- Home

- »

- Healthcare IT

- »

-

Life Sciences Next-generation Customer Engagement Platforms Market Report, 2033GVR Report cover

![Life Sciences Next-generation Customer Engagement Platforms Market Size, Share & Trends Report]()

Life Sciences Next-generation Customer Engagement Platforms Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment Mode, By Functionality, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-729-3

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Life Sciences Next-generation Customer Engagement Platforms Market Summary

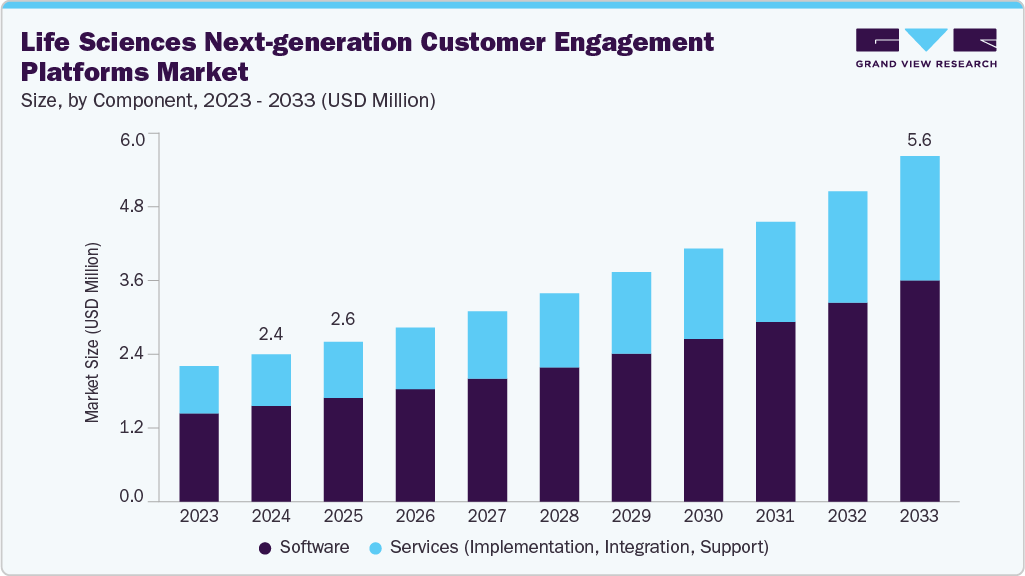

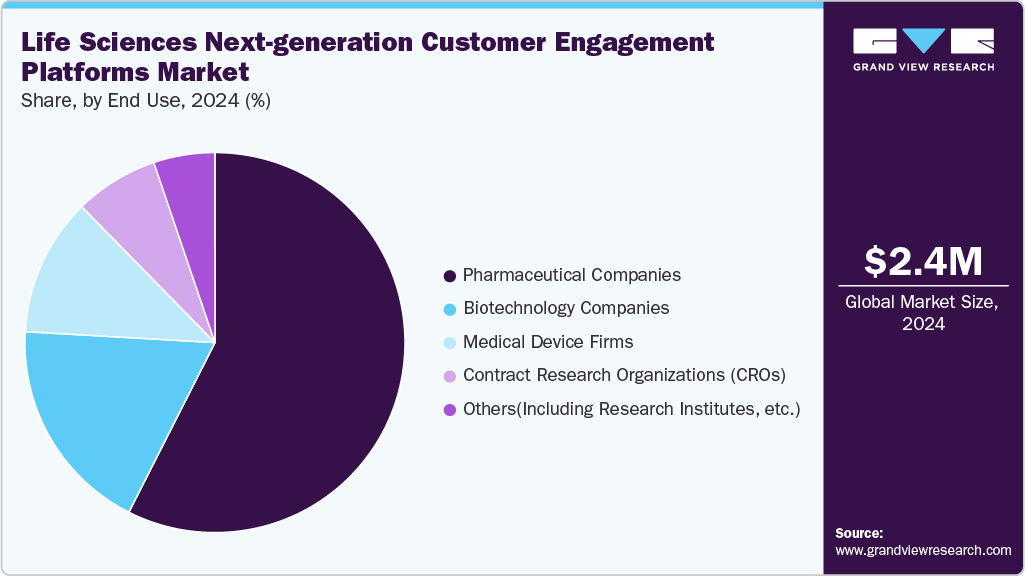

The global life sciences next-generation customer engagement platforms market size was estimated at USD 2.37 billion in 2024 and is projected to reach USD 5.56 billion by 2033, growing at a CAGR of 10.13% from 2025 to 2033. Healthcare providers increasingly focus on personalized care, necessitating advanced engagement platforms to tailor interactions and enhance patient outcomes.

