- Home

- »

- Healthcare IT

- »

-

Life Sciences Quality Management Software Market Report 2033GVR Report cover

![Life Sciences Quality Management Software Market Size, Share & Trends Report]()

Life Sciences Quality Management Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment Mode (Web & Cloud-based, On-premise), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-491-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Life Sciences Quality Management Software Market Summary

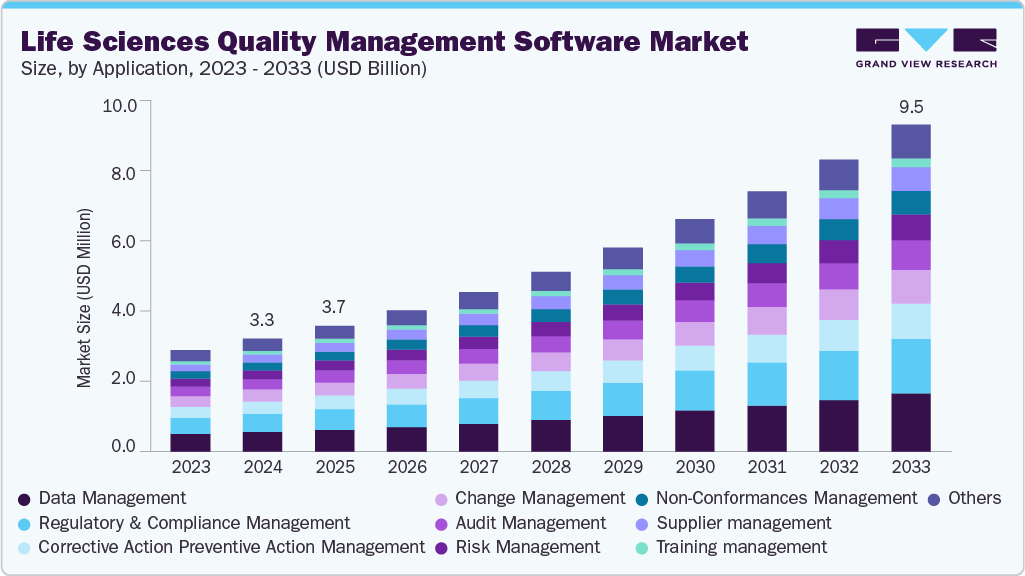

The global life sciences quality management software market size was estimated at USD 3.27 billion in 2024 and is projected to reach USD 9.47 billion by 2033, growing at a CAGR of 12.65% from 2025 to 2033. Technological advancements and the growing need to comply with regulatory guidelines are factors driving market growth.

Key Market Trends & Insights

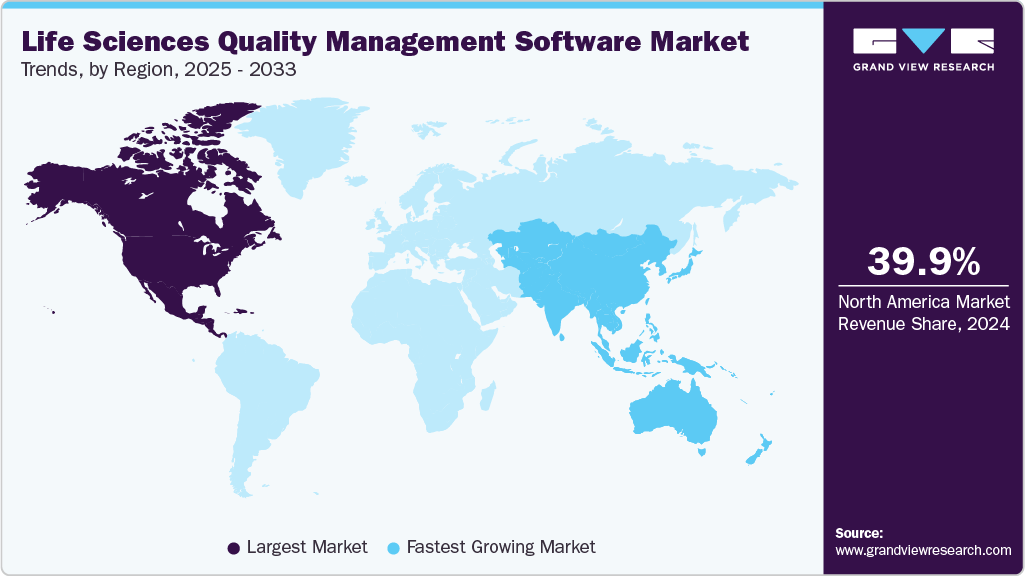

- North America dominated the life sciences quality management software market with the largest revenue share 39.98% in 2024.

