Machine Condition Monitoring Market Size, Share & Trends Analysis Report By Monitoring Technique, By Component, By Product Type, By Application, By Architecture Type, By Plant Type, By Monitoring Process, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-013-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Machine Condition Monitoring Market Trends

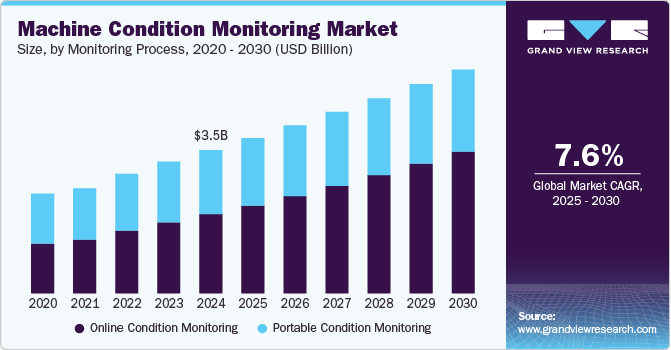

The global machine condition monitoring market size was estimated at USD 3.49 billion in 2024 and is expected to grow at a CAGR of 7.6% from 2025 to 2030. The need to provide advanced diagnostics and help determine the machine's health has underpinned the market growth. Manufacturers have sought condition monitoring systems to optimize and monitor the performance and maintenance of their equipment. Besides, the trend for lean manufacturing has prompted manufacturers to seek condition monitoring to bolster production efficiency, minimize downtime and enhance spare parts supplies and cost prediction.

Stakeholders have exhibited traction for condition monitoring for enhanced productivity, equipment longevity, elimination & reduction of downtime, minimizing scrap parts, and leveraging automation based on real-time machine condition data. In February 2024, eNETDNC, a machine monitoring software provider, integrated Microsoft Power BI Desktop into its machine monitoring software, enabling users to create customizable, real-time reports and dashboards. This integration allows customers to optimize processes by visualizing key performance indicators, machine statuses, and production trends interactively.

Machine condition monitoring measures equipment parameters to prevent a breakdown and identify changes that could hint at a developing fault. The technique has gained ground across oil & gas, automotive, power generation, metal & mining, marine, and aerospace. It is an invaluable part of predictive maintenance that has become trendier to boost asset life and cost savings, ensure operator safety and streamline operations. Besides, the prevalence of IoT has brought a paradigm shift to foster communication between devices. Adopting smart machines has led stakeholders to make informed decisions and boost diagnostic efficiency.

As the demand for operational efficiency grows, industries are increasingly leveraging advanced machine condition monitoring technologies, such as artificial intelligence and machine learning. These technologies enhance predictive maintenance strategies by analyzing historical data to identify patterns and predict potential failures before they occur. Furthermore, the integration of cloud computing allows for centralized data storage and analysis, enabling real-time monitoring and remote access to machine performance data. This shift not only improves decision-making but also facilitates proactive maintenance practices, ultimately reducing downtime and maintenance costs while maximizing productivity and equipment reliability.

Monitoring Technique Insights

The vibration monitoring segment led the market in 2024, accounting for over 26% share of the global revenue. The high share can be attributed to the soaring demand to detect wear, imbalances, and misalignments. The rising penetration of monitoring vibration has played a pivotal role in offering insights into detecting faults at an early stage. Vibration monitoring solutions have witnessed an uptick in minimizing maintenance, integration, and operational complexities. Industry players have increased investments in continuously monitoring equipment, including cooling tower gearboxes, boiler feed pumps, steam turbines, and gas. End users will likely embed vibration monitoring into their system to foster reliability and protect data. The technology will remain highly sought-after for diagnosing emerging issues and robust troubleshooting.

The oil analysis segment is predicted to foresee significant growth in the forecast years. This growth can be attributed to increasing demand for predictive maintenance, driven by data analytics to prevent equipment failures and reduce costs related to unplanned downtime. Additionally, growing awareness of the benefits of oil analysis in preventing disruptions and optimizing operational efficiency is fueling its adoption. Technological advancements, such as online monitoring and remote analysis capabilities, further enhance the accessibility and cost-effectiveness of oil analysis, contributing to its expanding presence in the market.

