- Home

- »

- IT Services & Applications

- »

-

Live Commerce Market Size & Share, Industry Report, 2033GVR Report cover

![Live Commerce Market Size, Share & Trends Report]()

Live Commerce Market (2025 - 2033) Size, Share & Trends Analysis By Product (Fashion & Apparel, Beauty & Personal Care, Electronics, Home & Living, Food & Beverage, Health & Wellness, Automotive), By Platform Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-427-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Live Commerce Market Summary

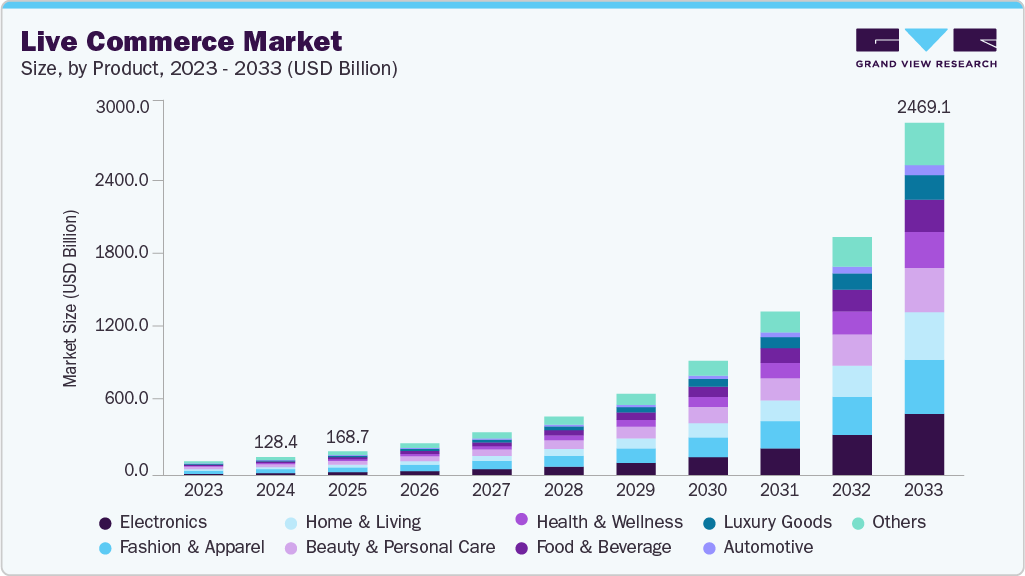

The global live commerce market size was estimated at USD 128.42 billion in 2024 and is projected to reach USD 2,469.06 billion by 2033, growing at a CAGR of 39.9% from 2025 to 2033 due to the increasing demand for interactive and immersive shopping experiences, the proliferation of social media platforms, and mobile penetration. Live commerce integrates live streaming with instant purchasing, allowing consumers to engage with hosts or influencers in real-time, ask questions, and make informed decisions.

Key Market Trends & Insights

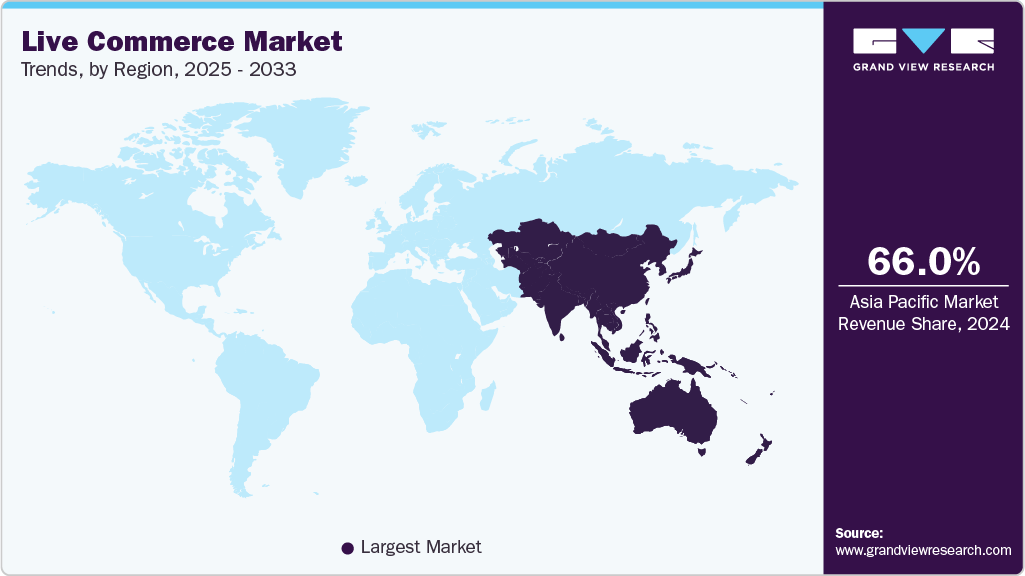

- Asia Pacific live commerce dominated the global market with the largest revenue share of 66.0% in 2024.