- The life sciences quality management software market in the U.S. is experiencing significant growth.

- Based on application, the data management segment led the market with the largest revenue share 17.52% in 2024.

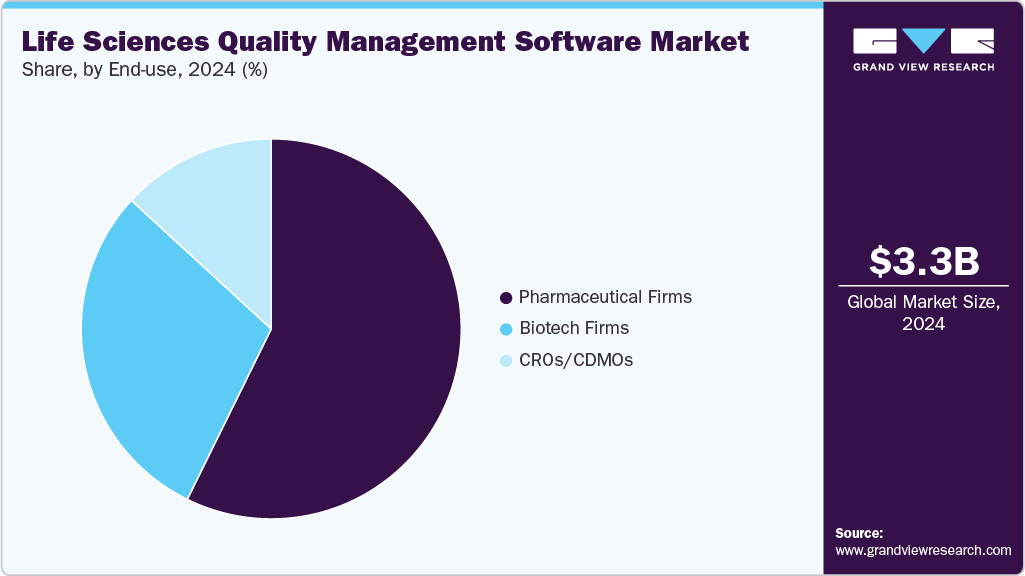

- Based on end use, the pharmaceutical firms segment led the market with the largest revenue share of 57.29% in 2024.

- Based on deployment mode, the cloud & web-based segment led the market with the largest revenue share of 77.03% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.27 Billion

- 2033 Projected Market Size: USD 9.47 Billion

- CAGR (2025-2033): 12.65%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the market is expected to expand due to the growing use of smart devices and the internet of things (IoT). The incorporation of the Six Sigma approach into life sciences Quality Management Software (QMS) is anticipated to open new opportunities for industrial expansion.The increasing demand for compliance with regulatory guidelines significantly drives the adoption of QMS in the life sciences industry. This shift is influenced by the need to ensure product safety, efficacy, and adherence to stringent regulations imposed by authorities, such as the FDA and ISO standards. The life sciences sector is highly regulated, requiring companies to maintain high-quality and safety standards. A robust QMS helps organizations meet these regulatory demands efficiently, ensuring that products are safe for public use and comply with necessary guidelines.

In addition, technological advancements are also a significant factor in harnessing the adoption of QMS in the life sciences industry. This transformation is largely due to the increasing need for compliance, efficiency, and innovation within a highly regulated environment. The life sciences sector is transitioning from traditional, paper-based QMS to digital Enterprise Quality Management Software (eQMS). This shift allows organizations to harmonize policies, processes, and documentation, ensuring that quality is integrated into every operational step. Digital systems facilitate real-time data access, enhancing decision-making and operational efficiency.

