Lithium Market Size, Share & Trends Analysis Report By Product (Carbonate, Hydroxide), By Application (Automotive, Consumer Goods, Grid Storage), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-581-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Lithium Market Size & Trends

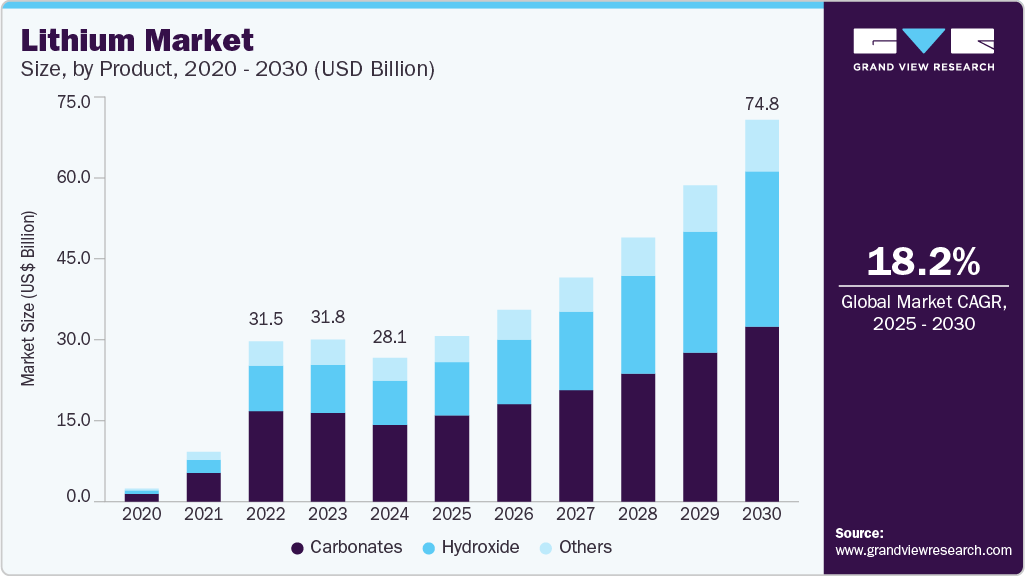

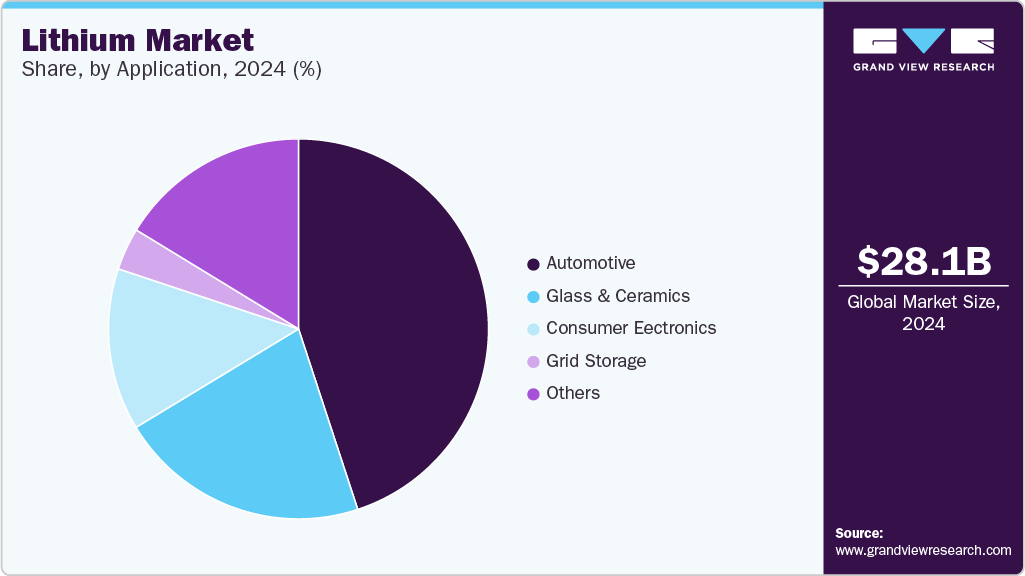

The global lithium market size was estimated at USD 28.08 billion in 2024 and is expected to grow at a CAGR of 18.2% from 2025 to 2030. Vehicle electrification is projected to attract a significant volume of lithium-ion batteries, which is anticipated to drive market growth over the forecast period.