Key Market Trends & Insights

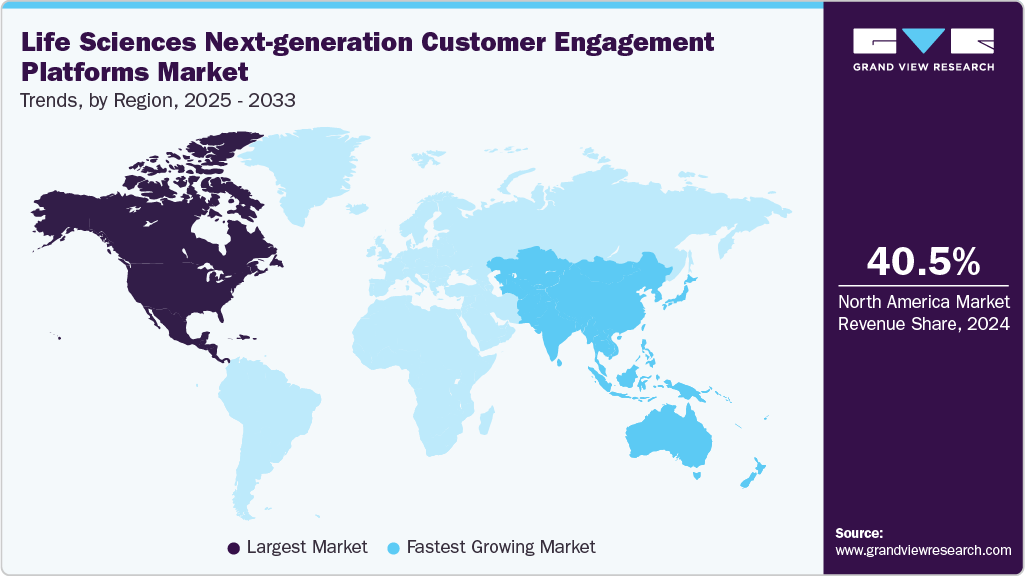

- North America dominated the market and accounted for a 40.51% share in 2024.

- The life sciences next-generation customer engagement platforms (CEP) market in the U.S. has grown significantly over the forecast period.

- By component, the software segment led the market with a share of over 65.01% in 2024.

- By deployment mode, Cloud / SaaS (multi-tenant, subscription) emerged as the leading deployment segment in 2024.

- By functionality, the core engagement layers’ segment led the market with a share of over 54.54% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.37 Billion

- 2033 Projected Market Size: USD 5.56 Billion

- CAGR (2025-2033): 10.13%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing need for customized interactions with healthcare professionals and patients, driving the development and implementation of advanced CEP solutions. The shift toward patient-centric care is accelerating demand for life sciences next-generation customer engagement platforms, as companies need digital tools that go beyond product promotion to deliver continuous support, education, and outcomes-focused engagement. For instance:-

In October 2024, Temedica and Roche extended their successful partnership, benefiting tens of thousands of patients with digital companion apps like Retinora for retinal diseases and Brisa for multiple sclerosis. These apps, built on Temedica’s platform and integrated with real-world evidence, provide personalized support that improves patient care, with ongoing expansions planned.

-

In March 2022, DarioHealth entered into a multi-year, USD 30 million strategic agreement with Sanofi U.S. to accelerate the commercial adoption of Dario's digital therapeutics platform and expand digital health solutions. The collaboration aims to promote Dario’s multi-condition digital therapeutics, increase sales reach in health plan and employer markets, and jointly develop new solutions to improve chronic disease management.

