- Home

- »

- Petrochemicals

- »

-

Lithium Carbonate Market Size, Share, Industry Report, 2030GVR Report cover

![Lithium Carbonate Market Size, Share & Trends Report]()

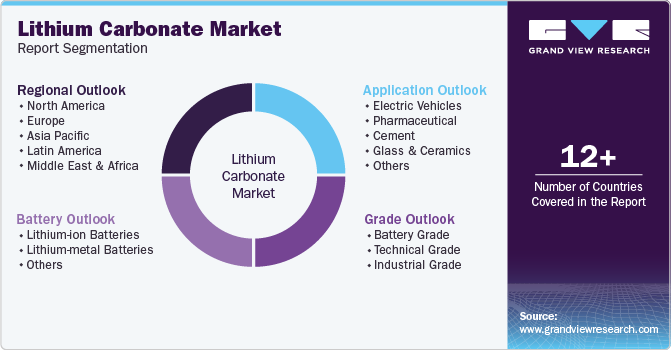

Lithium Carbonate Market (2025 - 2030) Size, Share & Trends Analysis Report By Battery (Lithium-ion Batteries, Lithium-metal Batteries), By Grade (Battery Grade, Technical Grade, Industrial Grade), By Application (Electric Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-500-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium Carbonate Market Summary

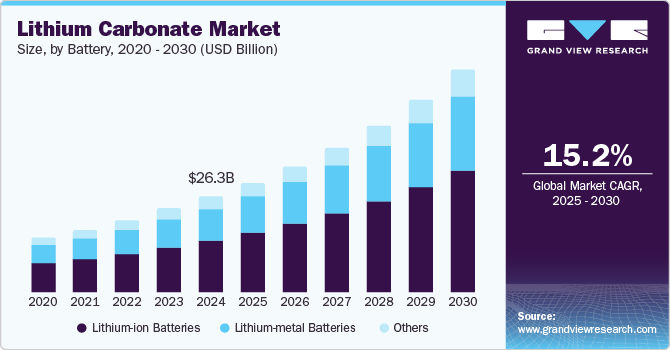

The global lithium carbonate market size was estimated at USD 26,307.4 million in 2024 and is projected to reach USD 61,052.6 million by 2030, growing at a CAGR of 15.2% from 2025 to 2030. The market is experiencing robust growth, driven by the rapid expansion of the electric vehicle (EV) industry.

Key Market Trends & Insights

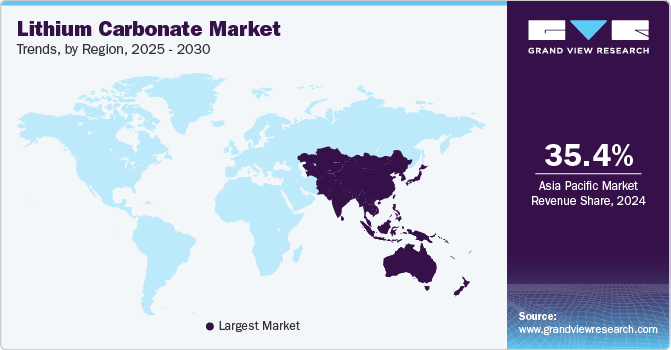

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Mexico is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, lithium-ion batteries accounted for a revenue of USD 16,199.7 million in 2024.

- Lithium-ion Batteries is the most lucrative battery type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 26,307.4 Million

- 2030 Projected Market Size: USD 61,052.6 Million

- CAGR (2025-2030): 15.2%

- Asia Pacific: Largest market in 2024

It is a critical raw material for lithium-ion batteries, which are essential for EVs. As governments worldwide implement stricter environmental regulations and offer incentives to encourage the adoption of clean energy and electric vehicles, the demand for the product has surged. Major automotive manufacturers are increasingly investing in EV production, further bolstering the market's growth trajectory.

The global push towards renewable energy storage solutions has significantly influenced the overall market. Energy storage systems (ESS) for solar and wind energy rely on lithium-ion batteries, creating a substantial demand for lithium carbonate. Urbanization and industrialization in emerging economies have also led to increased usage of electronic devices, further propelling the need for lithium-based batteries.