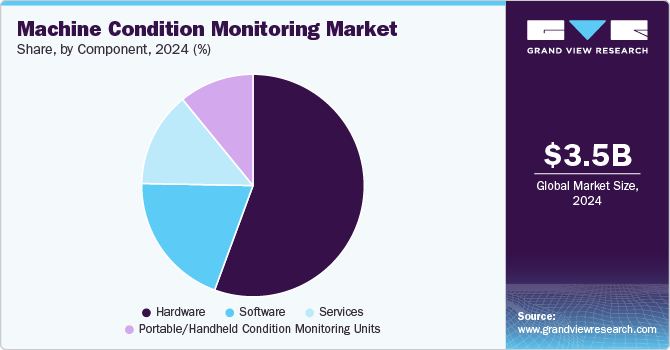

Component Insights

The hardware segment accounted for the largest market revenue share in 2024. The high share can be attributed to the increasing use of infrared sensors, ultrasonic detectors, vibration analyzers, and accelerometers. The technologies used in condition monitoring have specialized knowledge of the areas where various types of failure can occur. Hardware or sensor manufacturers offer their products in two varieties, static and dynamic, depending on the different frequencies the hardware or sensors have. Additionally, this allows manufacturers to minimize machine downtime and implement successful predictive maintenance.

The portable/handheld condition monitoring units segment is expected to showcase significant growth over the forecast period. The growth is attributed to factors such as the rising demand for predictive maintenance in industrial settings, the increasing popularity of wireless connectivity enabling remote monitoring of assets, and the decreasing cost of portable condition monitoring units. These units offer advantages over traditional wired systems, including flexibility, ease of installation, and maintenance. Their popularity grows as they cater to industrial organizations seeking effective and cost-efficient asset monitoring and maintenance solutions.

Product Type Insights

The motor segment accounted for the largest market revenue share in 2024. The growth is attributed to the rising demand for motors in key industries like oil and gas, automotive, and manufacturing. Ensuring motors are in their optimal condition is essential to prevent failures, boost operational efficiency, and minimize downtime, thereby driving the growth of the motors segment in machine condition monitoring. As the demand for motors in various industries continues to increase, the motors segment is anticipated to maintain its growth trajectory in the foreseeable future.

The bearings segment will witness significant growth in the coming years. The increasing demand for machine tools in the manufacturing, automotive, and aerospace industries drives the overall growth of the machine tool market, subsequently bolstering the demand for bearings. Additionally, there is a rising need for high-precision bearings to cater to the requirements of machine tools that demand utmost accuracy and precision. Moreover, the growing adoption of automation in manufacturing further propels the demand for machine tools and bearings. The increasingly stringent regulations about noise and vibration emissions from machine tools are pushing manufacturers to seek high-performance bearings that can help reduce emissions, aligning with regulatory standards.

Application Insights

The turbines & generators segment accounted for the largest market revenue share in 2024.The escalating demand for preventive maintenance in the power generation industry drives the segment's growth. These components are crucial for power plants, and early identification of potential issues through machine condition monitoring helps prevent costly outages. The segment's growth is further fueled by the increasing use of renewable energy sources, necessitating advanced monitoring solutions and the adoption of predictive maintenance strategies to optimize costs and uptime. Moreover, the development of new technologies, such as vibration analysis and infrared thermography, provides more accurate and detailed data on the condition of turbines and generators, boosting the segment's prominence.

The HVAC systems segment will witness significant growth in the coming years. The increasing demand for energy-efficient and sustainable HVAC solutions and the rising popularity of smart HVAC systems with remote control capabilities drive this growth. Additionally, the need to enhance indoor air quality in buildings and the expansion of the commercial and industrial sectors further contribute to the segment's prominence. Key trends supporting this growth include adopting green technologies such as geothermal heat pumps and solar-powered HVAC systems, using smart thermostats and connected devices for remote control, and developing advanced technologies like demand-response HVAC systems that automatically adjust settings based on occupancy levels.

