- Home

- »

- Advanced Interior Materials

- »

-

Linen Fiber Market Size And Share, Industry Report, 2033GVR Report cover

![Linen Fiber Market Size, Share & Trends Report]()

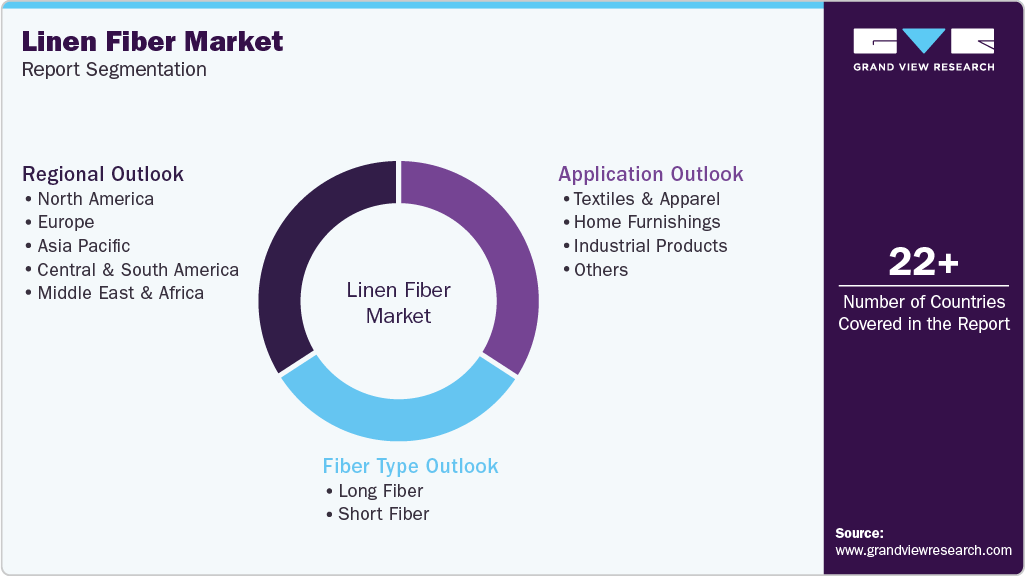

Linen Fiber Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Textiles & Apparel, Home Furnishings, Industrial Products), By Fiber Type (Long Fiber, Short Fiber), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-775-0