-

In September 2021, Genentech (Roche) deployed Lifelink Systems’ AI-powered chatbot to improve patient communication in clinical trials. This demonstrated the need for platforms that can manage 24/7, scalable, and compliant patient touchpoints, which directly fuels CEP adoption.

These instances demonstrate how the industry is incorporating patient-centered approaches into engagement strategies. As digital companions, AI chatbots, and digital therapeutics collaborations grow, life sciences companies are compelled to adopt advanced customer engagement platforms that integrate these tools, support compliant interactions, and deliver measurable value across the care ecosystem, ultimately fueling market growth.

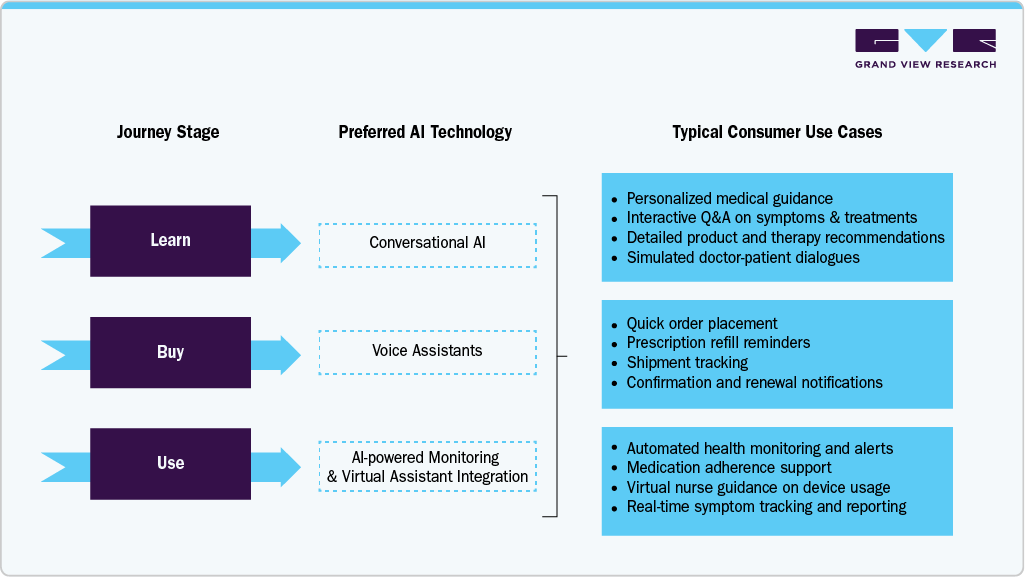

AI Technologies Shaping Consumer Engagement in Life Sciences: A Phase-by-Phase Overview

Understanding consumer engagement in life sciences requires analyzing how AI technologies align with consumer journey stages. The following chart highlights specific AI tools, such as conversational AI and voice assistants, used at each stage, supporting interactions from initial education and decision-making to purchasing and ongoing product use. This emphasizes the need to incorporate customized AI features into next-generation customer engagement platforms to enhance the consumer experience and improve health outcomes.