Key Highlights:

- Asia Pacific lithium market is dominated globally, with the largest revenue share of more than 47% in 2024

- China lithium market held a revenue share of approximately 40.0% in 2024.

- Based on application, consumer electronics segment held the revenue share of 12.9% in 2024.

- Based on product, Carbonate segment held the revenue share of 53.7% in 2024.

The automotive application segment is expected to grow substantially, driven by stringent regulations imposed by government bodies on ICE automakers to reduce vehicle carbon dioxide emissions. This has shifted automakers' interest toward producing EVs, which is anticipated to benefit from the demand for lithium and related products.

Government subsidies for EVs and investments in this space will likely be an additional booster to market growth. The U.S. holds major significance in battery production after China, which makes it one of the key lithium-consuming countries in the world. As of 2024, the U.S. possesses substantial lithium resources, with estimates ranging from 14 million metric tons to 20–40 million tons, depending on new geological findings. Despite this, domestic lithium production remains limited. In 2024, the U.S. produced approximately 610 metric tons of lithium, accounting for about 0.3% of global production. This output is insufficient to meet the growing demand driven by the electric vehicle (EV) market.

The U.S. government is investing heavily in domestic lithium production. Today, the U.S. Department of Energy (DOE) announced an investment of USD 25 million across 11 projects to advance materials, processes, machines, and equipment for domestic manufacturing of next-generation batteries. These projects will advance platform technologies upon which battery manufacturing capabilities can be built, enabling flexible, scalable, and highly controllable processes.

Recognizing the strategic importance of lithium, the U.S. Department of the Interior designated it as a critical mineral in 2018, a move that expedited the mine permitting process. This was highlighted by the approval of the Thacker Pass Lithium Mine by the Bureau of Land Management in January 2021. Operated by Lithium Nevada Corporation, this mine is poised to become the largest lithium supply source in the U.S., with projections indicating its capability to produce approximately 60 kilotons of battery-grade lithium carbonate annually by 2026.

The U.S. government is implementing measures to ensure a sufficient lithium supply to meet the increasing demand from various industries. In September 2023, an agreement worth USD 90 million was signed between Albemarle Corporation and the U.S. government to support domestic mining and production of lithium. The agreement's objective is to assist Albemarle in reopening its Kings Mountain, N.C., lithium mine, which is anticipated to commence operations between 2025 and 2030. Albemarle's Kings Mountain mine is expected to contribute to expanding domestic lithium production for the country's battery supply chain. Arkansas is sitting atop lithium reserves that could be vast enough to satisfy the entire world’s demand for EV batteries, according to the US Geological Survey (USGS).

Price Trends

Lithium prices attained significant elevations from Q1 2022 to Q2 2023; after this, they started observing a declining trend. Despite robust supply increments since 2020, the demand for the metal has underperformed relative to projections, both in cyclical and structural terms, leading to the development of market surpluses. A report from the government of Australia highlights that rising inventories have contributed to a downturn in lithium prices. This subdued price forecast has led to the announcement of operational shutdowns and reductions in production across several critical lithium-producing countries, including Australia.

Drivers, Opportunities & Restraints

The global lithium market is experiencing robust growth, driven by the escalating demand for lithium-ion batteries (LIBs) across various industries. This surge is primarily attributed to the increasing adoption of electric vehicles (EVs), advancements in consumer electronics, and the expansion of renewable energy storage solutions.

Lithium-ion batteries are integral to powering EVs, offering high energy density and efficiency. For instance, General Motors (GM) and LG Energy Solution are developing lithium manganese-rich (LMR) battery technology for future EVs to enhance energy density and reduce costs. This innovation is expected to significantly improve the affordability and range of electric vehicles, thereby accelerating their adoption.

