR of 3.5% from 2025 to 2033.

- By substrate material, alkali-free glass borosilicate glass segment accounted for the largest market revenue share of over 38.0% in 2024.

- By application, smartphones and tablets segment is anticipated to register the fastest CAGR of 5.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 9.64 Billion

- 2033 Projected Market Size: USD 15.42 Billion

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

As display technologies evolve and consumer preferences shift towards thinner, lighter, and higher-resolution screens, manufacturers are increasing their consumption of high-quality LCD glass. The proliferation of devices using LCD panels is accelerating due to rising disposable incomes, expanding internet penetration, and increased digital media consumption across developed and developing economies. Technological advancements in display glass manufacturing are significantly contributing to market expansion. Innovations such as ultra-thin substrates, improved durability, and better optical properties enable more sophisticated display applications. These enhancements support integrating newer product formats, including foldable devices, automotive dashboards, and wearable screens. As R&D investments grow, the performance gap between LCDs and emerging display types is narrowing, allowing this technology to remain competitive in cost-sensitive markets.The automotive sector has emerged as a crucial end-use industry. Demand for robust and high-performance glass is rising with the adoption of advanced driver-assistance systems (ADAS), digital instrument clusters, infotainment systems, and head-up displays. Automakers are increasingly integrating larger screens into vehicle interiors to improve user experience, contributing to higher consumption of specialty materials. This trend aligns with the broader shift toward smart and connected vehicles across North America, Europe, and Asia.

Another key driver is the rising demand for large-sized panels, especially in television and commercial signage. The global transition from CRT and plasma screens to flat-panel displays in residential and commercial applications is expanding the market. As screen sizes increase, the quantity and quality of substrate glass required per unit also rise. This dynamic, coupled with competitive pricing and improvements in panel efficiency, continues to favor LCDs despite competition from OLED.

Supportive government policies and investments in display panel manufacturing are boosting the market in regions like China, South Korea, and India. These countries are incentivizing domestic production of flat panels to reduce import dependency and strengthen technological capabilities. Establishing local manufacturing hubs drives demand for upstream materials, including display glass, while creating cost efficiencies for panel makers. This regional push is expected to sustain demand growth over the forecast period.

Drivers, Opportunities & Restraints

The rising demand for display panels in consumer electronics, automotive systems, and industrial equipment is a major market growth driver. Consumers increasingly prefer high-resolution and energy-efficient screens in devices like smartphones, TVs, laptops, and monitors, pushing manufacturers to expand LCD panel production. The automotive industry's growing adoption of digital dashboards and infotainment systems adds to this momentum. Beyond consumer and automotive use, public signage, medical devices, and smart appliances continue to support stable demand for display glass.

Opportunities are emerging by developing thinner, stronger, and more flexible substrates. Advances in materials and production techniques now allow integration into foldable displays, ultra-light laptops, and uniquely shaped in-vehicle screens. Countries like India, Vietnam, and Brazil are experiencing rising electronics consumption, driven by digital adoption and a growing middle class. In parallel, Asia Pacific's pivot toward local display manufacturing is creating sustained growth potential for glass suppliers across the region.

The market also faces notable challenges. OLED and micro-LED displays are gaining ground in premium segments due to their superior contrast and slim designs. Their increasing adoption is limiting LCD's share in high-end applications. Additionally, volatility in raw material prices and the capital-intensive nature of glass manufacturing make it harder for new players to enter and compete effectively.

Substrate Material Insights

Alkali-free glass is growing due to its superior electrical insulation, chemical durability, and thermal stability. This type of glass is particularly well-suited for high-performance display panels, where minimal ionic contamination is critical to ensure long-term device reliability. Its composition, free of alkali metals like sodium or potassium, prevents unwanted interactions with liquid crystal materials and thin-film transistors, enhancing image quality and display lifespan. As a result, alkali-free glass is widely used in TFT-LCD applications found in televisions, smartphones, tablets, and laptops.

The borosilicate glass segment in the market is gaining traction due to its excellent thermal resistance, mechanical strength, and chemical stability. Its ability to withstand high processing temperatures without deformation makes it suitable for applications involving harsh manufacturing environments or high-temperature treatments. The low coefficient of thermal expansion minimizes the risk of cracking or warping during panel fabrication, making borosilicate glass a preferred substrate in specialized or industrial-grade LCDs used in aerospace, automotive, medical, and outdoor digital signage.