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Linen Fiber Market Summary

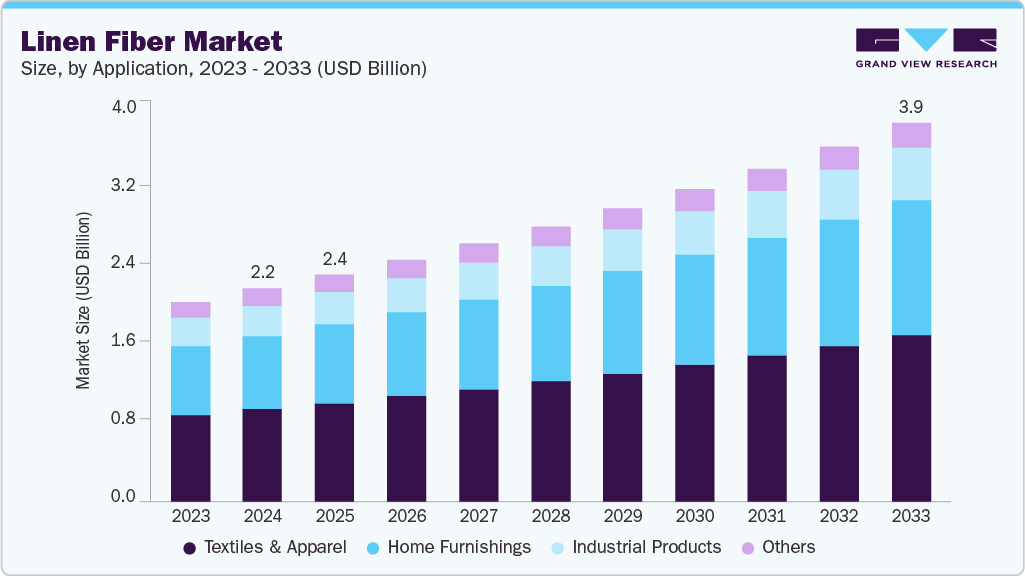

The global linen fiber market size was estimated at USD 2.21 billion in 2024 and is projected to reach USD 3.93 billion by 2033, growing at a CAGR of 6.6% from 2025 to 2033, driven by the rising demand for sustainable and eco-friendly textiles across the fashion and home furnishing industries. Linen, being a natural and biodegradable fiber derived from the flax plant, aligns with the growing consumer shift toward environmentally responsible products.

Key Market Trends & Insights

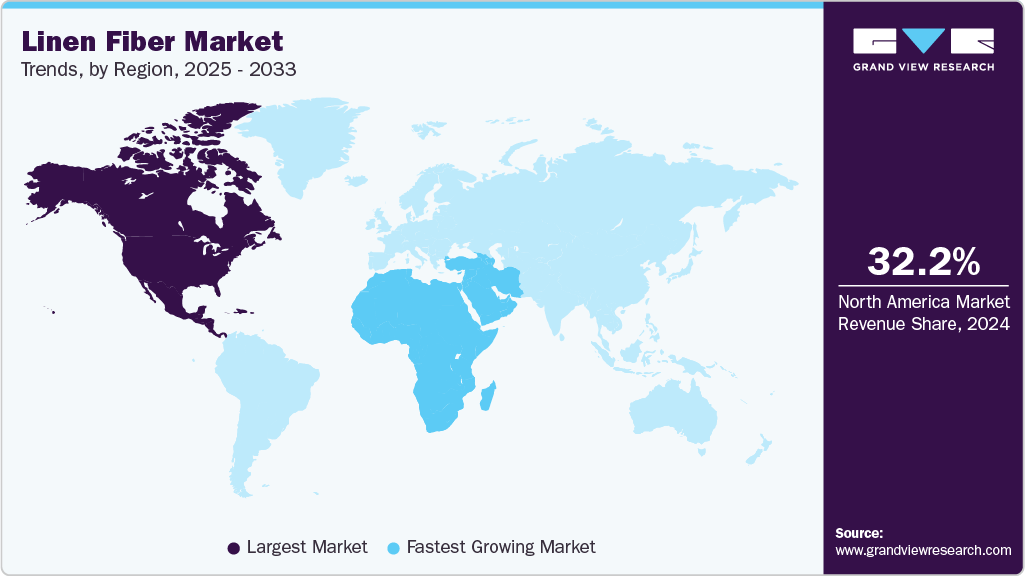

- North America dominated the linen fiber market with the largest revenue share of 32.2% in 2024.

- The linen fiber market in the U.S. is influenced by a strong shift toward environmentally responsible consumption patterns and premium-quality fabrics.

- By application, the home furnishings segment is expected to grow at the fastest CAGR of 7.0% from 2025 to 2033 in terms of revenue.