Lithium oxide serves as a flux in the glass and ceramics industry. Additionally, lithium is utilized to produce lubricants, where lithium stearate acts as a thickening agent, improving performance and durability. As the global emphasis on clean energy intensifies, lithium's pivotal role in energy storage systems, such as those used for solar and wind energy, further underscores its importance.

Energy storage systems (ESS) play a crucial role in decoupling energy production from consumption, facilitating the integration of renewable sources like solar and wind into the grid. Lithium-ion batteries (LIBs) have emerged as the dominant technology in ESS, accounting for over 75% of global electrochemical storage capacity in 2023. This dominance is attributed to their high energy density, long cycle life, and scalability, making them ideal for applications ranging from grid stabilization to electric vehicles (EVs). The rapid adoption of EVs, driven by stringent emission regulations and advancements in battery technology, further propels the demand for LIBs. Innovations such as lithium manganese-rich (LMR) batteries are expected to enhance energy density and reduce costs, potentially offering over 400 miles of range per charge.

Lithium extraction processes can have detrimental environmental effects, including water contamination and ecosystem degradation. In regions like Argentina, Bolivia, and Chile, mining operations have been linked to increased droughts and soil contamination due to the extensive water usage and chemical leaks associated with lithium mining. Additionally, in countries like Nigeria, illegal mining operations often exploit child labor under hazardous conditions, raising significant ethical issues. The extraction and processing of lithium are concentrated in a few regions, leading to supply chain vulnerabilities. For instance, while Ukraine possesses significant lithium reserves, it lacks the infrastructure for refining, which China predominantly controls. This dependency on Chinese processing facilities poses strategic risks for countries aiming to diversify their supply chains.

Product Insights

Lithium Carbonate (Li2CO3) is the most stable inorganic compound used to form other compounds, such as LiOH and even pure metal. Carbonate products are also used in the treatment of bipolar disorder.

This compound is also used in batteries and has several applications in the construction sector, including waterproofing slurries and adhesives. LiOH is a white hygroscopic crystalline material and an inorganic compound primarily used by battery manufacturers; it is commercially available as anhydrous and monohydrate.

It is used in transportation applications, such as manufacturing submarines and spacecraft. Rapid development in battery technologies propels demand for LiOH, thus driving market growth. Many automotive players are inclined to adopt LiOH for battery manufacturing, which is expected to positively benefit market growth.

For instance, in 2024, BMW strengthened its electric vehicle (EV) supply chain through strategic partnerships to secure lithium supplies. A notable development was BMW's agreement with Critical Metals Corp., which included a USD 15 million pre-payment for lithium hydroxide (LiOH) from the Wolfsberg Lithium Project in Austria. This arrangement underscores BMW's commitment to ensuring a stable supply of critical materials for EV production in Europe.

Application Insights

The consumer electronics application segment is anticipated to register the fastest revenue CAGR of more than 27.6% from 2025 to 2030. This segment is projected to grow owing to the increasing sales of electronic devices that use Li-ion batteries, such as mobile phones, laptops, cameras, portable radios, speakers, and MP3 players.

Characteristics such as low weight, ample energy storage, and small size drive demand for batteries and positively influence their growth. Single-use, non-rechargeable Li-ion batteries are used in remote controllers, handheld games, cameras, and smoke detectors.

Rechargeable lithium-polymer cells are used in cell phones, laptops, toys, digital cameras, small and large appliances, tablets, e-readers, and power tools. These batteries are made from critical materials, such as cobalt, graphite, and lithium, and need to be handled with safety and precautions. Various developed countries invest increasingly in deploying energy storage systems based on Li-ion batteries, thus fuelling market growth.

In 2024, the U.S. Department of Energy announced USD 3 billion in funding across 25 projects through the U.S. Bipartisan Infrastructure Law to support new commercial-scale domestic facilities to extract and process lithium and other critical minerals, manufacture key battery components, recycle batteries, support next-generation battery manufacturing, and develop new technologies to increase U.S. lithium reserves.

For instance, the UK launched a 50-megawatt energy system connected to the high-voltage transmission system of its National Grid. This project is part of the USD 48.5 million Energy Superhub Oxford (ESO) plan for the country. Pivot Power is leading the project, which the Government of the UK backs.