Furthermore, advancements in battery technologies, including solid-state and high-capacity lithium-ion batteries, are driving innovation and increasing the consumption of the product. The rising adoption of portable electronic devices and consumer preferences for lightweight, long-lasting batteries continue to fuel market growth. These trends and efforts to secure a sustainable lithium supply chain are positioning it as a cornerstone of the global energy transition.

Drivers, Opportunities & Restraints

The surging demand for consumer electronics, such as smartphones, laptops, and wearable devices, further drives the industry. Lithium-ion batteries, which rely on lithium carbonate, are essential for powering these devices due to their lightweight and high energy efficiency. Moreover, ongoing technological advancements in battery manufacturing, including innovations that enhance energy density and reduce charging times, have increased reliance on high-purity lithium carbonate to meet performance benchmarks.

Supportive government policies also contribute to market growth. Many nations are incentivizing local lithium production and processing to strengthen critical mineral supply chains and reduce import dependence. The rise of lithium-ion battery recycling initiatives, driven by sustainability goals, creates a secondary demand for lithium carbonate derived from recycled materials, further bolstering the market’s expansion.

The industry offers numerous growth opportunities, especially in the EV and renewable energy sectors. Emerging economies, particularly in Asia-Pacific and Latin America, present untapped potential due to the increasing penetration of EVs and infrastructure development. Innovations in lithium extraction technologies, such as direct lithium extraction (DLE), promise to improve efficiency and sustainability, opening new avenues for market players. Developing solid-state batteries and other advanced battery technologies is also expected to create a high demand for ultra-pure lithium carbonate. Furthermore, collaborations between battery manufacturers and mining companies and government support for critical mineral supply chains enhance growth prospects for the market.

The fluctuating prices of lithium carbonate, driven by supply-demand imbalances and geopolitical issues, can impact market stability. Environmental concerns related to lithium mining, including water usage and habitat disruption, pose regulatory and reputational risks for producers. The limited availability of high-grade lithium resources and lengthy extraction processes further constrain supply chains. Additionally, competition from alternative battery chemistries, such as sodium-ion and hydrogen fuel cells, could threaten the market long-term. Balancing sustainability with scalability remains a critical challenge for the industry's continued expansion.

Battery Insights

The lithium-ion batteries segment accounted for the largest revenue market share, 53.6%, in 2024. The increasing demand for lithium-ion batteries (LIBs) is one of the main drivers of the product market, as lithium-ion batteries are extensively used in applications ranging from electric vehicles (EVs) to renewable energy storage systems and consumer electronics. As the shift toward clean energy solutions accelerates, the demand for EVs has surged, fueling the need for lithium-ion batteries, which rely on lithium carbonate as a core component.

The lithium-metal batteries segment is anticipated to grow significantly at a CAGR of 15.1% over the forecast period. The growing interest in lithium-metal batteries (LMBs) as a next-generation energy storage solution is driving their demand in the global lithium carbonate industry. Lithium-metal batteries are known for their higher energy density than traditional lithium-ion batteries, making them highly attractive for applications requiring longer battery life and lighter weight, such as electric vehicles (EVs) and advanced consumer electronics.

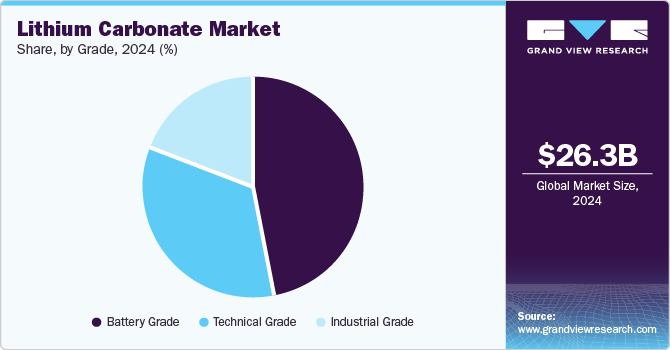

Grade Insights

The battery grade segment dominated the market with a market share of 47.6% in 2024. Expanding renewable energy sources, particularly solar and wind, also fuels the demand for battery-grade lithium carbonate. As these energy sources become more prevalent, there is a growing need for energy storage solutions to stabilize the grid and ensure a reliable energy supply. Battery-grade lithium carbonate is a critical material for high-performance batteries used in large-scale energy storage systems, where efficiency and reliability are paramount. The increasing investments in grid-scale energy storage and off-grid applications, especially in countries focusing on renewable energy integration, drive the demand for battery-grade lithium carbonate.