Moreover, modern QMS leverages data analytics to drive informed decision-making. By utilizing advanced technologies, such as artificial intelligence (AI) and machine learning (ML), organizations can predict potential issues before they arise and optimize manufacturing processes, leading to improved product quality & shorter development cycles. Several companies have recently launched innovative solutions in the life sciences sector, particularly focusing on AI integration to enhance various operational aspects. For instance, in June 2024, ComplianceQuest launched an AI-integrated QMS designed for the life sciences industry in partnership with Salesforce. This newly launched software, the Life Sciences Cloud, is expected to enhance various aspects of life sciences operations, including clinical trials & patient engagement.

Case Study & Insights: AI Integration in Quality Management Systems for Life Sciences

The case study from Qualityze highlights the transformative impact of AI on QMS across various industries, particularly in pharmaceuticals and life sciences.

Result:

The integration of AI into QMS is revolutionizing how companies manage quality control and assurance. By leveraging AI-driven insights, organizations can optimize their processes, improve customer satisfaction, and maintain compliance with regulatory standards. As industries continue to embrace these technologies, they set new benchmarks for excellence in quality management.

Market Concentration & Characteristics

The life sciences quality management software industry experiences a high degree of innovation driven by technological advancements. Integrating artificial intelligence in QMS helps streamline drug development and manufacturing processes by automating repetitive tasks and reducing the risk of noncompliance. For instance, in April 2023, Dot Compliance launched an innovative, ready-to-use AI-based eQMS for life sciences. This system utilizes ChatGPT and proprietary algorithms to optimize quality processes, automate tasks, and enhance compliance, allowing quality assurance professionals to focus on critical priorities.

"There is a wealth of untapped potential for innovation in quality management regarding compliance, and Dot Compliance has shown leadership in this space. Its ready-to-use AI capabilities via the eQMS accelerate our use of Dot Compliance's solution, and will drive internal discussions on the many ways we can use it, creating more spare time for our teams that would have used managing quality events, and a platform to gain knowledge and understanding of quality processes much faster."

-Chairman and CEO of BioForum

The industry is experiencing a high level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in April 2024, ABOUT Healthcare acquired AI analytics company Edgility to offer patient progression solutions with predictive and prescriptive analysis. The impact of regulations is high, with various local regulatory bodies governing the market. Various regulatory authorities, such as the U.S. FDA, MHRA, EMA, etc., establish the criteria under which electronic records are considered trustworthy and reliable, equivalent to traditional paper records, thereby ensuring compliance and safeguarding product quality. For instance, in January 2024, the FDA introduced the Quality Management System Regulation (QMSR) to update the Current Good Manufacturing Practice (CGMP) standards for medical devices, aligning them with the Quality System (QS) regulation.

The industry is witnessing moderate product expansion, driven by an increasing customer base for quality management software. Firms are aligning with technology providers and consulting agencies to enhance their product offerings and expand market reach. For instance, in April 2024, Clarivate Plc, a provider of transformative intelligence, announced the acquisition of Global QMS, Inc., commonly known as Global Q. This company offers cloud-based solutions that help life sciences clients automate regulatory reporting and compliance management.

Application Insights

Based on applications, the data management segment dominated the market in 2024 and accounted for the largest revenue share of 17.52%. The rising volume of inconsistent healthcare data and the increased demand from regulatory organizations for reports that adhere to exacting quality standards are the main factors influencing this growth. The pharmaceutical industry frequently uses Big Data. These companies employ data for a variety of tasks, such as analyzing clinical findings and assessing the efficacy of medications based on actual health outcomes.

Furthermore, the regulatory and compliance management segment is expected to grow at the fastest CAGR from 2025 to 2033. The segment's growth is attributed to the increasing complexity of regulatory requirements, the need for enhanced data integrity and traceability, and the growing emphasis on patient safety. As science companies face increased scrutiny regarding product quality and safety, they must adopt a robust QMS that integrates regulatory compliance features. These systems facilitate real-time compliance status monitoring, streamline audit processes, and ensure proper documentation practices.