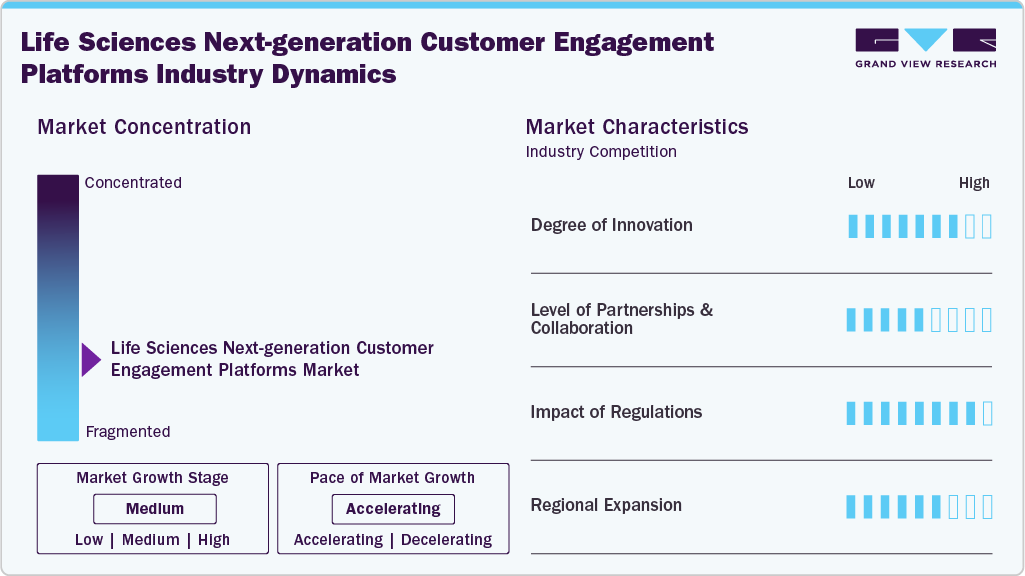

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, moderate growth was observed in regional expansion.

The life sciences next-generation customer engagement platforms (CEP) industry is evolving as companies integrate advanced AI-powered tools to strengthen omnichannel strategies. For instance, in December 2025, Aktana launched its GenAI-powered Action Agent, designed to empower life sciences field teams with smarter, data-driven decision-making and seamless integration into leading CRM systems like Veeva and Salesforce. This innovation enables organizations to automate critical tasks, enhance personalization, and adapt to shifting CRM landscapes, ultimately future-proofing engagement models and accelerating value delivery.

The life sciences next-generation customer engagement platforms (CEP) industry is expected to witness strong growth driven by strategic partnerships and collaborations that enhance digital innovation and engagement capabilities. For instance, in April 2024, IQVIA and Salesforce expanded their global partnership to develop Salesforce’s Life Sciences Cloud, integrating IQVIA’s Orchestrated Customer Engagement (OCE) innovations with Salesforce’s CRM and AI technologies. The collaboration aims to launch a unified platform in 2025, transforming healthcare professional and patient engagement while supporting nearly 400 existing OCE customers through 2029.

Regulations play a critical role in shaping the life sciences' next-generation customer engagement platforms market by influencing platform deployment, data management, and adoption rates. Strict requirements from agencies such as the FDA, EMA, and other regulatory bodies ensure data privacy, patient safety, and promotional standards compliance. Adherence to evolving guidelines around digital health communication, real-world evidence use, and omnichannel engagement practices is essential for successful market entry and expansion.

The life sciences next-generation customer engagement platforms (CEP) industry is witnessing growth across various regions, driven by the rising shift toward patient-centric care, increasing adoption of digital and AI-powered engagement tools, and advancements in omnichannel communication strategies. In addition, favorable regulatory support for digital health initiatives and strategic partnerships between global technology providers and life sciences companies are accelerating market penetration.

