- Home

- »

- Biotechnology

- »

-

Leukapheresis Market Size & Share, Industry Report, 2030GVR Report cover

![Leukapheresis Market Size, Share & Trends Report]()

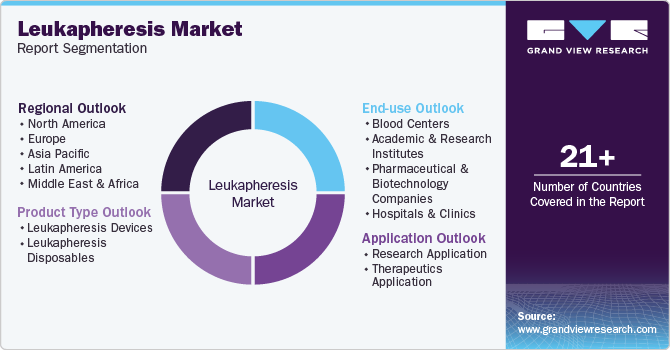

Leukapheresis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Leukapheresis Devices, Leukapheresis Disposables), By Application (Research Application, Therapeutic Application), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-357-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Leukapheresis Market Summary

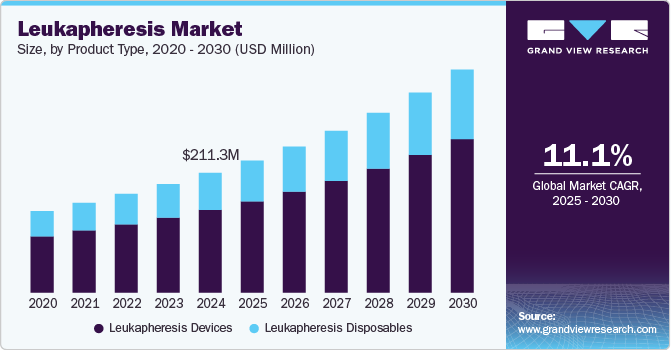

The global leukapheresis market size was estimated at USD 211.3 million in 2024 and is projected to reach USD 394.1 million by 2030, growing at a CAGR of 11.05% from 2025 to 2030. The increasing prevalence of blood disorders and autoimmune diseases, technological advancements in leukapheresis procedures, and growing demand for personalized medicine are expected to drive the market growth.

Key Market Trends & Insights

- North America dominated the leukapheresis market with the largest revenue share of 36.86% in 2024.

- The U.S. leukapheresis market is expected to grow at the fastest CAGR over the forecast period.

- Based on product type, the leukapheresis devices segment led the market with the largest revenue share of 69.12% in 2024.

- Based on application, the research application segment led the market with the largest revenue share of 77.65% in 2024.

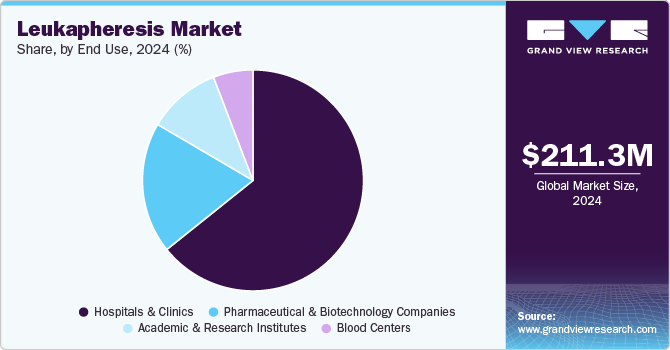

- Based on end-use, the hospitals & clinics segment led the market with the largest revenue share of 64.25% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 211.3 Million

- 2030 Projected Market Size: USD 394.1 Million

- CAGR (2025-2030): 11.05%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the increasing investments in research and development activities are further contributing to the market growth. The rising incidence of blood disorders like leukemia, lymphoma, and autoimmune diseases such as rheumatoid arthritis and multiple sclerosis are significantly driving the market growth.