Architecture Type Insights

The on-premises segment accounted for the largest market revenue share in 2024. On-premises is often managed or self-hosted and ensures organizations meet specific market requirements enabling the teams to optimize their workload and create a highly customizable environment. To ensure the machines are operating efficiently, engineers need the ability to keep track and monitor the status and enable teams to pinpoint long running or inefficient machines easily. Furthermore, the cost-effectiveness of on-premises solutions significantly contributed to their widespread adoption. With businesses keen on budget optimization, the affordability of these solutions rendered them highly attractive, offering access to robust monitoring capabilities without straining financial resources.

The hybrid cloud segment will witness significant growth in the coming years. The increasing demand for machine tools in the manufacturing, automotive, and aerospace industries drives the overall growth of the machine tool market, subsequently bolstering the demand for bearings. Additionally, there is a rising need for high-precision bearings to cater to the requirements of machine tools that demand utmost accuracy and precision. Moreover, the growing adoption of automation in manufacturing further propels the demand for machine tools and bearings. The increasingly stringent regulations about noise and vibration emissions from machine tools are pushing manufacturers to seek high-performance bearings that can help reduce emissions, aligning with regulatory standards.

Plant Type Insights

The brownfield plant segment accounted for the largest market revenue share in 2024. This is because brownfield plants are older, nearing the end of their lifespan, and face a higher risk of failures and downtime, creating a pressing need for condition monitoring. Factors such as increased safety focus in the industrial sector, regulatory compliance requirements, and the higher probability of equipment problems in older setups contribute to the larger market share for machine condition monitoring in brownfield plants. Proactive monitoring in these environments is crucial for businesses to ensure operational efficiency, minimize risks, and avoid costly disruptions.

The greenfield plant segment is estimated to grow significantly over the forecast period. The growing demand for new plants, both in developing countries and to replace aging infrastructure in developed nations, is fueling the requirement for machine conditioning services in this segment. Additionally, stringent environmental regulations imposed by governments worldwide are pushing businesses to adopt more efficient and environmentally friendly machine conditioning solutions, benefiting greenfield plants designed with these considerations in mind. Furthermore, technological advancements in machine conditioning facilitate easier and more efficient maintenance of machines in greenfield plants, further bolstering the segment's growth prospects.

Monitoring Process Insights

The online condition monitoring segment accounted for the largest revenue share in 2024. The growth is attributed to the soaring demand for data monitoring and management to reduce downtime and defects and bolster machine life. Leading manufacturers are poised to prioritize advanced monitoring systems to expand penetration across untapped regions. The need for real-time metrics and alert notifications has triggered the demand for the online monitoring system to boost the machine's health information. The penetration of sensors in monitoring technology has fueled the trend for online monitoring systems for data accuracy. Further, the emergence of industrial IoT has furthered the footfall of software as a service for economies of scale and leveraged companies to emphasize core competencies. Prevailing trends suggest bullish demand for remote monitoring will underpin the machine condition monitoring market share. Avenues of growth and innovation are likely to emanate from preventive measures to minimize latencies and costs.

The portable condition monitoring segment is predicted to foresee significant growth in the forecast period. Portable condition monitoring assists in gathering and analyzing data concerning critical machinery. They are easy to operate, light, quick, and incredibly capable. The portable machine diagnostics operation type's features and attributes will propel the segment's growth. Besides, condition monitoring sensors have gained ground for better decision-making across the end use sectors. Industry players also tend to use portable wireless sensors to troubleshoot complex system failures and monitor conditions. Industry players have also implemented Bluetooth and SaaS platforms to foster flexibility and streamline operations.

End Use Insights

The power generation segment accounted for the largest market revenue share in 2024.The growth is attributed to the high failure rate for some components, such as increased repair costs, entire system overhauls, and unsafe work environments in the power and generation industry. As this industry is product intensive, it requires continuous machinery maintenance. Further, the oil and gas segment will acquire a significant market share due to a bullish demand for oil analysis, thermography, and vibration monitoring. The industry has witnessed unprecedented demand for condition monitoring to keep up with the demand for sensor applications to boost efficiency and productivity. The need for protecting and monitoring assets, and detecting leaks in pipelines, piping, and pressure vessels, has prompted forward-looking companies to foster the efficiency and health of machines. The trend for remote monitoring and predictive asset management could propel the market growth potential, encouraging stakeholders to bolster their footprint. The rising security and asset performance footfall has spurred the need for condition monitoring for upstream and downstream operations. Amidst surging energy costs, leading companies are poised to invest in condition-monitoring software and tools.