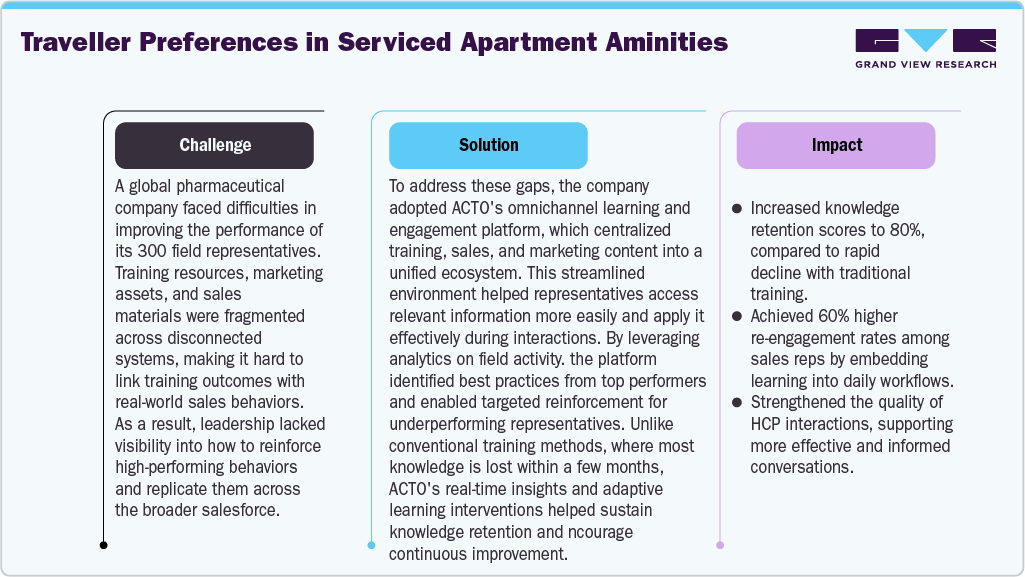

Case Study: Enhancing Sales Effectiveness Through Omnichannel Engagement

A global pharmaceutical company leveraged ACTO’s omnichannel learning and engagement platform to unify training, sales, and marketing content, enabling data-driven performance improvements.

Component Insights

Software held the largest share of 65.01% in 2024, driven by the growing adoption of AI-powered tools that enhance personalization, engagement, and data-driven decision-making. For instance, in October 2024, Swoop launched its proprietary GenAI platform with custom privacy-safe AI Assistants, enabling pharmaceutical marketers to transform large healthcare datasets into actionable insights, deliver tailored communications to healthcare professionals and patients, and optimize omnichannel marketing strategies while ensuring compliance with data privacy regulations.

The services segment (implementation, integration, and support) is projected to register the highest CAGR from 2025 to 2033, as companies increasingly rely on expert support to ensure seamless deployment, system interoperability, and ongoing optimization of advanced AI-driven solutions. The rising complexity of integrating platforms with existing CRM systems and regulatory requirements further fuels demand for specialized service providers.

Deployment Mode Insights

The cloud/SaaS (multi-tenant, subscription) deployment model held the largest market share in 2024, driven by its scalability, cost-effectiveness, and ease of access. Life sciences companies quickly adopt cloud-based solutions to enable real-time data sharing, support remote field teams, and incorporate AI-driven analytics into their engagement strategies. The subscription-based model also lowers upfront costs while providing continuous updates and ensuring compliance with changing regulatory standards.

The cloud/SaaS (multi-tenant, subscription) deployment model is also projected to register the fastest CAGR over the forecast period. Its rapid growth is fueled by the increasing demand for flexible, scalable, and cost-efficient solutions that support omnichannel engagement.

Functionality Insights

The core engagement layers segment accounted for the largest revenue market share in 2024, driven by the widespread adoption of end-to-end content management, engagement channel optimization, and commercial learning and training solutions. These foundational capabilities form the backbone of customer engagement strategies, enabling life sciences companies to streamline interactions, standardize communication, and improve commercial effectiveness.

The advanced software capabilities segment is expected to register the highest CAGR over the forecast period, driven by growing demand for role-specific tools, cognitive capabilities, and AI-driven insights. For instance, in September 2022, Veeva Crossix introduced Omnichannel Boost and HCP Trigger Data products to advance omnichannel marketing for life sciences brands, helping integrate direct-to-consumer and HCP campaigns with field force activity to deliver more personalized, data-driven engagement.

End Use Insights

The pharmaceutical companies segment held the largest share of 57.48 % in 2024, driven by their extensive field force operations, high adoption of digital engagement tools, and the need to deliver consistent, compliant interactions with healthcare professionals and patients. Large pharma companies continue to invest heavily in omnichannel platforms to optimize sales, marketing, and medical affairs engagement, ensuring better insights and measurable outcomes across their global operations.

The biotechnology companies segment is projected to register the highest CAGR during the forecast period, as smaller and mid-sized biotech firms increasingly adopt advanced, AI-driven, and omnichannel customer engagement solutions to scale operations, improve patient support, and compete effectively with larger pharmaceutical players. The biotech sector’s focus on personalized medicine, niche therapies, and digital-first strategies to engage physicians, payers, and patients efficiently fueled the rapid growth.