For instance, the Leukemia & Lymphoma Society reports that an estimated total of 184,720 people in the U.S. are expected to receive a diagnosis of leukemia, lymphoma, or myeloma in 2023. Similarly, in May 2023, a study in The Lancet involving 22 million people found autoimmune disorders affect 1 in 10 individuals, highlighting the influence of socioeconomic, seasonal, and regional factors and offers insights into the causes of these diseases, including Rheumatoid arthritis, Type 1 diabetes, and Multiple sclerosis. Thus, propelling the demand for leukapheresis over the forecast period.

The advancements in leukapheresis technologies are improving the efficiency, safety, and outcomes of the procedure. The introduction of automated systems, continuous flow centrifugation systems, and closed-system devices is expected to enhance the precision and effectiveness of leukapheresis. Thereby reducing the procedure times, minimizing donor discomfort, and optimizing cell collection yields. In October 2022, the Clinical Applications Committee of The American Society for Apheresis (ASFA), along with the IEC Therapy Subcommittee, AABB, and various other organizations, prepared a white paper. This document outlines guidelines for performing leukapheresis to retrieve mononuclear cells from pediatric and adult patients who are part of immune effector cell therapies, whether for commercial endeavors or research initiatives. Thus, anticipated to propel the market growth over the forecast period.

The shift towards personalized medicine approaches that tailor treatment strategies to individual patient profiles is fueling the demand for leukapheresis procedures. Leukapheresis plays a crucial role in cell-based therapies, such as chimeric antigen receptor (CAR) T-cell therapy and stem cell transplantation. In December 2023, an article in Transfusion and Apheresis Science underscored the challenges in manufacturing CAR-T cells, beginning with the extraction of T cells through leukapheresis from peripheral blood. The article emphasized the critical role of an effective leukapheresis product in achieving successful CAR-T cell therapy and highlighted the significance of comprehending the factors that impact T cell quality.

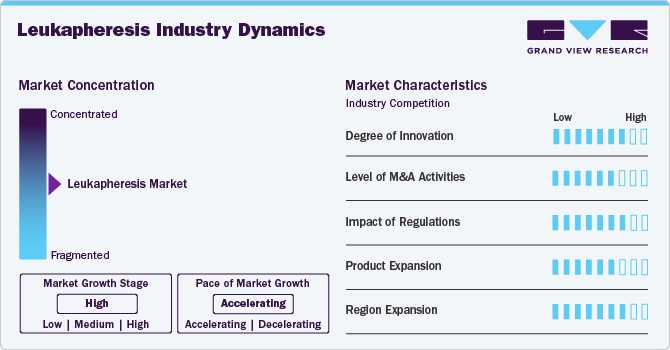

Market Concentration & Characteristics

The leukapheresis industry is anticipated to experience a medium degree of innovation in the global market owing to the advancements in technology leading to more efficient and precise procedures. Companies such as Terumo BCT introduced innovative leukapheresis systems such as the Spectra Optia Apheresis System, which offers automated mononuclear cell collection for cell therapy applications. Thereby significantly improving the efficacy and safety of leukapheresis procedures and impelling the demand.

The leukapheresis industry has seen a low level of merger and acquisition activity. The market is characterized by a smaller number of specialized players, primarily focusing on developing and manufacturing leukapheresis devices and related technologies. Moreover, the regulatory complexities associated with medical devices and biotechnologies, including leukapheresis systems, are hampering the market growth. However, despite these challenges, the increasing demand for leukapheresis procedures driven by rising incidences of hematologic disorders and advancements in biotechnology is anticipated to boost the activity in M&A within the global market.

Regulations profoundly impact the market growth owing to the stringent standards for safety, efficacy, and quality, which manufacturers are expected to gain for market approval. These requirements create significant barriers to entry, as companies must navigate complex approval processes and rigorous clinical validation.

The leukapheresis industry has been experiencing relatively low growth in terms of product expansion. This is attributed to regulatory hurdles, stringent clinical validation requirements, and the high cost of research & development, anticipating significant challenges for companies seeking to introduce new leukapheresis products.