- The live commerce industry in the U.S. is expected to grow significantly over the forecast period.

- By product, fashion and apparel led the market and held the largest revenue share of 21.3% in 2024.

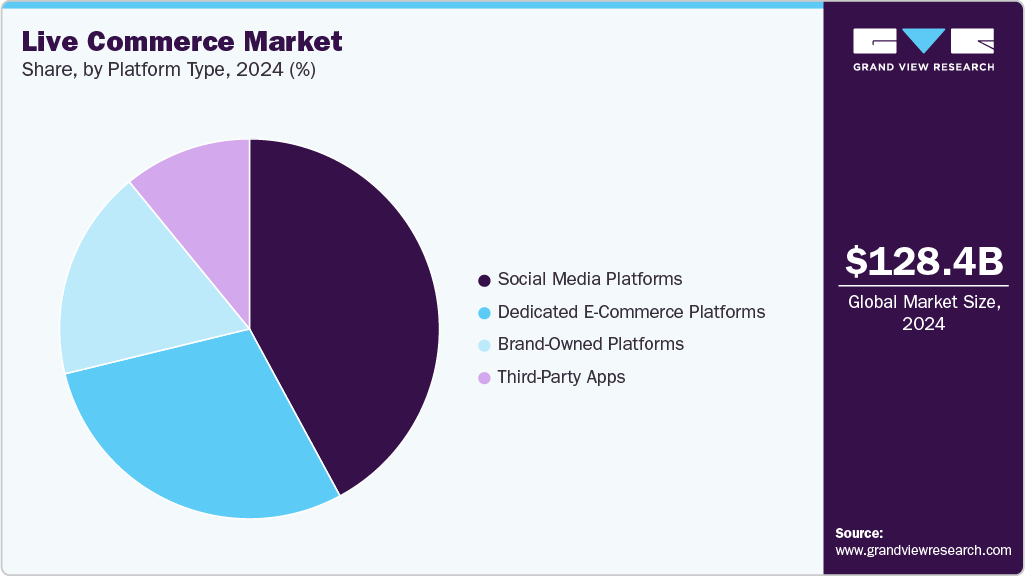

- By platform type, social media platforms led the market and held the largest revenue share of 42.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 128.42 Billion

- 2033 Projected Market Size: USD 2,469.06 Billion

- CAGR (2025-2033): 39.9%

- Asia Pacific: Largest market in 2024

The real-time engagement boosts customer trust and purchasing confidence, increasing conversion rates. Platforms such as TikTok, Instagram, YouTube, and Facebook have integrated live shopping features, enabling brands to reach vast audiences quickly and cost-effectively. In parallel, the rise in smartphone usage and faster internet connectivity, especially 5G, has enhanced streaming quality and accessibility, making live commerce viable even in tier-2 and tier-3 cities across Asia, Latin America, and Africa. Influencer and celebrity-driven marketing also play a significant role. Brands increasingly collaborate with influencers to promote products during live sessions, leveraging their follower base to drive sales. These influencers bring authenticity and relatability, appealing to Gen Z and Millennial consumers.

In addition, technological innovations such as AI, AR, and data analytics are transforming the live commerce industry. AI-powered recommendation engines personalize product suggestions in real-time, while AR allows consumers to virtually try products before purchasing. Real-time analytics enable sellers to adjust their strategies instantly during live sessions, maximizing engagement and sales. For instance, in June 2025, AnyMind Group, a Japanese BPaaS (Business Process as a Service) provider specializing in marketing, digital transformation, and e-commerce, launched its generative AI-powered live commerce platform, AnyLive, in Japan. The platform introduces advanced features such as AI-generated avatars, automated content scripting, and real-time AI engagement with viewers, aiming to enhance interactive shopping experiences and streamline live commerce operations in the region.