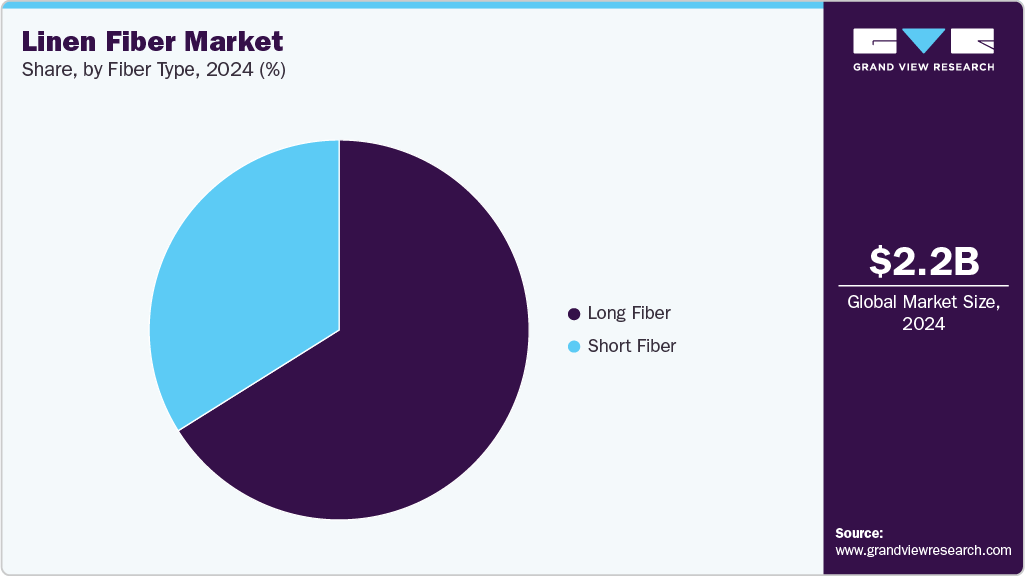

- By fiber type, the long fiber segment dominated the industry, accounting for a revenue share of 66.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.21 Billion

- 2033 Projected Market Size: USD 3.93 Billion

- CAGR (2025-2033): 6.6%

- North America: Largest market in 2024

- Middle East & Africa: Fastest-growing market

The fiber’s minimal water and pesticide requirements during cultivation further enhance its appeal in the context of sustainable production practices. Additionally, increasing awareness about the environmental impact of synthetic fibers has prompted manufacturers and designers to adopt linen as a preferred material for apparel, upholstery, and décor applications.

Technological advancements in fiber processing and textile manufacturing have further contributed to the expansion of the market. Modern spinning, weaving, and finishing technologies have improved linen’s softness, versatility, and color retention, addressing earlier limitations such as stiffness and wrinkling. These innovations have broadened linen’s applicability beyond traditional uses, extending into sportswear, technical textiles, and blended fabrics. The integration of linen with fibers such as cotton and polyester has enabled manufacturers to create cost-effective products with enhanced functional properties, thus increasing its acceptance among diverse consumer segments.

Additionally, growing government initiatives promoting natural fiber cultivation and sustainable textile production are fostering market development. Several countries in Europe and Asia are supporting flax farming through subsidies and research programs to strengthen local linen production capabilities. Expanding global trade networks and e-commerce platforms are also facilitating easier access to linen products, accelerating their penetration in both developed and emerging markets. The increasing emphasis on circular fashion and biodegradable materials positions linen fiber as a vital component of the future textile landscape.