Regional Insights

The life sciences next-generation customer engagement platforms market in North America is witnessing robust growth, driven by the increasing adoption of AI-powered tools, digital health solutions, and omnichannel engagement strategies across the pharmaceutical, biotechnology, and medical device sectors. The region’s focus on patient-centric care, rising demand for personalized communications, and the need for data-driven decision-making fuel platform adoption. Supportive government initiatives promoting healthcare digitization, interoperability, and real-world evidence integration further reinforce market expansion.

U.S. Life Sciences Next-generation Customer Engagement Platforms Market Trends

The life sciences next-generation customer engagement platforms market in the U.S. is experiencing significant growth, driven by a focus on patient-centric care, AI-enabled omnichannel engagement, and data-driven decision-making across pharmaceutical, biotechnology, and medical device companies. Adoption is further supported by government initiatives promoting healthcare digitization, interoperability, and telehealth, along with the presence of advanced healthcare infrastructure and major life sciences firms. For instance, in June 2025, Simplify Healthcare launched Xperience1, a next-generation AI-powered platform designed to streamline benefits inquiry management by providing accurate, real-time, and role-specific responses across multiple channels to enhance patient and provider engagement, demonstrating the increasing adoption of intelligent CEP solutions in the U.S. market.

Europe Life Sciences Next-generation Customer Engagement Platforms Market Trends

The life sciences next-generation customer engagement platforms market in Europe is growing steadily and is driven by AI-powered tools, digital health solutions, and omnichannel engagement strategies. Rising demand for personalized, data-driven interactions and patient-centric care is fueling adoption, with supportive government initiatives, such as the European Life Sciences Strategy, launched in July 2025, aiming to strengthen EU competitiveness and promote innovation, creating a favorable environment for next-generation CEP solutions.

The UK life sciences next-generation customer engagement platforms market is expanding as pharmaceutical, biotechnology, and medical device companies increasingly leverage AI-driven and omnichannel engagement tools to deliver personalized, patient-centric interactions. The 10-Year Health Plan for England, launched in June 2025, emphasizes shifting care from hospitals to communities, moving from analogue to digital systems, and focusing on prevention over treatment, creating a favorable environment for adopting advanced CEP solutions that enhance engagement and support health innovation.

The life sciences next-generation customer engagement platforms market in Germany is witnessing steady growth, driven by the adoption of AI-powered tools, digital health solutions, and omnichannel engagement strategies across pharmaceutical, biotechnology, and medical device sectors. Rising demand for personalized, patient-centric interactions and data-driven decision-making is accelerating platform adoption.

Asia Pacific Life Sciences Next-generation Customer Engagement Platforms Market Trends

The life sciences next-generation customer engagement platforms market in the Asia Pacific is experiencing rapid growth, driven by increasing adoption of AI-powered tools, digital health solutions, and omnichannel engagement strategies across pharmaceutical, biotechnology, and medical device companies. Rising demand for personalized, patient-centric interactions and data-driven decision-making is fueling platform adoption, while regional competitors-including global CEP providers and local technology firms are actively expanding their presence through partnerships, platform launches, and service innovations.

Japan life sciences next-generation customer engagement platforms market is growing steadily, driven by the increasing adoption of AI-powered tools, digital health solutions, and omnichannel engagement strategies. Rising demand for personalized, patient-centric interactions, a strong focus on improving healthcare efficiency, and expanding digital healthcare infrastructure are key factors fueling the market’s growth.

The life sciences next-generation customer engagement platforms market in China is expanding, driven by increasing adoption of AI-powered tools, digital health solutions, and omnichannel engagement strategies by pharmaceutical, biotechnology, and medical device companies. For instance, in November 2024, Bayer China launched its OPERA 2.0 healthcare customer engagement platform, powered by Salesforce and hosted on Alibaba Cloud, integrating previously disparate systems into a unified, low-latency solution. This platform enhances service delivery for thousands of users, complies with Chinese regulations, and plans to incorporate AI to improve service efficiency and patient well-being, highlighting the country’s growing focus on digital transformation in life sciences engagement.

Latin America Life Sciences Next-generation Customer Engagement Platforms Market Trends

The life sciences next-generation customer engagement platforms market in Latin America is expanding, driven by rising healthcare digitization, growing mobile and internet penetration, and increasing focus on patient-centric care. For instance, in October 2024, Brazil’s Ministry of Health launched a national digital health initiative in collaboration with local AI providers to implement a unified health information system to improve patient data interoperability and support more efficient healthcare delivery, fueling the adoption of advanced CEP solutions across the region.