Product Insights

The fashion and apparel segment dominated the market and accounted for the revenue share of 21.3% in 2024, driven by the fast-changing trends and seasonality in fashion, which align well with the agility of live commerce. Brands can quickly launch new collections, conduct flash sales, or clear out seasonal inventory during engaging livestreams. This format helps shorten the product lifecycle and encourages impulse buying, particularly effective in fashion where consumer preferences shift rapidly.

The health and wellness segment is anticipated to grow at the highest CAGR during the forecast period due to the consumers’ rising interest in holistic self-care and preventive healthcare. As more people become proactive about managing their physical and mental well-being, there is a growing appetite for nutritional supplements, organic products, fitness tools, and personal care items. Live commerce offers a platform for brands to educate consumers in real time about product benefits, usage methods, and health outcomes-bridging the knowledge gap that often exists in this segment.

Platform Type Insights

The social media platforms segment dominated the market and accounted for the largest revenue share in 2024, driven by the seamless integration of content, community, and commerce within a single ecosystem. Platforms like Instagram, TikTok, Facebook, and YouTube have evolved beyond traditional social networking to become powerful shopping environments. Moreover, social platforms' massive built-in user base and high engagement levels contribute to this segment’s growth. With billions of daily active users, these platforms allow brands to reach highly targeted audiences based on interests, demographics, or browsing behavior.

The brand-owned platforms segment is expected to grow at a significant CAGR over the forecast period due to brands’ increasing desire for greater control over the customer experience, data, and monetization strategies. By hosting live commerce directly on their websites or mobile apps, brands can fully customize their visual identity, user interface, and interactive elements to align with brand values and storytelling. This enhances customer trust and reinforces brand loyalty, especially among repeat buyers who prefer a consistent and curated shopping environment. Moreover, brand-owned platforms support seamless backend integration with inventory, logistics, and CRM systems, creating a more efficient and responsive supply chain.

Regional Insights

North America live commerce held a significant share in the global live commerce market in 2024, driven by the region's advanced digital infrastructure and a strong culture of early technology adoption. High internet penetration, widespread use of mobile devices, and a mature e-commerce landscape provide the foundation for rapid integration of live shopping experiences. In addition, increasing collaboration between tech companies and retailers to develop interactive shopping technologies, along with growing demand for personalized and immersive online experiences, is fueling market expansion across sectors like beauty, electronics, and fashion.

U.S. Live Commerce Market Trends

The live commerce market in the U.S. is expected to grow significantly at a CAGR of 37.2% from 2025 to 2033, due to the rising influence of creator-driven marketing and the integration of livestreaming into popular social platforms like TikTok and Instagram. The country’s diverse and trend-sensitive consumer base, particularly Gen Z and Millennials, is increasingly engaging with interactive product demos and influencer-led events. Furthermore, major retailers and D2C brands are experimenting with live commerce to reduce return rates and boost customer loyalty through more informed and engaging purchase experiences.

Europe Live Commerce Market Trends

The live commerce market in Europe is anticipated to grow considerably from 2025 to 2033 due to the region’s emphasis on omnichannel retail strategies and the growing consumer demand for transparency and real-time engagement. Retailers are adopting live commerce to showcase sustainable practices, ethical sourcing, and product authenticity, appealing to Europe’s eco-conscious and quality-focused shoppers. In addition, increasing regulatory support for secure digital transactions and cross-border e-commerce encourages adoption across domestic and international brands.

The UK live commerce market is expected to grow rapidly in the coming years, owing to the expansion as retailers look for innovative ways to bridge the gap between online convenience and in-store engagement. British consumers are drawn to livestreams that feature expert product demonstrations, interactions, and exclusive time-limited offers. The popularity of online shopping events, along with strong mobile commerce adoption and high social media usage, is prompting heritage brands and digital startups to invest in livestream shopping formats.

The live commerce market in Germany held a substantial market share in 2024 due to the country's strong emphasis on product reliability and detailed information. German consumers, known for their research-oriented buying behavior, respond positively to live sessions' educational value and product transparency. Live commerce platforms integrating interactive comparisons, technical explanations, and real-time customer feedback are gaining traction, especially in consumer electronics, home appliances, and health-related products.

Asia Pacific Live Commerce Market Trends

The live commerce market in Asia Pacific dominated the global market with the largest revenue share of 66.0% in 2024, due to the region’s mobile-first population, high social media engagement, and widespread use of super apps that combine shopping, payments, and streaming. Countries like South Korea, Thailand, and Indonesia are seeing explosive growth as consumers embrace live selling formats that blend entertainment and commerce. The region’s young, digital-native population, combined with increasing investments from domestic tech firms and global brands, accelerates live commerce adoption across diverse product categories.