Regional expansion efforts are ongoing in the leukapheresis industry, at a moderate level compared to other factors. Companies such as Haemonetics Corporation expand their presence globally through strategic partnerships and collaborations. These initiatives aim to increase market penetration in key regions and capitalize on emerging opportunities in developing healthcare markets worldwide.

Product Type Insights

The leukapheresis devices segment led the market with the largest revenue share of 69.12% in 2024. The leukapheresis devices segment is further segmented into centrifugation-based devices and membrane filtration-based devices. The growing prevalence of blood disorders such as leukemia and lymphoma, increasing demand for stem cell transplantation procedures, and advancements in technology leading to more efficient and automated systems are anticipated to drive centrifugation-based devices.

The rising incidence of autoimmune diseases and chronic conditions requiring therapeutic apheresis, along with the need for selective depletion or collection of specific cell populations like white blood cells, is significantly fueling the demand for membrane filtration-based devices. In January 2023, StemExpress introduced CellsExpress, aiming to accelerate research and development by providing bulk, customized isolated cell types from their high-quality Leukopaks, streamlining processes for researchers. Thus, these new product launches are anticipated to propel the demand for leukapheresis devices over the forecast period.

The leukapheresis disposables segment is expected to grow at the fastest CAGR of 11.24% over the forecast period. This is attributed to the increasing procedural volumes, growing awareness about blood component separation techniques, and stringent regulatory guidelines ensuring patient safety. Owing to the expanding patient pool with hematologic disorders and solid tumors, is boosting the demand for disposables used during these procedures, thereby propelling the number of leukapheresis procedures. For instance, Haemonetics Corporation offers comprehensive disposable kits compatible with its MCS+ system to facilitate efficient cell collection and processing during leukapheresis procedures. Thus anticipating segmental growth over the forecast period.

Application Insights

Based on application, the research application segment led the market with the largest revenue share of 77.65% in 2024. Research applications in this market are primarily driven by the increasing focus on developing novel therapies for various diseases, such as cancer and autoimmune disorders. Owing to the need for isolating specific cell populations, like T cells or stem cells, for further study and therapeutic development the demand for leukapheresis procedures in research is anticipated to boost over the forecast period. In December 2023, the journal Cancers reported that patients with acute myeloid leukemia (AML) who have FLT3-ITD mutations showed better outcomes and lower early mortality rates after undergoing emergency leukapheresis, compared to other patients with leukocytosis.

The therapeutics application segment is anticipated to grow at the fastest CAGR of 11.65% over the forecast period. Therapeutic applications of leukapheresis are being driven by the increasing adoption of cell-based therapies and personalized medicine approaches. An article from August 2022 in the journal Transfusion Medicine and Hemotherapy, discussed that even with a diminished patient count, therapeutic leukapheresis continues to be a viable, safe, and effective treatment option for certain cases.

End-use Insights

Based on end-use, the hospitals & clinics segment led the market with the largest revenue share of 64.25% in 2024. Owing to the complicated role in healthcare, including direct patient care, therapeutic procedures, and diagnostic services. In July 2022, the Hoxworth Blood Center at the University of Cincinnati unveiled its newly renovated Apheresis Center. The center partners with UCH (UCMC and West Chester). The Christ Hospital, and Cincinnati Children's Hospital Medical Center for therapeutic procedures. These collaborations are anticipated to propel the segment's growth over the forecast period.

The pharmaceutical & biotechnology companies segment is expected to witness the fastest CAGR of 12.19% over the forecast period. Pharmaceutical and biotechnology companies play a crucial role in the leukapheresis industry as they utilize leukapheresis products for research, drug development, and manufacturing processes. Increasing focus on personalized medicine and cell-based therapies are significant drivers for these companies. Leukapheresis enables the isolation of specific cell populations like T cells or monocytes for research purposes or therapeutic applications, aligning with the trend towards precision medicine. In November 2023, Charles River Laboratories International, Inc. announced the addition of CliniPrime Cryopreserved Leukopaks to its GMP-compliant offerings, enhancing cell therapy development and manufacturing. These cryopreserved leukopaks serve as crucial, donor-derived starting material for gene-modified cell therapy research and development.