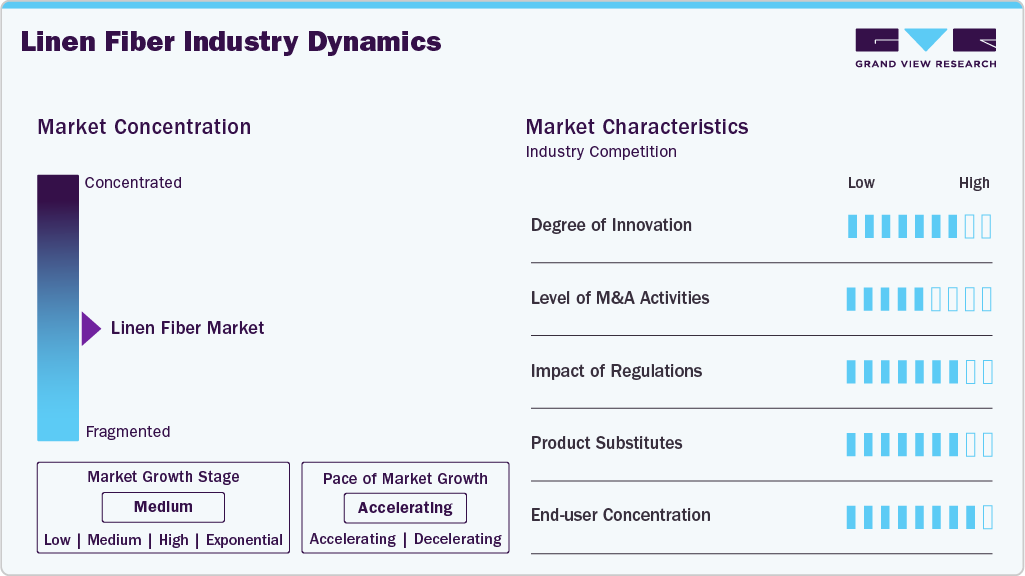

Market Concentration & Characteristics

The industry exhibits a moderately fragmented structure, characterized by a balanced mix of established players and emerging regional producers. The degree of innovation in the market is steadily increasing, with companies focusing on enhancing fiber softness, dye absorption, and wrinkle resistance through advanced processing technologies. Mergers and strategic collaborations are becoming more common as manufacturers aim to expand production capacities, secure raw material sources, and strengthen global distribution networks. Additionally, sustainability-focused innovation is driving competition, with several producers investing in organic flax cultivation and eco-friendly processing methods to meet international environmental standards.

Regulatory frameworks play a significant role in shaping market dynamics, particularly in regions emphasizing sustainable agricultural practices and textile safety standards. Compliance with environmental and labor regulations has led to improved transparency across the value chain. While direct substitutes for linen, such as cotton and hemp, exist, the fiber’s distinctive combination of durability, breathability, and natural texture limits the extent of substitution. End-user concentration remains diverse, spanning apparel, home textiles, and industrial applications, with increasing demand from premium lifestyle and luxury fashion brands contributing to stable market growth.

Application Insights

Based on application, the textiles & apparel segment dominated the industry, accounting for a revenue share of 43.5% in 2024, driven by the increasing consumer preference for natural, breathable, and sustainable fabrics. Linen’s moisture-wicking, hypoallergenic, and lightweight properties make it ideal for summer and casual wear. The growing popularity of eco-conscious fashion brands and luxury designers is further fueling demand. Additionally, technological advancements in spinning and finishing have improved fabric softness and versatility, broadening its appeal in modern apparel. The rising disposable income and demand for premium-quality clothing also contribute to this segment’s growth.

The home furnishings segment is expected to grow at the fastest CAGR of 7.0% over the forecast period, driven by the expanding demand for durable, elegant, and eco-friendly interior materials. Linen’s natural luster, strength, and aesthetic appeal make it a preferred choice for curtains, upholstery, and bedding. Increasing awareness of sustainable home décor and the popularity of minimalist interior trends have accelerated its use in residential and hospitality sectors. Moreover, the fabric’s ability to regulate temperature and resist wear enhances its suitability for long-term furnishings.

Fiber Type Insights

The long fiber segment dominated the industry, accounting for a revenue share of 66.1% in 2024, driven by its superior strength, smooth texture, and suitability for high-quality yarn production. Long linen fibers are widely used in the manufacturing of premium apparel, fine linens, and industrial textiles due to their durability and refined appearance. The growing demand for luxury fashion and designer home fabrics is encouraging producers to increase long fiber output. Technological improvements in fiber processing are enhancing quality, consistency, and production efficiency.

Short fiber segment is anticipated to grow significantly at a CAGR of 6.2% during the forecast period, driven by its cost-effectiveness and versatility in producing blended fabrics and technical textiles. Short linen fibers are increasingly used in applications such as upholstery, industrial fabrics, and composites. The rising trend of blending linen with cotton or synthetic fibers to achieve improved softness and strength is boosting demand. Textile manufacturers favor short fibers for their ease of processing and adaptability in mass production.