The technical grade is anticipated to register the fastest CAGR of 15.6% over the forecast period. Technological advancements in lithium extraction and refining processes enable more efficient production of high-purity technical-grade lithium carbonate. As lithium resources become more accessible and extraction methods evolve, the supply of technical-grade lithium carbonate has grown, providing opportunities for industries that require it for various specialized applications.

Application Insights

The electric vehicles segment accounted for the largest revenue market share, 54.7%, in 2024. The expansion of global EV manufacturing capacity, with major automakers transitioning to electric models and new entrants in the EV market, is significantly boosting product consumption. As vehicle production scales up, the corresponding need for lithium-ion batteries rises, driving the demand for lithium carbonate.

The glass & ceramics segment is expected to register the fastest CAGR of 15.6% over the forecast period. This segment of the global lithium carbonate industry is driven by the material's unique properties that enhance the quality and performance of glass and ceramic products. It is used as a fluxing agent in the production of glass, reducing the melting temperature of raw materials and improving the efficiency of the manufacturing process. This contributes to lower energy consumption, making the production of glass products more cost-effective and sustainable. As demand for high-quality glass products rises in various industries, including automotive, construction, and consumer goods, the need for lithium carbonate in glass production continues to grow.

Regional Insights

The region's burgeoning electric vehicle (EV) industry primarily drives the North American lithium carbonate market. Governments across the U.S. and Canada are introducing tax incentives, subsidies, and supportive regulations to encourage EV adoption, increasing demand for the product in EV battery production. Additionally, major automotive manufacturers are ramping up investments in EV production facilities within North America, further boosting the demand for locally sourced lithium carbonate.

U.S. Lithium Carbonate Market Trends

The increasing adoption of renewable energy sources is a key driver of the U.S. lithium carbonate market. Lithium-ion batteries, essential for energy storage systems, are widely used to store solar and wind power energy. This trend aligns with the U.S. government's ambitious renewable energy goals, further driving the industry demand. Moreover, expanding grid storage solutions, critical for stabilizing energy distribution networks, has amplified the need for high-quality battery materials, including lithium carbonate.

Asia Pacific Lithium Carbonate Market Trends

The Asia Pacific lithium carbonate market is experiencing significant growth driven by the region's leadership in electric vehicle (EV) adoption and production. Countries like China, Japan, and South Korea are at the forefront of EV manufacturing, and the increasing demand for electric vehicles is pushing up the need for lithium-ion batteries, which rely heavily on lithium carbonate. The region's governments support EV growth through policies, subsidies, and the establishment of EV manufacturing hubs, further accelerating the market’s expansion. As a result, the demand for the product is rising to meet the growing production of EV batteries.

In Asia Pacific, countries like China and India are experiencing rapid growth in the electronics sector, with high demand for smartphones, laptops, and other portable devices. These devices rely on lithium-ion batteries, further driving the need for lithium carbonate. As advancements in technology continue to push the boundaries of battery performance, including longer battery life and faster charging, the need for high-quality lithium carbonate will continue to rise.

Europe Lithium Carbonate Market Trends

Europe is expected to experience rapid growth, and a key driver is the country’s focus on developing a robust renewable energy infrastructure. The demand for energy storage systems, essential to balance intermittent renewable energy sources like wind and solar power, is increasing across the region. Lithium-ion batteries, powered by lithium carbonate, are vital for these storage solutions, making the market essential to the region’s green energy transition. The EU's Green Deal and other initiatives focused on decarbonizing energy sectors provide additional impetus to the demand for lithium carbonate for energy storage applications.