The chemicals segment will exhibit an impressive CAGR during the assessment period. This growth can be attributed to various factors, including the chemicals industry's rising demand for predictive maintenance solutions and the adoption of Industry 4.0 technologies, which drive the need for more efficient machine condition monitoring solutions. Furthermore, the segment is benefiting from the chemicals industry's growing focus on sustainability, with companies turning to machine condition monitoring to optimize operations and prevent unplanned downtime, thereby reducing their environmental impact. Additionally, stringent regulatory requirements on worker safety and environmental protection are compelling chemical plants to invest in advanced machine condition monitoring systems to ensure compliance and avoid penalties, further boosting the market's growth.

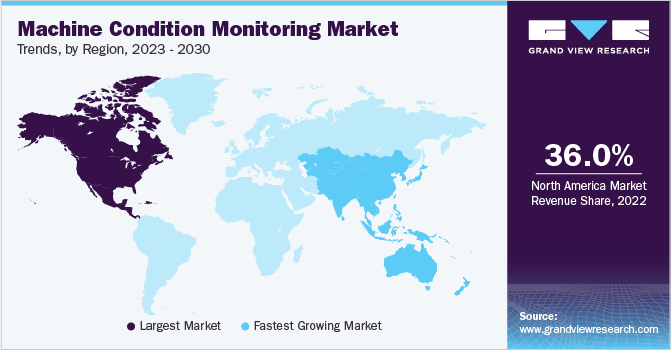

Regional Insights

North America dominated with a revenue share of over 36% in 2024. The U.S. and Canada are slated to provide promising growth opportunities against bullish demand from power generation, aerospace, oil & gas, marine, and food & beverages industries. The trend for vibration monitoring has become pronounced for oil condition monitoring in the oil and gas platform machinery lubricants. With a surge in offshore oil exploration across North America, forward-looking companies could strengthen their position in the regional market. Oil condition monitoring is poised to receive an uptick in predictive maintenance and reliability.

U.S. Machine Condition Monitoring Market Trends

The U.S. machine condition monitoring market is expected to grow in 2024, driven by the ongoing shift towards Industry 4.0, where manufacturers are increasingly implementing smart technologies to enhance operational efficiency. The U.S. manufacturing sector's commitment to reducing downtime and maintenance costs through predictive maintenance solutions is a key factor propelling this growth.

Europe Machine Condition Monitoring Market Trends

The machine condition monitoring market in the Europe region is expected to witness significant growth over the forecast period, driven by increasing investments in automation and digitalization across various industries. The region's stringent regulations regarding equipment safety and environmental standards are compelling companies to adopt advanced monitoring solutions to ensure compliance and minimize operational risks.

Asia Pacific Machine Condition Monitoring Market Trends

The machine condition monitoring market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. China is anticipated to be the largest market in the region, followed by India and Japan, owing to their extensive manufacturing bases and government initiatives promoting Industry 4.0 technologies. Furthermore, major players such as SKF, General Electric, and Honeywell International Inc., investing in research and development and expanding their reach in the Asia Pacific region, further propels the market's expansion.

Key Machine Condition Monitoring Company Insights

Some key players in the machine condition monitoring market, such as Emerson Electric Co., General Electric, Honeywell International Inc., and SKF, are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

Emerson Electric Co. is a global technology and engineering company specializing in automation solutions and industrial equipment. Within the machine condition monitoring sector, Emerson Electric Co. offers a comprehensive suite of products and services designed to optimize asset performance and enhance operational efficiency. Their monitoring solutions leverage advanced technologies, including IoT and AI, to provide real-time insights into equipment health, enabling predictive maintenance strategies. Emerson Electric Co 's portfolio includes wireless sensors, diagnostic tools, and software platforms that facilitate seamless data integration and analysis.

-

General Electric is known for its diverse portfolio across various sectors, including aviation, healthcare, and renewable energy. In the machine condition monitoring space, General Electric provides advanced solutions that leverage predictive analytics and IoT technology to enhance asset reliability and performance. Their digital offerings, such as the GE Digital Twin technology, enable real-time monitoring and analysis of equipment health, facilitating proactive maintenance strategies.