Regional Insights

North America linen fiber market held the largest revenue share of 32.2% in 2024, driven by the rising preference for sustainable and natural fabrics within the fashion and home furnishing sectors. Consumers are increasingly seeking eco-friendly alternatives to synthetic textiles, fueling demand for linen-based clothing, upholstery, and bedding. The region’s mature retail infrastructure and the growing influence of sustainable fashion brands have further supported this trend. Additionally, advancements in textile processing technologies and the adoption of organic production methods have strengthened the appeal of linen products. The increasing awareness of the environmental benefits of flax cultivation also contributes to market expansion across the United States and Canada.

U.S. Linen Fiber Market Trends

The linen fiber market in the U.S. is influenced by a strong shift toward environmentally responsible consumption patterns and premium-quality fabrics. The demand for lightweight, breathable materials in summer apparel and interior décor is steadily increasing. Major retailers and fashion houses are integrating linen products into their collections to meet consumer demand for comfort and sustainability. Furthermore, the rise of online textile retailing and the growing popularity of organic home furnishing products have accelerated market penetration. Government emphasis on sustainable agricultural practices also supports domestic flax cultivation and linen production initiatives.

Asia Pacific Linen Fiber Market Trends

The linen fiber market in Asia Pacific is driven by increasing disposable income, changing fashion preferences, and the region’s large-scale textile manufacturing base. Growing awareness of sustainable materials among urban consumers is propelling the use of linen in apparel, home décor, and industrial applications. Countries such as India, China, and Japan are witnessing heightened adoption of natural fibers in line with eco-conscious fashion trends. The region’s strong export potential for linen textiles further enhances market prospects. Additionally, supportive government programs promoting natural fiber industries are contributing to the overall growth momentum.

China linen fiber market is driven by the rising consumer awareness of sustainability and an evolving textile industry focused on innovation. The country’s vast manufacturing capacity and investments in advanced spinning and finishing technologies have improved product quality and production efficiency. Chinese designers and apparel brands are increasingly incorporating linen into their collections, catering to both domestic and export markets. Furthermore, government initiatives encouraging natural fiber cultivation and reducing dependence on synthetic materials support long-term market growth. The combination of affordability, versatility, and eco-friendliness positions linen as a valuable textile input in China’s evolving fashion and furnishing sectors.

Europe Linen Fiber Market Trends

The linen fiber market in Europe benefits from the region’s historical expertise in flax cultivation and strong consumer inclination toward high-quality, sustainable textiles. European countries are major producers and exporters of premium linen products, supported by advanced processing technologies and strict environmental regulations. Growing demand for ethically sourced and biodegradable fabrics across fashion and home décor segments continues to drive regional market expansion. Additionally, the presence of luxury textile brands and the promotion of eco-certified production practices reinforce Europe’s leadership in the global linen industry. Increasing investment in innovation and sustainable value chains further enhances market competitiveness.

Germany linen fiber market is supported by a well-established textile manufacturing industry and a strong consumer shift toward sustainable lifestyle products. German consumers value durability, comfort, and environmental responsibility, making linen a preferred choice for apparel and interior textiles. The country’s emphasis on green manufacturing and strict regulatory standards has encouraged producers to adopt sustainable sourcing and processing techniques. Moreover, collaborations between research institutions and textile manufacturers are fostering innovations that enhance the softness and performance of linen fibers. The increasing use of linen in eco-luxury fashion and home décor continues to bolster market demand.

Central & South America Linen Fiber Market Trends

The linen fiber market in Central & South America is gaining traction due to growing interest in natural and breathable textiles suited for the region’s warm climate. Rising consumer spending on home furnishings and premium apparel is driving demand for linen-based products. Countries such as Brazil, Argentina, and Mexico are witnessing increased adoption of sustainable fashion trends influenced by global movements toward eco-friendly living. Local textile industries are gradually incorporating linen into their production portfolios to diversify material offerings. Additionally, expanding trade relationships with European producers is facilitating access to high-quality flax fibers and finished linen goods.