Middle East & Africa Life Sciences Next-generation Customer Engagement Platforms Market Trends

The life sciences next-generation customer engagement platforms market in the MEA is growing, driven by efforts to improve patient interactions, streamline healthcare operations, and support data-driven decision-making. For instance, in October 2023, IQVIA announced that Sanofi will deploy its Orchestrated Customer Engagement (OCE) platform in select countries across Africa and the Middle East. Built on Salesforce technology and powered by IQVIA's Connected Intelligence, the platform aims to deliver real-time insights, AI-driven recommendations, and predictive outcomes, helping Sanofi speed up its omnichannel strategy and enhance engagement with customers and healthcare partners in the region.

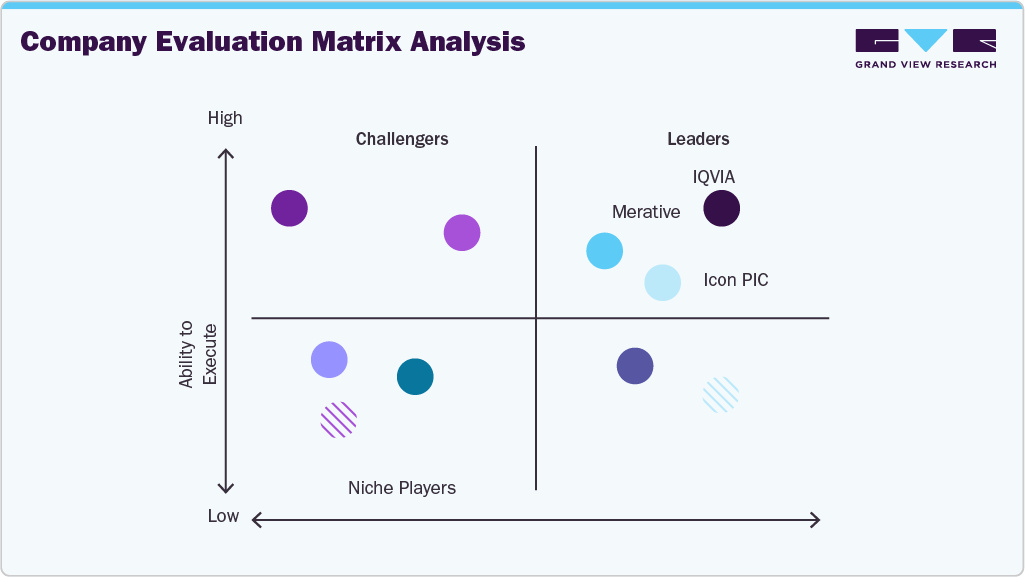

Key Life Sciences Next-generation Customer Engagement Platforms Company Insights

The market is highly fragmented, with many small and large players operating. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships play a key role in propelling the market growth.

Key Life Sciences Next-generation Customer Engagement Platforms Companies:

The following are the leading companies in the life sciences next-generation customer engagement platforms market. These companies collectively hold the largest market share and dictate industry trends.

- Aktana

- IQVIA (OCE)

- Veeva Systems

- Exeevo

- Pitcher

- Salesforce

- ACTO Technologies Inc.

- Allego

- Bigtincan

- ODAIA Intelligence Inc.

- Qstream Inc.

- Seismic

- Tellius

- Viseven

- Vodori

- WhizAI

- ZS Associates

- Okra

- P360

- Quantified.ai

- verbTEAMS SoloFire

Recent Developments

-

In June 2025, Cognizant and Google Cloud launched the Cognizant Autonomous Customer Engagement platform, an AI-driven contact center solution designed to deliver hyper-personalized customer experiences across industries. The platform integrates Google Cloud's Voice AI and machine learning technologies to provide real-time, omnichannel support, combining AI agents with human oversight to enhance customer interactions.