Japan live commerce market is expected to grow rapidly in the coming years, driven by the convergence of high-tech consumer behavior and a strong cultural affinity for storytelling and detail. Japanese consumers value rich, informative content and are drawn to live sessions emphasizing quality, craftsmanship, and aesthetic appeal. Growth is also supported by integrating AI translation tools for regional influencers and an increase in local brands using livestreaming to differentiate themselves from large e-commerce marketplaces.

The live commerce market in China held a substantial market share in 2024 due to the deep integration of e-commerce and live streaming on platforms such as Taobao Live, Douyin, and Kuaishou. The Chinese market benefits from a highly developed digital payment infrastructure, sophisticated supply chains, and a highly responsive consumer base to influencer and KOL (Key Opinion Leader) marketing. Government support for digital innovation and the popularity of shoppertainment formats have made live commerce a mainstream retail channel across urban and rural areas.

Key Live Commerce Company Insights

Key players operating in the live commerce industry are Amazon.com, Inc., Facebook (Meta Platforms), Taobao.com, Kuaishou Technology, NTWRK, and JD.com. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, Kuaishou Technology announced the global rollout of Kling AI’s new multi-image reference feature, a significant advancement in AI video generation. This innovation tackles the long-standing challenge of maintaining visual consistency by allowing the AI to analyze and merge elements from multiple reference images. Combined with user-provided text prompts, the technology enables the creation of cohesive, high-quality videos, offering content creators enhanced control and creative flexibility.

-

In February 2024, NTWRK announced an agreement to acquire media publisher Complex, aiming to build a new hub for superfan culture at the intersection of commerce, digital media, and music. The move signals a new chapter in Complex’s evolution, strengthening its role as a leading voice for youth-driven trends, products, and style in the digital era.

Key Live Commerce Companies:

The following are the leading companies in the live commerce market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Bilibili

- Facebook (Meta Platforms)

- Heliophilia Pte. Ltd. (Lemon8)

- JD.com

- Kuaishou Technology

- NTWRK

- Pinterest TV

- Popshop Live

- QVC, Inc.

- Shopify (Shopify Live)

- Taobao.com

- TikTok (ByteDance)

- YouTube (Google)

Live Commerce Market Report Scope

Report Attribute

Details

Market size in 2025

USD 168.73 billion

Revenue forecast in 2033

USD 2,469.06 billion

Growth rate

CAGR of 39.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, platform type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon.com, Inc., Bilibili, Facebook (Meta Platforms), Heliophilia Pte. Ltd. (Lemon8), JD.com, Kuaishou Technology, NTWRK, Pinterest TV, Popshop Live, QVC, Inc., Shopify (Shopify Live), Taobao.com, TikTok (ByteDance), YouTube (Google)

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Live Commerce Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global live commerce market report based on product, platform type, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Fashion and Apparel

-

Beauty and Personal Care

-

Electronics

-

Home and Living

-

Food and Beverage

-

Health and Wellness

-

Automotive

-

Luxury Goods

-

Others

-

-

Platform Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Social Media Platforms

-

Dedicated E-Commerce Platforms

-

Brand-Owned Platforms

-

Third-Party Apps

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global live commerce market size was estimated at USD 128.42 billion in 2024 and is expected to reach USD 168.73 billion in 2025.

b. The global live commerce market is expected to grow at a compound annual growth rate of 39.9% from 2025 to 2033 to reach USD 2,469.06 billion by 2033.

b. The fashion and apparel segment accounted for the largest market share of 21.3% in 2024 due to the fast-changing trends and seasonality in fashion, which align well with the agility of live commerce. Brands can quickly launch new collections, conduct flash sales, or clear out seasonal inventory during engaging livestreams.

b. Some key players operating in the live commerce market include Amazon.com, Inc., Bilibili, Facebook (Meta Platforms), Heliophilia Pte. Ltd. (Lemon8), JD.com, Kuaishou Technology, NTWRK, Pinterest TV, Popshop Live, QVC, Inc., Shopify (Shopify Live), Taobao.com, TikTok (ByteDance), YouTube (Google)

b. Growth of the live commerce market can be attributed to the increasing demand for interactive and immersive shopping experiences, the proliferation of social media platforms and, mobile penetration. Live commerce integrates live streaming with instant purchasing, allowing consumers to engage with hosts or influencers in real-time, ask questions, and make informed decisions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.