Application Insights

The LCD TVs segment represents one of the largest application areas in the market, driven by the continued global demand for high-definition and large-screen televisions. LCD technology remains the most widely adopted display format for TVs due to its cost-effectiveness, energy efficiency, and consistent image quality across various screen sizes. As consumers shift toward larger and thinner television screens, the demand for high-quality LCD glass substrates that offer clarity, strength, and dimensional stability continues to rise. Manufacturers are investing in advanced production lines to support the fabrication of ultra-large panels requiring larger sheets of defect-free glass.

The desktop monitors segment is supported by steady demand from professional and personal computing environments. LCD monitors are widely used in offices, educational institutions, gaming setups, and home workstations, where clarity, resolution, and screen size are key purchasing criteria. As remote work, digital education, and e-sports gain traction globally, there is a consistent rise in the demand for high-resolution and ergonomically designed desktop monitors. This trend boosts the requirement for high-quality glass substrates supporting sharp image reproduction, durability, and wide viewing angles.

Regional Insights

The rapid expansion of consumer electronics manufacturing in the Asia Pacific is a major factor boosting the LCD glass market. Countries like China, South Korea, Japan, and India have become global hubs for producing smartphones, tablets, laptops, televisions, and monitors. Growing demand for high-resolution, slim, and energy-efficient screens drives the need for advanced LCD glass substrates. Rising disposable income, increasing digital adoption, and faster product replacement cycles strengthen the region's market foundation.

North America LCD Glass Market Trends

The LCD glass market in North America is propelled by strong consumer demand for high-performance electronic devices. With widespread use of smartphones, tablets, laptops, and large-screen televisions, the region maintains a steady appetite for high-resolution, energy-efficient displays. Consumers increasingly prefer 4K and 8K displays, driving demand for advanced glass substrates that offer improved durability, clarity, and thermal resistance. This trend is further supported by high replacement rates and frequent technology upgrades, especially in the U.S. and Canada.

The U.S. LCD glass market is witnessing a surge in demand for premium consumer electronics across the U.S., which is a major factor driving LCD glass consumption. Innovation and investment by domestic companies further support the market. Leading U.S.-based firms are developing next-generation glass products featuring improved thermal resistance, reduced weight, and enhanced optical performance. These innovations cater to emerging trends like curved displays, ultra-thin devices, and hybrid display systems. Major investments in research facilities and manufacturing infrastructure are helping position the U.S. as a hub for specialized LCD glass technologies.

Europe LCD Glass Market Trends

The LCD glass market in Europe is growing significantly due to the automotive innovation in Europe. In 2024, nearly 2 million battery-electric vehicles were registered across Europe, accounting for approximately 15.4% of all new car sales. Despite a slight year-on-year decline in EV volumes, the overall adoption remains strong, particularly in countries like Germany, France, and Sweden. This growing presence of electric vehicles has accelerated the integration of digital instrument clusters, infotainment screens, and driver-assistance displays. For example, BMW’s latest electric vehicles feature elegantly curved LCDs that require glass with high impact resistance and excellent optical clarity. The increasing number of EVs on Europe’s roads highlights rising demand for specialized, durable, and lightweight glass tailored to in-vehicle display applications.

Latin America LCD Glass Market Trends

The LCD glass market in Latin America is growing due to the growing demand for affordable consumer electronics is a primary market growth driver. Countries like Brazil and Argentina have seen a steady increase in smartphone penetration, television sales, and laptop adoption as middle-class populations expand. For example, Brazilian consumers have increasingly shifted toward smart TVs and mid-range Android smartphones, which rely on durable LCD glass for their displays. As electronics become more accessible, regional demand for standard and advanced glass substrates continues to rise.