Deployment Mode Insights

Based on deployment mode, the cloud & web-based segment held the largest market share in 2024, and is expected to register growth at the fastest CAGR during the forecast period. The adoption of web and cloud-based quality management software in the life sciences sector is transforming how organizations manage compliance and quality assurance processes. By leveraging these technologies, companies can enhance collaboration, ensure regulatory adherence, and ultimately deliver higher-quality products more efficiently. As the industry continues to evolve, these systems will be integral in navigating the complexities of modern life sciences operations.

The on-premise segment is anticipated to grow at a significant CAGR from 2025 to 2033. On-premises life sciences QMS is designed to help organizations in the life sciences sector manage quality processes, ensure regulatory compliance, and enhance operational efficiency. These systems are installed locally on the organization's servers and require significant investment in hardware and maintenance. Many healthcare entities prefer on-premises solutions due to their enhanced data security capabilities. These systems allow organizations to maintain control over sensitive data, minimizing the risk of breaches that could compromise patient safety and regulatory compliance.

End Use Insights

The pharmaceutical firms segment held the largest market share of 57.29% in 2024. QMS enables pharmaceutical companies to develop quality products, control suppliers, support data integrity, and maintain compliance. The adoption of standardized QMS procedures is increasing as pharmaceutical businesses expand globally. In addition, growing expenses in drug manufacturing and the rising use of technology in the pharmaceutical industry are driving market growth. For instance, a 2021 report from the Congressional Budget Office estimated that developing a new drug, including both initial investment and expenses on unsuccessful drugs, can range from under USD 1 billion to over USD 2 billion. Furthermore, pharmaceutical enterprises globally are recognizing the strategic significance of implementing a comprehensive QMS to enhance overall company performance and secure a competitive edge.

This has led to various market providers taking strategic steps to meet this growing demand. For instance, in April 2022, ComplianceQuest partnered with EZEN, a company that offers digital transformation services to the life sciences and healthcare sectors, as the pharmaceutical industry prioritizes quality assurance, demand for innovative QMS solutions is expected to increase, driving market growth.

“ComplianceQuest’s solutions will help EZEN’s clients to maximize quality and achieve compliance in the safest and most environmentally sustainable way possible. “Being able to partner with an organization that is focused on digital transformation, we can augment the expertise of EZEN’s team with solutions that are expressly focused on quality, safety, and environmental sustainability.”

- Prashanth Rajendran, CEO of Compliance Quest

The biotech firms segment is expected to grow at the fastest CAGR over the forecast period. The need for regulatory compliance, enhanced efficiency, data-driven insights, improved collaboration, effective risk management, robust supplier relationships, increased customer satisfaction, and cost reductions drives the integration of QMS in biotechnology. These factors collectively contribute to a more streamlined operation that meets the challenges of a rapidly evolving industry landscape.

Regional Insights

North America dominated the life sciences quality management software market with the largest revenue share of 39.98% in 2024. The life sciences quality management software (QMS) market in North America is evolving rapidly, driven by the need for stringent compliance with regulatory standards and the increasing complexity of product development processes. Companies in the life sciences sector, including pharmaceuticals and biotechnology, seek to maintain high-quality standards while navigating regulations. These systems help organizations manage documentation, ensure product safety, and facilitate compliance efforts across various product lifecycle stages.

U.S. Life Sciences Quality Management Software Market Trends

The life sciences quality management software market in the U.S. is experiencing significant growth, driven by an increasing emphasis on regulatory compliance and the need for enhanced operational efficiency within the pharmaceutical, biotechnology, and medical device sectors. The necessity for QMS arises from the complex regulatory landscape that governs these industries, where adherence to standards such as Good Manufacturing Practices (GMP), ISO 13485, and Food and Drug Administration (FDA) regulations is critical. Companies are increasingly adopting QMS solutions to facilitate processes, ensure product quality, and mitigate risks associated with non-compliance. For instance, in January 2023, Palantir Technologies launched a Quality Management System for life sciences to meet GxP requirements, integrated with its Foundry platform. The solution accelerates therapeutic launch processes, enables end-to-end clinical data analysis, and ensures compliance with 21 CFR Part 11, serving major pharmaceutical and contract research organizations.