Regional Insights

North America dominated the leukapheresis market with the largest revenue share of 36.86% in 2024. In January 2023, Charles River Laboratories International, Inc. announced the launch of their new CliniPrime suite, designed to enhance the production of cell and gene-modified cell therapies with GMP-compliant cellular starting materials. A focal product, the CliniPrime Fresh Leukopaks, addresses the need for readily available, cGMP-enabled enriched leukocyte cellular starting materials, streamlining the development and commercialization of advanced therapies by reducing client resource investment and risk.

U.S. Leukapheresis Market Trends

The U.S. leukapheresis market is expected to grow at the fastest CAGR over the forecast period.In March 2023, Blood Transfusion featured an article on breakthroughs in microfluidic cell separation technology. This innovation facilitates a centrifugation-free, low extracorporeal volume method for leukapheresis in children.

Europe Leukapheresis Market Trends

The Europe leukapheresis market was identified as a lucrative region in this industry.In November 2021, Terumo Blood and Cell Technologies and Immunicom launched a groundbreaking cancer immunotherapy in Germany, France, Italy, and Spain. This treatment aims to amplify the immune system's ability to fight tumors by removing immune inhibitors from the blood, potentially reducing adverse effects compared to traditional therapies.

The UK leukapheresis market is expected to grow at the fastest CAGR over the forecast period. Rising awareness about the benefits of leukapheresis in treating various hematological conditions, such as malignant (cancerous), and benign (not cancerous), including anemia and autoimmune blood disorders, and blood coagulation - bleeding and clotting, propel the market growth in this market.

The leukapheresis market in France is anticipated to grow at a significant CAGR over the forecast period. Technological advancements in leukapheresis equipment led to improved efficiency and patient outcomes in blood transfusion procedures. These innovations significantly reduce procedure times, enhancing the comfort and overall experience for patients.

The Germany leukapheresis market is expected to grow at a substantial CAGR over the forecast period, driven by the growing investments in research and development of novel leukapheresis techniques and devices. These advancements pave the way for the emergence of personalized medicine approaches in the treatment of blood-related disorders

Asia Pacific Leukapheresis Market Trends

The leukapheresis market in Asia Pacific is anticipated to witness at the fastest CAGR of 12.30% from 2025 to 2030. The increasing prevalence of blood disorders and autoimmune diseases is driving the demand for leukapheresis procedures in the Asia Pacific region.This surge in demand is further supported by the expanding healthcare infrastructure and rising investments in medical technology across the region, making advanced treatments more accessible to patients.

The Chinaleukapheresis market is expected to grow at a substantial CAGR over the forecast period. Growing healthcare infrastructure and increasing investments in advanced medical technologies are propelling the leukapheresis industry in China. The growth is attributed to a rise in the number of patients undergoing stem cell transplantation procedures.

The leukapheresis market in Japan is anticipated to grow at a significant CAGR over the forecast period. Technological advancements in leukapheresis devices and procedures are boosting the market growth in Japan, and enhancing treatment outcomes for patients. The market expanding due to a surge in research activities focusing on developing novel therapies utilizing leukapheresis techniques,

The India leukapheresis market is anticipated to grow at a rapid CAGR over the forecast period. In 2022, an article in the Asian Journal of Transfusion Science reported that Leukapheresis significantly lowered the leukemic cell load by half in patients with HL, offering temporary advantages. The procedure's cost-effectiveness stood at 20%, with limited factors impacting its efficacy.

Middle East and Africa Leukapheresis Market Trends

The leukapheresis market in the Middle East and Africa is projected to grow at the fastest CAGR during the forecast period, due to the rising incidence of leukemia and other blood-related disorders. In October 2022, an article from the Journal of the Egyptian National Cancer Institute reported a rapid increase in cancer rates across the Middle East, predicting a 1.8-fold rise in incidence by 2030.

The Saudi Arabialeukapheresis market is expected to grow at a significant CAGR over the forecast period, due to the government initiatives aimed at improving healthcare infrastructure and services. In Saudi Arabia, these efforts are particularly notable, with the government actively promoting public-private partnerships to enhance the country's healthcare system and introducing cutting-edge medical technologies, including state-of-the-art leukapheresis devices.