Key Machine Condition Monitoring Companies:

The following are the leading companies in the machine condition monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- ALS

- Emerson Electric Co.

- General Electric

- Honeywell International Inc.

- Megget PLC

- NATIONAL INSTRUMENTS CORP

- Parker Hannifin

- Rockwell Automation, Inc.

- SKF

- Schaeffler AG

Recent Developments

-

In July 2024, I-care, a predictive maintenance and industrial performance solution, acquired assets and licenses of Germany-based Sensirion AG's predictive maintenance product line. This deal boosts I-care's presence in Germany and strengthens its global leadership in industrial predictive maintenance while ensuring continuity for Sensirion AG's former customers.

-

In June 2024, SPM Instrument AB., a Sweden-based company, acquired Status Pro Maschinenmesstechnik GmbH a Germany based, a condition monitoring expert. The acquisition will support SPM Instrument AB's innovation and growth in the sector, allowing the company to strengthen its presence in Germany and enhance customer service capabilities.

-

In March 2024, KCF Technologies launched Piezo Sensing as part of its SMARTsensing suite, enhancing machine health monitoring with high-resolution data and advanced fault detection. This technology enables early detection of issues, reducing downtime maintenance costs and improving operational efficiency and safety across various industrial applications.

Machine Condition Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.78 billion |

|

Revenue forecast in 2030 |

USD 5.46 billion |

|

Growth rate |

CAGR of 7.6% from 2025 to 2030 |

|

Actual data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Monitoring technique, component, product type, application, architecture type, plant type, monitoring process, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

ALS; Emerson Electric Co.; General Electric; Honeywell International Inc.; Megget PLC; NATIONAL INSTRUMENTS CORP; Parker Hannifin; Rockwell Automation, Inc.; SKF; Schaeffler AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Machine Condition Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global machine condition monitoring market report based on monitoring technique, component, product type, application, architecture type, plant type, monitoring process, end use, and region:

-

Monitoring Technique Outlook (Revenue, USD Billion, 2017 - 2030)

-

Torque Monitoring

-

Vibration Monitoring

-

Oil Analysis

-

Thermography

-

Corrosion Monitoring

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Portable/Handheld Condition Monitoring Units

-

Software

-

Services

-

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Valves

-

Compressors

-

Turbines

-

Gearbox

-

Motors

-

Bearings

-

Couplings

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

HVAC Systems

-

Turbines & Generators

-

Material Handling

-

Conveyors

-

Pump Systems

-

Sprockets

-

Bushings & Hubs

-

Control Cabinet Monitoring

-

Paper Presses

-

Storage Rooms

-

Motor Control

-

Lubricant Level Monitoring on CNC Machines

-

Others

-

-

Architecture Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Public Cloud

-

Edge Platform

-

Hybrid Cloud

-

On-premises

-

-

Plant Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Greenfield Plant

-

Brownfield Plant

-

-

Monitoring Process Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online Condition Monitoring

-

Portable Condition Monitoring

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Mining

-

Primary Metals

-

Power Generation

-

Automotive

-

Oil & Gas

-

Aerospace

-

Food & Beverages

-

Chemicals

-

Marine

-

Pharmaceutical

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global machine condition monitoring market size was estimated at USD 3.49 billion in 2024 and is expected to reach USD 3.78 billion in 2025.

b. The global machine condition monitoring market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 5.46 billion by 2030.

b. North America dominated the machine condition monitoring market with a share of 36% in 2024. The growth is attributable to countries such as U.S. and Canada, which are slated to provide promising growth opportunities against bullish demand from power generation, aerospace, oil & gas, marine, and food & beverages industries.

b. Some key players operating in the machine condition monitoring market include ALS, Emerson Electric Co., General Electric, Honeywell International Inc., Megget PLC, NATIONAL INSTRUMENTS CORP, Parker Hannifin, Rockwell Automation, Inc., SKF, Schaeffler AG

b. Key factors driving the machine condition monitoring market growth include rising demand for highly secure cloud computing solutions that provide real-time condition monitoring, surging adoption of wireless technology in machine condition monitoring, and rise in the use of predictive maintenance techniques.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."