Europe Life Sciences Quality Management Software Market Trends

The life sciences quality management software market in Europe observed lucrative growth in 2024, driven by the growing requirement to comply with strict regulatory standards and the need for improved operational efficiency. As pharmaceutical and biotechnology firms strive to comply with strict regulations imposed by agencies such as the European Medicines Agency (EMA) and the FDA, the demand for robust QMS solutions has increased.

The UK life sciences quality management software market is expected to grow over the forecast period, owing to the increasing regulatory demands and a strong emphasis on quality assurance. Moreover, a stringent regulatory landscape has created a crucial need for effective quality management systems to facilitate processes and reduce risks associated with non-compliance.

The life sciences quality management software market in Germany held the largest market share in 2024 in the European market. As pharmaceutical and biotechnology industries face stringent regulations from authorities such as the European Medicines Agency (EMA) and the Federal Institute for Drugs and Medical Devices (BfArM), organizations adopt QMS solutions to ensure product quality and safety. The growing emphasis on patient safety and risk management further emphasizes the necessity for effective quality management systems to streamline processes, enhance documentation, and facilitate audits.

Asia Pacific Life Sciences Quality Management Software Market Trends

The life sciences quality management software market in the Asia Pacific is poised to grow at the fastest CAGR from 2025 to 2033 due to the increasing regulatory requirements imposed by health authorities, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Moreover, rapid technological advancements, including cloud computing and artificial intelligence, have facilitated the development of more sophisticated QMS tools that enhance efficiency and data accuracy. Furthermore, the rise of contract research organizations (CROs) and contract manufacturing organizations (CMOs) in the Asia Pacific has created a demand for integrated QMS solutions to support complex supply chains and multi-site operations, further driving market growth.

Japan life sciences quality management software market is expected to grow significantly over the forecast period. The increasing regulatory requirements and the need for enhanced operational efficiency within the pharmaceutical, biotechnology, and medical device sectors have significantly influenced the growth of life sciences QMS in Japan. As Japan continues to be a significant player in the global life sciences market, companies are increasingly adopting QMS solutions, thereby propelling market growth.

The life sciences quality management software market in China held the largest revenue share in 2024. The growth of life sciences QMS in China has been significantly influenced by the rapid expansion of the pharmaceutical and biotechnology sectors, alongside increasing regulatory requirements. As China’s economy continues to evolve, the demand for high-quality healthcare products has surged, prompting companies to adopt advanced QMS solutions to ensure compliance with stringent regulations set forth by authorities such as the National Medical Products Administration (NMPA).

Latin America Life Sciences Quality Management Software Market Trends

The life sciences quality management software market in Latin America is anticipated to grow at a significant CAGR over the forecast period, driven by the increasing regulatory demands and the need for enhanced operational efficiency. As the life sciences sector in Latin America continues to evolve, the emphasis on quality management intensifies, further contributing to market growth.

Middle East & Africa Life Sciences Quality Management Software Market Trends

The life sciences quality management software market in the Middle East and Africa is expected to grow at a significant CAGR over the forecast period. The market is characterized by a dynamic landscape driven by increasing regulatory requirements and the need for enhanced compliance in the pharmaceutical and biotechnology sectors. Governments across the region are implementing stricter regulations to ensure product safety and efficacy, which has led to a rising demand for robust QMS solutions.

Key Life Sciences Quality Management Software Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Life Sciences Quality Management Software Companies:

The following are the leading companies in the life sciences quality management software market. These companies collectively hold the largest Market share and dictate industry trends.

- Dassault Systèmes

- IQVIA (Pilgrim)

- MasterControl Solutions, Inc.

- AmpleLogic

- Qualio - QMS for Life Sciences

- QT9 Software

- Sparta Systems- TrackWise (Honeywell International Inc.)

- AssurX, Inc

- ETQ, LLC (Hexagon)

- Veeva Systems

- Qualityze

- Ideagen

Recent Developments

- In May 2025, MasterControl received FedRAMP Moderate authorization for its Quality Excellence Gov (Qx Gov) solution, making it the first QMS to meet this federal cybersecurity standard.