Middle East & Africa LCD Glass Market Trends

The Middle East & Africa region is anticipated to grow significantly over the forecast period. Economic diversification efforts in the Gulf Cooperation Council (GCC) countries fuel electronics and display demand. Nations like the UAE and Saudi Arabia invest heavily in technology and smart infrastructure as part of their long-term economic plans. For example, Saudi Arabia’s Vision 2030 includes the development of digital education platforms and smart cities, where high-definition displays are central to control systems, signage, and user interfaces. These initiatives are increasing the use of LCD panels in public, commercial, and industrial applications, supporting the need for specialized glass.

Key LCD Glass Company Insights

Some of the key players operating in the market include AGC, Corning Incorporated, and others.

-

AGC, formerly known as Asahi Glass Co., Ltd., is a Japan-based multinational company and one of the largest glass manufacturers globally. Founded in 1907 and headquartered in Tokyo, AGC operates across multiple segments, including glass, electronics, chemicals, and ceramics. It has a significant global footprint with manufacturing and R&D facilities in Asia, Europe, and the Americas. AGC’s electronics division supplies high-performance materials for display, semiconductor, and optoelectronics applications. The company is known for its technological leadership, especially in developing ultra-thin, chemically strengthened, precision-engineered glass products in advanced electronic devices.

-

Corning Incorporated is a U.S.-based technology company founded in 1851 and headquartered in Corning, New York. It is a global leader in materials science, with expertise in specialty glass, ceramics, and optical physics. Corning’s operations span multiple industries, including telecommunications, life sciences, automotive, and consumer electronics. The company has built its reputation on innovation and long-term R&D investment, particularly in developing high-strength, high-clarity glass for advanced display technologies. Corning is best known to consumers for its Gorilla Glass product line, which has become a standard in mobile device displays.

Key LCD Glass Companies:

The following are the leading companies in the LCD glass market. These companies collectively hold the largest market share and dictate industry trends.

- Asahi Glass Co., Ltd. (AGC)

- BOE Technology Group Co., Ltd.

- China National Building Material Group Corporation (CNBM)

- Corning Incorporated

- LG Display Co., Ltd.

- Nippon Electric Glass Co., Ltd. (NEG)

- Samsung Display Co., Ltd.

- Schott AG

- Sharp Corporation

- TCL Technology Group Corporation

Recent Development

-

In May 2024, Vedanta Limited announced that it would acquire an additional 46.57% stake in Japanese display glass manufacturer AvanStrate Inc. from HOYA Corporation, increasing its total ownership to 98.2%. The acquisition is a significant step in Vedanta’s strategy to diversify beyond natural resources into high-tech manufacturing, especially in electronics. With over 700 patents and advanced production facilities in Asia, AvanStrate’s expertise in LCD glass substrates will support Vedanta’s ambitions to establish India’s first integrated fabrication unit for display glass and panels.

LCD Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.08 billion

Revenue forecast in 2033

USD 15.42 billion

Growth rate

CAGR of 5.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Substrate material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Brazil

Key companies profiled

Asahi Glass Co., Ltd. (AGC); BOE Technology Group Co., Ltd.; China National Building Material Group Corporation (CNBM); Corning Incorporated; LG Display Co., Ltd.; Nippon Electric Glass Co., Ltd. (NEG); Samsung Display Co., Ltd.; Schott AG; Sharp Corporation; TCL Technology Group Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LCD Glass Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global LCD glass market report based on substrate material, application, and region.

-

Substrate Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Alkali-free Glass

-

Borosilicate Glass

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

LCD TVs

-

Desktop Monitors

-

Notebook PCs

-

Smartphones & Tablets

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global LCD glass market size was estimated at USD 9.64 billion in 2024 and is expected to reach USD 10.08 billion in 2025.

b. The global LCD glass market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 15.42 billion by 2033.

b. The borosilicate glass segment dominated the market with a revenue share of 61.0% in 2024.

b. Some of the key players of the global LCD glass market are Corning Incorporated, Asahi Glass Co., Ltd. (AGC), Nippon Electric Glass Co., Ltd. (NEG), LG Display Co., Ltd., Samsung Display Co., Ltd., Sharp Corporation, BOE Technology Group Co., Ltd., China National Building Material Group Corporation (CNBM), Schott AG, TCL Technology Group Corporation, and others.

b. The key factor driving the growth of the global LCD glass market is the increasing demand for high-resolution displays in consumer electronics such as smartphones, televisions, laptops, and tablets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.