Middle East & Africa Linen Fiber Market Trends

The linen fiber market in the Middle East & Africa is driven by rising urbanization, increasing disposable income, and growing awareness of natural fabric benefits. The region’s hot climatic conditions make breathable and moisture-absorbent fabrics like linen particularly desirable for apparel and home furnishings. Countries such as the UAE and Saudi Arabia are witnessing heightened demand for luxury linen textiles in the hospitality and interior design sectors. Additionally, the expansion of retail and e-commerce platforms is making premium linen products more accessible to consumers. Efforts to promote sustainable materials within local textile industries further support regional market growth.

Key Linen Fiber Company Insights

Key players operating in the linen fiber market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Libeco-Lagae, Safilin.

-

Libeco-Lagae specializes in manufacturing high-quality linen fabrics for apparel, interior furnishings, and industrial applications. Its product range includes upholstery linen, table linen, and eco-friendly textile collections made from sustainably grown flax. Libeco emphasizes environmentally responsible production with full traceability from flax to fabric.

-

Safilin focuses on transforming high-grade flax fibers into long and short fiber yarns used in fashion, home textiles, and technical fabrics. Safilin is known for its vertically integrated production process and commitment to sustainability, ensuring superior fiber quality and consistent performance across its product lines.

Siulas AB, Kingdom Holdings Limited are some of the emerging participants in the market.

-

Siulas AB specializes in the production of linen yarns, fabrics, and finished home textile products. The company offers a wide range of woven linen fabrics used in apparel, home décor, and traditional garments. Siulas AB combines modern weaving technologies with authentic craftsmanship, producing eco-friendly, durable, and aesthetically refined linen textiles for domestic and international markets.

-

Kingdom Holdings Limited is a major global manufacturer of linen and flax yarns. The company operates advanced spinning facilities and exports high-quality linen products to numerous international markets. Its portfolio includes wet-spun and dry-spun linen yarns catering to apparel, home textile, and industrial applications.

Key Linen Fiber Companies:

The following are the leading companies in the linen fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Libeco-Lagae

- Safilin

- Siulas AB

- Kingdom Holdings Limited

- China Linen Textile Industry Ltd.

- Northern Linen BV

- Baird McNutt

- Lenzi Egisto S.p.A.

- Glen Raven, Inc.

Recent Developments

- In 2024, Libeco, a leading European linen weaving company, expanded its operations by inaugurating a new weaving facility in Flanders, Belgium. This development aims to boost the company’s production capacity for linen fabrics and effectively cater to the rising global demand for high-quality linen materials.

Linen Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.36 billion

Revenue forecast in 2033

USD 3.93 billion

Growth rate

CAGR of 6.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, fiber type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; India; China; Japan

Key companies profiled

Libeco-Lagae; Safilin; Siulas AB; Kingdom Holdings Limited; China Linen Textile Industry Ltd.; Northern Linen BV; Baird McNutt; Lenzi Egisto S.p.A.; Glen Raven, Inc.

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Linen Fiber Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global linen fiber market report based on application, fiber type, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Textiles & Apparel

-

Home Furnishings

-

Industrial Products

-

Others

-

-

Fiber Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Long Fiber

-

Short Fiber

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global linen fiber market size was estimated at USD 2.21 billion in 2024 and is expected to reach USD 2.36 billion in 2025.

b. The global linen fiber market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach USD 3.93 billion by 2033.

b. Textiles & apparel segment dominated the global linen fiber market, accounting for a revenue share of 43.5% in 2024, driven by the increasing consumer preference for natural, breathable, and sustainable fabrics.

b. Key players in the linen fiber market include Libeco-Lagae, Safilin, Siulas AB, Kingdom Holdings Limited, China Linen Textile Industry Ltd., Northern Linen BV, Baird McNutt, Lenzi Egisto S.p.A., and Glen Raven, Inc.

b. Key factors driving the linen fiber market include growing demand for sustainable and eco-friendly textiles, advancements in fiber processing technologies, increasing consumer preference for natural fabrics, and rising applications across apparel, home furnishings, and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.