The leukapheresis market in Kuwait is anticipated to witness at a substantial CAGR during the forecast period. Growing investments in research and development activities related to leukapheresis technologies are driving market expansion in Kuwait. According to the International Trade Administration in December 2023, more than 80% of healthcare spending in Kuwait is allocated to the public healthcare sector.

Key Leukapheresis Company Insights

Key players operating in the leukapheresis industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Leukapheresis Companies:

The following are the leading companies in the leukapheresis market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories International, Inc.

- Adacyte Therapeutics

- AllCells, LLC

- Asahi Kasei Medical

- Haemonetics Corporation

- Macopharma

- Cerus Corporation

- SB-Kawasumi Laboratories, Inc.

- StemExpress, LLC.

- Haemonetics Corporation

- Caltag Medsystems Limited

- Lonza Group AG

- ZenBio

- Terumo BCT, Inc.

- Macopharma SA

- Miltenyi Biotec

- Fresenius SE & Co. KGaA

- Guangzhou Daji Medical Science

- MEDICA S.p.A

- PuriBlood Medical Co. Ltd.

- Beijing ZKSK Technology Co. Ltd.

Recent Developments

-

In March 2024, the FDA approved Breyanzi from Bristol Myers Squibb, a novel CAR T cell treatment for adults with certain types of leukemia and lymphoma. Starting with leukapheresis, the treatment collects patients' white blood cells to produce the therapy.

-

In August 2023, the Reveos Automated Whole Blood Processing System, developed by Terumo Blood and Cell Technologies, was approved by the FDA. This device enhances the processing of whole blood into white blood cells and various components, with the goal of augmenting the blood supply in the U.S.

-

In May 2023, Akadeum Life Sciences introduced a new range of products for cell therapy research, enhancing their BACS Microbubble technology for easy isolation of T cells and PBMCs from leukapheresis material, avoiding traditional lysis or centrifugation steps.

Leukapheresis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 233.3 million

Revenue forecast in 2030

USD 394.1 million

Growth rate

CAGR of 11.05% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Charles River Laboratories International, Inc.; Adacyte Therapeutics; AllCells, LLC; Asahi Kasei Medical; Haemonetics Corporation; Macopharma; Cerus Corporation; SB-Kawasumi Laboratories, Inc.; StemExpress, LLC.;; Caltag Medsystems Limited; Lonza Group AG; ZenBio; Terumo BCT, Inc.; Macopharma SA; Miltenyi Biotec; Fresenius SE & Co. KGaA; Guangzhou Daji Medical Science; MEDICA S.p.A; PuriBlood Medical Co. Ltd.; Beijing ZKSK Technology Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Leukapheresis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global leukapheresis market report based on product type, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Leukapheresis Devices

-

Centrifugal Devices

-

Membrane Separators

-

-

Leukapheresis Disposables

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Application

-

Cancer Research

-

Immunology Research

-

Others

-

-

Therapeutics Application

-

Hematologic Disorders

-

Autoimmune Diseases

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Centers

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global leukapheresis market size was estimated at USD 211.3 million in 2024 and is expected to reach USD 233.3 million in 2025.

b. The global leukapheresis market is expected to grow at a compound annual growth rate of 11.05% from 2025 to 2030 to reach USD 394.1 million by 2030.

b. North America dominated the leukapheresis market with a share of 36.86% in 2024 and is expected to grow at the highest CAGR over the forecast period. This is attributable to growing technological advancements and the presence of key players operating in the market.

b. Some key players in the leukapheresis market include Charles River Laboratories International, Inc.; Adacyte Therapeutics; AllCells, LLC; Asahi Kasei Medical; Haemonetics Corporation; Macopharma; Cerus Corporation; SB-Kawasumi Laboratories, Inc.;

b. Key factors driving the leukapheresis market growth include the increasing prevalence of blood disorders and autoimmune diseases, technological advancements in leukapheresis procedures, and growing demand for personalized medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.