Regional Insights

The lithium market in North America held a global revenue share of more than 11.0% in 2024. The government's increasing focus on reducing carbon emissions in the automotive sector is expected to propel market growth in the coming years.

U.S. Lithium Market Trends

The U.S. lithium market is one of North America's largest lithium consumers. The market growth is attributed to favorable government policies and initiatives on green energy transition, and EVs are propelling the demand for the product in the region.

Asia Pacific Lithium Market Trends

Asia Pacific lithium market is dominated globally, with the largest revenue share of more than 47% in 2024, owing to rapidly developing automotive, glass, and consumer goods industries in countries such as China, Japan, and South Korea. The region will expand further, maintaining its dominance and growing at the fastest CAGR in volume over the forecast period.

China lithium market held a revenue share of approximately 40.0% in 2024. The rising focus on renewable energy and EV production positively influences the product market.

Europe Lithium Market Trends

The lithium market in Europe held the second-largest share of global revenue in 2024 and is projected to witness steady growth from 2025 to 2030. The market's growth in Europe can be attributed to the region's increasing production of EVs. The increasing government regulation is expected to propel the demand for the product in the region.

Latin America Lithium Market Trends

The growth of the lithium market in Latin America is supported by the availability of resources has spurred local mining activities and attracted foreign investments, boosting the lithium industry in the region.

Key Lithium Company Insights

Some key players operating in the market include Albemarle, Ganfeng Lithium Co., Ltd., and Mineral Resources.

-

Albemarle’s lithium segment is developing lithium-based materials for various industries. The segment manufactures lithium carbonate, hydroxide, chloride, value-added lithium specialties, and reagents, including butyllithium and lithium aluminum hydride. In addition, the segment offers technical services such as handling reactive lithium products and customer recycling services for lithium-containing by-products obtained from synthesis with organolithium products, lithium metal, and other reagents.

-

Ganfeng Lithium Co., Ltd. serves various industries, including electric vehicles, pharmaceuticals, chemicals, energy storage, and 3C (Computer, Communication, and Consumer Electronics) products. The company can extract lithium from ore, brine, and recycled materials, offering more than 40 lithium and other metal compounds.

Key Lithium Companies:

The following are the leading companies in the lithium market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corp.

- Ganfeng Lithium Co., Ltd.

- SQM S.A.

- Tianqi Lithium Corporation

- Livent Corp.

- Lithium Americas Corp.

- Pilbara Minerals

- Orocobre Limited

- Mineral Resources Group Co., Ltd.

Lithium Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 32.38 billion |

|

Revenue forecast in 2030 |

USD 74.81 billion |

|

Growth rate |

CAGR of 18.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative Units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; China; Japan; South Korea |

|

Key companies profiled |

Albemarle Corp.; Ganfeng Lithium Co., Ltd.; SQM S.A.; Tianqi Lithium Corporation.; Livent Corp.; Lithium Americas Corp.; Pilbara Minerals; Orocobre Limited; Mineral Resources Group Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Lithium Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lithium market report based on of product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbonates

-

Hydroxide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Grid Storage

-

Glass & Ceramics

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global lithium market size was estimated at USD 28.08 billion in 2024 and is expected to grow at a CAGR of 18.2% from 2025 to 2030.

b. The global lithium market is expected to grow at a compound annual growth rate of 18.2% from 2025 to 2030 to reach USD 74.81 billion by 2030.

b. The carbonate product segment dominated the market in 2024, with the largest share of 53.0% in terms of volume.

b. Some of the key vendors of the global Lithium market are Albemarle Corp., Ganfeng Lithium Co., Ltd., SQM S.A., Tianqi Lithium Corp., Livent Corp., Lithium Americas Corp., Pilbara Minerals, Orocobre Ltd., Pty. Ltd., Mineral Resources.

b. The global lithium market is experiencing robust growth, driven by the escalating demand for lithium-ion batteries (LIBs) across various industries. This surge is primarily attributed to the increasing adoption of electric vehicles (EVs), advancements in consumer electronics, and the expansion of renewable energy storage solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."