"Achieving FedRAMP authorization is a powerful validation of our commitment to security, trust, and operational excellence in quality management. This milestone not only opens the door to deeper collaboration with federal agencies, but also reinforces our promise to all customers that their data is protected by the highest standards in the industry."

- Jon Beckstrand, CEO of MasterControl

- In August 2024, Honeywell launched Honeywell Quality Management Review (HQMR), a digital application for life sciences that streamlines and automates quality management review processes.

“This new solution helps transform the traditional QMR process into a more insightful and actionable practice, ensuring organizations adhere to regulatory guidelines with ease.”

-Martin Dowdall, Vice President and General Manager of connected life sciences at Honeywell

- In July 2024, QT9 Software launched QT9 QMS Version 16.0, which introduces two new modules and several enhancements to improve quality management processes.

"We value our customers and look to their interests when making product enhancements. This latest version of QT9 QMS reinforces our commitment to providing customers with a comprehensive, scalable quality management system that fully meets their needs."

- QT9 Software President Brant Engelhart.-

In October 2023, Honeywell launched a new automation application to enhance product quality review processes for the life sciences industry. This software is designed to automate and streamline the Annual Product Quality Review (APQR) process, which is crucial for medical organizations to assess product quality and comply with regulatory requirements efficiently.

-

In July 2023, MasterControl entered into a partnership with Avendium to enhance quality and compliance management for life sciences organizations. This collaboration combines MasterControl's leadership in integrated quality management software with Avendium's expertise in vendor and supplier management.

-

In October 2022, Qualio - QMS for Life Sciences launched its Modern Validation Pack to enhance quality and compliance processes for the life sciences sector. This initiative is designed to help companies navigate the latest updates in Good Automated Manufacturing Practice (GAMP) and Computerized System Assurance (CSA) guidelines from the FDA, promoting a more efficient and less resource-intensive validation process.

-

In April 2022, Hexagon AB acquired ETQ, a prominent provider of SaaS-based quality management systems (QMS), environmental health and safety (EHS), and compliance management software.

Life Sciences Quality Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.65 billion

Revenue forecast in 2033

USD 9.47 billion

Growth rate

CAGR of 12.65% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment mode, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dassault Systèmes; IQVIA (Pilgrim); MasterControl Solutions, Inc.; AmpleLogic; Qualio - QMS for Life Sciences; QT9 Software; Sparta Systems- TrackWise (Honeywell International Inc.); AssurX, Inc; ETQ, LLC (Hexagon); Veeva Systems; Qualityze; Ideagen

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Life Sciences Quality Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global life sciences quality management software market report based on application, deployment method, end use, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Data Management

-

Training management

-

Supplier management

-

Regulatory and Compliance Management

-

Corrective Action Preventive Action (CAPA) Management

-

Audit Management

-

Change Management

-

Non-Conformances Management

-

Inspection Management

-

Risk Management

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud & Web based

-

On-premises

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Firms

-

Biotech Firms

-

CROs/CDMOs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global life sciences quality management software market size was estimated at USD 3.27 billion in 2024 and is expected to reach USD 3.65 billion in 2025.

b. The global life sciences quality management software market is expected to grow at a compound annual growth rate of 12.65% from 2025 to 2033 to reach USD 9.47 billion by 2033.

b. North America dominated the life sciences quality management software market with a share of over 39.98% in 2024. This is attributable to the need for stringent compliance with regulatory standards and the increasing complexity of product development processes.

b. Some key players operating in the life sciences quality management software market include Dassault Systèmes; IQVIA (Pilgrim); MasterControl Solutions, Inc.; AmpleLogic; Qualio - QMS for Life Sciences; QT9 Software; Sparta Systems- TrackWise (Honeywell International Inc.); AssurX, Inc; ETQ, LLC (Hexagon); Veeva Systems; Qualityze; Ideagen

b. Key factors driving the life sciences quality management software market growth include technological advancements in the life science industry and a growing need to comply with regulatory guidelines.

b. The pharmaceutical firm segment dominated the life sciences quality management software market and accounted for a more than 57.29% revenue share in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.