-

In March 2025, PharmaCord and Mercalis announced their merger to form Valeris, a next-generation platform designed to meet the evolving needs of the biopharmaceutical industry. The combined entity aims to enhance patient outcomes and advance healthcare delivery by providing a comprehensive suite of solutions, including patient services, market access, and healthcare provider engagement tools. The merger is expected to close by the third quarter of 2025, subject to customary regulatory approvals.

“Kieron Scrutton, senior vice president of commercial and digital technology at GSK.

This combination is about more than growth, it’s about impact and transformation to meet evolving manufacturer and patient needs. By uniting PharmaCord’s deep expertise in hub services with Mercalis’s established leadership in end-to-end patient access solutions and robust infrastructure, we are building a next-generation platform that redefines how life science companies bring innovative therapies to market.”

- Robert Truckenmiller, CEO of PharmaCord

-

In November 2023, Veeva Systems announced that GSK would be among the first top biopharma companies to migrate to Veeva Vault CRM. This move aims to enhance GSK's customer engagement by leveraging advanced technology to interact with healthcare professionals based on their needs, leading to more effective engagement.

“Data and technology are core to achieving GSK’s aim to positively impact 2.5 billion people by the end of 2030, so moving to Vault CRM is a clear next step for us as we advance our highly tailored HCP engagement.”

Life Sciences Next-generation Customer Engagement Platforms Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.57 billion

Revenue forecast in 2033

USD 5.56 billion

Growth rate

CAGR of 10.13% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, functionality, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Aktana; IQVIA (OCE); Veeva System;, Exeevo; Pitcher; Salesforce; ACTO Technologies Inc.; Alleg;, Bigtincan; ODAIA Intelligence Inc.; Qstream inc.; Seismic; Tellius; Viseven; Vodori; WhizAI; ZS Associates; Okra; P360; Quantified.ai; verbTEAMS SoloFire

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Life Sciences Next-generation Customer Engagement Platforms Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global life sciences next-generation customer engagement platforms market report based on component, deployment mode, functionality, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services (implementation, integration, support)

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud / SaaS (multi-tenant, subscription)

-

On-premise

-

-

Functionality Outlook (Revenue, USD Million, 2021 - 2033)

-

Core Engagement Layers

-

End to end content management

-

Engagement channel optimization

-

Commercial learning and training

-

-

Advanced Software Capabilities

-

Cognitive Capabilities

-

Functional Role Coverage

-

Sales

-

Marketing

-

Medical Affairs

-

Market Access

-

Patient Services

-

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Contract Research Organizations (CROs)

-

Medical Device Firms

-

Others (Including Research Institutes, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global life sciences next-generation customer engagement platforms market is expected to grow at a compound annual growth rate of 10.13% from 2025 to 2033 to reach USD 5.56 billion by 2033.

b. Some key players operating in the life sciences next-generation customer engagement platforms market include Aktana, IQVIA (OCE), Veeva Systems, Exeevo, Pitcher, Salesforce, ACTO Technologies Inc., Allego, Bigtincan, ODAIA Intelligence Inc., Qstream inc., Seismic, Tellius, Viseven, Vodori, WhizAI, ZS Associates, Okra, P360, Quantified.ai, and verbTEAMS, SoloFire

What are the factors driving the life sciences next-generation customer engagement platforms market?b. Key factors that are driving the market growth include increasing focus on personalized care, necessitating advanced engagement platforms to tailor interactions and enhance patient outcomes. Growing need for customized interactions with healthcare professionals and patients, driving the development and implementation of advanced CEP solutions. In addition Growing adoption of AI-powered tools that enhance personalization, engagement, and data-driven decision-making is further propelling the market growth

b. The global life sciences next-generation customer engagement platforms (CEP) market size was estimated at USD 2.37 billion in 2024 and is expected to reach USD 2.57 billion in 2025.

b. North America dominated the life sciences next-generation customer engagement platforms market with a share of 40.51 % in 2024, driven by the increasing adoption of AI-powered tools, digital health solutions, and omnichannel engagement strategies across the pharmaceutical, biotechnology, and medical device sectors. The region’s focus on patient-centric care, rising demand for personalized communications, and the need for data-driven decision-making are fueling platform adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.