Latin America Lithium Carbonate Market Trends

Latin America's growing emphasis on sustainability and environmental responsibility drives innovation and investment in more eco-friendly lithium extraction processes. The push for greener technologies, such as direct lithium extraction (DLE), is gaining traction in the region, which could significantly reduce the environmental impact of traditional mining methods. This shift towards more sustainable practices helps mitigate public concern over mining practices and strengthens the region's position as a sustainable source of the product in the global market.

Middle East & Africa Lithium Carbonate Market Trends

The Middle East & Africa (MEA) lithium carbonate market is experiencing growth driven by increasing demand for electric vehicles (EVs) and renewable energy solutions. As the global transition to clean energy accelerates, the adoption of EVs in the region is expected to rise significantly, driven by supportive government policies and growing environmental awareness. While the EV market in the MEA is still emerging, governments are implementing policies to incentivize the production and sale of electric vehicles, further boosting demand for the vehicle in these vehicles.

Key Lithium Carbonate Company Insights

Some of the key players operating in the market include Albemarle, Ganfeng Lithium Co., Ltd., and Mineral Resources.

-

Albemarle’s lithium segment is developing lithium-based materials catering to a wide range of industries. The segment manufactures lithium carbonate, hydroxide, chloride, value-added lithium specialties, and reagents, including butyllithium and lithium aluminum hydride. In addition, the segment offers technical services such as handling reactive lithium products and customer recycling services for lithium-containing by-products obtained from synthesis with organolithium products, lithium metal, and other reagents.

-

Ganfeng Lithium Co., Ltd. serves various industries, including electric vehicles, pharmaceuticals, chemicals, energy storage, and 3C (Computer, Communication, and Consumer Electronics) products. The company can extract lithium from ore, brine, and recycled materials. The company offers more than 40 lithium and other metal compounds.

Key Lithium Carbonate Companies:

The following are the leading companies in the lithium carbonate market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corp.

- Ganfeng Lithium Co., Ltd.

- SQM S.A.

- Tianqi Lithium Corporation

- Livent Corp.

- Lithium Americas Corp.

- Pilbara Minerals

- Orocobre Limited Pty. Ltd.

- Mineral Resources Group Co., Ltd.

Lithium Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30,141.9 million

Revenue forecast in 2030

USD 61,052.6 million

Growth Rate

CAGR of 15.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Battery, grade, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil, Argentina; Saudi Arabia; South Africa

Key companies profiled

Albemarle Corp.; Ganfeng Lithium Co., Ltd.; SQM S.A.; Tianqi Lithium Corp.; Livent Corp.; Lithium Americas Corp.; Pilbara Minerals; Orocobre Ltd. Pty. Ltd.; Mineral Resources

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium Carbonate Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lithium carbonate market report by battery, grade, application, and region.

-

Battery Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Lithium-ion Batteries

-

Lithium-metal Batteries

-

Others

-

-

Grade Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Battery Grade

-

Technical Grade

-

Industrial Grade

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Electric Vehicles

-

Pharmaceutical

-

Cement

-

Glass & Ceramics

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lithium carbonate market size was estimated at USD 26.30 billion in 2024 and is expected to reach USD 30.14 billion in 2025.

b. The global lithium carbonate market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2030 to reach USD 61.05 billion by 2030.

b. Electric vehicles dominated the lithium carbonate market with a market share of 54.7% in 2024. The expansion of global EV manufacturing capacity, with major automakers transitioning to electric models and new entrants in the EV market, is significantly boosting product consumption. As vehicle production scales up, the corresponding need for lithium-ion batteries rises, driving the demand for lithium carbonate

b. Some key players operating in lithium carbonate market include Albemarle Corp.; Ganfeng Lithium Co., Ltd.; SQM S.A.; Tianqi Lithium Corp.; Livent Corp.; Lithium Americas Corp.; Pilbara Minerals; Orocobre Ltd. Pty. Ltd.; Mineral Resources and others

b. The market is experiencing robust growth, driven by the rapid expansion of the electric vehicle (EV) industry. It is a critical raw material for lithium-ion batteries, which are essential for EVs. As governments worldwide implement stricter environmental regulations and offer incentives to encourage the adoption of clean energy and electric vehicles, the demand for the product has surged

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.